What are the spot trading guidelines for copy traders?

1. What is spot copy trading?

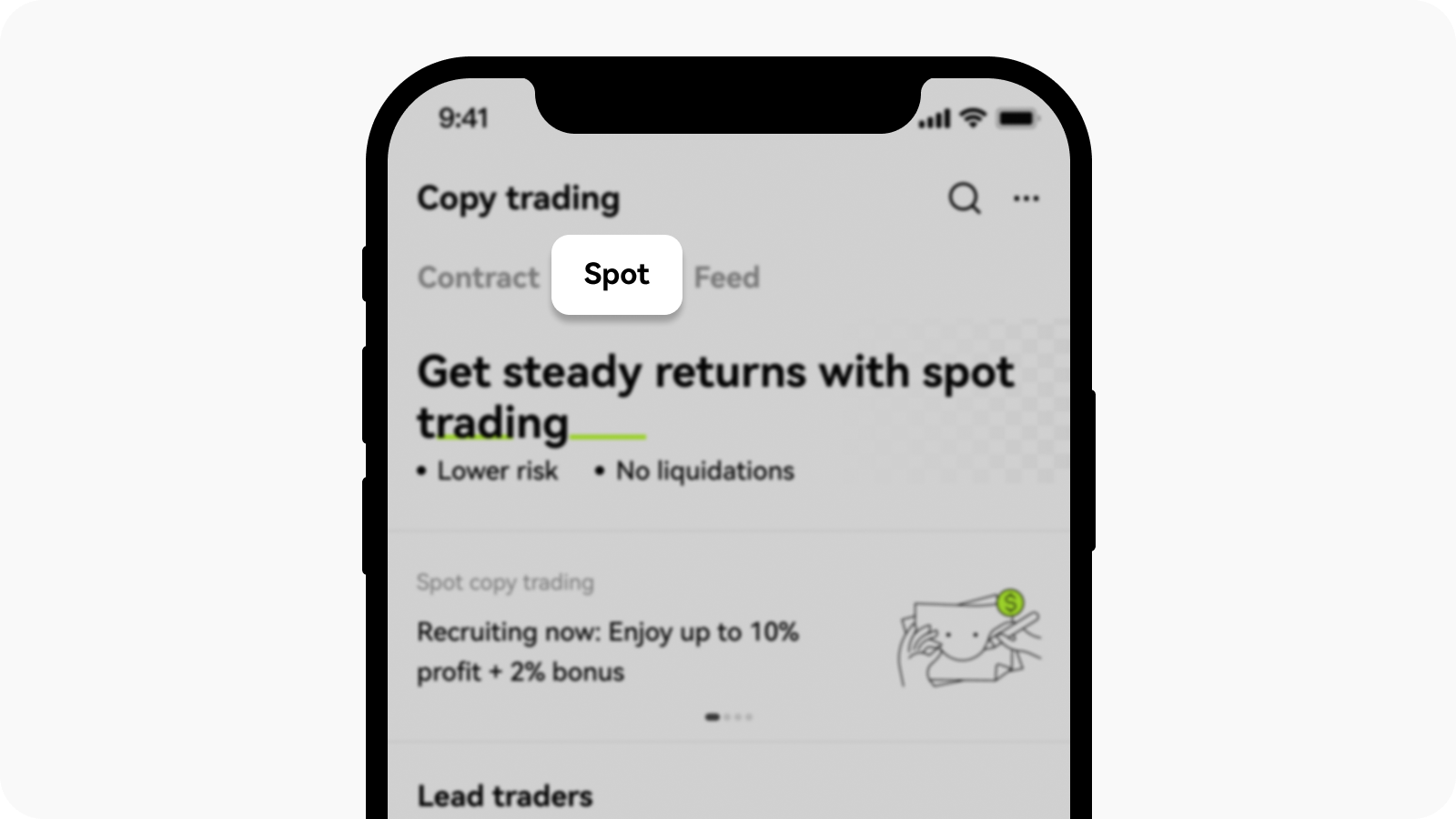

OKX spot copy trading is a novel social investment approach and a valuable portfolio management tool. We've identified top-performing spot traders whose trades you can automatically replicate. This means you no longer need to constantly monitor the market to discover the best opportunities. Spot copy trading comes with no leverage or liquidation risks, making it a lower-risk and more stable investment option for traders. We offer a wide range of cryptocurrencies to help you leverage some of the best market depth in the industry. Furthermore, our copy trading feature includes a mechanism that allows lead traders to share up to 13% of their profits with you.

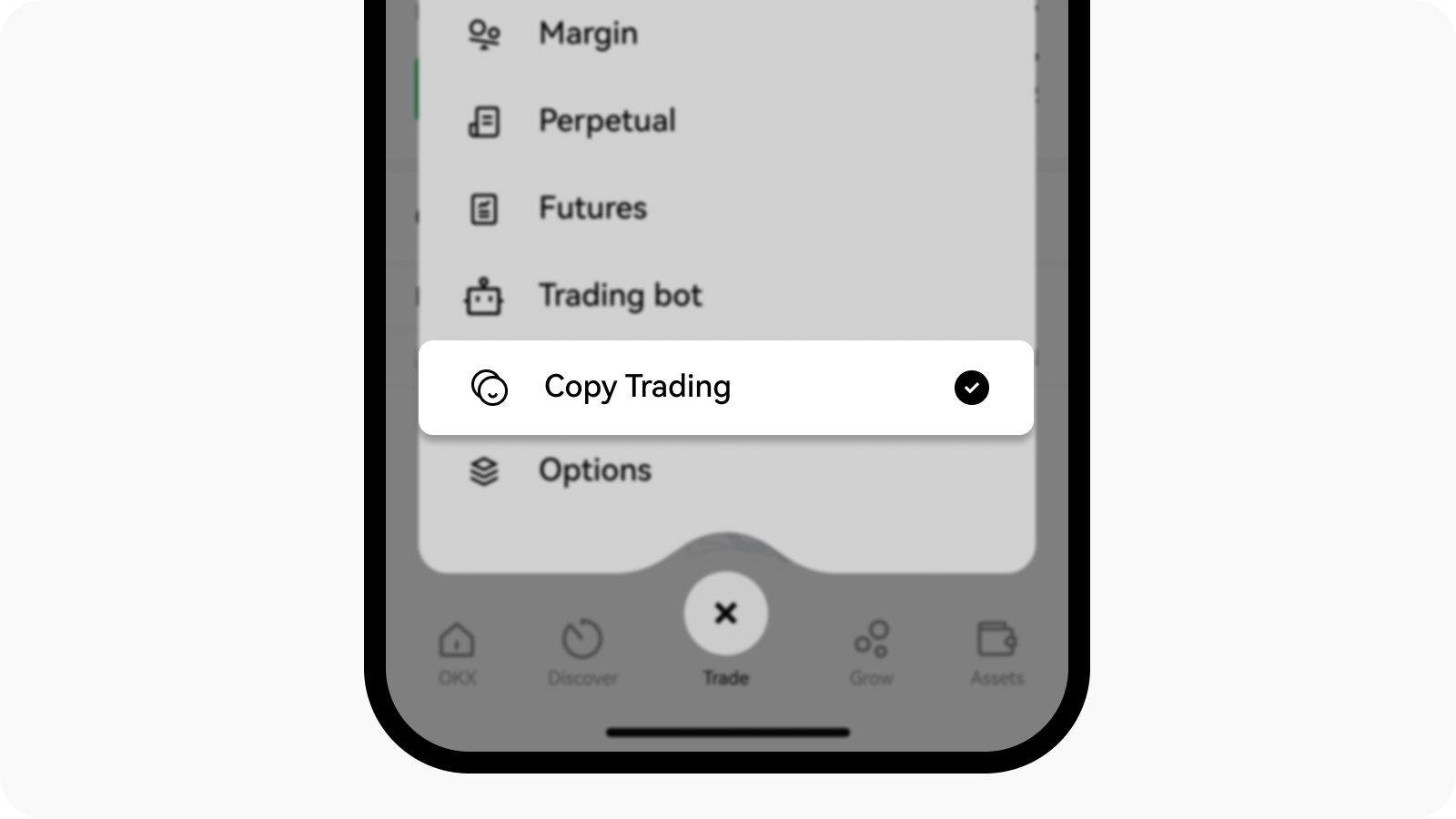

2. How do I create a copy trade order?

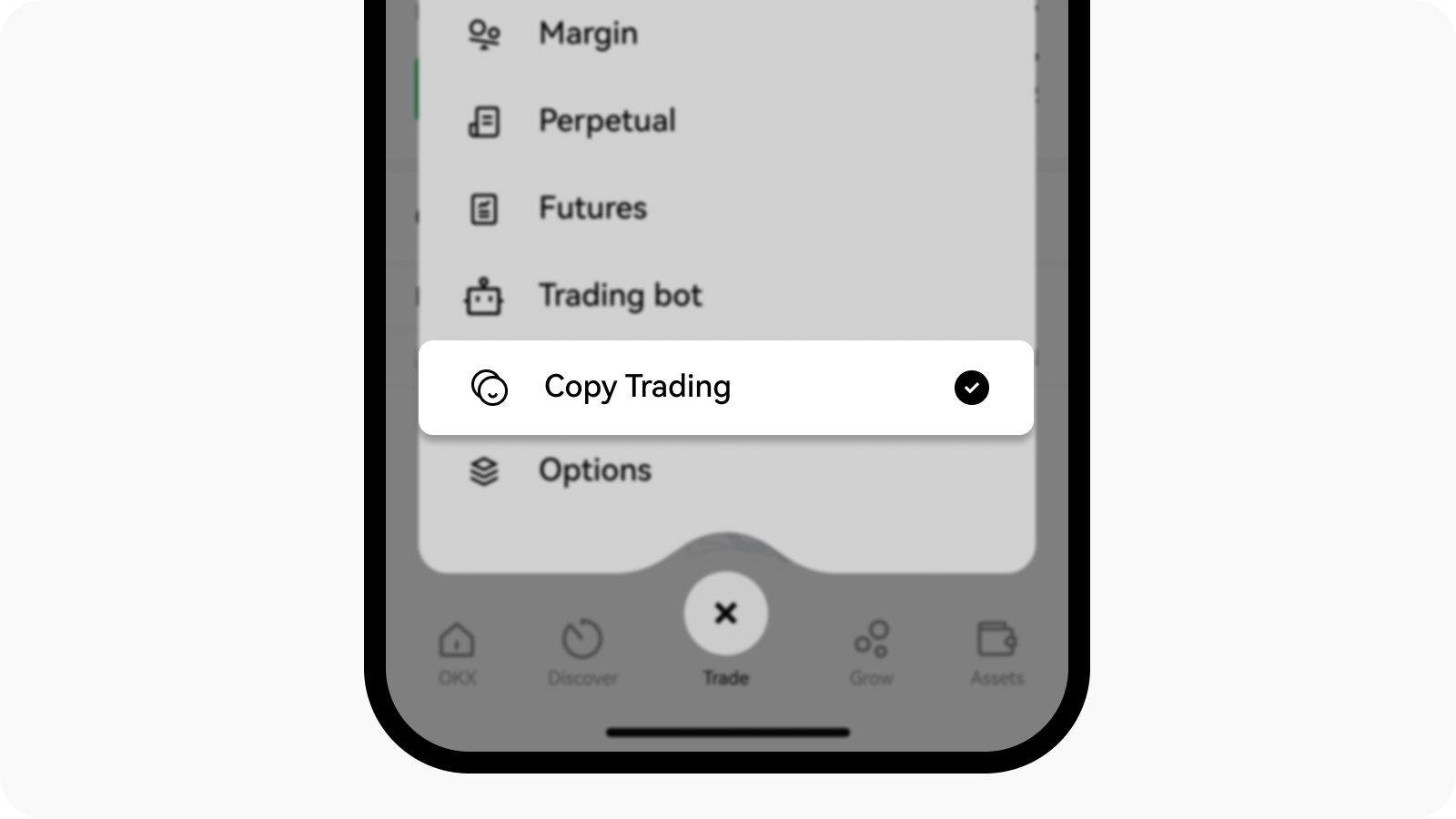

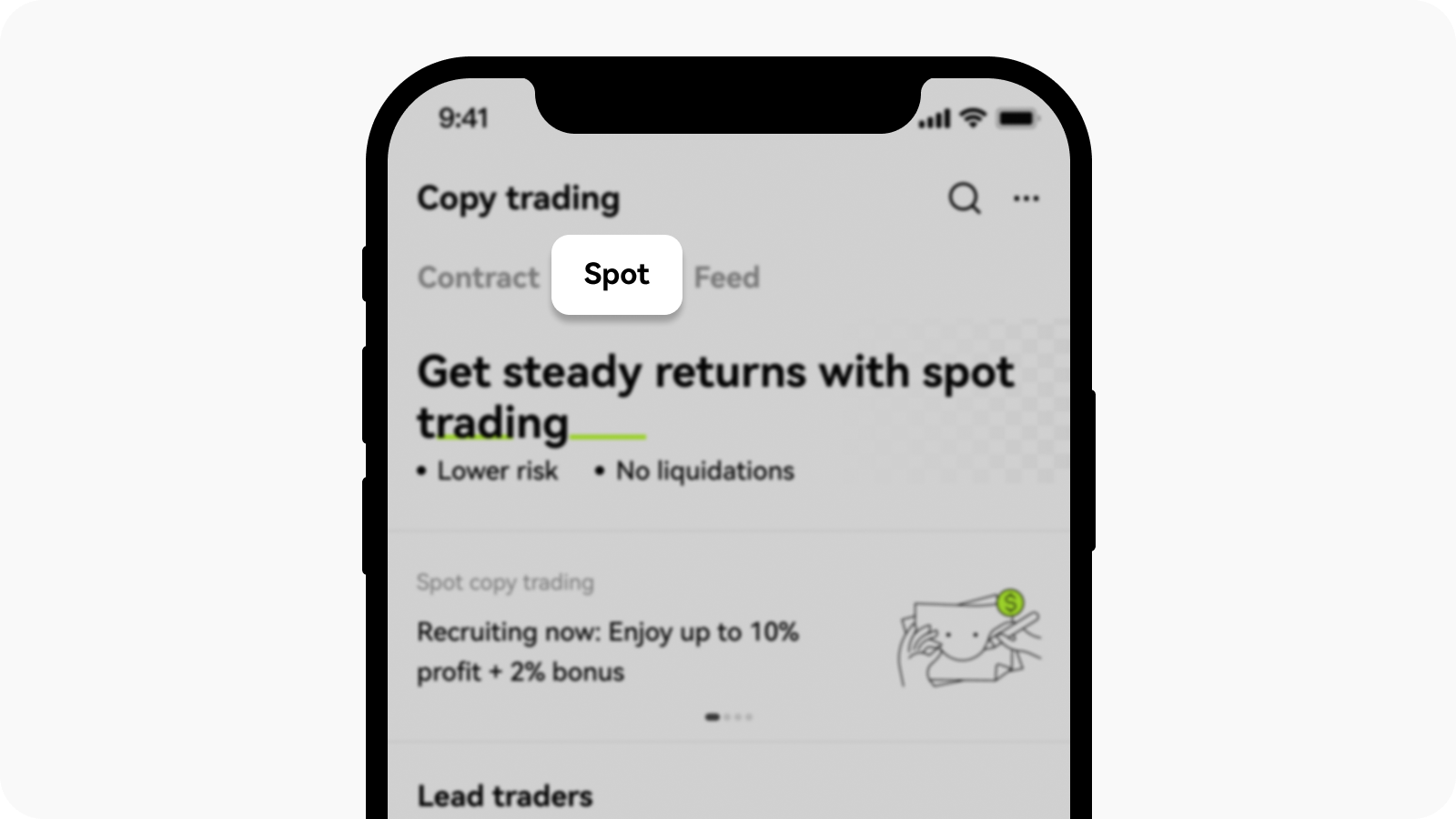

Go to Trade and select Copy trading and Spot copy trading.

Open Copy Trading page

Open Spot copy trading page

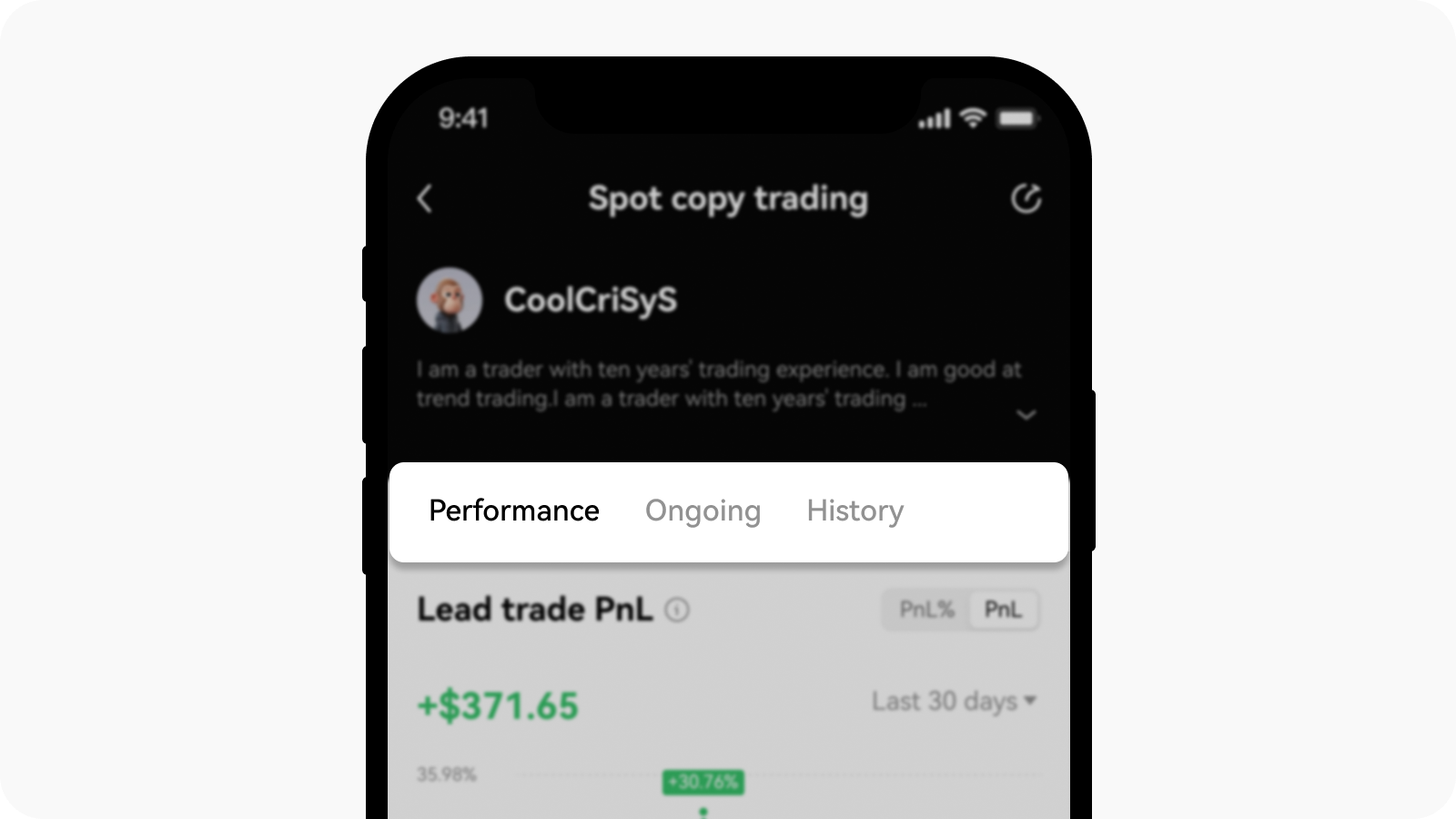

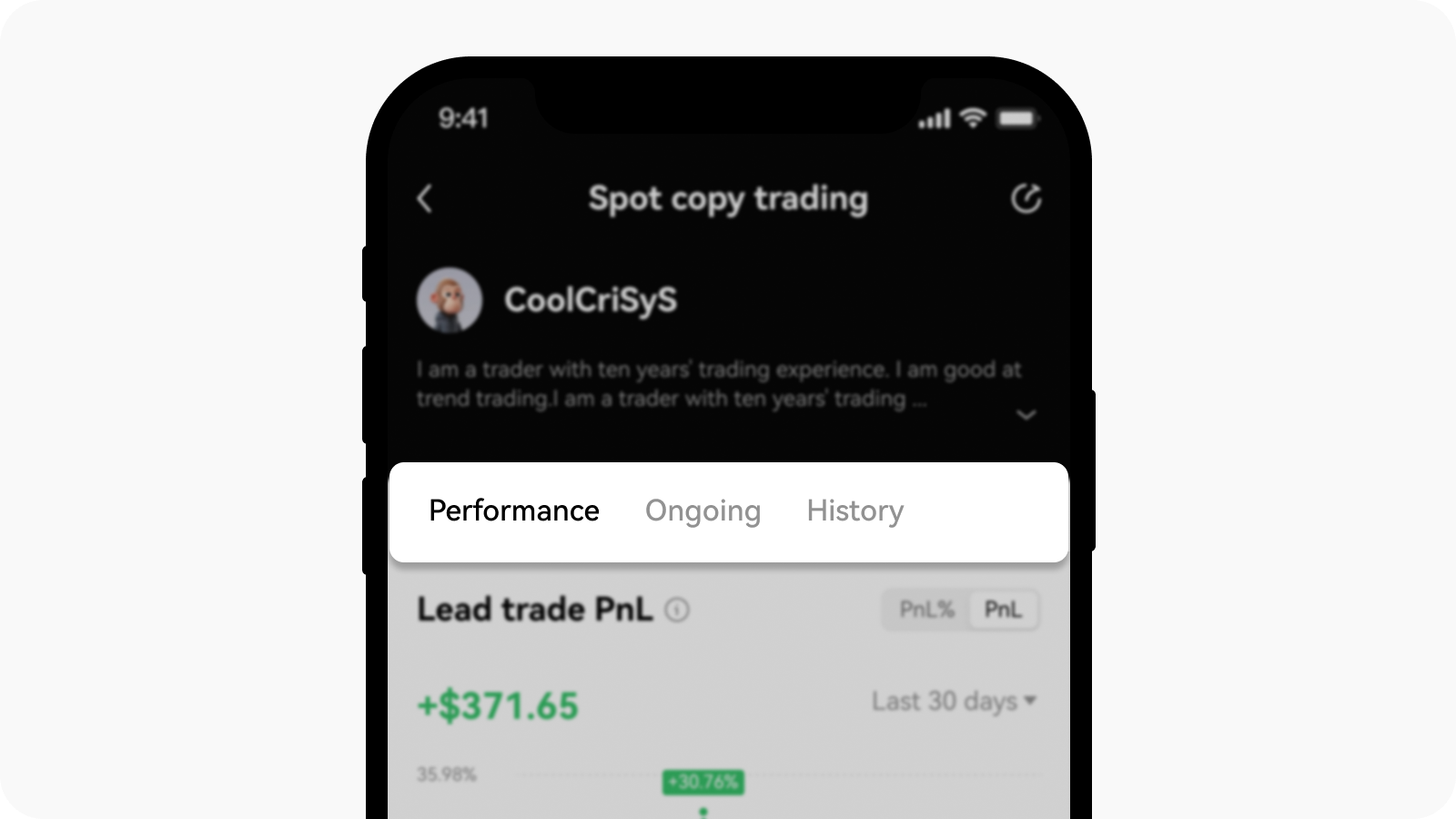

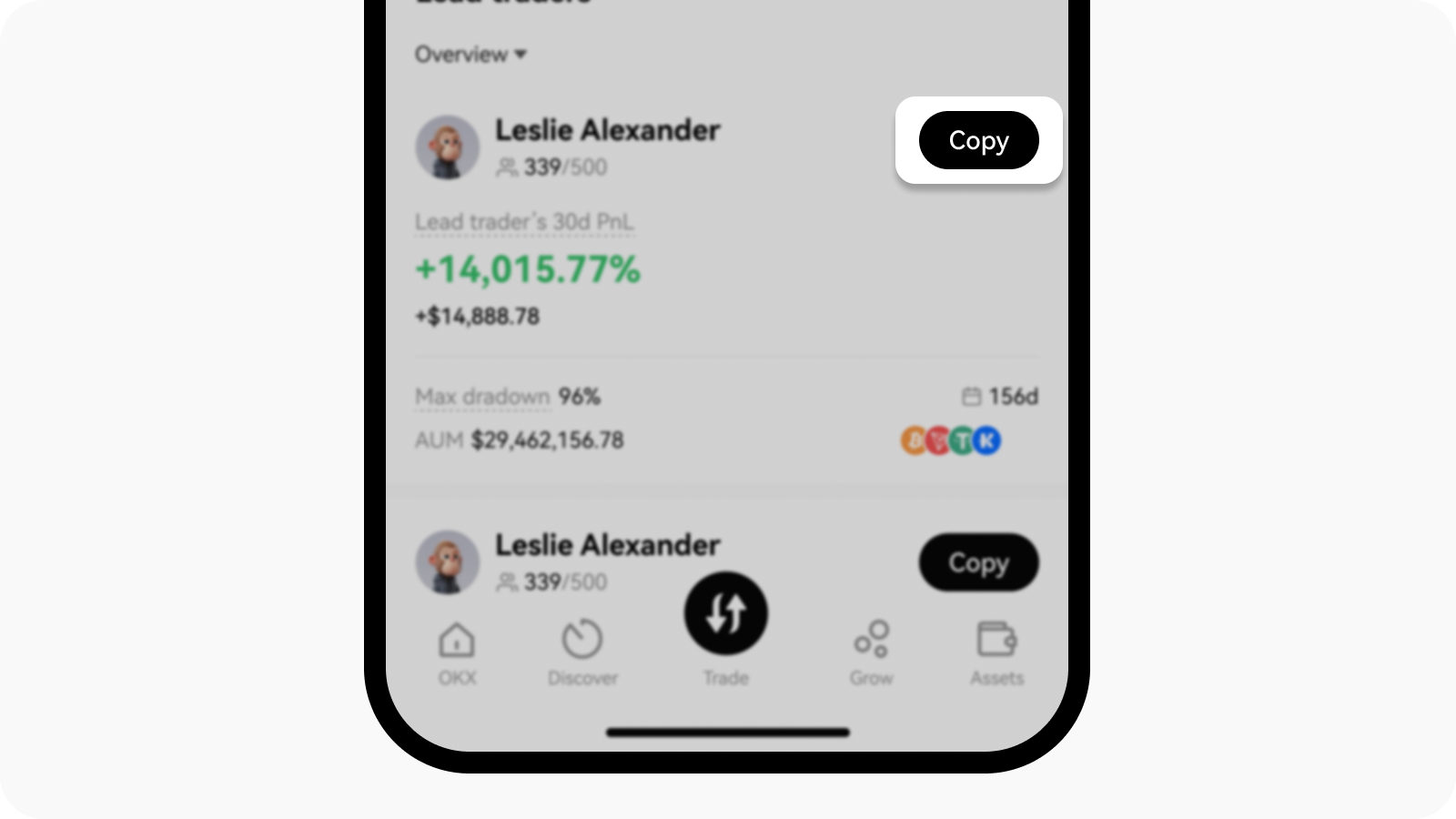

You can view each lead trader's profile to understand their key trading statistics and performance, helping you find a suitable lead trader. You can refer to the table below for the metric of the lead trader's profile. Please note that the data will refresh hourly.

Metric Definition AUM - AUM = Total investment amount of all copy traders

- Copy trader investment amount = Trader's max total copy trade amount or USDT equity in trading account (whichever is less)PnL Total profit or loss this trader made from their spot lead trades PnL% The PnL / Maximum investment during the selected period. Investment calculations include funds that are transferred in and out of the trader's account. Lead trader investment The amount of USDT in the lead trader's trading account Win rate Number of days with profitable trades / Number of days trader has led spot trades

Understand the lead trader profile

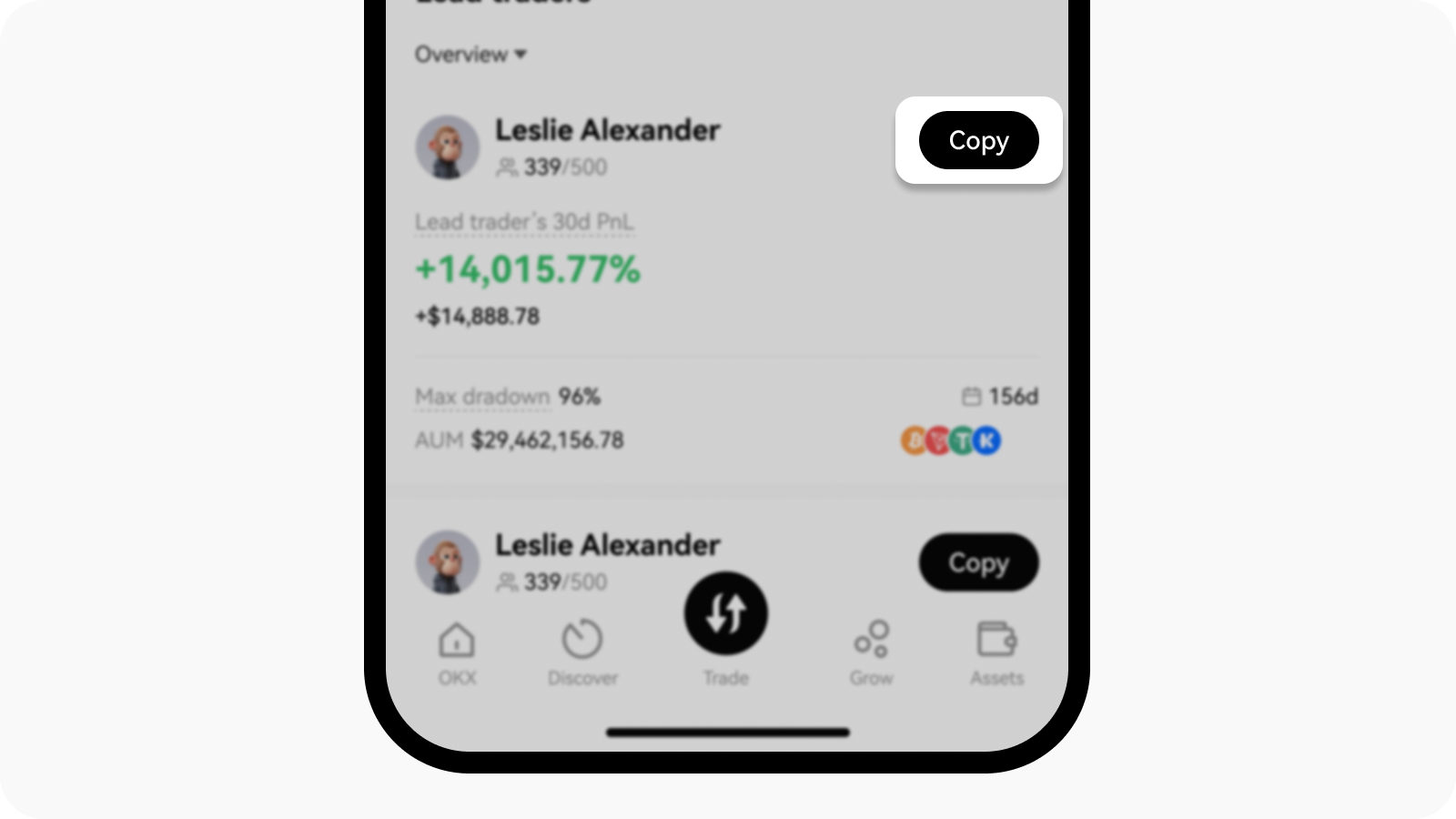

Select Copy to follow your preferred lead trader's trading strategy

Select copy to copy lead trader's trading strategy

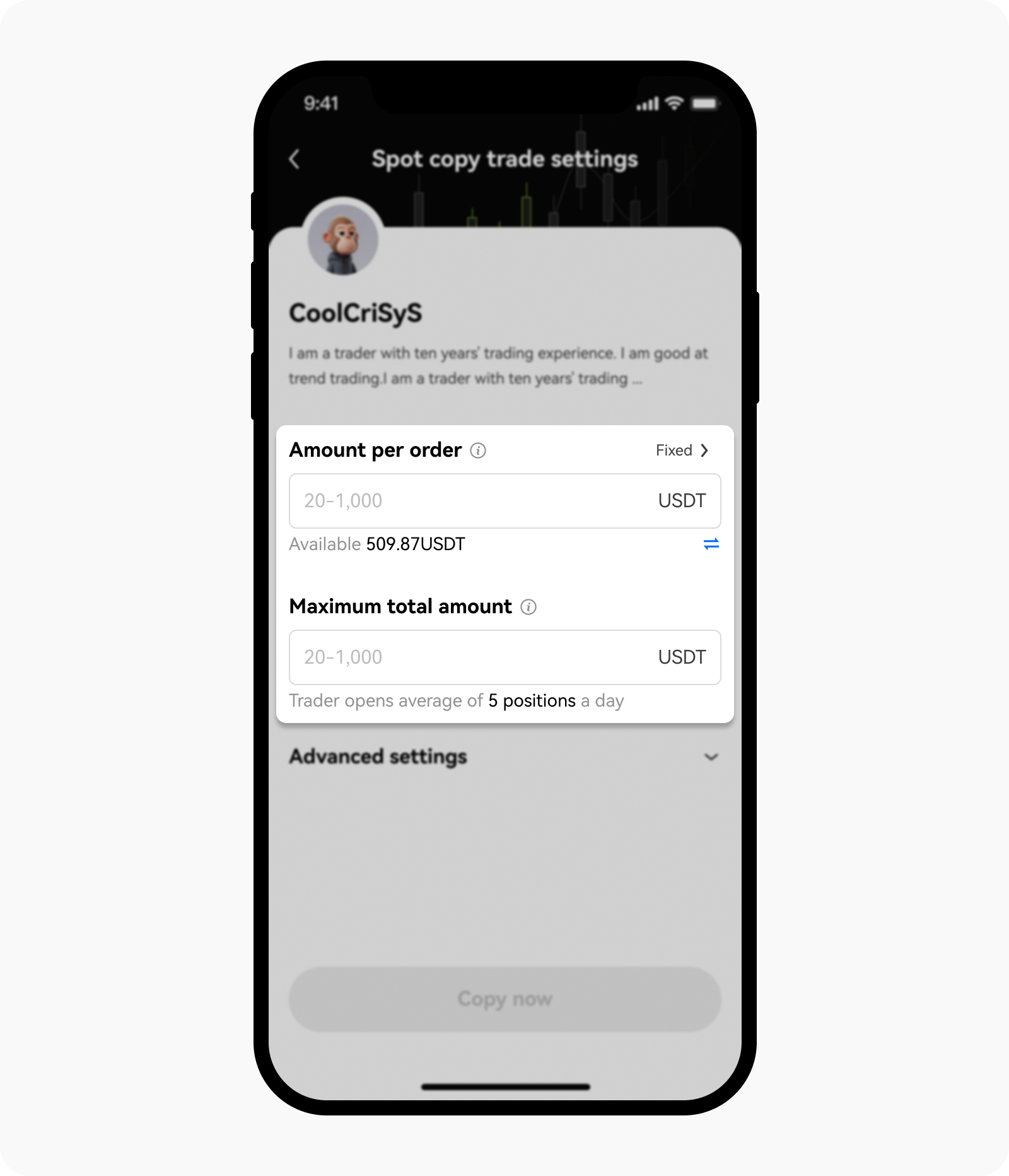

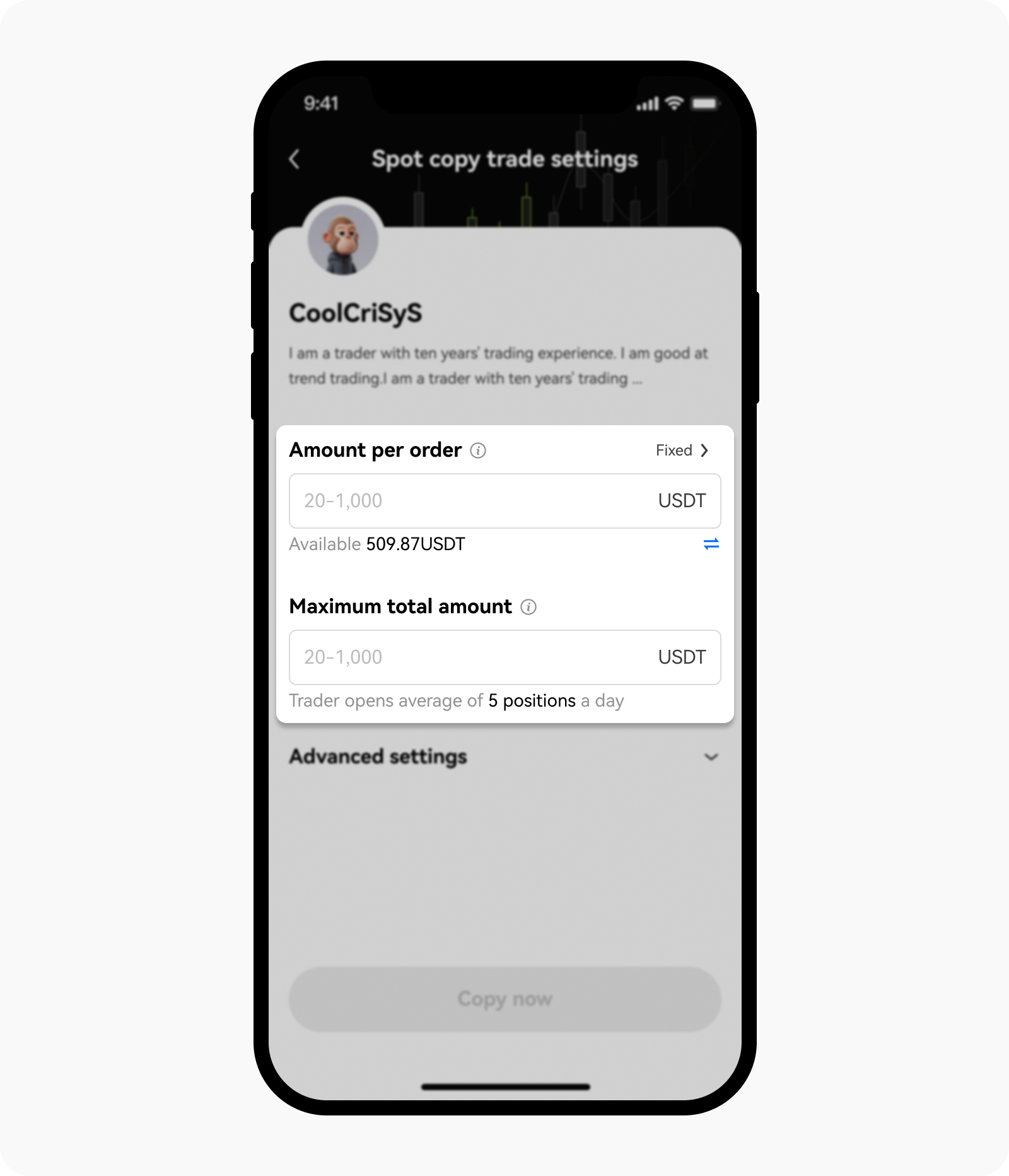

Set your copy trading setting according to your needs. Details of the settings are briefed in the table below.

Setting Description Copy trade amount type Fixed amount: when you copy a trade, you'll invest the same fixed amount in each order Proportional amount: when you copy a trade, the total value of your trade will be proportional to the lead traders, based on the multiplier you set. Your copy trade value = lead trader's order value × your multiplier Amount per copy Fixed amount: set a fixed amount to invest in each copy trade order. For example, if you set this to 10 USDT, you'll invest 10 USDT in each copy trade order. Proportional amount: set a multiplier to apply to the lead trader's order value to calculate your own order value. For example, if the lead trader's order value is 1,000 USDT and you set a multiplier of 01.x, your order value will be 100 USDT. Maximum total amount The maximum total you'll invest at one time across all copy trades under one trader. When this value is reached, you'll stop copying new buy orders until you sell spot trade crypto you're holding. Copy trade crypto You'll only copy trades that use this crypto. We recommend keeping this the same as the lead trader. Stop loss for trader The maximum total loss you can accept across all trades under one lead trader. When your total losses reach this amount, you'll stop copying the lead trader. Your unsold assets will be handled according to the action you set. Take profit per order A take profit for each individual copy trade order Stop loss per order A stop loss for each individual copy trade order

Set your copy trade setting

3. What are the rules for buying and selling crypto in copy trades?

Here are some rules that you should take note of when you're creating copy trade orders.

| Rules | Trading rules |

|---|---|

| Trading price | Buying: you'll place a buy order when the lead trader does if the price doesn't change by more than 0.5% Selling: you'll place a sell order when the lead trader does |

| Trading fees | Same as manual spot trading |

| Trading crypto | All spot lead trades use USDT as the quote currency. We support 114 cryptocurrencies to use as your base currency, and plan to introduce more. Learn more about spot lead trading pairs |

| Requirements to successfully copy |

- The spot trade must use one of the cryptocurrencies that supports spot copy trading - Your trading account must have sufficient USDT funds to place the order - The order value must be higher than the minimum limit - The difference between lead trader and copy trader's buy price can't exceed 0.5% - The lead trader must not trigger risk control Learn more about reasons for spot copy trade failures |

| Frozen funds | Any crypto you buy in a spot copy trade will be frozen and can't be used for other purposes. It will be released once you sell it. You can check your frozen assets under your assets. |

4. Where do I manage my spot copy trades?

You can manage your spot copy trade at My copies. You can either set take profit or stop loss to your spot copy trade. Alternatively, you can sell your crypto as well.

5. How do I check my profit-sharing?

Go to Trading > Transactions > Transaction types > Other to find profit-sharing transaction details.

Here are some profit-sharing rules that you should take note

If a spot copy trade makes a profit when the crypto is sold, our system will automatically deduct the trading fees, and then withhold the profit-sharing amount. On the settlement day, we'll calculate the total PnL over the whole settlement period. The actual profit-sharing amount will be sent to the lead trader's funding account. If the withholding amount is greater than the actual profit-sharing amount, the difference will be returned to the copy trader's trading account.

Profit-sharing will only be settled if a copy trader isn't copying any ongoing trades from a lead trader. Otherwise, profit-sharing will be delayed until the first settlement date when the copy trader isn't copying any ongoing spot trades.

The OKX settlement cycle of the copy trading system is weekly from every Monday 00:00 (UTC+8) to Sunday 23:59:59 (UTC+8). Profit sharing will be calculated every Monday at 00:00 (UTC+8).

Here is an example of how profit sharing is calculated: A lead trader creates spot lead trades for BTC/USDT, ETH/USDT, and ETC/UDST. Their profit-sharing level is L2, and their profit-sharing ratio is 10%. Below is an example of how their copy trader's profit-sharing is calculated.

| Date | Trading history | Profit and loss after fees | Witholding amount (10% of profits) |

|---|---|---|---|

| April 17 (Mon) | BTC/USDT Bought: April 1, 2023 Sold: April 17, 2023 |

+200 USDT | 20 USDT |

| April 18 (Tue) |

BTC/USDT Bought: April 6, 2023 Sold: April 18, 2023 ETH/USDT Bought: April 6, 2023 Sold: April 18, 2023 |

-50 USDT +300 USDT |

0 30 USDT |

| April 19 (Wed) | No new buy orders BTC/USDT Bought: April 6, 2023 Sold: Not yet sold ETC/USDT Bought: April 6, 2023 Sold: Not yet sold |

N/A | N/A |

| April 20 (Thur) | ETC/USDT Bought: April 6, 2023 Sold: April 20, 2023 |

-500 USDT | 0 |

| April 21 (Fri) | No new buy orders BTC/USDT Bought: April 6, 2023 Sold: Not yet sold ETC/USDT Bought: April 6, 2023 Sold: Not yet sold |

N/A | N/A |

| April 22 (Sat) | ETC/USDT Bought: April 6, 2023 Sold: April 22, 2023 |

+500 USDT | 50 USDT |

| April 23 (Sun) | BTC/USDT Bought: April 6, 2023 Sold: April 23, 2023 |

+100 USDT | 10 USDT |

| New settlement period starts | |||

| April 24 (Mon) | ETH/USDT Bought: April 24, 2023 Sold: April 24, 2023 |

+300 USDT | 30 USDT |

| April 25 (Tue) | BTC/USDT Bought: April 24, 2023 Sold: April 25, 2023 |

-1,000 USDT | 0 |

| Settlement period (April 17 - 23) | |||

| Net PnL in settlement period: 200 - 50 + 300 - 500 + 500 + 100 = 550 USDT Total withholding amount: 20 + 30 + 50 + 10 = 110 USDT Actual profit shared with lead trader: 550 USDT × 10% = 55 USDT Returned to copy trader: 110 - 55 = 55 USDT |

|||