On top of our extensive trading pairs, decentralized finance offerings and opportunities to earn crypto, we provide customizable crypto trading bots to help traders leverage various automated trading strategies. In this guide we will cover:

How to access OKX's trading bots

What OKX's different trading bots are

What is the Spot Grid bot

What is the Futures Grid bot

What is the Spot DCA (Martingale) bot

What is the Dip Sniper bot

What is the Peak Sniper bot

What is the Smart Portfolio bot

What is the Recurring Buy bot

What is the Arbitrage Order bot

What is the Iceberg Order bot

What is the Time Weighted Average Price (TWAP) order bot

How to stop a trading bot and close a trade

How to access OKX’s trading bot

Step 1

Visit the OKX homepage and log in to your account using the Login button at the top-right corner of the screen. Enter your email address or telephone number and password, and click Log in. Alternatively, you can scan the QR code using the OKX app.

Step 2

Complete any two-factor authentication checks you have active on your account and click Continue.

Step 3

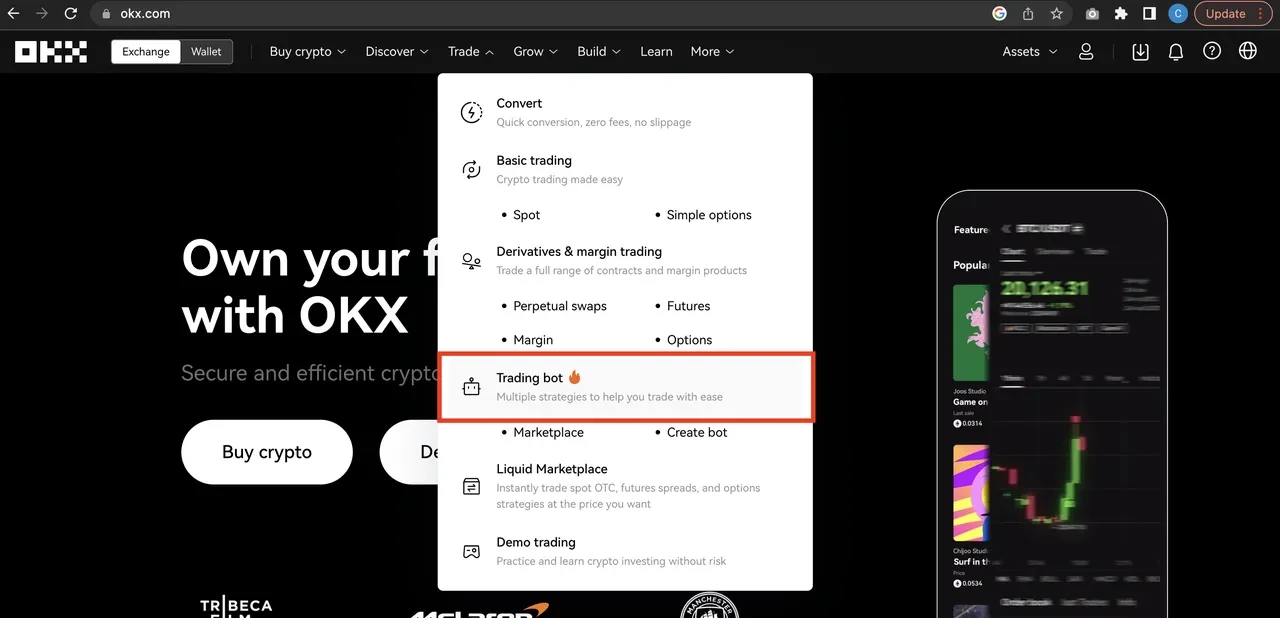

On the OKX homepage, hover over Trade and click Trading bot.

Step 4

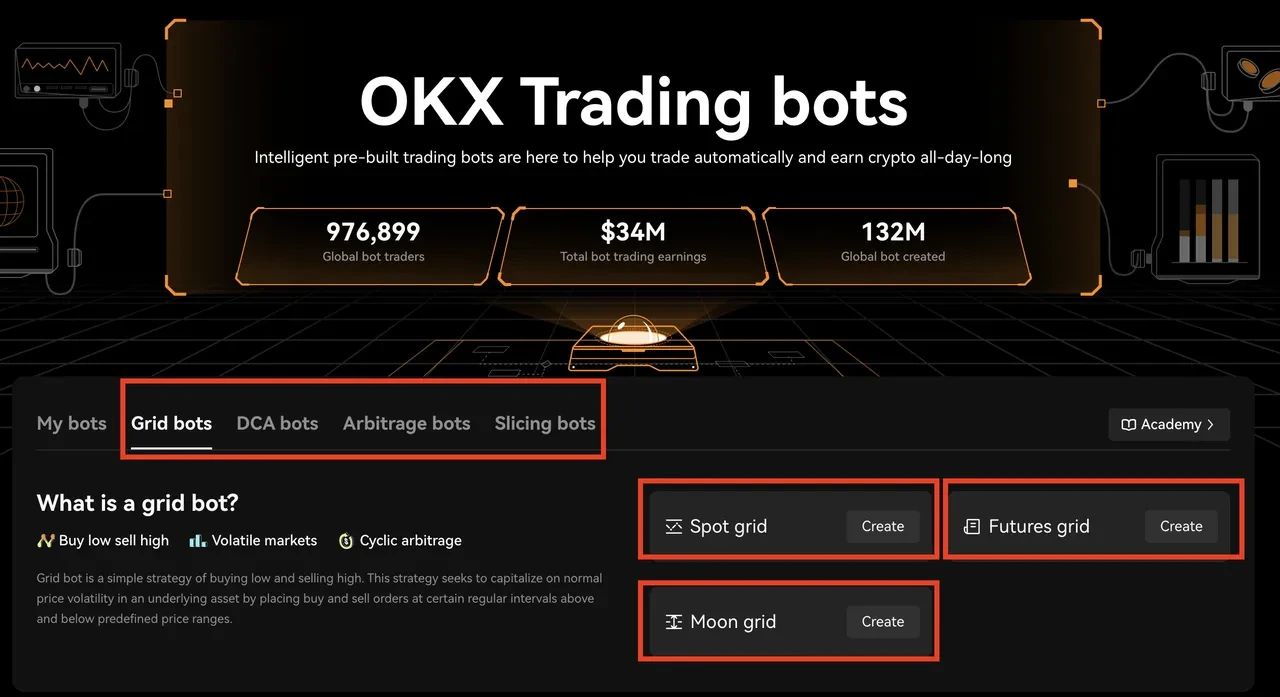

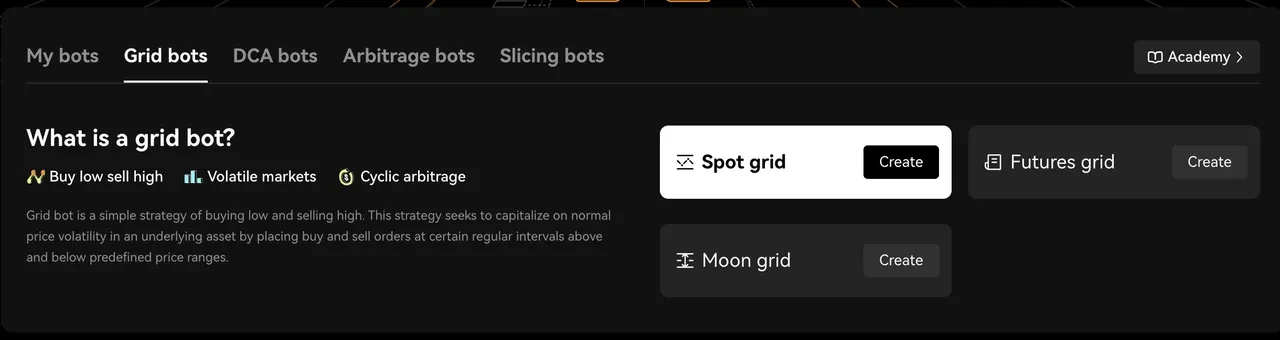

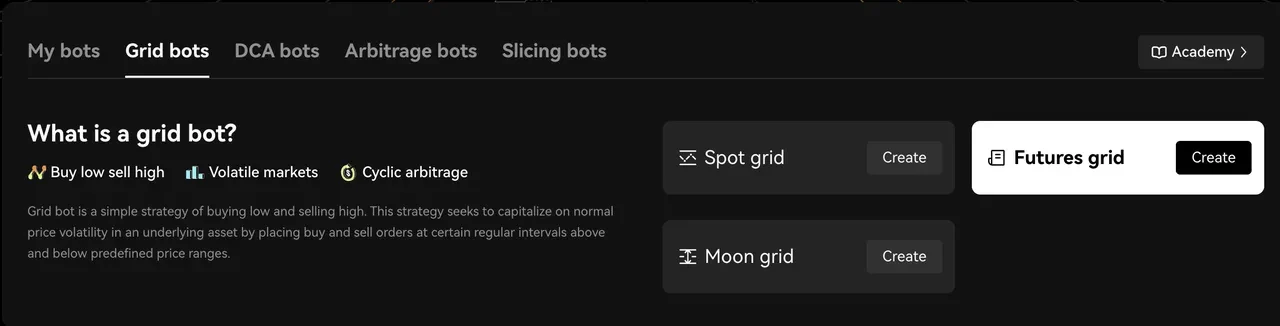

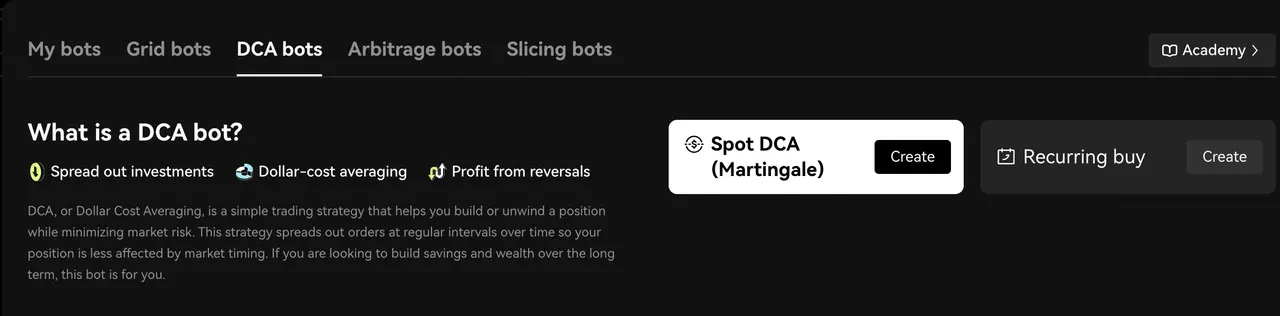

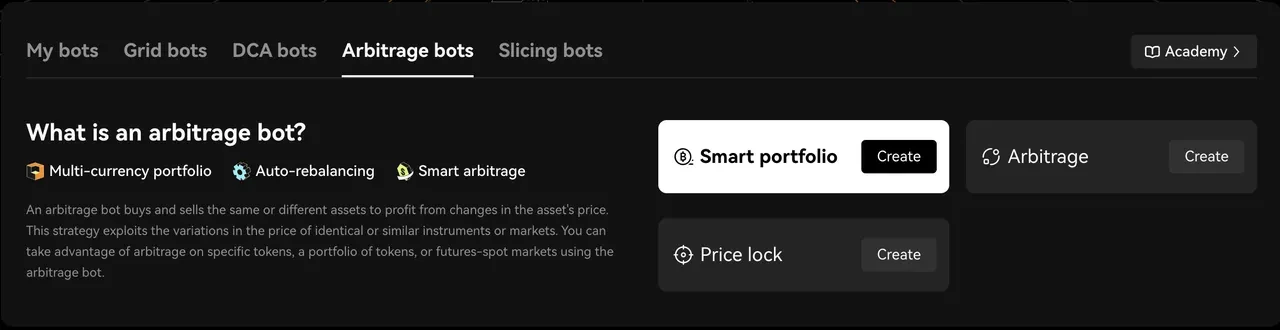

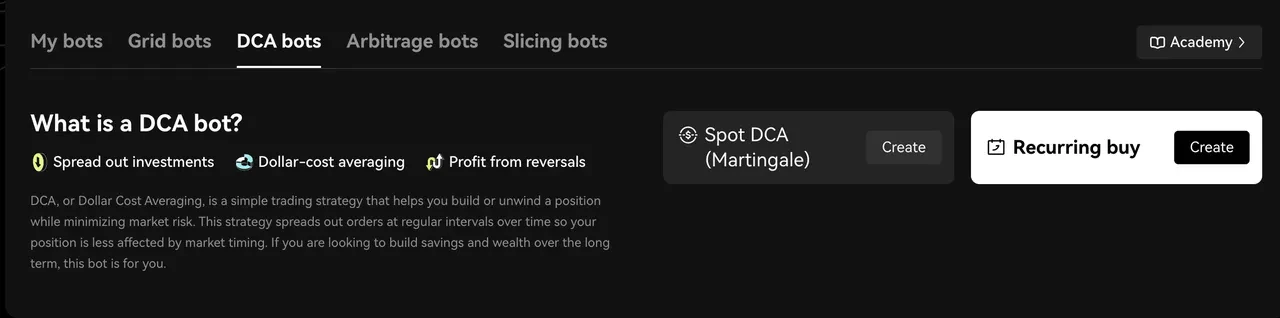

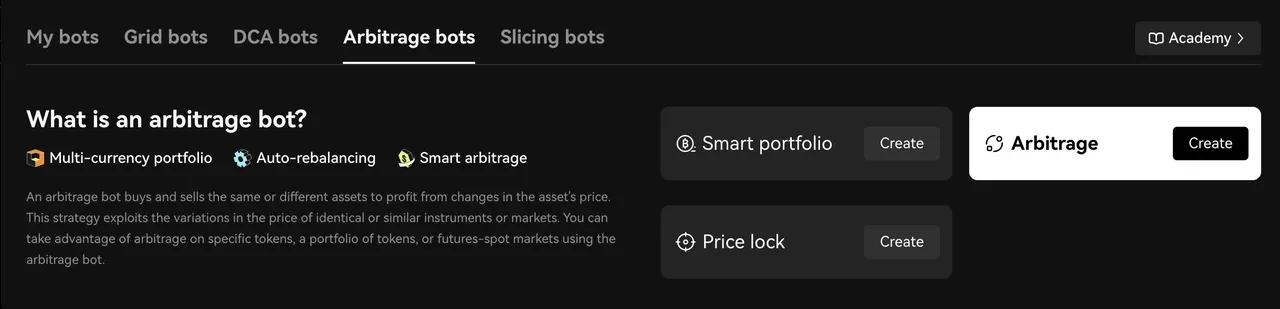

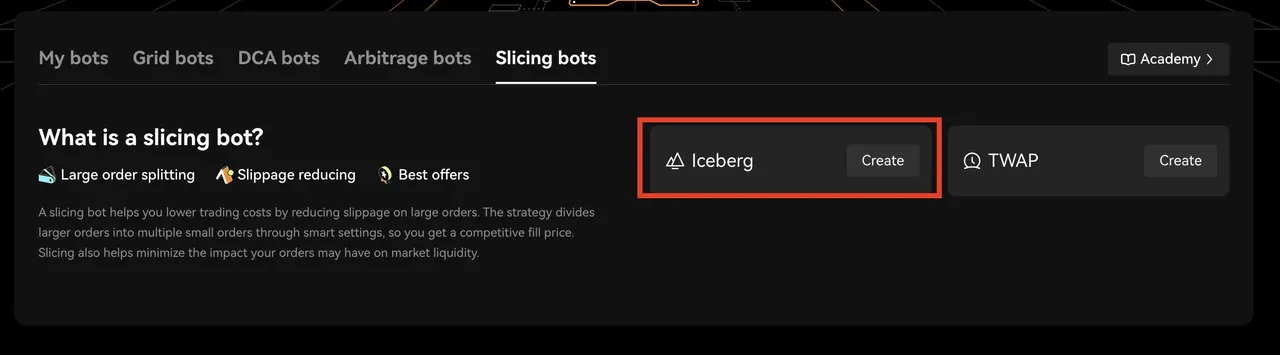

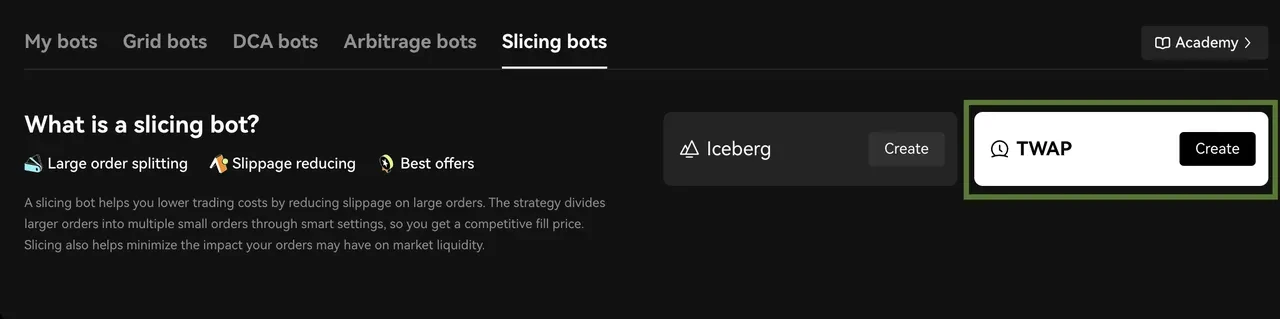

On the Trading bot page, you'll see a variety of bot strategies such as Grid bots, DCA bots, Arbitrage bots, and Slicing bots.

What are OKX's trading bots?

Here are all of OKX's different trading bots, each based on a different strategy:

Spot grid

Futures grid

Smart portfolio

Spot DCA (Martingale)

Price lock

Recurring buy

Arbitrage

Iceberg orders

TWAP (Time-Weighted Average Price) orders

Spot grid, futures grid, smart portfolio and recurring buy are the most straightforward bots to use. Meanwhile, arbitrage order, iceberg order, and TWAP are suited to more advanced users as they have more complex risk profiles.

What is the Spot Grid trading bot?

The spot grid bot sets grid lines between an upper and lower price set by the user, and automatically sells crypto if the traded asset’s price increases and reaches one of the lines. Conversely, the bot automatically buys crypto if the price decreases to one of the lines.

You can determine the spot grid’s parameters yourself or choose the AI strategy, which is based on previous price movements. The AI strategy uses back-tested parameters to increase the likelihood of profit. Setting the trading bot grids yourself is slightly riskier but allows greater user control.

Learn how to use the spot grid trading bot.

What is the Futures Grid bot?

The futures grid trading bot is similar to the spot grid bot but it buys and sells long or short futures contracts rather than buying and selling assets in the spot market. Again, the futures trading bot uses a grid system to place orders above and below the current price, and buys and sells different futures contracts to profit from price volatility. The futures grid bot supports three distinct trading strategies:

Long

Short

Neutral

A crucial difference between the futures and spot grid bots is that traders can trade with leverage on futures contracts. Note that leverage trading carries its own risks – it is crucial to understand them before using the futures grid trading bot.

Learn how to use the futures grid crypto trading bot.

What is the Spot DCA (Martingale) trading bot?

The Spot DCA (Martingale) trading bot allows traders to buy specific assets at specified intervals to split their asset allocation at multiple price levels. In short, traders use the DCA approach to buy when they think the price is low and sell when they think it’s high, or hit their take-profit target.

While the DCA strategy is well-known and commonly used by traders, OKX's Spot DCA (Martingale) bot allows users more flexibility. Users can choose to either enter their position or to select their entry time using technical indicators (Flexible start conditions), and reserve only the minimum necessary funds (Initial Order + First Safety Order) upon order creation, and transfer funds later when needed.

A separate feature, the Continuous trading cycles feature, allows the bot to run throughout trading cycles indefinitely to continue trading from dip-to-rebound thanks to safety orders, and/or start new cycles after achieving the defined Take-Profit target.

Learn how to use the Spot DCA (Martingale) trading bot.

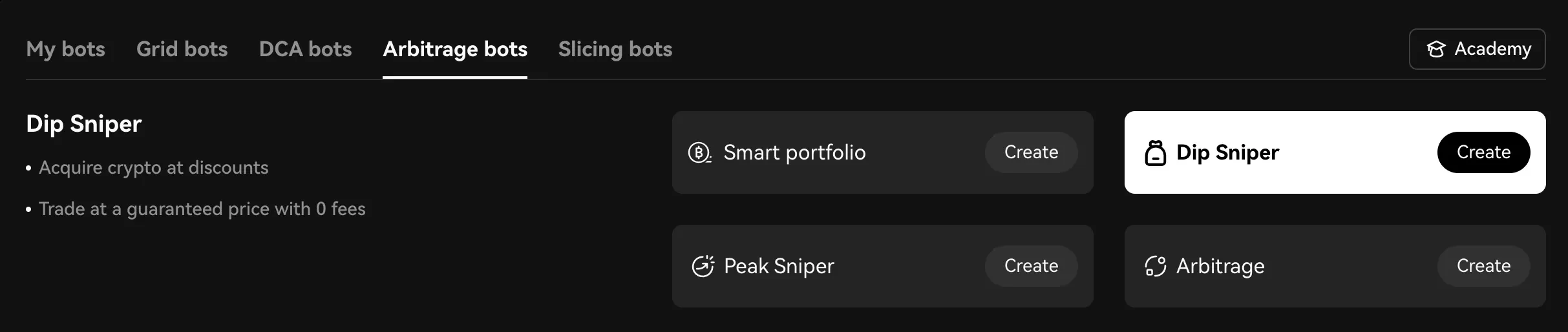

What is the Dip Sniper trading bot?

Dip Sniper is designed for traders looking to buy low in the cryptocurrency market, Dip Sniper is a trading bot that guarantees a portion of your order will be filled at the dip on expiry. With Dip Sniper, you can set your desired price to buy a specific asset and, regardless of market fluctuations, the bot will execute a portion of your order at the dip on expiry. This means you have the opportunity to secure a lower price for your desired asset, even if the market doesn't reach your target price.

With Dip Sniper, you can unlock growth opportunities by buying low and maximizing your potential gains. Take advantage of market fluctuations and secure more favorable prices for your desired assets. Dip Sniper empowers you to make informed buying decisions and seize opportunities to enhance your trading strategies.

Learn how to use the Dip Sniper trading bot.

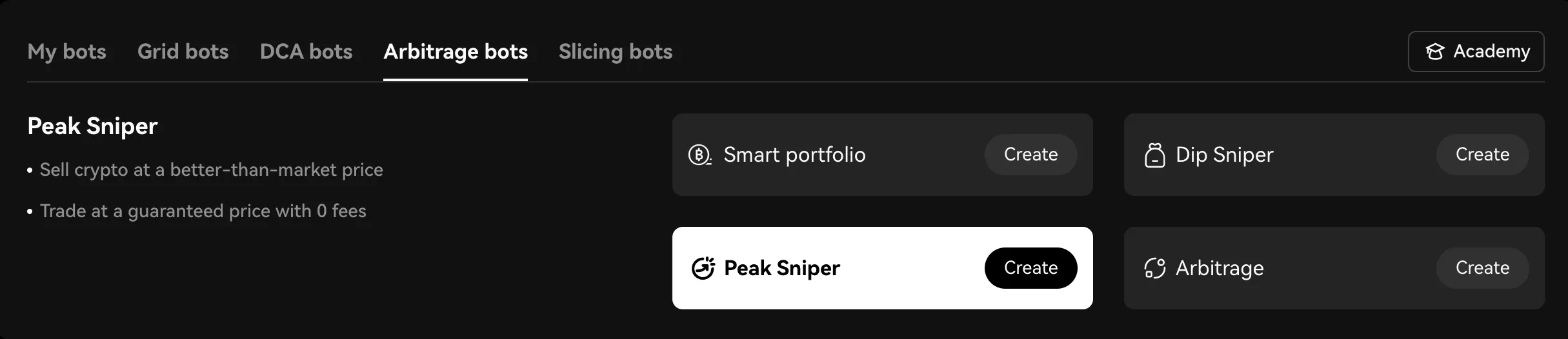

What is the Peak Sniper trading bot?

For traders aiming to sell at the peak, Peak Sniper is the ideal trading bot. With Peak Sniper, you can make sure that a portion of your order will be filled at the peak price on expiry. Simply set your desired price to sell a particular asset, and the bot will execute a portion of your order at the peak, maximizing your gains. Even if the market doesn't reach your target price, Peak Sniper guarantees a portion of your order will be filled at the peak, allowing you to capitalize on the highest possible selling point.

With Peak Sniper, you can maximize your growth by selling at the peak and securing gains at the highest possible price. By using Peak Sniper's powerful features, you can enhance your trading strategies, optimize your selling decisions, and unlock new growth potential in the cryptocurrency market.

Learn how to use the Peak Sniper trading bot.

What is the Smart Portfolio trading bot?

Smart portfolio is the trading bot’s automated portfolio balancing feature. When using this strategy, traders specify how they want their smart portfolio to be distributed across assets. If price volatility causes an asset to represent more than its intended allocation, the bot automatically sells the asset to buy those that are underperforming.

The bot supports two rebalancing triggers. In “scheduled” mode, it checks the proportion of each asset at regular intervals set by the user. If it observes a deviation from the intended allocations, it sells the asset that has increased in total portfolio share and uses the proceeds to buy the other asset or assets.

In “proportional” mode, the bot only rebalances the portfolio when it has become imbalanced by a user-determined percentage. Imagine you set up your smart portfolio to rebalance on a 5% or more imbalance with a 25% ETH allocation, a 25% SOL allocation and a 50% BTC allocation. If the BTC price pumps relative to ETH and SOL, and your BTC becomes 80% or more of your total portfolio, the bot will sell BTC to buy ETH and SOL.

The smart portfolio bot is highly customizable. In addition to the two distinct rebalance triggers, traders can include up to 10 cryptos in their portfolio and specify an individual percentage for each.

Learn how to use the smart portfolio crypto trading bot.

What is the Recurring Buy trading bot?

The recurring buy bot can buy up to 20 different cryptocurrencies at regular intervals to average out their buying price.

The recurring buy crypto trading bot strategy uses your USDT balance to buy crypto at chosen intervals. OKX also supports recurring buys with credit and debit cards via the “Buy Crypto” section.

Dollar-cost averaging is one of the most straightforward investment strategies because it doesn’t require any skill, only long-term conviction in an asset. OKX’s recurring buy trading bot makes the DCA strategy even more straightforward to implement — you literally just set it and forget it!

Learn how to use the recurring buy crypto trading bot.

What is the Arbitrage Trading bot?

The Arbitrage trading bot simplifies locking in profits from price discrepancies between different trading instruments supported on OKX. The bot seeks to create what are known as “delta neutral” positions. This means that if one position loses money, the other leg of the trade would profit the same amount, resulting in no loss or gain. Profits come from price differences between instruments or funding rate payments.

The arbitrage crypto trading bot has two modes:

Funding rate. In this mode, a long or short position is opened in the spot market for any supported crypto. At the same time, the bot opens the opposite position in the same asset with a perpetual swap. The two positions should be delta neutral, which means that any funding rate payments received from the trader on the other side of the perpetual swap are profit.

Spread arbitrage. This mode presents opportunities to profit from the price difference between futures contracts with different settlement dates, or futures and spot prices. When the bot opens delta neutral positions with the same underlying asset using two differently priced instruments, the difference becomes profit at the settlement time.

Although the arbitrage bot makes it very easy to implement profitable arbs between different instruments, it is a slightly more complex strategy than those mentioned above. There is also more risk involved, particularly when making custom arbitrage portfolios. Therefore, the arbitrage bot is more suited to experienced traders.

Learn how to use the arbitrage crypto trading bot.

What are Iceberg orders?

Iceberg Orders are large buys or sells broken down into many smaller orders. They are particularly useful when making a large trade relative to the size of the market. Even a small order can move the asset price in illiquid markets, resulting in a less favorable entry or exit. Iceberg Orders attempt to mask large orders and limit the impact of price slippage. To place Iceberg Orders, click the Iceberg button from the Slicing bots menu.

In the Iceberg section, select the product and trading pair you want to trade using the menu in the top-left corner. You can use the Iceberg bot in the Spot, Perpetual, Futures, Margin and Options markets. If you’ve never traded futures or perpetual swaps before, we recommend you read OKX’s tutorials about each product before attempting to use the arbitrage bot. This will help you understand the risks when trading futures or perpetual swaps.

Traders can then choose the amount of slippage you can tolerate — i.e., the amount by which the price can move when executing your trade — in the price range field. They can do this in increments of the trading pair’s base asset using the Var. option or as a percentage of your order price by using the Ratio option.

Learn how to use the Iceberg orders trading bot.

What is the Time Weighted Average Price (TWAP) bot?

TWAP mode — short for time-weighted average price — seeks to execute a large trade over a specified period. It is similar to an iceberg order in that it attempts to enter or exit a market with a large position without significantly moving the asset’s price. To enter the trading bot’s TWAP mode, click TWAP from the Slicing bots menu.

Using TWAP orders, you may choose whether you want to buy or sell the first asset listed in the trading pair and input your tolerated price slippage. Selecting Var. enables you to enter an amount denoted in the second asset from the trading pair. Meanwhile, clicking Ratio allows you to choose your slippage based on a percentage move from the price limit.

Learn how to use Time Weighted Average Price (TWAP) bot.

How to stop a trading bot and close a trade?

Step 1

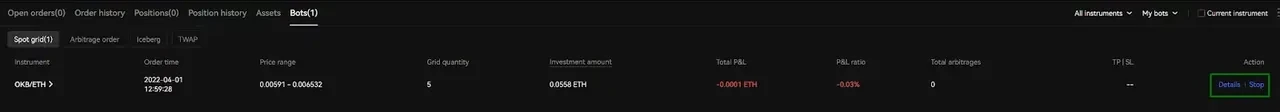

You can check on any trades you have created using the trading bot in the Bots tab of the trading dashboard. Here you can view details of your trades, including their profitability to date. It's also where you can stop the bot manually.

Step 2

If you want to stop an active bot, just click Stop next to the relevant trade.

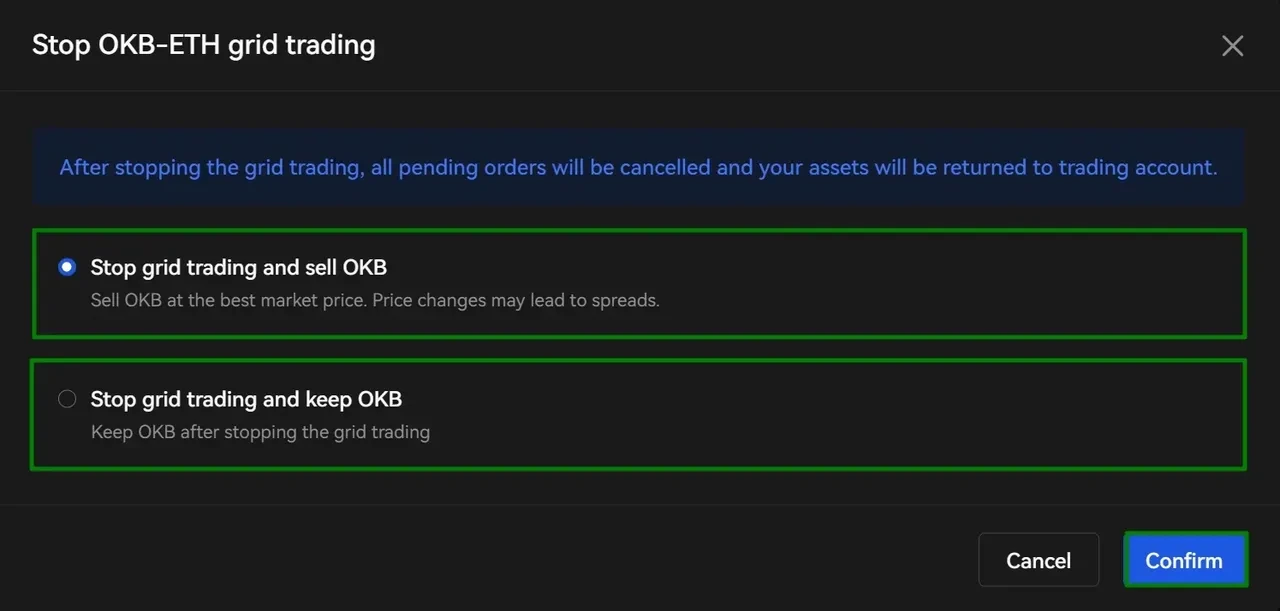

Step 3

You can then keep the asset traded or exit your position to USDT. Choose the appropriate option and click Confirm.

Your trade will then disappear from the Bots section and appear in the History section.

If you experience any difficulties using the trading bot, feel free to contact our support team via the OKX Telegram group or our dedicated Support Center.

DISCLAIMER

THIS BLOG IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. IT IS NOT INTENDED TO PROVIDE ANY INVESTMENT, TAX, OR LEGAL ADVICE, NOR SHOULD IT BE CONSIDERED AN OFFER TO PURCHASE OR SELL OR HOLD DIGITAL ASSETS. DIGITAL ASSET HOLDINGS, INCLUDING STABLECOINS, INVOLVE A HIGH DEGREE OF RISK, CAN FLUCTUATE GREATLY, AND CAN EVEN BECOME WORTHLESS. YOU SHOULD CAREFULLY CONSIDER WHETHER TRADING OR HOLDING DIGITAL ASSETS IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PLEASE CONSULT YOUR LEGAL/TAX/INVESTMENT PROFESSIONAL FOR QUESTIONS ABOUT YOUR SPECIFIC CIRCUMSTANCES.

© 2025 OKX。本文可以全文複製或分發,也可以使用本文 100 字或更少的摘錄,前提是此類使用是非商業性的。整篇文章的任何複製或分發亦必須突出說明:“本文版權所有 © 2025 OKX,經許可使用。”允許的摘錄必須引用文章名稱並包含出處,例如“文章名稱,[作者姓名 (如適用)],© 2025 OKX”。不允許對本文進行衍生作品或其他用途。