An iceberg order is an algorithmic order allowing users to slice large orders into multiple small orders. These orders will be placed on the market according to their preferred mode (quick execution/price-speed balance/passive queuing). When one of the smaller orders has been completely filled, or the level has been changed from the initial orders, the system will check the depth and place the order accordingly.

Quick execution: Bringing fast execution, this mode adopts a more aggressive approach when placing the first order. For instance, the first buy order will be placed at the best ask price, the second order at a price between the best bid and the best ask, the third order at the best bid, and so on.

Price-speed balance: For a balanced execution between time and price, this option adopts a moderate approach when placing the first order. For instance, the first buy order will be placed at a price between the best bid and the best ask, the second order at the best bid, the third order at the second best bid, and so on.

Passive queuing: When it comes to trading, a better price for a buyer usually means buying a digital asset at a lower price, and for a seller, it means selling a digital asset at a higher price.

Why use iceberg

Iceberg helps to minimize the market impact of an order by preventing the significant price shifts a large visible order might cause. Iceberg reduces visibility to other traders, making it harder for them to anticipate or counter the trader's intentions by providing control and flexibility in executing the order. Iceberg orders benefit traders that handle large quantities, allowing them to achieve more favorable execution without alerting the entire market to their actions.

How to access iceberg App

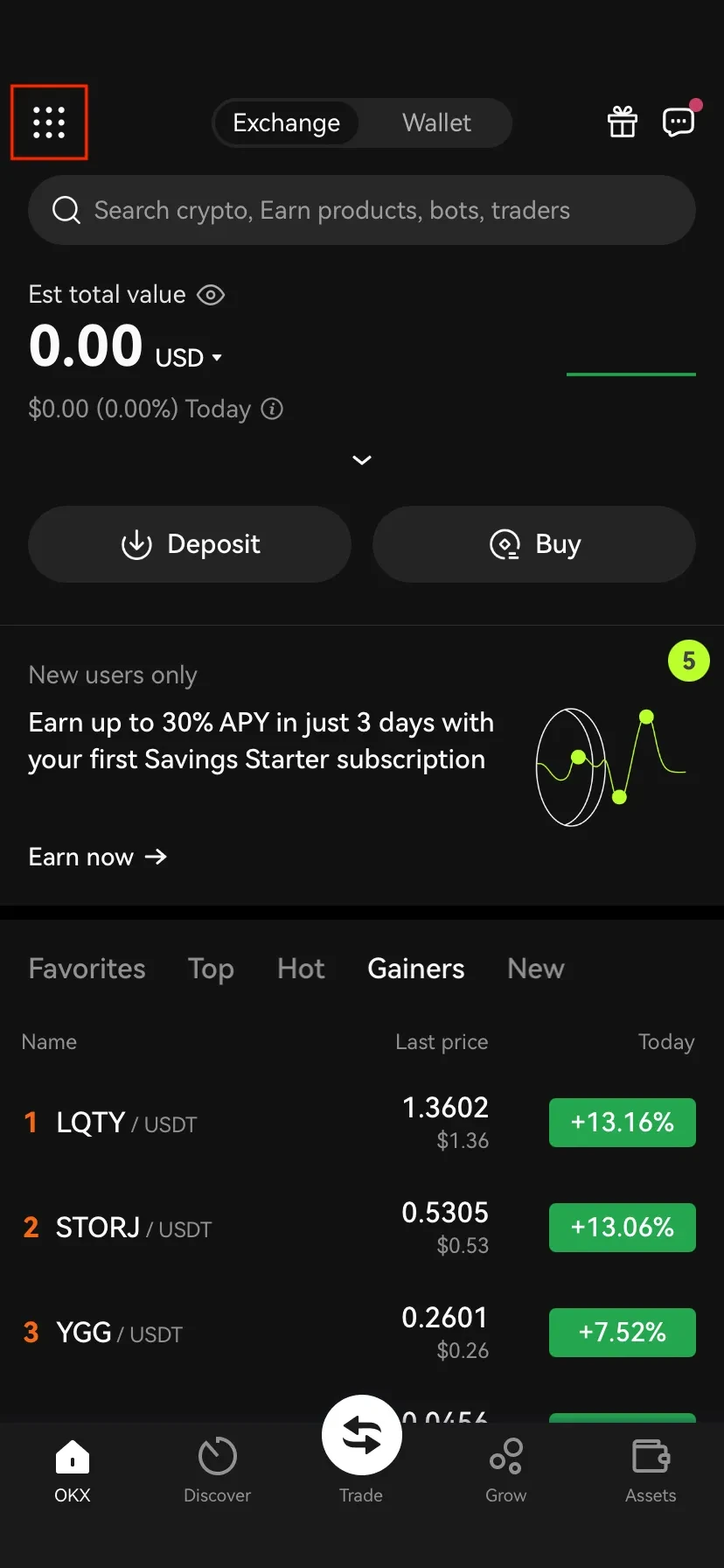

When in the OKX exchange mode on the app, tap the bento menu icon in the top left-hand corner. Next, select 'bots' from the 'trade' section.

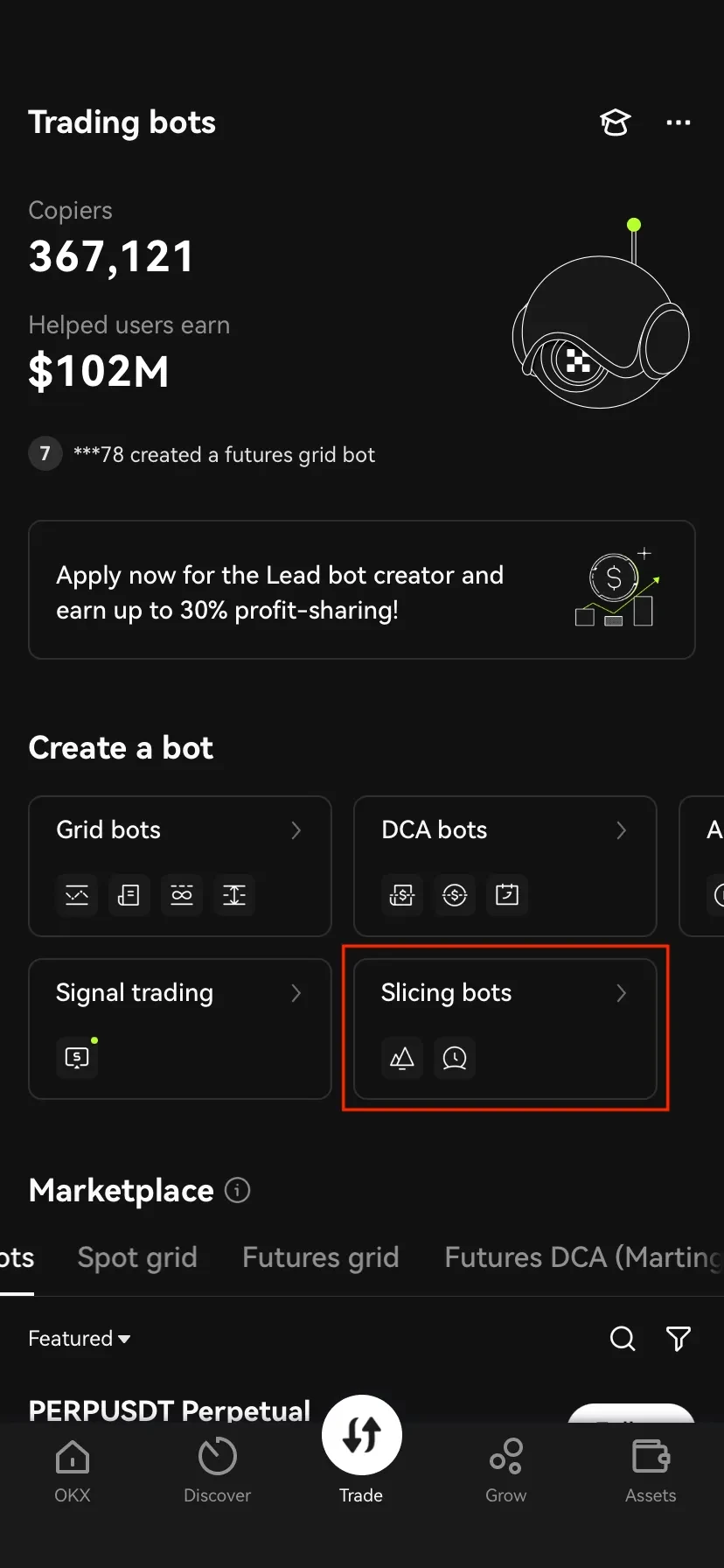

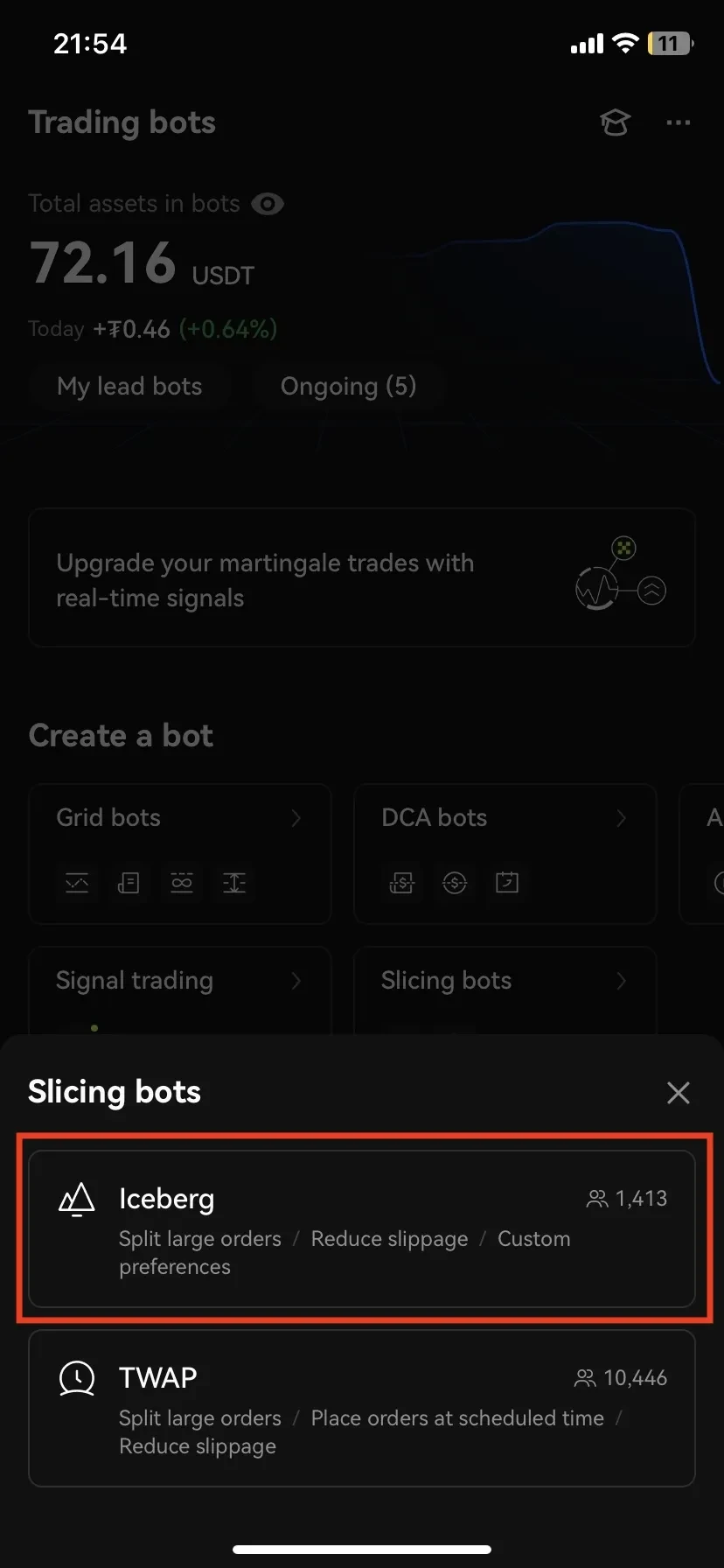

In the bots section, tap 'slicing bots'.

Then, choose 'iceberg'.

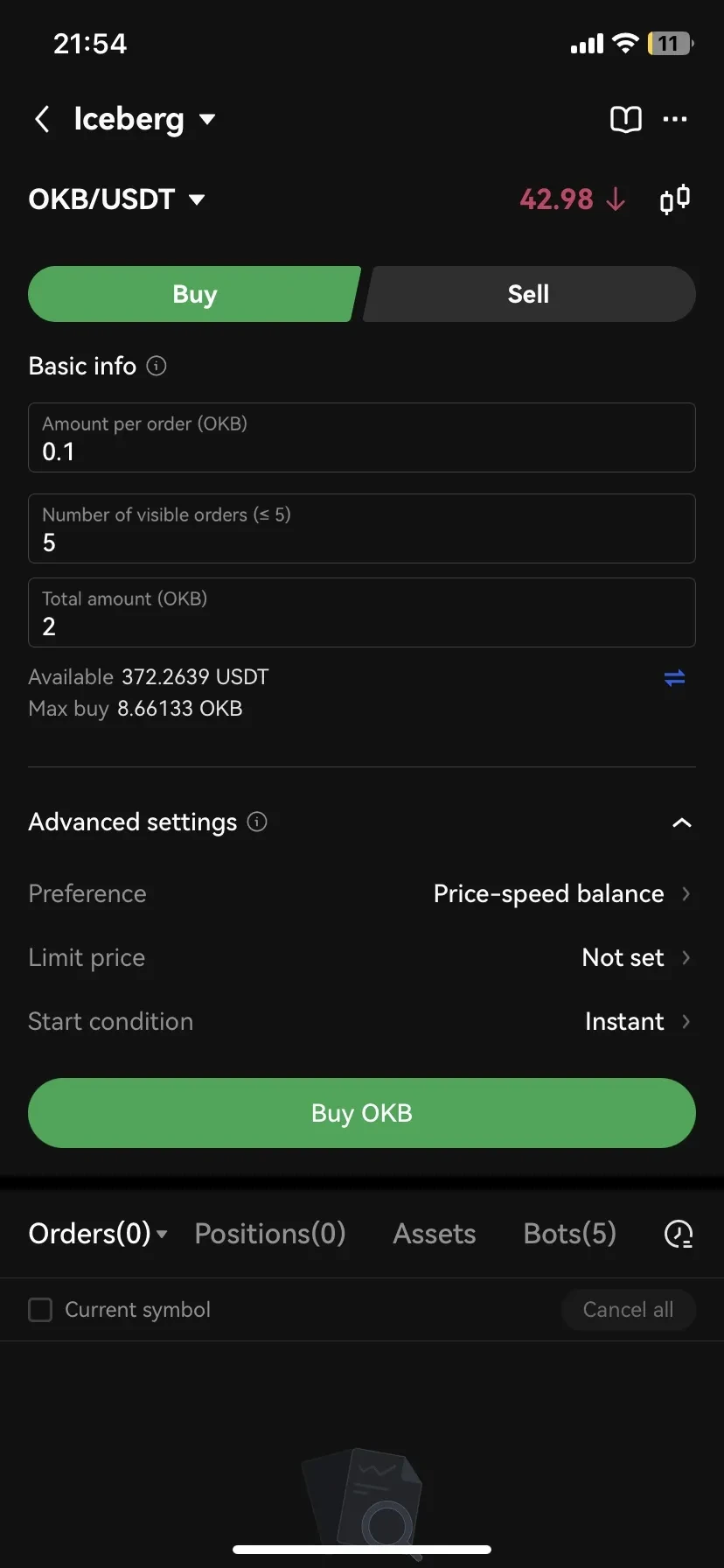

After choosing your preferred trading pair, complete the mandatory inputs:

Amount per order

Number of visible orders

Total amount

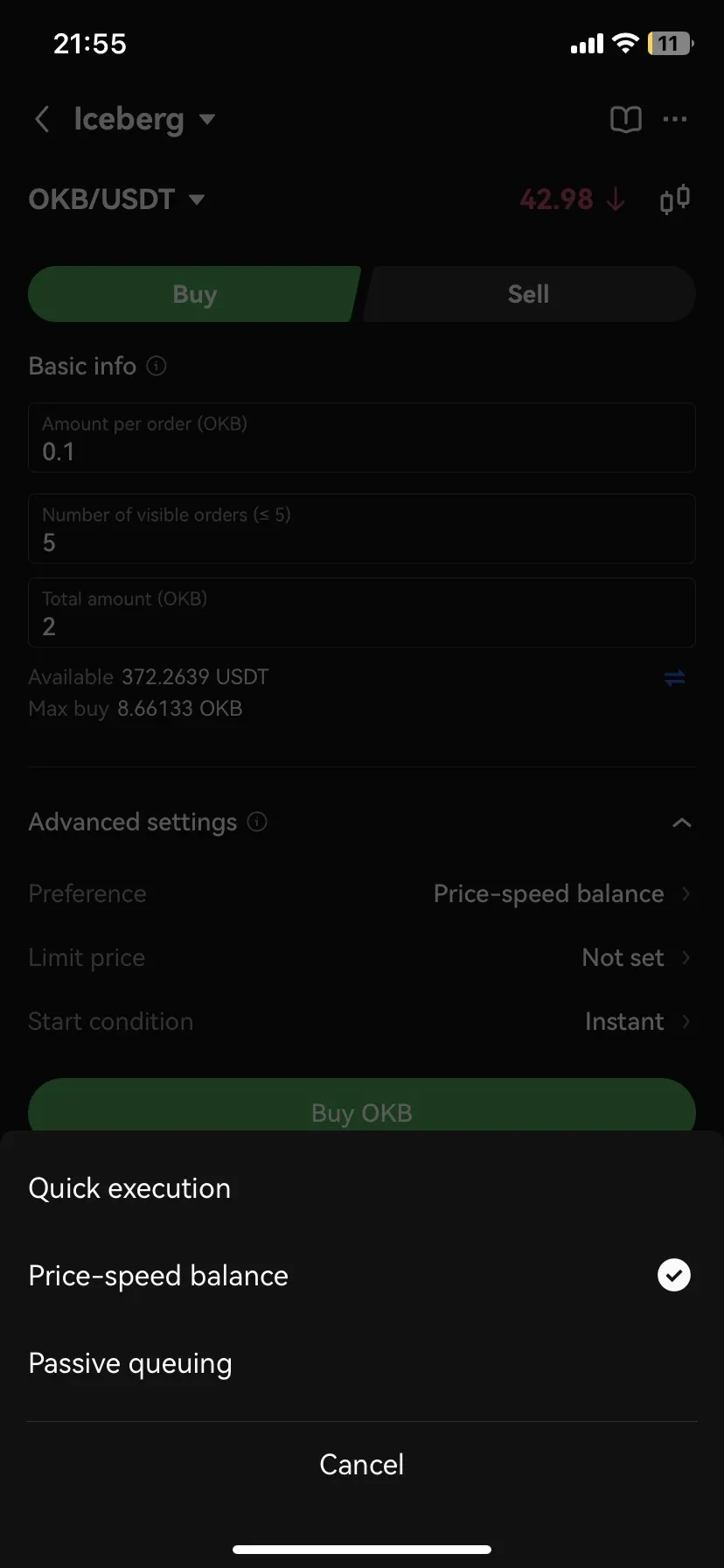

And, select any advanced settings you wish to apply:

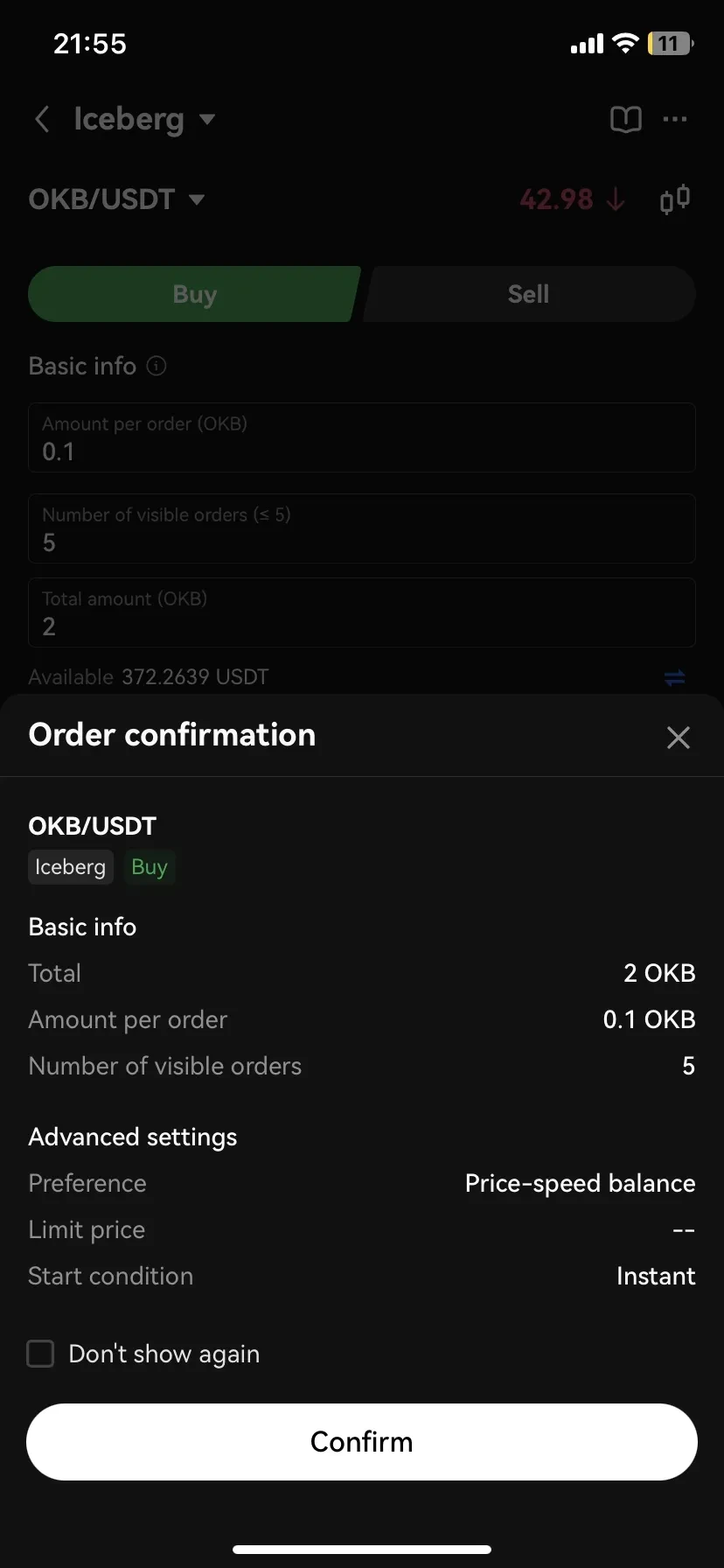

Now, review your order before tapping 'confirm' to execute it.

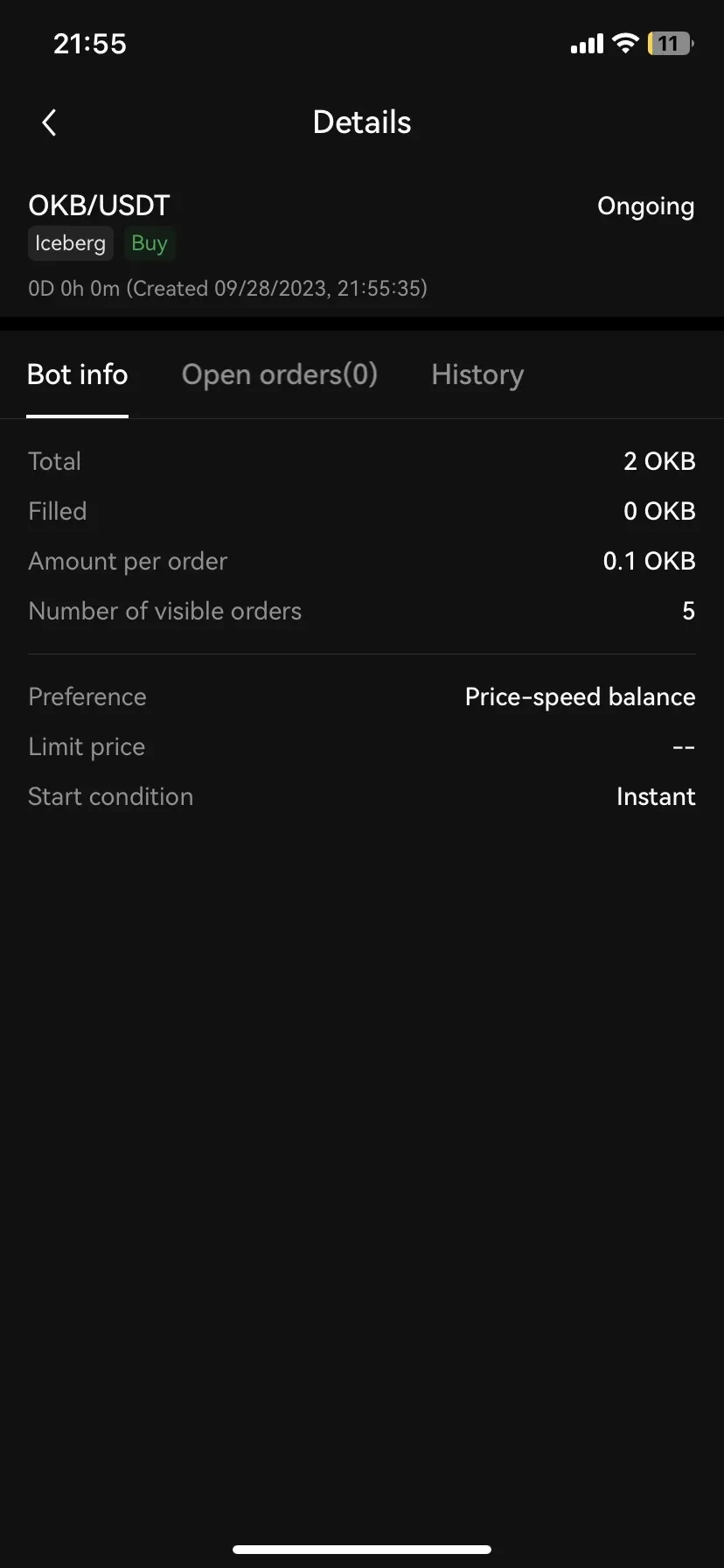

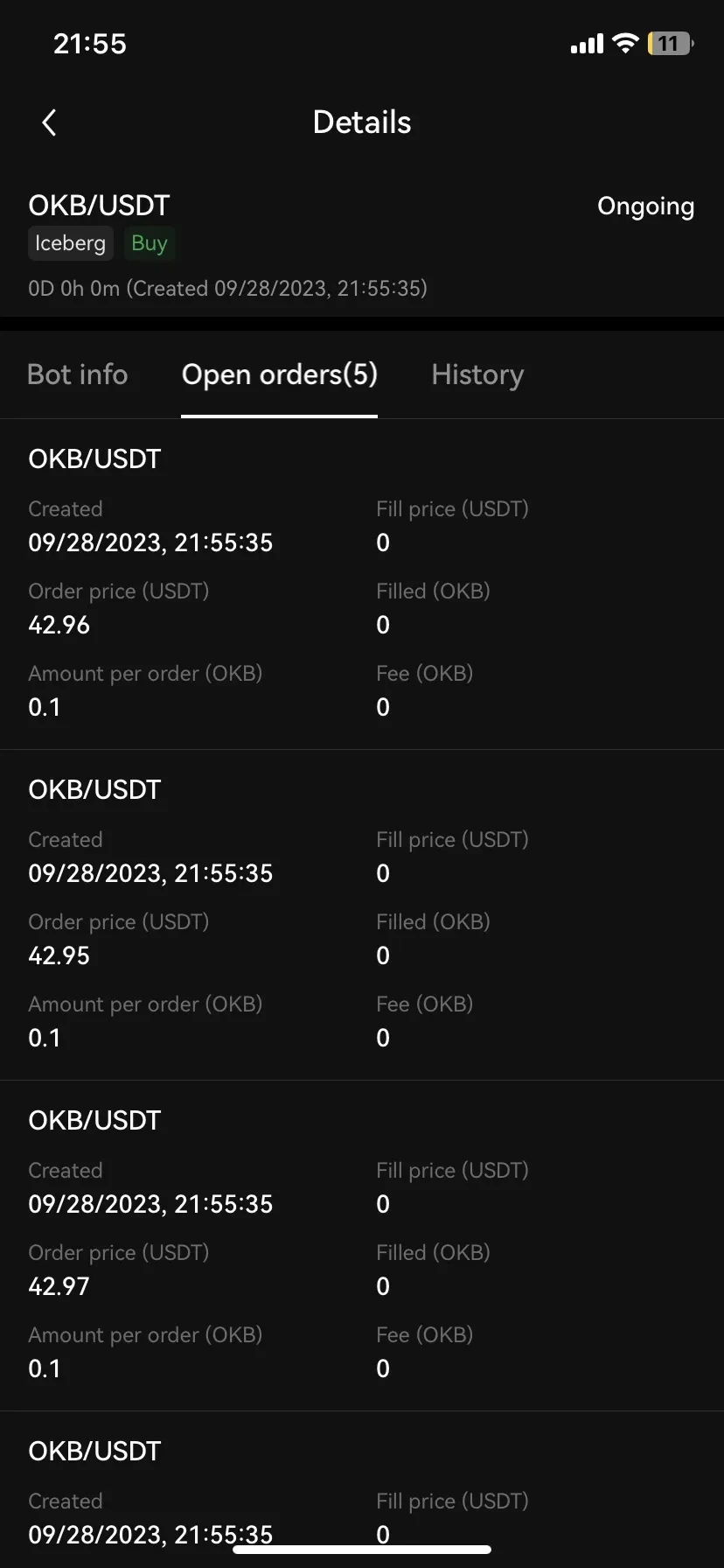

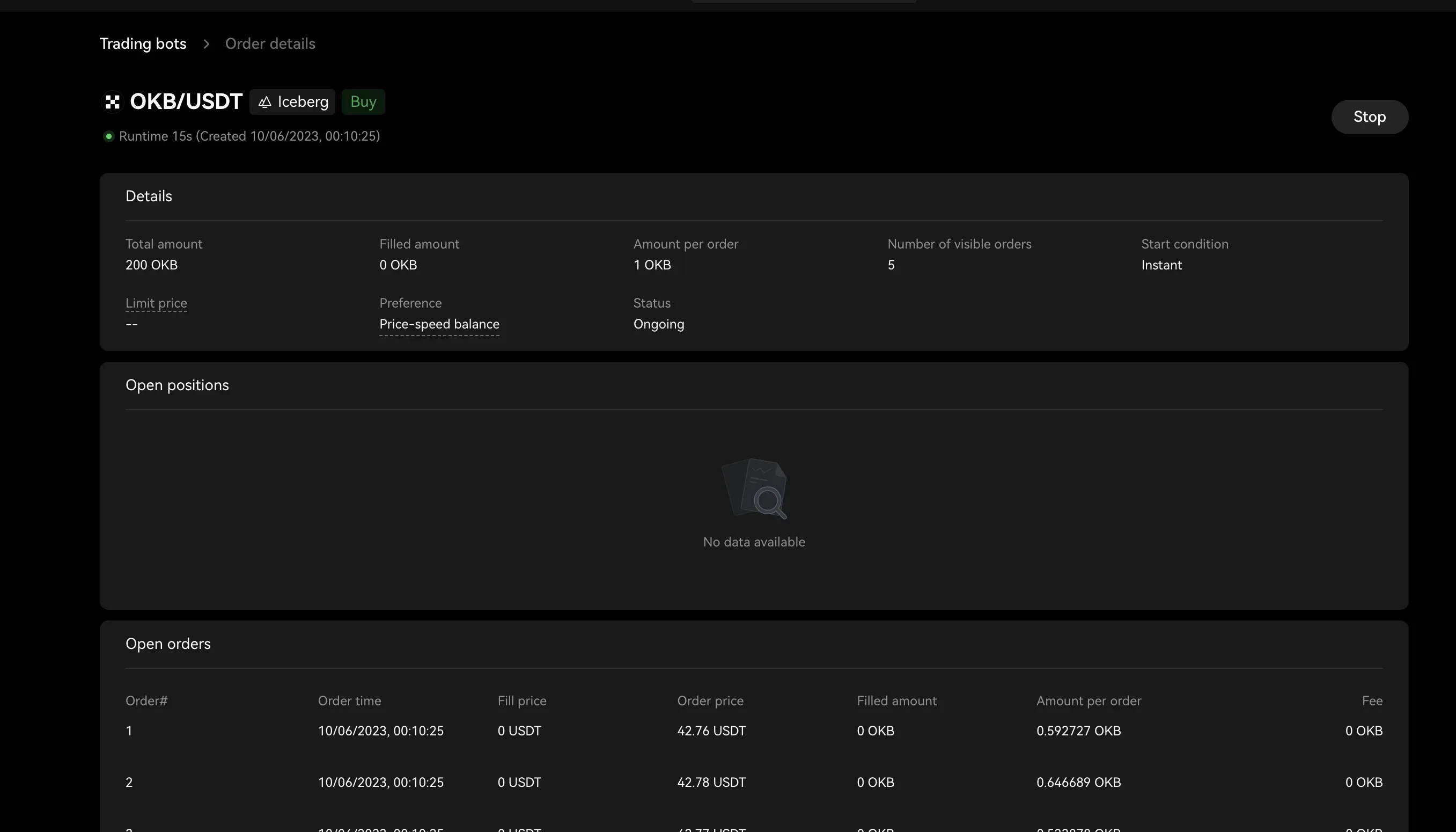

The details tab will show information on your active bots and any open orders, alongside your history

Web

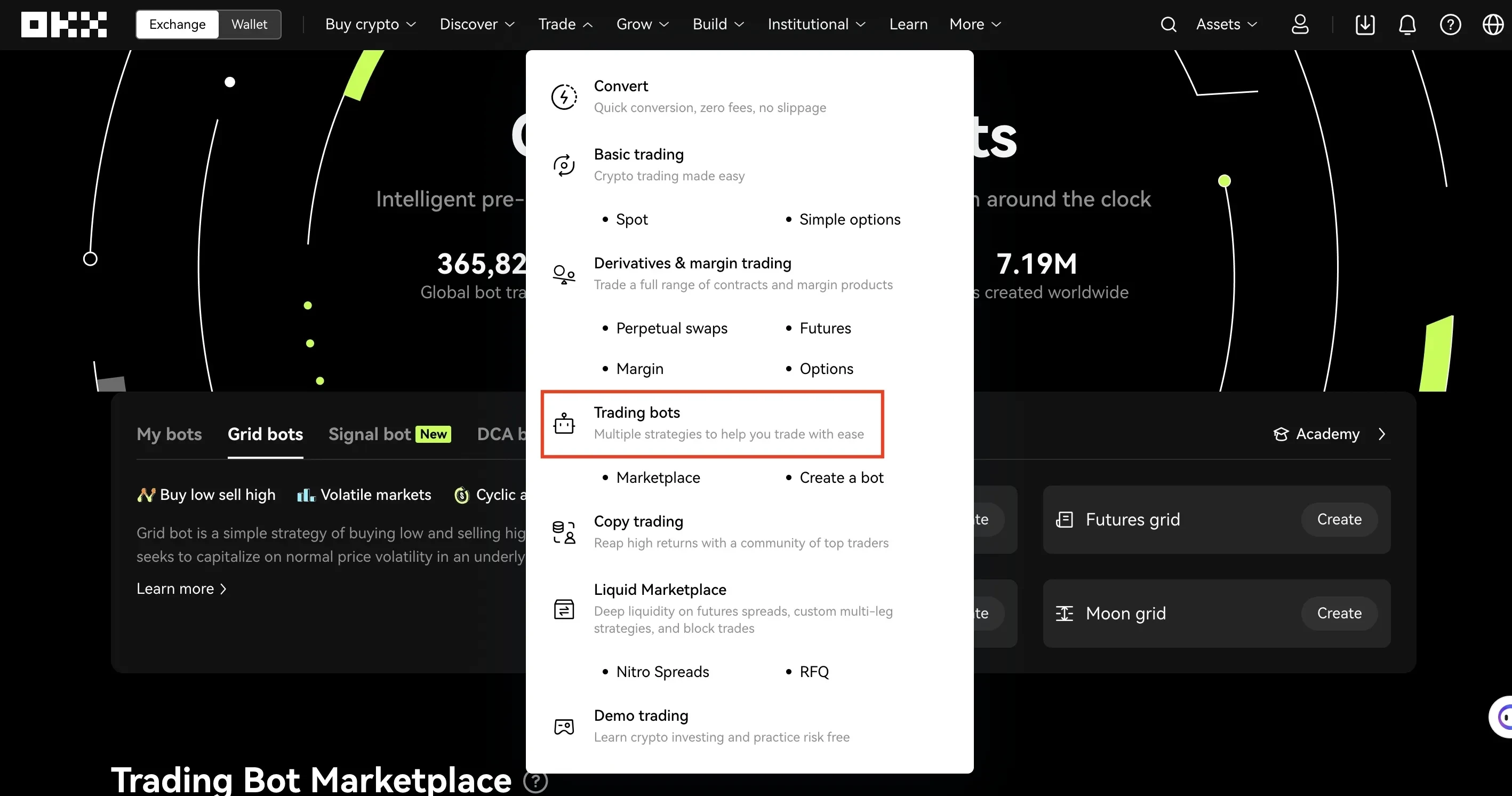

When accessing the OKX exchange via web, select 'trade' from the main navigation bar and click 'trading bots' from the drop down menu.

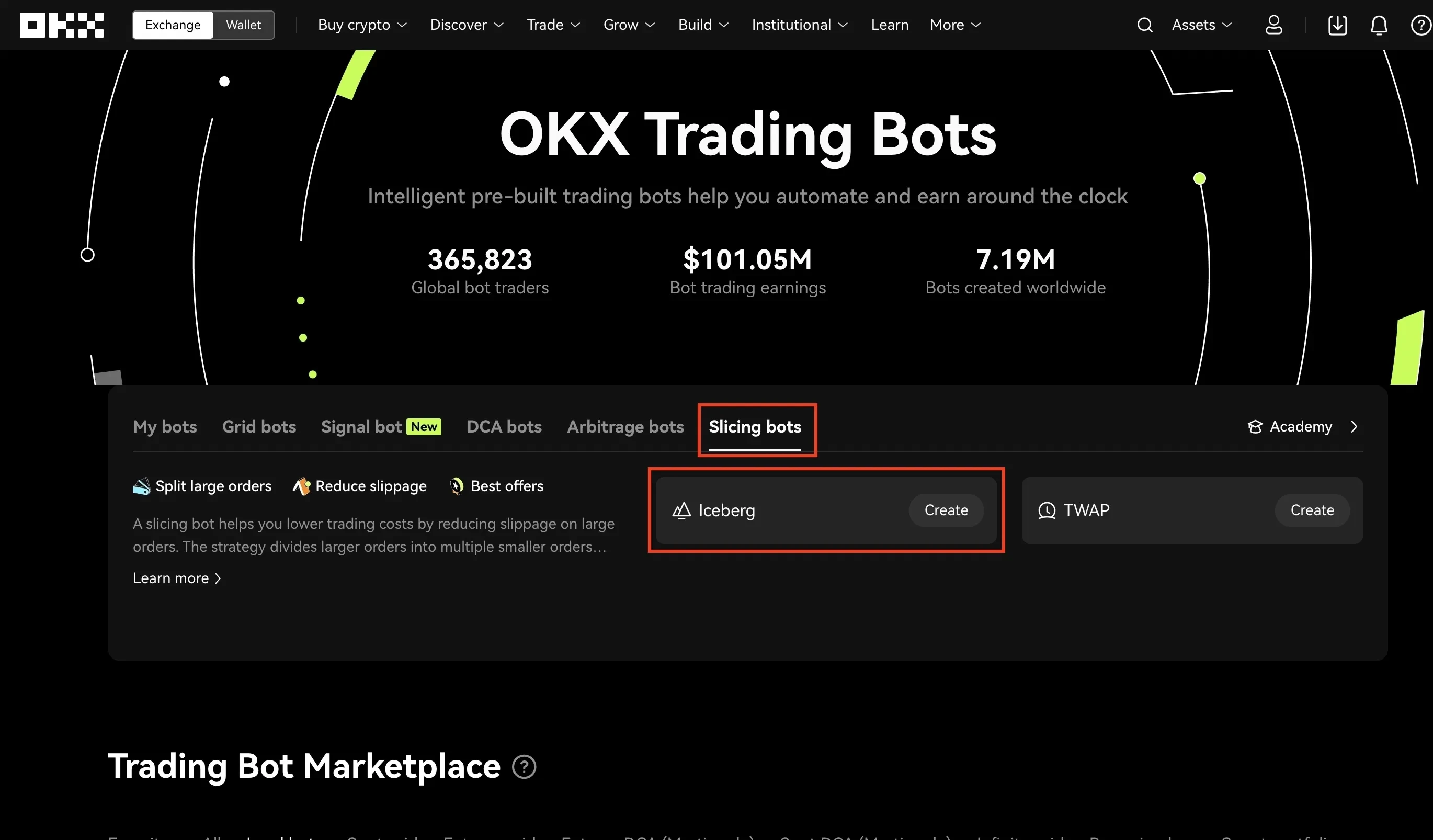

Next, choose 'slicing bots' and beneath this, 'iceberg'.

Now, you can input the necessary 'basic info' and select your preferred 'advanced settings' under each respective section.

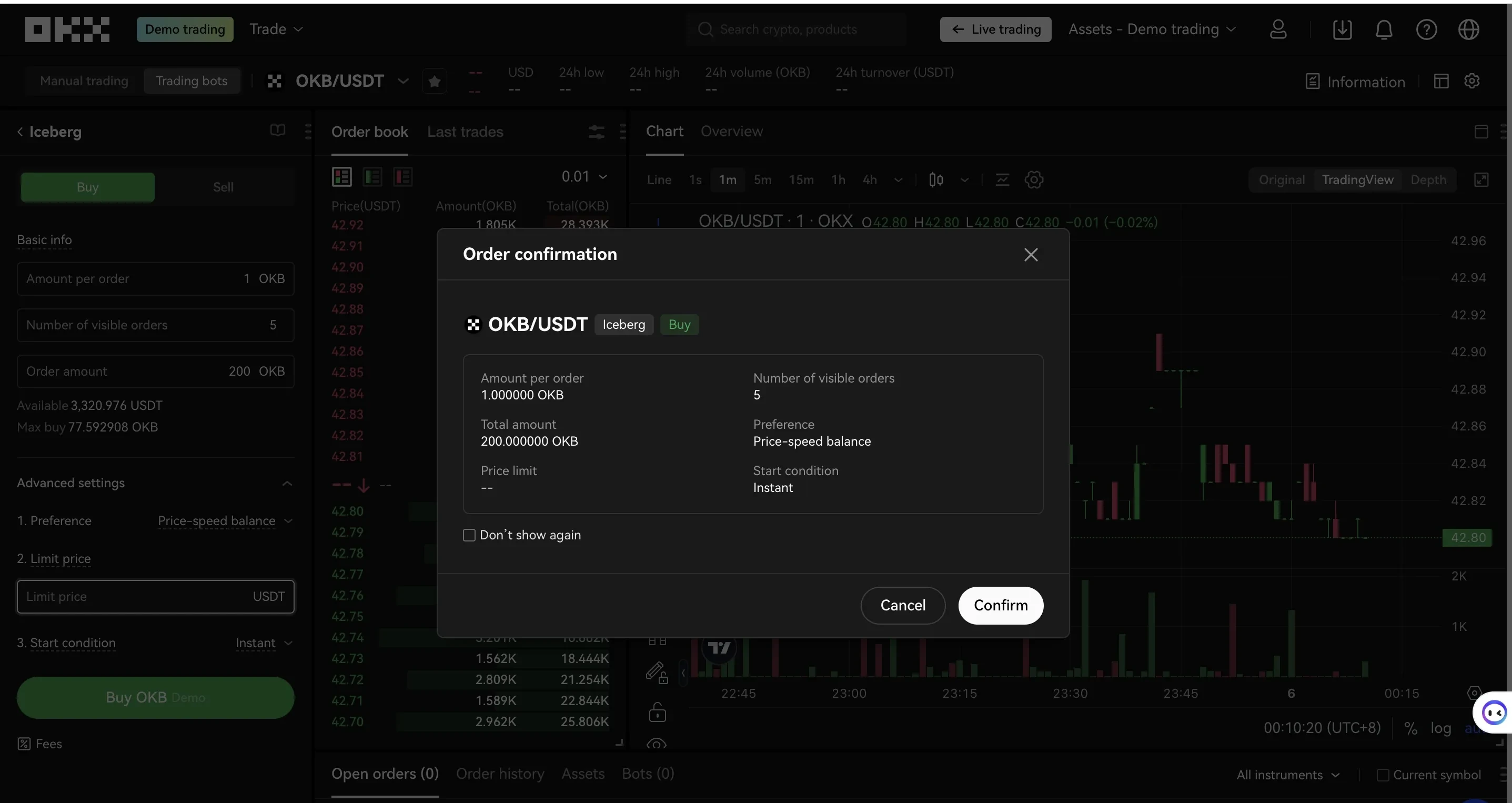

You'll be asked to check the order details before confirming.

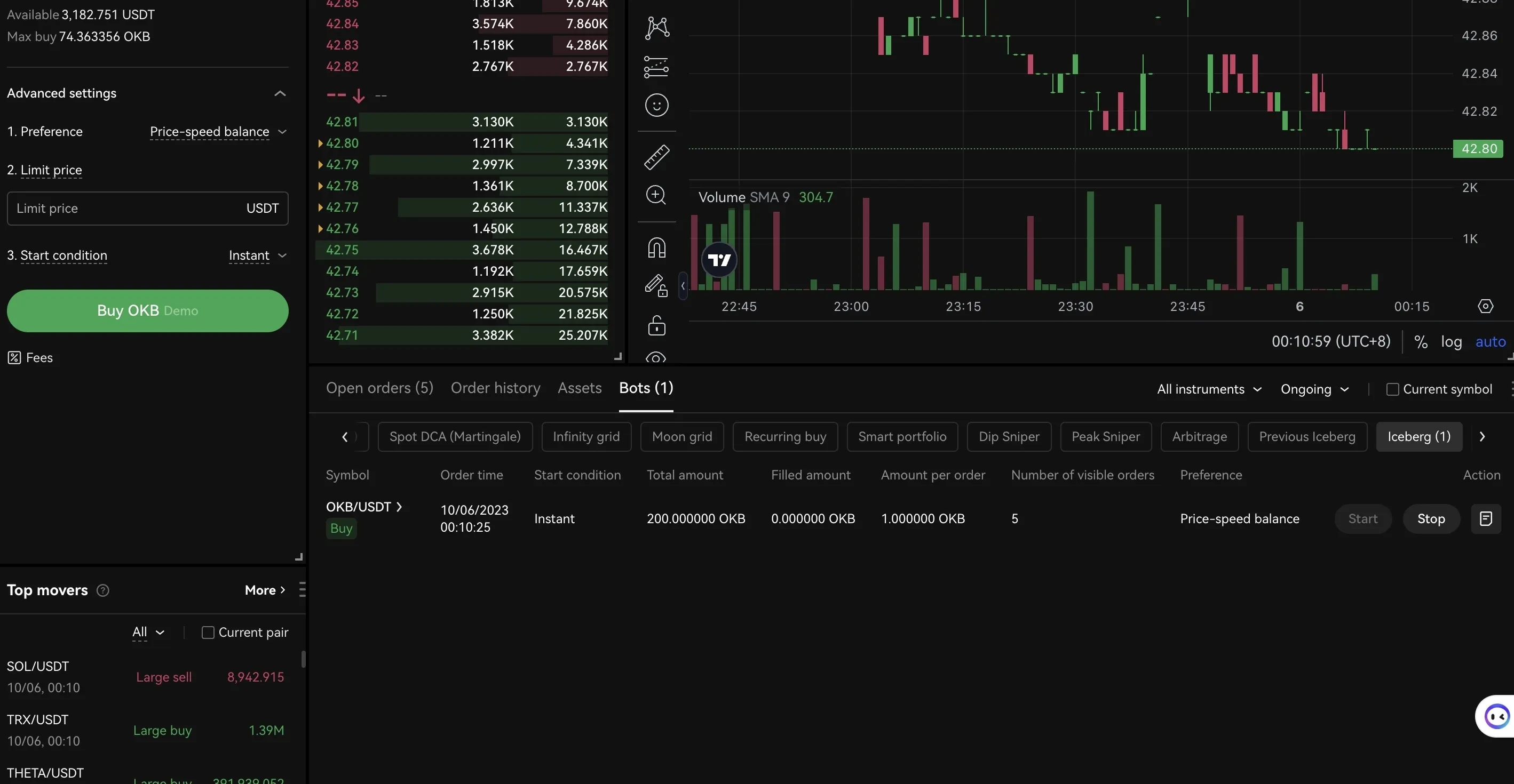

And, your active bots and open orders will be available to view on the platform.

How to use iceberg

Amount per order

Let's use buy orders as an example. When the market price is lower than the limit price, small buy orders will be placed based on your preference (there's more on preference below). This number indicates the amount per order that will be placed in the order book. The system will multiply the number by a random number between 0.5-0.1

Number of visible orders

The number of split orders placed on the market order book each time the bot executes a trade

Order amount

Total amount of your orders in base currency.

Preference

You can choose to apply one of the following when placing your orders.

Quick execution

Price-speed balance

Better price

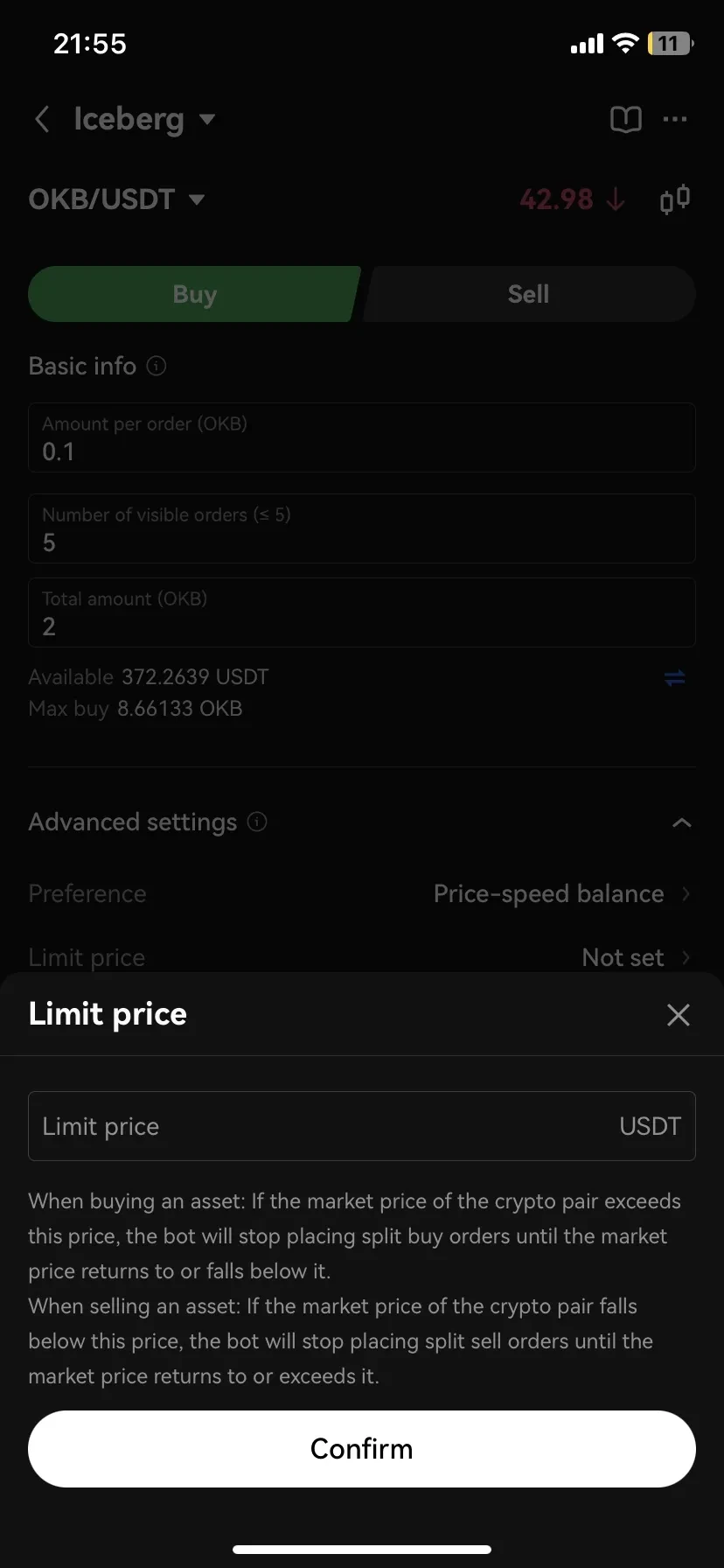

Limit price

When buying an asset: If the market price of the crypto pair is higher than this price, the bot stops placing split buy orders and will resume when the price drops lower than the limit price.

When selling an asset: If the market price of the crypto pair is lower than this price, the bot stops placing split sell orders and will resume when the price increases to be higher than the limit price.

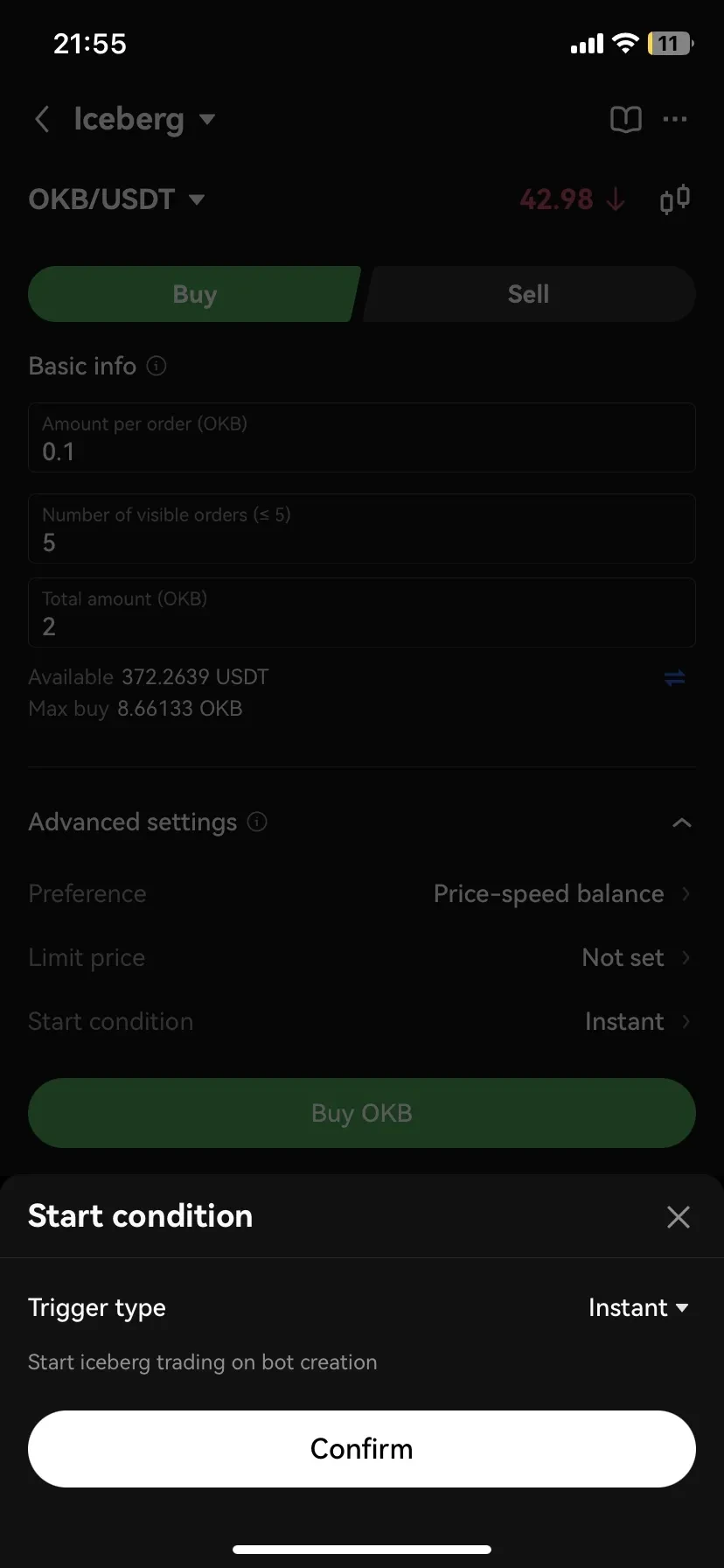

Start settings

Instant: Start iceberg trading on bot creation.

Price: Start the iceberg bot when the trigger price is reached.

RSI: Start the iceberg bot when the technical indicator is triggered, and other conditions are met.

How iceberg works

Let's say you want to buy BTC while the price is lower than 35,000, and you'd like to buy it with an iceberg order. To do so, you'd input the following:

Set the amount per limit order as 0.1 BTC.

Set the number of visible order as five.

Set the order amount as 5 BTC.

Set the preference as speed-price balance.

Set the limit price as 35,000 USDT.

Set the start condition to start immediately.

What would happen:

Place and try to keep five orders on the order book.

Place the first limit buy order at a price that equals to: (ask 1 + bid 1)/2.

Place the second limit order at the bid 1 price, the third limit order at bid 2 price, the forth order at bid 3 price and the fifth order at bid 4 price.

The amount per order is around 0.1 BTC (multiplied by a random number).

If the price goes above 35,000, order placing will be stopped. The iceberg order will resume only if the price comes back and is lower than 35,000.

If the order is filled, check the levels on the order book and place new orders based on the new levels.

If the price changes the levels on the order book, cancel the old orders and place new orders based on the new price levels.

Disclaimer:

THIS ARTICLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. IT IS NOT INTENDED TO PROVIDE ANY INVESTMENT, TAX, OR LEGAL ADVICE, NOR SHOULD IT BE CONSIDERED AN OFFER TO PURCHASE OR SELL OR HOLD DIGITAL ASSETS. DIGITAL ASSET HOLDINGS, INCLUDING STABLECOINS, INVOLVE A HIGH DEGREE OF RISK, CAN FLUCTUATE GREATLY, AND CAN EVEN BECOME WORTHLESS. YOU SHOULD CAREFULLY CONSIDER WHETHER TRADING OR HOLDING DIGITAL ASSETS IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PLEASE CONSULT YOUR LEGAL/TAX/INVESTMENT PROFESSIONAL FOR QUESTIONS ABOUT YOUR SPECIFIC CIRCUMSTANCES.

© 2025 OKX。本文可以全文複製或分發,也可以使用本文 100 字或更少的摘錄,前提是此類使用是非商業性的。整篇文章的任何複製或分發亦必須突出說明:“本文版權所有 © 2025 OKX,經許可使用。”允許的摘錄必須引用文章名稱並包含出處,例如“文章名稱,[作者姓名 (如適用)],© 2025 OKX”。不允許對本文進行衍生作品或其他用途。