This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

MILO

Milo Inu price

0xd9de...cbe1

$0.000000011218

+$0.00000

(-1.34%)

Price change for the last 24 hours

How are you feeling about MILO today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

MILO market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$3.87M

Network

BNB Chain

Circulating supply

345,059,073,174,599 MILO

Token holders

121345

Liquidity

$1.57M

1h volume

$5,891.96

4h volume

$27,214.75

24h volume

$120,567.56

Milo Inu Feed

The following content is sourced from .

ChainCatcher 链捕手

Finishing: Jerry, ChainCatcher

Important Information:

The SEC awarded $6 million to joint whistleblowers

Paul S. Atkins was inaugurated as Chairman of the 34th U.S. SEC

Unicoin refuses to settle with the SEC and will enter court to defend the charges

WSJ: Trump will make the Fed a scapegoat for any economic impact of the trade war

JD.com issues stablecoins to enhance global supply chains and cross-border payment capabilities

Upbit will list DeepBook (DEEP) spot trading

OKX will delist KISHU, MAX, MILO, MXC, SSWP spot

Binance Alpha adds SKYAI, TROLL, and Wizard

Binance Wallet will airdrop Dolomite (DOLO) to eligible users

"What are the important events that have occurred in the last 24 hours?"

The SEC awarded $6 million to joint whistleblowers

According to the official website of the Securities and Exchange Commission (SEC), the SEC issued about $6 million in rewards to joint whistleblowers who provided critical information, prompted the initiation of investigations and assisted in enforcement actions.

The award is based on the Investor Protection Fund constituted by the fines for non-compliance, in line with the whistleblowing incentive mechanism set forth in the Dodd-Frank Act. The identity of the whistleblower will continue to be protected by confidentiality.

Paul S. Atkins was inaugurated as Chairman of the 34th U.S. SEC

According to the official announcement of the U.S. Securities and Exchange Commission (SEC), Paul Paul S. Atkins has officially assumed the chairmanship of the 34th U.S. SEC.

Paul S. Atkins was nominated by Trump on Jan. 20 and confirmed by the Senate on April 9. He has served as a member of the SEC and has long been involved in the reform of digital asset and market regulation, emphasizing regulatory transparency and cost-effectiveness.

Unicoin refuses to settle with the SEC and will enter court to defend the charges

According to Decrypt, Miami crypto company Unicoin was required by the SEC to reach a settlement by April 18 for alleged violations of securities registration and anti-fraud regulations, but the company's CEO Alex Konanykhin refused to compromise and said that he would go through the court to respond to the lawsuit.

The SEC alleges that it distributed the token UNIC through an airdrop, misleadingly claiming that it was "asset-backed" and "SEC compliant," and allegedly reselling restricted securities without an exemption. Konanykhin called the allegations "pushed by a legacy of the previous Gensler era" and planned to countersue the SEC for billions of dollars in damages.

WSJ: Trump will make the Fed a scapegoat for any economic impact of the trade war

According to Wall Street Journal reporter Nick Timiraos, known as the "Fed mouthpiece", he said in an article on X that US President Trump has signaled that he will blame the Fed if his trade war causes the economy to weaken and the Fed does not cut interest rates soon.

JD.com issues stablecoins to enhance global supply chains and cross-border payment capabilities

According to the "Daily Economic News", recently, Dr. Shen Jianguang, vice president and chief economist of JD.com, was interviewed in Hong Kong. He pointed out that stablecoins are decentralized commercial issuances at the corporate level, which are subject to minimal fluctuations due to macroeconomic impacts, and JD.com issued stablecoins to further enhance JD.com's global supply chain and cross-border payment capabilities.

At present, JD.com has entered the "sandbox" test stage of Hong Kong's stablecoin issuance, and the formulation of stablecoin-related bills in Hong Kong is still in progress, and there are no clear terms. It is expected that after the approval of Hong Kong's Stablecoin Bill, the Hong Kong Monetary Authority will be able to officially release the details of the establishment of stablecoins.

Upbit will list DeepBook (DEEP) spot trading

According to official information, Upbit will list the DEEP won trading pair.

OKX will delist KISHU, MAX, MILO, MXC, SSWP spot

According to the official announcement, OKX will officially delist the KISHU/USDT, MAX/USDT, MILO/USDT, MXC/USDT, SSWP/USDT trading pairs from 4:00~6:00 p.m. (UTC+8) on April 29, 2025. Deposits in the relevant currencies have been suspended on April 22, and withdrawals will be suspended on July 29.

Binance Alpha adds SKYAI, TROLL, and Wizard

According to the official page, Binance Alpha has added SKYAI, TROLL and Wizard.

Binance Wallet will airdrop Dolomite (DOLO) to eligible users

Binance Alpha announced that it will list Dolomite (DOLO), and trading is expected to open on April 24, Beijing time, the exact time is to be determined. To celebrate the launch, eligible Binance Exchange users will receive a 260 DOLO airdrop on their Alpha account 10 minutes after the start of trading.

Eligible users are required to maintain an average daily asset of at least $50 in Binance Exchange and wallet, and purchase at least $100 in alpha on Binance Exchange from 00:00 April 15, 2025 to 23:59 (UTC) on April 21, 2025.

"What are some great articles to read in the last 24 hours"

What's left of Coinbase without compliance bonuses?

Stripped of its aura of compliance, its "noble indifference" is becoming more and more dangerous.

ABCDE stops investing in Vernal, and crypto VC opens the road to transformation and survival?

How to survive at the moment when liquidity is depleted has become a problem for many Crypto VCs.

Received a donation from God V, an article about the Cyber Nation Sandbox Zuitzerland| CryptoSeed

Zuitzerland is a Swiss-based cyber national sandbox project dedicated to exploring technology-driven models of the society of the future.

Wall Street in troubled times

There is no one on Wall Street who is not hostile to Trump.

Vitalik's criticism of Pumpfun sparks a controversy over values, which is more important, PMF or morality?

Vitalik's criticism of Pump.fun has caused controversy, and the values of different chain communities have collided, and his adherence to his philosophy has attracted attention.

