看跌日历价差策略

一、定义:

看跌日历价差策略,也是期权交易策略的一种,它指的是用户同时以相同行权价和数量买入较晚到期的看跌期权并卖出较早到期的看跌期权的一种操作方式。

二、获利方式:

在期权交易市场,越接近期权到期日,时间对价格变动的影响也会越大。一般来说,交易者卖出的较短期限的期权价值将会比交易者持有的较长期限的期权价值下降地更快(时间衰减),交易者因此从中获取利润。在其他外在条件(如现货价格、隐含波动率及时间优惠率等)没有巨幅变动的情况下,这种关系将保持不变。

此外,一般来讲,较长期限内波动率上升,而较短期限内波动率下降,不同到期日的期权的波动率变化会造成部分误差定价,这也就是广义上理解的波动率的期限结构:根据同币种的期权的不同到期日,波动率变化所造成的定价是不同的,这也是交易者获利的空间。

对于看跌日历价差策略的买方来说,通常情况下,交易者会按照预期在短腿到期时平仓,以减轻到期日临近和期限结构变化带来的潜在波动率所造成的影响。如果交易一直保持开放,直到长腿到期,看涨日历价差策略就会自动转变成看跌策略,这也意味着交易者只期望从价格变化中获利。

从看跌日历价差策略的卖方视角来看,他们可能认为对波动率期限结构的预测是一种过度反应。交易者可以通过卖出该策略获取更高的溢价,但也会面临着市场变化与其预期相反的风险。

理论上,在期限结构或者波动率的影响下,此策略的最大收益和亏损是没有上限的。

这些底层逻辑,和看涨日历价差策略基本一致。

三、交易细节:

执行此策略需满足以下条件:

1)两条腿的数量相同,即:

买入1个价内看跌期权 Buy 1 ATM call option (腿1)

卖出1个价内看跌期权 Sell 1 ATM call option (腿2)

2)两条腿的执行价相同,但是到期日不同

提示一:关于保证金规则

做多:满足做空看涨期权(腿2)初始保证金及维持保证金率的要求

做空:满足做空看涨期权(腿1)初始保证金及维持保证金率的要求

组合保证金模式:由于腿1和腿2是相关的,所以会抵消一些风险,对于保证金的要求也会降低

提示二:关于净策略价值

做多:腿1权利金(卖方报价)(较晚到期) – 腿2权利金(买方报价)(较早到期)

做空:腿2权利金(卖方报价)(较早到期)- 腿1权利金(买方报价)(较晚到期)

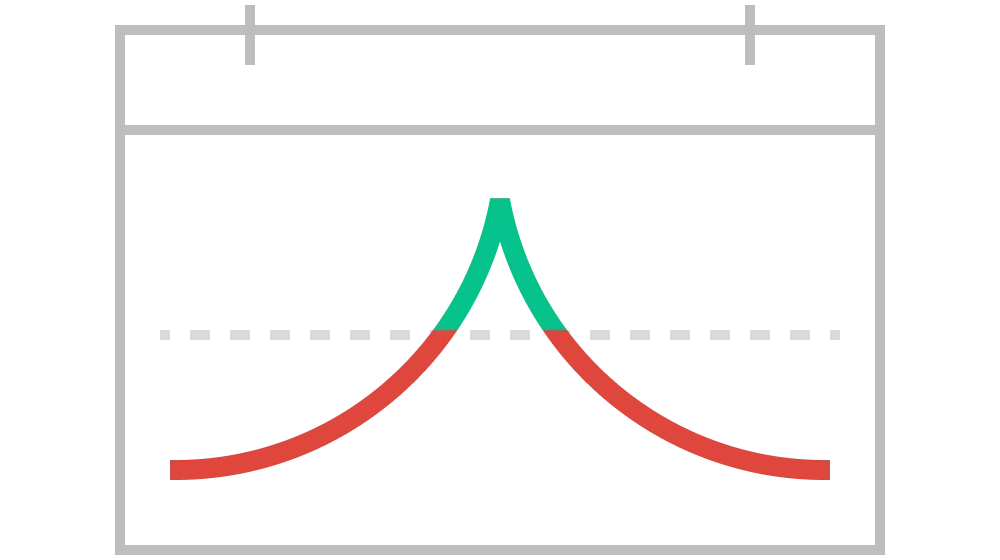

提示三:关于收益曲线图

四、具体的交易示例:

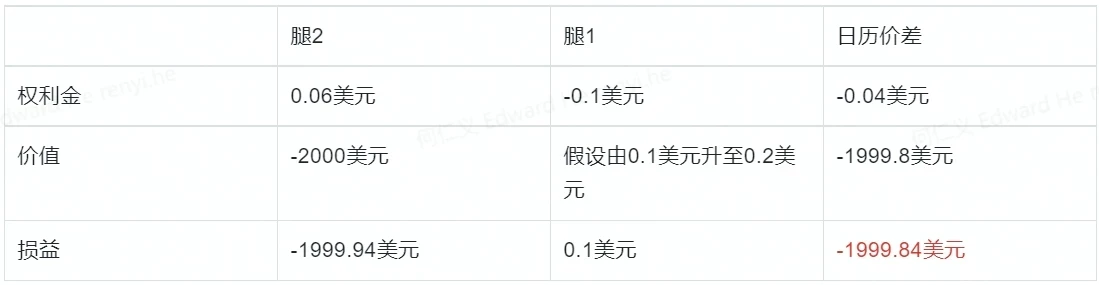

假设在一次执行该策略的交易中,交易细节如下表所示:

那么,就会存在以下3种情况 —

情况一(价内情况):

BTC在腿2到期日价格:18000美元,则:

通常情况下,交易者会按照预期在短腿到期时平仓,所以在腿2到期日,

总亏损为:净策略价值 +(执行价格2-到期时的价格2)-腿1在腿2到期时的权利金

情况二(价格没变动):

BTC在腿2到期日价格:20000美元,则:

因为两条腿都处于价平(at-the-money, ATM),会产生策略净价的损失,交易者通常会在腿2到期时平仓,即:

总收益为:腿1在腿2到期时的权利金- 净策略价值

(腿1在腿2到期时的权利金:腿1原本价格-腿1时间衰减)

在这种情况下,我们假设腿1的其他指标都几乎保持不变,并且大于(不保证)腿2的溢价。交易者可以收集腿1和腿2的由于时间衰减所造成的价差,也因此从中获利。

情况三(最坏情况):

当腿2到期时,做空的腿在价内(in-the-money, ITM),做多的腿在价外(out-the-money, OTM)

BTC在腿1到期日价格:25000美元(到期时的价格1)

BTC在腿2到期日价格:15000美元 (到期时的价格2) ,则:

通常情况下,交易者会按照预期在短腿到期时平仓,所以在腿2到期日,

总亏损为:净策略价值 +(执行价格2-到期时的价格2)-腿1在腿2到期时的权利金

© 2025 OKX。 本文可以全文复制或分发,或使用不超过 100 字的摘录,前提是此类使用仅限非商业用途。对全文的复制或分发必须明确注明:“本文版权所有 © 2025 OKX,经许可使用。” 允许的摘录必须标明文章标题并注明出处,例如“文章标题,作者姓名 (如适用) ,© 2025 OKX”。不允许对本文进行任何衍生作品或其他用途。

相关信息:数字资产交易服务由 OKX Australia Pty Ltd (ABN 22 636 269 040) 提供;关于衍生品和杠杆交易的信息由 OKX Australia Financial Pty Ltd (ABN 14 145 724 509,AFSL 379035) 提供,仅适用于《2001年公司法》(Cth) 下定义的大额客户;其他产品和服务由提供这些产品和服务的相关 OKX 实体提供 (请参阅服务条款)。

本文所含信息仅为一般性信息,不应视为投资建议、个人推荐或购买任何加密货币或相关产品的要约或招揽。在做出决策前,您应自行进行研究并寻求专业建议,确保理解相关产品的风险。过去的表现并不代表未来的结果,切勿承担超过您能够承受的损失风险。如需了解更多信息,请阅读我们的服务条款和风险披露和免责声明。

本内容翻译与英文版本不一致时,以英文版本为准。