COMP

Compound price

$40.7900

+$0.67000

(+1.66%)

Price change for the last 24 hours

How are you feeling about COMP today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Compound market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$364.74M

Circulating supply

8,941,799 COMP

89.41% of

10,000,000 COMP

Market cap ranking

47

Audits

Last audit: Apr 8, 2021

24h high

$41.8400

24h low

$40.0800

All-time high

$911.64

-95.53% (-$870.85)

Last updated: May 12, 2021

All-time low

$22.7600

+79.21% (+$18.0300)

Last updated: Jun 10, 2023

Compound Feed

The following content is sourced from .

CoinDesk

What if there were a crypto protocol that specialized in arbitrating on-chain disputes?

Imagine if, whenever prediction markets like Polymarket settled in a controversial manner, users had a formal way to appeal through a sort of neutral on-chain court system. Or if decentralized autonomous organizations (DAOs) could rely on an efficient, knowledgeable third party to help them make decisions. Or if insurance contracts could automatically execute payouts when specific real-world events occurred.

That’s essentially what Albert Castellana Lluís and his team are building with GenLayer, a crypto project that markets itself as a decision-making system, or trust infrastructure.

“We're using a blockchain that has multiple AIs coordinate and reach agreement on subjective decisions, as if they were a judge," Castellana, co-founder and CEO of YeagerAI told CoinDesk in an interview. "We're basically building a global synthetic jurisdiction that has an embedded court system that doesn’t sleep, that’s super cheap, and that’s super fast.”

The demand for such an arbitration project may spike in the coming years with the development of AI agents — sophisticated programs powered by artificial intelligence that are capable of carrying out complex tasks in an autonomous manner.

When it comes to crypto markets, AI agents can be used in all kinds of ways: for trading memecoins, arbitraging bitcoin on exchanges, monitoring the security of DeFi protocols, or providing market insights through in-depth analysis, to cite only a few use-cases. AI agents will also be able to hire other AI agents in order to complete even more complex assignments.

Such agents may proliferate at an unexpected rate, Castellana said. In his view, most crypto market participants could be managing a handful of them by the end of 2025.

“These agents, they work super fast, they don’t sleep, they don’t go to jail. You don’t know where they are. Are they going to pass anti-money laundering rules? Are they going to have a bank account? Can they even use a Visa card?” Castellana said. “How can we enable fast transactions between them? And how can trust happen in a world like this?”

Thanks to its unique architecture, GenLayer could provide a solution by allowing entities — human or AI — to get a reliable, neutral opinion to weigh in on any decision in record time. “Anywhere where you normally would have a third party made of a bunch of humans… We replace them with a global network that provides a consensus between different AIs, a network that can make decisions in a way that is as correct and as unbiased as possible,” Castellana said.

Synthetic court system

GenLayer doesn’t seek to compete with other blockchains like Bitcoin, Ethereum or Solana — or even DeFi protocols such as Uniswap or Compound. Rather, the idea is for any existing crypto protocol to be able to connect to GenLayer and make use of its infrastructure.

GenLayer’s chain is powered by ZKsync, an Ethereum layer 2 solution. Its network counts 1,000 validators, each one connected to a large language model (LLM) such as OpenAI’s ChatGPT, Google’s Bert or Meta’s Llama.

Let’s say a market on Polymarket settles in a controversial manner. If Polymarket is connected to GenLayer, users of the prediction market have the ability to raise the issue (or, as Castellana put it, to create a “transaction”) with its synthetic court system.

As soon as the transaction comes in, GenLayer picks five validators at random to rule on it. These five validators query an LLM of their choice in order to find information on the topic at hand, and then vote on a solution. That produces a ruling.

But the Polymarket users, in our example, don’t necessarily need to be satisfied with the ruling: they can decide to appeal the decision. In which case, GenLayer picks another set of validators — except this time, their number jumps to 11. Just like before, the validators issue a ruling based on the information they gather from LLMs. That decision can also be appealed, which makes GenLayer pick 23 validators for another ruling, then 47 validators, then 95, and so on and so forth.

The idea is to rely on Condorcetʼs Jury Theorem, which according to GenLayer’s pitch deck states that “when each participant is more likely than not to make a correct decision, the probability of a correct majority outcome increases significantly as the group grows larger.” In other words, GenLayer finds wisdom in the crowd. The more validators are involved, the more likely they are to zero in on an accurate answer.

“What this means is that we can start small and very efficiently, but also we can escalate to a point where something very, very tricky, they can still get right,” Castellana said.

The average transaction takes roughly 100 seconds to process, Castellana said, and the court’s decision becomes final after 30 minutes — a timeframe that can be elongated if multiple appeals occur. But that means the protocol can reach a decision on major issues in a very short period of time, day or night, instead of going through arduous real-world litigation processes which may take months or even years.

Looking at incentives

GenLayer’s mission naturally raises a question: is it possible to game the system? For example, what if all of the validators select the same AI (say, ChatGPT) to solve a given proposal? Wouldn’t that mean that ChatGPT will have essentially issued the ruling?

Every time you query an LLM, you generate a new seed, Castellana said, so you obtain a different answer. On top of that, validators have the freedom of choosing which LLM to use based on the topic at hand. If it’s a relatively easy question, perhaps there’s no need to use an expensive LLM; on the other hand, if the question is particularly complex, the validator may opt for a higher-quality AI model.

Validators may even end up in a situation where they feel like they’ve seen a certain type of question so many times that they can pre-train a small model for a specific purpose. “We think that, over time, there's just going to be endless new models,” Castellana said.

There’s a strong incentive for validators to be on the winning side of the decision-making process, because they’re financially rewarded for it — while the losing side ends up incurring costs associated with using computation, without collecting any rewards.

In other words, the question is not whether one’s validator is providing a correct answer, but whether it manages to side with the majority.

Since validators have no idea what other validators are voting, the goal is for them to use the necessary resources to provide accurate information with the expectation that other validators will converge on that information as well — because arriving at the same incorrect answer would probably require rigorous coordination.

And if that gambit doesn’t work out, the appeal system is ready to kick in.

“If I know that I'm reusing a good LLM, and I think that other people are using a bad LLMs and that's why I lost, then I have quite a big incentive to appeal, because I know that with more people, there’s going to be an incentive for them to be using better LLMs as well” since other validators will want to earn the rewards from a successful appeal, Castellana said.

The system makes it hard for validators to collude, because they only have 100 seconds to reach a decision, and they don’t know whether they will be picked to settle specific questions. An entity would need to control between 33% and 50% of the network to be able to attack it, Castellana said.

Like Ethereum, GenLayer will be using a native token for its financial incentives. With a testnet already launched, the project should go live by the end of the year, according to Castellana. “There's going to be a very big incentive for people to come and build things on top,” he said.

35.26K

1

吴说区块链

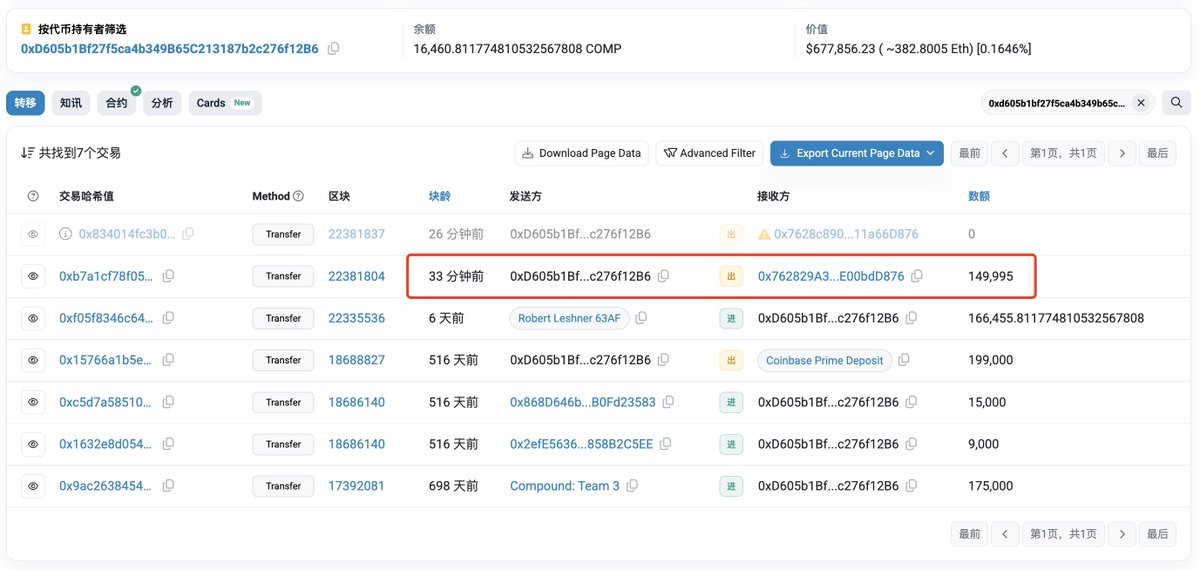

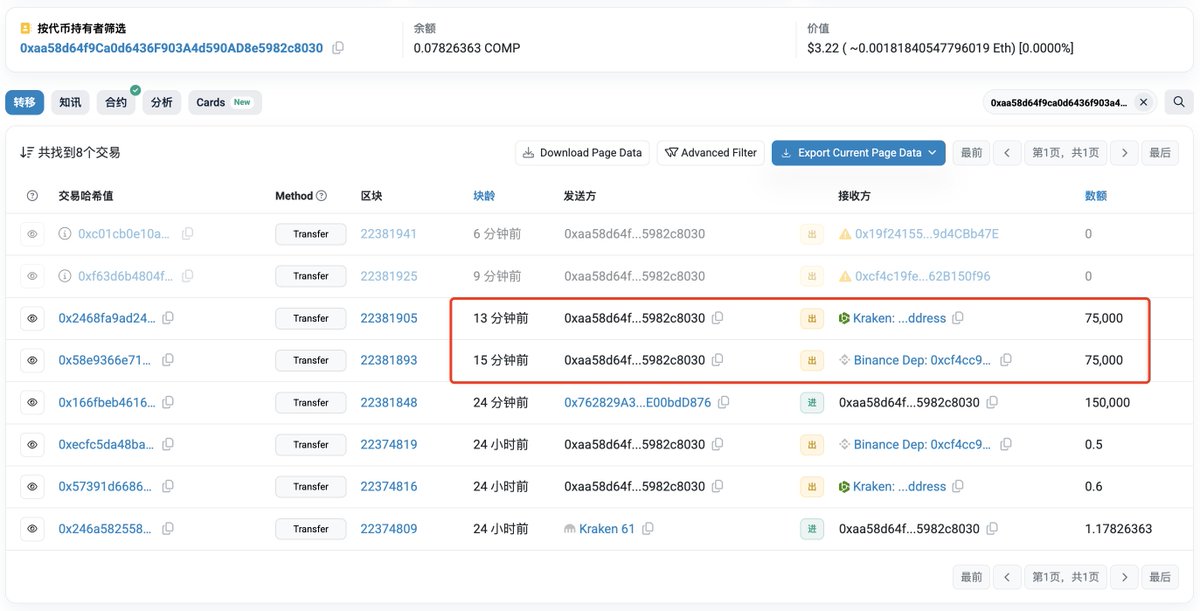

Wu Blockchain has learned, according to monitoring by @EmberCN, that an address belonging to the Compound team transferred 150,000 COMP (approximately $6.24 million) to CEX 20 minutes ago: 75,000 COMP (approximately $3.12 million) to Binance and 75,000 COMP (approximately $3.12 million) to Kraken.

Show original34.46K

1

COMP calculator

Compound price performance in USD

The current price of Compound is $40.7900. Over the last 24 hours, Compound has increased by +1.67%. It currently has a circulating supply of 8,941,799 COMP and a maximum supply of 10,000,000 COMP, giving it a fully diluted market cap of $364.74M. At present, the Compound coin holds the 47 position in market cap rankings. The Compound/USD price is updated in real-time.

Today

+$0.67000

+1.66%

7 days

-$4.0000

-8.94%

30 days

-$4.9500

-10.83%

3 months

-$14.9700

-26.85%

Popular Compound conversions

Last updated: 05/03/2025, 16:12

| 1 COMP to USD | $40.7900 |

| 1 COMP to PHP | ₱2,270.49 |

| 1 COMP to EUR | €36.0890 |

| 1 COMP to IDR | Rp 671,993.4 |

| 1 COMP to GBP | £30.7316 |

| 1 COMP to CAD | $56.3738 |

| 1 COMP to AED | AED 149.82 |

| 1 COMP to VND | ₫1,060,858 |

About Compound (COMP)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Compound FAQ

What is Compound?

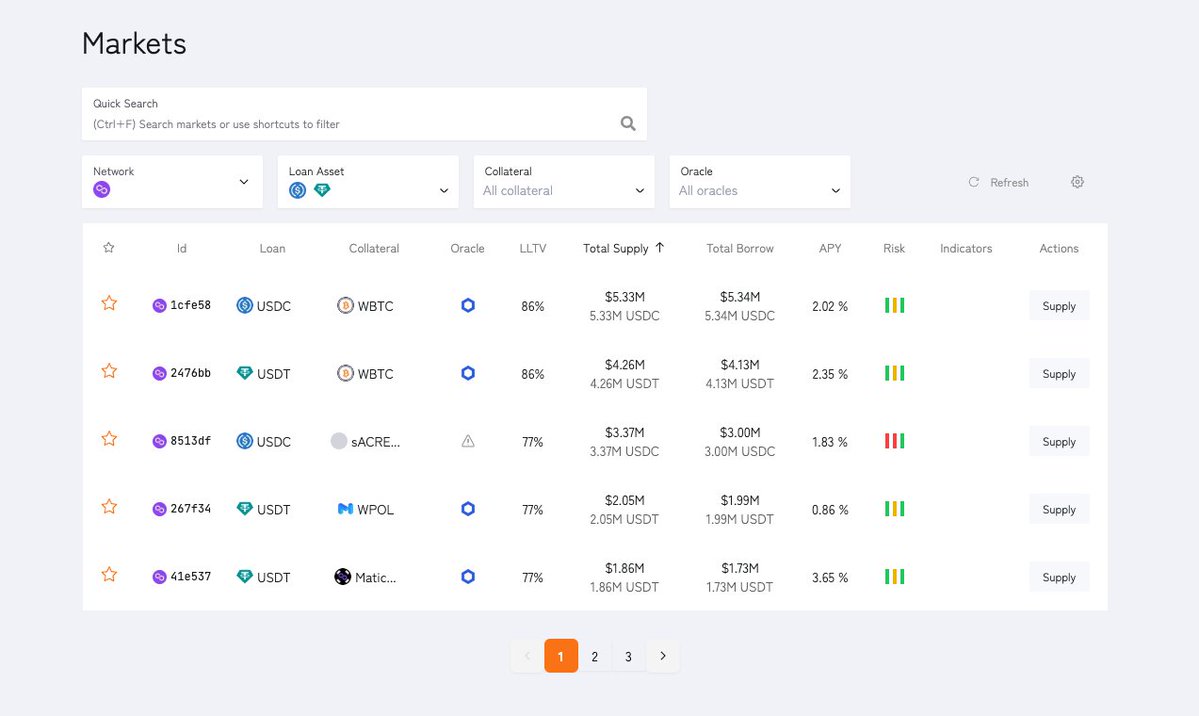

Compound is a decentralized finance (DeFi) platform facilitating cryptocurrency lending and borrowing. It operates through the use of a governance token called COMP.

What are the utility and benefits of holding COMP?

Holding COMP offers several utilities and benefits within the Compound ecosystem. COMP holders can participate in liquidity farming programs and stake their tokens on platforms like OKX Earn to earn rewards. Additionally, COMP can be used for decentralized borrowing and lending on the Compound platform. Furthermore, COMP holders can engage in governance by proposing and voting on protocol changes, influencing the direction and development of the ecosystem.

What is the COMP price prediction?

While it’s challenging to predict the exact future price of COMP, you can combine various methods like technical analysis, market trends, and historical data to make informed decisions.

How much is 1 Compound worth today?

Currently, one Compound is worth $40.7900. For answers and insight into Compound's price action, you're in the right place. Explore the latest Compound charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Compound, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Compound have been created as well.

Will the price of Compound go up today?

Check out our Compound price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

COMP calculator

Socials