AAVE

AAVE price

$229.27

-$7.1600

(-3.03%)

Price change from 00:00 UTC until now

How are you feeling about AAVE today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

AAVE market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$3.46B

Circulating supply

15,115,257 AAVE

94.47% of

16,000,000 AAVE

Market cap ranking

28

Audits

Last audit: Dec 2, 2020

24h high

$239.23

24h low

$216.42

All-time high

$665.71

-65.57% (-$436.44)

Last updated: May 19, 2021

All-time low

$25.9300

+784.18% (+$203.34)

Last updated: Nov 5, 2020

AAVE Feed

The following content is sourced from .

ChainCatcher 链捕手

Article author: 0x9999in1, MetaEra

"Since we published our research report on ETH at $1,700, the price of ETH has increased by more than 70% in just over a decade." Jack Yi, founder of LD Capital, shared this "good news" on his social platform.

This is not only a confirmation of the market trend, but also like a battle-hardened veteran who has once again won the rewards with judgment and courage on the battlefield.

As a veteran investor in the crypto industry since 2015, Jack Yi has not only witnessed the growth and transformation of mainstream cryptocurrencies such as Bitcoin and Ethereum, but also accumulated a wealth of market insights through investment in more than 200 projects. Recently, MetaEra had the pleasure of inviting Jack Yi to conduct an in-depth interview to share his experience growing up in the market cycle, optimistic predictions about the future value of Ethereum, and effective strategies to deal with market volatility.

Essence view

● As the entire financial infrastructure and crypto-native innovation place, the ETH ecosystem is still the most leading in the entire industry.

● The greatest value in the blockchain field has been proved to be financial substitution and upgrading, rather than Web2 application substitution.

● ETH as a financial infrastructure has more than ten times the potential for market growth.

● Focusing on future trends is at the core of our investment.

● The strong Hengqiang and the higher requirements for investment and research, so we are forced to update our knowledge and information, and we cannot rely on simple cycle thinking to invest.

Full text of the interview

MetaEra: As a crypto OG, you have a lot of experience in the crypto investment space, please share what experiences in your career have had a significant impact on your current market analysis and decision-making?

Jack Yi: I've been in the crypto industry since 2015 and used to be in classical investing. Several key milestones had a big impact on me, one was the early Bitcoin mining and buying of Ethereum, which caught up with the upward trend phase, and the crazy new project investment boom in 2017. But during the Great Bear Market of 2018 and 2019, the industry encountered its first trough, and after the 312 incident, it ushered in another mad bull, and then entered the bear market again, in the process, participated in more than 200 project investments, and went through the pains of more than a dozen trading teams and team management, countless joys and sorrows to really establish the cycle concept and the current investment philosophy.

MetaEra: In your latest research report, you put forward an optimistic forecast for ETH to reach $10,000 in the long term. Please elaborate on the main arguments and technical logic in support of this prediction?

Jack Yi: First of all, this forecast is based on our trend judgment of this bull market. CZ predicts that the price of Bitcoin could be between $500,000 and $1 million, while we conservatively estimate that Bitcoin could reach $300,000, so it is reasonable to expect Ethereum to rise to $10,000. ETH as the entire financial infrastructure and crypto-native innovation, the ecology is still the most leading in the entire industry, and the ETH Foundation has also refocused on the development of the L1 ecology, and secondly, the reason why ETH has fallen a lot before is because of the market leverage cleaning factor, too many large investors rely on the last round of bull market thinking to long ETH, and the liquidation of large accounts and multiple armies will inevitably rebound reasonably, because ETH shorted nearly 10 million ETH on the whole network at the moment of $1700, which is a historic opportunity for multiple armies, full of momentum.

MetaEra: In the face of ETH rising for several days, the gold content of your research report is still rising, do you have any views you would like to share for users who have already executed investment actions and are still waiting?

Jack Yi: I think investing requires a lot of patience to withstand the volatility process. As a head asset, ETH itself should be a long-term allocation, and if you have executed investment actions, you should take it for a long time until you think this round of bull market is over before selling; For users who are still waiting, they can buy gradually, and they don't have to worry about buying high if they have a normal pullback, the cycle is lengthened investment allocation mode, or looking for new assets with more growth potential, because the rebound and recovery of ETH will lead the industry to a bull market, and only ETH and the ecological recovery can bring back the bull market, BTC is an electronic gold asset.

MetaEra: What specific steps do you recommend investors take to manage risk and capture opportunities in the ETH ecosystem in the face of market volatility?

Jack Yi: Volatility is the biggest feature of finance, for investors, can not expect to invest in the most ideal price, no one's trading can be at the ideal point of buying and selling, can only extend the cycle to set the buy and sell price, ETH ecology will indeed have a lot of good assets The growth rate will exceed ETH, this requires professional investment and research capabilities, because the higher the return, the greater the risk, we focused on the analysis of head projects like UNI, ENJ and AAVE in the research report.

