AEVO

Aevo price

$0.12226

+$0.0058900

(+5.06%)

Price change for the last 24 hours

How are you feeling about AEVO today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Aevo market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$110.61M

Circulating supply

903,184,800 AEVO

90.31% of

1,000,000,000 AEVO

Market cap ranking

--

Audits

Last audit: --

24h high

$0.12381

24h low

$0.11389

All-time high

$14.2030

-99.14% (-$14.0807)

Last updated: Mar 13, 2024

All-time low

$0.075600

+61.71% (+$0.046660)

Last updated: Apr 9, 2025

Aevo Feed

The following content is sourced from .

冰蛙

《Gaib: Missed Nvidia Stock? This Time You Can Directly Buy Its "On-Chain GPU Stock"》

Summary in one sentence: Extremely bullish on GAIB, it could be the future "computing power Taobao" on the chain. (Not an ad)

__________________

1. Explain what Gaib does in one sentence

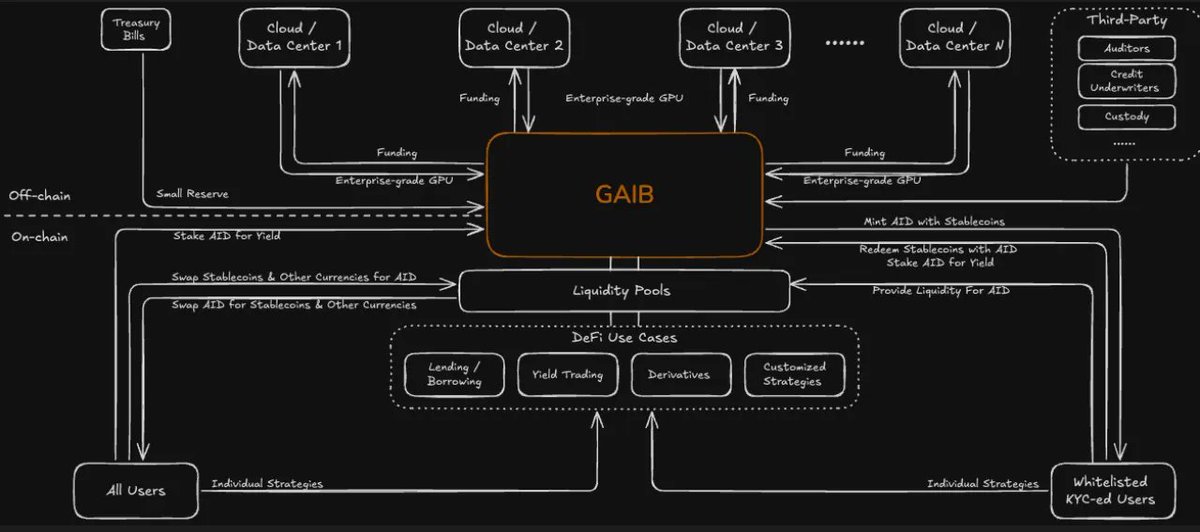

GAIB (GPU-AI-Blockchain Infrastructure), as expressed in the project's official white paper, is the world's first economic protocol focused on transforming GPU computing power assets into tradable financial instruments, unlocking the trillion-dollar AI computing market value through blockchain.

Its core innovation lies in constructing the "AI Synthetic Dollar AID," a yield-bearing stablecoin backed by cash flows from physical GPU assets, and building a complete DeFi ecosystem around AID, connecting off-chain computing power resources with on-chain liquidity.

In simple terms, its business model is: users mint AID with USDC, then invest in GPUs, AI companies use these GPUs to generate cash flow, GAIB distributes dividends periodically, and users holding sAID can enjoy these earnings and participate in other DeFi profit-making activities.

_________________

2. Why is this feasible? Can it make money?

In the AI era, GPUs are undoubtedly the most core "hard currency." According to incomplete statistics, by 2025, global tech giants will invest over $300 billion in GPU computing power. Taking Nvidia's H100/GB200 as an example, a single chip costs nearly $30,000 to $50,000, and building a data center with AI training capabilities requires investments of billions or even tens of billions of dollars. This has led to the following issues and Gaib's solutions.

1. Demand side: AI explosion combined with "supply-demand asymmetry"

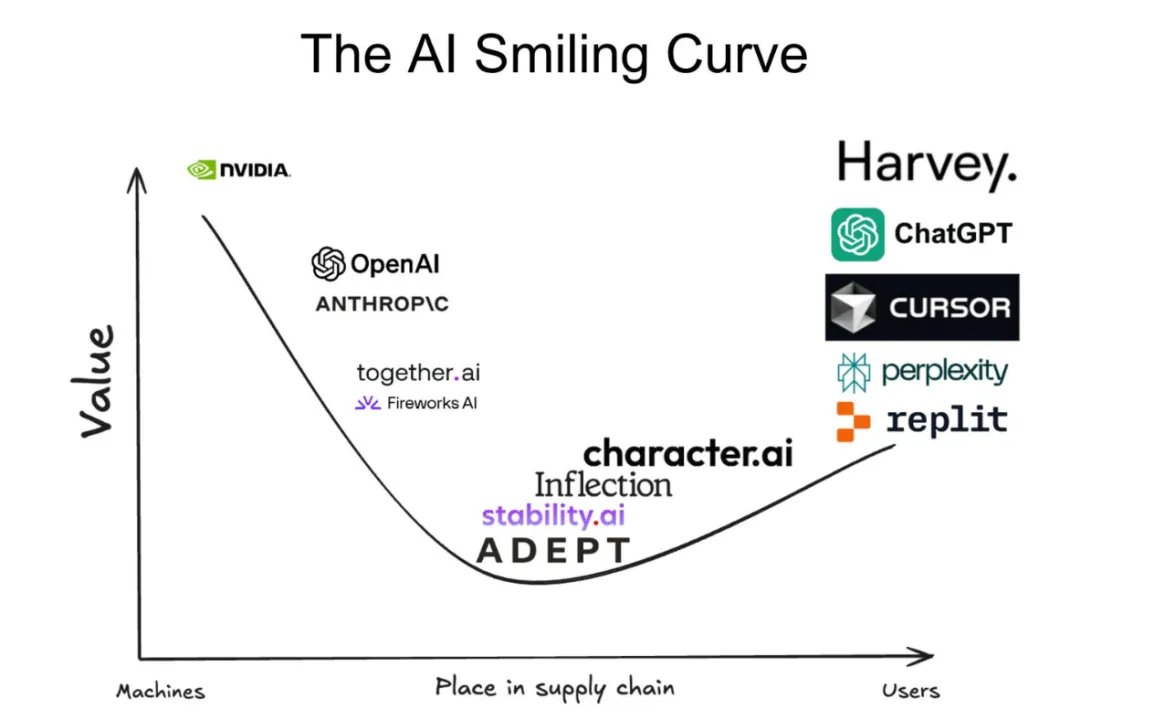

Currently, the large model training market is almost monopolized by a few tech giants, with GPU resources concentrated in the hands of mega institutions like OpenAI, Google, and Meta. However, after the second half of 2024, we see a trend of AI applications flourishing, especially in inference and AI Agent vertical scenarios. These innovative projects do not need to build data centers worth hundreds of billions, but they still require a large amount of high-performance GPU resources.

The problem is: traditional data centers or cloud service providers cannot flexibly respond to these small and medium demands, leading to a severe structural mismatch in the computing power market—resources are concentrated while demand is dispersed, supply and demand are extremely asymmetric, and demand far exceeds supply.

2. Financial side: Traditional financing paths do not support "computing power assets"

Theoretically, these high-value GPU clusters can be used as financing assets. However, in reality, GPUs are not considered "collateralizable standard assets" by traditional banks, nor can they be easily divided or standardized, making it almost impossible for the traditional financial system to cover computing power financing needs.

Currently, there are some computing power leasing platforms in the traditional market trying to solve this pain point, but they generally have two major issues:

First, they cannot split ownership, resulting in poor financing liquidity;

Second, there is no standardization mechanism, the income structure is not transparent, and the participation threshold is high.

3. Gaib's solution: On-chain "computing power financial market + computing power stablecoin"

Gaib's innovation lies in not just doing computing power leasing, but creating an efficient and liquid computing power financial market on the chain.

1) Tokenizing the future earnings of enterprise-grade GPUs to enable split trading;

2) Constructing a yield-bearing stablecoin AID backed by real GPU asset cash flows, which can be used for staking, lending, and combined yield strategies;

3) Utilizing the DeFi ecosystem to enable efficient financing and free circulation of these assets globally.

The core value of this mechanism has three points:

1) For GPU providers, it offers an unprecedented financing channel for GPU holders;

2) For participating users, it provides DeFi users with a safe, real, and visible new type of asset;

3) For developers, it opens a fair participation channel in the underlying infrastructure for small and medium developers.

In other words, Gaib turns "computing power" into a combinable and configurable financial asset, truly realizing the capitalization of computing power.

If we say Nvidia is the king of "selling shovels" in the AI era, then what Gaib wants to do is to build a "shovel bank/shovel exchange" on Nvidia's shovel empire, turning physical shovels into tradable "computing power stocks."

__________________

3. How does Gaib specifically help you make money? Breakdown of the gameplay

1. Off-chain asset side: GPU financing asset packages under three models

GAIB collaborates with top global cloud/data centers to construct three types of protocol trading structures around GPU deployment:

All the above transactions are over-collateralized by physical GPUs, with bankruptcy isolation structures set up, allowing for liquidation or continued custody and operation by strategic partners in case of default.

2. On-chain architecture: AID stablecoin system

GAIB tokenizes GPU financing transactions and issues AID (AI Dollar), a stablecoin backed by off-chain revenue assets:

1) AID: Not an ordinary stablecoin, it not only benchmarks the dollar value but also represents real GPU revenue rights;

2) sAID: A yield-bearing certificate obtained by users staking AID, which can automatically accumulate earnings;

3) Underlying revenue comes from: cash flow of GPU transaction packages + treasury reserves, forming a support system;

4) Mechanism design: AID minting and burning mechanism to ensure its anchoring to real asset value;

5) Exit mechanism: Whitelisted users can redeem 1:1, ordinary users can exchange for stablecoins through AMM pools.

Additionally, sAID can also participate in lending, liquidity mining, yield derivatives, and various DeFi gameplay (already integrated with mainstream dex - Curve, AEVO, Uniswap; Pendle, etc.), effectively connecting GPU underlying assets to on-chain DeFi.

Purely from a revenue perspective, underlying revenue + DeFi revenue + points revenue, even in the most basic debt model, the highest yield may exceed 40%.

__________________

4. Analysis of participation opportunities? Where are the risks? How does the project mitigate them?

In early 2025, the project conducted a pilot with the decentralized GPU platform Aethir, completing a $100,000 tokenized financing pilot in 10 minutes, proving strong market demand; the funds raised were used to support physical GPU clusters, and investors have already started receiving returns.

This marks that GAIB's "GPU asset tokenization" model has been validated and has the foundation for replication and scaling.

From the project perspective, traditional RWA products mostly enter through treasury tokenization, with annual yields generally around 4%-5%; GAIB's underlying basic yield is as high as 10% or more, with financing terms covering 3 months to 3 years, but realistically, due to strong GPU demand, financing terms are generally shorter, with faster turnover.

From a risk perspective, the main risks are the credit risk of underlying assets and the liquidity risk of AID. The most critical is the credit risk of underlying assets. GAIB and other cooperating underwriters on its platform will adhere to comprehensive credit analysis requirements and cooperate with third-party audit institutions when necessary.

Each loan is over-collateralized by physical GPUs and their related service contracts. Additionally, these GPU data will be displayed in real-time on a decentralized network.

In case of default, underwriters have the right to liquidate GPUs to protect investors or continue to manage and operate GPUs through strategic data center partners to ensure continuous revenue generation. At least from a mechanism perspective, it tries to avoid risks at the most fundamental asset level.

In terms of specific participation, if you are a whitelisted user (KYC verified), you can directly mint AID with USDC to participate in the project and stack DeFi earnings.

If you are not whitelisted, you can directly exchange AID through liquidity pools. You can also join the project's AID waiting list, which is currently queuing, and for LPs, the project will have Points/Token incentives and will jointly incentivize with Dex.

__________________

5. Summary and outlook: The value is far more than a yield-bearing stablecoin

GAIB is not just a "yield-bearing stablecoin" project; it is reconstructing the capital market infrastructure of the AI era in a DeFi way.

At the end of last year, GAIB completed a $5 million Pre-Seed financing led by Hack VC, with participation from well-known institutions such as Animoca, Aethir, and the Near Foundation.

Judging from the lineup of investors, it is not difficult to see that GAIB is at the forefront of the trend. Especially Hack VC, as an institution that has invested in multiple top projects, its endorsement itself is a market trend indicator.

It is worth mentioning that from the team lineup, the project's Co-Founder Alex Yeh is also the founder of Realtek (one of the world's top seven chip companies, a listed company), and its cloud company GMI Cloud is a partner of Nvidia. The founder's resources and understanding of the industry are important prerequisites to ensure the project's healthy operation and success.

What GAIB is promoting is not a "high-yield product" or a "stablecoin protocol," but a new paradigm:

It connects AI infrastructure and global capital pools, using GPU cash flow as an anchor asset, turning "dead assets" in data centers into tradable, combinable, and liquid financial assets.

Through AID, a new type of "yield-bearing dollar," anyone can participate in the AI computing power market—without understanding AI, buying chips, or deploying nodes, just "collecting rent" on the chain every day.

It is providing a permissionless, global, and transparent financing channel for AI infrastructure, allowing investors and computing power providers to connect directly, no longer relying on intermediaries or centralized resource allocation.

In the future, if AID can truly become the "currency" of the AI era—like the dollar in the industrial era, undertaking functions of circulation, settlement, and pricing, it will leverage not just a DeFi sub-track, but the financial hub of the AI economy.

We can even put it this way: GAIB is like the "computing power Taobao" on the chain—AI companies "open stores" (mortgage graphics cards for financing), investors "shop" (buy computing power cash flow assets), and the platform is responsible for matching and transaction clearing.

The imagination space of this model will far exceed the story of a "yield stablecoin," but will move towards the foundational role of a new paradigm in AI finance.

Show original

29.73K

49

ChainCatcher 链捕手

According to Aevo's official X account, Aevo's governance proposal AGP-2 has been approved by the community and will resume the monthly on-chain buyback program. According to the proposal, AEVO token holders voted to restart the on-chain token buyback mechanism, which takes place on a monthly basis. In the announcement, Aevo thanked all participants and voters for their support of the AGP-2 proposal.

Show original15.81K

0

AEVO calculator

Aevo price performance in USD

The current price of Aevo is $0.12226. Over the last 24 hours, Aevo has increased by +5.06%. It currently has a circulating supply of 903,184,800 AEVO and a maximum supply of 1,000,000,000 AEVO, giving it a fully diluted market cap of $110.61M. At present, the Aevo coin holds the 0 position in market cap rankings. The Aevo/USD price is updated in real-time.

Today

+$0.0058900

+5.06%

7 days

-$0.02124

-14.81%

30 days

+$0.034160

+38.77%

3 months

-$0.03674

-23.11%

Popular Aevo conversions

Last updated: 05/18/2025, 15:18

| 1 AEVO to USD | $0.12247 |

| 1 AEVO to EUR | €0.10972 |

| 1 AEVO to PHP | ₱6.8343 |

| 1 AEVO to IDR | Rp 2,019.96 |

| 1 AEVO to GBP | £0.092201 |

| 1 AEVO to CAD | $0.17110 |

| 1 AEVO to AED | AED 0.44983 |

| 1 AEVO to VND | ₫3,174.44 |

About Aevo (AEVO)

- Official website

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Aevo FAQ

How much is 1 Aevo worth today?

Currently, one Aevo is worth $0.12226. For answers and insight into Aevo's price action, you're in the right place. Explore the latest Aevo charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Aevo, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Aevo have been created as well.

Will the price of Aevo go up today?

Check out our Aevo price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Asset details

Name

OKcoin Europe LTD

Relevant legal entity identifier

54930069NLWEIGLHXU42

Name of the crypto-asset

Aevo

Consensus Mechanism

The Ethereum network uses a Proof-of-Stake Consensus Mechanism to validate new transactions on the blockchain. Core Components 1. Validators: Validators are responsible for proposing and validating new blocks. To become a validator, a user must deposit (stake) 32 ETH into a smart contract. This stake acts as collateral and can be slashed if the validator behaves dishonestly. 2. Beacon Chain: The Beacon Chain is the backbone of Ethereum 2.0. It coordinates the network of validators and manages the consensus protocol. It is responsible for creating new blocks, organizing validators into committees, and implementing the finality of blocks. Consensus Process 1. Block Proposal: Validators are chosen randomly to propose new blocks. This selection is based on a weighted random function (WRF), where the weight is determined by the amount of ETH staked. 2. Attestation: Validators not proposing a block participate in attestation. They attest to the validity of the proposed block by voting for it. Attestations are then aggregated to form a single proof of the block’s validity. 3. Committees: Validators are organized into committees to streamline the validation process. Each committee is responsible for validating blocks within a specific shard or the Beacon Chain itself. This ensures decentralization and security, as a smaller group of validators can quickly reach consensus. 4. Finality: Ethereum 2.0 uses a mechanism called Casper FFG (Friendly Finality Gadget) to achieve finality. Finality means that a block and its transactions are considered irreversible and confirmed. Validators vote on the finality of blocks, and once a supermajority is reached, the block is finalized. 5. Incentives and Penalties: Validators earn rewards for participating in the network, including proposing blocks and attesting to their validity. Conversely, validators can be penalized (slashed) for malicious behavior, such as double-signing or being offline for extended periods. This ensures honest participation and network security.

Incentive Mechanisms and Applicable Fees

Ethereum, particularly after transitioning to Ethereum 2.0 (Eth2), employs a Proof-of-Stake (PoS) consensus mechanism to secure its network. The incentives for validators and the fee structures play crucial roles in maintaining the security and efficiency of the blockchain. Incentive Mechanisms 1. Staking Rewards: Validator Rewards: Validators are essential to the PoS mechanism. They are responsible for proposing and validating new blocks. To participate, they must stake a minimum of 32 ETH. In return, they earn rewards for their contributions, which are paid out in ETH. These rewards are a combination of newly minted ETH and transaction fees from the blocks they validate. Reward Rate: The reward rate for validators is dynamic and depends on the total amount of ETH staked in the network. The more ETH staked, the lower the individual reward rate, and vice versa. This is designed to balance the network's security and the incentive to participate. 2. Transaction Fees: Base Fee: After the implementation of Ethereum Improvement Proposal (EIP) 1559, the transaction fee model changed to include a base fee that is burned (i.e., removed from circulation). This base fee adjusts dynamically based on network demand, aiming to stabilize transaction fees and reduce volatility. Priority Fee (Tip): Users can also include a priority fee (tip) to incentivize validators to include their transactions more quickly. This fee goes directly to the validators, providing them with an additional incentive to process transactions efficiently. 3. Penalties for Malicious Behavior: Slashing: Validators face penalties (slashing) if they engage in malicious behavior, such as double-signing or validating incorrect information. Slashing results in the loss of a portion of their staked ETH, discouraging bad actors and ensuring that validators act in the network's best interest. Inactivity Penalties: Validators also face penalties for prolonged inactivity. This ensures that validators remain active and engaged in maintaining the network's security and operation. Fees Applicable on the Ethereum Blockchain 1. Gas Fees: Calculation: Gas fees are calculated based on the computational complexity of transactions and smart contract executions. Each operation on the Ethereum Virtual Machine (EVM) has an associated gas cost. Dynamic Adjustment: The base fee introduced by EIP-1559 dynamically adjusts according to network congestion. When demand for block space is high, the base fee increases, and when demand is low, it decreases. 2. Smart Contract Fees: Deployment and Interaction: Deploying a smart contract on Ethereum involves paying gas fees proportional to the contract's complexity and size. Interacting with deployed smart contracts (e.g., executing functions, transferring tokens) also incurs gas fees. Optimizations: Developers are incentivized to optimize their smart contracts to minimize gas usage, making transactions more cost-effective for users. 3. Asset Transfer Fees: Token Transfers: Transferring ERC-20 or other token standards involves gas fees. These fees vary based on the token's contract implementation and the current network demand.

Beginning of the period to which the disclosure relates

2024-04-20

End of the period to which the disclosure relates

2025-04-20

Energy report

Energy consumption

119.30865 (kWh/a)

Energy consumption sources and methodologies

The energy consumption of this asset is aggregated across multiple components:

To determine the energy consumption of a token, the energy consumption of the network(s) ethereum is calculated first. Based on the crypto asset's gas consumption per network, the share of the total consumption of the respective network that is assigned to this asset is defined. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.

AEVO calculator

Socials