零基础学K线丨25 常用分析指标7—SAR

涨跌有趋势,读懂价格语言。

买卖有信号,告别感觉交易。

一、SAR抛物线指标

首先我们来了解一下什么是SAR抛物线指标?

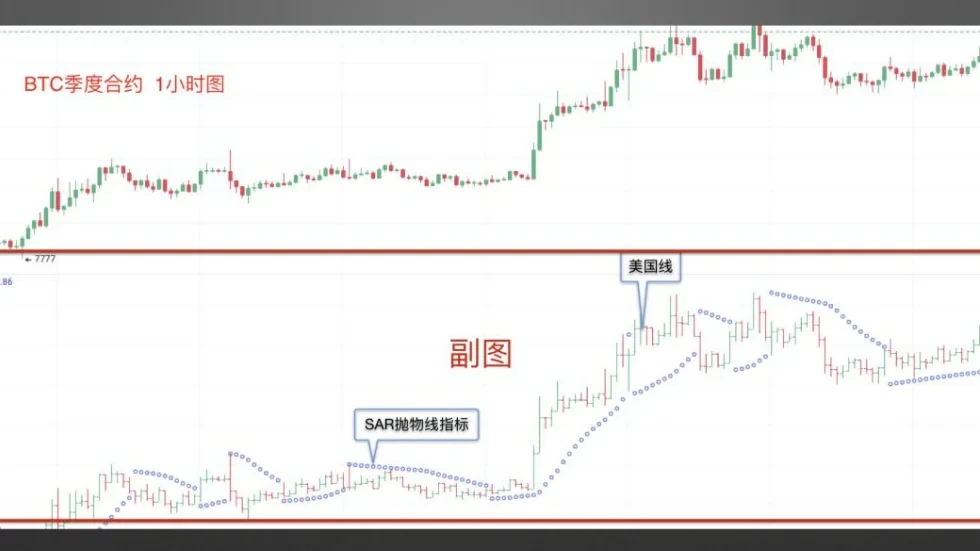

在实际应用中,SAR指标除了可以在主图上添加外,还可以在副图上添加,分别如图所示。

主图SAR指标:截图来自欧易OKX BTC季度合约1小时图,图中由小蓝点构成的抛物线即为SAR指标,英文全称“Stop and Reverse,中译为停损点转向指标,因其形态也被称作抛物线指标,是一个判断趋势转变的辅助指标。

副图SAR指标:截图同样来自欧易OKX BTC季度合约1小时图,图中红框中显示部分为副图区域,该指标区的价格标记为美国线,围绕美国线上下的抛物线为副图SAR指标。

二、SAR指标的应用规则

认识了SAR指标后,如何通过该指标研判行情转势并进行交易呢?

截图来自欧易OKX ETH季度合约日线图,当币价K线向上有效突破位于K线上方的SAR指标时,形成空转多的转势信号,后市大概率上涨;当币价K线向下有效跌破位于K线下方的SAR指标时,形成多转空的转势信号,后市大概率下跌。

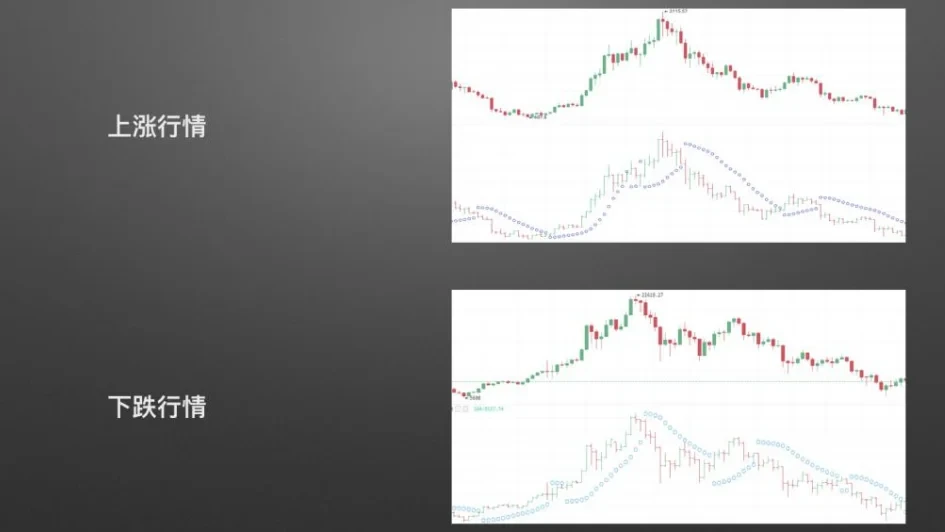

明确了转势信号后,如何通过SAR指标判断涨跌趋势能否延续呢?

我们分别以上涨行情和下跌行情加以分析,如图所示。

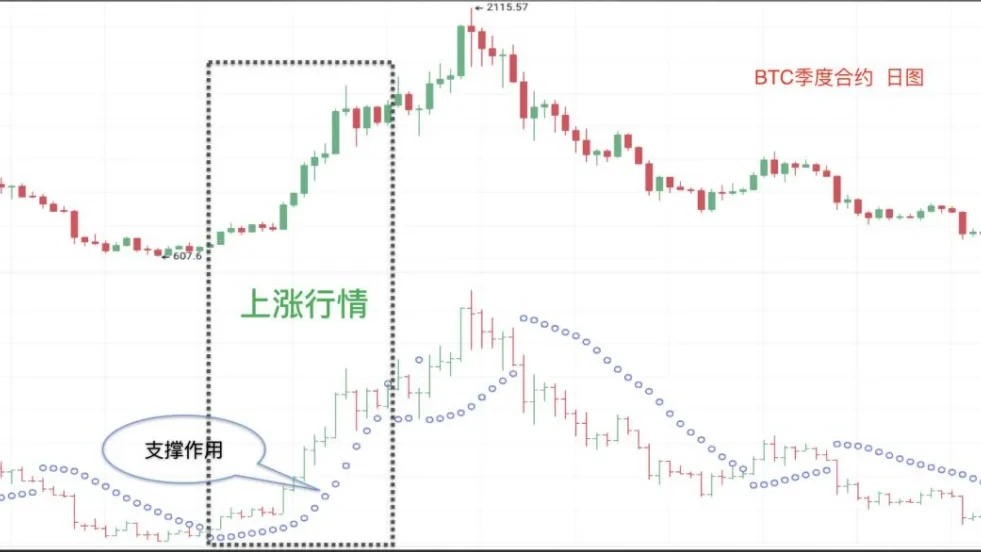

在上涨行情中,截图来自欧易OKX BTC季度合约日线图,如图中黑色虚线框区域所示,当价格线运行在SAR指标曲线的上方时,为上涨行情,表明此时该指标对币价起支撑的作用,支撑币价不断上涨,延续币价上涨趋势,投资者短期可以继续持币待涨,直到SAR指标再度发出明确的卖出信号。

在下跌行情中,截图来自欧易OKX BTC季度合约日线图,如图中黑色虚线框区域所示,当价格线运行在SAR指标曲线的下方时,表明此时该指标对币价起压力的作用,促使币价进一步下跌,延续币价下跌趋势,投资者应继续以观望为主,直到SAR指标再度发出明确的买入信号。

最后我们讲一下SAR指标的实战应用。

实战案例分别为案例一和案例二,如图所示。

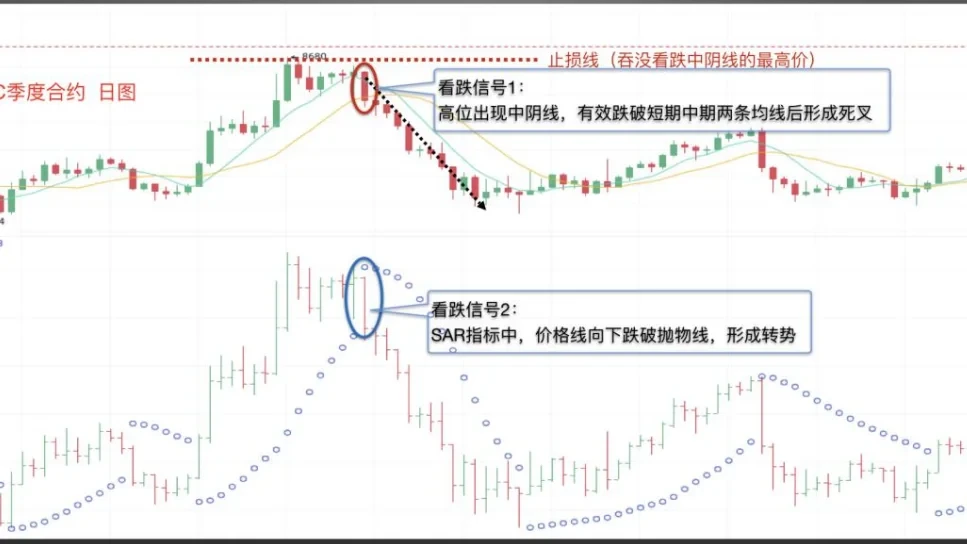

案例一:SAR指标配合两条均线的实战应用,截图来自欧易OKX BTC季度合约日图,当价格线位于SAR指标抛物线上方运行时,币价不断上涨,价格高位出现中阴线,跌穿短期中期两条均线,并形成死叉,此为看跌信号1;同时SAR指标中,价格线向下跌破抛物线,形成看跌信号2,止损位可设在上述中阴线的最高价,之后币价迎来下跌。

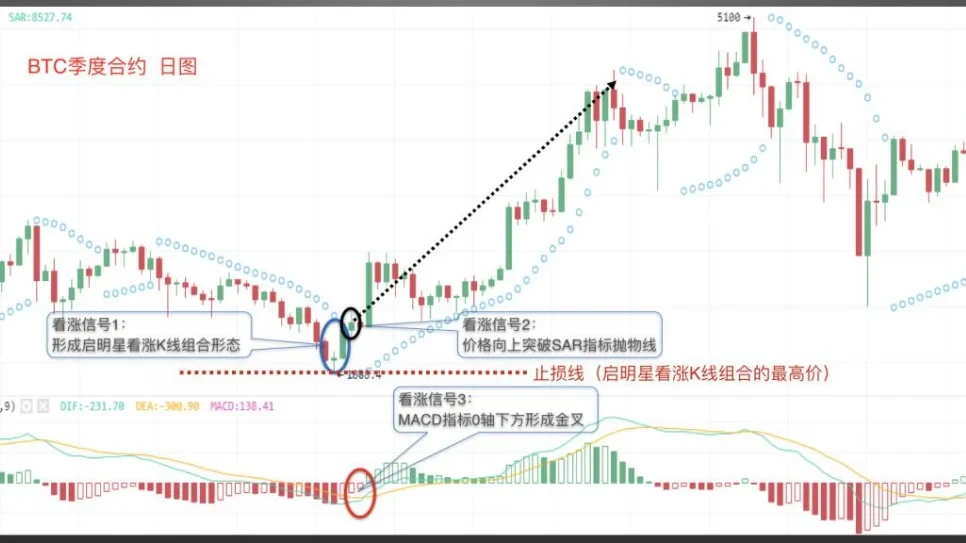

案例二:SAR指标配合K线组合形态及MACD的实战应用,截图来自欧易OKX BTC季度合约日图,币价在SAR指标下方运行,底部形成了启明星看涨K线组合形态,形成看涨信号1;接着价格向上突破SAR指标抛物线,形成看涨信号2;同时,MACD指标在0轴下方形成金叉,出现看涨信号3,止损线可设在启明星看涨K线组合形态的最低价,之后币价迎来上涨。

最后,针对交易者对SAR指标的使用作以下几点特别提醒:

第一,虽然SAR指标适用于持续的上涨行情或者持续的下跌行情中,但是SAR指标不能帮助买在最低价,也不能卖在最高价。

第二,SAR指标不适用于反复震荡行情中,因为此时SAR指标的买卖信号十分频繁,容易造成损失。

第三,SAR指标和K线之间的距离越长,显示当前的上涨或者下跌行情越强势。

关于SAR指标的相关内容我们就讲到这里。下节课程,我们开始讲TD指标。

© 2025 OKX。 本文可以全文复制或分发,或使用不超过 100 字的摘录,前提是此类使用仅限非商业用途。对全文的复制或分发必须明确注明:“本文版权所有 © 2025 OKX,经许可使用。” 允许的摘录必须标明文章标题并注明出处,例如“文章标题,作者姓名 (如适用) ,© 2025 OKX”。不允许对本文进行任何衍生作品或其他用途。

相关信息:数字资产交易服务由 OKX Australia Pty Ltd (ABN 22 636 269 040) 提供;关于衍生品和杠杆交易的信息由 OKX Australia Financial Pty Ltd (ABN 14 145 724 509,AFSL 379035) 提供,仅适用于《2001年公司法》(Cth) 下定义的大额客户;其他产品和服务由提供这些产品和服务的相关 OKX 实体提供 (请参阅服务条款)。

本文所含信息仅为一般性信息,不应视为投资建议、个人推荐或购买任何加密货币或相关产品的要约或招揽。在做出决策前,您应自行进行研究并寻求专业建议,确保理解相关产品的风险。过去的表现并不代表未来的结果,切勿承担超过您能够承受的损失风险。如需了解更多信息,请阅读我们的服务条款和风险披露和免责声明。

本内容翻译与英文版本不一致时,以英文版本为准。