MetaEra: Even if short-term price fluctuations are not taken into account, where do you see Ethereum's greatest growth potential in the next five to ten years?

Jack Yi: First of all, the blockchain field has proven to be the biggest value is financial substitution and upgrading, rather than engaging in Web2 application substitution, the scale of the entire global financial field is up to hundreds of billions of dollars in the market, and the crypto field has too many advantages to do, as the entire industry advances, ETH as a financial infrastructure, there is more than ten times the market growth potential, this is not an exaggeration.

MetaEra: The crypto market has been bullish and bearish several times, how to define the current cycle of the crypto market? How should investors adjust their strategies to different market stages?

Jack Yi: As far as my personal observation is concerned, we are currently at the beginning of the arrival of the bull market, in fact, you see that BTC and SOL (when SOL is 25~30 dollars, we have released 2 SOL research reports in a row) have increased by 6 times and 20 times respectively, but in this cycle, because of the excessive variety of projects, and the MEME bull market led by compliant ETFs and listed companies focusing on buying BTC and SOL, there is no general rise in the market, which is also in line with the laws of mature financial markets, you go to look at U.S. stocks, In the bull market for decades, not all listed companies can win the index, and the strong Hengqiang and the requirements for investment research are higher, so they force everyone to update their knowledge and information, and cannot rely on simple cyclical thinking to invest.

MetaEra: What track will LD Capital focus more on at the moment? Does it have an investment logic that is different from that of other investment institutions?

Jack Yi: We are currently focusing on secondary market investment, and we are preparing to set up two secondary institutions in different directions, namely Trend Research and Liquid Digital, and for primary market investment, we see infrastructure construction, AI and IPO opportunities. For example, in 2022, we advised every founder to raise as much capital as possible and simplify the team structure to survive the bear market and wait for the bull market to come.

MetaEra: What are the potential implications of changing regulatory policies around the world on the cryptocurrency market? What do you think of this challenge?

Jack Yi: After the U.S. president, who is the most friendly to the crypto community, took office, the global crypto industry ushered in the best regulatory environment, and Hong Kong, the financial center of Asia, is also releasing more crypto-friendly policies. Now, the most important influencing factors include the approval of crypto ETFs, the increase in investment by listed companies in crypto assets such as Bitcoin, and the continuous listing of crypto companies, and I believe there will be more positive news in the future.

MetaEra: In your opinion, what have been the most significant changes in the blockchain and cryptocurrency industry over the past few years? What does this mean for the future?

Jack Yi: Over the past few years, as cryptocurrencies have gradually integrated into mainstream financial markets, the cyclical nature of the crypto industry has become less pronounced, which is very positive for the long-term development of the industry. At the same time, it also puts forward higher requirements for the professionalism of investors. Secondly, we need to think about the opportunities in the future industry, compliance and on-chain are the big paradigm shifts we are currently seeing. In addition, IPO, infrastructure construction, AI and other restructuring opportunities, focusing on future trends is the core of our investment, and everyone is welcome to exchange views on future opportunities.

Show original

3.19K

0

52Hz Database

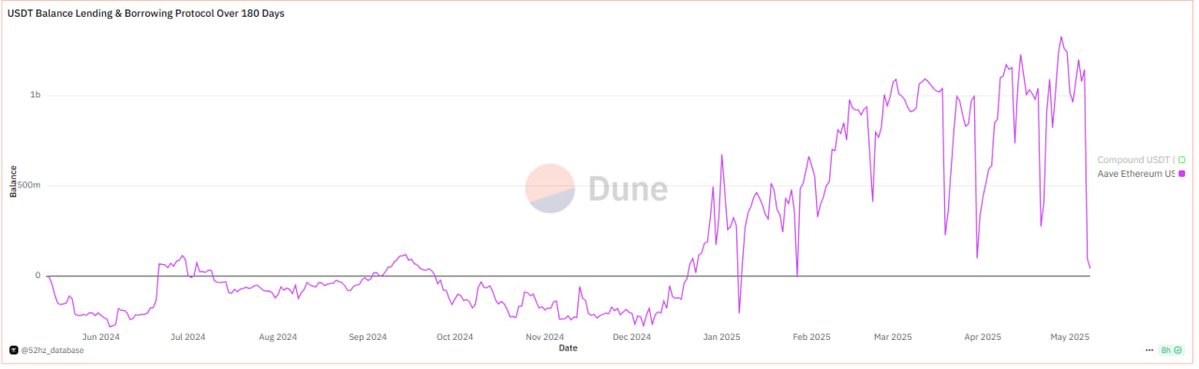

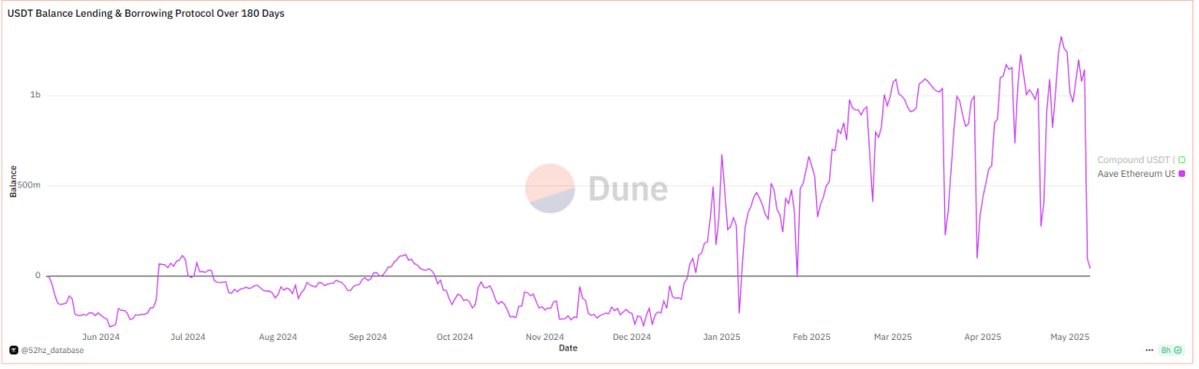

What does this chart tell us about the recent price push?

Update on chart analysis "USDT Balance Lending & Borrowing Protocol"

Looking at the chart, we can see that every time the purple line drops suddenly, there are signs of a rebound. So, what is the reason?

Looking back at the past, during previous sudden drops, this purple line always tended to reverse and rise higher than the initial peak before the sharp decline (marked with red and green circles in the image). This indicates that borrowed funds from this platform, after being used to push the market price, are immediately settled, including both principal and interest.

However, after last week's price push, funds from the #AAVE platform, after being used to push, have only been partially withdrawn (about half) and are showing signs of continuing to decline -> This proves that a portion of the funds is staying in the market, helping to strengthen the sustainable upward trend in the medium and long term.

Currently, we are just waiting for the purple line to drop below 0 and go sideways to officially confirm the market's medium to long-term upward wave.

Drop a heart to support the team for upcoming updates ❤️

52Hz Database

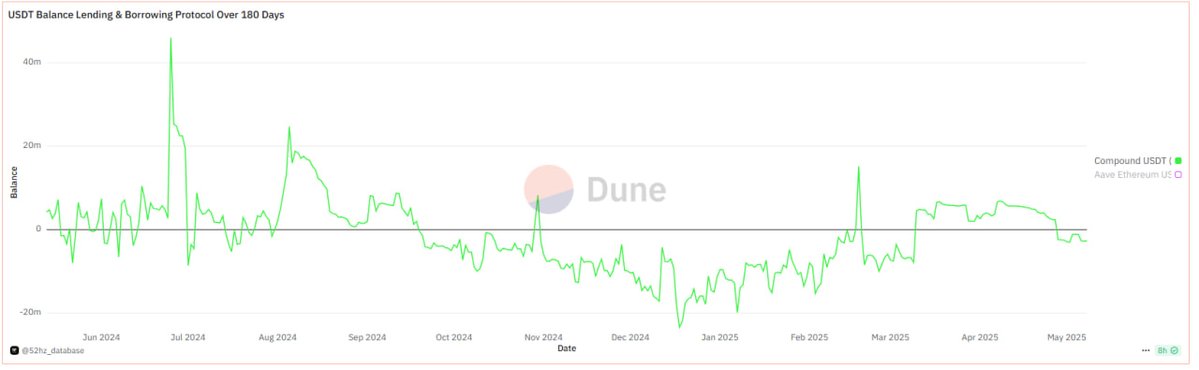

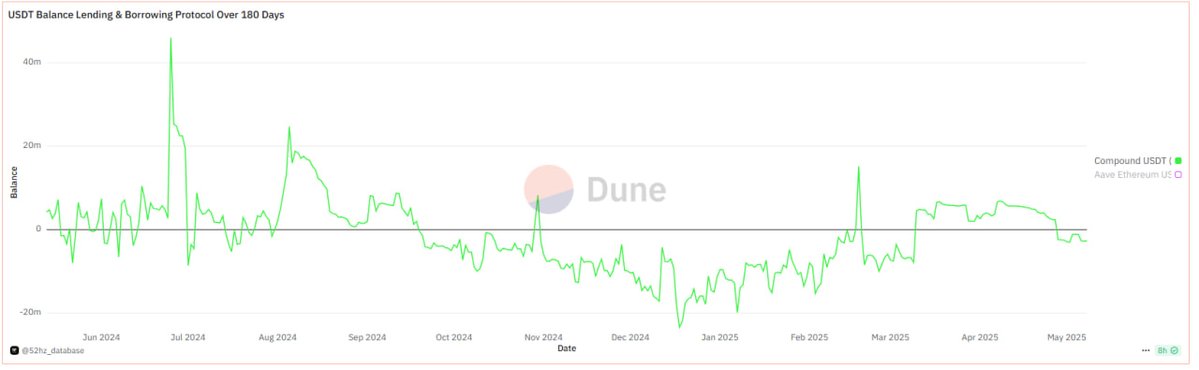

Read this article to find out whether today's market rally can sustain in the long term.

Analysis and evaluation of today's market rally

Today's market push largely stems from $USDT balances on the two L&B platforms, #AAVE and #Morpho.

Analysis and a look back at the past of the two balance lines on the L&B platform:

#Compound: When the green line breaks below 0 and shows signs of flattening underneath, it indicates that funds are flowing directly into the market. We can observe this during the period from mid-November to the end of December last year (image).

#AAVE: The pink line is currently recording a rapid and sudden decline, indicating that funds from #AAVE are also being strongly withdrawn to push market prices. In all three previous instances when this line dropped suddenly, the market experienced short- and medium-term rallies (image).

However, for the market to rise strongly and remain stable in the long term, both of these lines need to flatten below 0 for an extended period. Currently, only the Compound line confirms this; let's wait and see the reaction from the #AAVE line.

Follow and hit the like button so the team can bring these data updates to everyone as soon as possible! ❤️🔥

4.1K

8

52Hz Database

What does this chart tell us about the recent price push?

Update on chart analysis "USDT Balance Lending & Borrowing Protocol"

Looking at the chart, we can see that every time the purple line drops suddenly, there are signs of a rebound. So, what is the reason?

Looking back at the past, during previous sudden drops, this purple line always tended to reverse and rise higher than the initial peak before the sharp decline (marked with red and green circles in the image). This indicates that borrowed funds from this platform, after being used to push the market price, are immediately settled, including both principal and interest.

However, after last week's price push, funds from the #AAVE platform, after being used to push, have only been partially withdrawn (about half) and are showing signs of continuing to decline -> This proves that a portion of the funds is staying in the market, helping to strengthen the sustainable upward trend in the medium and long term.

Currently, we are just waiting for the purple line to drop below 0 and go sideways to officially confirm the market's medium to long-term upward wave.

Drop a heart to support the team for upcoming updates ❤️

52Hz Database

Read this article to find out whether today's market rally can sustain in the long term.

Analysis and evaluation of today's market rally

Today's market push largely stems from $USDT balances on the two L&B platforms, #AAVE and #Morpho.

Analysis and a look back at the past of the two balance lines on the L&B platform:

#Compound: When the green line breaks below 0 and shows signs of flattening underneath, it indicates that funds are flowing directly into the market. We can observe this during the period from mid-November to the end of December last year (image).

#AAVE: The pink line is currently recording a rapid and sudden decline, indicating that funds from #AAVE are also being strongly withdrawn to push market prices. In all three previous instances when this line dropped suddenly, the market experienced short- and medium-term rallies (image).

However, for the market to rise strongly and remain stable in the long term, both of these lines need to flatten below 0 for an extended period. Currently, only the Compound line confirms this; let's wait and see the reaction from the #AAVE line.

Follow and hit the like button so the team can bring these data updates to everyone as soon as possible! ❤️🔥

2.76K

1

AAVE price performance in USD

The current price of AAVE is $229.27. Since 00:00 UTC, AAVE has decreased by -3.03%. It currently has a circulating supply of 15,115,257 AAVE and a maximum supply of 16,000,000 AAVE, giving it a fully diluted market cap of $3.46B. At present, the AAVE coin holds the 28 position in market cap rankings. The AAVE/USD price is updated in real-time.

Today

-$7.1600

-3.03%

7 days

+$56.0300

+32.34%

30 days

+$83.2300

+56.99%

3 months

-$27.1500

-10.59%

Popular AAVE conversions

Last updated: 05/14/2025, 19:37

| 1 AAVE to USD | $229.12 |

| 1 AAVE to BRL | R$1,285.32 |

| 1 AAVE to PHP | ₱12,778.90 |

| 1 AAVE to EUR | €203.59 |

| 1 AAVE to IDR | Rp 3,791,494 |

| 1 AAVE to GBP | £171.61 |

| 1 AAVE to CAD | $318.72 |

| 1 AAVE to AED | AED 841.57 |

About AAVE (AAVE)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

AAVE FAQ

How much is 1 AAVE worth today?

Currently, one AAVE is worth $229.27. For answers and insight into AAVE's price action, you're in the right place. Explore the latest AAVE charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as AAVE, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as AAVE have been created as well.

Will the price of AAVE go up today?

Check out our AAVE price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials