How do I deposit EUR with SEPA bank transfer?

You can complete a EUR deposit from your bank account to your OKX account. EUR local bank transfers are currently only offered to our European customers (residents from EEA countries, excluding France). We accept both SEPA (Standard) and SEPA Instant. Use SEPA Instant for real-time EUR deposits. Make sure to check with your bank about their fees and SEPA instant availability.

To initiate a transfer, you will need to access your bank account and provide your unique OKX account details.

How do I make a cash deposit?

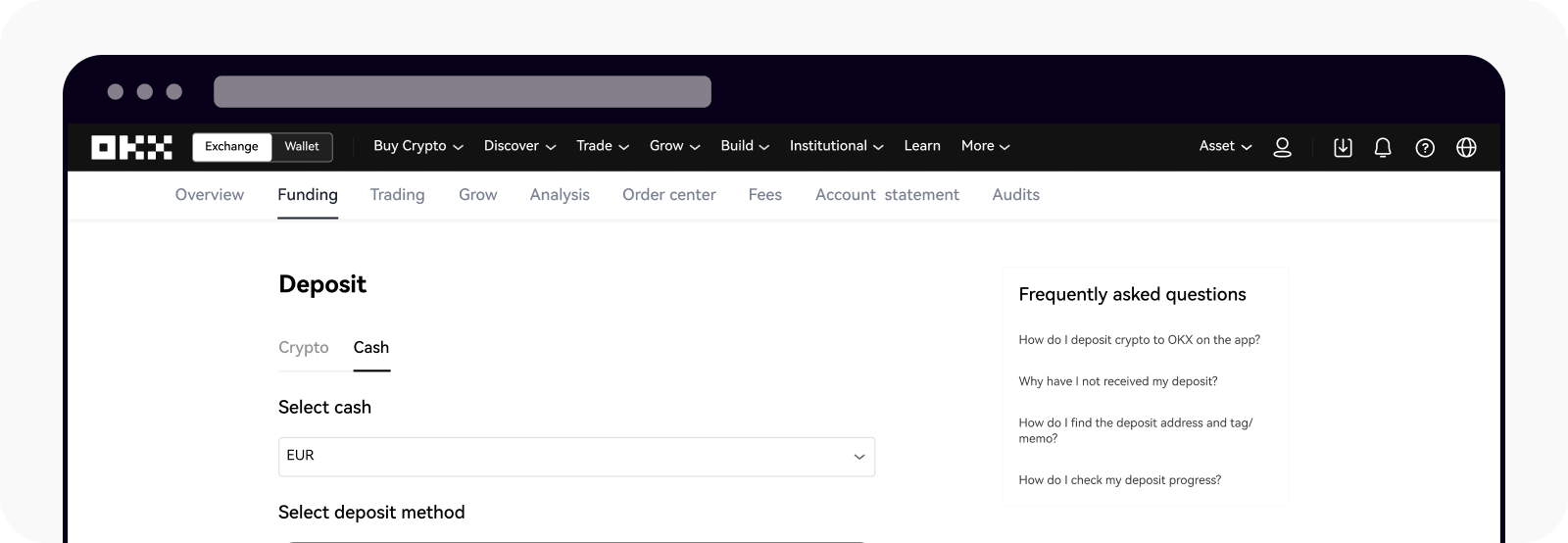

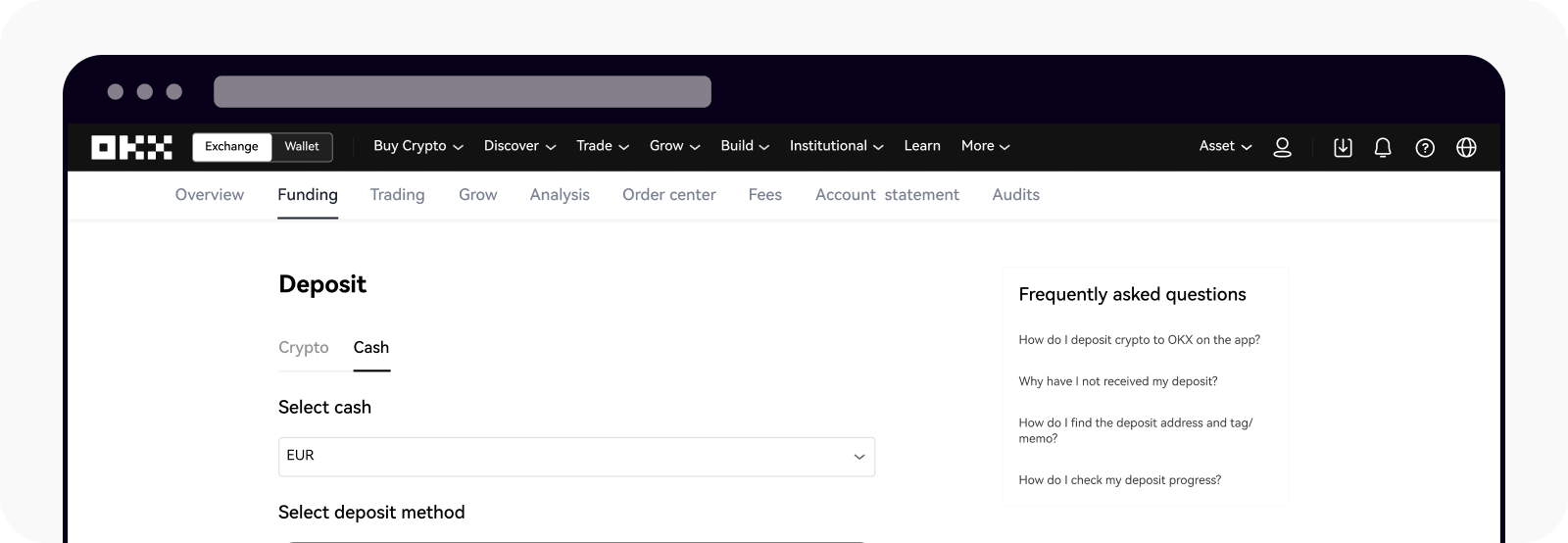

On the web

Login to your account at okx.com, go to Assets and select Deposit

Select Euro to start making cash deposit

Go to Euro to start making cash deposit

Select a deposit method and Next to check the required details for your transfer, then select Next

Review our instructions and initiate a deposit with your bank online using the deposit details provided

Confirm the deposit transaction from your bank account

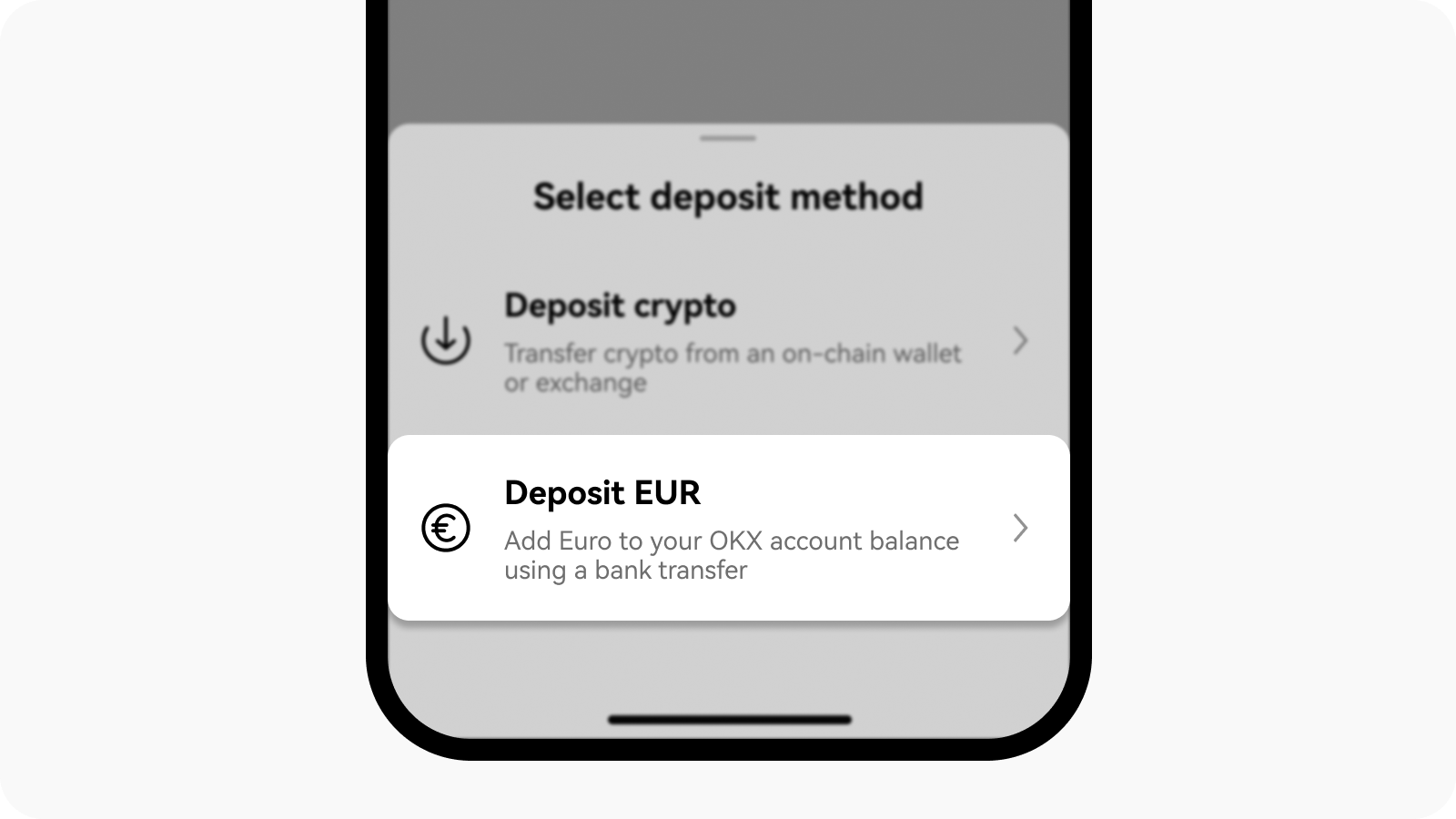

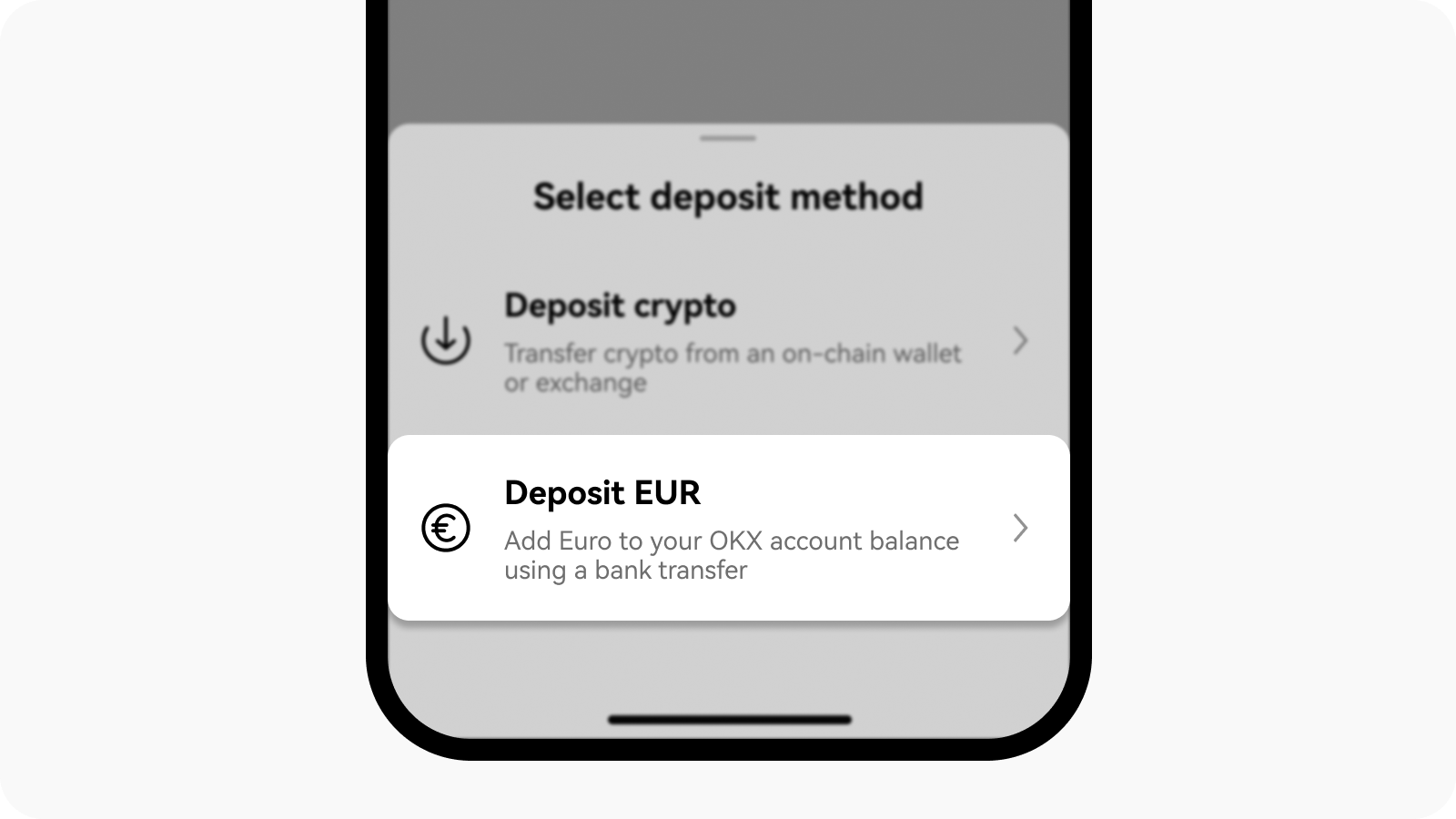

On the app

Open your OKX app, select Deposit > Deposit EUR

Opening deposit page from homepage

Select the deposit method you prefer and Next to check the required details for your transfer, then select Next

Review our instructions and initiate a deposit with your bank online using the deposit details provided

Confirm the deposit transaction from your bank account

Note:

The deposit processing time will differ based on your bank and transfer mode (SEPA Standard/SEPA Instant).

Make sure the name on your OKX account matches the name on your bank account for a smooth deposit transaction. Any deposits from a third party will be rejected.

While we don't charge a fee for EUR deposits via SEPA bank transfers, additional transfer fees may be charged by your bank. To learn more about our fees and processing time, read more in Introducing cash deposits and withdrawals.

The processing time of your EUR deposit will vary depending on the SEPA payment type you've used. If your bank supports SEPA Instant and your payment is sent as 'Urgent', you should see your EUR deposit within a few seconds. Otherwise, it may take up to 2 business days before the amount is reflected in your account.

FAQ

1. What's the difference between SEPA and SEPA Instant?

SEPA (Standard) transfers typically take 1–2 business days to process and are available during banking hours. SEPA Instant allows you to deposit EUR in seconds, 24/7. SEPA Instant is a great option for fast deposits within the €100,000 limit. Check with your bank for transfer availability and any applicable fees.

2. Why do I need to verify my identity before making a deposit?

We ask you to verify your identity to follow local regulations, keep our platform secure, and help determine the best payment methods for your region.

3. Why can't I see the "Deposit EUR" feature?

To comply with local laws and regulations, cash deposits are only available in specific regions. This may mean that your account is currently not eligible to access this feature.

4. Why am I only able to select certain payment method types?

To comply with local laws and regulations, the payment methods available to you on your account will be limited to those that are appropriate based on the identity verification documents you have provided during onboarding to OKX.

5. Why am I encountering a "Cash deposit unavailable" message?

This means that fiat payment services aren't currently available in your region. You can refer to here for more details and we'll keep you updated on any regional expansions.

6. How do I check my cash deposit history?

You can review your deposit history:

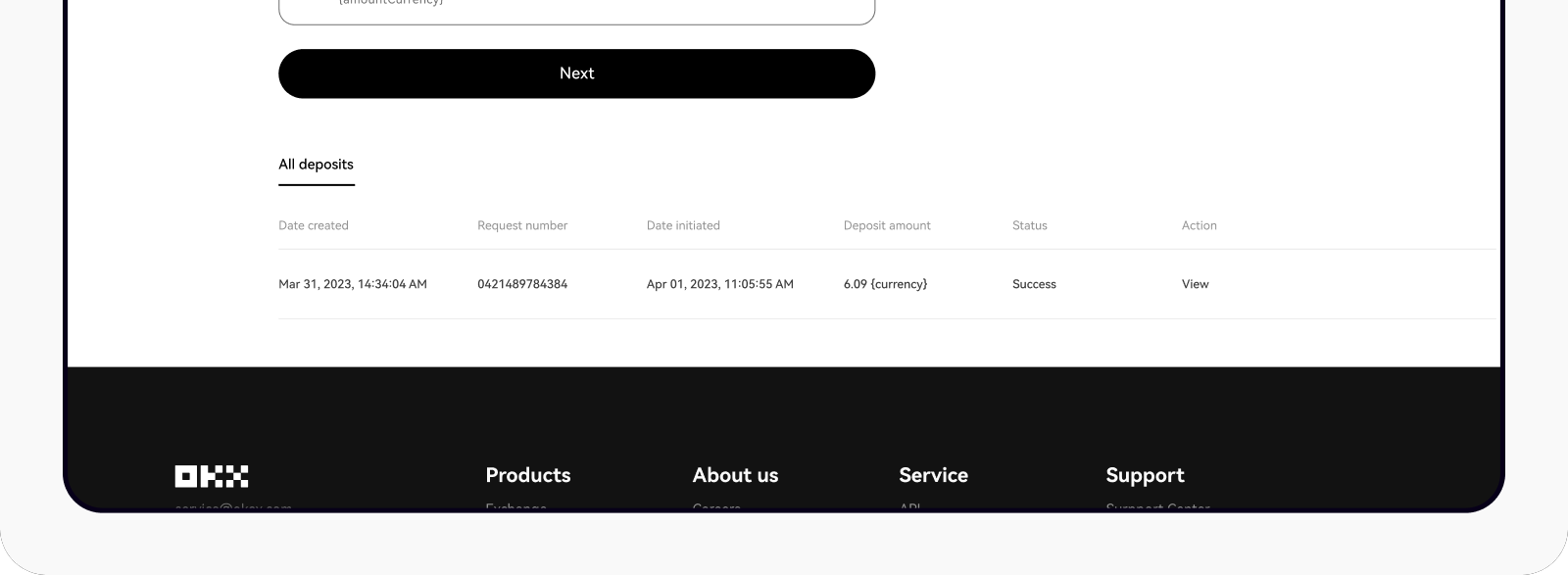

On the web: select Assets > Deposit > All deposits

On the app: select Portfolio > transactions > filter Cash deposit type

Web: all deposits on the deposit page

App: transactions on the Portfolio page