AAVE

AAVE price

$264.70

+$46.4600

(+21.28%)

Price change for the last 24 hours

How are you feeling about AAVE today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

AAVE market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$4.02B

Circulating supply

15,117,175 AAVE

94.48% of

16,000,000 AAVE

Market cap ranking

23

Audits

Last audit: 2 Dec 2020

24h high

$267.78

24h low

$212.04

All-time high

$665.71

-60.24% (-$401.01)

Last updated: 19 May 2021

All-time low

$25.9300

+920.82% (+$238.77)

Last updated: 5 Nov 2020

AAVE Feed

The following content is sourced from .

Odaily

Original | Odaily Daily (@OdailyChina)

Author|Azuma(@azuma_eth)

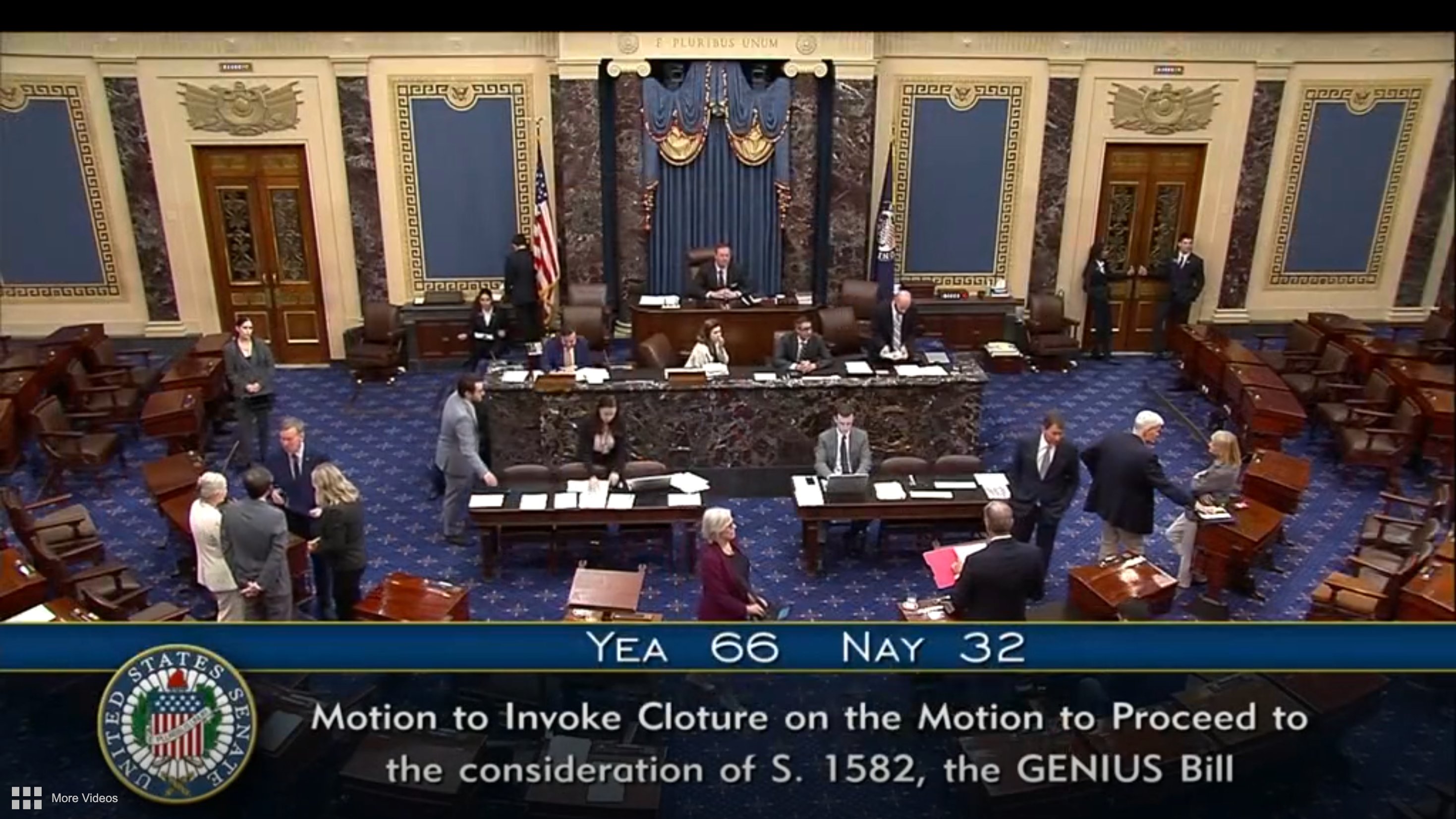

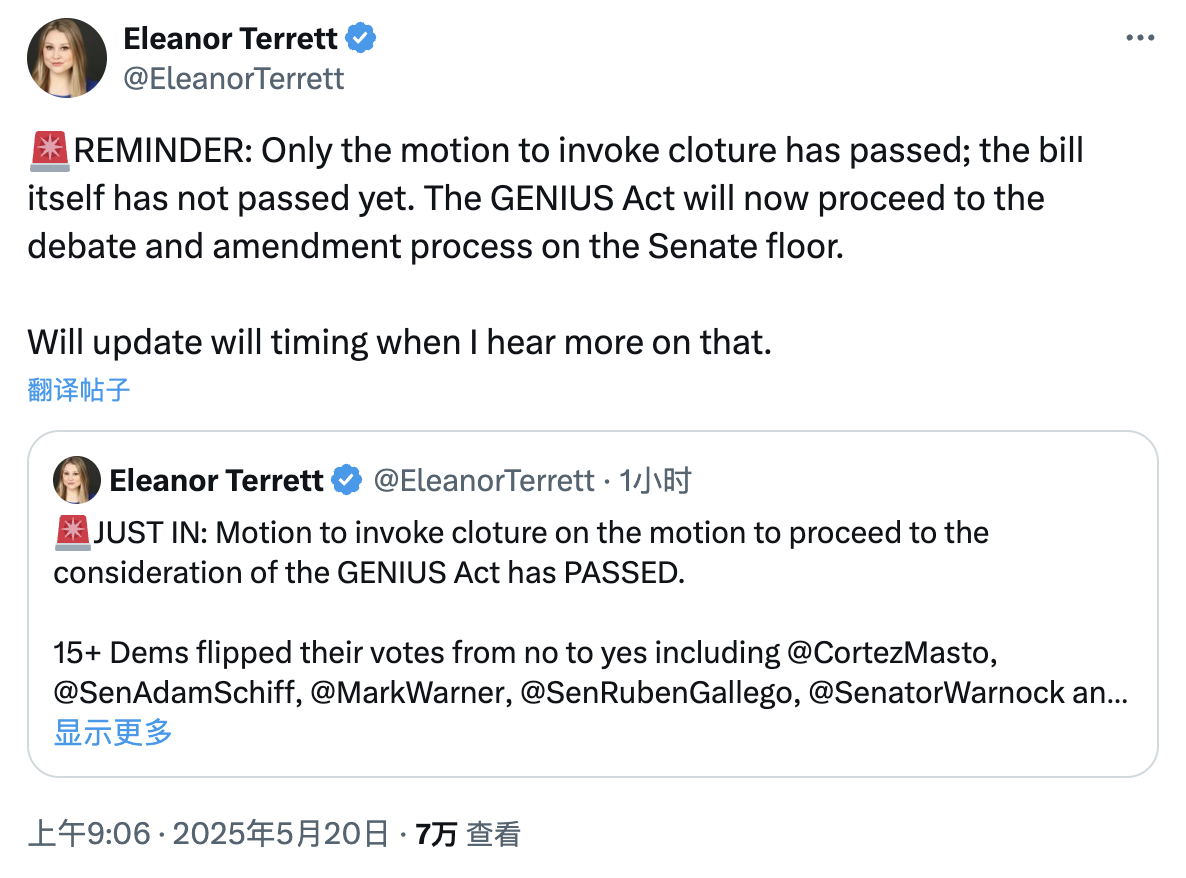

In the early morning of May 20, Beijing time, the much-watched stablecoin regulation bill (GENIUS Act) ushered in a key breakthrough in a vote in the U.S. Senate - the Senate voted 66 in favor and 32 against to pass the closing debate vote of the GENIUS Act. This means that the Senate has agreed to halt the debate on the bill, with a final vote coming in 30 hours at the latest.

Is the final vote complete?

It should be clearly emphasized that many media outlets and KOLs this morning have misreported the latest progress of the GENIUS Act, and in fact, the Senate voted to end the debate, and the bill itself has not yet passed the final vote.

However, this can still be seen as a key breakthrough for the GENIUS Act in getting through Congress, as the end of debate voting is a key mechanism in the U.S. Congressional legislative process, specifically designed to break the impasse in which the dissenting minority wants to block the bill's vote through "endless debate."

In the GENIUS Act case, Democratic senators, represented by Elizabeth Warren, have been the main force hindering the GENIUS Act process, and it was because of the collective opposition of Democratic senators that the GENIUS Act failed to advance further in the Senate vote on May 8 because it received only 49 votes (which did not meet the minimum requirement of 60 votes). However, in this morning's end-of-debate vote, 15 Democratic senators, including Adam Schiff, Mark Warner, and others, changed their vote from no to yes — meaning that in the upcoming final vote, this group of Democratic senators is likely to be a key force in the GENIUS Act running through the Senate.

Odaily Note: NBC reported that the reason for the multiple Democratic Senate vote changes was that bipartisan representatives negotiated an agreement last week, and in exchange, the bill added some amendments, including changes to consumer protections and restrictions on the issuance of stablecoins by tech companies, and expanded ethical standards to special government employees — which will apply to Musk and David Sacks for the time being.

GENIUS Act Content

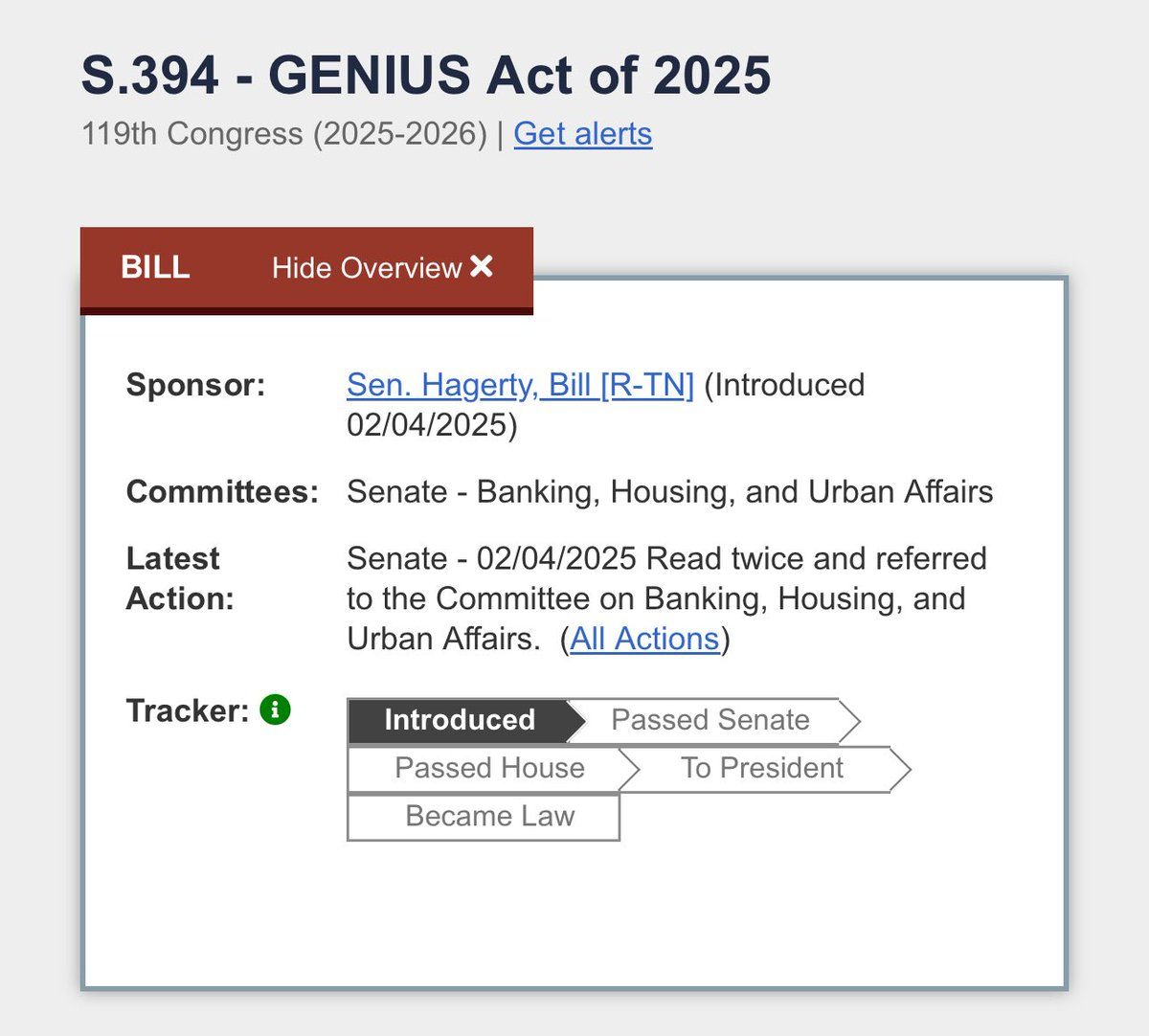

On February 4, 2025, U.S. Senators Bill Hagerty, Tim Scott, Kirsten Gillibrand, and Cynthia Lummis jointly proposed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS Act). It aims to establish a legal framework for the legal use of stablecoin payments in the United States.

The core provisions of the Act are as follows:

Payment Stablecoin Definition: A digital asset pegged to a fixed monetary value, fully backed by U.S. dollars or other highly liquid assets at a 1:1 ratio, dedicated to payment and settlement scenarios.

Dual-licensing regulation: Federally regulated, with issuers with a market capitalization of more than $10 billion subject to federal regulation; State-level regulation, with the option of state-level registration for small publishers (subject to federal equivalence).

100% Reserve Requirement: Reserve assets are limited to cash, short-term U.S. Treasury bonds, or central bank deposits, and must be segregated from working capital. A certificate of sufficiency of reserves is required to be submitted every month to ensure that users can redeem at face value.

Mandatory Disclosure of Transparency: Regular disclosure of reserve composition and redemption policies, compliance audits conducted by a CPA firm.

Anti-Money Laundering Compliance: Bringing issuers under the Bank Secrecy Act to meet financial institution-level AML obligations.

Priority user protection: When an issuer goes bankrupt, stablecoin holders' claims take precedence over other claimants.

Clear regulatory ownership: Clearly stipulate that payment stablecoins do not belong to the category of securities, commodities or investment companies, and draw a clear regulatory boundary.

In short, as the first federal-level stablecoin bill, the GENIUS Act has been widely regarded by the industry as an important development for stablecoins to move out of the wild growth stage, officially enter the scope of compliance, and is expected to move towards the broader market such as payments.

It is precisely because of the importance of the GENIUS Act that many parties in the industry have invested in lobbying efforts in order to get through the legislative process as soon as possible and successfully land.

After the Senate, what is left?

According to the U.S. legislative process, if the GENIUS Act can successfully run through the Senate, it will still be voted on by the House of Representatives, and then submitted to President Trump for signature before it finally becomes law.

Barron's reported that the bill is expected to go more smoothly in the House of Representatives, which does not need an absolute majority to approve it.

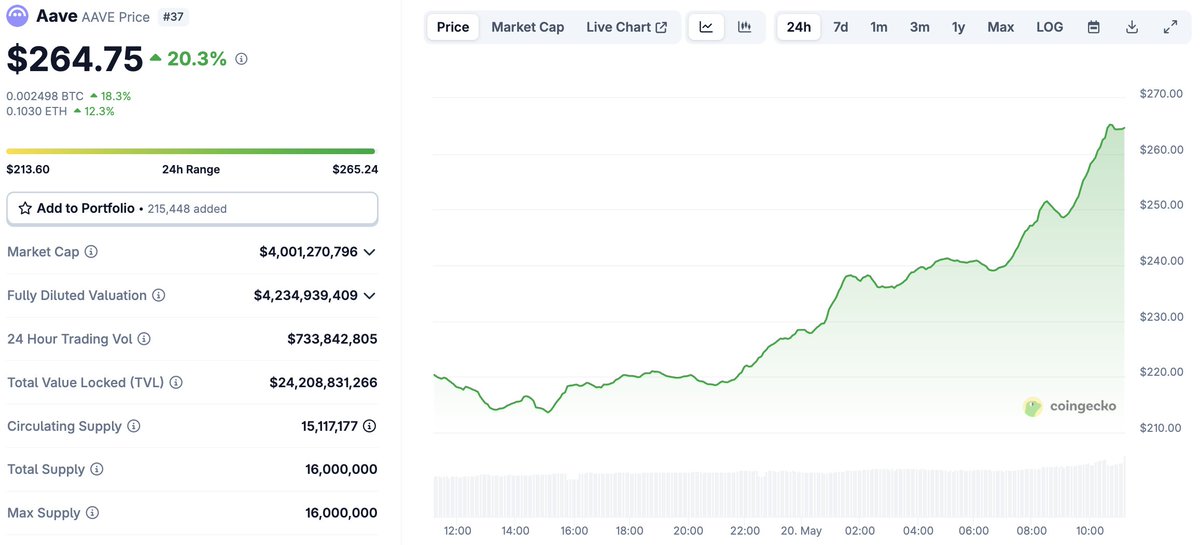

How has the market reacted?

Perhaps due to the positive blessing of the GENIUS Act, which has already made a key breakthrough in the Senate, the crypto market, which suffered a large correction yesterday, has seen a strong rebound today - BTC is back above the $106,000 mark, and a new high seems to be just around the corner.

Looking forward to the market changes after the implementation of the GENIUS Act, as the first step towards compliance and a broader market for stablecoins, the bill is undoubtedly a huge positive for the entire industry, and some of the projects whose business content is highly related to stablecoins have benefited greatly - for example, entering Aave (AAVE), Pendle (PENDLE), and Frax (FRAX) have all seen large increases that are better than the overall performance of the market; In addition, Ethereum (ETH), as the main front for the current compliant stablecoin issuance, may also be able to capture greater capital inflows.

Within the stablecoin market, the GENIUS Act, which clearly requires federal and state dual licensing supervision, may also become an opportunity for a track-level reshuffle, and Circle (USDC), which has long followed the compliance route and is registered in the United States, and the Trump family project WLFI (USD 1) may receive stronger compliance endorsements, while Tether (USDT), the king of the current stablecoin track, may face greater regulatory challenges due to problems such as overseas registration and questionable transparency. In response, Tether has officially announced plans to launch a new stablecoin in the United States, and Tether has recently lobbied in Washington to try to promote more friendly policies.

However, these are the final steps of the GENIUS Act, and for now, the top priority in front of the bill will be the final vote in the Senate that will take place in a maximum of 30 hours, when Odaily will follow up on the results of the vote.

Show original

2.52K

0

JackYi

With the passage of the stablecoin bill, everyone is chasing the concept of stablecoins, the hottest of which are $AAVE and $ENA, which are our secondary investment and research institutions @Trend_Research_ laid out in advance in the last ETH ecological opportunity

JackYi

If BTC reaches 300,000 this cycle, ETH has a chance of 10,000, and ETH ecological leaders UNI, AAVE, AND ENA will also be good, looking forward to a crazy bull market together

13.96K

4

Yueya.eth🎩

Both $CRV and $AAVE pulled a big yang today.

These two agreements are not the target of chasing up for me, but the underlying assets that are worth buying repeatedly.

If you fall down, you will have an opportunity, and if you go up, you will watch quietly. Faith is never about words, it's about having the ability to hold something with a clear structure for a long time.

Assets that can truly go through the cycle are not afraid to wait.

Yueya.eth🎩

"In the past two months, there have been far more TradFi institutions than ever before in contacting us for DeFi data."

- @0xngmi, co-founder of DefiLlama

👆 This is an important signal: TradFi is systematically researching DeFi.

They're not here to rush the narrative, but they're revisiting:

Which protocols have a clear structure, manageable risks, and clear benefit logic – i.e., which ones can fit into their risk control framework and configuration model.

In my opinion, Aave and Curve are two of the most accessible cases for institutions to take into account in this type of assessment:

Aave: The most standard on-chain lending protocol

Floating interest rates, mortgage rules, liquidation lines, logical standards, and transparent parameters

The segregated market mechanism introduced by Aave V3 is in line with the "risk zoning" management idea of institutions

The full-chain data is open and the interface is friendly, which is suitable for risk control modeling and backtesting

To TradFi, it's like a "composable, non-custodial banking system".

Curve: The underlying liquidation layer of stablecoin liquidity

The low-slippage AMM mechanism supports large-value stablecoin exchanges, which is a natural "on-chain foreign exchange market"

The veCRV + bribe model is gradually understood as a structure that combines on-chain governance and income rights

Under the general trend of stablecoins becoming a cross-border settlement tool, their system role is increasingly concerned

Institutional research Curve is not bullish or down, but looks at the efficiency of liquidation and the rationality of governance.

They don't want narrative, they want structure.

Whether DeFi can make it to their radar depends on:

1: Is the data structure clear?

2: Is the revenue model predictable?

3: Can the risk parameters be implemented?

4: Can I connect to an existing system?

By the time these protocols are actually researched, tested, and modeled by institutions, the way the market prices them may have changed.

I'll also be compiling a list of protocols that are "under research by TradFi" in the future.

If you know of some projects that are being quietly investigated, welcome to add them together. 🍺

11.72K

30

AAVE price performance in USD

The current price of AAVE is $264.70. Over the last 24 hours, AAVE has increased by +21.29%. It currently has a circulating supply of 15,117,175 AAVE and a maximum supply of 16,000,000 AAVE, giving it a fully diluted market cap of $4.02B. At present, the AAVE coin holds the 23 position in market cap rankings. The AAVE/USD price is updated in real-time.

Today

+$46.4600

+21.28%

7 days

+$47.1500

+21.67%

30 days

+$123.00

+86.80%

3 months

+$11.7200

+4.63%

Popular AAVE conversions

Last updated: 20/05/2025, 12:04

| 1 AAVE to USD | $266.02 |

| 1 AAVE to AUD | $412.93 |

| 1 AAVE to PHP | ₱14,821.84 |

| 1 AAVE to EUR | €236.70 |

| 1 AAVE to IDR | Rp 4,370,297 |

| 1 AAVE to GBP | £199.15 |

| 1 AAVE to CAD | $371.52 |

| 1 AAVE to AED | AED 977.08 |

About AAVE (AAVE)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

AAVE FAQ

How much is 1 AAVE worth today?

Currently, one AAVE is worth $264.70. For answers and insight into AAVE's price action, you're in the right place. Explore the latest AAVE charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as AAVE, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as AAVE have been created as well.

Will the price of AAVE go up today?

Check out our AAVE price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials