How do I automate strategies on Arbitrage bot?

When the price of an asset in the spot market differs from its price in a futures contract, traders can take advantage of these differences by placing trades in both markets at the same time. This strategy is called spread arbitrage. Another opportunity arises from funding rate arbitrage, where you buy an asset in the spot market and sell it in a perpetual contract to earn funding rate payments.

How do I set up Arbitrage trading bot?

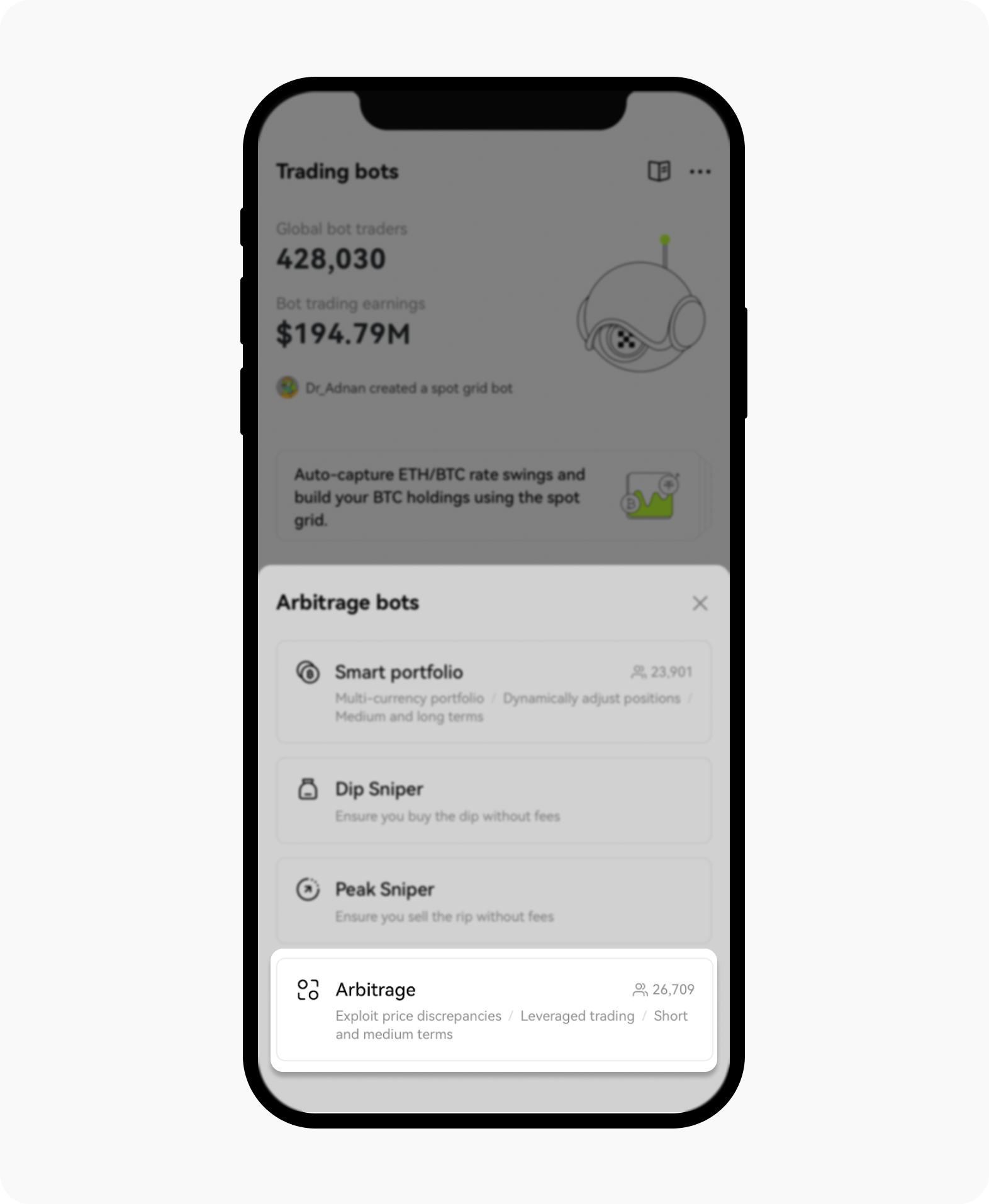

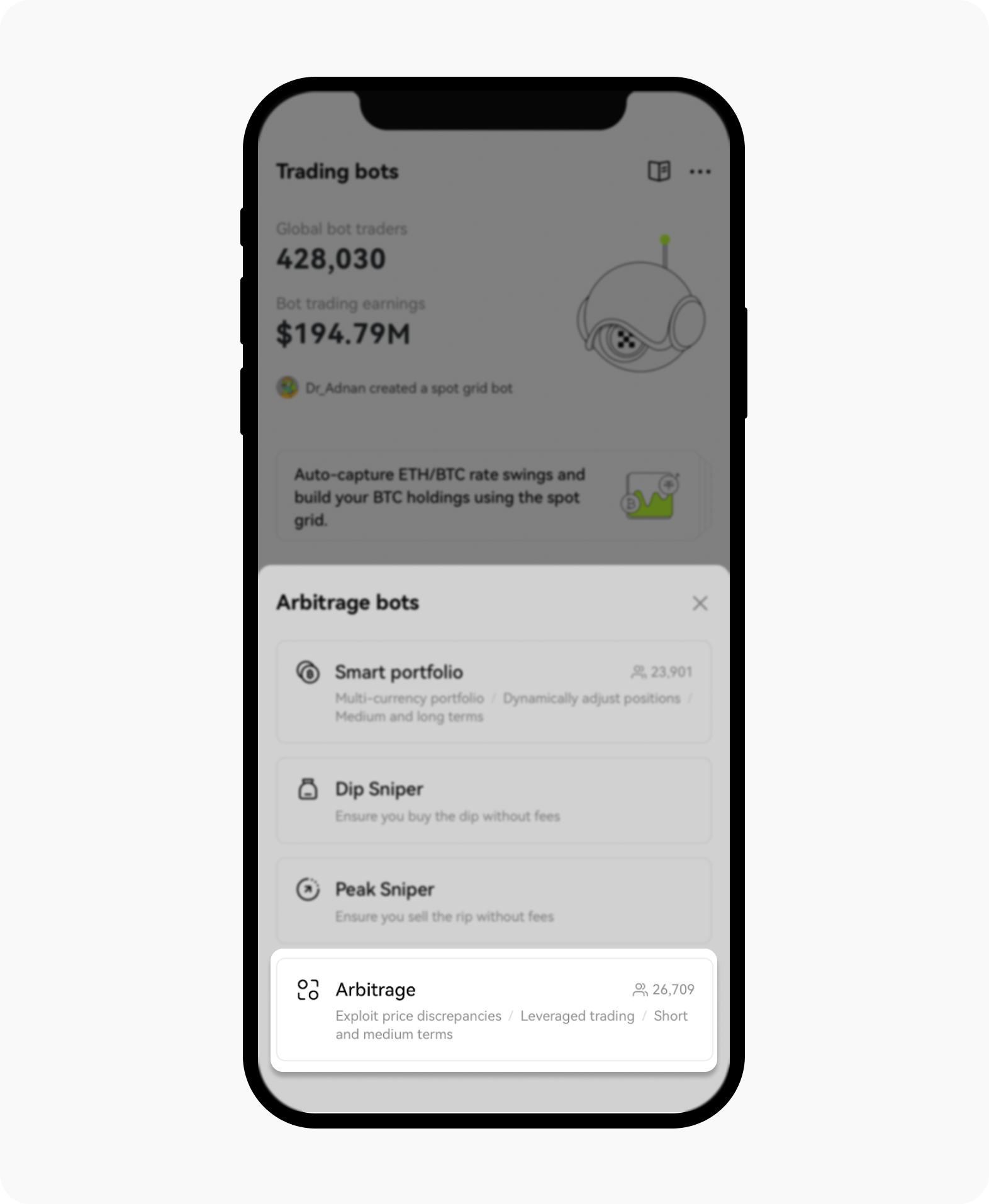

Select Arbitrage order from the list of trading bot strategies

