What’s a HODL grid bot?

HODL grid bots use BTC as a quote currency, and continuously buy and sell BTC and the target crypto using a spot grid.

The key strategy is to accumulate both cryptocurrencies by buying each whenever the price is low. This strategy aims to achieve consistent growth over time.

About this bot

The HODL Grid Bot uses a grid strategy to accumulate more crypto when prices drop, helping you steadily build your portfolio during market swings.

If you believe that a top cryptocurrency will grow more than BTC in the long run, this bot can help you increase your holdings of both, amplifying your gains.

Imagine you’re Cat. Cat wanted to grow her cryptocurrency without constantly monitoring the market. On February 27, 2024, the price of SOL was 112 USDT, and BTC was 53,000 USDT.

Cat set up a bot with 10,000 USDT worth of BTC to automatically swap between SOL and BTC, depending on how their prices moved.

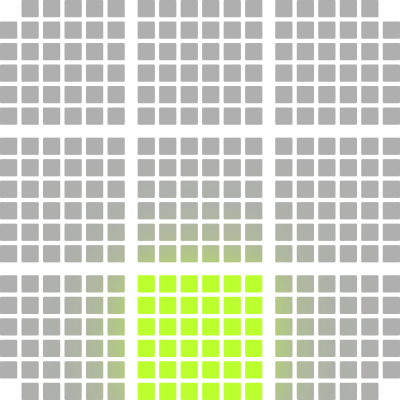

Over the next several months, from March to September, SOL’s price jumped up and down, but it always stayed within a range 0.002 - 0.003 BTC.

The bot worked behind the scenes, swapping between the two coins whenever there was a chance to profit.

By mid-September, SOL rose to 130 USDT and BTC hit 55,000 USDT.

While SOL's price was up 16%, Cat's bot outperformed, boosting her gains to 25% by actively trading between SOL and BTC. She benefited not only from the price increase but also from growing her coin holdings.

Trending

Bot setup

Zero profit sharing

Zero management fees