AEVO

Aevo price

$0.12588

+$0.0023500

(+1.90%)

Price change for the last 24 hours

How are you feeling about AEVO today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Aevo market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$113.54M

Circulating supply

903,996,699 AEVO

90.39% of

1,000,000,000 AEVO

Market cap ranking

162

Audits

Last audit: --

24h high

$0.12785

24h low

$0.11876

All-time high

$14.2030

-99.12% (-$14.0771)

Last updated: Mar 13, 2024

All-time low

$0.075600

+66.50% (+$0.050280)

Last updated: Apr 9, 2025

Aevo Feed

The following content is sourced from .

冰蛙

Gaib: Missing out on Nvidia stock? This time you can buy its "on-chain GPU stock" directly》

In a word: I am extremely optimistic about GAIB, which may be the future of the on-chain "computing power Taobao". (Non-wide)

__________________

1. Make it clear in one sentence what Gaib does

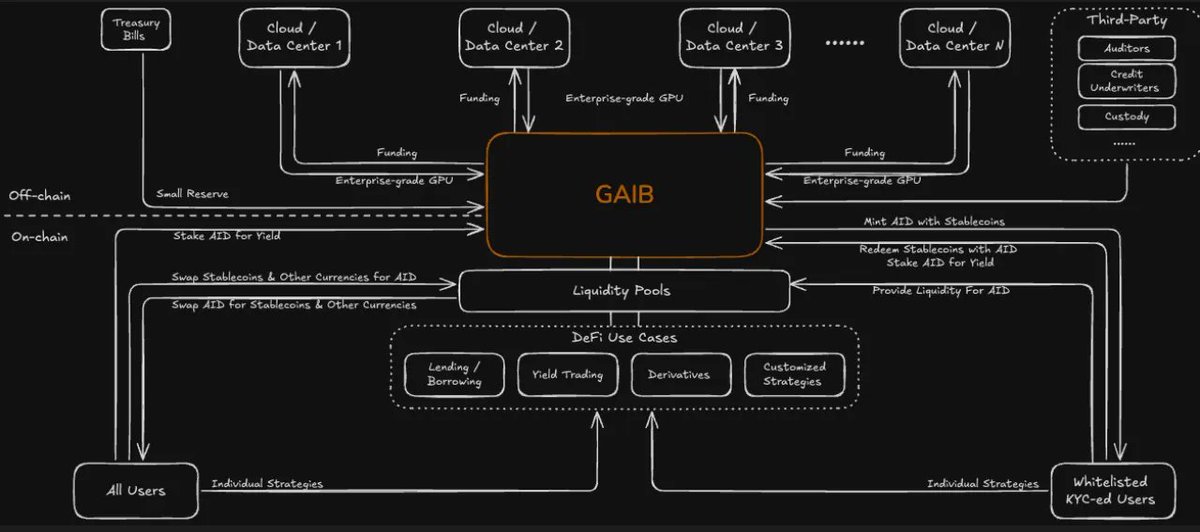

GAIB (GPU-AI-Blockchain Infrastructure), expressed in the project's official white paper, is the world's first economic protocol focusing on transforming GPU computing assets into tradable financial instruments, unleashing the trillion-dollar AI computing market value through blockchain.

Its core innovation lies in the construction of "AI synthetic USD AID", a yield-based stablecoin supported by the cash flow of physical GPU assets, and the establishment of a complete DeFi ecosystem around AID, connecting off-chain computing resources and on-chain liquidity.

In one sentence, its business model is expressed in layman's terms: users mint AID with USDC, and then invest in GPUs, AI companies use these GPUs to work to generate cash flow, and GAIB regularly dividends, users can enjoy this income by holding SAID, and can also use it to participate in other DeFi to make money.

_________________

2. Why is this possible? Can you make money?

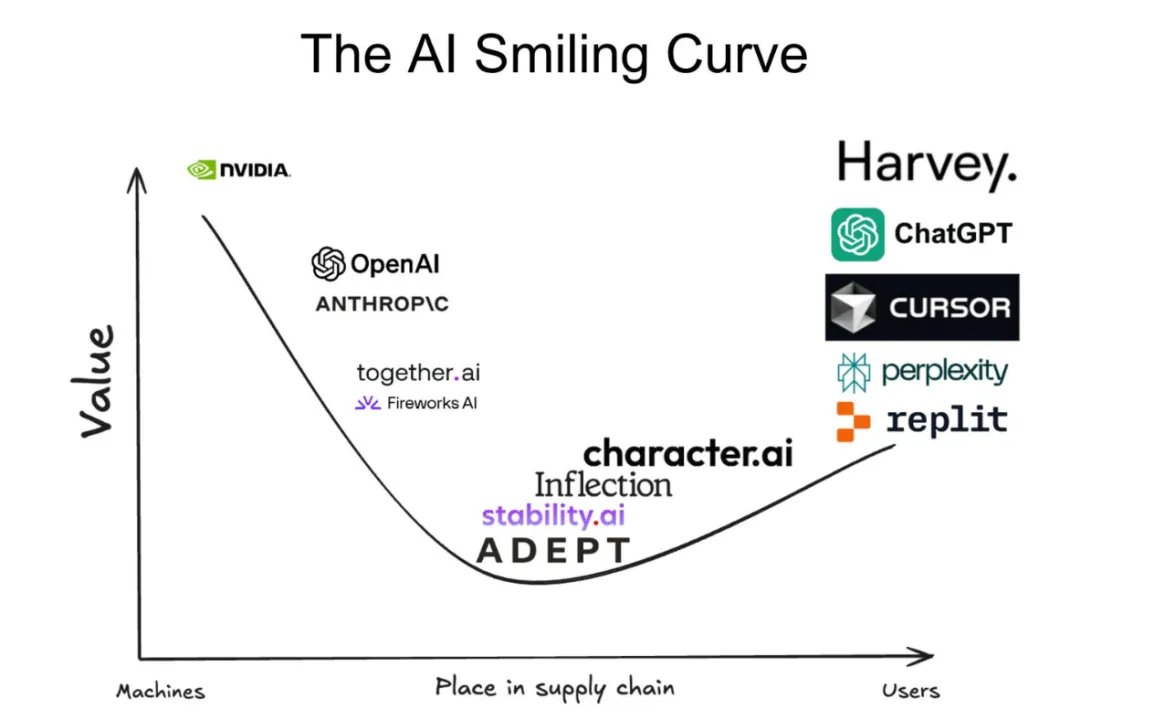

In the era of AI, GPU is undoubtedly the core "hard currency". According to incomplete statistics, by 2025, the total investment of global technology giants in GPU computing power will exceed 300 billion US dollars. Taking NVIDIA H100/GB200 as an example, the price of a single chip is close to 3-50,000 US dollars, and building a data center with AI training capabilities often requires billions or even tens of billions of US dollars. This led to the following problem and Gaib's solution.

1. Demand side: AI outbreak superimposed "supply and demand asymmetry"

At present, the large model training market is almost monopolized by a few technology giants, and GPU resources are concentrated in the hands of super-large institutions such as OpenAI, Google, and Meta. However, after entering the second half of 2024, we will see a trend of AI applications blooming, especially in inference and AI agent vertical scenarios. Although these innovative projects do not require the construction of tens of billions of data centers, they also require a large number of high-performance GPU resources.

The problem is that traditional data centers or cloud service providers cannot flexibly respond to these small and medium-sized needs, resulting in a serious structural mismatch in the computing power market - resources are concentrated and demand is scattered, supply and demand are extremely asymmetrical, and demand is far greater than supply.

2. Financial side: traditional financing paths do not support "computing power assets"

Theoretically, these high-value GPU clusters could be used as financing assets. However, in reality, GPUs are not regarded as "collateral standard assets" by traditional banks, and are difficult to be segmented or standardized, resulting in the traditional financial system almost unable to cover the financing needs of computing power.

At present, there are some computing power leasing platforms in the traditional market that try to solve this pain point, but there are two major problems:

First, it is impossible to split ownership, and the financing liquidity is poor;

Second, there is no standardized mechanism, the income structure is not transparent, and the threshold for participation is high.

3. Gaib's solution: on-chain "hashrate financial market + hashrate stablecoin"

Gaib's innovation lies in the fact that it is not just a computing power lease, but a computing power financial market that is efficient and liquid on the chain

1) Tokenize the future revenue of enterprise-grade GPUs to enable split transactions;

2) Build a yield-based stablecoin AID backed by real GPU asset cash flow, which can be used for staking, lending, and portfolio income strategies;

3) Leverage the DeFi ecosystem to enable efficient financing and free circulation of these assets on a global scale.

The core value of this mechanism is threefold:

1) For GPU providers, it provides unprecedented financing channels for GPU holders;

2) For participating users, it provides DeFi users with safe, real, and visible new assets;

3) For developers, it opens a fair channel for small and medium-sized developers to participate in the underlying infrastructure.

In other words, Gaib has turned "computing power" into a composable and configurable financial asset, truly realizing the capitalization of computing power.

If we say that NVIDIA is the king of "selling shovels" in the AI era, then what Gaib wants to do is to build another "shovel bank/shovel exchange" on NVIDIA's shovel empire to turn physical shovels into tradable "computing power stocks".

__________________

3. How does Gaib help you make money? Gameplay disassembly

1. Off-chain assets: GPU financing asset packages in three types of modes

GAIB has partnered with the world's top cloud/data centers to build three types of protocol transaction structures around GPU deployment:

All of the above transactions are overcollateralized by physical GPUs, with a bankruptcy isolation structure, which can be liquidated or transferred to strategic partners to continue to operate in escrow in case of default.

2. On-chain architecture: AID stablecoin system

GAIB tokenized a portfolio of GPU-funded transactions to issue AID (AI Dollar), a stablecoin backed by off-chain yield assets:

1) AID: It is not an ordinary stablecoin, it not only benchmarks the value of the US dollar, but also represents the real GPU income right;

2) sAID: Users can automatically accumulate income by staking the income certificates obtained by staking AID;

3) The underlying income comes from: cash flow of GPU trading packages + treasury bond reserves, which constitute a support system;

4) Mechanism design: AID casting and destruction mechanism to ensure that it is anchored to the real asset value;

5) Exit mechanism: Whitelisted users can redeem 1:1, and ordinary users can exchange stable coins through the AMM pool.

In addition, sAID can also participate in various Defi games such as lending, liquidity mining, and income derivatives (which have been integrated with mainstream dex - Curve, AEVO, Uniswap; Pendle, etc.), which is equivalent to directly opening up the entire line from the underlying assets of the GPU to the Defi on the chain.

Purely from the perspective of income, the underlying income + Defi income + integral income, etc., even with the most basic debt model, the highest return may be up to 40%.

__________________

4. Participation Opportunity Analysis? Where are the risks? How can the project be circumvented?

At the beginning of 2025, the project launched a pilot with Aethir, a decentralized GPU platform, and completed a $100,000 tokenized financing pilot within 10 minutes, proving that the market demand is strong. The funds raised are used to support physical GPU clusters, and investors are already starting to reap the rewards.

This indicates that GAIB's "GPU asset tokenization" model has run through and has the basis for replication and scale.

From the perspective of projects, traditional RWA products are mostly tokenized by treasury bonds, with an annualized return of 4%-5%; The underlying base income of the GAIB project is as high as more than 10%, and the financing term covers from 3 months to 3 years, but from a practical point of view, due to the strong demand for GPUs, the general financing term will be shorter and the turnover speed will be faster.

From the perspective of risk, there are mainly credit risks of underlying assets and liquidity risks of AID. The most critical is the credit risk of the underlying asset. GAIB and other cooperating underwriters on its platform follow sound credit analysis requirements and, where necessary, cooperate with third-party auditors.

Each loan is overcollateralized by the physical GPU and its associated service contract. In addition, this GPU data will also be displayed on the decentralized network in real time.

In the event of default, the underwriters have the right to liquidate the GPUs to protect investors, or continue to host and manage the GPUs through strategic data center partners to ensure continued revenue generation. At least in terms of mechanism, try to avoid the risk of the occurrence of the lowest assets.

In terms of specific participation, if you are a whitelisted user (through KYC users), you can directly mint AID in 1:1 USDC to participate in the project and superimpose Defi income.

If it is non-whitelisted, it can be exchanged directly through the liquidity pool. At present, you can also join the AID waitlist of the project, which is in the queue, and for LPs, the project will have Points/Token to incentive, and will also cooperate with Dex to jointly incentive.

__________________

5. Summary and outlook: The value is much more than a yield-based stablecoin

GAIB is not a simple "income stablecoin" project, it is reconstructing the capital market infrastructure in the AI era in a DeFi way.

At the end of last year, GAIB closed a $5 million Pre-Seed funding round led by Hack VC, with participation from Animoca, Aethir, Near Foundation and other well-known institutions.

Judging from the lineup of investors, it is not difficult to find that GAIB is standing on the cusp. In particular, Hack VC, as an institution that bets on several top projects, its endorsement itself is a bellwether of market trends.

It is worth mentioning that from the perspective of the team lineup, the project Co-Founder Alex Yeh is also the founder of Realtek (one of the world's seven largest chip companies, a listed company), and its cloud company GMI Cloud is a partner of NVIDIA.

GAIB is not promoting a "high-yield product" or a "stablecoin protocol", but a new paradigm:

It connects AI infrastructure and global pools of funds, using GPU cash flow as an anchor asset, transforming "dead assets" sleeping in data centers into tradable, composable, and liquid financial assets.

Through AID, a new type of "income-based dollar", it allows anyone to participate in the AI computing power market - no need to understand AI, buy chips, or deploy nodes, and "collect rent on the chain" every day.

It is providing a permissionless, global, open and transparent financing channel for AI infrastructure, allowing investors to connect directly with computing power providers, and no longer rely on intermediaries or centralized-led resource allocation.

In the future, if AID can truly become the "currency" of the AI era - like the US dollar did in the industrial age, taking on the functions of circulation, settlement and pricing, then it will not only leverage a DeFi sub-track, but also the financial center of the AI economy.

We can even compare GAIB to the "computing power Taobao" on the chain - AI companies come to "open stores" (mortgage graphics card financing), investors come to "shop" (buy computing power cash flow assets), and the platform is responsible for matching and transaction clearing.

The imagination of this model will go far beyond the story of a "yield stablecoin", but move towards an infrastructure-level role in the new paradigm of AI finance.

Show original

83.83K

97

吴说区块链

Wu said that it was learned that Aevo's governance proposal AGP-2 has been approved and will resume the monthly on-chain buyback program. According to the proposal, AEVO token holders voted to restart the on-chain token buyback mechanism, which takes place on a monthly basis.

Show original81.78K

8

ChainCatcher 链捕手

According to Aevo's official X account, Aevo's governance proposal AGP-2 has been approved by the community and will resume the monthly on-chain buyback program. According to the proposal, AEVO token holders voted to restart the on-chain token buyback mechanism, which takes place on a monthly basis. In the announcement, Aevo thanked all participants and voters for their support of the AGP-2 proposal.

Show original19.79K

0

Aevo price performance in USD

The current price of Aevo is $0.12588. Over the last 24 hours, Aevo has increased by +1.90%. It currently has a circulating supply of 903,996,699 AEVO and a maximum supply of 1,000,000,000 AEVO, giving it a fully diluted market cap of $113.54M. At present, the Aevo coin holds the 162 position in market cap rankings. The Aevo/USD price is updated in real-time.

Today

+$0.0023500

+1.90%

7 days

-$0.01819

-12.63%

30 days

+$0.028180

+28.84%

3 months

-$0.03252

-20.54%

Popular Aevo conversions

Last updated: 05/22/2025, 07:41

| 1 AEVO to USD | $0.12560 |

| 1 AEVO to BRL | R$0.70940 |

| 1 AEVO to PHP | ₱6.9910 |

| 1 AEVO to EUR | €0.11086 |

| 1 AEVO to IDR | Rp 2,054.64 |

| 1 AEVO to GBP | £0.093594 |

| 1 AEVO to CAD | $0.17409 |

| 1 AEVO to AED | AED 0.46133 |

About Aevo (AEVO)

- Official website

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Aevo FAQ

How much is 1 Aevo worth today?

Currently, one Aevo is worth $0.12588. For answers and insight into Aevo's price action, you're in the right place. Explore the latest Aevo charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Aevo, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Aevo have been created as well.

Will the price of Aevo go up today?

Check out our Aevo price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials