DAI

DAI price

$1.0000

+$0.000100000

(+0.01%)

Price change for the last 24 hours

How are you feeling about DAI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

DAI market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$3.66B

Circulating supply

3,661,367,939 DAI

100.00% of

3,661,367,939 DAI

Market cap ranking

--

Audits

Last audit: 1 May 2021

24h high

$1.0006

24h low

$0.99770

All-time high

$8,976.00

-99.99% (-$8,975.00)

Last updated: 2 Aug 2019

All-time low

$0.0011000

+90,809.09% (+$0.99890)

Last updated: 2 Aug 2019

DAI Feed

The following content is sourced from .

常为希 |加密保安🔸🚢🇺🇸

It's boring

The various concepts are either PVP or changing people

RWAFI is actually similar to the DeFi that everyone used to defi

But RWAFI to the agencies

That is, the big leeks

In the past, it was the coins of the chain to be pledged, such as ETH staking and minting DAI

Now rwafi

It's all US Treasury dollars

At the heart of it is an attempt to find a reservoir for the debt problem

BTC's hodler has also gone from being an individual player to a big fund and sovereign player

Show original9.29K

4

Ethereum Intern

crypto is very good for international payments. frictionless financial rails without the extractive fees of banks or payment institutions

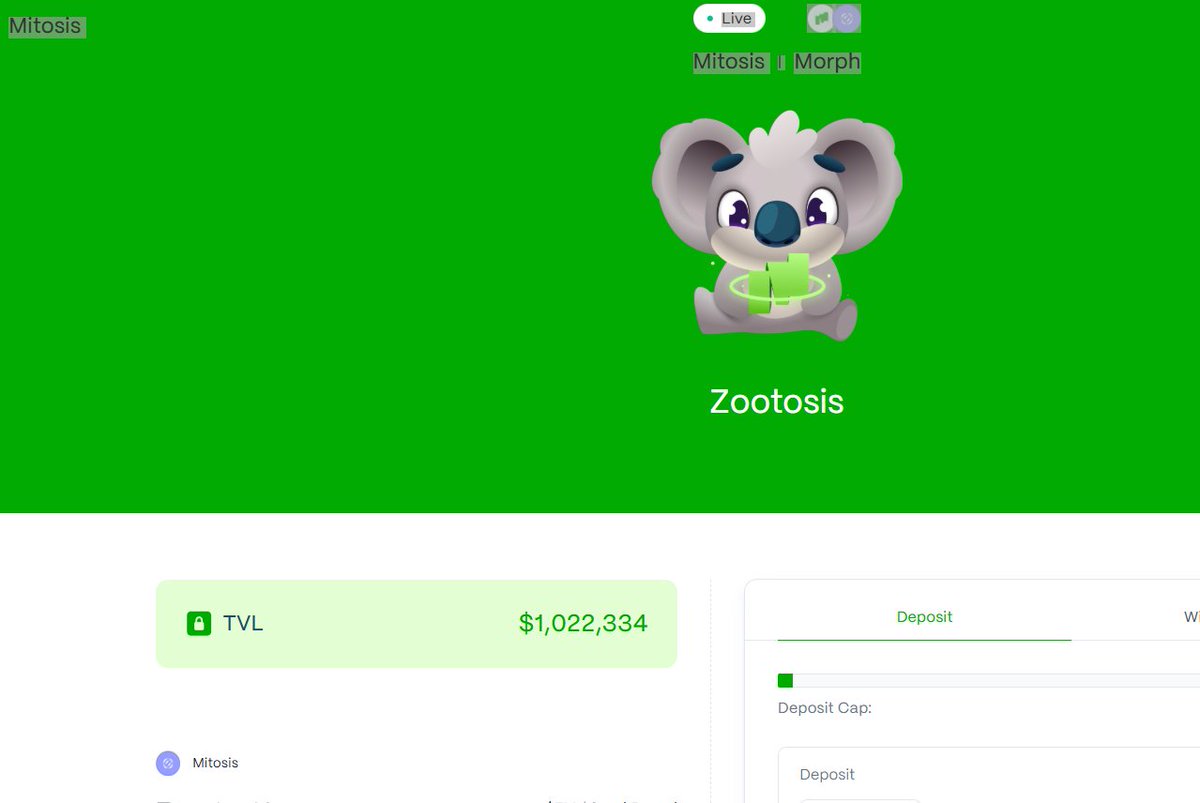

@megaeth_labs @Mega_Ecosystem are yall willing to donate a couple USDC to save the bunnies?

PaperImperium

I will match the next $500 in USDC, USDT, or DAI donated to Carrot Cottage Rabbit Rescue in the UK.

Cross-border donations are a great use case for crypto!

Their ETH address: 0x8b6d985ee32BCC398e022df5B478E9508414e61A (you can confirm in their profile under the payments button)

18.17K

44

Carnation reposted

PaperImperium

I will match the next $500 in USDC, USDT, or DAI donated to Carrot Cottage Rabbit Rescue in the UK.

Cross-border donations are a great use case for crypto!

Their ETH address: 0x8b6d985ee32BCC398e022df5B478E9508414e61A (you can confirm in their profile under the payments button)

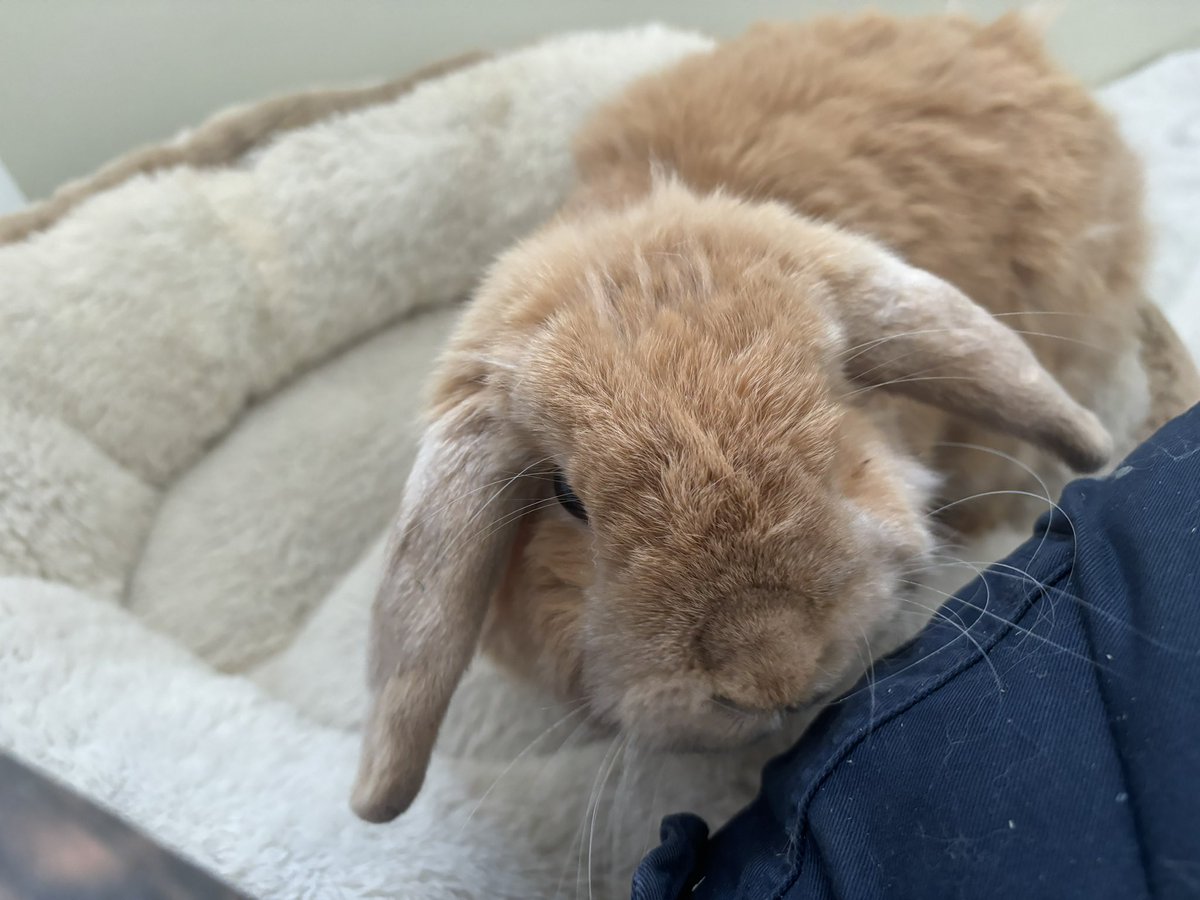

Carrot cottage rabbit rescue

We are very pleased to introduce Bella.

Saved from euthanasia.

Bella has what appears to be a massive ear based abscess. We’ve been here before with Faye. Bella is 8years old and we are going to do everything in our power to make the rest of her life as comfortable as possible.

We will be seeing dr Sophie asap and hopefully get a surgical answer to this problem ❤️

31.31K

23

BNN

Ethereum Pectra Upgrade - Kicking Off the Super Meme Cycle on ETH

I’ll give you reasons to pay attention to the two most potential memes in the market right now.

✅ Speaking of ETH, the Pectra Upgrade on May 7 will be the most significant event of 2025, and there’s always a wave to welcome such events.

✅ The upgrade includes a standout feature: Paying gas fees with ERC-20 tokens.

Users can pay gas fees with tokens like USDC, DAI, or even memecoins (such as $MOONKIN or $KEKIUS MAXIMUS) instead of ETH. This is especially useful when users don’t have enough ETH in their wallet but hold other tokens.

1. $Moonkin

✅ Moonkin is a character from the game World of Warcraft (WoW), a figure that inspired the idea of decentralization, leading to the creation of Ethereum.

✅ The Moonkin image was first posted by Vitalik on April 1, 2025, in a tweet about it:

Link:

✅ $Moonkin isn’t just an ordinary meme; from its inception, it has carried the mission to become the new representative image of ETH, with the goal of “Make ETH Great Again.”

2. $Kekius Maximus

✅ Kekius Maximus is inspired by Elon Musk and arguably has the strongest community on X today. It’s no longer just a character from Elon Musk’s game but has become a global Cult Meme!

👌 ETH remains the origin of smart contracts in blockchain, and we need to unite and support Vitalik to “Make ETH Great Again” by backing $Moonkin.

👌 Elon Musk is the King of Memes—the inspiration for memes since the early days of the crypto market. Supporting $Kekius Maximus means keeping Elon Musk at the top spot.

Show original

40.6K

208

DAI price performance in USD

The current price of DAI is $1.0000. Over the last 24 hours, DAI has increased by +0.01%. It currently has a circulating supply of 3,661,367,939 DAI and a maximum supply of 3,661,367,939 DAI, giving it a fully diluted market cap of $3.66B. At present, the DAI coin holds the 0 position in market cap rankings. The DAI/USD price is updated in real-time.

Today

+$0.000100000

+0.01%

7 days

-$0.00090

-0.09%

30 days

-$0.00010

-0.01%

3 months

-$0.00050

-0.05%

Popular DAI conversions

Last updated: 20/05/2025, 19:12

| 1 DAI to USD | $0.99990 |

| 1 DAI to AUD | $1.5580 |

| 1 DAI to PHP | ₱55.7049 |

| 1 DAI to EUR | €0.88839 |

| 1 DAI to IDR | Rp 16,434.91 |

| 1 DAI to GBP | £0.74775 |

| 1 DAI to CAD | $1.3935 |

| 1 DAI to AED | AED 3.6726 |

About DAI (DAI)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

DAI FAQ

How much is 1 DAI worth today?

Currently, one DAI is worth $1.0000. For answers and insight into DAI's price action, you're in the right place. Explore the latest DAI charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as DAI, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as DAI have been created as well.

Will the price of DAI go up today?

Check out our DAI price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials