AAVE

AAVE-pris

$239,16

+$15,4100

(+6,88 %)

Prisförändring de senaste 24 timmarna

Hur känner du för AAVE idag?

Dela dina känslor här genom att göra tummen upp om du känner dig bullish för coin eller tummen ner om du känner dig bearish.

Rösta för att visa resultat

Friskrivningsklausul

Det sociala innehållet på den här sidan ("Innehållet"), inklusive men inte begränsat till tweets och statistik som tillhandahålls av LunarCrush, kommer från tredje part och tillhandahålls " i befintligt skick" och endast i informationssyfte. OKX garanterar inte innehållets kvalitet eller sanningshalt, och innehållet representerar inte OKX:s åsikter. Det är inte avsett att tillhandahålla (i) investeringsrådgivning eller -rekommendationer; (ii) ett erbjudande eller en uppmaning att köpa, sälja eller inneha digitala tillgångar; eller (iii) finansiell, redovisnings-, juridisk eller skatterådgivning. Digitala tillgångar, inklusive stabil kryptovaluta och NFT:er, innebär en hög grad av risk och kan fluktuera kraftigt. Priset och prestandan för den digitala tillgången är inte garanterade och kan ändras utan föregående meddelande.<br>OKX tillhandahåller inga rekommendationer om investeringar eller tillgångar. Du bör noga överväga om handel eller innehav av digitala tillgångar är lämpligt för dig, med tanke på din ekonomiska situation. Vänligen rådfråga en juridisk-/skatte-/investeringsrådgivare för frågor om just dina specifika omständigheter. För mer information, vänligen se våra <a href="/help/terms-of-service">Användarvillkor</a> och <a href="/help/risk-compliance-disclosure">Riskvarning</a>. Genom att använda tredjepartswebbplatsen (”third-party website/TPW”) godkänner du att all användning av TPW kommer att omfattas av och regleras av villkoren i TPW. Om inte annat uttryckligen anges skriftligen är OKX och dess dotterbolag ( OKX ) inte på något sätt associerade med ägaren eller operatören av TPW. Du samtycker till att OKX inte är ansvarigt eller skyldigt för någon förlust, skada eller andra konsekvenser som uppstår på grund av din användning av TPW. Vänligen observera om att användning av en TPW kan resultera i förlust eller minskning av dina tillgångar. Produkten kanske inte är tillgänglig i alla jurisdiktioner.

AAVE marknadsinfo

Marknadsvärde

Marknadsvärde beräknas genom att multiplicera det cirkulerande utbudet av ett coin med dess senaste pris.

Börsvärde = Cirkulerande utbud × Senaste pris

Börsvärde = Cirkulerande utbud × Senaste pris

Cirkulerande utbud

Totalt belopp för ett coin som är allmänt tillgängligt på marknaden.

Marknadsvärde-rankning

Ett coins rankning i termer av marknadsvärde.

Högsta någonsin

Högsta pris ett coin har nått i sin handelshistorik.

Lägsta någonsin

Lägsta pris ett coin har nått i sin handelshistorik.

Marknadsvärde

$3,62B

Cirkulerande utbud

15 116 963 AAVE

94,48 % av

16 000 000 AAVE

Marknadsvärde-rankning

27

Granskningar

Senaste granskningen: 2 dec. 2020

Högsta priset under 24 tim

$244,05

Lägsta priset under 24 tim

$219,87

Högsta någonsin

$665,71

−64,08 % (-$426,55)

Senast uppdaterad: 19 maj 2021

Lägsta någonsin

$25,9300

+822,32 % (+$213,23)

Senast uppdaterad: 5 nov. 2020

AAVE-flödet

Följande innehåll är hämtat från .

BCheque

Ingen lögn, detta var en del av min investeringstes

Det är ett foto, och ett foto kan vara en del av en investeringstes

När jag pratade med @legendarygainz_ insåg jag att de flesta människor inte kan känna igen människor eftersom vi är på X så mycket

Du ser ett foto med

- Stani från Aave

- Kille från Ethena

- Jeff från Hyperliquid

- Bing från Megaeth

- Taiki från Steady Lads

- SPÅR AV VITALIK

- och @infinex grundaren Kain som har en runda öppen

wdyd?

Tryck på Köp på den investerbara rundan (efter att ha gjort lite mer research)

Visa original13,95 tn

43

𝔏𝔲𝔨𝔢🥝

$123,456,789

Marc “Billy” Zeller 👻 🦇🔊

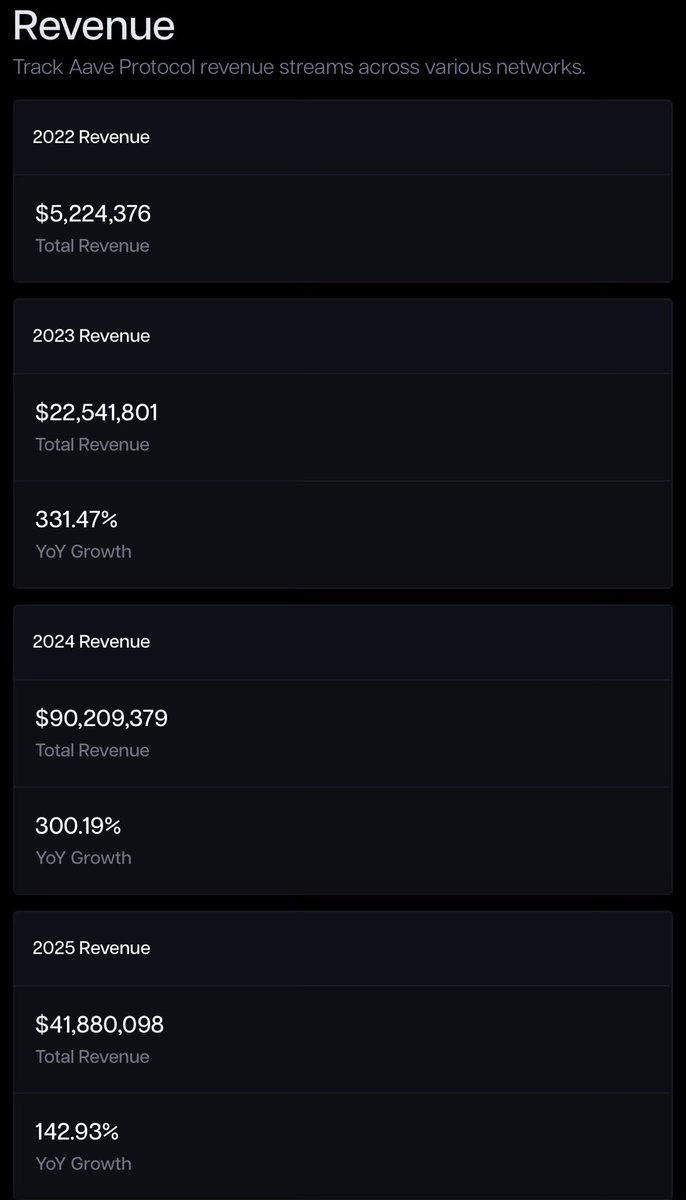

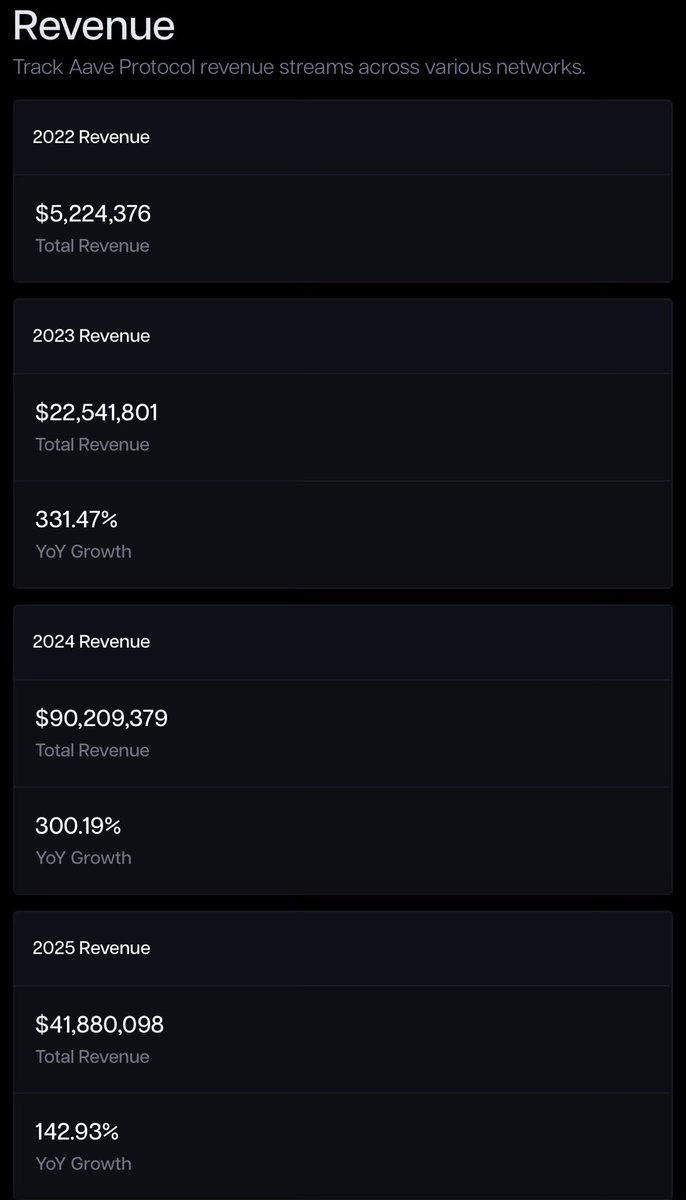

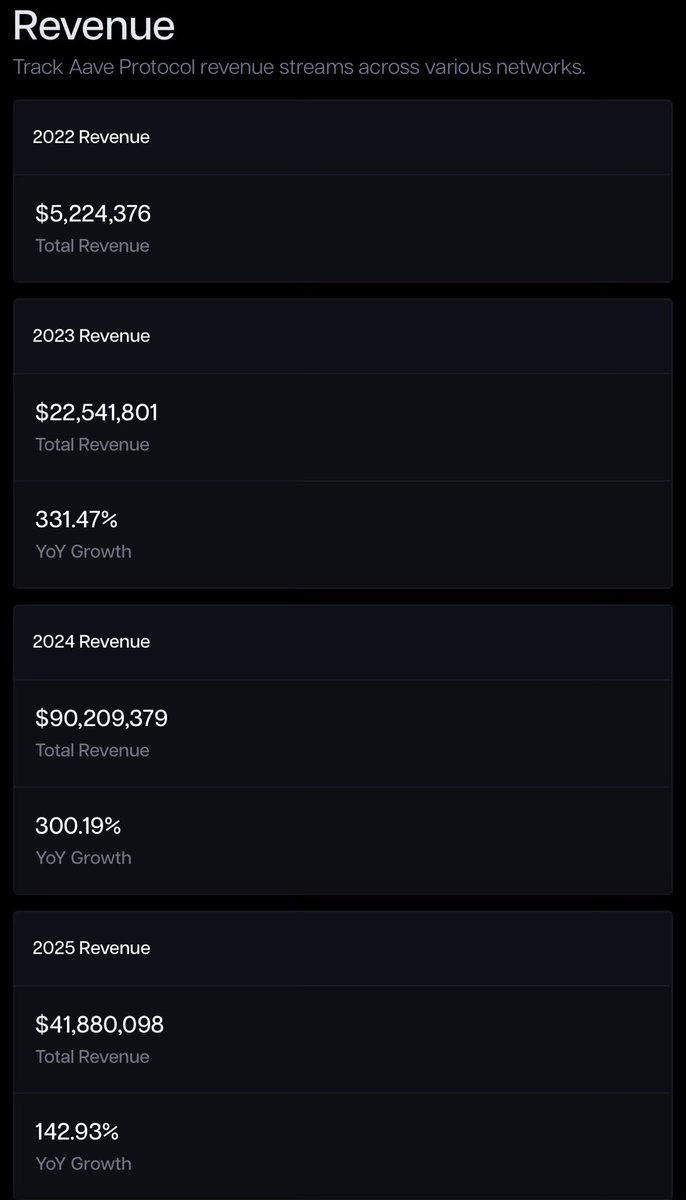

Aave DAO:s intäktstillväxt ignorerar tjur- eller björncykler genom att anta en doktrin om endast uppgång.

Vad tror du att våra intäkter kommer att sluta på i slutet av 2025?

Jag ger 2500 GHO och $2500 värde av $AAVE till närmaste svar och en person som retweetar detta.

Använd bara Aave.

3,08 tn

1

CupoJoseph 🐌

Aave är den viktigaste innovationen i antal gå upp bara teknik i decennier.

Jag förväntar mig fullt ut att Aave snart kommer att vara en av de största finansinstituten i världen.

Marc “Billy” Zeller 👻 🦇🔊

Aave DAO:s intäktstillväxt ignorerar tjur- eller björncykler genom att anta en doktrin om endast uppgång.

Vad tror du att våra intäkter kommer att sluta på i slutet av 2025?

Jag ger 2500 GHO och $2500 värde av $AAVE till närmaste svar och en person som retweetar detta.

Använd bara Aave.

3,51 tn

5

Marc “Billy” Zeller 👻 🦇🔊

Aave DAO:s intäktstillväxt ignorerar tjur- eller björncykler genom att anta en doktrin om endast uppgång.

Vad tror du att våra intäkter kommer att sluta på i slutet av 2025?

Jag ger 2500 GHO och $2500 värde av $AAVE till närmaste svar och en person som retweetar detta.

Använd bara Aave.

Visa original

30,38 tn

201

AAVE-kalkylator

AAVE prisutveckling i USD

Aktuellt pris på AAVE är $239,16. Under de senaste 24 timmarna har AAVE ökade med +6,89 %. Det har för närvarande ett cirkulerande utbud av 15 116 963 AAVE och ett maximalt utbud av 16 000 000 AAVE, vilket ger ett marknadsvärde efter full utspädning på $3,62B. För tillfället innehar AAVE-coin position 27 i marknadsvärdesrankningar. AAVE/USD-priset uppdateras i realtid.

Idag

+$15,4100

+6,88 %

7 dagar

+$22,7000

+10,48 %

30 dagar

+$100,04

+71,90 %

3 månader

-$25,4700

−9,63 %

Populära AAVE-omvandlingar

Senast uppdaterad: 2025-05-19 01:46

| 1 AAVE till USD | 239,29 $ |

| 1 AAVE till EUR | 214,38 € |

| 1 AAVE till PHP | 13 353,22 ₱ |

| 1 AAVE till IDR | 3 946 726 Rp |

| 1 AAVE till GBP | 180,15 £ |

| 1 AAVE till CAD | 334,30 $ |

| 1 AAVE till AED | 878,91 AED |

| 1 AAVE till VND | 6 202 436 ₫ |

Om AAVE (AAVE)

Betyget som anges är ett sammanställt betyg som inhämtats av OKX från källorna som anges, och det anges endast för informativa syften. OKX garanterar inte betygens kvalitet eller korrekthet. Det är inte avsett att utgöra (i) investeringsrådgivning eller rekommendation, (ii) ett erbjudande eller en uppmaning att köpa, sälja eller inneha digitala tillgångar, eller (iii) finansiell, redovisningsmässig, juridisk eller skattemässig rådgivning. Digitala tillgångar, inklusive stabil kryptovaluta och NFT:er, omfattas av hög risk, kan skifta kraftigt och till och med bli värdelösa. Priset och prestanda för de digitala tillgångarna garanteras inte, och de kan förändras utan föregående meddelande. Dina digitala tillgångar täcks inte av försäkran mot potentiella förluster. Historisk avkastning är ingen garanti om framtida avkastning. OKX garanterar inte någon avkastning, återbetalning av huvudbelopp eller ränta. OKX tillhandahåller inga rekommendationer om investeringar eller tillgångar. Du bör noga överväga om handel med eller innehav av digitala tillgångar är lämpligt för dig med hänsyn till din ekonomiska situation. Rådgör med din jurist, skatteexpert eller investeringsrådgivare om du har frågor om dina specifika omständigheter.

Visa mer

- Officiell webbplats

- Vitbok

- Github

- Block explorer

Om tredjeparts webbplatser

Om tredjeparts webbplatser

Genom att använda tredjepartswebbplatsen (”TPW”) samtycker du till att all användning av TPW kommer att omfattas av och styras av villkoren i TPW. Om inte annat uttryckligen anges skriftligen är OKX och dess affiliates (”OKX”) inte på något sätt associerade med ägaren eller operatören av TPW. Du samtycker till att OKX inte är ansvarigt eller skadeståndsskyldigt för förlust, skada eller andra konsekvenser som uppstår till följd av din användning av TPW. Var medveten om att användning av en TPW kan leda till förlust eller minskning av dina tillgångar.

Vanliga frågor för AAVE

Hur mycket är 1 AAVE värd idag?

För närvarande är en AAVE värd $239,16. För svar och insikt om prisåtgärder för AAVE är du på rätt plats. Utforska de senaste diagrammen för AAVE och handla ansvarsfullt med OKX.

Vad är kryptovalutor?

Kryptovalutor, till exempel AAVE, är digitala tillgångar som fungerar på en offentlig reskontra som kallas blockkedjor. Läs mer om coins och tokens som erbjuds på OKX och deras olika attribut, som inkluderar live-priser och realtidsdiagram.

När uppfanns kryptovalutor?

Tack vare finanskrisen 2008 ökade intresset för decentraliserad finansiering. Bitcoin erbjöd en ny lösning genom att vara en säker digital tillgång på ett decentraliserat nätverk. Sedan dess har många andra tokens som t.ex. AAVE skapats också.

Kommer priset på AAVE gå upp idag?

Se vår AAVE prisprognossida för att förutse framtida priser och fastställa dina prismål.

ESG-upplysning

ESG-regleringar (Environmental, Social och Governance) för kryptotillgångar syftar till att ta itu med eventuell miljöpåverkan (t.ex. energiintensiv mining), främja transparens och säkerställa etiska förvaltningsmetoder för att anpassa kryptoindustrin till bredare hållbarhets- och samhälleliga mål. Dessa regleringar uppmuntrar efterlevnad av standarder som minskar risker och främjar förtroende för digitala tillgångar.

Tillgångsdetaljer

Namn

OKcoin Europe LTD

Relevant juridisk enhetsidentifierare

54930069NLWEIGLHXU42

Namn på kryptotillgången

Aave Token

Konsensusmekanism

Aave Token is present on the following networks: avalanche, binance_smart_chain, ethereum, gnosis_chain, huobi, near_protocol, polygon, solana.

The Avalanche blockchain network employs a unique Proof-of-Stake consensus mechanism called Avalanche Consensus, which involves three interconnected protocols: Snowball, Snowflake, and Avalanche. Avalanche Consensus Process 1. Snowball Protocol: o Random Sampling: Each validator randomly samples a small, constant-sized subset of other validators. Repeated Polling: Validators repeatedly poll the sampled validators to determine the preferred transaction. Confidence Counters: Validators maintain confidence counters for each transaction, incrementing them each time a sampled validator supports their preferred transaction. Decision Threshold: Once the confidence counter exceeds a pre-defined threshold, the transaction is considered accepted. 2. Snowflake Protocol: Binary Decision: Enhances the Snowball protocol by incorporating a binary decision process. Validators decide between two conflicting transactions. Binary Confidence: Confidence counters are used to track the preferred binary decision. Finality: When a binary decision reaches a certain confidence level, it becomes final. 3. Avalanche Protocol: DAG Structure: Uses a Directed Acyclic Graph (DAG) structure to organize transactions, allowing for parallel processing and higher throughput. Transaction Ordering: Transactions are added to the DAG based on their dependencies, ensuring a consistent order. Consensus on DAG: While most Proof-of-Stake Protocols use a Byzantine Fault Tolerant (BFT) consensus, Avalanche uses the Avalanche Consensus, Validators reach consensus on the structure and contents of the DAG through repeated Snowball and Snowflake.

Binance Smart Chain (BSC) uses a hybrid consensus mechanism called Proof of Staked Authority (PoSA), which combines elements of Delegated Proof of Stake (DPoS) and Proof of Authority (PoA). This method ensures fast block times and low fees while maintaining a level of decentralization and security. Core Components 1. Validators (so-called “Cabinet Members”): Validators on BSC are responsible for producing new blocks, validating transactions, and maintaining the network’s security. To become a validator, an entity must stake a significant amount of BNB (Binance Coin). Validators are selected through staking and voting by token holders. There are 21 active validators at any given time, rotating to ensure decentralization and security. 2. Delegators: Token holders who do not wish to run validator nodes can delegate their BNB tokens to validators. This delegation helps validators increase their stake and improves their chances of being selected to produce blocks. Delegators earn a share of the rewards that validators receive, incentivizing broad participation in network security. 3. Candidates: Candidates are nodes that have staked the required amount of BNB and are in the pool waiting to become validators. They are essentially potential validators who are not currently active but can be elected to the validator set through community voting. Candidates play a crucial role in ensuring there is always a sufficient pool of nodes ready to take on validation tasks, thus maintaining network resilience and decentralization. Consensus Process 4. Validator Selection: Validators are chosen based on the amount of BNB staked and votes received from delegators. The more BNB staked and votes received, the higher the chance of being selected to validate transactions and produce new blocks. The selection process involves both the current validators and the pool of candidates, ensuring a dynamic and secure rotation of nodes. 5. Block Production: The selected validators take turns producing blocks in a PoA-like manner, ensuring that blocks are generated quickly and efficiently. Validators validate transactions, add them to new blocks, and broadcast these blocks to the network. 6. Transaction Finality: BSC achieves fast block times of around 3 seconds and quick transaction finality. This is achieved through the efficient PoSA mechanism that allows validators to rapidly reach consensus. Security and Economic Incentives 7. Staking: Validators are required to stake a substantial amount of BNB, which acts as collateral to ensure their honest behavior. This staked amount can be slashed if validators act maliciously. Staking incentivizes validators to act in the network's best interest to avoid losing their staked BNB. 8. Delegation and Rewards: Delegators earn rewards proportional to their stake in validators. This incentivizes them to choose reliable validators and participate in the network’s security. Validators and delegators share transaction fees as rewards, which provides continuous economic incentives to maintain network security and performance. 9. Transaction Fees: BSC employs low transaction fees, paid in BNB, making it cost-effective for users. These fees are collected by validators as part of their rewards, further incentivizing them to validate transactions accurately and efficiently.

The Ethereum network uses a Proof-of-Stake Consensus Mechanism to validate new transactions on the blockchain. Core Components 1. Validators: Validators are responsible for proposing and validating new blocks. To become a validator, a user must deposit (stake) 32 ETH into a smart contract. This stake acts as collateral and can be slashed if the validator behaves dishonestly. 2. Beacon Chain: The Beacon Chain is the backbone of Ethereum 2.0. It coordinates the network of validators and manages the consensus protocol. It is responsible for creating new blocks, organizing validators into committees, and implementing the finality of blocks. Consensus Process 1. Block Proposal: Validators are chosen randomly to propose new blocks. This selection is based on a weighted random function (WRF), where the weight is determined by the amount of ETH staked. 2. Attestation: Validators not proposing a block participate in attestation. They attest to the validity of the proposed block by voting for it. Attestations are then aggregated to form a single proof of the block’s validity. 3. Committees: Validators are organized into committees to streamline the validation process. Each committee is responsible for validating blocks within a specific shard or the Beacon Chain itself. This ensures decentralization and security, as a smaller group of validators can quickly reach consensus. 4. Finality: Ethereum 2.0 uses a mechanism called Casper FFG (Friendly Finality Gadget) to achieve finality. Finality means that a block and its transactions are considered irreversible and confirmed. Validators vote on the finality of blocks, and once a supermajority is reached, the block is finalized. 5. Incentives and Penalties: Validators earn rewards for participating in the network, including proposing blocks and attesting to their validity. Conversely, validators can be penalized (slashed) for malicious behavior, such as double-signing or being offline for extended periods. This ensures honest participation and network security.

Gnosis Chain – Consensus Mechanism Gnosis Chain employs a dual-layer structure to balance scalability and security, using Proof of Stake (PoS) for its core consensus and transaction finality. Core Components: Two-Layer Structure Layer 1: Gnosis Beacon Chain The Gnosis Beacon Chain operates on a Proof of Stake (PoS) mechanism, acting as the security and consensus backbone. Validators stake GNO tokens on the Beacon Chain and validate transactions, ensuring network security and finality. Layer 2: Gnosis xDai Chain Gnosis xDai Chain processes transactions and dApp interactions, providing high-speed, low-cost transactions. Layer 2 transaction data is finalized on the Gnosis Beacon Chain, creating an integrated framework where Layer 1 ensures security and finality, and Layer 2 enhances scalability. Validator Role and Staking Validators on the Gnosis Beacon Chain stake GNO tokens and participate in consensus by validating blocks. This setup ensures that validators have an economic interest in maintaining the security and integrity of both the Beacon Chain (Layer 1) and the xDai Chain (Layer 2). Cross-Layer Security Transactions on Layer 2 are ultimately finalized on Layer 1, providing security and finality to all activities on the Gnosis Chain. This architecture allows Gnosis Chain to combine the speed and cost efficiency of Layer 2 with the security guarantees of a PoS-secured Layer 1, making it suitable for both high-frequency applications and secure asset management.

The Huobi Eco Chain (HECO) blockchain employs a Hybrid-Proof-of-Stake (HPoS) consensus mechanism, combining elements of Proof-of-Stake (PoS) to enhance transaction efficiency and scalability. Key Features of HECO's Consensus Mechanism: 1. Validator Selection: HECO supports up to 21 validators, selected based on their stake in the network. 2. Transaction Processing: Validators are responsible for processing transactions and adding blocks to the blockchain. 3. Transaction Finality: The consensus mechanism ensures quick finality, allowing for rapid confirmation of transactions. 4. Energy Efficiency: By utilizing PoS elements, HECO reduces energy consumption compared to traditional Proof-of-Work systems.

The NEAR Protocol uses a unique consensus mechanism combining Proof of Stake (PoS) and a novel approach called Doomslug, which enables high efficiency, fast transaction processing, and secure finality in its operations. Here's an overview of how it works: Core Concepts 1. Doomslug and Proof of Stake: - NEAR's consensus mechanism primarily revolves around PoS, where validators stake NEAR tokens to participate in securing the network. However, NEAR's implementation is enhanced with the Doomslug protocol. - Doomslug allows the network to achieve fast block finality by requiring blocks to be confirmed in two stages. Validators propose blocks in the first step, and finalization occurs when two-thirds of validators approve the block, ensuring rapid transaction confirmation. 2. Sharding with Nightshade: - NEAR uses a dynamic sharding technique called Nightshade. This method splits the network into multiple shards, enabling parallel processing of transactions across the network, thus significantly increasing throughput. Each shard processes a portion of transactions, and the outcomes are merged into a single "snapshot" block. - This sharding approach ensures scalability, allowing the network to grow and handle increasing demand efficiently. Consensus Process 1. Validator Selection: - Validators are selected to propose and validate blocks based on the amount of NEAR tokens staked. This selection process is designed to ensure that only validators with significant stakes and community trust participate in securing the network. 2. Transaction Finality: - NEAR achieves transaction finality through its PoS-based system, where validators vote on blocks. Once two-thirds of validators approve a block, it reaches finality under Doomslug, meaning that no forks can alter the confirmed state. 3. Epochs and Rotation: - Validators are rotated in epochs to ensure fairness and decentralization. Epochs are intervals in which validators are reshuffled, and new block proposers are selected, ensuring a balance between performance and decentralization.

Polygon, formerly known as Matic Network, is a Layer 2 scaling solution for Ethereum that employs a hybrid consensus mechanism. Here’s a detailed explanation of how Polygon achieves consensus: Core Concepts 1. Proof of Stake (PoS): Validator Selection: Validators on the Polygon network are selected based on the number of MATIC tokens they have staked. The more tokens staked, the higher the chance of being selected to validate transactions and produce new blocks. Delegation: Token holders who do not wish to run a validator node can delegate their MATIC tokens to validators. Delegators share in the rewards earned by validators. 2. Plasma Chains: Off-Chain Scaling: Plasma is a framework for creating child chains that operate alongside the main Ethereum chain. These child chains can process transactions off-chain and submit only the final state to the Ethereum main chain, significantly increasing throughput and reducing congestion. Fraud Proofs: Plasma uses a fraud-proof mechanism to ensure the security of off-chain transactions. If a fraudulent transaction is detected, it can be challenged and reverted. Consensus Process 3. Transaction Validation: Transactions are first validated by validators who have staked MATIC tokens. These validators confirm the validity of transactions and include them in blocks. 4. Block Production: Proposing and Voting: Validators propose new blocks based on their staked tokens and participate in a voting process to reach consensus on the next block. The block with the majority of votes is added to the blockchain. Checkpointing: Polygon uses periodic checkpointing, where snapshots of the Polygon sidechain are submitted to the Ethereum main chain. This process ensures the security and finality of transactions on the Polygon network. 5. Plasma Framework: Child Chains: Transactions can be processed on child chains created using the Plasma framework. These transactions are validated off-chain and only the final state is submitted to the Ethereum main chain. Fraud Proofs: If a fraudulent transaction occurs, it can be challenged within a certain period using fraud proofs. This mechanism ensures the integrity of off-chain transactions. Security and Economic Incentives 6. Incentives for Validators: Staking Rewards: Validators earn rewards for staking MATIC tokens and participating in the consensus process. These rewards are distributed in MATIC tokens and are proportional to the amount staked and the performance of the validator. Transaction Fees: Validators also earn a portion of the transaction fees paid by users. This provides an additional financial incentive to maintain the network’s integrity and efficiency. 7. Delegation: Shared Rewards: Delegators earn a share of the rewards earned by the validators they delegate to. This encourages more token holders to participate in securing the network by choosing reliable validators. 8. Economic Security: Slashing: Validators can be penalized for malicious behavior or failure to perform their duties. This penalty, known as slashing, involves the loss of a portion of their staked tokens, ensuring that validators act in the best interest of the network.

Solana uses a unique combination of Proof of History (PoH) and Proof of Stake (PoS) to achieve high throughput, low latency, and robust security. Here’s a detailed explanation of how these mechanisms work: Core Concepts 1. Proof of History (PoH): Time-Stamped Transactions: PoH is a cryptographic technique that timestamps transactions, creating a historical record that proves that an event has occurred at a specific moment in time. Verifiable Delay Function: PoH uses a Verifiable Delay Function (VDF) to generate a unique hash that includes the transaction and the time it was processed. This sequence of hashes provides a verifiable order of events, enabling the network to efficiently agree on the sequence of transactions. 2. Proof of Stake (PoS): Validator Selection: Validators are chosen to produce new blocks based on the number of SOL tokens they have staked. The more tokens staked, the higher the chance of being selected to validate transactions and produce new blocks. Delegation: Token holders can delegate their SOL tokens to validators, earning rewards proportional to their stake while enhancing the network's security. Consensus Process 1. Transaction Validation: Transactions are broadcast to the network and collected by validators. Each transaction is validated to ensure it meets the network’s criteria, such as having correct signatures and sufficient funds. 2. PoH Sequence Generation: A validator generates a sequence of hashes using PoH, each containing a timestamp and the previous hash. This process creates a historical record of transactions, establishing a cryptographic clock for the network. 3. Block Production: The network uses PoS to select a leader validator based on their stake. The leader is responsible for bundling the validated transactions into a block. The leader validator uses the PoH sequence to order transactions within the block, ensuring that all transactions are processed in the correct order. 4. Consensus and Finalization: Other validators verify the block produced by the leader validator. They check the correctness of the PoH sequence and validate the transactions within the block. Once the block is verified, it is added to the blockchain. Validators sign off on the block, and it is considered finalized. Security and Economic Incentives 1. Incentives for Validators: Block Rewards: Validators earn rewards for producing and validating blocks. These rewards are distributed in SOL tokens and are proportional to the validator’s stake and performance. Transaction Fees: Validators also earn transaction fees from the transactions included in the blocks they produce. These fees provide an additional incentive for validators to process transactions efficiently. 2. Security: Staking: Validators must stake SOL tokens to participate in the consensus process. This staking acts as collateral, incentivizing validators to act honestly. If a validator behaves maliciously or fails to perform, they risk losing their staked tokens. Delegated Staking: Token holders can delegate their SOL tokens to validators, enhancing network security and decentralization. Delegators share in the rewards and are incentivized to choose reliable validators. 3. Economic Penalties: Slashing: Validators can be penalized for malicious behavior, such as double-signing or producing invalid blocks. This penalty, known as slashing, results in the loss of a portion of the staked tokens, discouraging dishonest actions.

Incitamentmekanismer och tillämpliga avgifter

Aave Token is present on the following networks: avalanche, binance_smart_chain, ethereum, gnosis_chain, huobi, near_protocol, polygon, solana.

Avalanche uses a consensus mechanism known as Avalanche Consensus, which relies on a combination of validators, staking, and a novel approach to consensus to ensure the network's security and integrity. Validators: Staking: Validators on the Avalanche network are required to stake AVAX tokens. The amount staked influences their probability of being selected to propose or validate new blocks. Rewards: Validators earn rewards for their participation in the consensus process. These rewards are proportional to the amount of AVAX staked and their uptime and performance in validating transactions. Delegation: Validators can also accept delegations from other token holders. Delegators share in the rewards based on the amount they delegate, which incentivizes smaller holders to participate indirectly in securing the network. 2. Economic Incentives: Block Rewards: Validators receive block rewards for proposing and validating blocks. These rewards are distributed from the network’s inflationary issuance of AVAX tokens. Transaction Fees: Validators also earn a portion of the transaction fees paid by users. This includes fees for simple transactions, smart contract interactions, and the creation of new assets on the network. 3. Penalties: Slashing: Unlike some other PoS systems, Avalanche does not employ slashing (i.e., the confiscation of staked tokens) as a penalty for misbehavior. Instead, the network relies on the financial disincentive of lost future rewards for validators who are not consistently online or act maliciously. o Uptime Requirements: Validators must maintain a high level of uptime and correctly validate transactions to continue earning rewards. Poor performance or malicious actions result in missed rewards, providing a strong economic incentive to act honestly. Fees on the Avalanche Blockchain 1. Transaction Fees: Dynamic Fees: Transaction fees on Avalanche are dynamic, varying based on network demand and the complexity of the transactions. This ensures that fees remain fair and proportional to the network's usage. Fee Burning: A portion of the transaction fees is burned, permanently removing them from circulation. This deflationary mechanism helps to balance the inflation from block rewards and incentivizes token holders by potentially increasing the value of AVAX over time. 2. Smart Contract Fees: Execution Costs: Fees for deploying and interacting with smart contracts are determined by the computational resources required. These fees ensure that the network remains efficient and that resources are used responsibly. 3. Asset Creation Fees: New Asset Creation: There are fees associated with creating new assets (tokens) on the Avalanche network. These fees help to prevent spam and ensure that only serious projects use the network's resources.

Binance Smart Chain (BSC) uses the Proof of Staked Authority (PoSA) consensus mechanism to ensure network security and incentivize participation from validators and delegators. Incentive Mechanisms 1. Validators: Staking Rewards: Validators must stake a significant amount of BNB to participate in the consensus process. They earn rewards in the form of transaction fees and block rewards. Selection Process: Validators are selected based on the amount of BNB staked and the votes received from delegators. The more BNB staked and votes received, the higher the chances of being selected to validate transactions and produce new blocks. 2. Delegators: Delegated Staking: Token holders can delegate their BNB to validators. This delegation increases the validator's total stake and improves their chances of being selected to produce blocks. Shared Rewards: Delegators earn a portion of the rewards that validators receive. This incentivizes token holders to participate in the network’s security and decentralization by choosing reliable validators. 3. Candidates: Pool of Potential Validators: Candidates are nodes that have staked the required amount of BNB and are waiting to become active validators. They ensure that there is always a sufficient pool of nodes ready to take on validation tasks, maintaining network resilience. 4. Economic Security: Slashing: Validators can be penalized for malicious behavior or failure to perform their duties. Penalties include slashing a portion of their staked tokens, ensuring that validators act in the best interest of the network. Opportunity Cost: Staking requires validators and delegators to lock up their BNB tokens, providing an economic incentive to act honestly to avoid losing their staked assets. Fees on the Binance Smart Chain 5. Transaction Fees: Low Fees: BSC is known for its low transaction fees compared to other blockchain networks. These fees are paid in BNB and are essential for maintaining network operations and compensating validators. Dynamic Fee Structure: Transaction fees can vary based on network congestion and the complexity of the transactions. However, BSC ensures that fees remain significantly lower than those on the Ethereum mainnet. 6. Block Rewards: Incentivizing Validators: Validators earn block rewards in addition to transaction fees. These rewards are distributed to validators for their role in maintaining the network and processing transactions. 7. Cross-Chain Fees: Interoperability Costs: BSC supports cross-chain compatibility, allowing assets to be transferred between Binance Chain and Binance Smart Chain. These cross-chain operations incur minimal fees, facilitating seamless asset transfers and improving user experience. 8. Smart Contract Fees: Deployment and Execution Costs: Deploying and interacting with smart contracts on BSC involves paying fees based on the computational resources required. These fees are also paid in BNB and are designed to be cost-effective, encouraging developers to build on the BSC platform.

Ethereum, particularly after transitioning to Ethereum 2.0 (Eth2), employs a Proof-of-Stake (PoS) consensus mechanism to secure its network. The incentives for validators and the fee structures play crucial roles in maintaining the security and efficiency of the blockchain. Incentive Mechanisms 1. Staking Rewards: Validator Rewards: Validators are essential to the PoS mechanism. They are responsible for proposing and validating new blocks. To participate, they must stake a minimum of 32 ETH. In return, they earn rewards for their contributions, which are paid out in ETH. These rewards are a combination of newly minted ETH and transaction fees from the blocks they validate. Reward Rate: The reward rate for validators is dynamic and depends on the total amount of ETH staked in the network. The more ETH staked, the lower the individual reward rate, and vice versa. This is designed to balance the network's security and the incentive to participate. 2. Transaction Fees: Base Fee: After the implementation of Ethereum Improvement Proposal (EIP) 1559, the transaction fee model changed to include a base fee that is burned (i.e., removed from circulation). This base fee adjusts dynamically based on network demand, aiming to stabilize transaction fees and reduce volatility. Priority Fee (Tip): Users can also include a priority fee (tip) to incentivize validators to include their transactions more quickly. This fee goes directly to the validators, providing them with an additional incentive to process transactions efficiently. 3. Penalties for Malicious Behavior: Slashing: Validators face penalties (slashing) if they engage in malicious behavior, such as double-signing or validating incorrect information. Slashing results in the loss of a portion of their staked ETH, discouraging bad actors and ensuring that validators act in the network's best interest. Inactivity Penalties: Validators also face penalties for prolonged inactivity. This ensures that validators remain active and engaged in maintaining the network's security and operation. Fees Applicable on the Ethereum Blockchain 1. Gas Fees: Calculation: Gas fees are calculated based on the computational complexity of transactions and smart contract executions. Each operation on the Ethereum Virtual Machine (EVM) has an associated gas cost. Dynamic Adjustment: The base fee introduced by EIP-1559 dynamically adjusts according to network congestion. When demand for block space is high, the base fee increases, and when demand is low, it decreases. 2. Smart Contract Fees: Deployment and Interaction: Deploying a smart contract on Ethereum involves paying gas fees proportional to the contract's complexity and size. Interacting with deployed smart contracts (e.g., executing functions, transferring tokens) also incurs gas fees. Optimizations: Developers are incentivized to optimize their smart contracts to minimize gas usage, making transactions more cost-effective for users. 3. Asset Transfer Fees: Token Transfers: Transferring ERC-20 or other token standards involves gas fees. These fees vary based on the token's contract implementation and the current network demand.

The Gnosis Chain’s incentive and fee models encourage both validator participation and network accessibility, using a dual-token system to maintain low transaction costs and effective staking rewards. Incentive Mechanisms: Staking Rewards for Validators GNO Rewards: Validators earn staking rewards in GNO tokens for their participation in consensus and securing the network. Delegation Model: GNO holders who do not operate validator nodes can delegate their GNO tokens to validators, allowing them to share in staking rewards and encouraging broader participation in network security. Dual-Token Model GNO: Used for staking, governance, and validator rewards, GNO aligns long-term network security incentives with token holders’ economic interests. xDai: Serves as the primary transaction currency, providing stable and low-cost transactions. The use of a stable token (xDai) for fees minimizes volatility and offers predictable costs for users and developers. Applicable Fees: Transaction Fees in xDai Users pay transaction fees in xDai, the stable fee token, making costs affordable and predictable. This model is especially suited for high-frequency applications and dApps where low transaction fees are essential. xDai transaction fees are redistributed to validators as part of their compensation, aligning their rewards with network activity. Delegated Staking Rewards Through delegated staking, GNO holders can earn a share of staking rewards by delegating their tokens to active validators, promoting user participation in network security without requiring direct involvement in consensus operations.

The Huobi Eco Chain (HECO) blockchain employs a Hybrid-Proof-of-Stake (HPoS) consensus mechanism, combining elements of Proof-of-Stake (PoS) to enhance transaction efficiency and scalability. Incentive Mechanism: 1. Validator Rewards: Validators are selected based on their stake in the network. They process transactions and add blocks to the blockchain. Validators receive rewards in the form of transaction fees for their role in maintaining the blockchain's integrity. 2. Staking Participation: Users can stake Huobi Token (HT) to become validators or delegate their tokens to existing validators. Staking helps secure the network and, in return, participants receive a portion of the transaction fees as rewards. Applicable Fees: 1. Transaction Fees (Gas Fees): Users pay gas fees in HT tokens to execute transactions and interact with smart contracts on the HECO network. These fees compensate validators for processing and validating transactions. 2. Smart Contract Execution Fees: Deploying and interacting with smart contracts incur additional fees, which are also paid in HT tokens. These fees cover the computational resources required to execute contract code.

NEAR Protocol employs several economic mechanisms to secure the network and incentivize participation: Incentive Mechanisms to Secure Transactions: 1. Staking Rewards: Validators and delegators secure the network by staking NEAR tokens. Validators earn around 5% annual inflation, with 90% of newly minted tokens distributed as staking rewards. Validators propose blocks, validate transactions, and receive a share of these rewards based on their staked tokens. Delegators earn rewards proportional to their delegation, encouraging broad participation. 2. Delegation: Token holders can delegate their NEAR tokens to validators to increase the validator's stake and improve the chances of being selected to validate transactions. Delegators share in the validator's rewards based on their delegated tokens, incentivizing users to support reliable validators. 3. Slashing and Economic Penalties: Validators face penalties for malicious behavior, such as failing to validate correctly or acting dishonestly. The slashing mechanism enforces security by deducting a portion of their staked tokens, ensuring validators follow the network's best interests. 4. Epoch Rotation and Validator Selection: Validators are rotated regularly during epochs to ensure fairness and prevent centralization. Each epoch reshuffles validators, allowing the protocol to balance decentralization with performance. Fees on the NEAR Blockchain: 1. Transaction Fees: Users pay fees in NEAR tokens for transaction processing, which are burned to reduce the total circulating supply, introducing a potential deflationary effect over time. Validators also receive a portion of transaction fees as additional rewards, providing an ongoing incentive for network maintenance. 2. Storage Fees: NEAR Protocol charges storage fees based on the amount of blockchain storage consumed by accounts, contracts, and data. This requires users to hold NEAR tokens as a deposit proportional to their storage usage, ensuring the efficient use of network resources. 3. Redistribution and Burning: A portion of the transaction fees (burned NEAR tokens) reduces the overall supply, while the rest is distributed to validators as compensation for their work. The burning mechanism helps maintain long-term economic sustainability and potential value appreciation for NEAR holders. 4. Reserve Requirement: Users must maintain a minimum account balance and reserves for data storage, encouraging efficient use of resources and preventing spam attacks.

Polygon uses a combination of Proof of Stake (PoS) and the Plasma framework to ensure network security, incentivize participation, and maintain transaction integrity. Incentive Mechanisms 1. Validators: Staking Rewards: Validators on Polygon secure the network by staking MATIC tokens. They are selected to validate transactions and produce new blocks based on the number of tokens they have staked. Validators earn rewards in the form of newly minted MATIC tokens and transaction fees for their services. Block Production: Validators are responsible for proposing and voting on new blocks. The selected validator proposes a block, and other validators verify and validate it. Validators are incentivized to act honestly and efficiently to earn rewards and avoid penalties. Checkpointing: Validators periodically submit checkpoints to the Ethereum main chain, ensuring the security and finality of transactions processed on Polygon. This provides an additional layer of security by leveraging Ethereum's robustness. 2. Delegators: Delegation: Token holders who do not wish to run a validator node can delegate their MATIC tokens to trusted validators. Delegators earn a portion of the rewards earned by the validators, incentivizing them to choose reliable and performant validators. Shared Rewards: Rewards earned by validators are shared with delegators, based on the proportion of tokens delegated. This system encourages widespread participation and enhances the network's decentralization. 3. Economic Security: Slashing: Validators can be penalized through a process called slashing if they engage in malicious behavior or fail to perform their duties correctly. This includes double-signing or going offline for extended periods. Slashing results in the loss of a portion of the staked tokens, acting as a strong deterrent against dishonest actions. Bond Requirements: Validators are required to bond a significant amount of MATIC tokens to participate in the consensus process, ensuring they have a vested interest in maintaining network security and integrity. Fees on the Polygon Blockchain 4. Transaction Fees: Low Fees: One of Polygon's main advantages is its low transaction fees compared to the Ethereum main chain. The fees are paid in MATIC tokens and are designed to be affordable to encourage high transaction throughput and user adoption. Dynamic Fees: Fees on Polygon can vary depending on network congestion and transaction complexity. However, they remain significantly lower than those on Ethereum, making Polygon an attractive option for users and developers. 5. Smart Contract Fees: Deployment and Execution Costs: Deploying and interacting with smart contracts on Polygon incurs fees based on the computational resources required. These fees are also paid in MATIC tokens and are much lower than on Ethereum, making it cost-effective for developers to build and maintain decentralized applications (dApps) on Polygon. 6. Plasma Framework: State Transfers and Withdrawals: The Plasma framework allows for off-chain processing of transactions, which are periodically batched and committed to the Ethereum main chain. Fees associated with these processes are also paid in MATIC tokens, and they help reduce the overall cost of using the network.

Solana uses a combination of Proof of History (PoH) and Proof of Stake (PoS) to secure its network and validate transactions. Here’s a detailed explanation of the incentive mechanisms and applicable fees: Incentive Mechanisms 4. Validators: Staking Rewards: Validators are chosen based on the number of SOL tokens they have staked. They earn rewards for producing and validating blocks, which are distributed in SOL. The more tokens staked, the higher the chances of being selected to validate transactions and produce new blocks. Transaction Fees: Validators earn a portion of the transaction fees paid by users for the transactions they include in the blocks. This provides an additional financial incentive for validators to process transactions efficiently and maintain the network's integrity. 5. Delegators: Delegated Staking: Token holders who do not wish to run a validator node can delegate their SOL tokens to a validator. In return, delegators share in the rewards earned by the validators. This encourages widespread participation in securing the network and ensures decentralization. 6. Economic Security: Slashing: Validators can be penalized for malicious behavior, such as producing invalid blocks or being frequently offline. This penalty, known as slashing, involves the loss of a portion of their staked tokens. Slashing deters dishonest actions and ensures that validators act in the best interest of the network. Opportunity Cost: By staking SOL tokens, validators and delegators lock up their tokens, which could otherwise be used or sold. This opportunity cost incentivizes participants to act honestly to earn rewards and avoid penalties. Fees Applicable on the Solana Blockchain 7. Transaction Fees: Low and Predictable Fees: Solana is designed to handle a high throughput of transactions, which helps keep fees low and predictable. The average transaction fee on Solana is significantly lower compared to other blockchains like Ethereum. Fee Structure: Fees are paid in SOL and are used to compensate validators for the resources they expend to process transactions. This includes computational power and network bandwidth. 8. Rent Fees: State Storage: Solana charges rent fees for storing data on the blockchain. These fees are designed to discourage inefficient use of state storage and encourage developers to clean up unused state. Rent fees help maintain the efficiency and performance of the network. 9. Smart Contract Fees: Execution Costs: Similar to transaction fees, fees for deploying and interacting with smart contracts on Solana are based on the computational resources required. This ensures that users are charged proportionally for the resources they consume.

Början av den period som upplysningen avser

2024-04-20

Slutet av den period som upplysningen avser

2025-04-20

Energirapport

Energiförbrukning

9552.84553 (kWh/a)

Energiförbrukningskällor och -metoder

The energy consumption of this asset is aggregated across multiple components:

To determine the energy consumption of a token, the energy consumption of the network(s) avalanche, binance_smart_chain, ethereum, gnosis_chain, huobi, near_protocol, polygon, solana is calculated first. Based on the crypto asset's gas consumption per network, the share of the total consumption of the respective network that is assigned to this asset is defined. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.

AAVE-kalkylator

Sociala medier