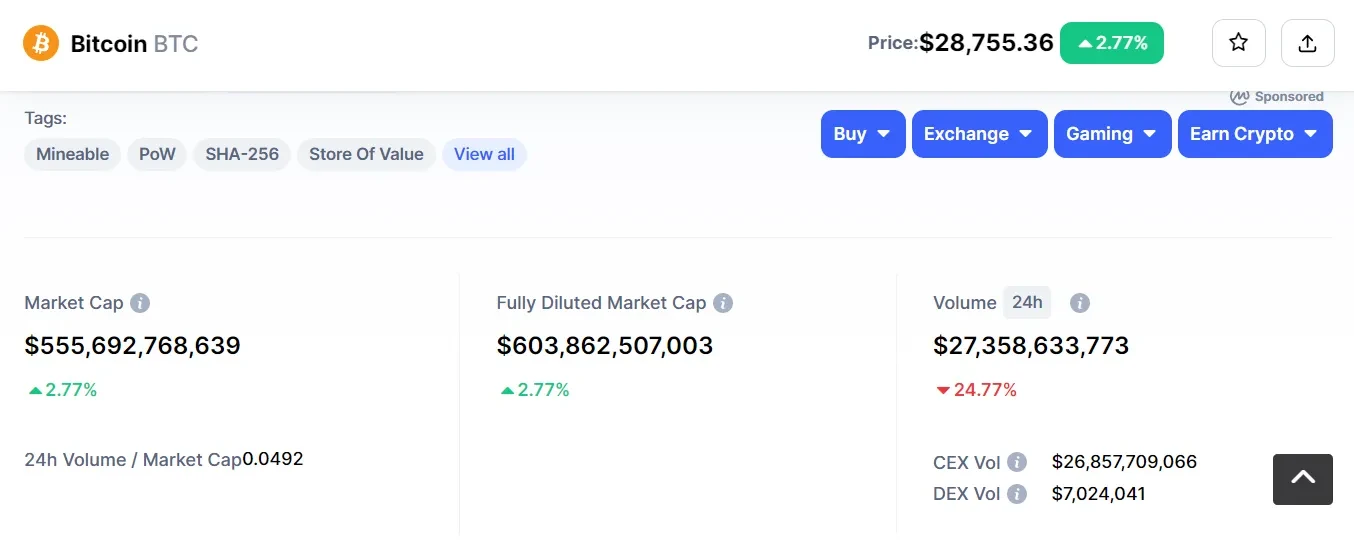

Bitcoin (BTC) is the world's most traded and largest cryptocurrency. With a current market capitalization of over $543 billion, Bitcoin has the largest share of the entire cryptocurrency market.

This guide explains what Bitcoin dominance is, how to calculate it, the factors that influence it, and other related details.

What Is Bitcoin dominance?

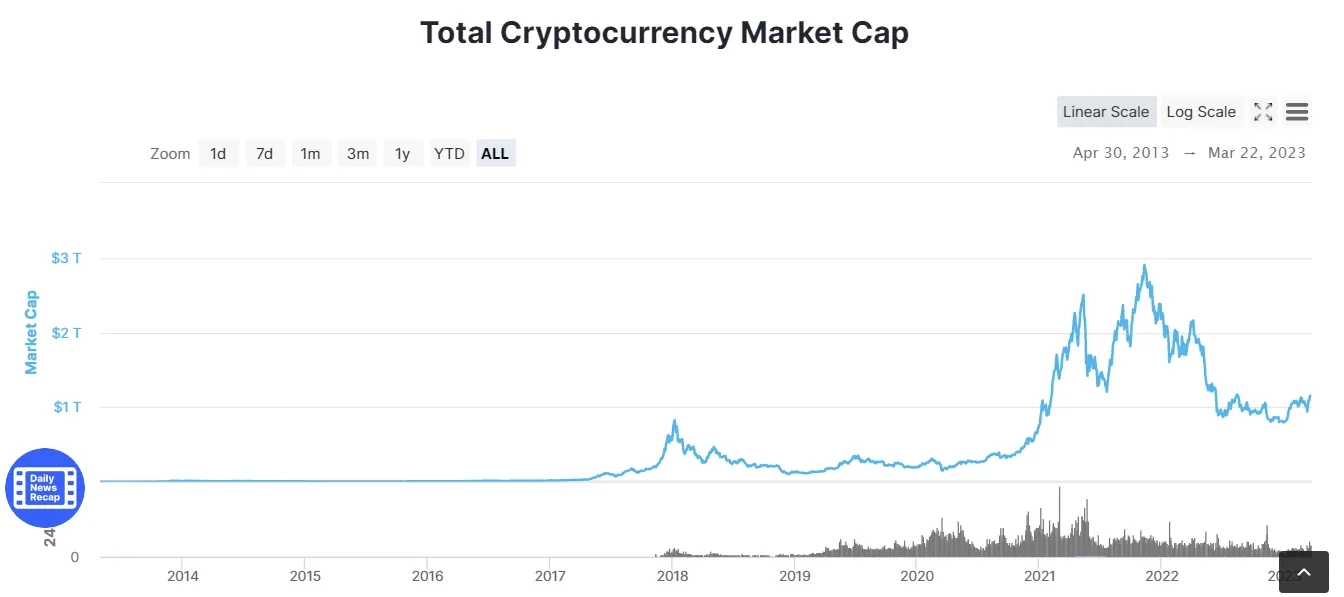

In simple terms, Bitcoin dominance is the ratio of BTC's market capitalization compared to the entire crypto market cap. Better still, it is the percentage of Bitcoin’s cryptocurrency market share from the total market capitalization of all existing cryptocurrencies. Total market capitalization refers to the total market value of all cryptocurrencies. An asset's market cap is determined by multiplying the asset's total supply by its current price.

Many years ago, Bitcoin had 100% of the entire crypto market share, as there was a period in which it was the only tradeable asset. But with the introduction of Ethereum and other altcoins, Bitcoin dominance continued to drop. However, despite the thousands of altcoins on the market, Bitcoin's dominance is yet to be topped.

How Is BTC market dominance calculated?

Due to the cryptos volatile nature, Bitcoin’s dominance isn't fixed and is ever changing. For instance, at the end of March 2023, Bitcoin’s market cap was about $543 billion. At the same time, the global crypto market cap was $1.18 trillion.

The Bitcoin dominance is the percentage that is calculated by dividing Bitcoin’s market share by the total market capitalization. Let's do the maths below:

Bitcoin Market Cap ($543 billion) ÷ Global Crypto Market Cap ($1.18 trillion) x 100% = 46%. In this example, the BTC dominance ratio as a percentage is 46%.

However, there's also a term called "Real BTC Dominance”. In this case, traders don't compare BTC's market cap with the global crypto market. Instead, it's compared with the combined market cap of proof-of-work cryptocurrencies. Some of these include Litecoin, Dogecoin and Bitcoin Cash. This method narrows BTC's performance to similar cryptocurrencies.

The relationship between Bitcoin dominance and market cap

Bitcoin dominance allows crypto traders to understand the trend of BTC and altcoins like Ethereum. Since BTC has the largest market share, it's easy to see the influence Bitcoin has on other altcoins. BTC's dominance has an inverse relationship with the market cap of other coins.

For instance, when Bitcoin dominance increases, the total market share of other cryptocurrencies reduces in value. Similarly, when BTC dominance reduces, the altcoin dominance increases.

Factors influencing Bitcoin dominanceAs stated earlier, Bitcoin dominance isn't fixed. The value changes from time to time due to various factors. Some of these influencing factors are highlighted below:

Market volatility

Arguably the most influential factor affecting Bitcoin's dominance is the market's volatility. As previously mentioned, the cryptocurrency market is highly volatile. This means the total market cap, including Bitcoin, experiences drastic changes. However, Bitcoin's market dominance can increase even when the total market cap plummets. It ultimately depends on the price movement of the altcoin market. If the value of altcoins takes a greater hit than Bitcoin's, then the Bitcoin dominance will likely rise.

Altcoin performance

Since Ethereum launched in 2015, thousands of other altcoins and tokens have been created. Before this time, Bitcoin was the only primary digital currency, so it enjoyed the entire market share. However, with the addition of more altcoins, the dominance of Bitcoin has been negatively impacted, especially as these assets increase in adoption and price.

Stablecoin popularity

While BTC is one of the most popular cryptocurrencies, its price volatility means investors move their funds from the asset during downturns. They turn to stablecoins. Stablecoins like Tether (USDT) have their values pegged to real-world assets like the USD, gold, and other assets. Because of this, assets like Tether, USD Coin (USDC), and Binance USD (BUSD) have grown in popularity.

Risk-averse investors prefer to use these stablecoins as a store of value during periods of extreme volatility. Investors tend to do this since price swings hardly impact the price of stablecoins. Therefore, as they become more prominent among investors, their market presence increases, negatively impacting BTC dominance

What are the uses of BTC dominance?

Crypto traders use Bitcoin dominance for a variety of reasons. Some of them include the following:

Risk-aversion

When the Bitcoin dominance increases in value, traders are treading cautiously. This implies they're taking money from risky altcoins and putting it into a more stable asset like Bitcoin. This usually happens during downturns within the market as investors look to hedge their portfolios against decline.

Tradeable

Besides being an indicator, the Bitcoin dominance index is also tradable on major cryptocurrency exchanges. It's offered as BTCDOM/USDT in its perpetual futures market. With this, traders can trade Bitcoin's market dominance.

Track market performance

Bitcoin is widely viewed as a measure of the performance of the total market cap in the crypto space. Given this, the broader crypto market capitalization tends to dip when the Bitcoin Dominance Index increases. However, when the BTC Dominance drops, the broader market sees a major uptrend due to increased investment in alternative digital assets like Ethereum, Shiba Inu, and others.

How to trade crypto using BTC dominance

Trading with BTC dominance is a common practice. The common way to trade crypto using BTC dominance is to identify periods in which altcoins outperform Bitcoin, otherwise known as Altcoin season.

Altcoin season occurs when altcoins experience a significant rise in prices while Bitcoin price stalls for a long period. This often leads to investors plowing their funds in these altcoins and kickstarting an uptrend in prices.

Investors can identify such periods by using the TradingView Bitcoin Dominance Index. This compares the BTC market capitalization relative to other cryptocurrencies. The end product helps show whether to buy BTC or if altcoins have a stronger trend in the financial landscape.

In the chart presented below, Bitcoin dominance is significantly rising, showing that an altcoin season is not in play.

Similarly, BTC dominance can be used to trade or predict cryptocurrency market extremes. When the BTC dominance ratio is very high, history shows that the coin’s price may fall. In contrast, low dominance suggests that the BTC price may experience an uptrend. As such, investors can use this data to determine when to buy or sell BTC.

Is the Bitcoin dominance a reliable indicator?

Bitcoin dominance is a common crypto trading analysis tool among investors. It can be a viable tool to identify the market trend since it reflects BTC's strength relative to the broader market. It also provides useful insights into changing market conditions and when to adjust trading strategies. However, like other market data and trends, it does not guarantee that Bitcoin and other altcoins will react in a certain manor. Instead, the Bitcoin dominance index should be used as a guide alongside other market indicators.

In addition, the crypto market is still witnessing the launch of several more altcoin projects. The more altcoins there are, the less dominance BTC will enjoy due to the increased market share of these projects. This could shrink the market dominance of Bitcoin as more altcoins appear. Nonetheless, it still holds a strong position in the market and can still be used in identifying profitable trading positions.

FAQ

What is the Bitcoin dominance index?

The BTC dominance index is a cryptocurrency market analysis tool. The tool helps investors determine the market trend between Bitcoin and altcoins or other proof-of-work coins.

Why is BTC dominance important?

BTC Dominance is crucial because it can provide insight into market trends. This way, when the BTC Dominance increases, it signals that investors are playing safe and hedging against riskier assets. When the BTC Dominance drops, it could suggest that investors are taking on riskier assets in hopes of higher profits. This helps traders get a snapshot of the overall market sentiment at a glance.

Where to check the BTC dominance chart?

The common place to find the Bitcoin dominance chart is on TradingView. Alternatively, users can use the chart available on CoinMarketCap.

How long does BTC dominance last?

BTC dominance will last as long as Bitcoin remains the most valuable digital currency. However, the coin's dominance fluctuates from time to time.

How is Bitcoin dominance calculated?

Bitcoin dominance is calculated by dividing Bitcoin’s market cap by the total market cap of all cryptocurrencies, then multiplying by 100%. This gives a percentage value which represents Bitcoin's share of the total crypto market.

What factors influence Bitcoin dominance?

Several factors can affect Bitcoin dominance, including market volatility, the performance of altcoins, and the popularity of stablecoins. Market volatility can result in drastic changes in the market caps of all cryptocurrencies, including Bitcoin. Altcoin performance and the introduction of new altcoins can decrease Bitcoin's dominance, and the increased use of stablecoins can also impact Bitcoin's share of the total market.

What does Bitcoin dominance tell us?

Bitcoin dominance is a measure of Bitcoin's market share compared to the entire crypto market. When Bitcoin's dominance increases, it indicates that investors may be moving their funds into Bitcoin as a safer investment compared to other cryptocurrencies. Conversely, a decrease in Bitcoin dominance could signal that investors are taking on riskier investments in altcoins.

What is real BTC dominance?

Real BTC Dominance is a term used to describe a measure of Bitcoin's market cap compared to the combined market cap of proof-of-work cryptocurrencies like Litecoin, Dogecoin, and Bitcoin Cash. This method provides a narrower comparison of Bitcoin's performance to similar cryptocurrencies.

Is the Bitcoin dominance a reliable indicator?

Bitcoin dominance can provide valuable insights into market trends and can be a useful tool for traders. However, like all market indicators, it is not infallible and should be used in conjunction with other market data and trends.

How to use BTC dominance for crypto trading?

BTC dominance is commonly used to identify the altcoin season - periods when altcoins outperform Bitcoin. If the BTC dominance is falling, this could signal an altcoin season, and traders may decide to invest in altcoins. Conversely, a rising BTC dominance could indicate a favorable market for Bitcoin.

What does the increase in stablecoin popularity mean for BTC dominance?

The rise in stablecoin popularity can negatively impact BTC dominance. During periods of high market volatility, investors often move their funds into stablecoins, which have their values pegged to real-world assets. This can result in a decrease in Bitcoin's market share.

What are the implications of more altcoins launching on BTC dominance?

The launch of more altcoins could potentially decrease Bitcoin's market dominance, as these new coins increase the total market cap of all cryptocurrencies. However, Bitcoin's dominance could remain high if it continues to be seen as a more stable or reliable investment compared to these new altcoins.

Disclaimer:

THIS ARTICLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. IT IS NOT INTENDED TO PROVIDE ANY INVESTMENT, TAX, OR LEGAL ADVICE, NOR SHOULD IT BE CONSIDERED AN OFFER TO PURCHASE OR SELL OR HOLD DIGITAL ASSETS. DIGITAL ASSET HOLDINGS, INCLUDING STABLECOINS, INVOLVE A HIGH DEGREE OF RISK, CAN FLUCTUATE GREATLY, AND CAN EVEN BECOME WORTHLESS. YOU SHOULD CAREFULLY CONSIDER WHETHER TRADING OR HOLDING DIGITAL ASSETS IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PLEASE CONSULT YOUR LEGAL/TAX/INVESTMENT PROFESSIONAL FOR QUESTIONS ABOUT YOUR SPECIFIC CIRCUMSTANCES.

© 2025 OKX。 本文可以全文复制或分发,或使用不超过 100 字的摘录,前提是此类使用仅限非商业用途。对全文的复制或分发必须明确注明:“本文版权所有 © 2025 OKX,经许可使用。” 允许的摘录必须标明文章标题并注明出处,例如“文章标题,作者姓名 (如适用) ,© 2025 OKX”。不允许对本文进行任何衍生作品或其他用途。

相关信息:数字资产交易服务由 OKX Australia Pty Ltd (ABN 22 636 269 040) 提供;关于衍生品和杠杆交易的信息由 OKX Australia Financial Pty Ltd (ABN 14 145 724 509,AFSL 379035) 提供,仅适用于《2001年公司法》(Cth) 下定义的大额客户;其他产品和服务由提供这些产品和服务的相关 OKX 实体提供 (请参阅服务条款)。

本文所含信息仅为一般性信息,不应视为投资建议、个人推荐或购买任何加密货币或相关产品的要约或招揽。在做出决策前,您应自行进行研究并寻求专业建议,确保理解相关产品的风险。过去的表现并不代表未来的结果,切勿承担超过您能够承受的损失风险。如需了解更多信息,请阅读我们的服务条款和风险披露和免责声明。

本内容翻译与英文版本不一致时,以英文版本为准。