Select Arbitrage from the pop-up menu at Trading bots > Arbitrage bots

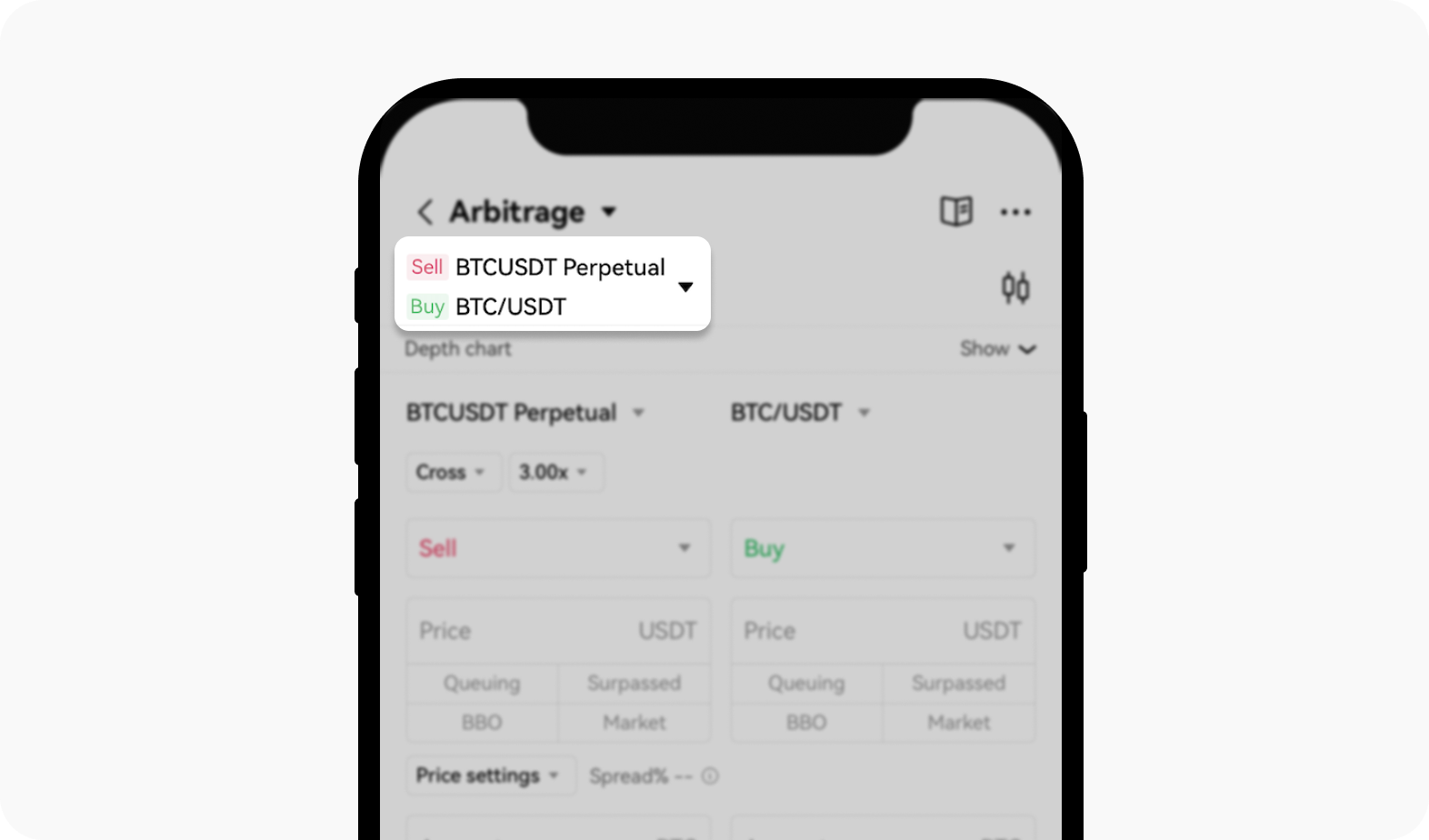

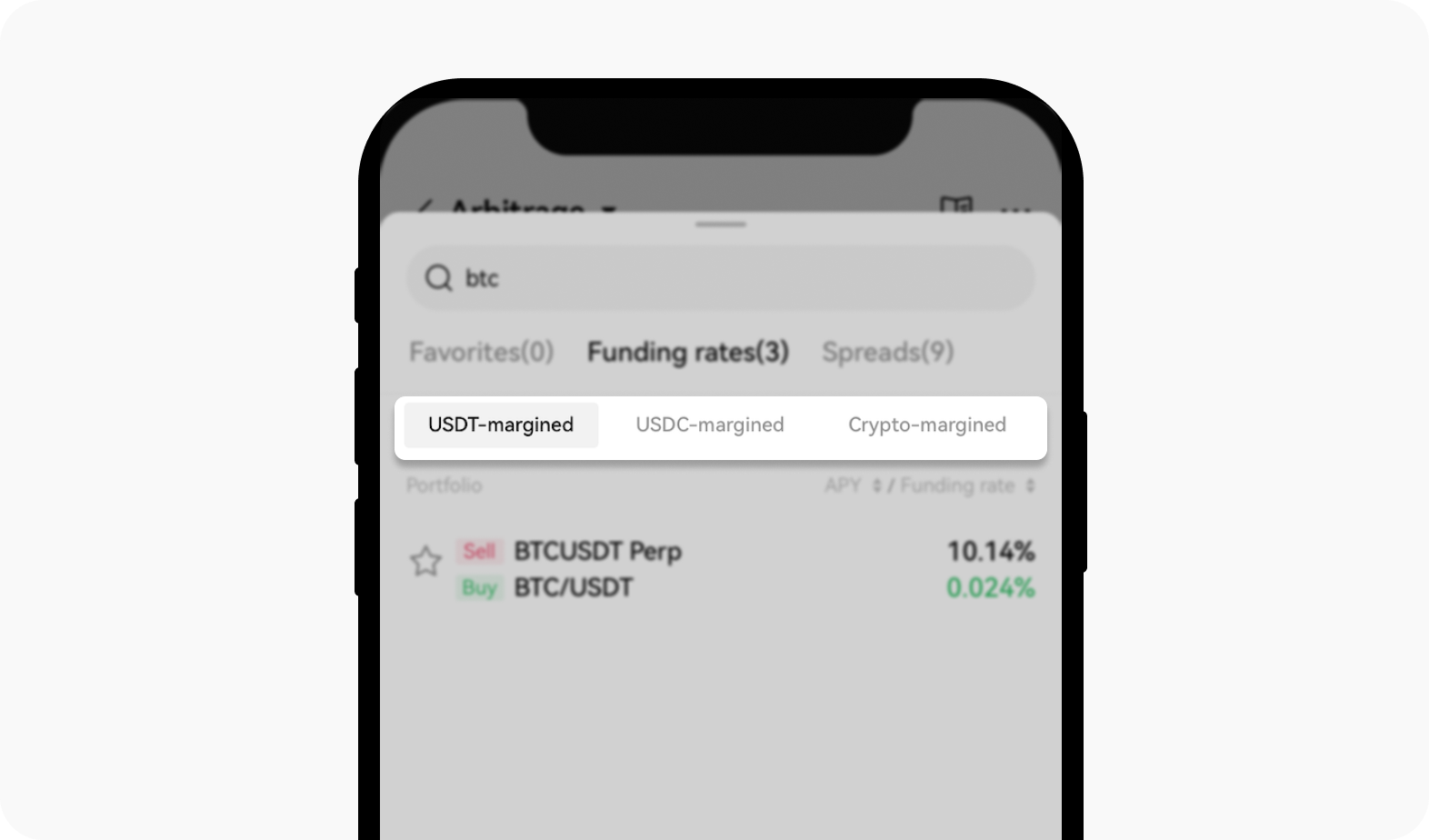

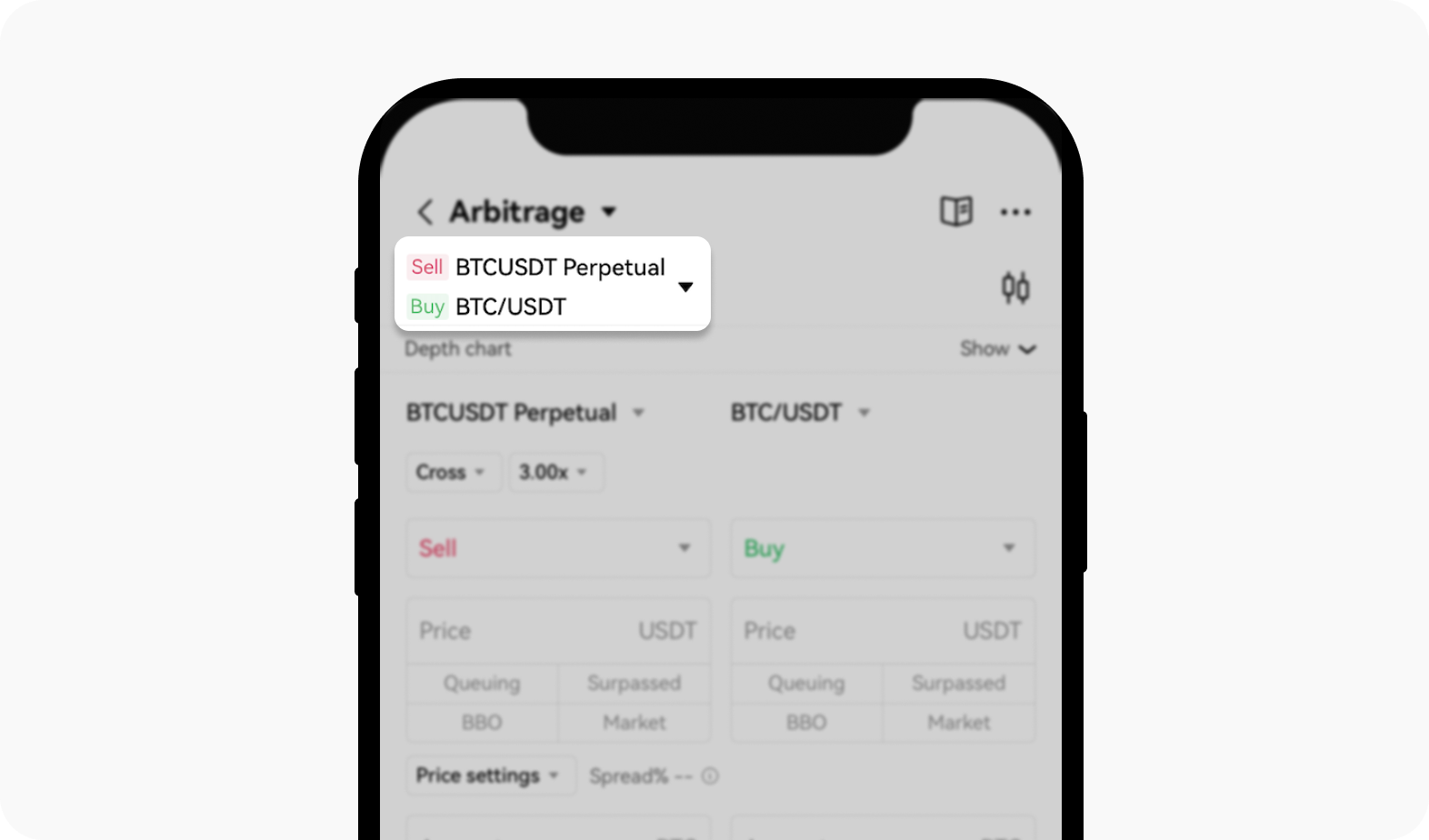

Then, select the trading pairs at the top to select the arbitrage bot you want to use

Select the trading pairs of your preference

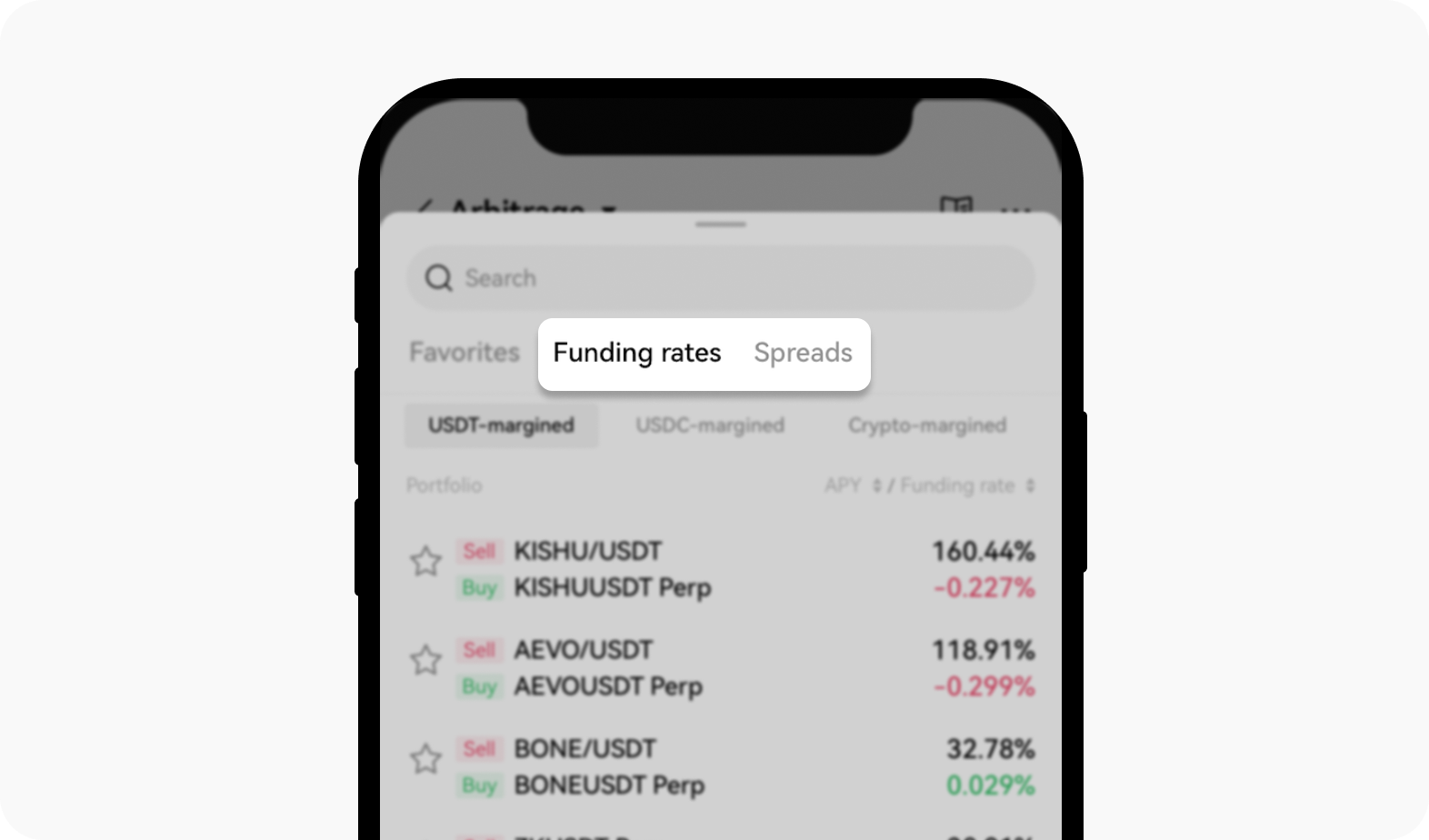

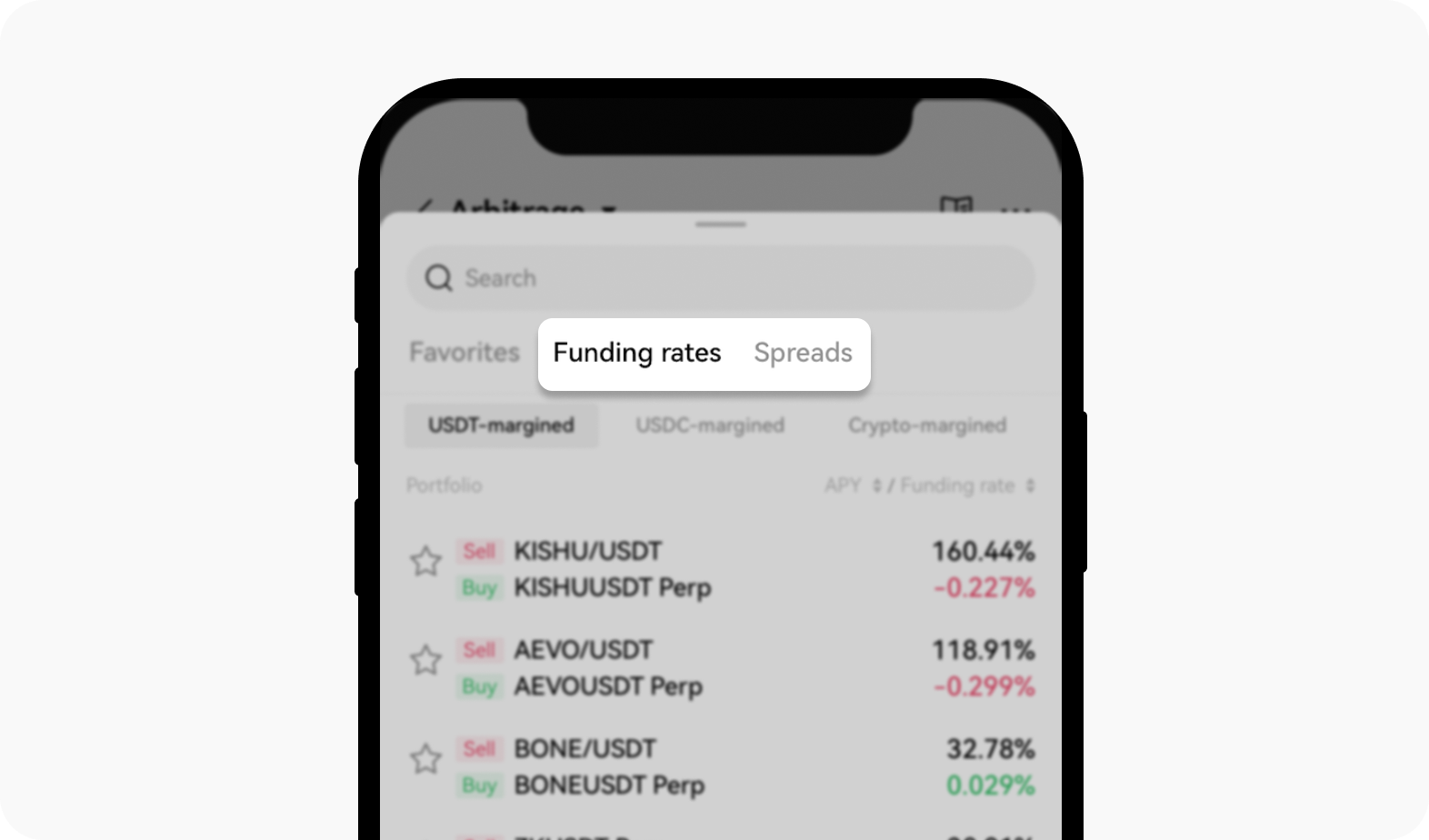

To profit from perpetual swap funding rate payments, select Funding rates. To arbitrage the spread between two instruments, select Spreads

Determine your strategy and select either Funding rates or Spreads

What's Spread arbitrage?

Spread arbitrage involves trading the price difference between two markets, such as spot and futures, or between two futures contracts. Here’s a simplified example:

You buy 1 BTC in the spot market at $50,000 and sell a futures contract at $50,100.

No matter how the price moves at settlement, you profit from the price difference.

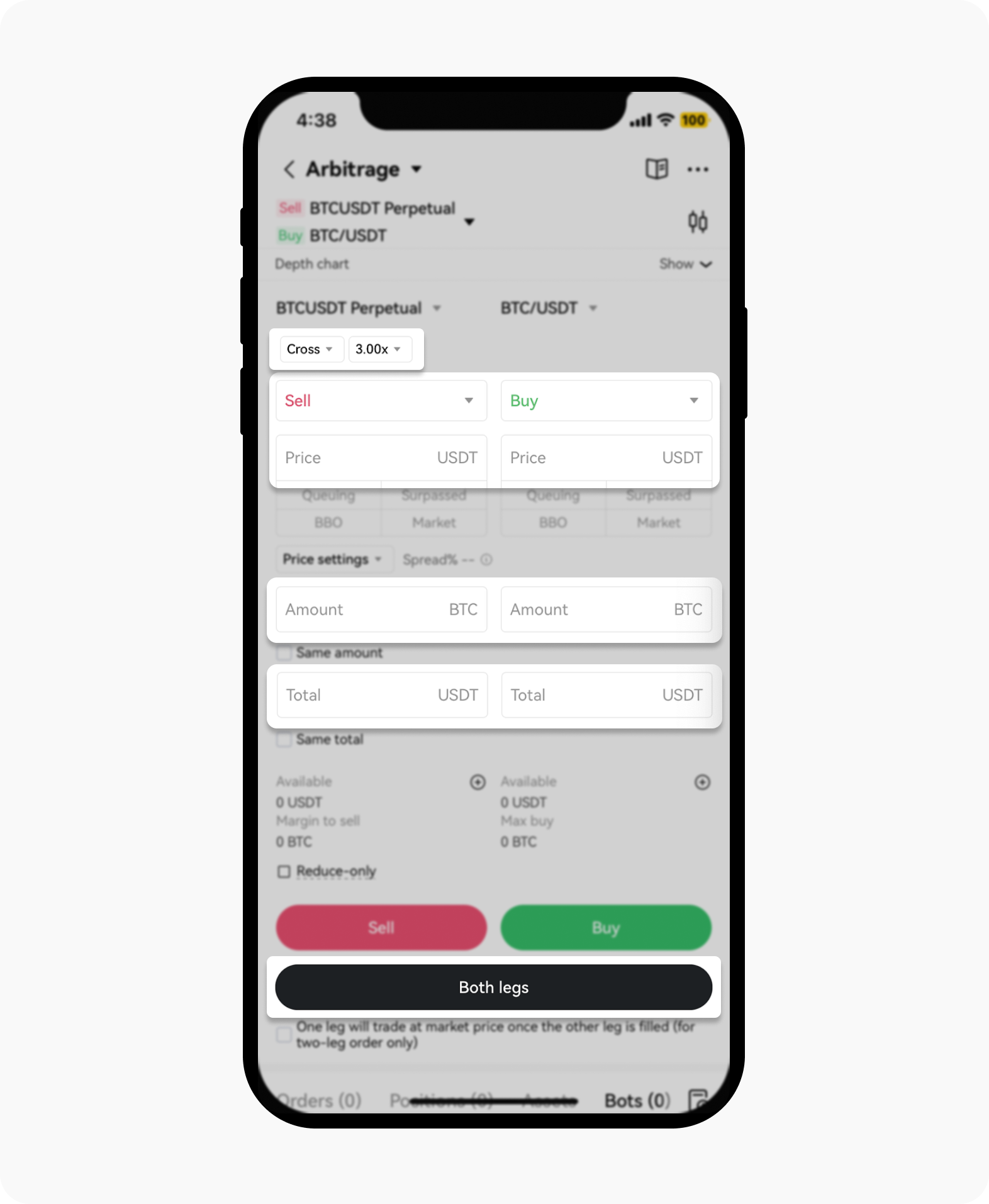

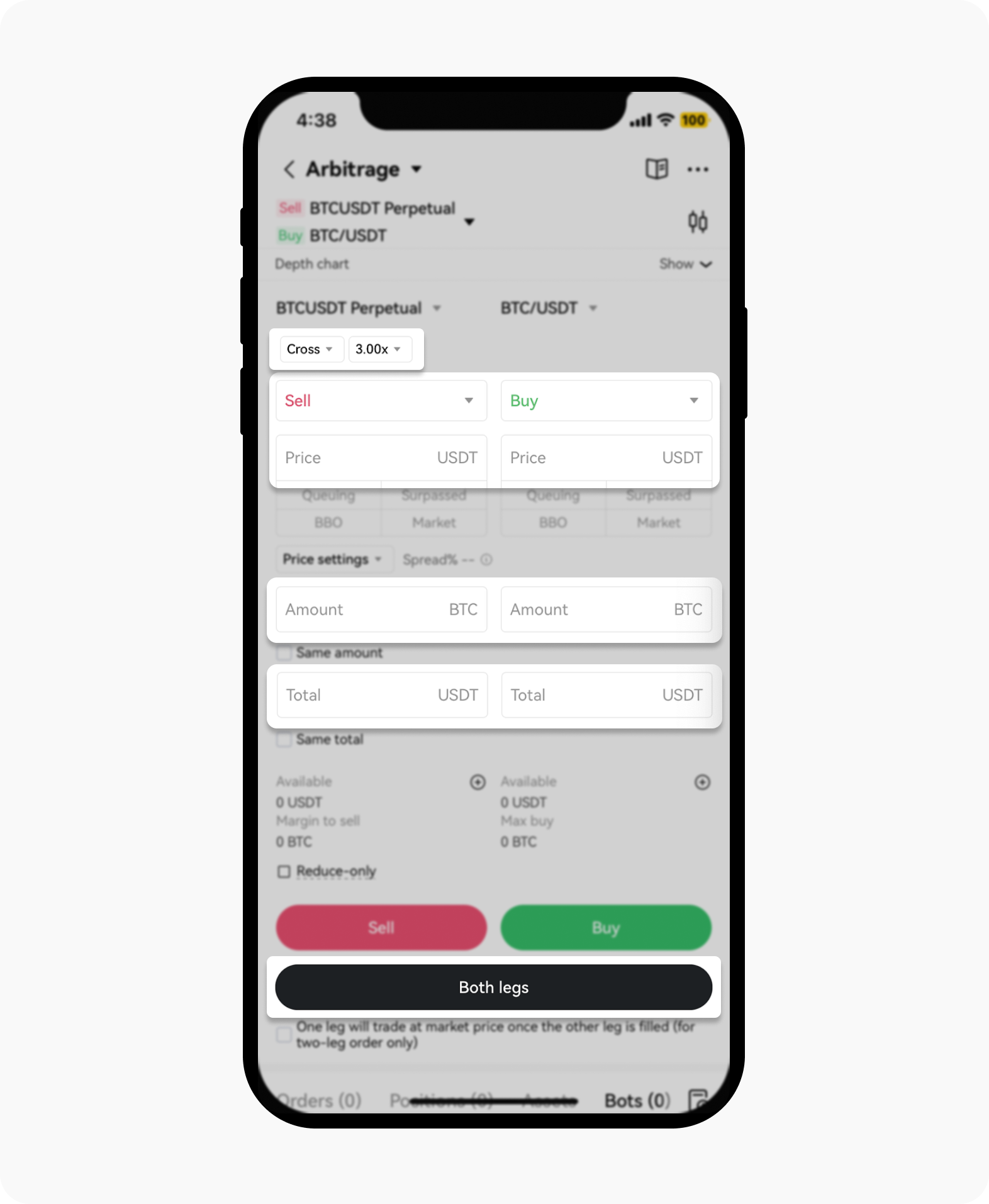

To set up spread arbitrage:

Select Spreads: choose between USDT-margined or USDC-margined, and select your strategy

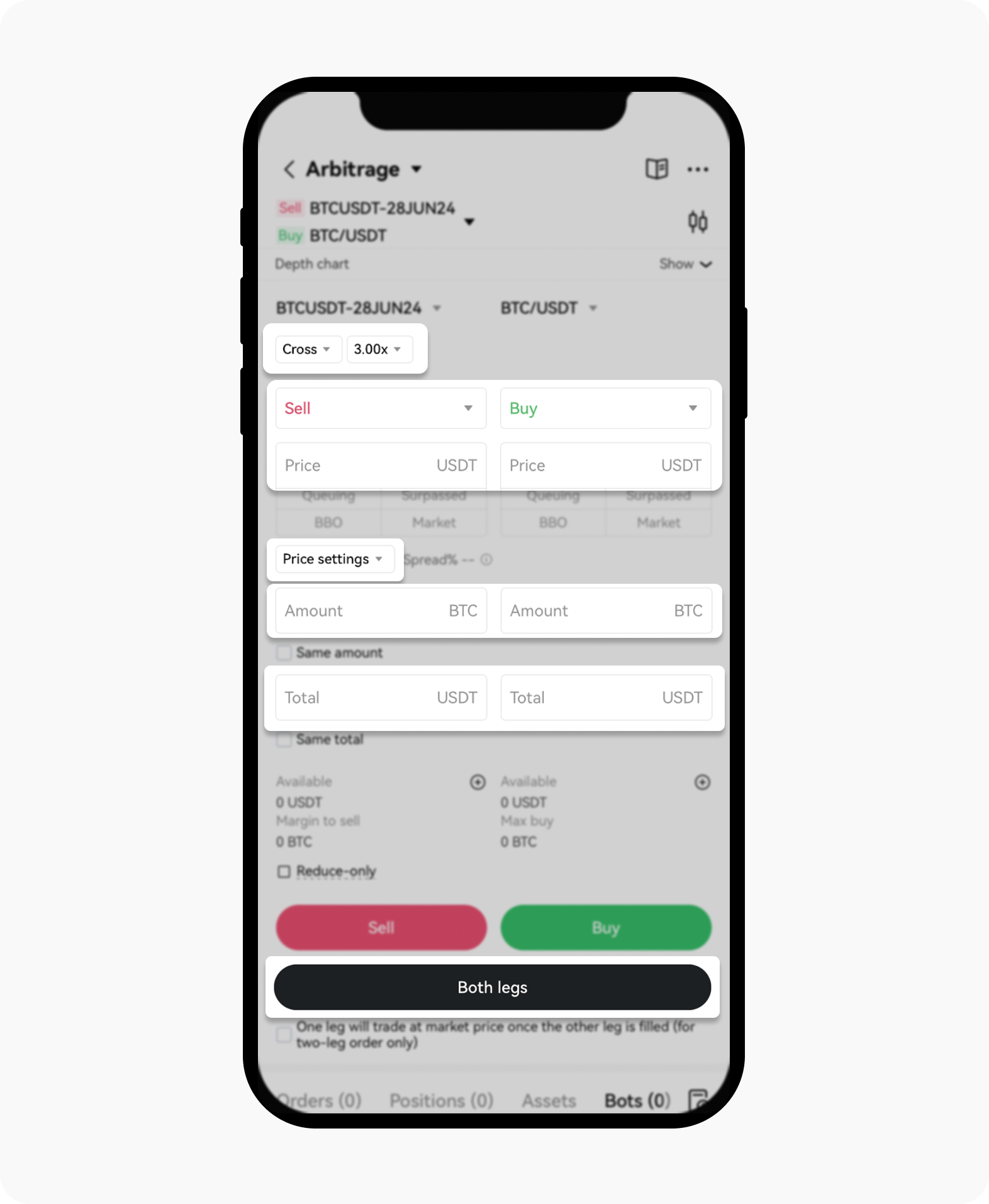

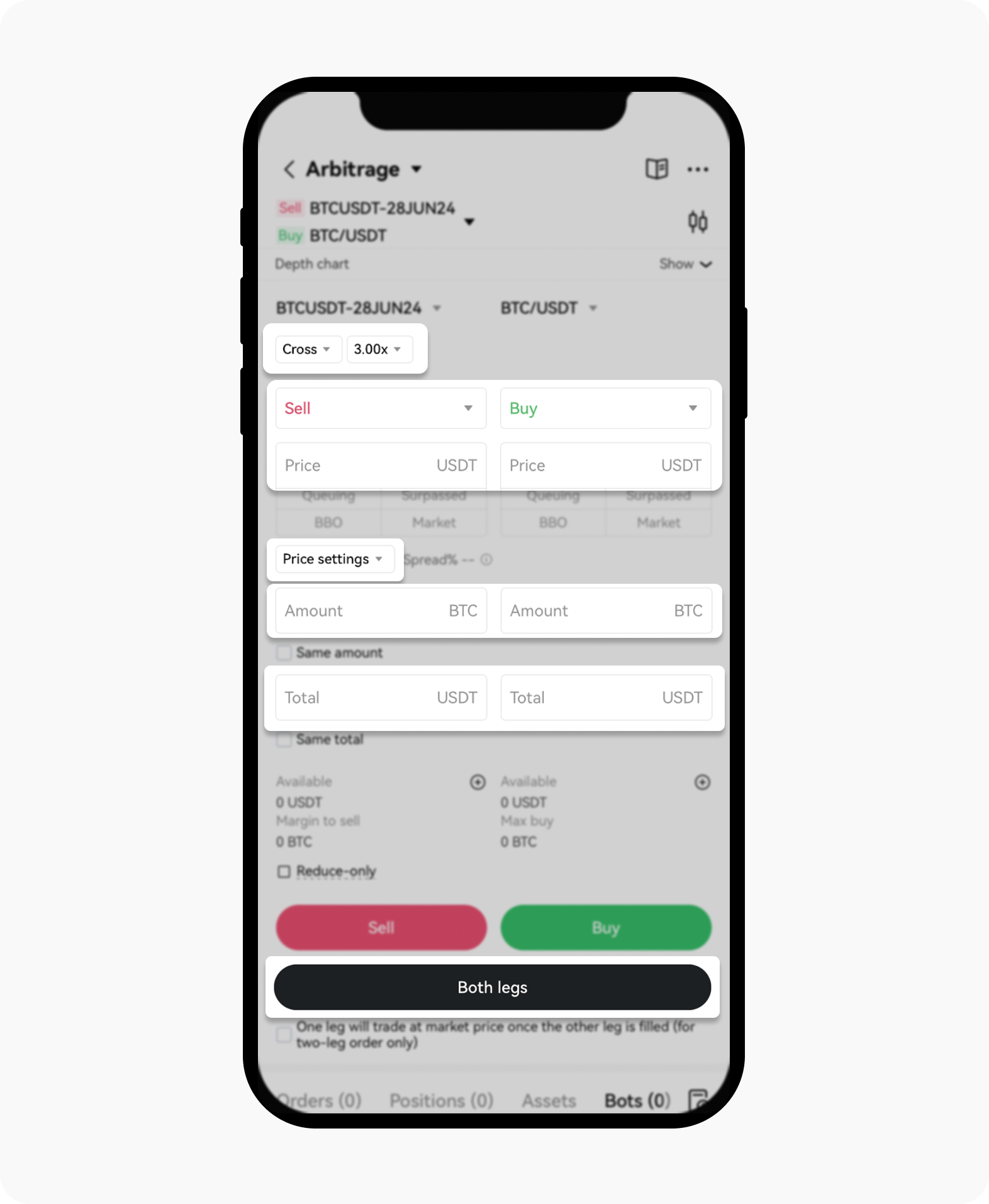

Input order details: set the prices for both legs of the order

Set Margin mode: choose between Cross and Isolated margin modes

Fill up and check all the parameters before selecting with Both legs to finalize your orders

Place both orders: fill in your details, review the setup, and place both orders

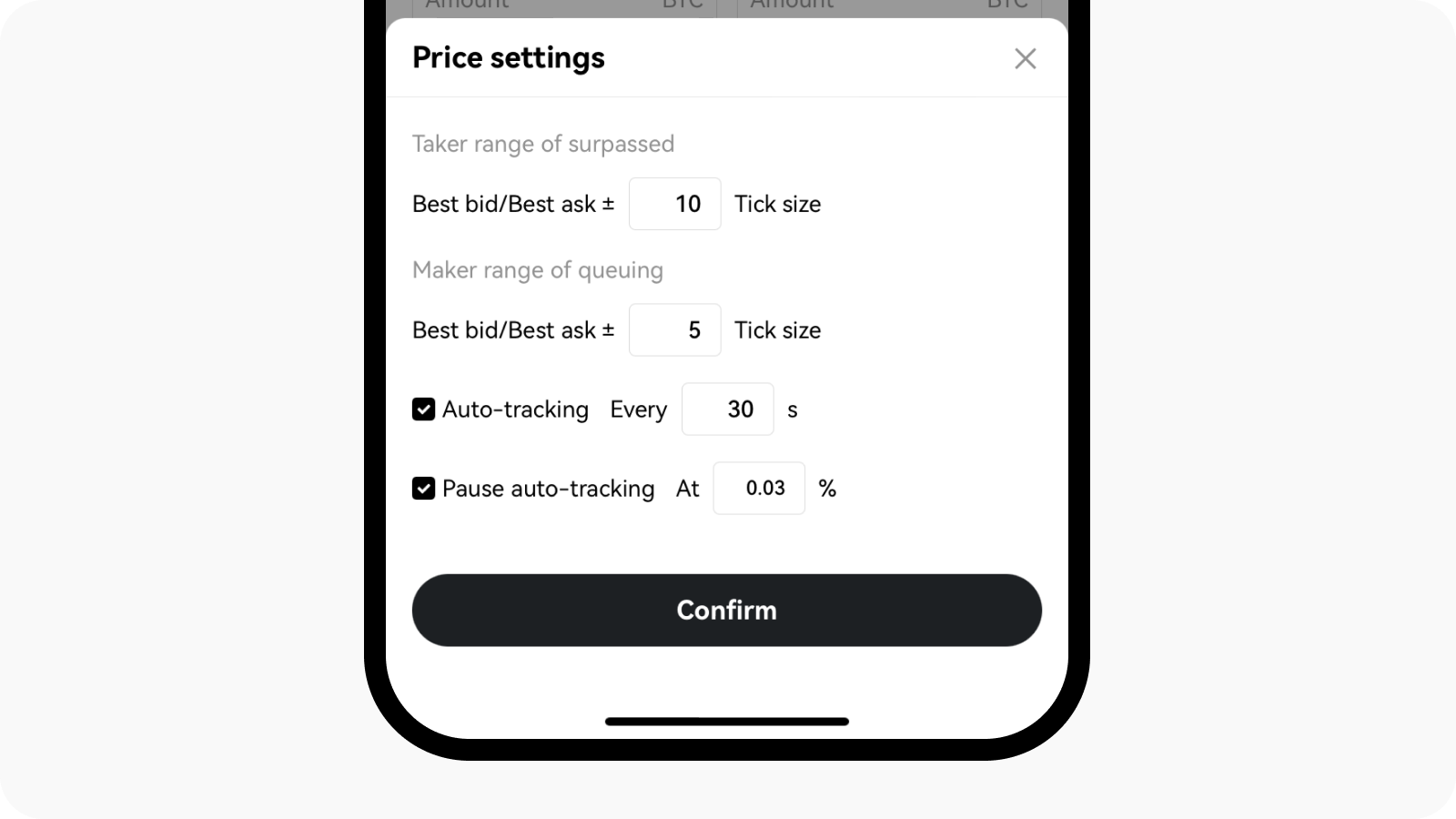

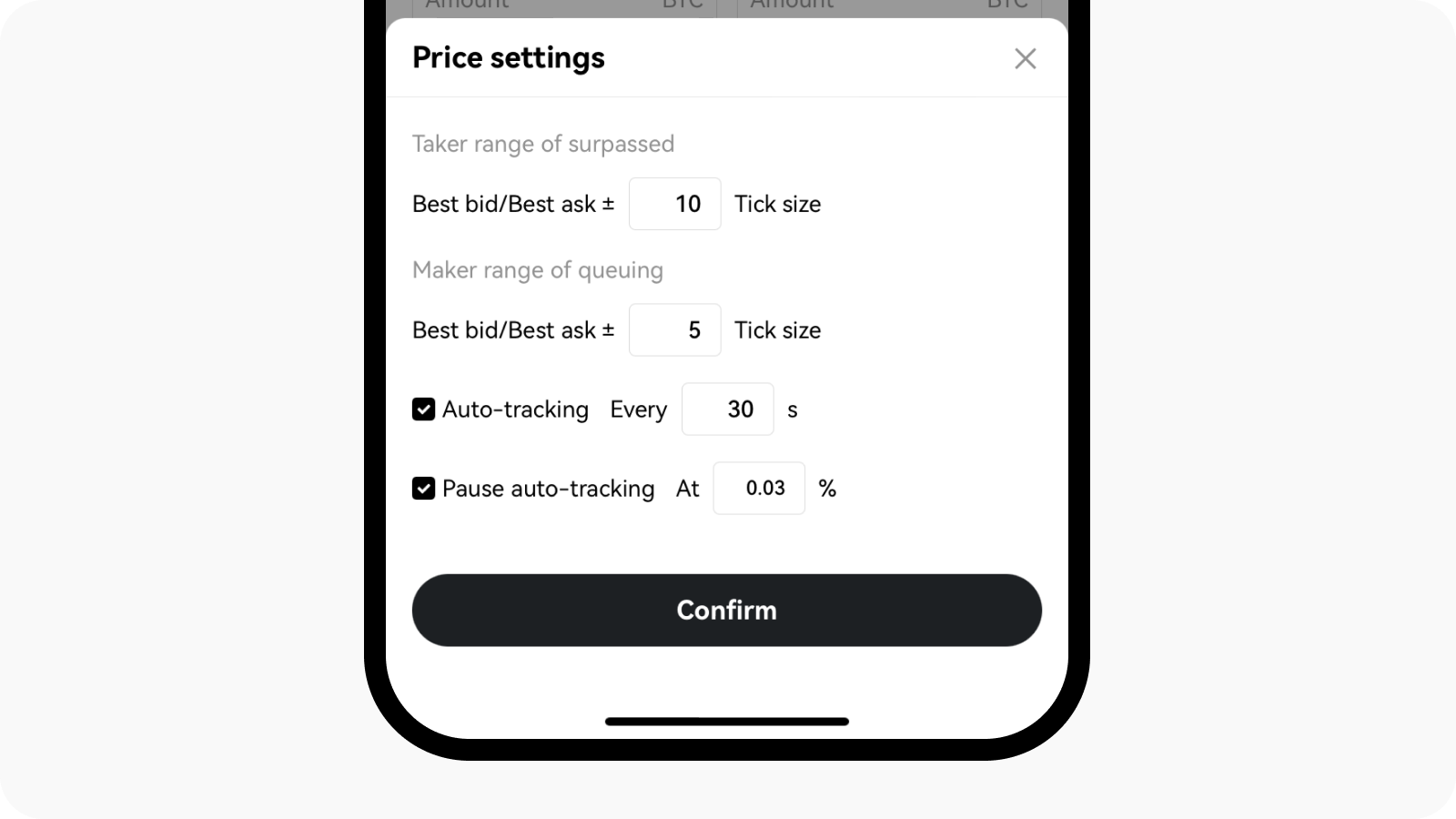

Set your range of queuing and surpassed parameters accordingly

What's funding rate arbitrage?

In this strategy, you hold both a spot asset and a short perpetual contract on the same asset. Your profit comes from the funding rate payments. Here's how to set it up:

Select Funding rates: Choose between Crypto-margined or USDT-margined to settle trades in your preferred currency. Then, select the portfolio to trade

Select your preferred margin under the Funding rates section

Input order details: fill in the trade details, such as USD price and amount. The bot will automatically choose to buy or sell based on the portfolio selected

Set Margin mode: choose between Cross Margin (uses all account funds) or Isolated Margin (only uses a set amount of funds)

Place both orders: review the details and hit Both Legs to execute both orders simultaneously

Set your parameters according to your preference before selecting Both legs to proceed with orders

Both strategies allow you to minimize risk while making the most of price differences or funding rate opportunities. For more information and to monitor your bot’s performance, check the trading bot section in your account.