Today we're seeing all kinds of decentralized applications (DApps) that make use of smart contracts to offer revolutionary levels of transparency, security, and autonomy. Unfortunately, they tend to operate in silos — sheltered from the ongoing catalysts of real-time events. That's where blockchain oracles like Pyth come in.

As the bridge between blockchains and real-time data sources, Pyth serves as a crucial intermediary that allows smart contracts to interact with real-world information and react to ongoing developments. Curious about how Pyth promises to change the way DApps operate?

From delivering real-time data with low latency to offering confidence intervals with each set of data, here's all you need to know about Pyth Network, the PYTH token, and its emergence as one of the fastest-growing financial oracles in decentralized finance (DeFi).

What is Pyth Network?

Pyth Network is a decentralized, pull-based blockchain oracle solution that specializes in collecting real-time, high-quality price data for a wide range of assets, including cryptocurrencies, commodities, and fiat currencies. Launched on the Solana blockchain, Pyth integrates over 90 exchanges, market makers, and financial services providers who share their exclusive price data on-chain. This data is then updated every 400 milliseconds, compiled, and distributed to various smart contract applications to give Pyth users access to the most high-fidelity, time-sensitive data possible.

Despite launching relatively recently in August 2021, Pyth has gathered a massive following and supports more than $80 billion in trading volume. The network is currently used by over 200 applications both on- and off-chain, and highlights a genuine need for high-fidelity data in the DeFi space.

What are blockchain oracles?

To truly appreciate the innovation Pyth Network is bringing to the DeFi space, we first have to understand what blockchain oracles are and how they're the cornerstone of the DeFi ecosystem.

Known as the bridge between real-world data and the digital world of blockchain networks, blockchain oracles serve as translators for data feeds. Since blockchains are incapable of accessing external data outside their network, blockchain oracles help to fill this gap by publishing off-chain price information on-chain. By providing accurate and timely real-world data, price oracles enable smart contracts to make informed decisions based on real-world events.

If you're wondering how blockchain oracles maintain their impartiality, that's where decentralization comes in. By distributing the data-fetching duties across multiple authorities, blockchain oracles can remain reliable since the data they're providing is tamper-proof.

How does Pyth Network work?

Pyth Network emerges as a groundbreaking solution to the price oracle conundrum. It introduces a decentralized and open-source approach to price oracle infrastructure, addressing the limitations of traditional centralized oracles.

Pyth Network's unique architecture guarantees data integrity, transparency, and reliability, making it an ideal choice for powering DApps that demand accurate real-time market data. In a high-throughput DeFi ecosystem with DApps like decentralized exchanges (DEXs) and lending protocols, blockchain oracles with high reliability are in high demand. Here, they help determine asset prices, collateral requirements, and other critical parameters.

Without reliable price oracles, these DeFi applications would be unable to function effectively, potentially leading to unintended miscalculations and financial losses. DEXs would be incapable of facilitating seamless token swaps without slippage, lending protocols would poorly manage collateralization ratios, and AMMs can't maintain liquidity pools at fair prices. That's where Pyth Network's high-fidelity, time-sensitive, real-world data comes into play.

Pyth Network's architecture

Pyth Network's unique architecture sets it apart from traditional price oracle solutions. Instead of relying on a single source of data, Pyth Network aggregates price feeds from a diverse network of publishers, including exchanges, market makers, and traditional financial institutions. As previously mentioned, this diverse network now includes a total of over 90 unique price feeds. This decentralized approach makes sure that the price data provided by Pyth Network is highly accurate, first-party, resilient to manipulation, and transparent to the public.

Pyth Network's on-demand, pull nature

Most blockchain oracles today make use of a “push” model, which involves an off-chain process that continuously sends transactions to update an on-chain price. In contrast, Pyth Network delegates this work to Pyth users. Essentially, Pyth price updates are created on Pythnet and streamed off-chain via the Wormhole Network, a cross-chain messaging protocol on the Solana blockchain. These permissionless price updates are signed such that the Pyth on-chain program can verify their authenticity.

Typically, users of Pyth Network prices will submit a single transaction that simultaneously updates the price and uses it in a downstream application. This ultimately promotes gas efficiency and lower latency since Pyth Network won't require gas fees for every price update, and every transaction can use a recent off-chain price as a reference.

How Pyth Network innovates as a blockchain oracle

While price oracles aren't new to the DeFi scene, Pyth Network does introduce a range of improvements that help set it apart. Here are the key innovations Pyth is introducing.

Unmatched oracle update frequencies

While other oracles might face delays or centralization risks, Pyth Network operates on Solana's high-performance blockchain. This guarantees near-instantaneous data updates, as Pyth promises frequencies of close to 400 milliseconds. With updates every fraction of a second, Pyth provides data that's as close to real-time as it gets. These data updates get even more frequent with an on-demand price update model that allows Pyth users to permissionlessly push price updates on-chain at every slot for usage. This speed, combined with decentralization, makes Pyth Network a game-changer for DApps requiring timely and accurate information.

Data confidence intervals

Compared to other blockchain oracles, Pyth publishes confidence intervals for all price feeds. These intervals are a certainty measure of the true price of an asset, since prices tend to vary depending on where the asset is being traded. The best thing about introducing confidence intervals is that it allows for continuous price availability during moments of high price volatility. Rather than stonewalling and rejecting certain prices from being fed to the network, Pyth uses these confidence intervals to assess their accuracy. This is so the true price of the asset can be measured without using price triggers to influence the correctness of price reflection.

During the Terra ecosystem collapse incident in May 2022, Pyth managed to accurately track the LUNA price during the UST de-peg. Back then, other price oracles experienced lapses because of hard-coded price triggers that caused circuit breakers. These circuit breakers stopped updating the price of an asset when prices went below 0.1 USD. However, Pyth Network maintained a solid uptime with a resilient LUNA/USD price feed that remained active throughout the situation.

The use of first-party data that's verifiable on-chain

Gone are the days when DApps had to rely on data of questionable quality from unverified sources. Unlike other blockchain oracles that tend to rely on opaque data from third-party sources, Pyth Network aggregates first-party price feeds from multiple publishers instead of relying on a single source of data. With first-party data from a range of established financial institutions in the traditional finance and crypto industries, the risk of manipulation is significantly reduced as integrity is maintained thanks to this decentralized approach. Additionally, as these data sources are publicly disclosed, there's greater overall transparency since users can verify the accuracy of the data on-chain with Solana Explorer.

Keen to find out how Pyth Network compares to industry-leading blockchain oracles? Here's an in-depth comparison of how Pyth Network compares to ChainLink that highlights key differentiators between Pyth and other blockchain oracles.

PYTH tokenomics

Curious about the future utility of PYTH tokens once they're available for public trading? One of the biggest forms of utility the Pyth Network team has in mind is participation in the Pyth DAO. By holding PYTH tokens, PYTH holders can take part in on-chain governance and determine the future of Pyth Network and key areas of development to work on. Some examples of responsibilities include:

Voting on the size of update fees.

Determining the reward distribution mechanism for data publishers.

Approving other software updates to on-chain programs across blockchains.

Determining how products are listed on Pyth Network and their reference data (e.g., number of decimal places in the price, reference exchanges).

Deciding how publishers will be allowed to provide data for price feeds.

Aside from PYTH's utility, here are some essential details about PYTH's tokenomics:

Max supply: 10,000,000,000 PYTH

Initial circulating supply: 1,500,000,000 (15%)

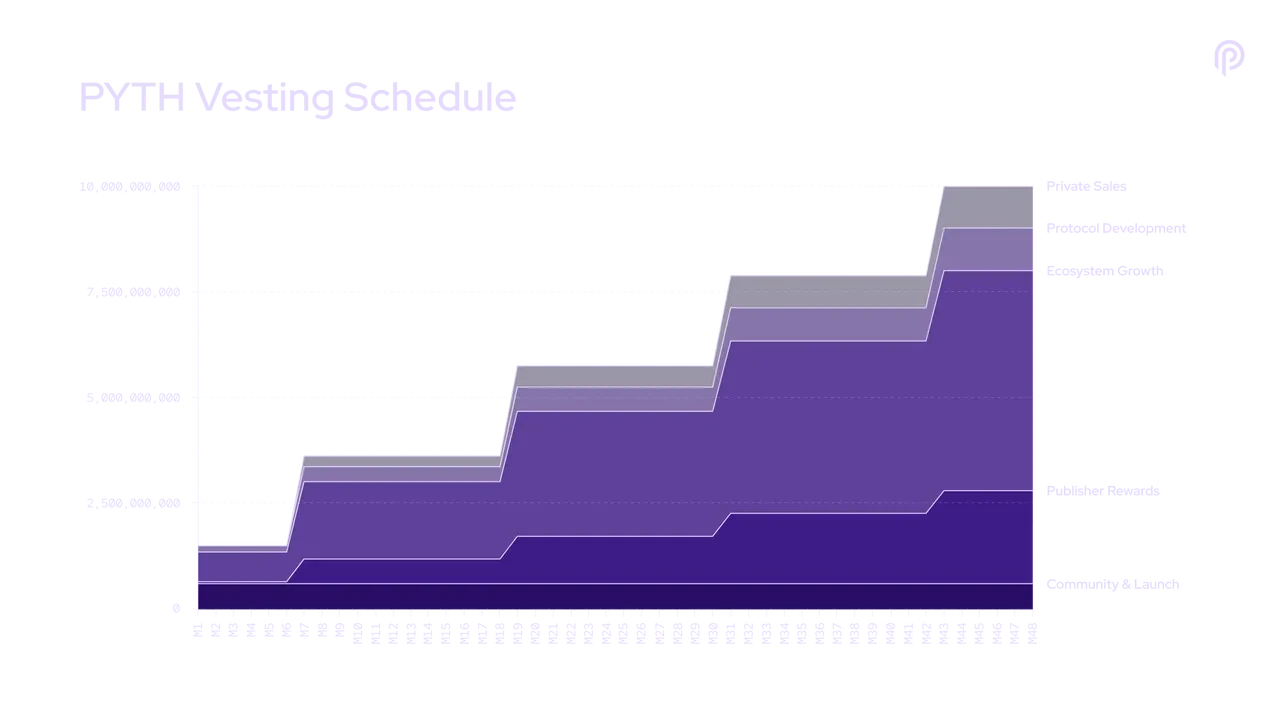

Vesting: 85% of the PYTH tokens are initially locked, and locked tokens will be respectively unlocked six, 18, 30, and 42 months after the initial token launch. For a clearer visualization of PYTH's vesting schedule, check out the graph below.

Of the 10 billion supply of PYTH tokens, 52% is allocated to Pyth Network's ecosystem growth. Pegged as a strategic allocation set aside for Pyth contributors, this allocated amount rewards a whole bunch of contributors, ranging from Pyth educators to early Pyth Network publishers. Ecosystem growth initiatives include funding for research projects that aim to advance the Pyth Protocol and incentivizing developers to build tools and resources that are Pyth Network friendly.

With such an ample portion of PYTH allocated to Pyth Network's future growth, it's safe to assume the team is ambitious with the project's future growth trajectory. On top of this 52%, an additional 16% is portioned towards protocol development alongside community and launch efforts. This will ideally give Pyth Network the marketing push it needs to achieve its lofty ambitions and establish a solid foundation regarding essentials like oracle tooling and stable data infrastructure.

How to participate in the Pyth Network retrospective airdrop

Keen to find out if you're eligible for the Pyth Network retrospective airdrop? In short, retrospective airdrop recipients are those who have interacted with DApps that use Pyth data or active community members who have interacted with Pyth Network's social media channels.

Here's a quick step-by-step guide for those who are eligible for PYTH token airdrop claims:

To begin the claiming process, first head to Pyth Network's airdrop claim page.

Then, choose the Pyth-supported ecosystems you're active in and check the Pyth Discord checkbox if it's relevant to you. The page will then check your wallet activity and Discord account to calculate how many PYTH tokens you're eligible to claim.

Once completed, your PYTH token allocation will be displayed per connected wallet or account. As PYTH is native to Solana, you'll need to connect your Solana wallet to receive your allocation.

On doing so, you'll need to select the 'sign' button to sign the transaction and complete the claiming process.

The final words and next steps

Due to the inherent isolated nature of blockchains, smart contracts are often self-contained away from external data sources. Fortunately, with Pyth Network serving as a critical intermediary, we'll be able to bridge the gap between real-world data and on-chain operations. With a laser-like focus on delivering accurate data and the inclusion of confidence intervals, the DeFi ecosystem is poised to achieve its true potential. Many believe this is possible if Pyth achieves its vision of revolutionizing how DeFi protocols access and make use of high-fidelity financial data.

Are you eager to learn more about Pyth Network and join the on-chain data revolution to supercharge smart contracts with first-party data? Craft a trading plan and trade PYTH with us today.

© 2025 OKX. Anda boleh memproduksi ulang atau mendistribusikan artikel ini secara keseluruhan atau menggunakan kutipan 100 kata atau kurang untuk tujuan nonkomersial. Jika Anda memproduksi ulang atau mendistribusikan artikel secara keseluruhan, Anda harus menyatakan dengan jelas: “Artikel ini © 2025 OKX dan digunakan dengan izin.” Kutipan terizinkan harus mencantumkan nama artikel dan menyertakan atribusi. Contoh: “Nama Artikel, [nama penulis jika memungkinkan], © 2025 OKX”. Karya derivatif atau penggunaan lain dari artikel ini tidak diperbolehkan.