Meme Hot List

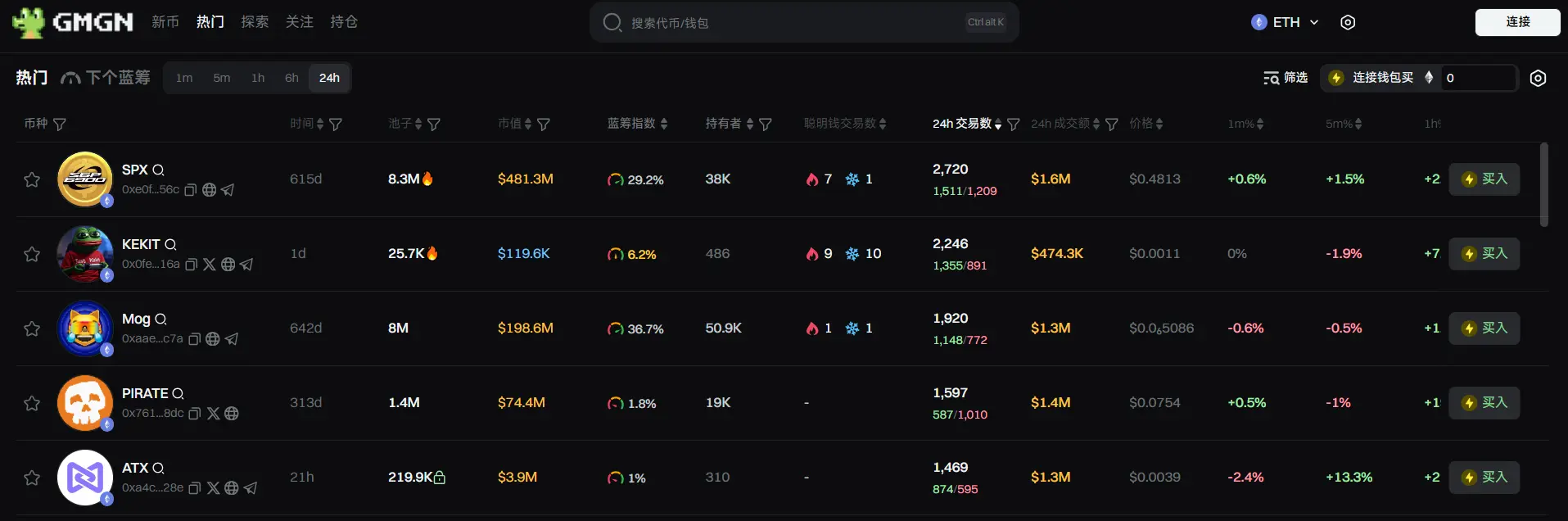

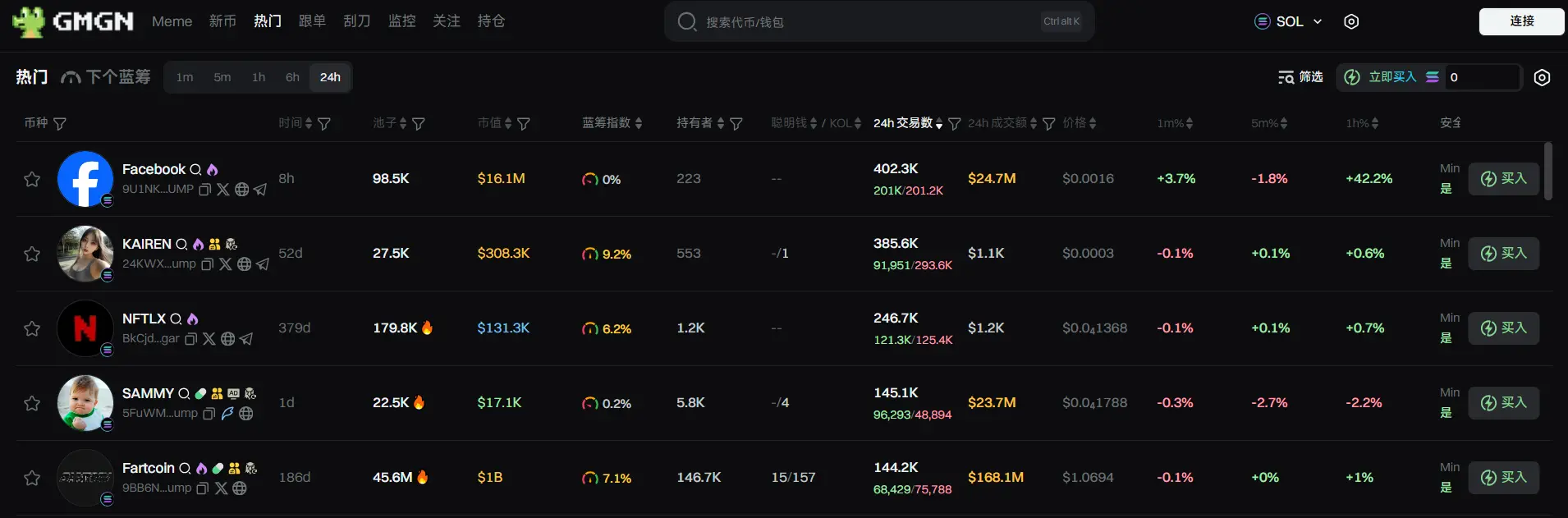

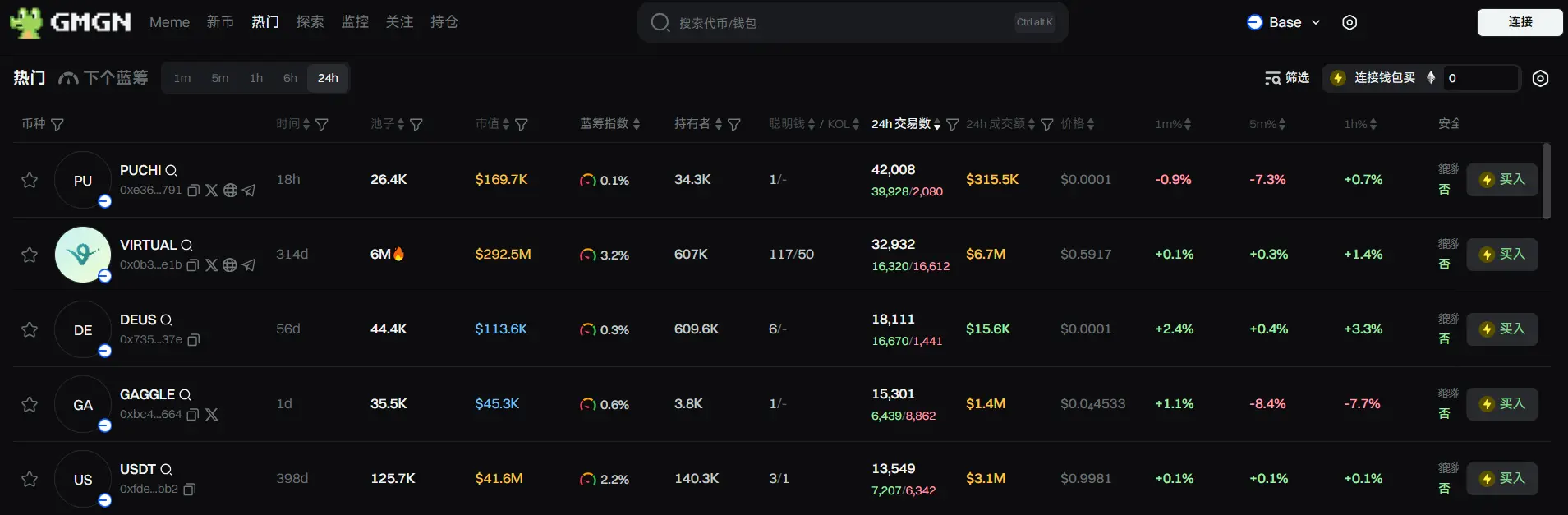

According to the market data of GMGN, a meme token tracking and analysis platform, as of 19:50 on April 22:

The top five popular Ethereum tokens in the past 24h are: SPX, KEKIT, Mog, PIRATE, and ATX

The top five popular tokens of Solana in the past 24h are: Facebook, KAIREN, NFTLX, SAMMY, and Fartcoin

The top five popular tokens in the past 24h Base are: PUCHI, VIRTUAL, DEUS, GAGGLE, USDT

Show original

31.29K

1

ChainCatcher 链捕手

According to the official announcement, OKX will officially delist the KISHU/USDT, MAX/USDT, MILO/USDT, MXC/USDT, SSWP/USDT trading pairs from 4:00~6:00 p.m. (UTC+8) on April 29, 2025. Deposits in the relevant currencies have been suspended on April 22, and withdrawals will be suspended on July 29.

Show original32.32K

0

Odaily

1. Popular CEX currencies

Top 10 and 24H Changes in CEX Turnover:

BTC: + 0.55%

ETH: - 0.66%

SOL: + 4.08%

XRP: - 0.39%

OM: - 13.06%

BNB:+ 0.55%

WCT: + 41.83%

SUI:- 1.86%

DOGE:+ 0.37%

ADA:- 0.19%

24H gainers list (data source is OKX):

AIDOGE: + 170.98%

WCT:+ 43.01%

OL:+ 36.74%

CORE:+ 19.34%

MILO:+ 16.62%

SWFTC:+ 15.05%

SAMO:+ 12.66%

RAY:+ 11.81%

POLYDOGE: + 11.66%

MDT:+ 11.65%

2. 24H hot search currency

WCT: Wallet sector project, which was launched on Korean exchanges Upbit and Bithumb yesterday;

OM: RWA Sector Project.

Headlines

Fed's Powell: The Fed will not be affected by political pressure

Fed Chair Jerome Powell said the Fed will not be affected by political pressure. The independence of the Federal Reserve is granted by law. The Fed's independence enjoys broad support across all parties. (Golden Ten)

Humanity Protocol Founder: TGE is coming, token H is coming

Terence Kwok, founder and CEO of Humanity Protocol, said in an article on the X platform, "After focusing on rigorous development for the past few months, we are now moving to the next stage. Token H is the economic engine of the validation network, aligning the incentives of all parties in the ecosystem, thereby achieving the long-term sustainability of Humanity. H's mission is to synergistically drive open identity infrastructure operations at scale: authentication, authentication, validation, management. TGE is coming, and token H is coming. ”

BNB completes its 31st quarterly token burn, which is about $916 million

The BNB Foundation announced the successful completion of the 31st quarterly BNB token burn, which burned a total of 1,579,207.72 BNB, or approximately $916 million. After this burn, the remaining amount of BNB to be burned is 40,886,572.43, and the total supply is 139,311,899.514.

Powell: Don't expect the Fed to bail out the market, Trump is changing every day

Fed Chair Jerome Powell said on Wednesday that the market's expectation that the Fed would step in to quell volatility may be wrong. Asked if the Fed would intervene in response to the sharp drop in the stock market, Fed Chair Jerome Powell said, "My answer is no, but I'll give an explanation." "I think the market is digesting the current situation, and the market is dealing with a lot of uncertainty, and that means volatility," Powell said at the meeting in Chicago. Powell said it was understandable that the market would have a hard time given that US President Donald Trump's tariff regime is changing dramatically. He also explained that it is difficult to know in real time what is causing the trouble. "I've had a lot of experience with major market movements, like the bond market," Powell said. Usually people form an idea, look back two months later, and find that they were completely wrong. Therefore, it is too early to conclude what is happening in the market. For now, he noted that part of the market turmoil stems from hedge funds cutting leverage or debt, adding: "In the short term, you may continue to see volatility in the market." ”

Industry news

A joint motion filed by the SEC and Ripple to stay the appeal has been granted

Former U.S. federal attorney James K. Filan posted on platform X that a joint motion filed by the U.S. Securities and Exchange Commission (SEC) and Ripple to stay the appeal has been granted, and the SEC has been directed to file a status report within 60 days of the issuance of the motion order.

Project highlights

Mantra: The team has not had any sell-offs and will launch an OM token support program

Mantra issued a statement of events in which the OM token price fell sharply and unexpectedly, stating that there was no sell-off by the MANTRA team. 100% OF THE FUNDS OF THE MANTRA MAINNET OM TEAM AND ADVISORY TEAM ARE STILL LOCKED, ERC-20 TOKENS ARE IN PUBLIC CIRCULATION AND ARE NOT CONTROLLED BY THE TEAM, AND CURRENTLY, THERE ARE 77.5 MILLION OM TOKENS IN CIRCULATION, AND THE NUMBER OF MAINNET OM WALLETS EXCEEDS 200,000.

TRUMP will unlock 40 million tokens on April 18th, representing approximately 20% of the circulating supply

According to on-chain analyst Ai Aunt, the TRUMP Dev address has removed 366,000 TRUMP and 4.6 million USDC from Meteora 16 hours ago. The address currently has 14.72 million TRUMP and 200 million USDC in liquidity on Meteora, while it still holds 15.38 million TRUMP, worth $120 million, on the chain. In addition, TRUMP will unlock 40 million tokens on April 18th, representing approximately 20% of the circulating supply and 4% of the total token supply.

ZKsync founders respond to security incidents: no-code or key leaks, and will publish the full findings

Alex Gluchowski, founder of ZKsync and CEO of Matter Labs, posted on social media to reiterate that there was no code, contract, or operator key leakage of the protocol, and said that ZKsync has stood the test because of its ultimate security architecture (Endgame). The team is currently investigating the security incident and will issue a detailed explanation once the investigation and recovery efforts are complete. Alex says he started the survey as soon as he received feedback from the community. He added that despite the recent general pressure on the token prices of most Layer 2 projects, ZKsync has performed relatively well, but the team still has an irritable, legally binding commitment to investors, partners, and members.

Investment and financing

DeFi protocol Neutrl closed a $5 million seed round led by STIX and others

DeFi protocol Neutrl announced the closing of a $5 million seed round led by digital asset private marketplace STIX and venture capital firm Accomplice, with participation from a number of crypto angel investors including Amber Group, SCB Limited, Figment Capital, and Nascent, including Ethena founder Guy Young and Arbelos Markets (recently FalconX). Acquisition) of Joshua Lim, a derivatives trader. It is reported that Neutrl's protocol investment structure is based on buying locked altcoins at a discounted price in the private market, and then hedging the risk exposure with perpetual contracts.

Bitcoin mining rig maker Auratine closed a $153 million Series C funding round led by StepStone Group

Bitcoin mining rig maker Auratine closed a $153 million Series C funding round led by StepStone Group with participation from Maverick Silicon, Premji Invest, Samsung Catalyst Fund, Qualcomm Ventures, Mayfield, MARA Holdings, GSBackers and other existing investors.

Resolv Labs closed a $10 million seed round led by Cyber.Fund and Maven11

Resolv Labs announced the closing of a $10 million seed round led by Cyber.Fund and Maven11, with Coinbase Ventures, Susquehanna, Arrington Capital, and Animoca Ventures, a protocol that offers USR stablecoin holders a crypto-native, delta-neutral yield strategy, The funding highlights the rapidly growing investor interest in stablecoin protocols that generate yield for token holders.

Crypto investment services firm Glider closed a $4 million funding round led by a16z

Crypto investment startup Glider closed a $4 million funding round led by a16z with participation from Coinbase Ventures, Uniswap Ventures, and GSR, with undisclosed valuation information. The New York-based company, which plans to use artificial intelligence to help users tailor their crypto investments to their needs, will join the Andreessen Horowitz crypto startup accelerator this spring.

Hana Network has raised a total of $6 million in funding, and the second and third phases of the mainnet will be officially launched in the coming months

According to official information, Hana Network, incubated by Yzi Labs and powered by Hyperliquid, announced that it has closed a total of $6 million in funding, with the participation of core members of L1/L2 projects and some KOLs in the recent No More CEX round of financing. In addition, Hanafuda already has 500,000 users and $40 million in TVL, and its mainnet Phases 2 and 3 are expected to go live in the coming months.

Character * voice

Santiment: The crypto market rebounded modestly, with traders optimistic about BTC's return to $90,000

Crypto analyst Santiment posted on platform X that the cryptocurrency market is showing a modest rally, with Bitcoin oscillating around $85,000 multiple times. Traders are optimistic about Bitcoin's return to $90,000, but the exact increase will likely depend on tariffs and global economic news for the rest of the week.

Coinbase executives: Singapore should launch a national digital asset strategy and establish a digital asset working group

Hassan Ahmed, head of Coinbase Singapore, wrote that Singapore should launch a national digital asset strategy, establish a digital asset working group, allow sovereign wealth funds to build strategic Bitcoin positions, relax the threshold for domestic retail investors to participate in the cryptocurrency market, double down on R&D and upskilling, and establish a tokenization regulatory lab to put crypto-native participants at the forefront.

Matrixport: Bitcoin ETF inflows are concentrated in leading institutions, reflecting stronger institutional demand than retail participation

In 2025, the net inflow of funds into the Bitcoin ETF will only be just above zero, despite a strong performance at the beginning of the year, with inflows of nearly $5.5 billion, according to Matrixport's chart released today. This came as a surprise, as bitcoin has outperformed US tech stocks this year, while gold has hit new all-time highs. Notably, Bitcoin ETFs saw a total net inflow of $35.5 billion, with BlackRock accounting for $39.6 billion and Fidelity accounting for $11.4 billion, with the two together accounting for the vast majority of the share. In contrast, inflows from other ETF issuers have been relatively limited.

Coinbase Research: Multiple indicators show that the market may enter a new round of "crypto winter"

Coinbase Research released an analysis report pointing out that the crypto market may have entered a new round of "crypto winter" due to the impact of global tariff escalation and macro uncertainty. The total market capitalization excluding BTC now stands at $950 billion, down 41% from its December 2024 high and down 17% from the same period last year. The report notes that major assets, including the COIN 50 index and BTC, have all fallen below the 200-day moving average, indicating that the overall market is entering a downtrend.

Show original

199.49K

8

MILO price performance in USD

The current price of milo-inu is $0.000000011218. Over the last 24 hours, milo-inu has decreased by -1.34%. It currently has a circulating supply of 345,059,073,174,599 MILO and a maximum supply of 690,000,000,000,000 MILO, giving it a fully diluted market cap of $3.87M. The milo-inu/USD price is updated in real-time.

5m

+0.06%

1h

-0.32%

4h

+0.27%

24h

-1.34%

About Milo Inu (MILO)

MILO FAQ

What’s the current price of Milo Inu?

The current price of 1 MILO is $0.000000011218, experiencing a -1.34% change in the past 24 hours.

Can I buy MILO on OKX?

No, currently MILO is unavailable on OKX. To stay updated on when MILO becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of MILO fluctuate?

The price of MILO fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Milo Inu worth today?

Currently, one Milo Inu is worth $0.000000011218. For answers and insight into Milo Inu's price action, you're in the right place. Explore the latest Milo Inu charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Milo Inu, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Milo Inu have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.