How do I apply for the VIP Loan?

What's VIP Loan?

Our VIP Loan provides a consistent interest rate throughout the entire borrowing period, ensuring you have predictable and manageable borrowing costs. This stability ensures you can plan your finances with confidence and avoid unexpected fluctuations in your repayment amounts. Additionally, the transparency and reliability of our fixed-rate structure make it easier for you to budget effectively and maintain control over your financial commitments throughout the loan term.

Note: VIP Loan is only open to VIP 5 and above.

What are the benefits of VIP Loan?

Consistent interest rate: borrow at a fixed rate throughout the term, providing you with the stability your need.

Easy loan redemption and extension: confidently manage your borrowing needs with our intuitive interface, making loan redemption and extension hassle-free.

Efficient matching of lending supply: our transparent peer-to-peer matching engine efficiently aligns your borrowing and lending demands, reviewing and matching available lending quotas from reliable lenders to meet your needs.

How do I subscribe to VIP Loan?

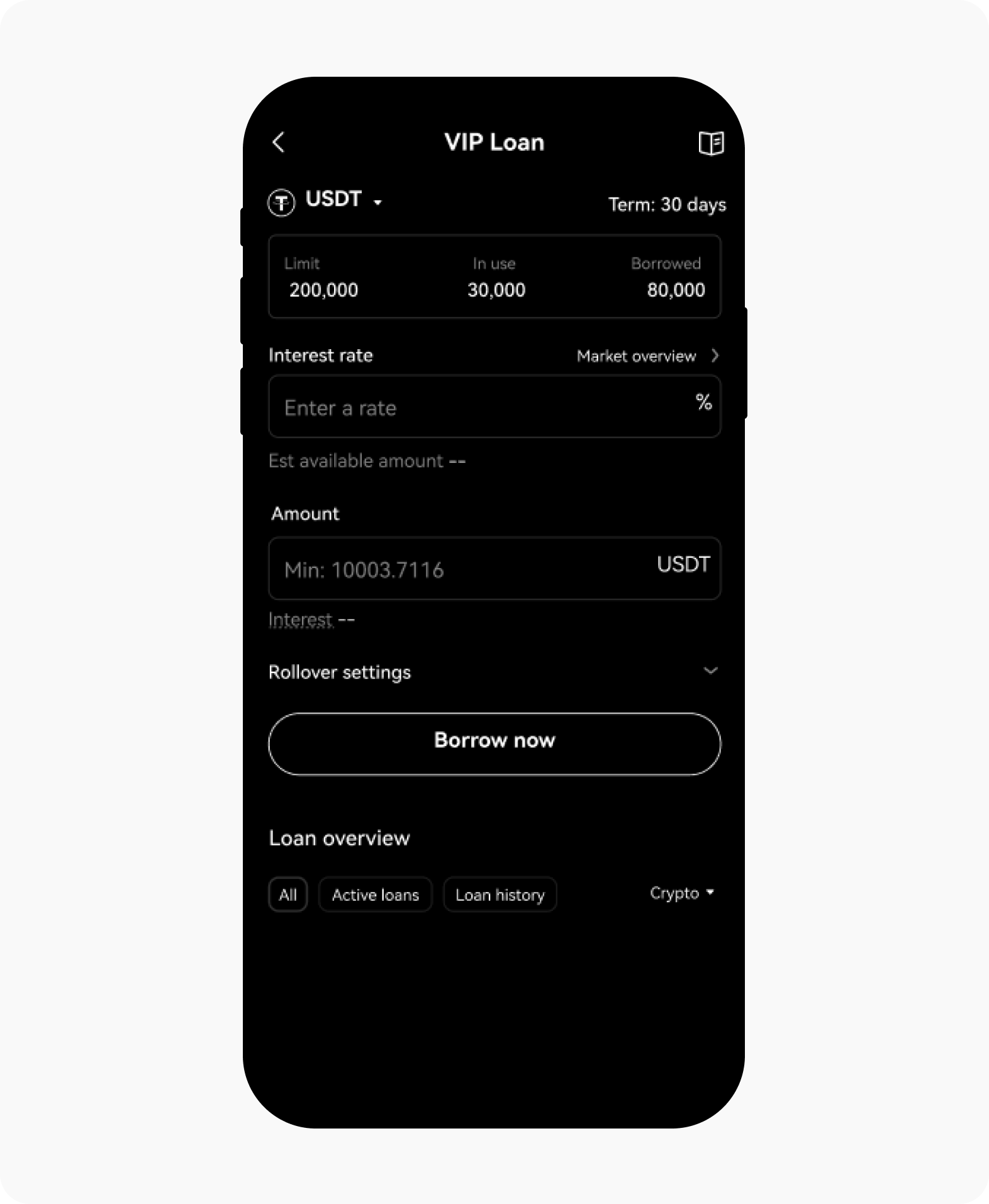

Head over to Trade > VIP Loan

Select Market overview for the latest borrowing rate and available liquidity

Fill in the preferred borrowing rate and borrowing quota

Navigate to VIP Loan when trading with ease

How do I manage VIP Loan?

Manage your loan with ease — under Loan overview, choose to repay early or rollover your loan

Follow below instructions according to your preferred rollover:

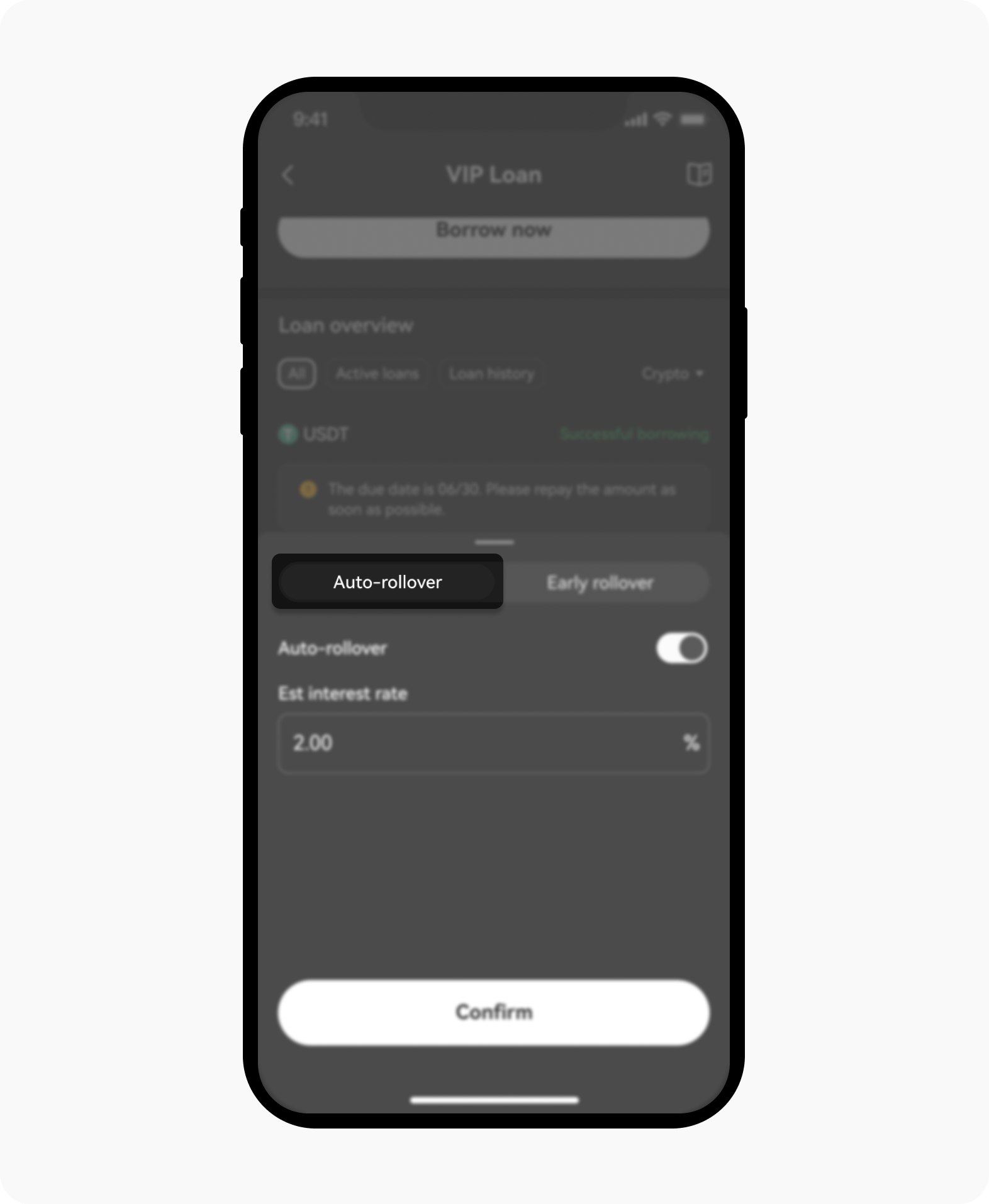

Auto-rollover:

To opt for auto-rollover, turn on the Auto-rollover option and enter the estimated interest rate you'd like to borrow at.

Upon successful roll over of your loan, a new order will be placed upon maturity.

Auto-rollover pop-up looks like before confirmation to roll over

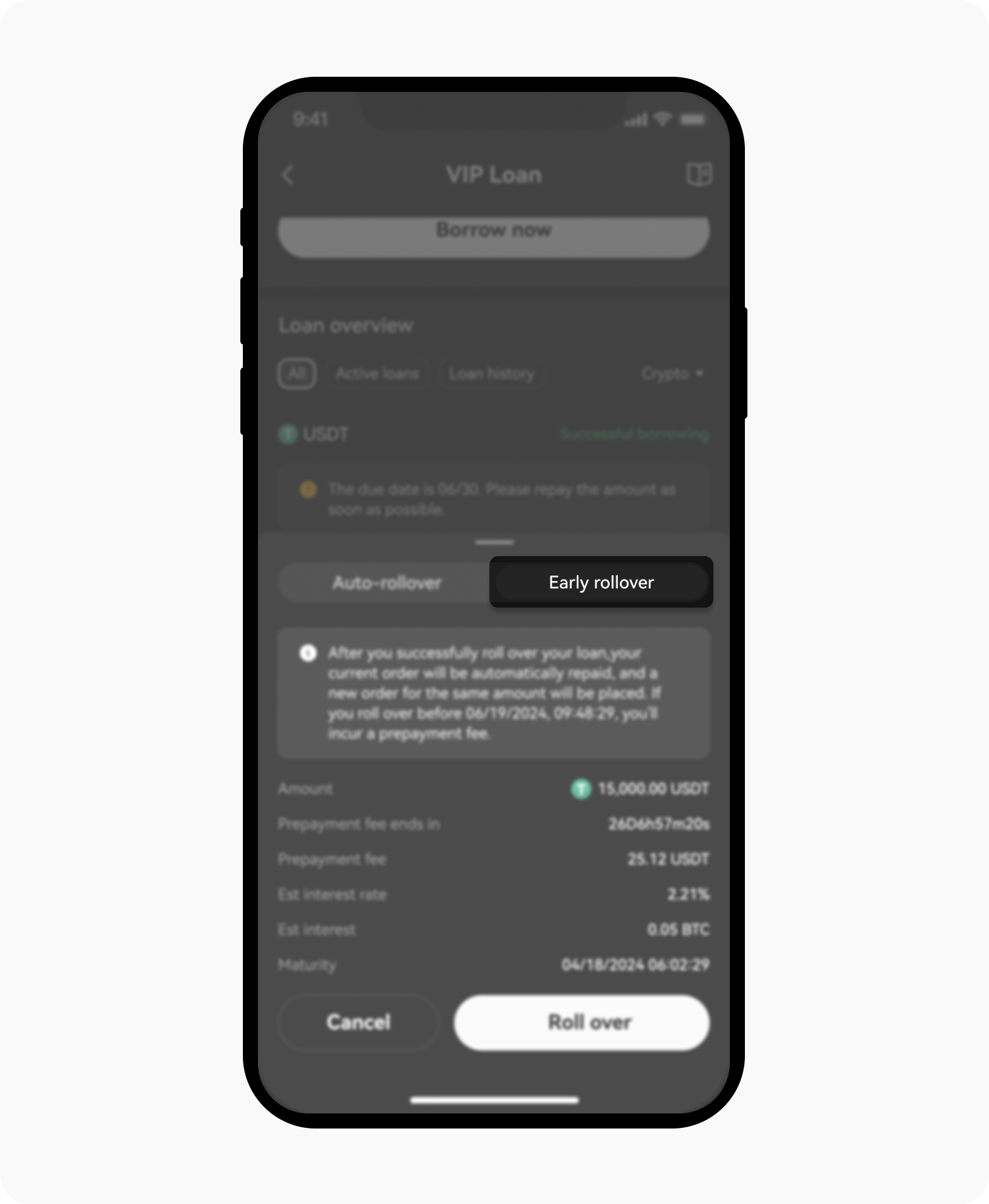

Early rollover: alternatively, you can opt for the Early rollover option by selecting it, allowing you to renew the order immediately without waiting for maturity.

The view on the Early rollover option before you confirm to roll over

When do I need to repay the loan?

Each VIP Loan has a fixed borrowing duration. You're obligated to repay the loan by the end of each borrowing term.

Early repayment is an option, but it comes with an additional cost of 30% interest on the remaining loan duration. However, this fee only applies if the repayment is made more than 6 hours before maturity. Early repayment or rolling over within 6 hours before maturity will not incur this fee.

If the loan isn't repaid by the end of the loan duration, there's an additional period of 30 days to settle the outstanding amount. However, during this time, a higher compensatory interest rate may be charged based on prevailing market conditions. In addition to that, payment overdue for over 30 days will trigger forced liquidation on your end.