XRP

XRP price

$2.0947

-$0.03020

(-1.43%)

Price change for the last 24 hours

How are you feeling about XRP today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

XRP market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$122.45B

Circulating supply

58,503,545,101 XRP

58.50% of

100,000,000,000 XRP

Market cap ranking

3

Audits

Last audit: Aug 16, 2023

24h high

$2.1615

24h low

$2.0805

All-time high

$3.4040

-38.47% (-$1.3093)

Last updated: Jan 17, 2025

All-time low

$0.10370

+1,919.96% (+$1.9910)

Last updated: Mar 13, 2020

XRP Feed

The following content is sourced from .

MoreMarkets

Every asset wants to have the "monetary premium."

A good way to achieve this premium is through utility in lending and collateral markets.

MoreMarkets is the global liquidity marketplace with a vertical DeFi stack that unlocks utility for idle assets, starting from $XRP.

Show original9.73K

1

TylerD 🧙♂️

The Morning Minute (5.6)

⏰Top News:

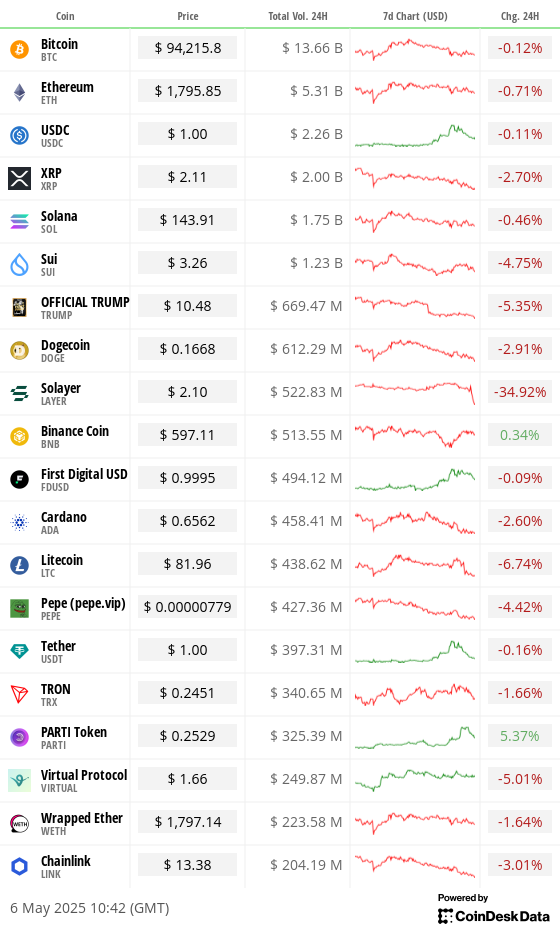

-Crypto majors continue decline; BTC at $93,800

-GENIUS bill faces issues in Congress over Trump’s involvement

-Bernstein predicts $330B in corporate BTC inflows by 2029

-Defi Development acquires another $72M of Solana

-Freight Technologies announces strategic TRUMP reserve

🌎 Macro Crypto and Memes

-Crypto majors are red this morning while gold jumps 2% to retest local highs; BTC -1% at $94,000, ETH -1% at $1,780, XRP -3% at 2.10, SOL -1% at $143

-FORM (+6%), XDC (+3%) and DEXE (+3%) led alts

-Senate Democrats are trying to delay the GENIUS Act (stablecoin legislation) due to concerns about President Trump's financial interests in crypto, potentially hindering broader market structure reforms

-Meanwhile a new draft crypto market structure bill is floating around the House and would end the SEC’s oversight over most crypto assets

-Semler Scientific purchased 167 BTC, increasing its total to 3,634 BTC ($342M)

-Bernstein analysts predicted $330B in corporate BTC inflows by 2029

-Florida became the latest state to withdraw its Bitcoin Reserve bill

-Vitalik has proposed reducing the Ethereum network's complexity to make it more accessible and maintainable

-Ripple announced a $25M investment in U.S. classrooms through Donors Choice and Teach for America

-VanEck filed for the first-ever BNB spot ETF

-A Kenyan High Court ordered Worldcoin to delete its citizens’ biometric data within 7 days

-eToro filed for an IPO seeking to raise $500M at a $4B valuation

-Defi Development (previously Janover) acquired another $72M of Solana via acquisition

In Memes

-Memecoin leaders were mostly red; DOGE -3%, Shiba -2%, PEPE -5%, TRUMP -4%, BONK -2% & FARTCOIN +1%

-Freight Technologies announced plans to raise funds to acquire the TRUMP memecoin, leading to a 100% gain last week before selling off this past Monday

💰 Token, Airdrop & Protocol Tracker

-Bybit announced stocks, indexes, oil and gold will be tradeable on its exchange soon

-Berachain’s BOYCO rewards unlock today

-Ethena is bringing its USDE to Hyperliquid

-Wasabi announced its first JLP vault along with 104% yield on its BERA deposits

-AIMI teased the first-ever agentic AI prediction market integration with Myriad with more info coming today

-Kraken listed USDT0, the omnichain version of USDT from Flare Networks

🤖 AI x Crypto

-Overall market cap fell 1% to $8.8B, leaders were mixed

-FARTCOIN (+2%), VIRTUAL (-5%), ai16z (+3%), AIXBT (-8%), and ALCH (-7%)

-MOBY (+20%) and SEKOIA (+10%) led notable movers

-Fartcoin led mindshare with a 10% share; AVA and Virtual are next

-Virtuals announced several changes to its Virgen points system

🚚 What is happening in NFTs

-ETH NFT leaders are mostly even; Punks even at 44.5 ETH, Pudgy even at 11.7, BAYC even at 13.85 ETH

-Good Vibes Club (+12%), Otherside Kodas (+29%), and Kaito Genesis (+17%) led notable movers

-BTC NFT leaders were mixed with Taproot Wizards +3% at 0.183 BTC, Bitcoin Puppets -3%, NodeMonkes -4%, OMB -1%, Quantum Cats +2%

-Abstract NFTs were very green led by Captain & Company (+40%), Kabu (+30%) and RUYUI (+21%)

Show original

29.93K

25

CoinDesk

By Omkar Godbole (All times ET unless indicated otherwise)

As bitcoin (BTC) and the wider crypto market await the Fed's rate decision on Wednesday, an anomaly has emerged that could weigh heavily on market mood: renewed doubt over the passing of U.S. crypto regulation.

Early Tuesday, CoinDesk reported that Senate Democrats are hesitant to push forward landmark stablecoin legislation, citing concerns over President Donald Trump's growing personal gains from his crypto ventures.

When Trump took office, many observers felt crypto regulation would proceed smoothly. Looking back, that optimism was probably misplaced. With the president actively involved in digital assets through family-linked projects like WLFI and memecoins, opposition has mounted, potentially slowing the regulatory progress.

That might lead investors to reprice regulatory uncertainty just as charts for BTC and XRP are signaling pullback risks. Additionally, according to CryptoQuant, there are signs of renewed weakness in bitcoin demand from U.S.-based investors.

"Over the past month, the premium recovered significantly but is now dropping again — aligning with the recent BTC price correction," CryptoQuant contributor AbramChart said.

On the positive side, U.S.-listed spot bitcoin exchange-traded funds (ETFs) marked three straight days of net inflows.

Acting CFTC Chairman Caroline Pham told crypto journalist Eleanor Terret that the derivatives market regulator plans to observe a handful of tokenization pilot programs to evaluate the technology and see how well tokenized assets function in the real world .

Speaking of traditional markets and macro, Taiwan dollar forward contracts signal extreme pressure on the U.S. dollar, meaning the greenback could continue to weaken against the Asian currency and probably major currencies like the euro. The broad-based USD weakness may act as a tailwind for crypto. FX market volatility could drive investors to gold and perhaps bitcoin, too, unless it leads to a broad-based risk-off, in which case BTC may feel the heat.

The other bullish development is the U.S. Treasury Secretary Scott Bessent's comments that U.S. rates now carry sovereign credit risk and not just long-term growth and inflation expectations. In other words, rates are artificially high because the U.S. government itself is now the risk premium, as pseudonymous observer EndGame Macro said. So, a shift away from U.S. assets and into alternative investments could continue. Stay alert!

What to Watch

Crypto:

May 6, 7:15 a.m.: Casper Network (CSPR) launches its 2.0 mainnet upgrade, introducing faster transactions, enhanced smart contracts, and improved staking features to boost enterprise adoption.

May 7, 6:05 a.m.: The Pectra hard fork network upgrade will get activated on the Ethereum (ETH) mainnet at epoch 364032. Pectra combines two major components: the Prague execution layer hard fork and the Electra consensus layer upgrade.

May 8: Judge John G. Koeltl will sentence Alex Mashinsky, the founder and former CEO of the now-defunct crypto lending firm Celsius Network, at the U.S. District Court for the Southern District of New York.

Macro

May 6, 9 a.m.: S&P Global releases Brazil April purchasing managers’ index (PMI) data.

Composite PMI Prev. 52.6

Services PMI Prev. 52.5

May 6, 10 a.m.: U.S. House Financial Services Committee and Agriculture Committee joint hearing titled “American Innovation and the Future of Digital Assets: A Blueprint for the 21st Century.” Livestream link.

May 7, 2 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC press conference is livestreamed 30 minutes later.

Federal Funds Rate Target Range Est. 4.25%-4.5% vs. Prev. 4.25%-4.5%

May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

Bank Rate Est. 4.25% vs. Prev. 4.5%

Earnings (Estimates based on FactSet data)

May 6: Cipher Mining (CIFR), pre-market, $-0.08

May 8: CleanSpark (CLSK), post-market, $-0.11

May 8: Coinbase Global (COIN), post-market, $1.88

May 8: Hut 8 (HUT), pre-market, $-0.10

May 8: MARA Holdings (MARA), post-market, $-0.52

May 13: Semler Scientific (SMLR), post-market

Token Events

Governance votes & calls

Uniswap DAO is voting on whether to pay Forse, a data‑analytics platform from StableLab, $60,000 in UNI to build an “analytics hub” that tracks how incentive programs are working on four more blockchains. Voting ends on May 6.

Arbitrum DAO is voting on whether to put the last $10.7 million from its 35 million ARB diversification plan into three low‑risk, dollar‑based funds from WisdomTree, Spiko and Franklin Templeton. Voting ends on May 8.

May 6, 1:30 p.m.: MetaMask and Aave to host an X Spaces session on USDC supplied to Aave being spendable on the MetaMask card.

May 7, 7:30 a.m.: PancakeSwap to host an X Spaces Ask Me Anything (AMA) session on the future of trading.

May 7, 9 a.m.: Binance to host an AMA on its Binance Seeds program.

May 7, 11 a.m.: Pendle to host a Pendle Yield Talk: Stablecoin Alpha X Spaces session.

May 8, 10 a.m.: Balancer and Euler to host an Ask Me Anything (AMA) session.

Unlocks

May 7: Kaspa (KAS) to unlock 0.55% of its circulating supply worth $13.24 million.

May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $8.97 million.

May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $55.93 million.

May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $54.97 million.

May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.12 billion.

May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $16.34 million.

Token Launches

May 7: Obol (OBOL) to be listed on Binance, Bitget, Bybit, Gate.io, MEXC,and others.

May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 1 of 2: Financial Times Digital Assets Summit (London)

Day 1 of 3: Stripe Sessions (San Francisco)

May 7-9: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

May 11-17: Canada Crypto Week (Toronto)

May 12-13: Dubai FinTech Summit

May 12-13: Filecoin (FIL) Developer Summit (Toronto)

May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

May 13: Blockchain Futurist Conference (Toronto)

May 13: ETHWomen (Toronto)

May 14-16: CoinDesk's Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

Tokens of some DeFi powerhouses are catching a bid as attention turns to fundamentals in a flat market.

Hyperliquid's HYPE token surged 72% over the past week, outpacing most of the top 100 tokens. The platform's gas-free, order book-based, decentralized exchange model is attracting traders seeking efficient and transparent trading environments.

AAVE has seen increased activity with the integration of Ripple's RLUSD stablecoin into its V3 Ethereum Core Market. The move aims to bridge traditional finance with DeFi, enhancing AAVE's appeal to institutional investors.

Despite a recent security breach on Curve Finance's X account, CRV managed to post a 40% gain in the past week, demonstrating investor confidence in the underlying protocol.

Kay Lu, CEO of HashKey Eco Labs, said in a note to CoinDesk that traders are turning to projects with stronger fundamentals and token economics as memecoins fall out of favor.

Derivatives Positioning

XMR, TAO, ADA lead majors in 24-hour growth of perpetual futures open interest. XRP, meanwhile, has the most negative 24-hour cumulative volume delta, hinting at an influx of selling pressure.

BTC's funding rate is barely positive, while ETH has flipped marginally negative, both pointing to weakening of bull momentum.

CME futures basis climbed to between 5% and 10%, reviving interest in cash-and-carry arbitrage trades, according to Binance Research.

Flows in the Deribit-listed options market have been mixed with May BTC calls and puts lifted.

Market Movements

BTC is down 0.19% from 4 p.m. ET Monday at $94,160 (24hrs: -0.18%)

ETH is down 1.09% at $1,795.10 (24hrs: -0.66%)

CoinDesk 20 is down 1.05% at 2,675.34 (24hrs: -0.96%)

Ether CESR Composite Staking Rate is up 7 bps at 2.964%

BTC funding rate is at 0.0046% (5.1147% annualized) on Binance

DXY is down 0.14% at 99.69

Gold is up 1.99% at $3,379.76/oz

Silver is up 2.13% at $32.99/oz

Nikkei 225 closed +1.04% at 36,830.69

Hang Seng closed +0.7% at 22,662.71

FTSE is down 0.18% at 8,580.67

Euro Stoxx 50 is down 1.14% at 4,719.66

DJIA closed on Monday -0.24% at 41,218.83

S&P 500 closed -0.64% at 5,650.38

Nasdaq closed -0.74% at 17,844.24

S&P/TSX Composite Index closed -0.31% at 24,953.52

S&P 40 Latin America closed -1.15% at 2,493.86

U.S. 10-year Treasury rate is up 1 bp at 4.36%

E-mini S&P 500 futures are down 0.74% at 5,629.75

E-mini Nasdaq-100 futures are down 1.05% at 19,845.50

E-mini Dow Jones Industrial Average Index futures are down 0.61% at 41,067.00

Bitcoin Stats

BTC Dominance: 64.91 (0.13%)

Ethereum to bitcoin ratio: 0.01910 (-0.52%)

Hashrate (seven-day moving average): 908 EH/s

Hashprice (spot): $50.13

Total Fees: 5.10 BTC / $480,379.20

CME Futures Open Interest: 143,680 BTC

BTC priced in gold: 28.1 oz

BTC vs gold market cap: 7.97%

Technical Analysis

VIRTUAL, the native token of the Base-native Virtuals Protocol for creating and owning AI agents, has established a base above the 23.6% Fibonacci retracement of the January-April sell-off.

The breakout means potential for a rally to the 38.2% Fibonacci level of $2.22.

VIRTUAL is the best-performing coin of the past 30 days.

Crypto Equities

Strategy (MSTR): closed on Monday at $386.53 (-1.99%), down 1.25% at $381.68 in pre-market

Coinbase Global (COIN): closed at $199.40 (-2.7%), down 0.63% at $198.15

Galaxy Digital Holdings (GLXY): closed at C$26.51 (-1.23%)

MARA Holdings (MARA): closed at $13.09 (-9.6%), down 1.22% at $12.93

Riot Platforms (RIOT): closed at $7.90 (-5.84%), down 1.27% at $7.80

Core Scientific (CORZ): closed at $8.75 (+0.11%)

CleanSpark (CLSK): closed at $8.09 (-8.17%), down 0.62% at $8.04

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.26 (-4.74%)

Semler Scientific (SMLR): closed at $33.58 (-7.13%), down 0.24% at $33.50

Exodus Movement (EXOD): closed at $41.28 (-7.84%), up 0.51% at $41.49

ETF Flows

Spot BTC ETFs:

Daily net flow: $425.5 million

Cumulative net flows: $40.63 billion

Total BTC holdings ~ 1.17 million

Spot ETH ETFs

Daily net flow: $0 million

Cumulative net flows: $2.53 billion

Total ETH holdings ~ 3.47 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Bitcoin's 30-day implied volatility has dropped to the lowest since July last year.

In other words, volatility is cheap, which is when seasoned traders typically prefer to buy options.

While You Were Sleeping

BlackRock, Citi CEOs to Visit Saudi Arabia Along With Trump (Bloomberg): Several top U.S. CEOs will speak May 13 at the Saudi-U.S. Investment Forum in Riyadh, the day President Donald Trump arrives to seek another $1 trillion in Saudi trade and investment.

Bitcoin Developers Plan OP_RETURN Limit Removal in Next Release (CoinDesk): Bitcoin Core’s plan to lift the cap has divided developers, with supporters citing cleaner UTXO handling and critics warning of spam risks and a shift away from financial use.

Watch Out Bitcoin Bulls, $99.9K Price May Test Your Mettle (CoinDesk): Long-term BTC holders may take profits at $99,900, aligning with their historical behavior of selling at 350% paper gains, according to on-chain data from Glassnode.

VIRTUAL Surges 200% in a Month as Smart Money Pours Into Virtuals Protocol (CoinDesk): The native token of the Base-powered decentralized AI agent platform has surged 207% in the past month, helped by $14.2 million in inflows from smart money, according to Nansen.

Ukraine Targets Moscow With Drones for Second Straight Night, Officials Say (Reuters): All four Moscow airports were shut for several hours after Russian forces intercepted 19 drones days before the city’s planned World War II victory anniversary celebrations.

Fed Confronts Lose-Lose Scenario Amid Haphazard Tariff Rollout (The Wall Street Journal): Fed officials are expected to delay rate cuts, fearing premature moves could intensify inflation driven by Trump’s tariffs and strained global supply chains.

In the Ether

Show original

18.07K

0

XRP price performance in USD

The current price of XRP is $2.0947. Over the last 24 hours, XRP has decreased by -1.42%. It currently has a circulating supply of 58,503,545,101 XRP and a maximum supply of 100,000,000,000 XRP, giving it a fully diluted market cap of $122.45B. At present, the XRP coin holds the 3 position in market cap rankings. The XRP/USD price is updated in real-time.

Today

-$0.03020

-1.43%

7 days

-$0.18630

-8.17%

30 days

+$0.043400

+2.11%

3 months

-$0.28640

-12.03%

Popular XRP conversions

Last updated: 05/06/2025, 21:41

| 1 XRP to USD | $2.0930 |

| 1 XRP to BRL | R$11.9037 |

| 1 XRP to PHP | ₱116.49 |

| 1 XRP to EUR | €1.8480 |

| 1 XRP to IDR | Rp 34,396.06 |

| 1 XRP to GBP | £1.5656 |

| 1 XRP to CAD | $2.8893 |

| 1 XRP to AED | AED 7.6875 |

About XRP (XRP)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Learn more about XRP (XRP)

XRP's Market Dynamics and Future Prospects

Introduction XRP has been a focal point in the cryptocurrency market, experiencing significant fluctuations influenced by various factors. This article explores the recent developments, technical indicators, and broader market dynamics affecting XRP.

Apr 24, 2025|OKX

What is Ripple XRP: Get to know all about XRP token

## What is Ripple XRP? Ripple XRP (XRP) is a digital asset that operates on the XRP Ledger, an open-source, permissionless, and decentralized blockchain technology. Designed to revolutionize global pa

Mar 25, 2025|OKX

What is XRP? Supporting fast and low-cost international payments

XRP emerged in 2012 aiming to redefine the way we conduct payments. Many believe that Ripple Payments — the product that leverages XRP for cross-border transactions — has the power to disrupt conventional banking infrastructure for the better. How? By allowing funds to be sent internationally at exceptional speed and with minimal fees.

Jan 23, 2025|OKX|

Beginners

Spot XRP ETF approval: is a Ripple ETF inevitable?

As one of the original Layer-1s to make waves in the crypto space, Ripple and its native currency XRP are no stranger to anyone familiar with crypto thanks to its cross-border efficiency and rapid low-cost transactions. With spot crypto ETFs being one of the key achievements of 2024 for the crypto industry, many weren't surprised when Ripple CEO Brad Garlinghouse made headlines by stating that an .

Nov 8, 2024|OKX|

Beginners

XRP FAQ

How much is 1 XRP worth today?

Currently, one XRP is worth $2.0947. For answers and insight into XRP's price action, you're in the right place. Explore the latest XRP charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as XRP, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as XRP have been created as well.

Will the price of XRP go up today?

Check out our XRP price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials