What are OKX's crypto trading bots and how do I utilize it?

Navigating the complexities of the cryptocurrency market can be challenging, but our crypto trading bots provide a solution. These automated tools are designed to execute trades based on predefined strategies, helping traders manage risks and capitalize on market movements. Let's explore what OKX’s trading bots are, how they work, and how you can leverage them to optimize your trading strategy.

How can I access OKX’s trading bot?

Hover over Trade and select Trading bots

Trading bots option is available under the Trade dropdown menu

On the Trading bot page, you'll find a range of tools and automated strategies such as Grid bots, DCA bots, Arbitrage bots, Slicing bots and Signal trading that allow you to set up your own, or copy another

There are four trading bot types that are up for selection

What are OKX's trading bots?

Here are all of our different trading bots, each based on a different strategy:

Spot grid

Futures grid

Futures DCA (Martingale)

Smart arbitrage

Spot DCA (Martingale)

Recurring buy

Signal bot

Iceberg orders

TWAP (Time-Weighted Average Price) orders

Smart portfolio

Arbitrage

Spot grid, Futures grid, Smart portfolio and Recurring buy are among the simpler bots to use. Meanwhile, Smart arbitrage order, Iceberg order, and TWAP are suited to users that may prefer more complex risk profiles.

What's the Spot grid trading bot?

You can find the Spot grid bot under the Bullish option

The spot grid bot works by setting price levels between an upper and lower limit that your choose. When the price of the asset rises to one of the grid lines, the bot automatically sells. If the price drops to a grid line, the bot automatically buys.

You can either set the grid parameters manually for full control or use the AI strategy, which relies on past price movements and back-tested data to increase the chances of profit.

Learn how to use the spot grid trading bot here.

What's the Futures grid trading bot?

You can choose the Futures grid bot under the Bullish option

The Futures grid trading bot works similarly to the Spot grid trading bot, but instead of buying and selling assets, it trades long or short futures contracts. It uses a grid system to place buy and sell orders above and below the current price, responding to market movements.

The Futures grid trading bot offers three trading strategies:

Long

Short

Neutral

One key difference is that with the Futures grid trading bot, you can trade with leverage, which can amplify both gains and risks. Make sure you fully understand the risks of leverage trading before using this bot.

Learn more about the Futures grid crypto trading bot here.

What's the Futures DCA (Martingale) trading bot?

Futures (DCA) Martingale is one of the trading bots under the Bearish option

This bot uses the Dollar-Cost Averaging (DCA) strategy for futures trading, where you buy assets at regular intervals, no matter the price, to balance out the ups and downs of the market.

The Martingale method increases your investment after each losing trade, aiming to make up for losses when the market turns around.

DCA helps you take advantage of market recoveries.

You can trade both long and short positions at the same time, so you don't miss any opportunities.

Learn how to use the Futures DCA (Martingale) trading bot here.

What's the Smart arbitrage trading bot?

Smart arbitrage is the latest addition to trading bots

The Smart arbitrage trading bot is an automated trading tool designed to reduce risk while taking advantage of market price fluctuations. It uses a Delta-neutral strategy, which means it holds equal but opposite positions in both the spot market (buying) and the perpetual swap market (selling). This way, price movements in either direction cancel each other out, protecting you from market volatility.

Instead of relying on price changes to make a profit, the bot focuses on earning through funding fees – the fees paid by traders in the perpetual market. When the funding rate is positive, these fees become the primary source of profit.

How does it work?

The bot buys crypto in the spot market and sells the same amount in the perpetual swap market.

By balancing these two opposite positions, the bot reduces the risk of market price swings.

The main profit comes from collecting funding fees, rather than depending on market direction.

The Smart arbitrage trading bot is easy to use for traders of all levels, offering two modes:

Custom mode: users set their own strategies and profit targets.

Smart mode: the system selects the best strategy automatically and adjusts key settings for you.

In short, the Smart arbitrage trading bot helps you make money by reducing risk and focusing on funding fees, making it ideal for both beginners and experienced traders.

Learn how to use the Smart arbitrage trading bot here.

What's the Spot DCA (Martingale) trading bot?

Spot (DCA) Martingale is another option available under the Bearish category

The Spot DCA (Martingale) trading bot helps traders buy specific assets at set intervals, spreading their purchases across different price levels. Essentially, traders can use the DCA strategy to buy when prices are low and sell when they reach a take-profit target or when the price is high.

While the DCA strategy is popular, our Spot DCA (Martingale) trading bot offers more flexibility. Users can choose when to enter a trade using technical indicators, and they only need to reserve the minimum funds required to start (Initial Order + First Safety Order). Additional funds can be added later as needed.

A special feature called Continuous Trading Cycles allows the trading bot to keep running, buying during dips and selling during rebounds, or starting new trading cycles after hitting the take-profit target.

Learn how to use the Spot DCA (Martingale) trading bot here.

What's the Recurring Buy trading bot?

Recurring buy can now be selected from the Bearish bots option

The recurring buy bot allows you to purchase up to 20 different cryptocurrencies at regular intervals, helping to average the buying price over time. It uses your USDT balance to automatically buy crypto at the intervals you choose. You can also make recurring buys with credit or debit cards through the Buy Crypto section.

Dollar-cost averaging (DCA) is a simple and effective strategy for long-term investors, and our Recurring buy bot makes it even easier. Just set it up, and the bot handles the rest.

Learn how to use the Recurring buy crypto trading bot here.

What's the Signal bot?

Signal bot is the latest addition which is listed under the Signal trading option

Discover a wealth of trading signals at your fingertips. Create and customize your own signals while gaining access to a diverse selection of signals from top providers. Empower your trading strategies and stay ahead of the game with our comprehensive signal trading platform.

Advanced trading signals

TradingView integration

Real-time execution

Learn how to use the Signal bot here.

What are Iceberg orders?

Iceberg orders are large buys or sells broken down into many smaller orders. They're particularly useful when making a large trade relative to the size of the market. Even a small order can move the asset price in illiquid markets, potentially resulting in a less favorable entry or exit. Iceberg Orders attempt to mask large orders and limit the impact of price slippage. To place Iceberg Orders, select Iceberg from the Slicing bots menu.

Iceberg bot option is available under the Slicing bots menu for your creation

In the Iceberg section, select the product and trading pair you want to trade using the menu. You can use the Iceberg bot in the Spot, Perpetual, Futures, Margin and Options markets. If you’ve never traded futures or perpetual swaps before, we recommend you read our tutorials about each product before attempting to use the arbitrage bot. This will help you understand the risks when trading futures or perpetual swaps.

Traders can then choose the amount of slippage you can tolerate — for example, the amount by which the price can move when executing your trade — in the price range field. They can do this in increments of the trading pair’s base asset using the Var. (Variable) option, that allows smaller portions (or "slices") to have varying quantities or as a percentage of your order price by using the Ratio option.

Learn how to use the Iceberg orders trading bot here.

What's the Time Weighted Average Price (TWAP) bot?

The TWAP Bot (Time-Weighted Average Price) helps execute large trades over a set period, aiming to minimize the impact on the asset’s price. It works by breaking a big order into smaller trades and spreading them out over time, similar to how an iceberg order hides the full size of a trade. This makes it ideal for entering or exiting large positions without moving the market too much.

TWAP bot is available under the Slicing bots option

How does it work?

You can choose whether you want to buy or sell the asset:

Set your price tolerance (slippage) to control how much the price can move from your target price.

You can also select either Var. (Variable) to enter an amount in the second asset of the trading pair or Ratio to set slippage as a percentage of the price limit.

This bot allows for smooth trading without large price jumps, making it perfect for those who want to trade signoficant amounts of crypto without disrupting the market.

Learn how to use TWAP trading bot here.

What's the Smart portfolio trading bot?

Select Smart portfolio from the list of bots option

The Smart portfolio bot automatically manages and balances your crypto portfolio based on the preferences you set. Instead of manually buying and selling assets, the bot does it for you. If one asset in your portfolio grows more than you want, the bot will sell some of it and buy more of the underperforming assets to keep your portfolio balanced.

How does it work?

You decide how much of each crypto you want in your portfolio (example, 50% BTC, 25% ETH, 25% SOL).

If price changes cause one asset to grow too much compared to the others, the bot will automatically sell some of the overperforming asset and buy more of the others to restore balance.

There are two ways the bot can rebalance:

Scheduled mode: checks the proportion of each asset at regular intervals set by the user. If it observes a deviation from the intended allocations, it sells the asset that has increased in total portfolio share and uses the proceeds to buy the other asset or assets.

Proportional mode: only rebalances the portfolio when it has become imbalanced by a user-determined percentage. For example, you set up your smart portfolio to rebalance on a 5% or more imbalance with a 25% ETH allocation, a 25% SOL allocation and a 50% BTC allocation. If the BTC price pumps relative to ETH and SOL, and your BTC becomes 80% or more of your total portfolio, the bot will sell BTC to buy ETH and SOL.

With Smart portfolio, you can include up to 10 cryptos, making it easy to maintain a well-balanced portfolio without constant monitoring.

Learn how to use the Smart portfolio crypto trading bot here.

What's the Arbitrage trading bot?

Arbitrage is one of the bots offered by us

The Arbitrage trading bot helps you lock in profits by taking advantage of price differences between different trading instruments. It uses a "delta neutral" strategy, meaning it opens two opposite positions. If one loses, the other gains, so the overall result is balanced. The profit comes from price differences or funding rate payments, not from market movements.

How does it work?

Funding rate mode: the bot opens a long or short position in the spot market and the opposite position in a perpetual swap for the same asset. The goal is to earn profits from funding rate payments while keeping your position balanced.

Spread arbitrage mode: the bot takes advantage of price differences between futures contracts with different settlement dates, or. Between futures and spot prices. The profit comes from the price gap at the settlement.

While the arbitrage bot simplifies the process of profiting from price differences, it’s a more advanced strategy and may involve some risk, especially when setting up custom portfolios.

Learn how to use the Arbitrage crypto trading bot here.

How do I stop a trading bot and close a trade?

You can check on any trades you have created using the trading bot in the Bots option of the trading dashboard. Here you can view details of your trades, including their profitability to date. It's also where you can stop the bot manually

If you want to stop an active bot, just select Stop next to your relevant trade

Under Bots section, select Stop to halt your live bot

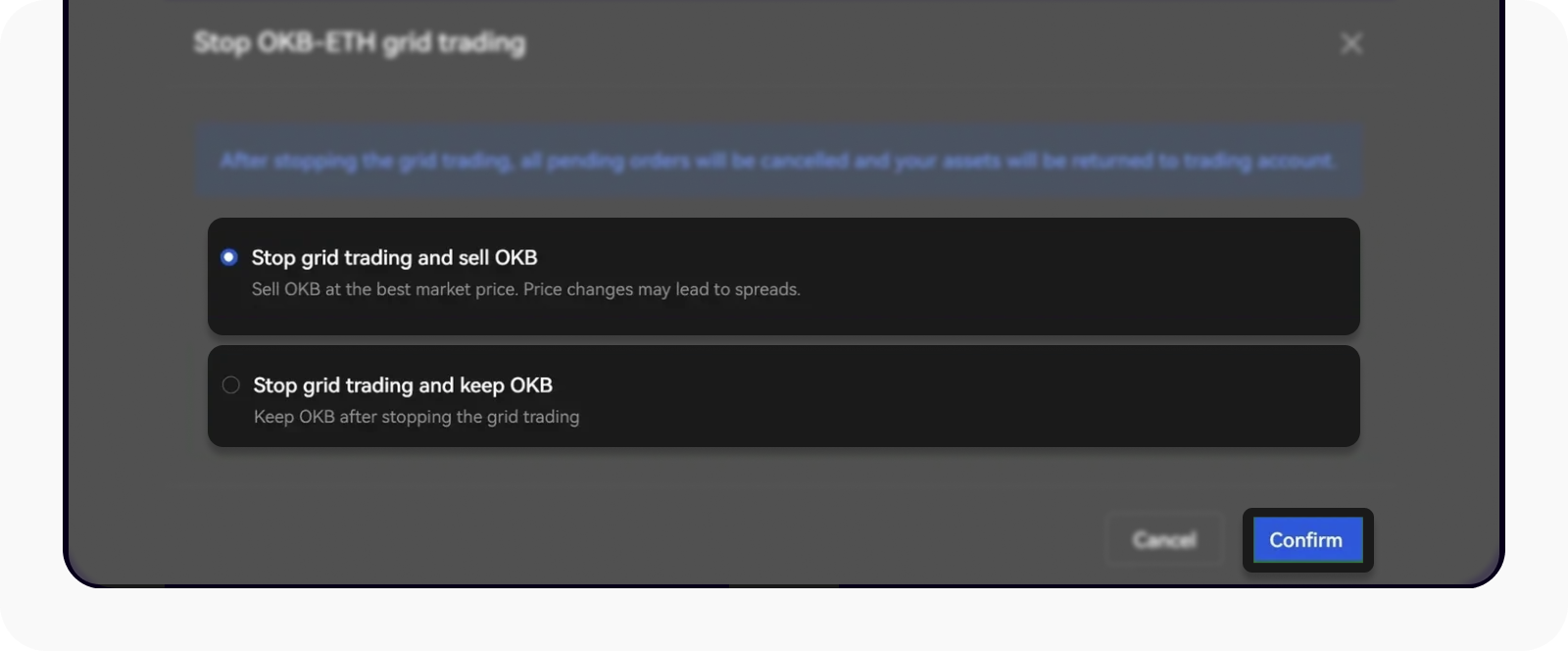

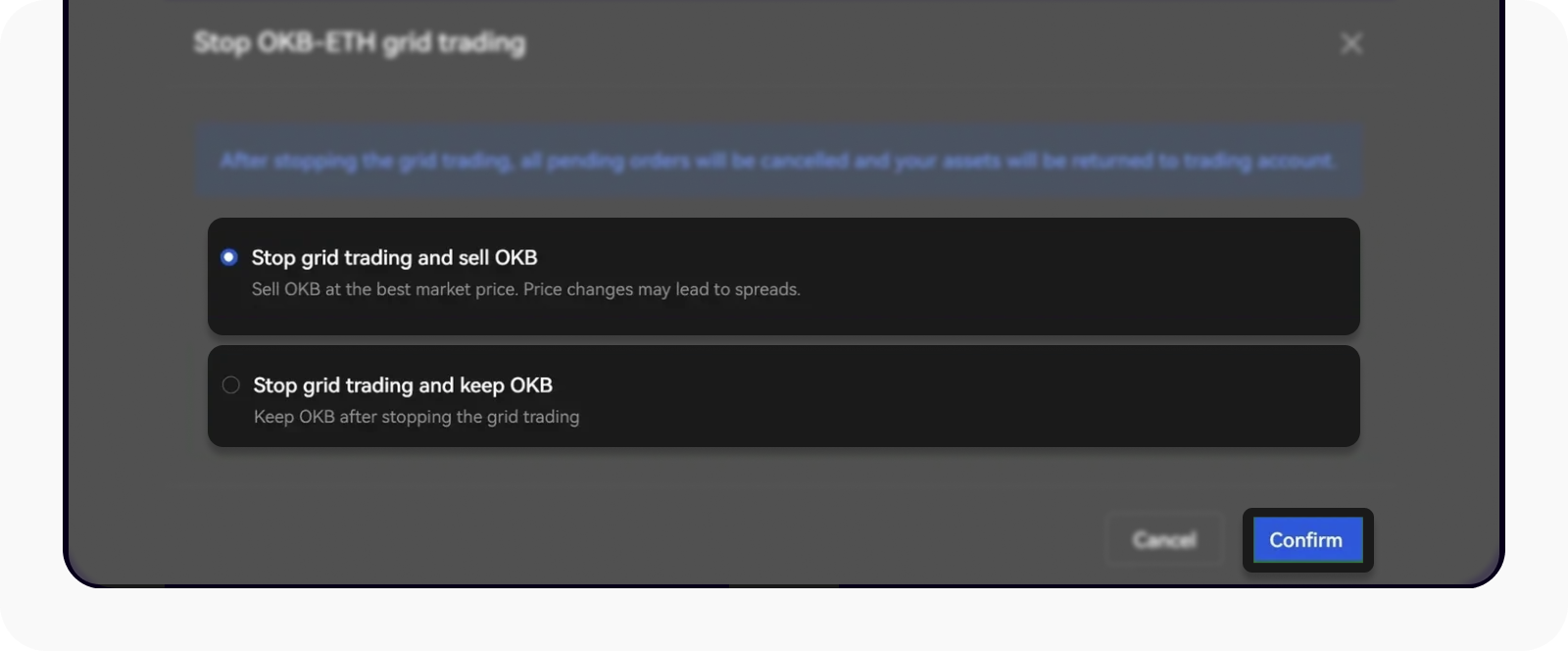

You can then keep the asset traded or exit your position to USDT. Choose the appropriate option and select Confirm

Select your preferred options before proceeding with stopping your bot

Your trade will then disappear from the Bots section and appear in the History section