This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

JUNO

Juno price

0x914e...26cd

$0.0013707

+$0.0013688

(+71,988.75%)

Price change for the last 24 hours

How are you feeling about JUNO today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

JUNO market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$1.37M

Network

Ethereum

Circulating supply

1,000,000,000 JUNO

Token holders

451

Liquidity

$0.00

1h volume

$52,095.74

4h volume

$109,689.96

24h volume

$1.70M

Juno Feed

The following content is sourced from .

PANews

Words: Yanz & Liam

Editor: Liam

"This time I really sold it!"

On April 22, the ETH/BTC exchange rate briefly fell to 0.01766, hitting a new low since 2020.

Lin Feng, who has continued to invest regularly and firmly held Ethereum for 4 years, couldn't stand it anymore and issued a heartbreak declaration in the circle of friends. Compared with a simple cut of meat, this is more like a collapse of faith, a farewell to dreams.

Also on this day, institutional investors are also taking action.

Galaxy Digital swapped ETH to SOL, and crypto VC Paradigm also transferred 5,500 ETH (about $8.66 million) to the brokerage platform Anchorage, which is suspected to be preparing for a sale.

The most ironic thing is that there is also an institution that has joined the army of coin sellers, the Ethereum Foundation. A wallet linked to the Ethereum Foundation deposited 1,000 ETH (about $1.58 million) into Kraken.

Ethereum, once seen as the standard-bearer of the blockchain revolution, seems to have reached its darkest hour.

Behind this collective exodus are stories of being forced to say goodbye to their ideals, as well as difficult choices of faith and interests.

And all of this is recorded, witnessed, and remembered in that group chat called "Ethereum Asylum".

Ethereum Asylum

"The name of our group at the beginning was not actually 'Ethereum Asylum', but 'I was wrong, I regret buying Ethereum.'"

On February 3, 2025, the cryptocurrency market fell collectively, with Ethereum plummeting 25% at one point, reaching as low as $2080.19 per coin, catching many Ethereum holders off guard, including Tangerine.

Tangerine, who previously worked in a venture capital institution (VC), entered the crypto market in 2021, and his research on Ethereum technology established his belief in entering the circle.

However, the drop in the price of Ethereum to $3,300 made Tangerine feel bad and muttered repeatedly, and the group chat "I was wrong, I regret buying Ethereum" came into being.

On February 3rd, Tangerine panicked all of a sudden—"I can't run away, so what about the brothers?" ”。

In order to seek psychological comfort and warmth, this small group of only 6 friends began to usher in more "people who made mistakes": there are super big families like Da Chengzi and Du Jun, as well as high-level VCs, everyone gathers here to heal each other and seek psychological comfort.

As Ethereum continued to fall, the number of "patients" increased day by day, gradually expanding and stabilizing to 250 people in just one month - Tangerine said: "Buying Ethereum is 'two hundred and five'", a deliberately controlled number with a bit of self-deprecation.

"At first, there were people shouting for a dip at $3,000, and then it fell to $2,500, $2,100, and the bottom buying voice became quieter and quieter. In the end, everyone began to ridicule, saying that the person who wanted to copy the bottom asked Mr. Yang Yongxin to call. So we changed the name of the group to "Ethereum Asylum" because everyone thought they were crazy. ”

Source: Big Orange @0xVeryBigOrange

As the leader of the group, Tangerine witnessed all this. He is an observer and a member of the asylum. But he was helpless, and it could even be said that most of the people who remained in the group were helpless.

Tangerine can't help but feel nostalgic for the summer of 2020.

That summer, Uniswap surpassed Coinbase in terms of trading volume, Compound's fiery liquidity mining made countless people rich overnight, and the concept of decentralized finance DeFi swept the entire crypto world.

DeFi Summer is like a frenzied technology feast, and Ethereum, as the protagonist of this feast, has attracted the attention of countless investors and developers.

For traditional Web2 VC practitioners like Tangerine, this is not only an opportunity to make money, but also an enlightenment and baptism of thought.

"We really did a lot of research at the time," Tangerine recalls, "Vitalik and the Ethereum Foundation (EF) drew a lot of pies, such as sharding, zero-knowledge proofs (zk)... At the time, I thought this was the future. ”

Similarly, Lin Feng also bought Ethereum in the summer of 2020, when he was full of hope and anticipation, and was excited about the vision of Ethereum as a "world computer".

"At that time, as an Ethereum holder, I was very proud, and this is the real value investment, innovation at the level of human civilization."

In addition to individuals such as Tangerine and Lin Feng, a large number of traditional VCs also entered the emerging land of Web3 that summer with curiosity and longing for the new continent.

As the founder and spiritual leader of Ethereum, Vitalik's words and deeds have attracted wide attention, and everyone has followed Vitalik's guidance on investment layout. A large number of VCs are betting heavily on the Ethereum ecological infrastructure, and the valuation of Vitalik's optimistic ZK and Layer 2 tracks has skyrocketed, with Scroll valued at $1.8 billion, zkSync valued at $2 billion, and Starknet valued at $8 billion...... All kinds of capital have entered the market, betting on Ethereum's scaling dream.

However, after the DeFi Summer fever receded, in the new cycle, the technology narrative was abandoned by investors and replaced by the opposite of technology, MEME, as if it were a mockery.

"We were adamant that Solana wasn't going to be an Ethereum killer, but now it seems that the market doesn't care about the core issues of privacy and security." This divergence makes Tangerine feel helpless, but what really gets him into trouble is his deep affection for Ethereum.

As a true believer, he not only held Ethereum heavily during the bull market, but also chose to stake ETH in exchange for long-term gains. However, when the market entered a cold winter, the price of ETH plummeted, and the staked assets could not be withdrawn, Tangerine, like many members of the madhouse, was caught in a dilemma.

In fact, most of these trapped people are not speculators with the mentality of "getting rich overnight", but long-term holders who have experienced multiple rounds of market fluctuations and have a certain understanding of Ethereum, commonly known as old leeks.

The paradox of this cycle is on full display here, with Paper Hands being rewarded with PVP and Diamond Hands being punished, and constantly experiencing the double torment of reality and cognition.

For them, Ethereum is both a symbol of hope and a shackle that they cannot shake off.

They love Ethereum because it represents technological innovation and future possibilities; They also hate Ethereum because the pain and distress caused by the falling price is real.

For Lin Feng, the pain of selling Ethereum comes from real financial losses on the one hand, but more importantly, it is "damage to the Dao heart". He entered the crypto world with Ethereum and is a self-proclaimed value investor. He used to be proud of investing in Ethereum, but now the reality makes him deny who he once was. What made him even more ashamed was that he found that the belief he had boasted about to the outside world was not firm, and in the face of the continuously falling K-line, he couldn't do it without looking at the price, and finally chose to give up.

Lin Feng sold Ethereum and sold his former dream.

However, most of the patients are still waiting in the "ward". Not only are they longing to be discharged from the hospital, but the dream they planted in the story three years ago is also waiting for another scorching summer.

There is no new story for Ethereum

"There has been no paradigm innovation in Ethereum this year!"

The well-known KOL Big Orange is also a member of the Ethereum madhouse, and on Twitter, he is the "E-guard leader" in the eyes of everyone.

On March 21, 2024, Big Orange tweeted that from today I am a dead long on Ethereum, and Ethereum will not reach a record high before May, and I eat.

Despite its passionate love, Big Orange also admits that there is a lack of innovation in Ethereum at the moment.

"There is nothing new that makes people shine," said Yuan Jie, co-founder of the public chain Conflux, who calls himself the "Web3 investment director", who once aspired to create an "Ethereum killer" and witnessed the rise and fall of the Ethereum ecosystem.

The boom in DeFi, NFT, and GameFi in the last cycle still haunts him, "At that time, there were a lot of new things to learn every day, and in the process of learning, participation could also get a good return on wealth." ”

In the "golden age", Ethereum has had the best story. In that year, the on-chain ecology grew explosively, and the "cult" of Ethereum was pushed to a climax, and the attention of capital, developers and users was highly focused on certain directions (such as Layer 2, DeFi, ZK technology, etc.) and once blindly expanded, and investors came and went and bustled.

The narrative of three years ago fed the boom of the previous cycle, but now, such a story is over.

Just as the land loses its fertility due to overcultivation, talking about the present, Yuan Jie said, "Vitalik is too deeply involved in the guidance of the direction of the industry and the formulation of the route with his personal charm, which leads to the failure of Ethereum's resource allocation."

Whether it's a breakthrough at the technical level or a new application in the ecosystem, Ethereum has failed to provide enough freshness to attract the attention of the market.

Boiling frogs in warm water, the Ethereum main chain is facing the dilemma of a "gradually barren land".

"The transaction volume and activity on the chain are very low, and the whole ecosystem is cooling, resulting in Ethereum's deflationary mechanism (EIP-1559) not working well", in the view of Big Orange, the deflationary mechanism of EIP-1559 is like a beautifully designed irrigation system, but in the absence of sufficient "water" (liquidity), this system can only be used for nothing, and cannot provide real nourishment for the Ethereum ecosystem.

To complicate matters further, such a barren land has blossomed into "blood-sucking flowers".

Layer 2, which carries the dream of Ethereum's scaling, is the common owner of the world, and each Layer 2 is orthodox with ether, but it has its own feudal state, sucking the value of the Ethereum mainnet and constantly weakening Ethereum's control over its own ecology.

"Everyone is vying to cross the assets of Ethereum to their own chain, because the more they cross, the higher the points, and the more airdropped tokens they will get," Yuan Jie said a little excited, he attributed these "bloodsucking flowers" and the current ecological homogenization results driven by the short-term profit-seeking mentality to the "prisoner's dilemma" of human nature.

Yuan Jie believes that this may not be Vitalik's original intention, but in the process of planning to expand the ecological boundaries of Ethereum with Layer 2, he ignored "the human nature of everyone who wants to get rich quickly and compete for the same piece of property", and finally "fell into a cycle of involution and self-extinction".

The Layer 2 network is highly fragmented, separating the user experience and on-chain liquidity, and the composability advantage that the Ethereum mainnet once boasted of in the DeFi Summer is gone, but Solana has become the habitat of many consumer applications with its simple feature of "fast".

"Now ETH, I think of ATOM, and I'm really afraid that ETH will repeat the mistakes of ATOM."

Lin Feng believes that ETH's dilemma is similar to the ATOM dilemma, both of which are experiencing "value transfer to the upstream".

In the Cosmos ecosystem, various sovereign application chains (such as OSMO, JUNO, etc.) are interconnected through the IBC protocol, but they capture the value of their own ecosystems, and ATOM, as a central hub, fails to effectively capture value from these chains.

After the rise of various Ethereum L2s, relying on sequencers, they have obtained a large amount of MEV and transaction fee income, which greatly reduces the value returned to the Ethereum mainnet and weakens the value capture ability of ETH.

"If the Ethereum main chain is successfully upgraded and the carrying capacity is greatly improved, then Ethereum may really usher in a new peak of development," Da Orange thinks.

How to reinvent greatness?

On April 22, when many institutions were selling ETH, F2Pool co-creator WangChun once again swapped 50 WBTC to 2,794 ETH, worth about $4.36 million, bringing a hint of thought to those who still hold ETH today.

Ethereum, the land that once gave birth to countless innovations, seems to need a long "fallow period".

When fallow is fallow for farming, some people cut the meat, and some people hold on.

Big Orange chooses to stick to it. The bull market in 2021 has made Big Orange reap a lot of money, and his affection for Ethereum has long gone beyond a mere investment relationship. For him, ETH is more than just an asset, it's more like a belief.

Among the "E guards" that still exist today, everyone has become a supernumerary advisor to the Ethereum Foundation, offering advice and advice to Ethereum, and according to their respective "reform measures", they can be roughly divided into two camps.

On the right, there is a strong push for drastic reforms, arguing that Ethereum should be more "practical" and compliant, "close to authority".

For example, Tangerine believes that Ethereum needs to "stop playing dead" and actively embrace compliance.

"Since the dawn of humanity, some things have been predestined. You can't compete with the state apparatus. If you want to survive well, or show your function, you should not fight against the entire state apparatus. ”

Between ideals and bread, the Ethereum Foundation needs to strike a balance. Yuanjie does not deny the purity of the Ethereum Foundation's focus on academic discussion and technological innovation, but a pragmatic business arm is necessary.

"If Trump is in power, we need Trump to accept Ethereum, then we need someone who doesn't hate Trump to get him. If Vitalik can't do it himself, he can let someone else do it. A good foundation, as a non-profit organization, should be able to accommodate a variety of decisions. ”

Lin Feng even believes that the Ethereum Foundation has focused too much on ideology in the past, neglected real creation and construction, and is too "weak", and the Ethereum Foundation needs a Trump-style reform figure to completely reform the atmosphere.

On the other hand, there is a leftist group that believes that the greatest value of Ethereum lies in "decentralization, which is the last "idealistic place" in the crypto world besides Bitcoin.

The well-known KOL Blue Fox Note said that he only pays attention to Ethereum, "whether it will continue to maintain the core values of decentralization, security and trustlessness in the future." If it is maintained, it will continue to be supported, and if it changes, no matter how high the price is, it will go directly. ”

"The crypto world needs an internationalist warrior, and no one can compare to Vitalik except the vanished Satoshi Nakamoto," said investor Jacob of Ethereum, who believes in Ethereum's values of not compromising with authority despite facing huge financial losses.

"SOL and other emerging high-performance public chains are essentially capital-driven company stock logic, and high efficiency is naturally more likely to cause market heat, but Ethereum is a new form of human civilization."

Behind this left-right battle is a different understanding of blockchain priorities – is it pragmatism, the pursuit of efficiency and commercial success, or the spirit of decentralization and freedom?

In the darkest hour, faith is more important than gold.

IOSG founder Jocy called for "Ethereum is not going to die, it's the most successful decentralized organization in the Web3 industry." Looking forward to the future, please cherish the Ethereum in your hands and look at its value and innovation from a ten-year perspective. ”

Back in the "Ethereum Maniahlum", that shelter that began out of panic is now a corner of history.

Whether it is the moment when Lin Feng presses the sell button, or every day when Big Orange holds it firmly, or every emotional fluctuation that Tangerine sees in the madhouse, they are recording and shaping the history of Ethereum.

No matter what the future holds, regardless of whether they leave or stick to it now, those who were once crazy about Ethereum will always remember that scorching summer and the Ethereum that once made them believe in the future.

Show original

4.69K

1

Odaily

Original author: Yanz & Liam

Original edited by Liam

"This time I really sold it!"

On April 22, the ETH/BTC exchange rate briefly fell to 0.01766, hitting a new low since 2020.

Lin Feng, who has continued to invest regularly and firmly held Ethereum for 4 years, couldn't stand it anymore and issued a heartbreak declaration in the circle of friends. Compared with a simple cut of meat, this is more like a collapse of faith, a farewell to dreams.

Also on this day, institutional investors are also taking action.

Galaxy Digital swapped ETH to SOL, and crypto VC Paradigm also transferred 5, 500 ETH (about $8.66 million) to the brokerage platform Anchorage, which is suspected to be preparing for a sale.

The most ironic thing is that there is also an institution that has joined the army of coin sellers, the Ethereum Foundation. A wallet linked to the Ethereum Foundation deposited 1,000 ETH (about $1.58 million) into Kraken.

Ethereum, once seen as the standard-bearer of the blockchain revolution, seems to have reached its darkest hour.

Behind this collective exodus are stories of being forced to say goodbye to their ideals, as well as difficult choices of faith and interests.

And all of this is recorded, witnessed, and remembered in that group chat called "Ethereum Asylum".

Ethereum Asylum

"Our original group name wasn't actually 'Ethereum Asylum', but 'I was wrong, I regret buying Ethereum.'"

On February 3, 2025, the cryptocurrency market fell collectively, with Ethereum plummeting 25% at one point, reaching a minimum of $2080.19 per coin, catching many Ethereum holders off guard, including Tangerine.

Tangerine, who previously worked in a venture capital firm (VC), entered the crypto market in 2021, and his research on Ethereum technology established his belief in entering the circle.

However, the drop in the price of Ethereum to $3,300 made Tangerine feel bad and muttered repeatedly, and the group chat "I was wrong, I regret buying Ethereum" came into being.

On February 3rd, Tangerine panicked all of a sudden—"I can't run away, so what about the brothers?".

In order to seek psychological comfort and warmth, this small group of only 6 friends began to usher in more "wrongdoers": there are super big families like Da Chengzi and Du Jun, as well as high-level VCs, everyone gathers here to heal each other and seek psychological comfort.

As Ethereum continued to fall, the number of "patients" increased day by day, gradually expanding and stabilizing to 250 in just one month - Tangerine said, "Buying Ethereum is 'two hundred and five'", a deliberately controlled number with a bit of self-deprecation.

"At first, there were people who shouted to buy the bottom when it was $3, 000, then it fell to $2, 500, $2, 100, and the bottom buying voice became quieter and quieter. In the end, everyone began to ridicule, saying that the person who wanted to copy the bottom asked Mr. Yang Yongxin to call. So we changed the name of the group to "Ethereum Asylum" because everyone thought they were crazy."

Source: VeryBigOrange @0x VeryBigOrange

As the leader of the group, Tangerine witnessed all this. He is an observer and a member of the asylum. But he was helpless, and it could even be said that most of the people who remained in the group were helpless.

Tangerine can't help but feel nostalgic for the summer of 2020.

That summer, Uniswap surpassed Coinbase in terms of trading volume, Compound's fiery liquidity mining made countless people rich overnight, and the concept of decentralized finance DeFi swept the entire crypto world.

DeFi Summer is like a frenzied technology feast, and Ethereum, as the protagonist of this feast, has attracted the attention of countless investors and developers.

For traditional Web2 VC practitioners like Tangerine, this is not only an opportunity to make money, but also an enlightenment and baptism of thought.

"We really did a lot of research at the time," Tangerine recalls, "Vitalik and the Ethereum Foundation (EF) drew a lot of pies, such as sharding, zero-knowledge proofs (zk)... At that time, I thought this was the future."

Similarly, Lin Feng also bought Ethereum in the summer of 2020, when he was full of hope and anticipation, and he was excited about the vision of Ethereum as a "world computer".

"At that time, as an Ethereum holder, I was very proud, and this is the real value investment, innovation at the level of human civilization."

In addition to individuals such as Tangerine and Lin Feng, a large number of traditional VCs also entered the emerging land of Web3 that summer with curiosity and longing for the new continent.

As the founder and spiritual leader of Ethereum, Vitalik's words and deeds have attracted wide attention, and everyone has followed Vitalik's guidance on investment layout. A large number of VCs have invested heavily in the Ethereum ecological infrastructure, and the valuation of Vitalik's optimistic ZK and Layer 2 tracks has skyrocketed, with Scroll valued at $1.8 billion, zkSync valued at $2 billion, and Starknet valued at $8 billion...... All kinds of capital have entered the market, betting on Ethereum's scaling dream.

However, after the DeFi Summer fever receded, in the new cycle, the technology narrative was abandoned by investors and replaced by the opposite of technology, MEME, as if it were a mockery.

"We were adamant that Solana wasn't going to be an Ethereum killer, but now it seems that the market doesn't care about the core issues of privacy and security." This divergence makes Tangerine feel helpless, but what really gets him into trouble is his deep affection for Ethereum.

As a true believer, he not only held Ethereum heavily during the bull market, but also chose to stake ETH in exchange for long-term gains. However, when the market entered a cold winter, the price of ETH plummeted, and the staked assets could not be withdrawn, Tangerine, like many members of the madhouse, was caught in a dilemma.

In fact, most of these trapped people are not speculators with a "get rich overnight" mentality, but long-term holders who have experienced multiple rounds of market fluctuations and have a certain understanding of Ethereum, commonly known as old leeks.

The paradox of this cycle is on full display here, with Paper Hands being rewarded with PVP and Diamond Hands being punished, and constantly experiencing the double torment of reality and cognition.

For them, Ethereum is both a symbol of hope and a shackle that they cannot shake off.

They love Ethereum because it represents technological innovation and future possibilities; They also hate Ethereum because the pain and distress caused by the falling price is real.

For Lin Feng, the pain of selling Ethereum comes from real financial losses on the one hand, but more importantly, "damage to the Dao heart". He entered the crypto world with Ethereum and is a self-proclaimed value investor. He used to be proud of investing in Ethereum, but now the reality makes him deny who he once was. What made him even more ashamed was that he found that the belief he had boasted about to the outside world was not firm, and in the face of the continuously falling K-line, he couldn't do it without looking at the price, and finally chose to give up.

Lin Feng sold Ethereum and sold his former dream.

However, most of the patients are still waiting in the "ward". Not only are they longing to be discharged from the hospital, but the dream they planted in the story three years ago is also waiting for another scorching summer.

There is no new story for Ethereum

"There has been no paradigm innovation in Ethereum this year!"

The well-known KOL Big Orange is also a member of the Ethereum madhouse, and on Twitter, he is the "leader of the E-guards" in everyone's eyes.

On March 21, 2024, Big Orange tweeted that from today I am a dead long on Ethereum, and Ethereum will not reach a record high before May, and I eat.

Despite its passionate love, Big Orange also admits that there is a lack of innovation in Ethereum at the moment.

"There is nothing new that makes people shine," Yuan Jie, co-founder of the public chain Conflux, calls himself a "Web3 investment director", who once aspired to create an "Ethereum killer" and witnessed the rise and fall of the Ethereum ecosystem.

The boom in DeFi, NFT, and GameFi in the last cycle still memorable, "At that time, there were a lot of new things to learn every day, and in the process of learning, participation could also get a good return on wealth."

In the "golden age", Ethereum has had the best story. In that year, the on-chain ecology grew explosively, and the "cult" of Ethereum was pushed to a climax, and the attention of capital, developers and users was highly focused on certain directions (such as Layer 2, DeFi, ZK technology, etc.) and once blindly expanded, and investors came and went, bustling.

The narrative of three years ago fed the boom of the previous cycle, but now, such a story is over.

Just as the land loses its fertility due to overcultivation, talking about the present, Yuan Jie said, "Vitalik is too deeply involved in the guidance of the industry direction and the formulation of the route with his personal charm, which leads to the failure of Ethereum's resource allocation."

Whether it's a breakthrough at the technical level or a new application in the ecosystem, Ethereum has failed to provide enough freshness to attract the attention of the market.

Boiling frogs in warm water, the Ethereum main chain is facing the dilemma of a "gradually barren land".

"The on-chain transaction volume and activity are very low, and the whole ecosystem is cooling, resulting in Ethereum's deflationary mechanism (EIP-1559) not working well", in Big Orange's view, the deflationary mechanism of EIP-1559 is like a beautifully designed irrigation system, but in the absence of sufficient "water" (liquidity), this system can only be used as a surface and cannot provide real nourishment for the Ethereum ecosystem.

To complicate matters further, such a barren land has produced "blood-sucking flowers".

Layer 2 carries the dream of Ethereum's scaling, and each Layer 2 is orthodox with ether, but it has its own feudal state, sucking the value of Ethereum's mainnet and constantly weakening Ethereum's control over its own ecology.

"Everyone is vying to cross the assets of Ethereum to their own chain, because the more they cross, the higher the points, and the more airdropped tokens they will get," Yuan Jie said a little excited, he attributed these "bloodsucking flowers" and the current ecological homogenization results driven by the short-term profit-seeking mentality to the "prisoner's dilemma" of human nature.

Yuan Jie believes that this may not be Vitalik's original intention, but in the process of planning to expand the boundaries of the Ethereum ecosystem with Layer 2, he ignored "the human nature of everyone who wants to get rich quickly and compete for the same family property", and finally "fell into a cycle of involution and self-extinction".

Layer 2 networks are highly fragmented, segregating user experience and on-chain liquidity, and the composability advantage that Ethereum Mainnet once boasted of in DeFi Summer has disappeared, but Solana has become the habitat of many consumer applications with its simple feature of "fast".

"Now ETH, I think of ATOM, and I'm really afraid that ETH will repeat the mistakes of ATOM."

Lin Feng believes that the predicament of ETH is similar to the predicament of ATOM, both of which are experiencing "value transfer to the upstream".

In the Cosmos ecosystem, various sovereign application chains (such as OSMO, JUNO, etc.) are interconnected through the IBC protocol, but they capture the value of their own ecosystems, and ATOM, as a central hub, fails to effectively capture value from these chains.

After the rise of various Ethereum L2s, relying on sequencers, they have obtained a large amount of MEV and transaction fee income, which greatly reduces the value returned to the Ethereum mainnet and weakens the value capture ability of ETH.

"If the Ethereum main chain is successfully upgraded and the carrying capacity is greatly improved, then Ethereum may really usher in a new peak of development," Da Chengzi thinks.

How to reinvent greatness?

On April 22, when many institutions were selling ETH, F2Pool co-creator WangChun once again swapped 50 WBTC to 2,794 ETH, worth about $4.36 million, bringing a hint of thought to those who still hold ETH today.

Ethereum, the land that once gave birth to countless innovations, seems to need a long "fallow period".

When fallow is fallow for farming, some people cut the meat, and some people hold on.

Big Orange chooses to stick to it. The bull market in 2021 has made Big Orange reap a lot of money, and his affection for Ethereum has long gone beyond a mere investment relationship. For him, ETH is more than just an asset, it's more like a belief.

Among the "E Guards" that still exist today, everyone has become a supernumerary advisor to the Ethereum Foundation, offering advice and advice to Ethereum, and can be roughly divided into two camps according to their respective "reform measures".

On the right, there is a push for drastic reforms, arguing that Ethereum should be more "practical" and compliant, "close to authority".

For example, Tangerine believes that Ethereum needs to "stop playing dead" and actively embrace compliance.

"Since the birth of humanity, some things have been predestined. You can't compete with the state apparatus. If you want to survive well, or to function well, you shouldn't go against the whole state apparatus."

Between ideals and bread, the Ethereum Foundation needs to strike a balance. Yuanjie does not deny the purity of the Ethereum Foundation's focus on academic discussion and technological innovation, but a pragmatic business arm is necessary.

"If Trump is in power, we need Trump to accept Ethereum, then we need someone who doesn't hate Trump to get him. If Vitalik can't do it himself, he can let someone else do it. A good foundation, as a non-profit organization, should be able to accommodate a wide range of decisions."

Lin Feng even believes that the Ethereum Foundation has focused too much on ideology in the past, neglected real creation and construction, and was too "weak", and the Ethereum Foundation needs a Trump-style reform figure to completely reform the atmosphere.

On the other hand, the left believes that the greatest value of Ethereum lies in "decentralization, which is the last "idealistic place" in the crypto world besides Bitcoin.

The well-known KOL Blue Fox Note said that he only pays attention to Ethereum, "whether it will continue to maintain the core values of decentralization, security and trustlessness in the future." If it is maintained, it will continue to be supported, and if it changes, no matter how high the price is, it will go directly.

"The crypto world needs an internationalist warrior, and no one else can compare to Vitalik except the vanished Satoshi Nakamoto," said investor Jacob, who invests in Ethereum and shares Ethereum's values of not compromising with authority despite facing huge financial losses.

"SOL and other emerging high-performance public chains are essentially capital-driven company stock logic, and high efficiency is naturally more likely to cause market heat, but Ethereum is a new form of human civilization."

Behind this left-right battle is a different understanding of blockchain priorities – is it pragmatism, the pursuit of efficiency and commercial success, or the spirit of decentralization and freedom?

In the darkest hour, faith is more important than gold.

IOSG founder Jocy called for "Ethereum is not going to die, it's the most successful decentralized organization in the Web3 industry. Looking to the future, please cherish the Ethereum in your hands and look at its value and innovation from a ten-year perspective."

Back in the "Ethereum Asylum", that shelter that began out of panic is now a corner of history.

Whether it is the moment when Lin Feng presses the sell button, or every day when Big Orange holds it firmly, or every emotional fluctuation that Tangerine sees in the madhouse, they are recording and shaping the history of Ethereum.

No matter what the future holds, regardless of whether they leave or stick to it now, those who were once crazy about Ethereum will always remember that scorching summer and the Ethereum that once made them believe in the future.

Show original

6.63K

0

InfoSpace OG

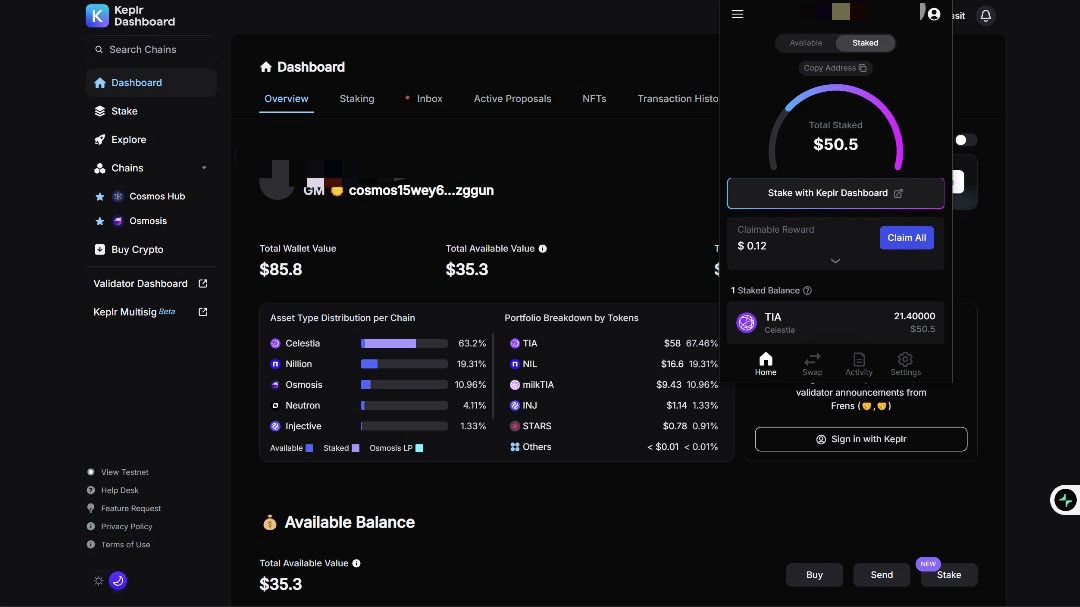

Btw 2022-2024, I staked

• 100 $JUNO+ ($5000) now worth $9.42

• 500 $EVMOS ($3500) now worth $1.66

• 200 $OSMO ($2400) now worth $42

• 200 $TIA ($4200) now worth $472

And many more….

Funny, I've never received any tangible Airdrop from holding any

Is Staking to earn a scam?

Show original

53.93K

327

Dungeon 🐉🎮⚛️ reposted

Dungeon 🐉🎮⚛️

Dungeon supports #Cosmos by bringing in users from outside the ecosystem with gaming. (3 games that are all very different launch in the next 3 months)

Please support us by staking (atoms, stars, flix, juno, passage, jackal, and osmo) or by picking up a Kosmic Quest first edition NFT on @StargazeZone

We are still entirely funded by Xanthar and our community ❤️🫡🙏

Show original6.18K

51

JUNO price performance in USD

The current price of juno is $0.0013707. Over the last 24 hours, juno has increased by +71,988.75%. It currently has a circulating supply of 1,000,000,000 JUNO and a maximum supply of 1,000,000,000 JUNO, giving it a fully diluted market cap of $1.37M. The juno/USD price is updated in real-time.

5m

-0.33%

1h

-0.33%

4h

-75.84%

24h

+71,988.75%

About Juno (JUNO)

JUNO FAQ

What’s the current price of Juno?

The current price of 1 JUNO is $0.0013707, experiencing a +71,988.75% change in the past 24 hours.

Can I buy JUNO on OKX?

No, currently JUNO is unavailable on OKX. To stay updated on when JUNO becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of JUNO fluctuate?

The price of JUNO fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Juno worth today?

Currently, one Juno is worth $0.0013707. For answers and insight into Juno's price action, you're in the right place. Explore the latest Juno charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Juno, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Juno have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials