What's a smart arbitrage bot?

Smart arbitrage is a trading strategy aimed at achieving more stable outcomes by balancing out the ups and downs of the market.

Imagine you buy Solana (SOL) on the spot market, and simultaneously sell an equivalent amount of SOL futures contracts, betting that the price will drop. By holding both positions, any gains or losses from one side are offset by the other, effectively reducing your overall risk. This strategy not only helps to stabilize your returns, but also allows you to earn consistent funding fees.

About this bot

This strategy is particularly effective with popular cryptocurrencies that typically have long-term positive funding rates, allowing for consistent returns even amidst price fluctuations.

It's well-suited for those seeking stable results in a volatile market, without the burden of actively managing trades.

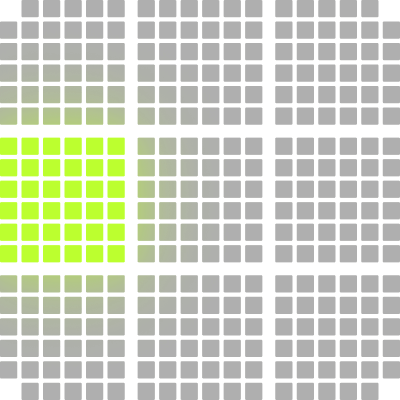

Imagine you're Amy. On September 28, the price of SOL was 158.20 USDT, with a funding rate of 0.009%.

Amy invested 10,000 USDT in a SOL/USDT smart arbitrage product. It automatically bought SOL on the spot market while simultaneously shorting it in the futures market, allowing her to capitalize on both sides of the trade.

Over the next 4 days, the funding rate remained positive, settling every 8 hours. This enabled Amy to earn funding fees 12 times. During this period, the rate peaked at 0.021%.

On October 2, the rate began to decline and eventually turned negative.

By October 2, the price of SOL had dropped to 144.50 USDT. At this point, Amy decided to stop the bot. Her total assets had grown to 10,050 USDT, including funding fees and gains from her short futures position, which successfully offset the decline in the spot price of SOL. As a result, her APR was 45.4%.

In comparison, had Amy simply bought SOL on the spot market, her APR would have been -9%. Thanks to the smart arbitrage strategy, Amy achieved consistent and profitable outcomes even during price declines.

Trending

Bot setup

Zero profit sharing

Zero management fees