The crypto market is considered the most volatile in the broader financial industry. The prices of coins and tokens are known to experience dramatic changes. This presents an excellent opportunity for experienced traders who can analyze markets quickly and react in time. However, novice traders sometimes make the mistake of entering the market too late.

The force that drives them to do so is something called the Fear Of Missing Out (FOMO). It is a powerful force but also a dangerous one, and it often leads to losses. This guide will explain the meaning of FOMO, and how it affects the market and traders.

What does FOMO mean?

In the trading industry, FOMO stands for Fear Of Missing Out. It is a relatively young concept described in 2000 by Dr. Dan Herman. He wrote about it in his paper titled The Journal of Brand Management.

As a concept, FOMO refers to the fear and anxiety that traders sometimes feel when they believe they are the only ones missing out on a potential trade. When fear and anxiety take over, traders' judgment can become clouded, which leads to them making rash decisions.

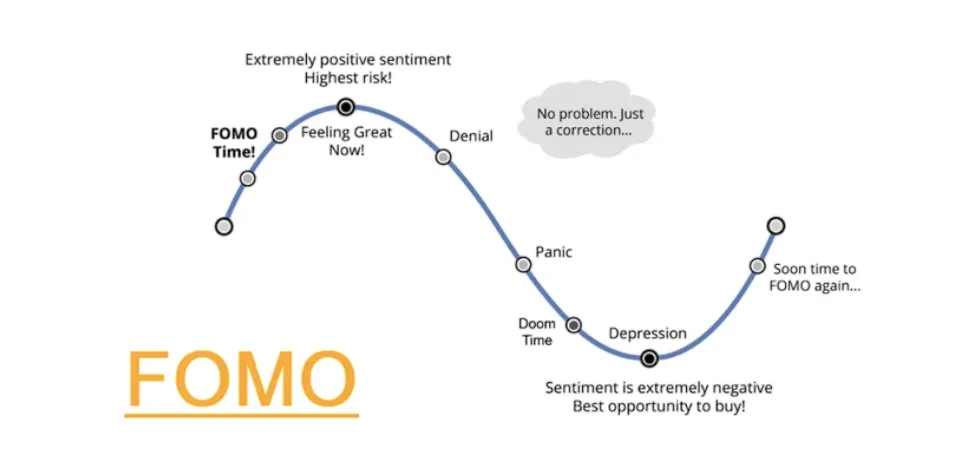

During such times, people start making decisions without thinking them through to feel included. This is exactly what happens in the crypto market. When prices suddenly start rising, traders flood the market as they anticipate further price appreciation. In reality, those who enter the market in reaction to such moves usually enter too late. By the time they join out of FOMO, the surge is already at its end, and traders see losses.

FOMO vs. JOMO

While FOMO is a well-known term in the crypto industry, it is worth noting that it has its counterpart, the Joy Of Missing Out (JOMO). JOMO comes from a belief that a project or situation is misleading, and missing out is a far better alternative.

Long-term investors often use the term JOMO. They are happy to miss out on a potentially profitable opportunity that might negatively affect their overall strategy.

How FOMO affects the crypto market?

FOMO can affect more than individual traders. It can affect the broader crypto market in several ways. One of the biggest ones is increasing the buying pressure. A FOMO-driven bull run could see the particular price of a token or coin appreciate significantly. This attracts more buyers, which further fuels the bullish momentum.

However, this increase in buying pressure could also adversely affect the market and its participants. FOMO-driven bull runs lead to high levels of volatility within the market, which could negatively affect traders.

FOMO can also open up opportunities for crypto market manipulators. Market manipulators such as certain crypto whales can — and often do — exploit the heightened emotions of other traders. When traders get sucked into the herd mentality, they can create a large bubble. Depending on the coin or token, whales have the buying power to burst these bubbles and profit from them.

How to manage FOMO?

Managing FOMO is, of course, possible. However, it can also be quite challenging. It requires discipline, critical thinking, and constant reminders to stick to your strategy. It is easy to forget these things when feelings take over. But, making decisions based on emotions is one of the leading causes of losses in crypto trading. With that said, here are some tips on what to do to avoid this:

Set clear investment goals and remind yourself to stick to the strategy for achieving them.

Make it a habit of conducting thorough research before making a trade.

Use risk management strategies to secure minimal losses while chasing high gains.

Practice patience and discipline; step back and assess the situation with a cool head.

Focus on the long-term value instead of making the most of short-term price movements.

Practice emotional control and recognize the fear of missing out on yourself.

FOMO and long-term investments

Focusing on long-term investments and value is one way to manage FOMO. FOMO primarily triggers traders who wish to profit from current opportunities. However, those who purchase coins or tokens and lock them up are more resistant.

Ultimately, traders are better off not making decisions based on FOMO. Always remember to step back from the hype and emotions and think clearly. Make sure your decisions are backed by research, logic, technical analysis, and probability.

Is FOMO bad for crypto, traders, and investors?

Generally speaking, FOMO is a powerful influencer on crypto traders and investors. It causes industry participants to make rash decisions by clouding their judgment. It affects their emotions and causes them to react instead of assessing the situation.

In the end, FOMO can create opportunities, but more often than not, it will cause impulsive behavior. This is why market participants are constantly warned about it. There are entire strategies dedicated to combating FOMO-based behavior in the crypto market.

FAQs

Is FOMO good for crypto?

Although some benefit from FOMO, more often than not, it causes impulsive behavior among market participants. This typically leads to losses and disappointment.

What is the meaning of FOMO in trading?

FOMO is short for Fear Of Missing Out. Its meaning is that it causes crypto users to react emotionally instead of logically.

What is the meaning of FUD?

While FOMO stands for Fear Of Missing Out, FUD's meaning is Fear, Uncertainty, and Doubt. FUD can cause traders to be overly-cautious and truly miss out on opportunities. On the other hand, FOMO causes traders to throw caution into the wind and react without thinking things through.

© 2025 OKX。本文可以全文复制或分发,也可以使用本文 100 字或更少的摘录,前提是此类使用是非商业性的。整篇文章的任何复制或分发亦必须突出说明:“本文版权所有 © 2025 OKX,经许可使用。”允许的摘录必须引用文章名称并包含出处,例如“文章名称,[作者姓名 (如适用)],© 2025 OKX”。不允许对本文进行衍生作品或其他用途。