Спотовый DCA-бот (Мартингейл)

Введение в спотового DCA-бота (Мартингейл)

Стратегия Мартингейла часто используется при торговле на форексе и с фьючерсами. Фьючерсный DCA — это торговый бот, использующий стратегию Мартингейла для торговли фьючерсами. Он позволяет автоматизировать сделки на основе этих принципов.

В чем разница между стратегией усреднения долларовой стоимости (DCA) и Мартингейлом

Усреднение долларовой стоимости (DCA) — это стратегия управления активами. Она включает разделение разовых позиций на несколько ценовых уровней с целью получить лучшую среднюю цену входа, когда рынок движется против начальной сделки, и выхода, когда достигается целевой тейк-профит. Мартингейл — это один из видов DCA и

торговая стратегия, основанная на концепции удваивания размера торговли после каждого убытка. Благодаря удвоению размера позиции после каждого убытка, размер следующей прибыльной сделки превышает совокупные убытки всех предыдущих сделок с дополнительной прибылью. Простыми словами, если сделка убыточная, то удваиваете следующую, чтобы вернуть убытки, надеясь на прибыль.

Стратегия Мартингейла может принести долгосрочный доход, используя колеблющуюся прибыль в рамках циклов восстановления (при торговле в длинном направлении) или коррекции (при торговле в коротком направлении), чтобы минимизировать потери от общей покупки.

Как работает спотовый DCA-бот (Мартингейл) на OKX?

Пользователи начинают торговый цикл с выбора уровня риска на основе ряда параметров (также можно выбрать один из стандартных профилей риска: умеренный, агрессивный или консервативный).

Стратегия запускается с первоначального ордера, который запрограммирован на выбранное число исполнений. Если цена актива падает на определенный процент, бот исполняет вторую сделку, кратную первому ордеру. Этот цикл повторяется, пока цена не достигнет максимального количества ордеров, уровня тейк-профита или стоп-лосса, установленных пользователем. Если будет достигнут целевой тейк-профит, бот запустит следующий торговый цикл.

Обычно эту стратегию используют трейдеры, которые считают, что цена актива вырастет, и хотят увеличить свою позицию, даже если стоимость временно снижается. В стратегии DCA активы покупаются дешево и продаются дорого.

По этой причине она обычно используется на волатильных рынках (значительных, но краткосрочных колебаниях рынка), а также на боковых рынках, которые, как считается, переживают краткосрочные отскоки.

Как начать

На сайте: перейдите в раздел «Торговать», нажмите Торговые боты > Маркетплейс > Спотовый DCA-бот (Мартингейл)

В приложении: перейдите в раздел «Торговать», нажмите Торговые боты > Спотовый DCA-бот (Мартингейл)

Введите параметры вручную, скопируйте лид-ботов или выберите протестированную на исторических данных стратегию ИИ, а затем укажите сумму инвестиций для создания спотового DCA-бота (Мартингейл). После создания бота эти средства изолируются на торговом аккаунте и используются только для торговли с ботом.

Настройка параметров

Вручную. Задавайте параметры на основе вашего собственного анализа рынка.

Вручную — автоисполнение. Автоматически заполняйте параметры, рекомендованные торговым ботом на основе протестированной стратегии.

ИИ-стратегия. Используйте параметры, рекомендованные протестированной стратегией (эти параметры протестированы на недельных данных для конкретной пары).

Лид-боты. Копируйте прибыльных ботов лид-трейдеров на маркетплейсе в одно нажатие.

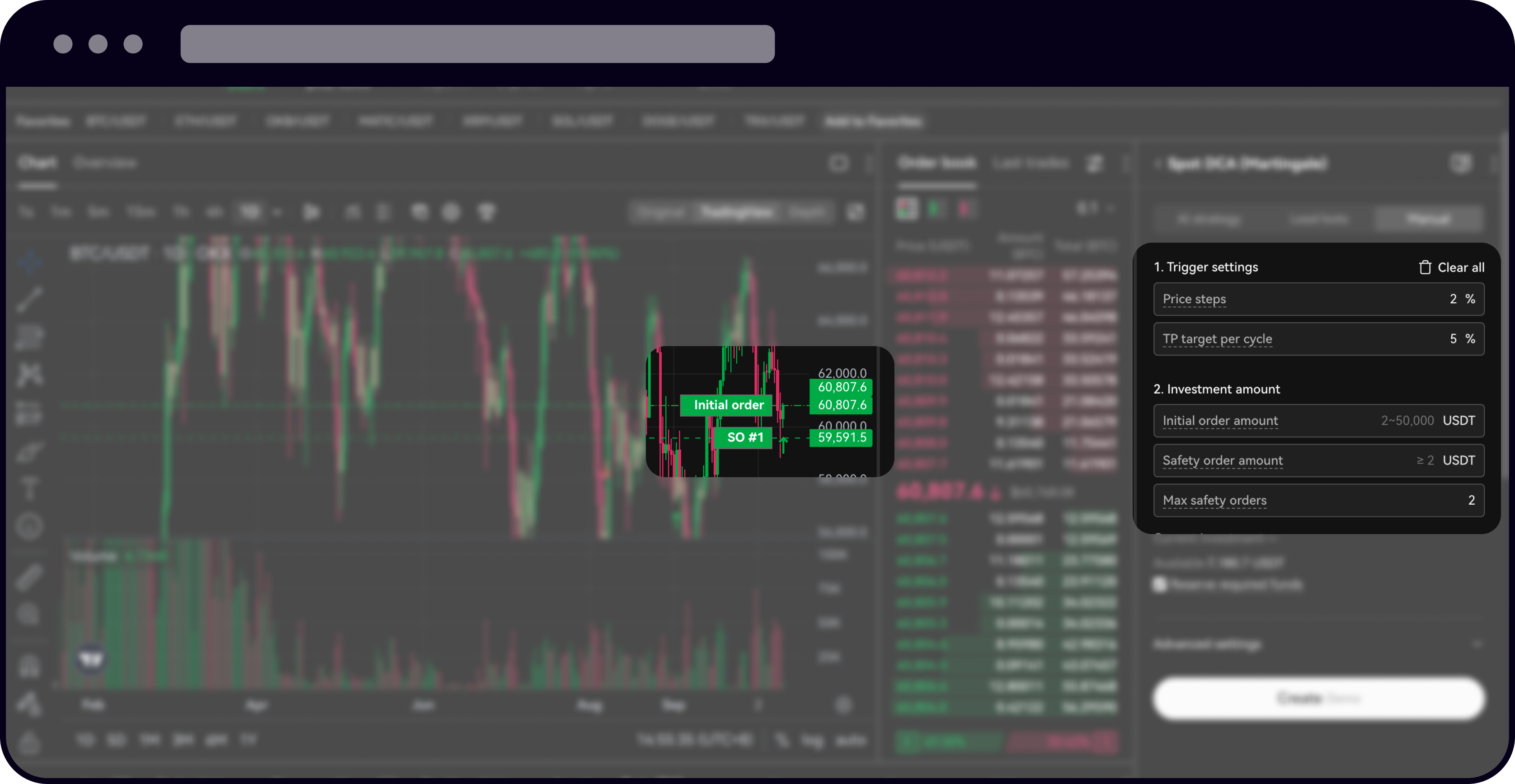

Параметры DCA-торговли

Шаги цены. Разница в процентах между двумя последовательными страховочными ордерами в валюте котировки.

Тейк-профит за цикл. При срабатывании и полном исполнении ордера тейк-профит бот завершит текущий индекс цикла и начнет следующий, как указано.

Начальная сумма. Первый ордер, созданный ботом DCA в начале каждого торгового цикла.

Сумма страховочного ордера. Страховочные ордера будут исполняться по нарастающей в каждом цикле торговли, чтобы снижать среднюю стоимость торговых пар и быстрее достигать цели тейк-профита.

Максимальное количество страховочных ордеров. Максимальное количество страховочных ордеров, которые можно разместить в торговом цикле. Фактическое количество размещенных страховочных ордеров может зависеть от маржи.

Множитель суммы. Применяется к сумме инвестиций для размещения следующего страховочного ордера. Это влияет на интенсивность усреднения цен входа ваших инвестиций. Например, при сумме страховочного ордера = 100 USDT множитель = 2. Будут размещены следующие страховочные ордера:

100 = (2^0 × 100)

200 = (2^1 × 100)

400 = (2^2 × 100), и т. д.

Множитель шага цены. Применяется к шагу цены для размещения следующего страховочного ордера. Это увеличивает или уменьшает ценовой разрыв между страховочными ордерами. Например, при шаге цены = 1%, множитель будет равен 2. Страховочные ордера будут размещаться при изменении цены:

1% = (0 + 1 × 2^0)%

3% = (1 + 1 × 2^1)%

7% = (3 + 1 × 2^2)%, и т. д.

Управление спотовым ботом DCA (Мартингейл)

На сайте: перейдите на главную страницу торговых ботов OKX и нажмите «Мои боты». Вы будете перенаправлены на панель управления ботами, где можете управлять запущенными ботами.

В приложении: перейдите на главную страницу торговых ботов OKX и нажмите «Мои боты». Вы будете перенаправлены на страницу «Мои боты», где можно управлять работающими ботами.

Функции управления DCA-ботами

Остановка бота. При остановке бота система отменит все отложенные ордера и продаст криптовалюту по рыночной цене. Средства от продажи будут возвращены на торговый аккаунт.

Информация. Узнайте больше о запущенном боте на странице с информацией о боте.

Повтор параметров. Копируйте параметры в одно нажатие, чтобы запускать такого же бота.

Отображение линий ордеров. На графике можно проверить данные по невыполненным ордерам активного бота в каждый цикл.

Пример

Торговая пара: BTC/USDT (если текущая цена составляет 25 000 USDT)

Шаги цены: 2%

Цель TP-ордера за цикл: 5%

Макс. число страховочных ордеров: 2

Запуск бота

Этап 1. Размещение начального ордера. Система создает новый цикл DCA и рассчитывает цену каждого страховочного ордера на основе цены начального ордера (25 000 USDT) в соответствии с указанным шагом цены (2%), например 24 500 USDT, 23 750 USDT и т. д. Система также рассчитает цену тейк-профита (TP) на основе начального ордера, например 26 250 USDT, который будет ордером тейк-профит DCA-бота.

Цена BTC (USDT) | Шаг цены (%)/целевое значение TP (%) | Средняя цена/прибыль (USDT) |

|---|---|---|

$25 000 | — (Начальный ордер) | $25 000 |

$24 500 | -2% (Страховочный ордер №1) | $24 750 |

$23 750 | -4% (Страховочный ордер №2) | $24 166,67 |

$26 250 | +5% (цель тейк-профита) | $26 250 - $24 166,67 = $2083,33 |

Этап 2. Работа бота. Изначально бот покупает одну позицию BTC по цене 25 000 USDT. Если цена BTC упадет на 2% до 24 500 USDT, бот автоматически купит еще одну по более низкой цене. При этом средняя цена входа по двум позициям будет равна 24 750 USDT. Если цена упадет еще на 4% до 23 750 USDT, бот купит еще одну позицию. Средняя цена входа по трем позициям составит 24 166,67 USDT.

Если цена BTC отскочит обратно к 25 375 USDT и достигнет вашего тейк-профит в 5%, бот продаст все три позиции с прибылью, а затем начнет новый цикл.

Уведомление о риске и примечания

Риски, связанные с рынком. При использовании этой стратегии сумма, потраченная на торговлю, может быстро увеличиться и достичь высокого значения уже после нескольких сделок. Ситуация усугубляется, если цена актива продолжает падать в течение длительного периода времени. Если трейдер продолжает удваивать сделки, вероятность убытков бесконечна. Если у трейдера заканчиваются средства и он выходит из сделки при использовании стратегии, потери могут быть весьма крупными. Кроме того, соотношение риска и прибыли подходит не каждому трейдеру. При использовании этой стратегии до получения прибыли затраты увеличиваются, а конечный результат может быть безубыточным. Кроме того, если актив продолжает падать в цене, есть вероятность, что он может упасть до нуля, и тогда средства трейдера потеряют всю стоимость. Мартингейл помогает зарабатывать на волатильности, но важно учитывать возможные потери и ответственно подходить к управлению рисками. Например, нужно устанавливать ордера стоп-лосс, чтобы ограничивать возможные потери.