RAY

Raydium price

$3.4727

+$0.046700

(+1.36%)

Price change for the last 24 hours

How are you feeling about RAY today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Raydium market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$1.01B

Circulating supply

289,786,142 RAY

52.21% of

555,000,000 RAY

Market cap ranking

59

Audits

Last audit: Jun 3, 2021

24h high

$3.8646

24h low

$3.3348

All-time high

$8.6799

-60.00% (-$5.2072)

Last updated: Jan 24, 2025

All-time low

$0.13400

+2,491.56% (+$3.3387)

Last updated: Dec 30, 2022

Raydium Feed

The following content is sourced from .

Alpha Seeker reposted

Emperor Osmo 🐂 🎯

Attention capital markets.

Internet capital markets.

Send it.

Yash

how to win the internet capital markets (icm) meta:

with 1000s of app token launches, it’s going to get chaotic on solana — here are my quick running thoughts:

–– first off, @believeapp is a great start and deserves credit for kicking off this meta. but it’s not truly icm (equity on-chain) — it’s more acm (attention capital markets):

1) no equity value — apps don’t have direct token integrations, and token holders don’t have claim to any revenue. it’s an attention token — and that’s fine!

2) attention = volumes = revenues [they're inherently incentivized to chase frothy narratives (like ai agents) to drive speculation]

3) >95% of apps will be from failed non-crypto founders looking for quick money — and that’s fine too, if they stick around and keep building in consumer crypto.

i'm hoping all of them embed a solana wallet soon in their apps, or they’ll just suck liquidity.

for investors (token buyers):

you've to guess: how much attention can this app get?

the best way –– try it out yourself and evaluate:

– virality: does it have social/referral/token mechanics to go viral?

– dev/founder: is the founder full-time or is this a side project? doesn’t matter who they are if they’re not committed.

– are they shipping and iterating based on feedback, or just launched and now shilling the token? (if you can, talk to the founder before taking a sizeable position –– avoid any shiller's words)

– crypto Integration: does the app actually use crypto, or is it a failed Web2 app trying to farm liquidity?

– longevity: any platform play or retention mechanics that can make it last longer?

– is the app live, or is it just a future launch? (most launches are bearish events — expectations usually outpace reality)

what's ahead for internet capital markets:

while believe is an early glimpse, if this meta sticks, it’ll evolve a lot. for instance:

1) launchpads will stay permissionless — but frontends will emerge to filter for quality. different frontends for different niches. protocol launchpads will compete (meteora dbc vs raydium Launchlab vs pump), but frontends will build moats via:

– quality filters

– integrations

– embedded builder engines (e.g., vibe coding with @devfunpump)

just like we have cex tiers, we’ll see tiers of frontend launchpads — ranked by user adoption and curation quality.

2) big opportunity for research firms and newsletters focused on liquid tokens (not alpha callers/shillers) –– think how it works in equity markets:

–– independent research orgs (institutional and retail) will give tokens moody’s-style ratings, publishing proper research reports to help retail navigate.

–– better research = better reputation = more influence.

3) someone will crack on-chain equity via an island jurisdiction (i.e owning tokens = owning equity of the app at the time of token launch itself) –– which @aeyakovenko pointed out as true internet capital markets.

re: AI. it'll accelerate this meta a lot –– it's a huge tailwind and timing couldn't have been better.

overall, love the focus on apps and consumers, combined with the speculation flywheel. i'll be doubling down on this meta –– and try my best to shape it. stay tuned.

solana apps szn.

attention capital markets.

internet capital markets. send it.

4.68K

46

Yash

how to win the internet capital markets (icm) meta:

with 1000s of app token launches, it’s going to get chaotic on solana — here are my quick running thoughts:

–– first off, @believeapp is a great start and deserves credit for kicking off this meta. but it’s not truly icm (equity on-chain) — it’s more acm (attention capital markets):

1) no equity value — apps don’t have direct token integrations, and token holders don’t have claim to any revenue. it’s an attention token — and that’s fine!

2) attention = volumes = revenues [they're inherently incentivized to chase frothy narratives (like ai agents) to drive speculation]

3) >95% of apps will be from failed non-crypto founders looking for quick money — and that’s fine too, if they stick around and keep building in consumer crypto.

i'm hoping all of them embed a solana wallet soon in their apps, or they’ll just suck liquidity.

for investors (token buyers):

you've to guess: how much attention can this app get?

the best way –– try it out yourself and evaluate:

– virality: does it have social/referral/token mechanics to go viral?

– dev/founder: is the founder full-time or is this a side project? doesn’t matter who they are if they’re not committed.

– are they shipping and iterating based on feedback, or just launched and now shilling the token? (if you can, talk to the founder before taking a sizeable position –– avoid any shiller's words)

– crypto Integration: does the app actually use crypto, or is it a failed Web2 app trying to farm liquidity?

– longevity: any platform play or retention mechanics that can make it last longer?

– is the app live, or is it just a future launch? (most launches are bearish events — expectations usually outpace reality)

what's ahead for internet capital markets:

while believe is an early glimpse, if this meta sticks, it’ll evolve a lot. for instance:

1) launchpads will stay permissionless — but frontends will emerge to filter for quality. different frontends for different niches. protocol launchpads will compete (meteora dbc vs raydium Launchlab vs pump), but frontends will build moats via:

– quality filters

– integrations

– embedded builder engines (e.g., vibe coding with @devfunpump)

just like we have cex tiers, we’ll see tiers of frontend launchpads — ranked by user adoption and curation quality.

2) big opportunity for research firms and newsletters focused on liquid tokens (not alpha callers/shillers) –– think how it works in equity markets:

–– independent research orgs (institutional and retail) will give tokens moody’s-style ratings, publishing proper research reports to help retail navigate.

–– better research = better reputation = more influence.

3) someone will crack on-chain equity via an island jurisdiction (i.e owning tokens = owning equity of the app at the time of token launch itself) –– which @aeyakovenko pointed out as true internet capital markets.

re: AI. it'll accelerate this meta a lot –– it's a huge tailwind and timing couldn't have been better.

overall, love the focus on apps and consumers, combined with the speculation flywheel. i'll be doubling down on this meta –– and try my best to shape it. stay tuned.

solana apps szn.

attention capital markets.

internet capital markets. send it.

Show original12.14K

115

Crypto Town Hall

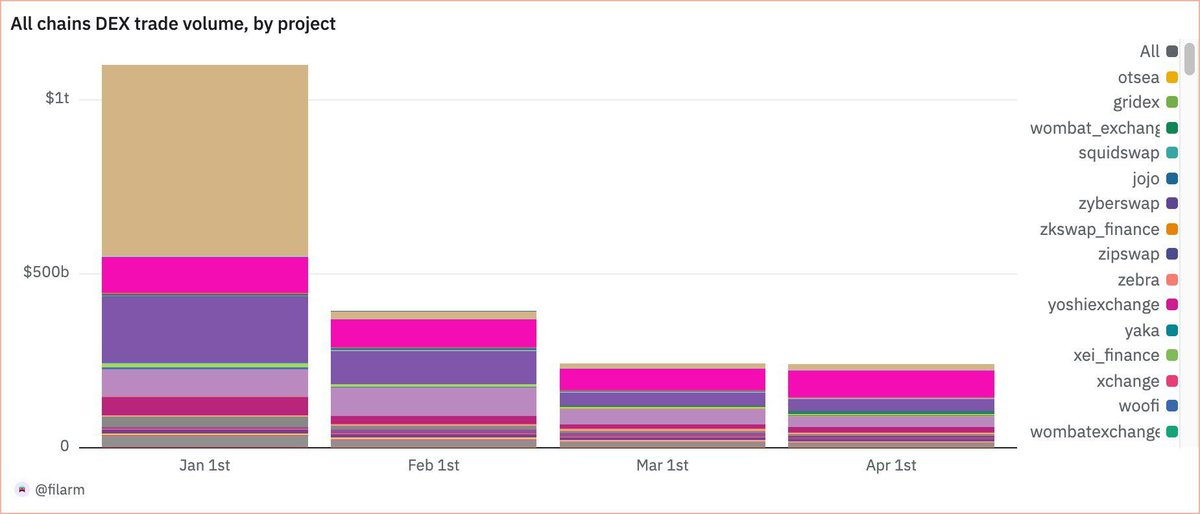

TRENCHES: UNISWAP LEADS APRIL DEX VOLUME AT $70B, RAYDIUM CLOSES STRONG WITH $33B

Uniswap dominated the decentralized exchange leaderboard in April, clearing $70 billion in monthly volume. Raydium followed as a surprise second, processing $33 billion amid Solana’s continued DeFi momentum. As cross-chain liquidity deepens and gas-efficient ecosystems gain traction, the volume race is heating up across Ethereum and Solana—pushing DEXs back into the spotlight.

Source: @Crypto_Briefing

Mario Nawfal’s Roundtable

DEFI: UNISWAP BECOMES FIRST DEX TO HIT $3 TRILLION IN TOTAL TRADING VOLUME

Source: DefiLlama

23.33K

73

TylerD 🧙♂️

The Morning Minute (5.14)

⏰Top News:

-Crypto majors are up 1-4% with ETH leading at $2,625

-Robinhood acquires Canadian crypto firm WonderFi for $180M

-Abraxas Capital Management buys ~$500M of ETH over past week

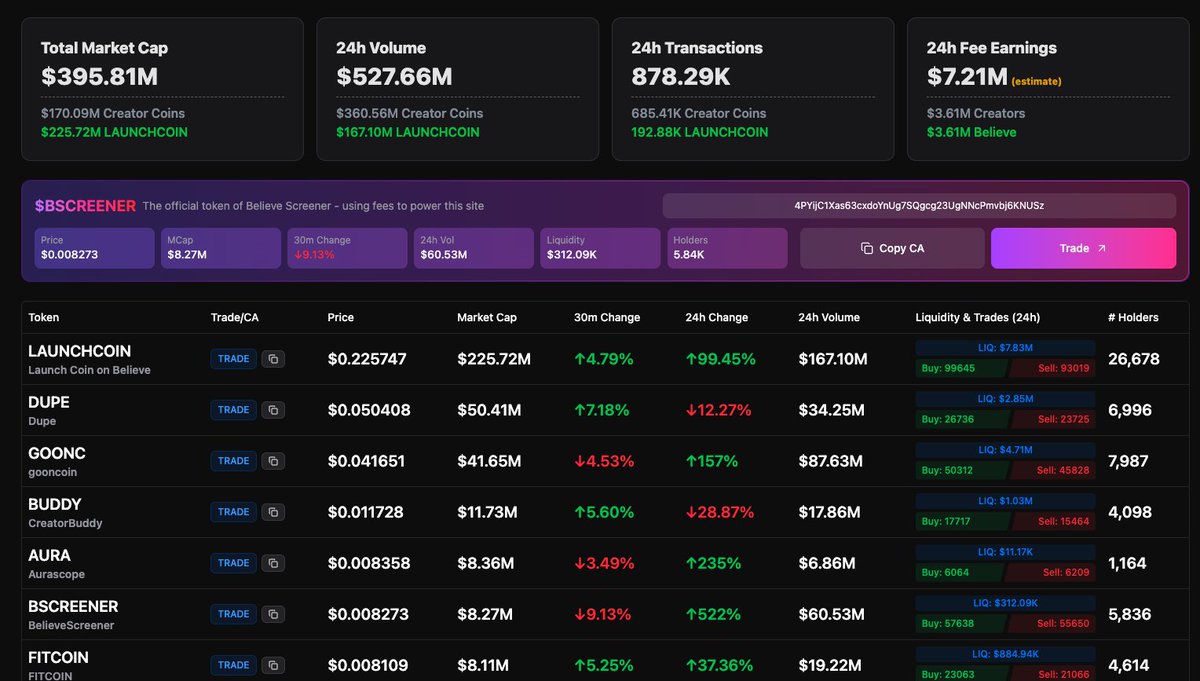

-Launchcoin ecosystem reaches $400M in size, sees $3.5M in daily fees

-CryptoPunks IP acquired by The Infinite Node Foundation for a reported $20M

🌎Macro Crypto and Memes

-Crypto majors are green with ETH leading; BTC +1% at $103,900, ETH +4.5% at $2,600, XRP +3% at $2.61, SOL +4% at $180

-RAY (+16%), PI (+13%), WAL (+11%) and ENA (+11%) led top alt movers

-BlackRock’s IBIT BTC ETF broke its 20-day streak of inflows, coming in flat on Monday

-Tether has purchased 4,812 BTC ($459M) to seed the treasury of 21 Capital, the new Bitcoin-focused company set to go public via a SPAC merger with Cantor Equity Partners

-Robinhood acquired WonderFi for $180M as it expands its crypto services into Canada

-VanEck launched VBILL as its first tokenised treasury fund on ETH, SOL and other chains, tokenized by Securitzie

-Solana published a 26-page paper on tokenized equities outlining while their uniquely qualified to be the blockchain of choice

-A Fidelity spokesmen gave a speech on Bitcoin, asking companies if they’re returning more than 65% on their invested capital and if not, telling them to buy Bitcoin

-Abraxas Capital Management has bought ~$500M of ETH in the past week

-Galaxy Digital posted a $295 million net loss in Q1, just before its planned Nasdaq debut

-Arizona Governor Katie Hobbs vetoed bills that would have expanded the state's use of digital assets but signed legislation imposing strict regulations on crypto ATMs

In Memes

Memecoin leaders were green; DOGE +3%, Shiba +3%, PEPE +1%, TRUMP +5%, BONK +4% & FARTCOIN +5%

Launchcoin dominated the Solana market again, with the overall ecosystem surging to $400M market cap led by LAUNCHCOIN running to $220M (+90%)

GOONCOIN (+150%), BSCREENER (+550%) and AURA (+240%) were other notable Believe app movers

💰 Token, Airdrop & Protocol Tracker

-Abstract head Luca Netz teased a Q4 TGE for $ABS on Tuesday

-The Believe app generated ~$3.5M in fees on the day, more than Pump Fun

-Kaito kicked off their partnership with Virtuals, with yappers and sKAITO holders staking 5k+ KAITO eligible to earn Virtuals Virgen points

-Ethos airdropped 256 Ethos Validator NFTs to their top contributors, which opened at a 2.5 ETH floor

-Hyperliquid added Fartcoin spot trading to its platform

🤖 AI x Crypto

-Overall market cap jumped 1% to $11.4B, leaders were mixed

-FARTCOIN (+5%), VIRTUAL (-2%), ai16z (-1%), GOAT (-8%), and AIXBT (even)

-SHOGGOTH (+50%), VVAIFU (+30%), BNKR (+30%) and CLANKER (+25%) led notable movers

-Virtual led mindshare with a 20% share; Fartcoin and REKT are next

-Coinbase is adding encrypted messaging allowing for AI Agent communication for its Coinbase Wallet

🚚 What is happening in NFTs?

-ETH NFT leaders are mixed with Punks leading; Punks +3% at 47.5 ETH, Pudgy -5% at 10.6, BAYC -3% at 12.1 ETH

-Chubbicorns (48%) and Moncats (+20%) led notable movers

-CryptoPunks jumped to 48 ETH ($128,000) after news of their acquisition by The Infinite Node foundation

-BTC NFT leaders were very green again; Taproot Wizards +5% at 0.204 BTC, Bitcoin Puppets +3%, NodeMonkes +6%, OMB +21%, Quantum Cats even

-Abstract NFTs went live on OpenSea leading to most collections jumping 10-20%

-Refik Anadol sold out his project ‘Biome Lumina’ in 25 minutes, which consisted of 1000 pieces at $5k a pop ($5M raise), now at a 3.15 ETH floor

-Meebits wearables went live for minting on OpenSea in partnership with PlayerZero

Show original

392.41K

50

Raydium price performance in USD

The current price of Raydium is $3.4727. Over the last 24 hours, Raydium has increased by +1.36%. It currently has a circulating supply of 289,786,142 RAY and a maximum supply of 555,000,000 RAY, giving it a fully diluted market cap of $1.01B. At present, the Raydium coin holds the 59 position in market cap rankings. The Raydium/USD price is updated in real-time.

Today

+$0.046700

+1.36%

7 days

+$0.99460

+40.13%

30 days

+$1.4562

+72.21%

3 months

-$1.7253

-33.20%

Popular Raydium conversions

Last updated: 05/15/2025, 08:45

| 1 RAY to USD | $3.4719 |

| 1 RAY to BRL | R$19.5798 |

| 1 RAY to PHP | ₱193.99 |

| 1 RAY to EUR | €3.1050 |

| 1 RAY to IDR | Rp 57,500.83 |

| 1 RAY to GBP | £2.6175 |

| 1 RAY to CAD | $4.8537 |

| 1 RAY to AED | AED 12.7523 |

About Raydium (RAY)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Raydium FAQ

How much is 1 Raydium worth today?

Currently, one Raydium is worth $3.4727. For answers and insight into Raydium's price action, you're in the right place. Explore the latest Raydium charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Raydium, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Raydium have been created as well.

Will the price of Raydium go up today?

Check out our Raydium price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials