DAI

DAI price

$0.99990

+$0

(+0.00%)

Price change for the last 24 hours

How are you feeling about DAI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

DAI market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$3.69B

Circulating supply

3,691,825,819 DAI

100.00% of

3,691,825,819 DAI

Market cap ranking

18

Audits

Last audit: 1 May 2021

24h high

$1.0005

24h low

$0.99960

All-time high

$8,976.00

-99.99% (-$8,975.00)

Last updated: 2 Aug 2019

All-time low

$0.0011000

+90,800.00% (+$0.99880)

Last updated: 2 Aug 2019

DAI Feed

The following content is sourced from .

Blockbeats

Original title: "Bancor sues Uniswap for eight years of AMM patent infringement, and is counterattacked: a waste of resources"

Original author: Crumax, Chain News

Bancor, a veteran DeFi protocol, recently filed a patent infringement lawsuit against decentralized exchange giant Uniswap, alleging unauthorized use of Bancor's patent-protected automated market maker (AMM) technology in 2017, which has caused widespread discussion and uproar in the community. In the face of Bancor's assertions, Uniswap countered that the lawsuit was "baseless".

Bancor sues Uniswap for unauthorized use of core AMM technology

According to The Block, the lawsuit was initiated by the Bprotocol Foundation, the nonprofit behind Bancor, and developer LocalCoin Ltd., and was filed in the U.S. District Court for the Southern District of New York on May 20. According to the complaint, Uniswap has been a decentralized trading protocol since 2018, and its core design adopts the "Constant Product Automated Market Maker (CPAMM)" architecture pioneered by Bancor, but it has never been legally authorized:

Bancor invented the automated market-making model as early as 2016, published a white paper, applied for a U.S. patent in 2017, and officially launched the world's first CPAMM-based DEX (decentralized exchange) that year. According to a press release issued by Bancor, the technology has been granted two patents in the United States and is arguably one of the key cornerstones in the DeFi space.

Bancor: We are the originators of automated market makers

According to Mark Richardson, project lead at Bancor, Uniswap has been using Bancor's patented technology for eight years without ever paying for it, so it has had to take legal action:

"When an organization continues to use our inventions to compete with us, but without authorization, we have to defend our intellectual property rights through legal means." He added, "If a company like Uniswap could use other people's technology at will, the innovation of the entire DeFi industry would be in jeopardy. This is not only for ourselves, but also for the healthy development of the entire decentralized finance ecosystem."

Uniswap Strikes Back: Unfounded and Wasteful of Resources

In response, a Uniswap Labs spokesperson countered: "This lawsuit is groundless, and we will do our best to defend ourselves." He pointed out that since the release of the Uniswap protocol, the code has been completely open source, and has been reviewed and verified by the community for a long time, and there is no infringement issue:

"At a time when DeFi is at an all-time high, litigation like this is just a waste of resources and attention." Uniswap founder Hayden Adams even joked, "It's probably the stupidest thing I've ever seen."

The exact amount of the claim has not yet been determined, but the judgment in this case may become an important precedent for defining the boundaries of DeFi patent rights.

Bancor vs Uniswap: The disparity in strength

While Bancor advocates defending its proprietary technology, there is a significant gap between the two in the DeFi market in terms of actual developments.

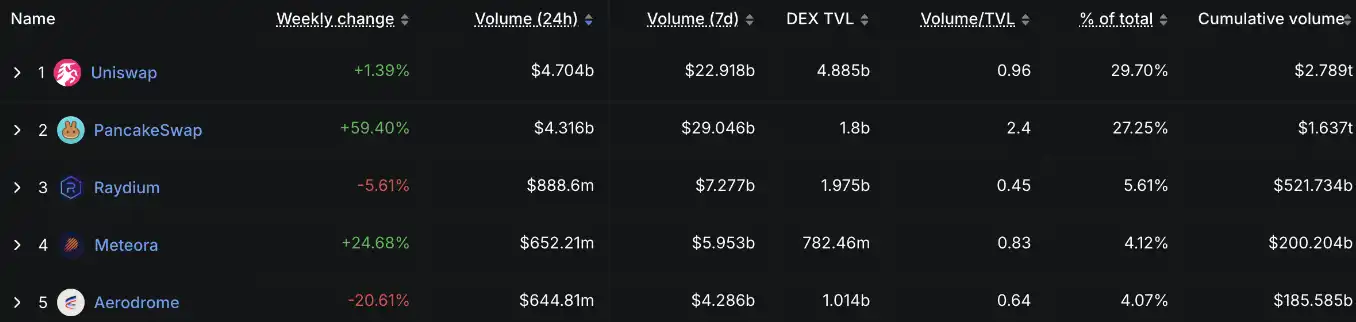

According to DefiLlama data, as of press time, Uniswap's daily trading volume is close to $4.7 billion, ranking first in the world. Since its inception, the cumulative trading volume has approached $2.8 trillion. Bancor, on the other hand, traded only $500,000 on the day, ranking 128th, with a huge disparity in strength.

This confrontation over technology patents and market strength is not only a legal dispute, but also reflects the new challenges and games that the DeFi industry faces after entering a mature stage. How the courts determine the validity of Bancor's patents in the future will have a profound impact on the boundaries of DeFi technology innovation.

Attached: Full analysis of the GENIUS Act of the U.S. stablecoin act

As stablecoins have gradually become an important tool for U.S. dollar payments and settlements, the U.S. Congress recently proposed the "GENIUS Act" (Guiding and Establishing National Innovation for U.S. Stablecoins Act), which aims to establish a coordinated compliance framework between the federal and state governments by clearly regulating the issuance conditions, reserve requirements and regulatory mechanisms of "payment stablecoins".

The core concept of the GENIUS Act: only regulate "payment stablecoins"

The bill explicitly limits the scope of regulation to "payment stablecoins", which are defined as "digital assets that are redeemed by the issuer with a fixed amount of fiat currency and maintain a stable exchange rate."

Exclude the following types:

· Fiat currency itself (e.g. USD)

· Bank deposits (even if recorded on the blockchain)

· Financial securities assets

· Decentralized vs. algorithmic stablecoins (e.g. DAI, FRAX)

Who can issue payment stablecoins?

Only the following three types of institutions are authorized to issue regulated payment stablecoins:

1. Federally supervised banks or their subsidiaries

2. A non-bank institution approved by the OCC (Office of the Comptroller of the Currency).

3. State-approved issuers (with assets of less than $10 billion)

Other unlicensed institutions are not allowed to issue or sell payment stablecoins to U.S. users after a three-year grace period.

Reserve requirement: 1:1 cash or equivalent assets, no re-pledge

Issuers are required to hold reserves of equivalent value, including:

· U.S. dollar cash vs. Fed account deposits

· Demand deposits covered by FDIC insurance

Short-term U.S. Treasury bonds maturing within 93 days

· Government Money Market Fund

· Eligible repurchase agreements or tokenized Treasury assets

Rehypoching is prohibited except for liquidity needs or permitted purposes.

Reporting & Compliance Obligations: Openness, Transparency, and Audit

All compliant issuers must:

· The composition and issuance of monthly reserves are disclosed

· Audited by a certified public accountant

· The CEO signs a certificate of authenticity with the CFO

· If the issuance size exceeds $50 billion, the annual financial report must be prepared and disclosed in accordance with GAAP standards

· Comply with the Bank Secrecy Act (BSA) and anti-money laundering regulations

Exceptions: Guarantee the freedom and privacy of users

The following are exempt from the Act:

· Person-to-Person Asset Transfer (P2P)

· The same person transfers stablecoins between domestic and foreign accounts

· Self-custody Wallet Operations (Hardware/Software Wallets)

Dual state and federal regulatory regimes

State-level issuers with assets of less than $10 billion can maintain state regulation, subject to approval by the federal Stablecoin Review Committee. After exceeding the $10 billion threshold, it must be subject to federal supervision or stop additional issuance.

Core goal: to stabilize the payment system and cut the DeFi field

The goal of the bill is to create a compliant "payment infrastructure" that separates itself from DeFi or algorithmic models, and does not intend to ban all stablecoins, but to establish a standard for "safe and redeemable" payment stablecoins to prevent systemic crash risks (such as Terra/UST).

DAI, FRAX are not regulated, but exchange policies are worth paying attention to

Although decentralized stablecoins such as DAI are not subject to the law, if US exchanges or payment platforms only support compliant stablecoins in the future, it may still have an indirect impact on such assets.

Risk Warning: Investing in cryptocurrencies carries a high degree of risk, its price may fluctuate dramatically and you may lose all of your principal. Please carefully assess the risks.

Link to original article

Show original

3.67K

0

撸币养家 | lubiyangjia.eth

Huma Finance: A PayFi network that redefines global payment liquidity|46 million+

As a long-term user who has been following the DeFi and payment track, the emergence of Huma Finance @humafinance has made my eyes shine. It is not just an ordinary lending protocol, but a PayFi network that focuses on "payment scenario liquidity". To put it simply, Huma Finance's goal is to make global payment behaviors no longer plagued by broken capital chains, whether it is corporate payroll, supply chain settlement, or personal cross-border payment, they can get instant liquidity support.

Project Basics: PayFi's unique positioning

The core logic of Huma Finance is "Invoice Financing". For example, a company has an account receivable that takes 30 days to arrive, but it urgently needs funds to pay employees or suppliers, and the traditional financial process is cumbersome and time-consuming. Huma converts this "future income" into instant liquidity through on-chain credit assessment and asset tokenization, without the need for overcollateralization.

Unlike general lending protocols such as AAVE and Compound, Huma focuses on "payment scenarios" and supports different chains and payment ecosystems (such as payroll, BNPL, supply chain finance, etc.) through modular design. Its bottom layer consists of two key parts:

Credit Risk Engine: Dynamically assess borrower credit through on-chain/off-chain data (such as DAO Treasury, corporate cash flow records, etc.).

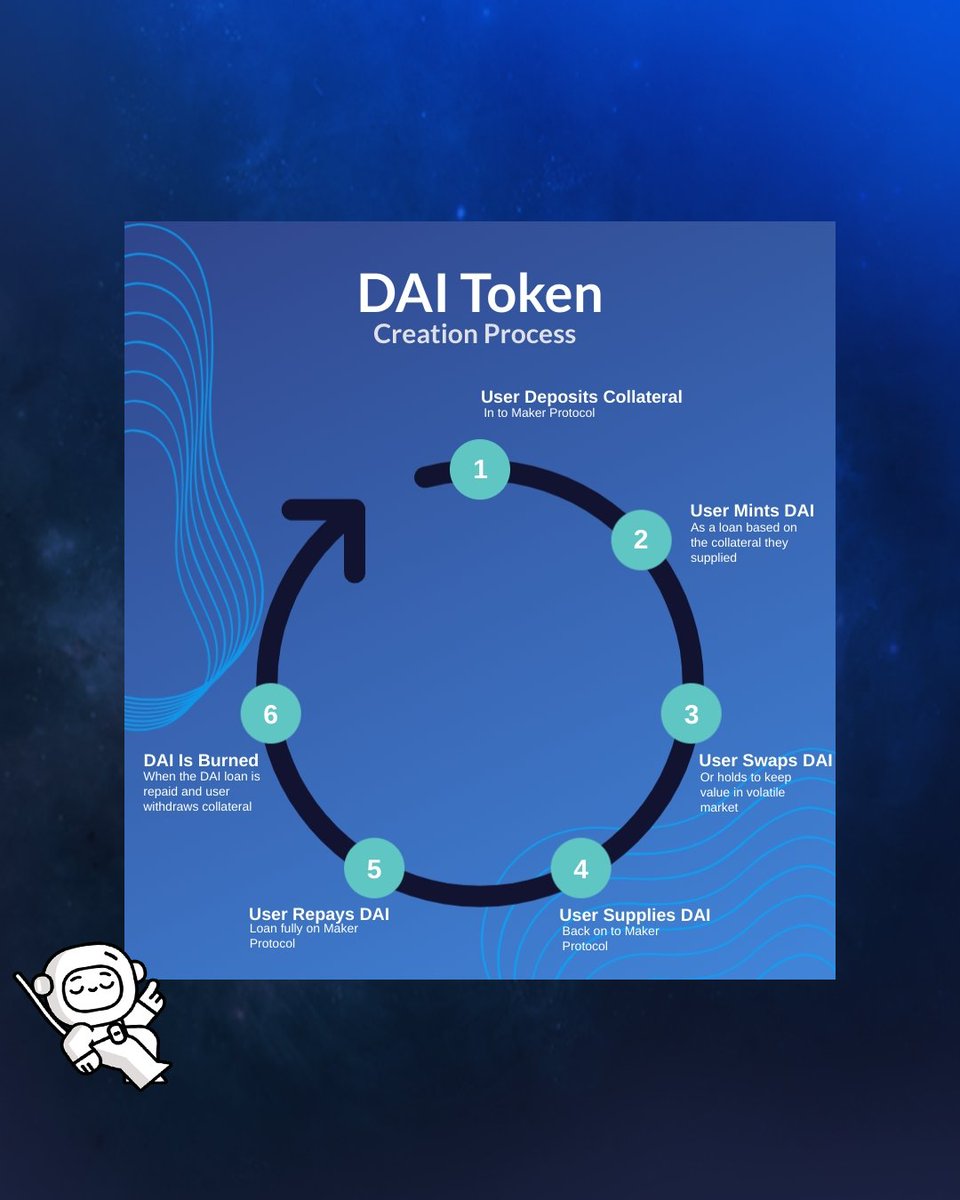

Liquidity pools: Fund providers (LPs) can participate and earn yield through stablecoins or tokenized assets (such as USDC, DAI).

Project Advantages: Why Huma Could Be a Dark Horse?

Deep cultivation in vertical fields: The DeFi lending track is already a red ocean, but the liquidity of payment scenarios is still not fully developed. Huma targets the trillion-dollar B2B and cross-border payments market.

Credit evaluation innovation: Traditional DeFi relies on overcollateralization, while Huma introduces the concept of "credit line", which is similar to the credit model of traditional finance, but is more user-friendly.

Modular scalability: Huma's architecture allows it to access different payment protocols (such as Request Network and Sablier), and may become the underlying financial layer of Web3 payments in the future.

Tokenomics: Incentives and Governance

Huma's token $HUMA has not yet been launched, but judging from the white paper, its design is biased towards utility + governance:

Staking rewards: LPs and borrowers can increase their credit limit or receive fee discounts by staking $HUMA.

Protocol Governance: Holders vote on risk parameters (e.g., collateral ratio, default liquidation rules).

Revenue share: A portion of the agreement revenue, such as interest differentials, may be used for buybacks, burns, or dividends.

The key point is that $HUMA value capture is directly tied to the size of payments on the Huma network – if more businesses adopt its financing services, the demand for tokens will rise as fees grow.

Financing Information: Why is Capital Optimistic?

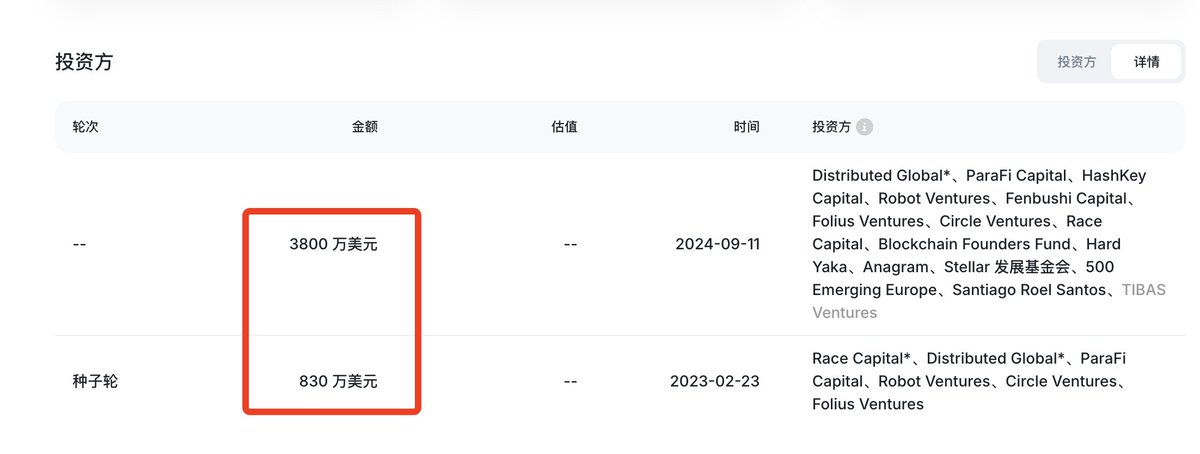

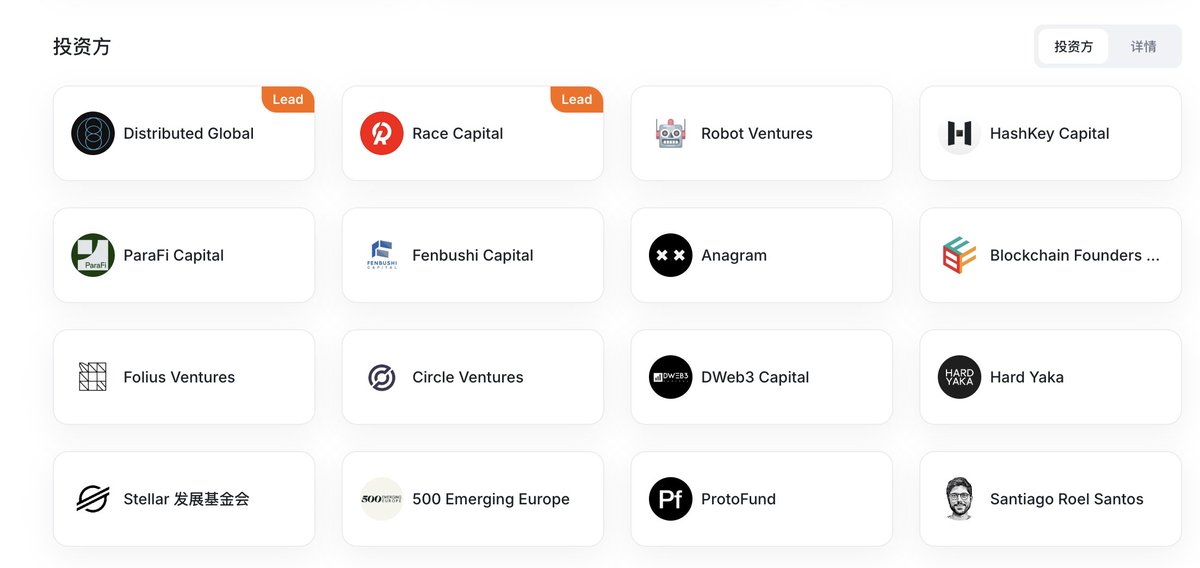

Huma's fundraising journey is worth noting:

February 2023: $8.3 million seed round, led by Race Capital and Distributed Global.

September 2024: $38 million Series A, with participation from traditional financial institutions such as Tiger Global and BlockTower.

The large amount of financing shows two points: first, the market recognizes the potential of the PayFi track, and second, Huma's team and technology (core members from PayPal, Stripe, etc.) have the ability to land.

Future Prospects and Challenges

Huma has a lot of room for imagination, especially in the areas of RWA (real world assets) and cross-border payments. For example, small and medium-sized enterprises in developing countries can quickly obtain advance financing for international orders through Huma without relying on local loan sharks.

But the challenges are also clear:

Credit risk: On-chain data is not sufficient to fully assess borrower eligibility, and it may be necessary to introduce Oracle or KYC mechanisms.

Regulatory compliance: When it comes to cross-border payments and tokenized receivables, differences in national laws can be a barrier to expansion.

Personal opinion: cautiously optimistic

As a user, I think the concept of Huma is very much in line with real needs – especially in the current context of the global economic downturn and tight cash flow. However, the success of PayFi depends on ecological cooperation (such as integration with Stablecoin issuers and payment gateways), not purely technical advantages.

In the short term, Huma needs to prove that its bad debt ratio is manageable and attract more real business users (rather than speculators). If it can do this, it has a chance to become the Web3 version of "Stripe Capital".

Summary: Huma Finance is not yet another "DeFi Lego", but an innovative protocol that tries to solve the pain points of the real economy. Despite the uncertainties ahead, its $38 million funding and clear positioning deserve long-term attention. @KaitoAI

(The above views are personal opinions only and do not constitute any investment advice)

Show original

45.02K

44

DAI calculator

DAI price performance in USD

The current price of DAI is $0.99990. Over the last 24 hours, DAI has increased by +0.00%. It currently has a circulating supply of 3,691,825,819 DAI and a maximum supply of 3,691,825,819 DAI, giving it a fully diluted market cap of $3.69B. At present, the DAI coin holds the 18 position in market cap rankings. The DAI/USD price is updated in real-time.

Today

+$0

+0.00%

7 days

-$0.00010

-0.01%

30 days

+$0.00030000

+0.03%

3 months

-$0.00060

-0.06%

Popular DAI conversions

Last updated: 22/05/2025, 08:36

| 1 DAI to USD | $0.99970 |

| 1 DAI to SGD | $1.2897 |

| 1 DAI to PHP | ₱55.6445 |

| 1 DAI to EUR | €0.88347 |

| 1 DAI to IDR | Rp 16,348.32 |

| 1 DAI to GBP | £0.74575 |

| 1 DAI to CAD | $1.3865 |

| 1 DAI to AED | AED 3.6719 |

About DAI (DAI)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

DAI FAQ

How much is 1 DAI worth today?

Currently, one DAI is worth $0.99990. For answers and insight into DAI's price action, you're in the right place. Explore the latest DAI charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as DAI, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as DAI have been created as well.

Will the price of DAI go up today?

Check out our DAI price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

DAI calculator

Socials