Keep up with the top industry updates as we present bi-weekly market insights that are valuable to traders in the institutional space.

In this week's edition, Kelvin Lam, CFA, Head of Institutional Research for OKX, wishes every reader a prosperous Chinese New Year as we enter the Year of the "loong." With the recent market rally and consolidation, and the upcoming Bitcoin halving event, we present three key indicators and observations, all starting with the word "long," symbolizing our celebration.

TL;DR

The crypto market rallied during the Chinese New Year holidays and is now consolidating. This edition of top-of-mind covers three "long" indicators traders can pay attention to and that potentially signal a promising future for Bitcoin.

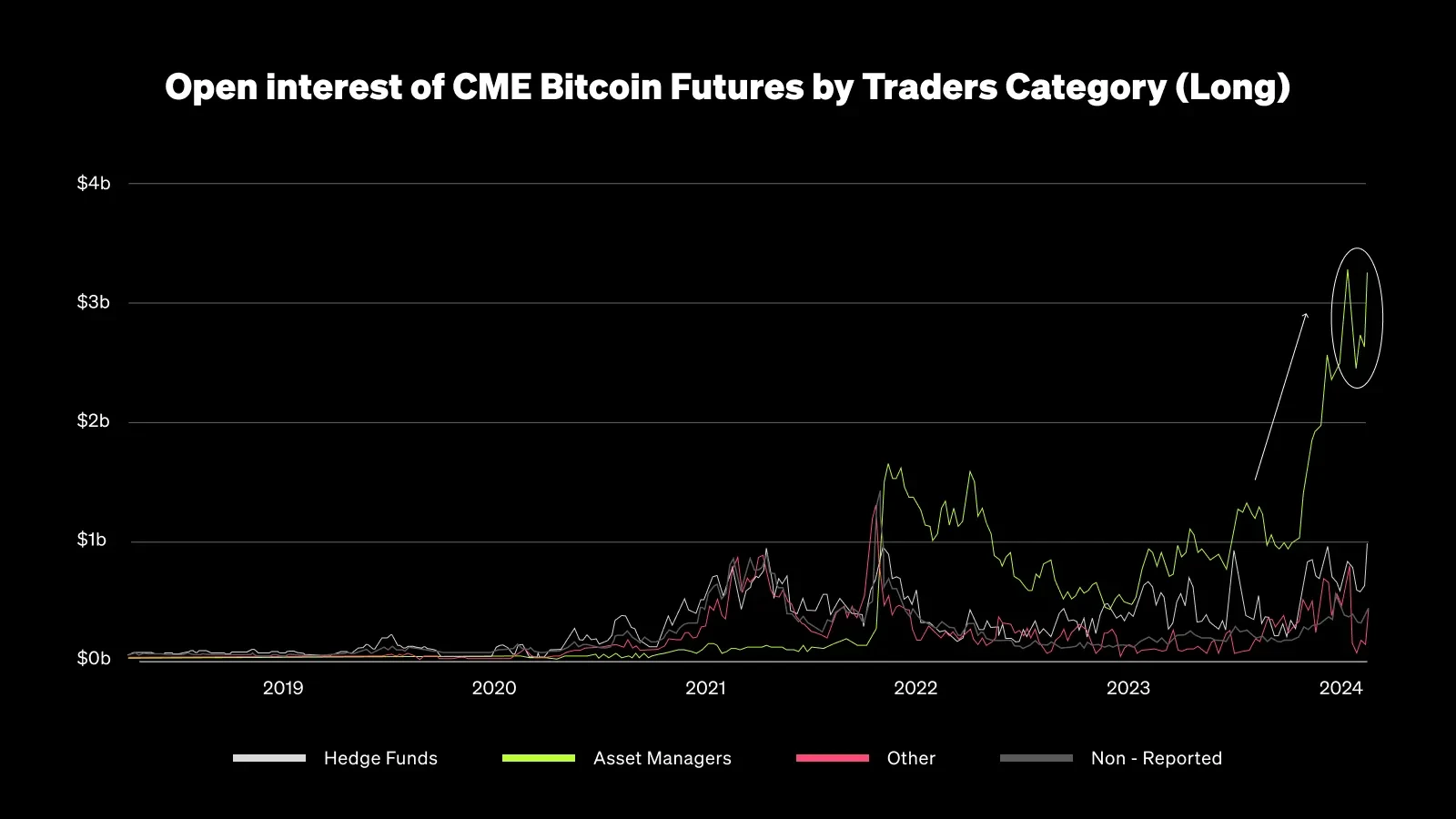

The Long Futures Open Interest on CME has surged to an all-time high among a particular group of institutions, coinciding with a decline in the supply held by long-term Bitcoin holders, indicating significant market implications that warrant consideration.

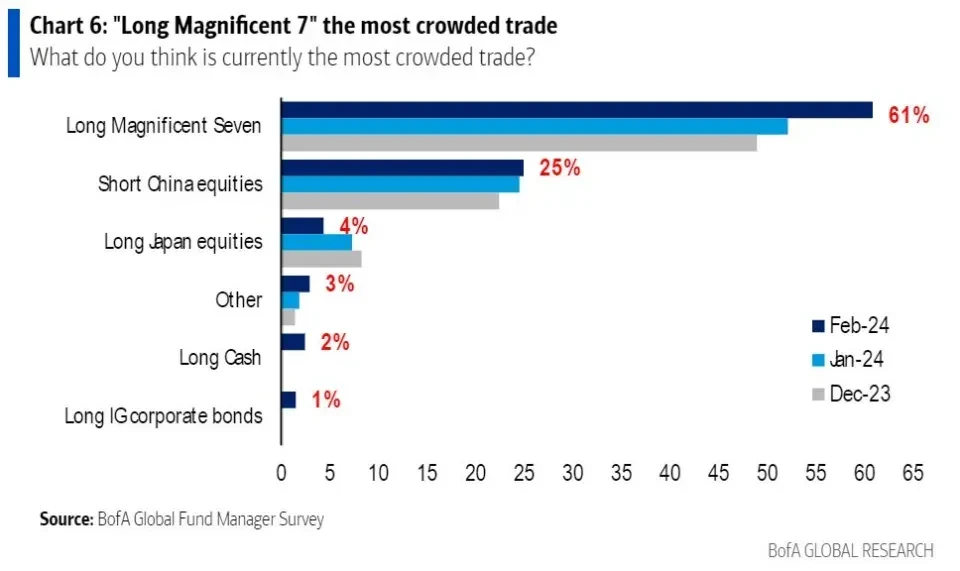

The trade of going long on the "Magnificent 7" in the stock market has become heavily crowded, leading traders to seek alternative options. In this context, Bitcoin emerges as an attractive choice, backed by the recent successful launch of spot Bitcoin ETFs and the continuous inflow of funds into these products.

The Year of the Dragon ("loong")

Celebrating the Year of the Dragon (pronounced as "loong" in Chinese), we extend our warm wishes for a prosperous Chinese New Year to all our readers. During the Chinese New Year holidays, the market experienced a rally, bringing optimism and market attention. Coincidentally, as the celebrations concluded, the market is now consolidating within a narrower price range. With the Bitcoin halving event approximately two months away, market participants are eagerly seeking signals and indicators to determine the current stage of the market. In this edition of top-of-mind, we present three key indicators and observations, all starting with the word long, symbolizing our celebration of the Year of the "loong".

1. Long Futures Open Interest on CME hits all-time high

In the second week of January 2024, the open interest of CME Bitcoin Futures by asset managers reached an all-time high of $3.31 billion.* Despite experiencing a minor downturn after the spot ETF announcement, the data has rebounded significantly, surging to a value of $3.28 billion and rapidly approaching the previous all-time high.* As per the U.S. Commodity Futures Trading Commission (CFTC) disclosures, asset managers encompass pension funds, endowments, insurance companies, mutual funds, and portfolio/investment managers whose clientele primarily consists of institutional investors.

*Source: The Block, CFTC COT, February 22, 2024

Why does this matter?

The open interest of CME Bitcoin Futures and long positions by asset managers began in early 2023 and subsequently surpassed the previous high in 2023 October. This coincided with the market's excitement surrounding the potential approval of a spot Bitcoin ETF, as demonstrated by filings from asset managers like BlackRock and Invesco. The SEC's decision not to appeal an earlier positive court ruling for Grayscale also added to the anticipation. These accumulating positions can be attributed to institutional demand for exposure to Bitcoin as an asset class, as well as speculation on the potential price appreciation resulting from a spot Bitcoin ETF approval.

The week after the spot Bitcoin ETFs were approved, the long open interest declined significantly as asset managers swiftly closed their positions to capitalize on gains. The rapid resurgence of these positions suggests that asset managers remain bullish on Bitcoin and continue to take long positions. Additionally, it's noteworthy that despite the influx of billions into Bitcoin Spot ETFs, CME Bitcoin Futures haven't been substituted. This could be due to asset managers performing due diligence on the new spot Bitcoin ETFs or the fact that trading futures on CME remains a preferred method for some institutions. While the market closely monitors daily spot Bitcoin ETF flows as an indicator of institutional interest in Bitcoin, the significance of CME's Bitcoin Futures data shouldn't be overlooked.

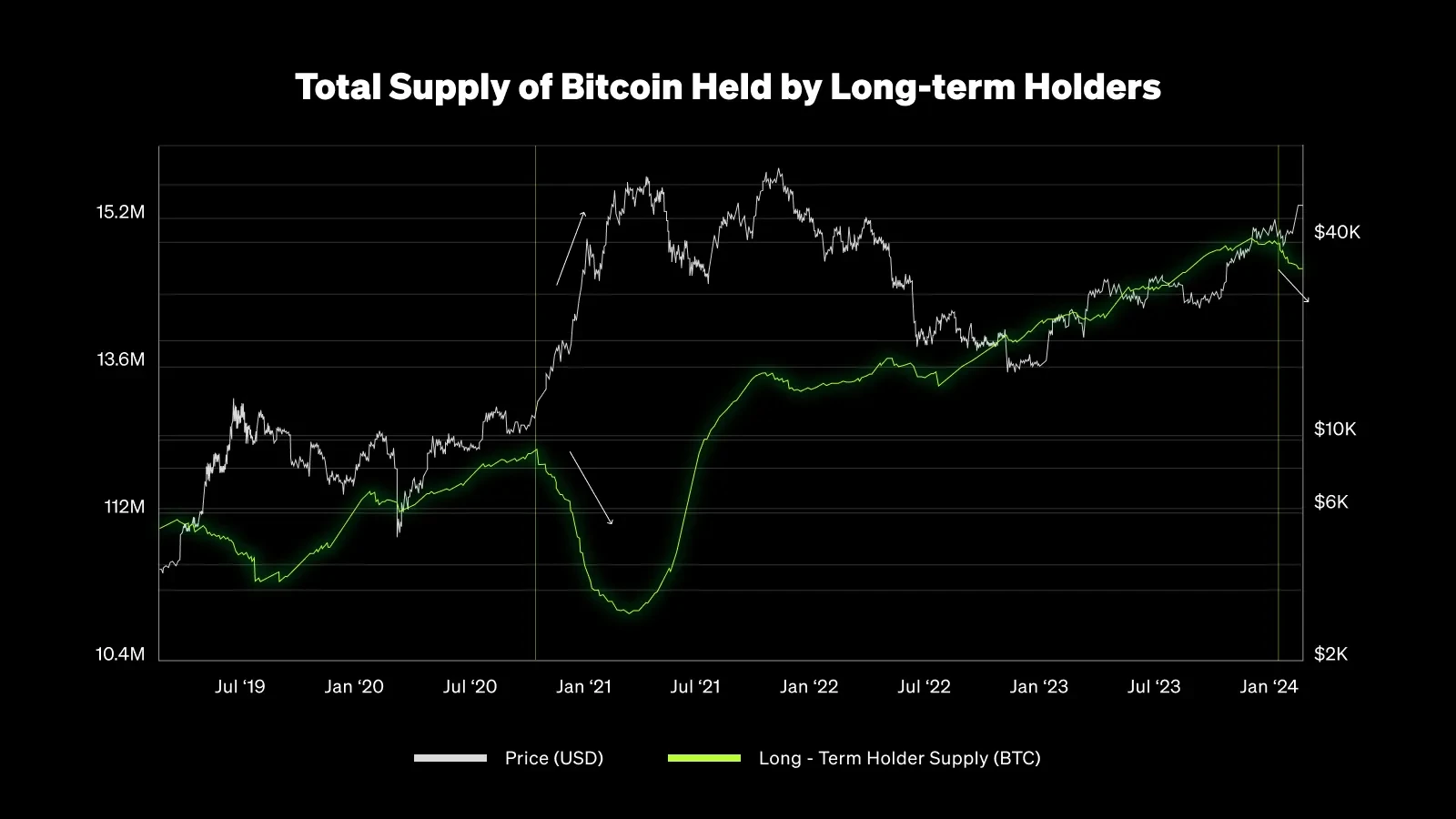

2. Long-term holders of Bitcoin supply decreases

Since the beginning of 2024, long-term Bitcoin holders have sold off over 300k BTC (see chart below) since the start of the year. The selling trend started in early December 2023 and accelerated after January 15, 2024. This movement is also a reversal of an uptrend that started almost three years ago during March 2021.

According to Glassnode, long-term holders retain their coins for a period spanning several months to years. The approximate threshold is a 155-day (~five months) holding period, after which it's increasingly unlikely dormant coins will be spent. This group tends to HODL over long time frames or temporarily decrease their Bitcoin positions in a bull market for profit taking.

Source: Glassnode

Why does this matter?

This indicator plays a crucial role in determining the current stage of the market cycle for Bitcoin. By closely examining the indicator alongside past market cycles, we can observe a pattern where long-term holders begin to divest their positions during the early stages of a bull market, often when the price approaches or reaches its previous high point. As prices rise, attracting widespread market attention, new traders join the market, further bolstering its strength.

Over time, long-term holders complete their selling phase and begin accumulating once again. This has historically signaled the market's peak, indicating the bull run has come to an end. It's also worth noting that Grayscale's GBTC redemption contributed over 150k of reduction in long-term holder supply out of the 300k reduction. As a result, the rate of selling (and profit taking) has just started to ramp up and is at a slower rate compared to the previous bull market that began in 2020. The pace of selling from long-term holders may not pick up until we see Bitcoin breaking the previous high of $69k.*

*Source: OKX

Long Magnificent 7 becomes the most crowded trade

The "Magnificent 7" refers to a group of leading technology companies, including Apple, Amazon, Microsoft, Meta Platforms, Alphabet, Tesla, and Nvidia. These companies have experienced significant stock price growth in the past year, and have gained popularity among stock traders. According to the latest fund manager survey conducted by Bank of America, going long on Magnificent 7 is the most crowded trade among the respondents of the survey. Based on the performance of a Magnificent 7 ETF, the year-to-date performance as of February 22, 2024 is +13% (outperforming Nasdaq 100's +7%)*.

*Source: TradingView

Why does this matter?

The Magnificent 7, with a total market capitalization exceeding $13 trillion*, stands as a significant force in the financial landscape. Meanwhile, Bitcoin has recently achieved a milestone of its own, surpassing a market cap of $1 trillion**. In terms of performance, Bitcoin has outshone the Magnificent 7 in both year-to-date and one-year timeframes, according to data from Tradingview. Adding to Bitcoin's accessibility, the introduction of the Bitcoin Spot ETF at the beginning of the year has provided stock traders with a direct avenue to trade Bitcoin through stock exchanges and brokers. This development has seen substantial interest, with over $5 billion in net inflows attracted to these new spot Bitcoin ETFs in around seven weeks.*** As institutional investors, traders, and wealth advisors seek unique returns beyond crowded trades, the spot Bitcoin ETF emerges as an attractive option with positive tailwinds like the Bitcoin halving and continuous institutional adoption. With institutional investors' due diligence on these newly launched Bitcoin Spot ETF vehicles currently underway, it's plausible that this trade could gain further popularity in the future.

*Source: Yahoo Finance, Feb 23 2024

**Source: OKX, Feb 23 2024

***Source: The Block, Feb 23 2024

OKX conversation on Telegram

For the latest insights, updates, and announcements beyond what's included in our bi-weekly newsletter, head over to our OKX Institutional Telegram channel.

As a private, members-only group, our Telegram channel allows for real-time dialogue where we can discuss and share market coloring, product roadmaps, and more with our valued institutional clients and partners.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” No derivative works or other uses of this article are permitted.