AAVE

AAVE price

$173.80

-$0.97000

(-0.56%)

Price change for the last 24 hours

How are you feeling about AAVE today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

AAVE market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$2.63B

Circulating supply

15,107,623 AAVE

94.42% of

16,000,000 AAVE

Market cap ranking

21

Audits

Last audit: Dec 2, 2020

24h high

$179.40

24h low

$171.99

All-time high

$665.71

-73.90% (-$491.91)

Last updated: May 19, 2021

All-time low

$25.9300

+570.26% (+$147.87)

Last updated: Nov 5, 2020

AAVE Feed

The following content is sourced from .

Shiro

Route2Fi is an OG here. 🫡

He's seen a lot of things change in DeFi, and yet even after all these years, he still sees a fragmented DeFi.

Here is his statement: the entire lending space operates in isolation.

And yes, that's undeniable.

That's why he understands how @0xSoulProtocol could change things.

Soul isn’t just another lending protocol—it’s a cross-chain, cross-protocol lending aggregator.

It lets users deposit collateral on one chain (e.g., Aave on Ethereum) and borrow from another (e.g., Venus on BNB Chain), all without bridging or moving funds manually.

Soul is connecting multiple lending markets, Soul is connecting liquidity, Soul is a new DeFi Primitive. 💎

I've mentioned Soul here already:

🔗

There is an incentivized Testnet & the Sale is coming soon 🪂:

🔗

NFA & DYOR 🫡

Route 2 FI

The space has changed a lot since the crazy Luna and Fantom days in 2021, with high yield lasting for months. DeFi got way more traction than we ever imagined from institutional players and retail users, especially in decentralized lending.

As an example, you can see @MorphoLabs and @aave's latest integrations aiming to create a bankless financial system accessible to billions of people globally.

However, there is a drawback: the entire lending space operates in isolation, with liquidity becoming increasingly fragmented as new protocols emerge across different chains.

I've recently been working with @0xSoulProtocol, and they introduced me to an exciting solution they're building: a cross-chain and cross-protocol lending protocol aggregator. While many projects have tried addressing the cross-chain dilemma, this might be the first time a protocol makes users lend and borrow across multiple protocols seamlessly.

At its core, Soul Protocol is a new DeFi primitive, not just another lending protocol, but an infrastructure layer connecting multiple lending markets. For the first time, you can deposit collateral in one protocol and borrow from another, even across entirely different blockchains.

Think of it like this: instead of being limited to choosing between Aave on Ethereum, Morpho on Arbitrum, or Kamino on Solana, Soul gives you simultaneous access to all of them through one unified interface, without manually bridging or moving assets. This means aggregated borrowing power, enhanced capital efficiency, and fewer assets sitting idle in isolated pools.

You can deposit assets in one ecosystem and leverage them across others to maximize returns, execute complex multi-chain strategies, or even capture arbitrage opportunities instantly.

Here’s a practical example: imagine a profitable arbitrage opportunity on BNB Chain, but your collateral is deposited on Aave Ethereum via Soul.

Rather than withdrawing your collateral, bridging it, and incurring significant delays and costs, Soul enables you to borrow directly from Venus on BNB Chain using your existing Aave Ethereum collateral. You swiftly execute the arbitrage trade, repay the borrowed amount, and keep the profit, all without ever moving your original assets.

Soul Protocol has been in development for around two years, built by a team that previously developed Hatom Protocol, the leading DeFi protocol on MultiversX.

Currently, Soul Protocol is running a points campaign designed to encourage community participation in stress-testing their protocol during the Testnet phase.

You can find a detailed breakdown of tasks here:

They've also announced their Public Sale, introducing an innovative and fair model where the final valuation of the project is defined based on community participation. All Public Sale tokens will be unlocked at TGE, which is nice.

The $SO token powers governance, boosted yields, and revenue sharing, with a fair public launch set for May 16. 25% of the total $SO supply allocated to the community in the public round. No low float, high FDV.

You can find more information about this here:

By removing barriers between chains and protocols, Soul can find PMF by creating a unified, borderless financial ecosystem and redefine the way we borrow, lend, and manage capital across the entire DeFi landscape.

2.56K

15

Shiro

Route2Fi is an OG here. 🫡

He's seen a lot of things change in DeFi, and yet even after all these years, he still sees a fragmented DeFi.

Here is his statement: the entire lending space operates in isolation.

And yes, that's undeniable.

That's why he understands how @0xSoulProtocol could change things.

Soul isn’t just another lending protocol—it’s a cross-chain, cross-protocol lending aggregator.

It lets users deposit collateral on one chain (e.g., Aave on Ethereum) and borrow from another (e.g., Venus on BNB Chain), all without bridging or moving funds manually.

Soul is connecting multiple lending markets, Soul is connecting liquidity, Soul is a new DeFi Primitive. 💎

I've mentioned Soul here already:

🔗

There is an incentivized Testnet & the Sale is coming soon 🪂:

🔗

NFA & DYOR 🫡

Route 2 FI

The space has changed a lot since the crazy Luna and Fantom days in 2021, with high yield lasting for months. DeFi got way more traction than we ever imagined from institutional players and retail users, especially in decentralized lending.

As an example, you can see @MorphoLabs and @aave's latest integrations aiming to create a bankless financial system accessible to billions of people globally.

However, there is a drawback: the entire lending space operates in isolation, with liquidity becoming increasingly fragmented as new protocols emerge across different chains.

I've recently been working with @0xSoulProtocol, and they introduced me to an exciting solution they're building: a cross-chain and cross-protocol lending protocol aggregator. While many projects have tried addressing the cross-chain dilemma, this might be the first time a protocol makes users lend and borrow across multiple protocols seamlessly.

At its core, Soul Protocol is a new DeFi primitive, not just another lending protocol, but an infrastructure layer connecting multiple lending markets. For the first time, you can deposit collateral in one protocol and borrow from another, even across entirely different blockchains.

Think of it like this: instead of being limited to choosing between Aave on Ethereum, Morpho on Arbitrum, or Kamino on Solana, Soul gives you simultaneous access to all of them through one unified interface, without manually bridging or moving assets. This means aggregated borrowing power, enhanced capital efficiency, and fewer assets sitting idle in isolated pools.

You can deposit assets in one ecosystem and leverage them across others to maximize returns, execute complex multi-chain strategies, or even capture arbitrage opportunities instantly.

Here’s a practical example: imagine a profitable arbitrage opportunity on BNB Chain, but your collateral is deposited on Aave Ethereum via Soul.

Rather than withdrawing your collateral, bridging it, and incurring significant delays and costs, Soul enables you to borrow directly from Venus on BNB Chain using your existing Aave Ethereum collateral. You swiftly execute the arbitrage trade, repay the borrowed amount, and keep the profit, all without ever moving your original assets.

Soul Protocol has been in development for around two years, built by a team that previously developed Hatom Protocol, the leading DeFi protocol on MultiversX.

Currently, Soul Protocol is running a points campaign designed to encourage community participation in stress-testing their protocol during the Testnet phase.

You can find a detailed breakdown of tasks here:

They've also announced their Public Sale, introducing an innovative and fair model where the final valuation of the project is defined based on community participation. All Public Sale tokens will be unlocked at TGE, which is nice.

The $SO token powers governance, boosted yields, and revenue sharing, with a fair public launch set for May 16. 25% of the total $SO supply allocated to the community in the public round. No low float, high FDV.

You can find more information about this here:

By removing barriers between chains and protocols, Soul can find PMF by creating a unified, borderless financial ecosystem and redefine the way we borrow, lend, and manage capital across the entire DeFi landscape.

2.25K

4

DeepDAO.io

👀

Stacy Muur

The table shows tokens held by DAO treasuries.

$ETH remains the most widely held asset across DAOs: 376 treasuries hold it, maybe because it anchors everything.

$USDC follows close, the stablecoin of choice for operational liquidity, held by 276 orgs. $POL and $SAFE are quietly becoming staples of infrastructure-heavy DAOs, while $OP, $UNI, and $ARB stack billions in value but live in far fewer hands. $GRT, $AAVE, and $ENS round out the list.

5.48K

1

Hydrated Jakub (🐍,🐍)

well deserved success while its just beginning

alexei

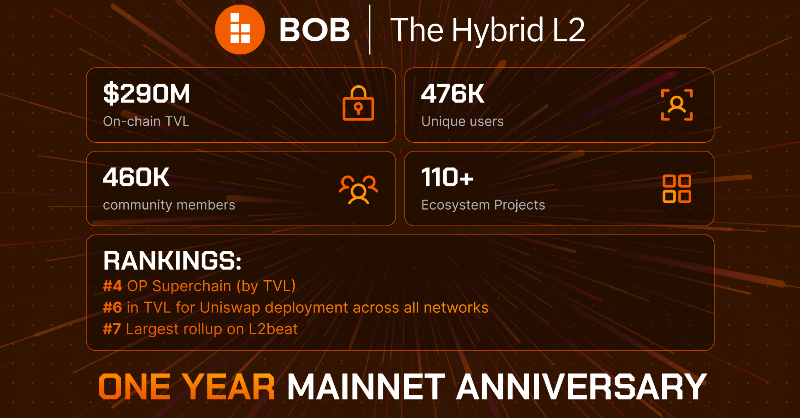

BOB Turns One: A Year of Building Bitcoin DeFi

One year ago, we launched BOB Mainnet with an ambitious goal: to build the best platform for Bitcoin DeFi. Today, we're proud to celebrate how far we've come.

In just 12 months, BOB has achieved:

- $300 million in on-chain deposits

- 500k users

- 27 million transactions

- 100+ projects actively building

But numbers only tell part of the story.

From day one,

we promised ourselves to remain focused and pragmatic—building not for hype or ideology, but to solve real problems for Bitcoin users.

That’s why BOB was conceived as a hybrid Layer 2: not just built on Bitcoin, but built for Bitcoin users—wherever they are. Anyone holding BTC, regardless of what chain or wallet they use, should have access to powerful, simple, trustless DeFi tools.

We believe Bitcoin’s strength lies in its security and user base, and that Ethereum’s DeFi ecosystem has matured in terms of infrastructure, tooling, and UX. BOB merges these two worlds into one platform: easy to access, fast to build on, and competitive with the best ecosystems out there.

Our vision for Bitcoin DeFi is driven by five core beliefs:

1) Trust-minimized Bitcoin bridges are essential.

We co-authored BitVM2, launched public testnets, and created BitVM/ACC to onboard institutional partners and lay the foundation for secure Bitcoin bridging.

2) BTC holders want yield

Bitcoin staking is a $200B+ opportunity waiting to happen. We've partnered with Babylon, Solv, Lombard, Bedrock and more to bring this vision to life.

3) Institutions will unlock BTC liquidity

Institutional users want custody and compliance first—so we’ve worked closely with Fireblocks, Cobo, Ledger, Chainlink and many more to integrate BOB into trusted infrastructure.

4) Bitcoin holders value trust over yield

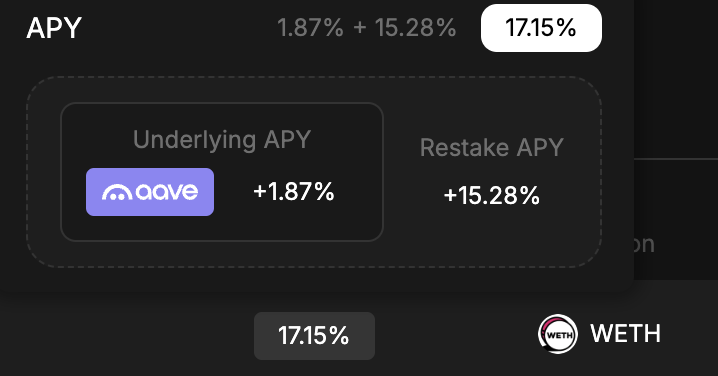

That’s why we’ve partnered with tier-1 DeFi protocols like Uniswap, Euler ... —with Aave in progress—to ensure Bitcoin users have access to the best.

5) UX is still the biggest hurdle

Complexity kills adoption. BOB hides it behind one-click actions, simplifying access to Bitcoin staking and DeFi without sacrificing decentralization.

Looking ahead,

we remain focused on our mission: to put Bitcoin at the heart of DeFi—not just as a store of value, but as a productive, liquid, and programmable asset. We're not aiming for a flippening in price—we're aiming for a flippening in utility, where more BTC flows through DeFi than through ETFs or centralized exchanges.

As we enter Year 2, our focus is on scaling Bitcoin’s reach across the ecosystem:

→ Onboarding more talented builders

→ Launching native, high-impact Bitcoin products

→ Expanding distribution through trusted partners

→ Shipping Bitcoin security and native bridging via BTC staking and BitVM

We want to bring Bitcoin DeFi to every BTC holder, no matter where they are—whether they're using a wallet, a neobank, a personal finance app, or a centralized exchange. That’s why we’re actively working with a wide range of businesses to help them offer yield-bearing and utility-driven Bitcoin products directly to their users.

Our mission,

is to create a seamless 1-click onramp into the world of Bitcoin DeFi—not only on BOB itself, but across all major chains offering Bitcoin products. All of this, secured by Bitcoin.

To our builders, partners, and community: Thank you for being part of this journey.

Year one was just the beginning.

Let’s put Bitcoin at the heart of DeFi.

3.85K

2

AAVE calculator

AAVE price performance in USD

The current price of AAVE is $173.80. Over the last 24 hours, AAVE has decreased by -0.56%. It currently has a circulating supply of 15,107,623 AAVE and a maximum supply of 16,000,000 AAVE, giving it a fully diluted market cap of $2.63B. At present, the AAVE coin holds the 21 position in market cap rankings. The AAVE/USD price is updated in real-time.

Today

-$0.97000

-0.56%

7 days

+$7.8800

+4.74%

30 days

+$15.4400

+9.74%

3 months

-$122.34

-41.32%

Popular AAVE conversions

Last updated: 05/02/2025, 21:09

| 1 AAVE to USD | $174.08 |

| 1 AAVE to PHP | ₱9,662.48 |

| 1 AAVE to EUR | €153.42 |

| 1 AAVE to IDR | Rp 2,863,158 |

| 1 AAVE to GBP | £130.94 |

| 1 AAVE to CAD | $240.60 |

| 1 AAVE to AED | AED 639.40 |

| 1 AAVE to VND | ₫4,527,438 |

About AAVE (AAVE)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Latest news about AAVE (AAVE)

CoinDesk 20 Performance Update: Index Gains 3.2% as All Assets Trade Higher

Sui (SUI) gained 8.2% and Aave (AAVE) gained 5.9%, leading index higher from Wednesday.

May 1, 2025|CoinDesk

CoinDesk 20 Performance Update: Index Declines 2% as Nearly All Assets Trade Lower

Aave (AAVE) fell 4.7% and Ripple (XRP) dropped 4%, leading the index lower from Tuesday.

Apr 30, 2025|CoinDesk

CoinDesk 20 Performance Update: Index Gains 4.7% as All 20 Assets Trade Higher

Sui (SUI) Surged 18.5% and Aave (AAVE) gained 9.4% from Tuesday.

Apr 23, 2025|CoinDesk

AAVE FAQ

What is AAVE used for?

AAVE is a decentralized crypto lending platform that facilitates the borrowing and lending of digital assets. AAVE automates the lending process using smart contracts, making it efficient and secure. The protocol focuses on overcollateralized loans, where borrowers must deposit more crypto assets as collateral than the amount they wish to borrow.

How is AAVE different from Compound?

AAVE differs from Compound (COMP) in several ways. AAVE provides flash loans, enabling consumers to borrow assets without security for a brief duration. On the other hand, COMP does not provide flash loans. Additionally, AAVE offers a decentralized governance mechanism where token holders may vote on modifications to the platform.

What is the AAVE price prediction?

While it’s challenging to predict the exact future price of AAVE, you can combine various methods like technical analysis, market trends, and historical data to make informed decisions.

How much is 1 AAVE worth today?

Currently, one AAVE is worth $173.80. For answers and insight into AAVE's price action, you're in the right place. Explore the latest AAVE charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as AAVE, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as AAVE have been created as well.

Will the price of AAVE go up today?

Check out our AAVE price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

AAVE calculator

Socials