UNI

Uniswap price

$5.3000

-$0.05000

(-0.94%)

Price change for the last 24 hours

How are you feeling about UNI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Uniswap market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$3.19B

Circulating supply

600,483,074 UNI

60.04% of

1,000,000,000 UNI

Market cap ranking

18

Audits

Last audit: --

24h high

$5.4280

24h low

$5.2180

All-time high

$44.9710

-88.22% (-$39.6710)

Last updated: 3 May 2021

All-time low

$1.0000

+430.00% (+$4.3000)

Last updated: 17 Sept 2020

Uniswap Feed

The following content is sourced from .

Banana Gun 🍌🔫

Amazing post by @Donnie100x. Must read!

DONNIE

"𝙏𝙝𝙞𝙨 𝙬𝙞𝙡𝙡 𝙗𝙚𝙘𝙤𝙢𝙚 𝙩𝙝𝙚 𝘽𝙞𝙣𝙖𝙣𝙘𝙚 𝙤𝙛 𝙤𝙣𝙘𝙝𝙖𝙞𝙣 𝙗𝙪𝙩 𝙬𝙞𝙩𝙝𝙤𝙪𝙩 𝘾𝙕.”

That’s @cryptocevo after testing @BananaGunBot Pro.

And when you zoom out, the metrics tell the same story.

Let’s break it down by the data 👇

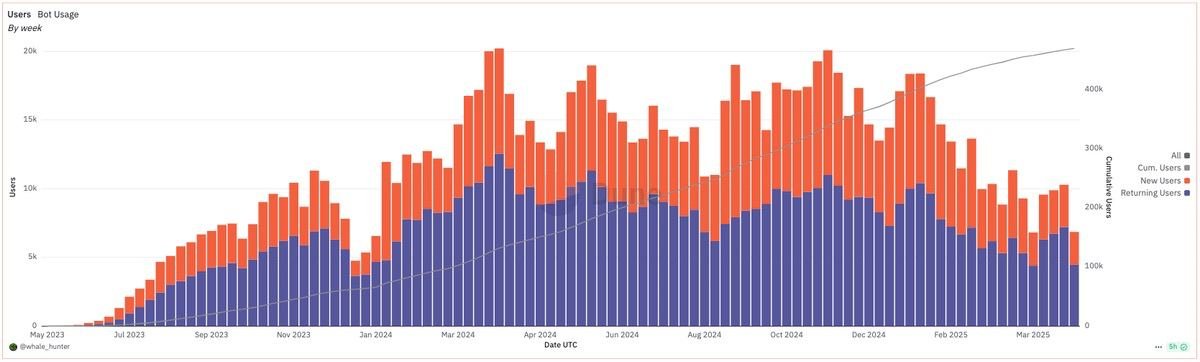

1. 𝐁𝐨𝐭 𝐔𝐬𝐚𝐠𝐞 (𝐔𝐬𝐞𝐫𝐬)

The consistent rise in returning users (blue bars) highlights deep retention: traders are integrating it into their daily flow.

That data matters more than vanity spikes.

Even during dips in new user growth (red), core usage held strong signalling real product-market fit rather than campaign-driven noise.

Notably, the cumulative user curve (gray line) shows long-term compounding: a steady climb past 400k total users by March 2025.

For a bot spanning chains like $ETH, $SOL, $BASE, $BNB, $S, and $UNI, this kind of organic stickiness is exactly what you'd expect from something built by on-chain traders, for on-chain traders.

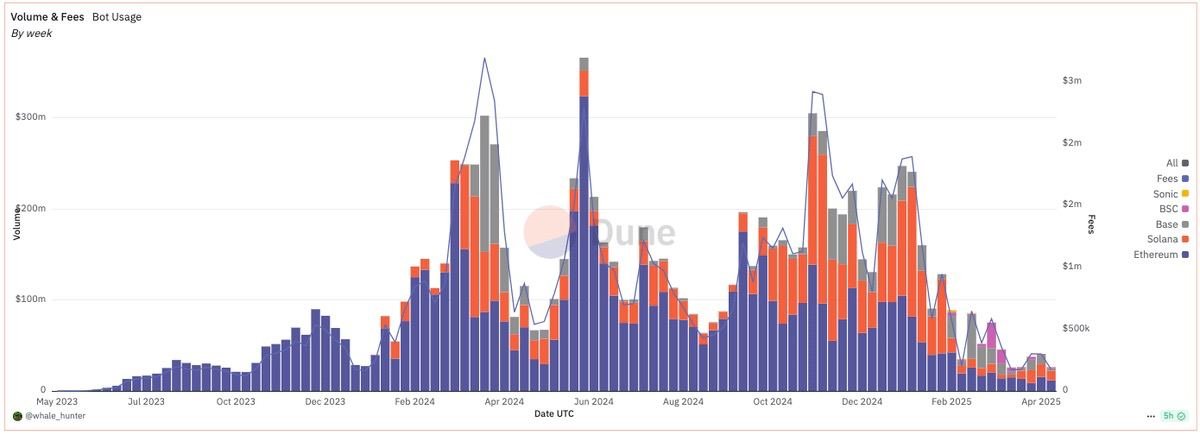

2. 𝐁𝐨𝐭 𝐔𝐬𝐚𝐠𝐞 (𝐕𝐨𝐥𝐮𝐦𝐞 & 𝐅𝐞𝐞𝐬)

The spikes in volume and fees, particularly during Q1 and Q4 2024 reflect conviction.

Traders were executing large, fee-generating positions across multiple chains, with Ethereum and Solana leading the charge.

The presence of newer chains like Base and Sonic in the later months points to Banana Gun’s agility in adapting to shifting ecosystems.

What’s especially telling is that even during broader market cooldowns, fee generation didn’t fully collapse.

That resilience suggests the bot is deeply embedded in the flow of active traders.

Volatility or not, it’s still extracting fees and facilitating meaningful volume, which is exactly what you'd expect from a tool that’s part of the on-chain trader’s daily stack.

3. $BANANA

After breaking past the $19 resistance level, price briefly touched $22 before consolidating in a tight range.

This sideways chop above prior highs suggests healthy digestion of gains rather than exhaustion.

Volume spikes on green candles confirm that buyers remain in control, even during pullbacks.

Watching for a clean push above $21.50 with rising volume to confirm continuation. Overall, structure remains intact.

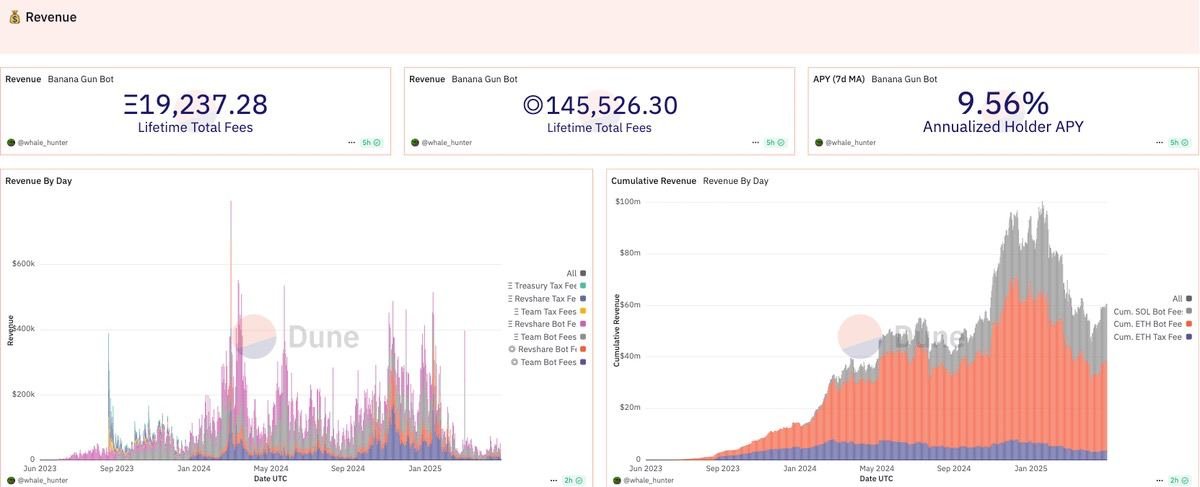

4. 𝐑𝐞𝐯𝐞𝐧𝐮𝐞𝐬 & 𝐇𝐨𝐥𝐝𝐞𝐫𝐬´ 𝐀𝐏𝐘

This final chart brings the Banana Gun story full circle: it’s a business with real, recurring revenue and tangible yield.

Over 19,000 ETH in lifetime fees, over 145,000 SOL-equivalent, and a sustained 9.56% APY for holders

The layered revenue sources (taxes, bot usage, revshares) show a system built for durability, not dependency on hype cycles.

And the compounding effect is clear in the cumulative curve: even with fee volatility, the trend remains unmistakably up and to the right.

If the earlier charts proved Banana Gun is sticky for users and valuable for traders, this one confirms it’s also delivering real economic value.

With metrics like this, how long until this becomes standard infra?

10.26K

124

DeepDAO.io

👀

Stacy Muur

The table shows tokens held by DAO treasuries.

$ETH remains the most widely held asset across DAOs: 376 treasuries hold it, maybe because it anchors everything.

$USDC follows close, the stablecoin of choice for operational liquidity, held by 276 orgs. $POL and $SAFE are quietly becoming staples of infrastructure-heavy DAOs, while $OP, $UNI, and $ARB stack billions in value but live in far fewer hands. $GRT, $AAVE, and $ENS round out the list.

10.25K

2

Stacy Muur

The table shows tokens held by DAO treasuries.

$ETH remains the most widely held asset across DAOs: 376 treasuries hold it, maybe because it anchors everything.

$USDC follows close, the stablecoin of choice for operational liquidity, held by 276 orgs. $POL and $SAFE are quietly becoming staples of infrastructure-heavy DAOs, while $OP, $UNI, and $ARB stack billions in value but live in far fewer hands. $GRT, $AAVE, and $ENS round out the list.

Show original

24.19K

55

Token Terminal 📊 reposted

Token Terminal 📊

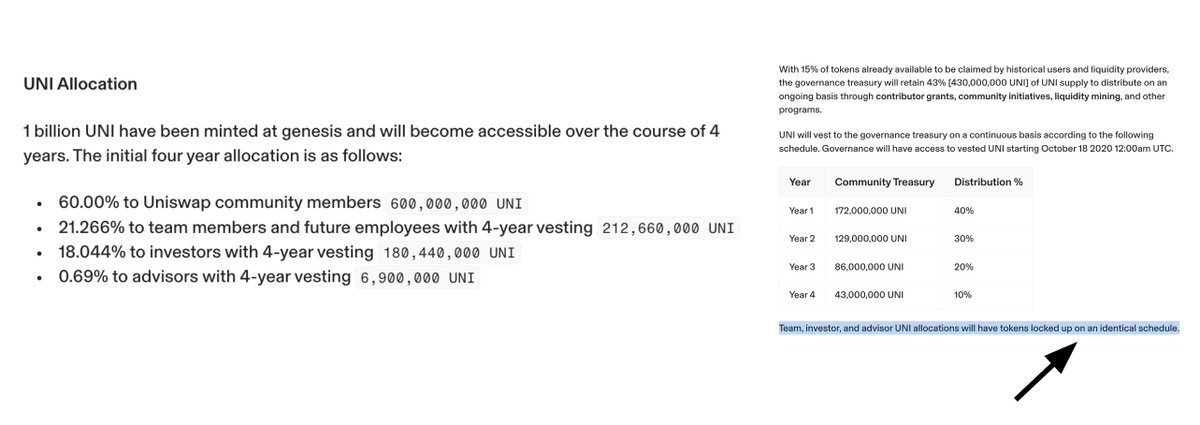

"Team, investor, and advisor UNI tokens vest over 4 years... without a normal 12-month cliff & with 40% front-loaded during the 1st year."

Token Terminal 📊

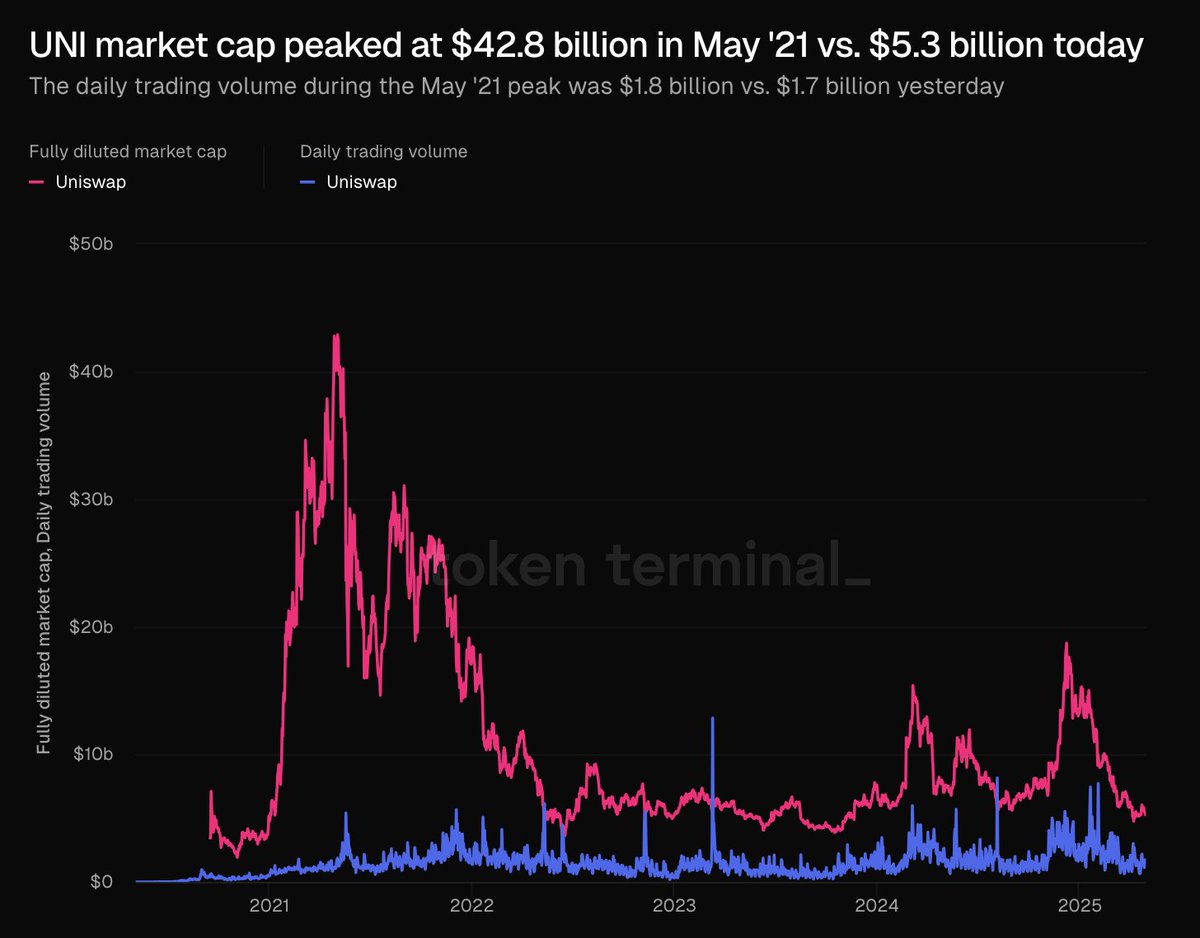

UNI market cap peaked at $42.8 billion in May '21 vs. $5.3 billion today.

The daily trading volume on Uniswap during the May '21 peak was $1.8 billion vs. $1.7 billion yesterday.

9.03K

14

UNI calculator

Uniswap price performance in USD

The current price of Uniswap is $5.3000. Over the last 24 hours, Uniswap has decreased by -0.93%. It currently has a circulating supply of 600,483,074 UNI and a maximum supply of 1,000,000,000 UNI, giving it a fully diluted market cap of $3.19B. At present, the Uniswap coin holds the 18 position in market cap rankings. The Uniswap/USD price is updated in real-time.

Today

-$0.05000

-0.94%

7 days

-$0.61900

-10.46%

30 days

-$0.81600

-13.35%

3 months

-$5.5580

-51.19%

Popular Uniswap conversions

Last updated: 02/05/2025, 22:43

| 1 UNI to USD | $5.3070 |

| 1 UNI to SGD | $6.8624 |

| 1 UNI to PHP | ₱294.57 |

| 1 UNI to EUR | €4.6667 |

| 1 UNI to IDR | Rp 87,157.17 |

| 1 UNI to GBP | £3.9839 |

| 1 UNI to CAD | $7.3200 |

| 1 UNI to AED | AED 19.4929 |

About Uniswap (UNI)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Learn more about Uniswap (UNI)

What is Uniswap (UNI): how does the popular DEX work?

Decentralized Exchanges (DEXs) have cemented their place in the blockchain and cryptocurrency industry. They provide a solution to centralization by allowing users to interact with their platform in a self-custodial manner. A prime example of one of the is . Since its creation in 2018, it's become the largest DEX in the world. According to , Uniswap sits on top with a TVL of over $4,000,000,000. This is above competitors like and , which as of late 2023 have less than half of Uniswap's TVL.

27 Feb 2025|OKX|

Beginners

We're the First to Fully Incorporate Uniswap Labs' Innovative API Into our DeFi Platform, Launching Our DEX's 'Snap' Trading Feature

Today, we're excited to announce that we are the first major industry player to fully integrate Uniswap Labs ’ trading APIs into our offerings, providing OKX users with greater accessibility to DeFi.

25 Apr 2024|OKX

Uniswap FAQ

How much is 1 Uniswap worth today?

Currently, one Uniswap is worth $5.3000. For answers and insight into Uniswap's price action, you're in the right place. Explore the latest Uniswap charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Uniswap, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Uniswap have been created as well.

Will the price of Uniswap go up today?

Check out our Uniswap price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

UNI calculator

Socials