Notice: The trading of this cryptocurrency is currently not supported on OKX. Continue trading with cryptocurrencies listed on OKX.

GUN

Gunz price

This data isn’t available yet

You’re a little early to the party. Check out these other crypto for now.

Gunz Feed

The following content is sourced from .

Odaily

Original by Ryan S. Gladwin

Original compilation: Deep Tide TechFlow

According to CoinGecko, after Imputable (IMX) dropped out of the rankings on Monday, there are no gaming tokens left in the top 100 cryptocurrencies by market capitalization. While there are still a handful of gaming tokens hovering at the bottom of the list, CoinMarketCap's ranking is almost unanimous: the performance of the top gaming tokens continues to be sluggish.

While crypto gaming has peaked in the mainstream market and player base over the past year, related tokens have rapidly ebbed and new token releases have struggled to gain traction.

According to Wayback Machine, just a year ago, there were 6 gaming tokens in the top 100 cryptocurrencies by market capitalization. At the time, CoinGecko's gaming token category had a total market capitalization of $29.3 billion. However, despite the launch of more tokens during this period, this number has now plummeted by 68% to only $9.24 billion.

Ethereum gaming platform Immutable was once the last holdout, but its token, IMX, has fallen sharply over the past year.

According to CoinGecko, in December 2023, IMX was the 31st largest cryptocurrency in the world by market capitalization. At the time, investment firm VanEck expressed strong confidence in Immutable, expecting IMX to be among the top 25 in 2024. Even a year ago today, IMX was ranked 34th.

Since then, however, IMX has plummeted 87% over the past year, due to a general cooling of the crypto gaming market and a SEC investigation (which Immutable recently said was closed).

In the past week alone, IMX has fallen by 29%, compared to Bitcoin's decline of just over 10%. IMX became the biggest weekly drop in CoinGecko's top 100 list until it slipped off the list and is currently ranked 103rd.

Other major gaming tokens that were once in the top 100 have also suffered heavy losses over the past year. For example, Gala Games (GALA) is down 80% (including a 19% drop this week) and The Sandbox (SAND) is down 64% over the same period (down 16% over the past seven days).

Those once-glorious established gaming tokens have fallen sharply since their peak in 2021. And even the recently launched mega-game tokens have not been escapable. Last year's launch of the Pixels (PIXEL) token plunged 98% from its peak, Notcoin (NOT) fell 94%, and Hamster Kombat (HMSTR) also slipped 68%.

Last week, Gunzilla Games' hit game Off the Grid and its Avalanche L1-based GUNZ network launched the GUN token, the largest in-game token offering in months. However, even though Off the Grid hasn't integrated GUN into the game, the token has fallen 62% from its peak.

Better games are on the rise

Off the Grid was named the best blockchain game of 2024 by Decrypt, and the game made a big splash last fall, fueling a positive perception of the quality of current crypto games.

This is in stark contrast to the Play-to-Earn craze of 2021, when the simple-gameplay monster battle game Axie Infinity was celebrated.

"The crypto gaming market in 2021 is arguably entirely narrative-driven, with few real products, with a few exceptions like Axie," the founder of Treeverse Games, who goes by the pseudonym Loopify, told Decrypt. "And now, a few years later, there are indeed more products, but they still take time and haven't really made it to the mainstream market yet."

At the time, Axie Infinity was a big hit, but its in-game economy, token value, and player base took a hit in early 2022. Today, there are a number of higher-quality games on the market, some of which have attracted millions of players – even if popularity and word-of-mouth don't always keep pace.

Hamster Kombat, for example, attracted 300 million players last summer with its Tap-to-Earn Telegram game, albeit with a simple and repetitive gameplay. However, since the launch of the token in September, players have left the market due to price issues, and the development team has been slow to roll out subsequent seasons.

Off the Grid became one of the few success stories last October, with its public release becoming one of the most successful in the blockchain gaming space, topping the Epic Games Store's list of free games and even surpassing Fortnite. In addition, the farm-based game Pixels and the card battle game Parallel have also received critical acclaim and attracted a growing audience, while the survival game Crypto: The Game has become a niche hit by going viral.

"I actually think the current state of crypto gaming is pretty solid," the GIA community manager for the crypto gaming team, who goes by the pseudonym Jaxie, told Decrypt. "We have some great games coming online right now, and those games have the potential to introduce millions of players to the crypto ecosystem."

But there were also mistakes

It takes time to make a good game – just look at Rockstar Games, which has spent seven years developing Grand Theft Auto 6 with a huge team and financial backing. This explains why, while the crypto gaming craze was on the rise a few years ago, we're only starting to see some results now.

However, crypto games that rush to success often end in failure. The Illuvium series is a prime example. According to CoinGecko, Illuvium's token (ILV) was first launched in 2021 and quickly soared to a peak of $1749, which sparked huge anticipation for the project. However, when the team launched three interconnected games in July 2024, the results fell short of expectations.

Illuvium's actual performance has been disappointing, with its co-founder Kieran Warwick admitting in February that criticism of the gameplay was "justified" and that a complete overhaul of the game was planned. Today, the price of the ILV token has plummeted 99.4% from its all-time peak and is currently trading at just $10.60.

The Core Question of Crypto Gaming: Games or Tokens?

"99% of crypto games aren't fun," said a member of the MLG team for the crypto gaming meme coin, which goes by the pseudonym Munnopoly, in an interview with Decrypt. "They look more like there's the token first, and then the game. I feel like they've been trying to bridge the gap with Web2 players. ”

The failure of the crypto gaming industry has shown that the development of high-quality games takes time and patience, and that projects that are rushed to launch and lack depth will only disappoint players and cause the value of the token to plummet.

Deadrop, once the highly-anticipated gamer, seems poised to bridge the gap between traditional gamers and Web3. Created by former Call of Duty and Halo developers and well-known streamer Dr. Disrespect was involved in the development, and the game caught the attention of mainstream gamers. However, the studio announced its closure after running out of funding in January of this year due to a falling out with the development team over allegations of alleged inappropriate conversations with minors.

"I think the cancellation of Deadrop is a major setback for the space," said content creator Mayor Reynolds. "This game is one of the few projects that has the potential to stand on its own and integrate Web3 features in a way that players can understand."

However, it is not unique for a gaming project to stop operating due to running out of funds. Recently, blockchain gaming ecosystem Treasure announced a massive restructuring and layoffs due to financial issues. And Blockworks reported last week that Neon Machine, the developer of Shrapnel, is also facing a depleted funding.

The development team of the Ethereum game The Mystery Society paused the development of the social reasoning game in February this year, and its co-founder, Chris Heatherly, bluntly said that the blockchain gaming industry is full of disruptive behavior.

"Greed and stupidity are killing almost all players in the field before they can prove themselves," Heatherly said in an interview with Decrypt. "We need to focus on building a healthy on-chain business model and not continue this fallacy of 'token issuance is a Ponzi scheme'. Every Web3 game founder I know is frustrated, tired, and all they're doing now is just trying to survive, but the real faith is fading day by day. ”

Reinventing the Narrative: Investors' Attention Shifts

According to Loopify, part of the problem with gaming tokens recently is that investors' focus has shifted to crypto assets that are more likely to make a quick profit. He noted that since the last gaming token bull run, investor interest has gone through meme coins, SocialFi, and more recently into artificial intelligence.

With each wave of investment flocking to new asset classes, gaming tokens are gradually losing traction. These tokens continue to exhibit high volatility in the market, but the recent decline has been more dramatic.

"The narrative of crypto gaming has long since disappeared, and with it fewer investors are willing to pay because the crypto industry essentially follows trends," Loopify said in an interview with Decrypt. "Even if these games are of higher quality and offer low-cost investment opportunities in the form of NFTs, tokens, or equity, the market will not be able to price them effectively right away. It will take time to reflect. ”

Jaxie asks a more fundamental question: do crypto games really need their own tokens? He believes that what players really care about is just having their own skins through the blockchain, not the game's exclusive tokens. While these tokens are capable of generating a speculative rush for a project, the negative effects of a token crash are enough to shake the community and create expectations that are difficult to achieve.

"Most games shouldn't use their own tokens at all," he said. "Launching a token is more of a marketing tool or a means of currying favor with existing users – don't get me wrong, I'm going to drop wool as well – but it's not really a useful token for gaming features."

Recently, there has been a wave of token issuance for "tap-to-earn" games, each of which needs to incentivize players to keep clicking through tokens. However, these tokens often lack practical use after issuance, resulting in a rapid decline in value. From "Hamster Kombat" to "Catizen" and "Zoo", similar stories play out over and over again.

In addition, the "play-to-airdrop trend" model, which was all the rage last year, is once again distributing tokens to players, but players have little incentive to hold them for the long term. Like the early Play-to-Earn craze, this model attracted a lot of attention and enthusiasm in the early days, but the eventual collapse was just as painful for the project and players.

"Most Web3 players are really just speculators in the crypto space, and their goal is to make money," Jaxie says bluntly. "Most crypto games have a lifespan of only 90 days, after which the number of players drops significantly – so why contribute to an economy that you know will shrink dramatically in three months?"

Show original39.45K

0

Blockbeats

Original Title: Gaming Tokens Are Disappearing From Crypto's Top 100—What Happened?

Original by Ryan S. Gladwin

Original compilation: Deep Tide TechFlow

According to CoinGecko, after Imputable (IMX) dropped out of the rankings on Monday, there are no gaming tokens left in the top 100 cryptocurrencies by market capitalization. While there are still a handful of gaming tokens hovering at the bottom of the list, CoinMarketCap's rankings are almost unanimous: the performance of the top gaming tokens continues to be sluggish.

While crypto gaming has peaked in the mainstream market and player base over the past year, related tokens have rapidly ebbed and new token releases have struggled to gain traction.

According to Wayback Machine, just a year ago, there were 6 gaming tokens in the top 100 cryptocurrencies by market capitalization. At the time, CoinGecko's gaming token category had a total market capitalization of $29.3 billion. However, despite the launch of more tokens during this period, this number has now plummeted by 68% to just $9.24 billion.

Ethereum gaming platform Immutable was once the last holdout, but its token, IMX, has fallen sharply over the past year.

According to CoinGecko, in December 2023, IMX was the 31st largest cryptocurrency in the world by market capitalization. At the time, investment firm VanEck expressed strong confidence in Immutable, expecting IMX to be among the top 25 in 2024. Even a year ago today, IMX was ranked 34th.

However, since then, IMX has plummeted 87% over the past year, due to a general cooling of the crypto gaming market and a SEC investigation (which Immutable recently said was closed).

In the past week alone, IMX has fallen by 29%, compared to Bitcoin's decline of almost 10%. IMX became the biggest weekly drop in CoinGecko's top 100 list until it slipped off the list and is currently ranked 103rd.

Other major gaming tokens that were once in the top 100 have also suffered heavy losses over the past year. For example, Gala Games (GALA) is down 80% (including a 19% drop this week) and The Sandbox (SAND) is down 64% over the same period (down 16% over the past 7 days).

Those once-glorious established gaming tokens have fallen sharply since their peak in 2021. And even the recently launched mega-game tokens have not been escapable. The Pixels (PIXEL) token, launched last year, plunged 98% from its peak, Notcoin (NOT) fell 94%, and Hamster Kombat (HMSTR) also slipped 68%.

Last week, Gunzilla Games' hit game Off the Grid and its Avalanche L1-based GUNZ network launched the GUN token, the largest in-game token offering in months. However, even though Off the Grid hasn't integrated GUN into the game, the token has fallen 62% from its peak.

Better games are on the rise

Off the Grid was named the 2024 Blockchain Game of the Year by Decrypt, and the game made a big splash last fall, fueling a positive perception of the quality of current crypto games.

This is in stark contrast to the Play-to-Earn craze of 2021, when the simple-gameplay monster battle game Axie Infinity was celebrated.

"The crypto gaming market in 2021 is arguably entirely narrative-driven, with few real products, with a few exceptions like Axie," the founder of Treeverse Games, who goes by the pseudonym Loopify, told Decrypt. "And now, a few years later, there are indeed more products, but they still take time and haven't really entered the mainstream market yet."

At the time, Axie Infinity was a hit, but its in-game economy, token value, and player base took a hit in early 2022. Today, there are a number of higher-quality games on the market, some of which have attracted millions of players – even if popularity and word-of-mouth don't always keep pace.

Hamster Kombat, for example, attracted 300 million players last summer with its Tap-to-Earn Telegram game, albeit with a simple and repetitive gameplay. However, since the launch of the token in September, players have left the market due to price issues, and the development team has been slow to roll out subsequent seasons.

Off the Grid became one of the few success stories last October, with its public release becoming one of the most successful in the blockchain gaming space, topping the Epic Games Store's list of free games and even surpassing Fortnite. In addition, the farm-based game Pixels and the card battle game Parallel have also received critical acclaim and attracted a growing audience, while the survival game Crypto: The Game has become a niche hit by going viral.

"I actually think the status quo of crypto gaming is pretty solid," the GIA community manager for the crypto gaming team, who goes by the pseudonym Jaxie, told Decrypt. "We have some great games coming online right now, and these games have the potential to introduce millions of players to the crypto ecosystem."

But there were also mistakes

It takes time to make a good game – just look at Rockstar Games, which has spent 7 years developing Grand Theft Auto 6 with a huge team and financial backing. This explains why, while the crypto gaming craze was on the rise a few years ago, we're only starting to see some results now.

However, crypto games that rush to success often end in failure. The Illuvium series is a prime example. According to CoinGecko, Illuvium's token (ILV) was first launched in 2021 and quickly soared to a peak of $1749, which sparked huge anticipation for the project. However, when the team launched three interconnected games in July 2024, the results fell short of expectations.

Illuvium's actual performance has been disappointing, with its co-founder Kieran Warwick admitting in February that criticism of the gameplay was "justified" and that he planned a complete overhaul of the game. Today, the price of the ILV token has plummeted 99.4% from its all-time peak and is currently trading at just $10.60.

The Core Question of Crypto Gaming: Games or Tokens?

"99% of crypto games aren't fun," said a member of the MLG team, a crypto gaming meme coin under the pseudonym Munnopoly, in an interview with Decrypt. "They look more like there's the token first, and then the game. I feel like they've been trying to bridge the gap with Web2 players."

The failure of the crypto gaming industry has shown that the development of high-quality games takes time and patience, and that projects that are rushed to launch and lack depth will only disappoint players and cause the value of the token to plummet.

The once-highly-anticipated Deadrop seems poised to bridge the gap between traditional gamers and Web3. Developed with the participation of former Call of Duty and Halo developer and renowned streamer Dr. Disrespect, the game has captured the attention of mainstream gamers. However, the studio announced its closure after running out of funding in January of this year due to a falling out with the development team over allegations of alleged inappropriate conversations with minors.

"I think the cancellation of Deadrop is a major setback for the space," said content creator Mayor Reynolds. "This game is one of the few projects that has the potential to stand on its own and integrate Web3 features in a way that players can understand."

However, it is not unique for a gaming project to stop operating due to running out of funds. Recently, blockchain gaming ecosystem Treasure announced a massive restructuring and layoffs due to financial issues. And Blockworks reported last week that Neon Machine, the developer of Shrapnel, is also facing a depleted funding.

The development team of the Ethereum game The Mystery Society paused the development of the social reasoning game in February, and its co-founder, Chris Heatherly, bluntly said that the blockchain gaming industry is full of disruptive behavior.

"Greed and stupidity are killing almost all players in the field before they can prove themselves," Heatherly said in an interview with Decrypt. "We need to focus on building a healthy on-chain business model, rather than continuing this fallacy of token issuance is a Ponzi scheme. Every Web3 gaming founder I know is frustrated, tired, and all they do now is to survive, but the real belief is fading."

Reinventing the Narrative: Investors' Attention Shifts

According to Loopify, part of the problem with gaming tokens recently is that investors' focus has shifted to crypto assets that are more likely to make a quick profit. He noted that since the last gaming token bull run, investor interest has gone through meme coins, SocialFi, and more recently into artificial intelligence.

With each wave of investment flocking to new asset classes, gaming tokens are gradually losing traction. These tokens continue to exhibit high volatility in the market, but the recent decline has been more dramatic.

"The narrative of crypto gaming has long since disappeared, and with it fewer investors willing to pay because the crypto industry essentially follows trends," Loopify said in an interview with Decrypt. "Even if these games are of higher quality and offer low-cost investment opportunities in the form of NFTs, tokens, or equity, the market will not be able to price them effectively right away. It will take time to reflect."

Jaxie asks a more fundamental question: do crypto games really need their own tokens? He believes that what players really care about is just having their own skins through the blockchain, not the game's exclusive tokens. While these tokens are capable of generating a speculative rush for a project, the negative effects of a token crash are enough to shake the community and create expectations that are difficult to achieve.

"Most games shouldn't use their own tokens at all," he said. "Launching a token is more of a marketing tool or a means of currying favor with existing users – don't get me wrong, I'm going to airdrop wool too—but it's not really a useful token for gaming features."

Recently, there has been a wave of token issuance for "tap-to-earn" games, each of which needs to incentivize players to keep clicking through tokens. However, these tokens often lack practical use after issuance, resulting in a rapid decline in value. From "Hamster Kombat" to "Catizen" and "Zoo", similar stories play out over and over again.

In addition, the "play-to-airdrop trend" model, which was all the rage last year, is once again distributing tokens to players, but players have little incentive to hold them for the long term. Like the early Play-to-Earn craze, this model attracted a lot of attention and enthusiasm in the early days, but the eventual collapse was just as painful for the project and players.

"Most Web3 players are really just speculators in the crypto space, and their goal is to make money," Jaxie says bluntly. "Most crypto games have a lifespan of only 90 days, after which the number of players drops significantly – so why contribute to an economy that you know is going to shrink dramatically in three months?"

Link to original article

Show original25.43K

0

TechFlow

by Ryan S. Gladwin

Compiler: Deep Tide TechFlow

According to CoinGecko, after Impute (IMX) dropped out of the rankings on Monday, there are no gaming tokens left in the top 100 cryptocurrencies by market capitalization. While there are still a handful of gaming tokens hovering at the bottom of the list, CoinMarketCap's ranking is almost unanimous: the performance of the top gaming tokens continues to be sluggish.

While crypto gaming has peaked in the mainstream market and player base over the past year, related tokens have rapidly ebbed and new token releases have struggled to gain traction.

According to Wayback Machine, just a year ago, there were 6 gaming tokens in the top 100 cryptocurrencies by market capitalization. At the time, CoinGecko's gaming token category had a total market capitalization of $29.3 billion. However, despite the launch of more tokens during the period, this number has now plummeted by 68% to just $9.24 billion.

Ethereum gaming platform Immutable was once the last holdout, but its token, IMX, has fallen sharply over the past year.

According to CoinGecko, in December 2023, IMX was the 31st largest cryptocurrency in the world by market capitalization. At the time, investment firm VanEck expressed strong confidence in Immutable and expected IMX to be among the top 25 in 2024. Even a year ago today, IMX was ranked 34th.

However, since then, IMX has plummeted 87% over the past year, due to a general cooling of the crypto gaming market and an investigation by the U.S. Securities and Exchange Commission (SEC) (which Impmutable recently said was closed).

In the past week alone, IMX has fallen by 29%, compared to Bitcoin's decline of just over 10%. IMX became the biggest weekly loser in CoinGecko's Top 100 list until it slipped out of the list and is currently ranked 103rd.

Other major gaming tokens that were once in the top 100 have also suffered heavy losses over the past year. For example, Gala Games (GALA) is down 80% (including a 19% drop for the week) and The Sandbox (SAND) is down 64% over the same period (down 16% over the past seven days).

Those once-glorious old gaming tokens have fallen sharply since their peak in 2021. And even the recently launched mega-game tokens have not been escapable. The Pixels (PIXEL) token, launched last year, plunged 98% from its peak, Notcoin (NOT) fell 94%, and Hamster Kombat (HMSTR) also slipped 68%.

Last week, Gunzilla Games' hit game Off the Grid and its Avalanche L1-based GUNZ network launched the GUN token, the largest in-game token offering in months. However, even though Off the Grid hasn't integrated GUN into the game, the token has fallen 62% from its peak.

Better games are on the rise

Off the Grid was named the best blockchain game of 2024 by Decrypt, and the game shone last fall, fueling a positive perception of the current quality of crypto games.

This is in stark contrast to the Play-to-Earn craze of 2021, when the simple-gameplay monster battle game Axie Infinity was celebrated.

"The crypto gaming market in 2021 can be arguably entirely narrative-driven, with few real products, with a few exceptions like Axie," the founder of Treeverse Games, who goes by the pseudonym Loopify, told Decrypt. "And now, a few years later, there are indeed more products, but they still take time and haven't really made it to the mainstream market yet."

At the time, Axie Infinity was a hit, but its in-game economy, token value, and player base took a hit in early 2022. Today, there are a number of higher-quality games on the market, some of which have attracted millions of players – even if popularity and word-of-mouth don't always keep pace.

Hamster Kombat, for example, attracted 300 million players last summer with its Tap-to-Earn Telegram game, albeit with a simple and repetitive gameplay. However, since the launch of the token in September, players have left the market due to price issues, and the development team has been slow to launch subsequent seasons.

Off the Grid became one of the few success stories in October last year, with its public release becoming one of the most successful in the blockchain gaming space, topping the Epic Games Store's free-to-play charts and even surpassing Fortnite. In addition, the farm-based game Pixels and the card battle game Parallel have also received critical acclaim and attracted a growing audience, while the survival game Crypto: The Game has become a niche hit by going viral.

"I actually think the current state of crypto gaming is pretty solid," the GIA community manager at GIA, who goes by the pseudonym Jaxie, told Decrypt. "We have some great games coming online right now, and those games have the potential to introduce millions of players to the crypto ecosystem."

But there were also mistakes

It takes time to make a great game – just look at Rockstar Games, which has been working on Grand Theft Auto 6 for seven years, with a huge team and financial backing. This explains why, while the crypto gaming craze was on the rise a few years ago, we're only starting to see some results now.

However, crypto games that rush to success often end in failure. The Illuvium series is a prime example. According to CoinGecko, Illuvium's token (ILV) was first launched in 2021 and quickly soared to a peak of $1,749, which sparked huge anticipation for the project. However, when the team launched three interconnected games in July 2024, the results fell short of expectations.

Illuvium's actual performance has been disappointing, with its co-founder Kieran Warwick admitting in February that criticism of the gameplay was "justified" and that he plans to overhaul the game. Today, the price of the ILV token has plummeted 99.4% from its all-time peak and is currently only $10.60.

The Core Question of Crypto Gaming: Games or Tokens?

"99% of crypto games aren't fun," said a member of the MLG team, a crypto gaming meme coin under the pseudonym Munnopoly, in an interview with Decrypt. "They look more like there's the token first, and then the game. I feel like they've been trying to bridge the gap with Web2 players. ”

The failure of the crypto gaming industry has shown that the development of high-quality games takes time and patience, and that projects that are rushed to launch and lack depth will only disappoint players and cause the value of the token to plummet.

Deadrop, once the highly-anticipated gamer, seems poised to bridge the gap between traditional gamers and Web3. Created by former Call of Duty and Halo developers and well-known streamer Dr. Disrespect was involved in the development, and the game caught the attention of mainstream gamers. However, due to the cooperation between the development team and Dr. Disrespect fell out over allegations of inappropriate conversations with minors, and the studio announced closure after it ran out of funding in January of this year.

"I think the cancellation of Deadrop is a major setback for the space," said content creator Mayor Reynolds. "This game is one of the few projects that has the potential to stand on its own and integrate Web3 features in a way that players can understand."

However, it is not unique for a gaming project to stop operating due to running out of funds. Recently, blockchain gaming ecosystem Treasure announced a massive restructuring and layoffs due to financial issues. And Blockworks reported last week that Neon Machine, the developer of Shrapnel, is also facing a depleted funding.

The development team of the Ethereum game The Mystery Society paused the development of the social reasoning game in February, and its co-founder, Chris Heatherly, bluntly said that the blockchain gaming industry is full of disruptive behavior.

"Greed and stupidity are killing almost all players in the field before they can prove themselves," Heatherly said in an interview with Decrypt. "We need to focus on building a healthy on-chain business model and not continue this fallacy of 'token issuance is a Ponzi scheme'. Every Web3 game founder I know is frustrated, tired, and all they're doing now is just trying to survive, but the real faith is fading day by day. ”

Reinventing the Narrative: Investors' Attention Shifts

According to Loopify, part of the problem with gaming tokens recently is that investors' focus has shifted to crypto assets that are more likely to make a quick profit. He noted that since the last gaming token bull run, investor interest has gone through meme coins, SocialFi, and more recently into artificial intelligence.

With each wave of investment flocking to new asset classes, gaming tokens are gradually losing traction. These tokens continue to exhibit high volatility in the market, but the recent decline has been more dramatic.

"The narrative of crypto gaming has long since disappeared, and with it fewer investors are willing to pay because the crypto industry essentially follows trends," Loopify said in an interview with Decrypt. "Even if these games are of higher quality and offer low-cost investment opportunities in the form of NFTs, tokens, or equity, the market can't price them effectively right away. It will take time to reflect. ”

Jaxie asks a more fundamental question: do crypto games really need their own tokens? He believes that what players really care about is just having their own skins through the blockchain, not the game's exclusive tokens. While these tokens are capable of generating a speculative rush for a project, the negative effects of a token crash are enough to shake the community and create expectations that are difficult to achieve.

"Most games shouldn't use their own tokens at all," he said. "Launching a token is more of a marketing tool or a means of currying favor with existing users – don't get me wrong, I'm going to drop wool as well – but it's not really a useful token for gaming features."

Recently, there has been a wave of token issuance for "tap-to-earn" games, each of which needs to incentivize players to keep clicking through tokens. However, these tokens often lack practical use after issuance, resulting in a rapid decline in value. From "Hamster Kombat" to "Catizen" and "Zoo", similar stories play out over and over again.

In addition, the "play-to-airdrop trend" model, which was all the rage last year, is once again distributing tokens to players, but players have little incentive to hold them for the long term. Like the early Play-to-Earn craze, this model attracted a lot of attention and enthusiasm in the early days, but the eventual collapse was just as painful for the project and players.

"Most Web3 players are really just speculators in the crypto space, and their goal is to make money," Jaxie bluntly said. "Most crypto games have a lifespan of only 90 days, after which the number of players drops significantly – so why contribute to an economy that you know will shrink dramatically in three months?"

Show original22.56K

1

Blockworks

When it comes to crypto gaming, is there any point in taking on the risk that comes with building a “AAA” game — or should studios just focus on simpler mobile games with dynamic economies instead?

Crypto founders at Ronin and Avalanche clashed over the issue on X this week.

In light of Off The Grid’s GUN token launch on Monday and perceived success as a blockchain game thus far, Ava Labs founder and CEO Emin Gün Sirer declared: “AVAX won gaming for sure. If you’re developing a AAA game, there’s only one proven platform to build on.”

“AAA” is a gaming industry buzzword with no official definition attached, but it typically refers to games that cost $25 million to $40 million or more to make and come from larger studios with substantial marketing budgets.

Off The Grid studio Gunzilla Games has its own dedicated, private Avalanche L1 chain called Gunz. The chain is nearing 500 million total transactions since its launch, according to Avascan data as of Wednesday morning.

GUN’s future price will be difficult to predict given the slated long-term unlocks and added supply to come, as some have pointed out. The token currently sits at a $32 million market cap, and its price is down 54% from its all-time high. But only 6% of the token’s total supply is currently in circulation.

Ronin, which made a name for itself as a gaming chain with its flagship Axie Infinity back in 2021, has taken a markedly different approach to crypto gaming. They’ve chosen to focus on mobile gameplay and game economies instead of on graphics, allowing them to keep budgets small while making the best games possible given those restrictions.

“AAA Web3 gaming is a waste of money,” wrote Ronin cofounder and chair Aleksander Larsen in response to Sirer on Wednesday morning.

“Come to $RON and let’s figure out the hard economic problems of web3 gaming together. $AVAX is focusing on the wrong thing and the token holders will suffer as a consequence,” Larsen continued, adding: “Congrats on your victory” with a salute emoji.

Is Avalanche focusing on the wrong thing? For one, the chain has other types of games that aren’t “AAA,” like Spellborne, a pixelated magic game.

Then there’s the question of objectives for each game — as well as each one’s target audience. Every crypto game will likely have a substantial cohort of players who are there just to “farm” or extract as much value as possible because of a crypto game’s play-to-earn elements, like Pixels founder Luke Barwikowski has found with his Ronin-based pixelated MMORPG.

But should higher-fidelity graphics be the goal for crypto games — which result in much higher costs and risk?

Two years ago, with the likes of Shrapnel, Off The Grid, and other ambitious projects splashing onto the blockchain gaming scene, pushing for a “AAA” game was trendy. But with VC firms pulling back on the inflated funding rounds of the 2021 post-pandemic boom, the number of crypto games with AAA plans has declined significantly since 2020.

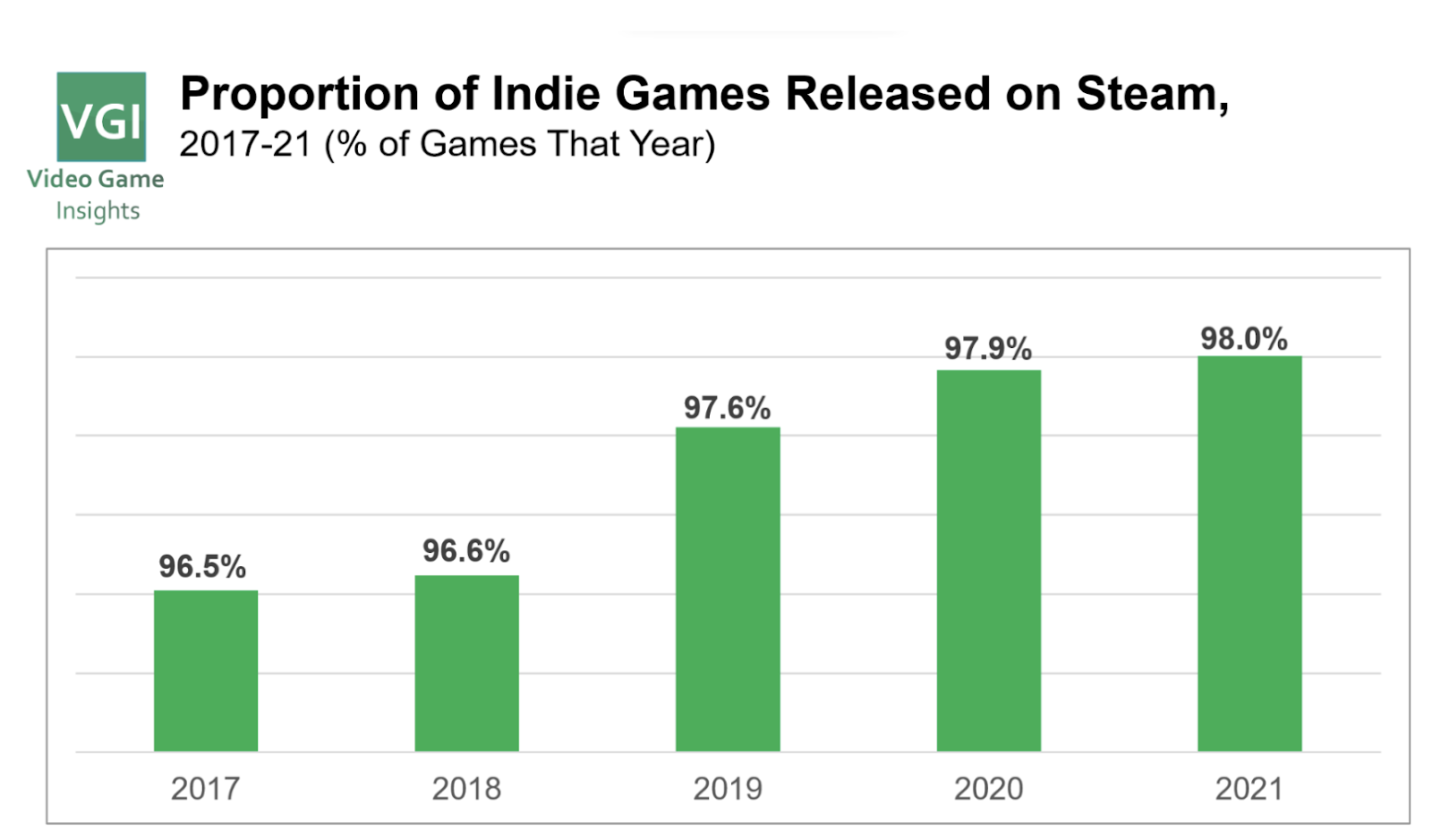

Last year, AAA titles made up less than 1% of crypto games, while indies made up over 90% of the total, per Game7 research. That ratio largely matches the broader gaming industry: Roughly 98% of Steam games are classified as indie.

Across both crypto gaming and the broader gaming industry, more releasing titles have been indie. This may be due to broader economic factors, including the waves of mass layoffs and studio shutdowns we’ve seen for years now across the gaming industry.

Mobile games also make up a large portion of the broader gaming pie, as 49% of games are mobile titles, according to data from analytics firm Adjust published last year.

I think there’s substantially less room for multiple “AAA-budget” games in the crypto space specifically because you’re competing with the likes of Call of Duty and Fortnite and require much higher levels of continued capital and revenue. Whether AAA crypto games want to admit it or not, they’re in the same bracket as multibillion-dollar giants like Microsoft and Epic Games when it comes to PC player choice. Call of Duty Black Ops Cold War, for example, released in 2020 and reportedly cost Activision $700 million to make.

Many typical gamers still aren’t going to get behind NFTs in video games, as we saw back in 2021 with smaller titles like the S.T.A.L.K.E.R. franchise. And we’ve seen this many times since with players’ mainly negative response to Ubisoft’s and Square Enix’s respective blockchain gaming endeavors.

Smaller games like mobile titles, however, aren’t at a major advantage. While 83% of mobile games are expected to fail, those lower-budget games come at a lower cost to studios.

The market has corrected to fit more realistic expectations — including expectations around funding. Can the crypto industry fund more than one AAA game at a time? I’m not sure.

Ronin is doing well in its niche, and Off The Grid is a rare breakout of a game for the blockchain gaming sector.

There’s definitely room for both to succeed — and I think they’ll continue to attract completely different types of gamers to their titles.

14.49K

1

How are you feeling about GUN today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

About Gunz (GUN)

Gunz FAQ

What is cryptocurrency?

Cryptocurrencies, such as GUN, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as GUN have been created as well.

Can I buy GUN on OKX?

No, currently GUN is unavailable on OKX. To stay updated on when GUN becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of GUN fluctuate?

The price of GUN fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.