VIP Loan

What is VIP Loan?

VIP Loan is a lending product for users that are at VIP5 level and above. As of May 30, 2024, VIP Loan supports loans of fixed interest rates for a fixed term of 30 days. This means that borrowers are charged constant interest during the loan period, providing both predictability and stability.

The enhanced VIP Loan works on a market model, matching borrowing orders (taker orders) to lending orders (maker orders). Lenders place orders on the Simple Earn (lending) order book, specifying an amount, term and interest rate. Borrowers place orders based on an interest rate, and choose their loan amounts accordingly, depending on available market liquidity. The system then matches borrowing orders to lending orders based on the borrower’s interest rate. Once a borrowing order matches the lending order(s), the weighted average interest rate for the lending order(s) becomes the interest rate for the borrowing order.

Once a matched borrowing order passes the interest deduction validation stage (whereby interest is calculated then deducted from the borrower's account immediately prior to commencement of the term), the loan term begins, a loan quota is provided to the borrower and interest is charged on the loan quota. Borrowers can view the estimated interest before placing an order.

VIP Loan uses a quota system, meaning loans aren’t added to the available balance in your trading account. Instead, a quota is provided to cover liabilities including negative balance in multi-currency or portfolio margin account modes, and isolated position liability in single-currency account mode. To that end, an automatic drawdown may be triggered immediately upon the loan quota being approved, if there are outstanding liabilities at the time that the loan quota is granted.

Example: Assume you have 1 BTC valued at 100 USDT. You can use your 1 BTC as collateral to borrow 1,000 USDT (at 10X leverage) and use those funds to buy 10 BTC. You’ll then have 11 BTC in your account and liability of 1,000 USDT.

This would not be possible in a scenario where market loans (i.e. Loans other than the VIP Loan) have a borrowing limit of, say, 500 USDT because other traders have already used the market loan liquidity. Consequently, despite having sufficient collateral, you can only borrow 500 USDT to buy 5 BTC, preventing you from completing your intended 10x leverage trade. With VIP Loan, you can borrow the additional 500 USDT.

It's worth noting that even if you don’t exceed the borrowing limit, you can only trade if you have sufficient collateral. Simply put, if your maintenance margin amounts to 0.1 BTC, you can only use 100 USDT from your allocated loan quota (this being 10X of your collateral, using the above example conversion rates). Amounts borrowed from VIP Loan count as quotas instead of assets; therefore, they don’t impact your margin.

Overview

Eligible users: VIP5 and above

Minimum borrowing amount: equivalent of 10,000 USDT

Account modes: single-currency margin, multi-currency margin, and portfolio margin. Note that you must repay amounts borrowed from VIP Loan before switching account modes.

How do I borrow from VIP Loan

What are borrowing limits

VIP Loan and market loans have independent borrowing limits. You can use VIP Loan with your main account and sub-accounts. Note that sub-accounts share the borrowing limits of main accounts.

VIP 5 | VIP 6 | VIP 7 | VIP 8 | |

|---|---|---|---|---|

USDT | 10,000,000 | 11,000,000 | 12,000,000 | 13,000,000 |

USDC | 2,000,000 | 2,200,000 | 2,400,000 | 2,600,000 |

BTC | 50 | 55 | 60 | 65 |

ETH | 2,500 | 2,750 | 3,000 | 3,250 |

How does VIP Loan work

You can borrow from the VIP Loan pool or market loan pool, which are used separately to calculate liability and interest according to your total loan amount. The fund pool for VIP Loan takes priority.

Example:

Liability | Borrowed (VIP Loan) | In use (VIP Loan) | In use (market loans) | |

Scenario 1: | 5,000 USDT | 0 | 0 | 5,000 USDT |

Scenario 2: | 6,000 USDT | 6,000 USDT | 6,000 USDT | 0 |

Scenario 3: | 15,000 USDT | 7,000 USDT | 7,000 USDT | 8,000 USDT |

Scenario 1: If you don’t have a VIP Loan quota, market loans cover your liability, and interest is calculated as usual.

Scenario 2: If you have sufficient VIP Loan quota, VIP Loan covers your liability. Interest is charged once your borrowing order matches one or more lending orders. Liability covered by VIP Loan doesn’t accrue additional interest.

Scenario 3: If you have insufficient VIP Loan quota, market loans cover your surplus liability.

In multi-currency account mode, your VIP Loan quota is first used to cover liability in isolated margin positions, starting from positions opened earlier, followed by liability in cross-margin positions. In single-currency account mode, your VIP Loan quota is used for positions opened earlier, without differentiating isolated margin positions from cross-margin positions.

When you reduce your liability by adjusting your positions, your quota is released in the reverse order as compared to borrowing. That means your quota from market loans is released before your quota from VIP Loan.

Example: If your total liability in one account is 5,000 USDT, with 4,000 USDT covered by VIP Loan and 1,000 USDT covered by market loans, your quota in use of VIP Loan and market loans will change as follows when you reduce your liability:

Liability (actual borrowing) | In use (VIP Loan) | In use (market loans) |

5,000 USDT | 4,000 USDT | 1,000 USDT |

4,500 USDT | 4,000 USDT | 500 USDT |

3,500 USDT | 3,500 USDT | 0 |

Interest

How is interest charged

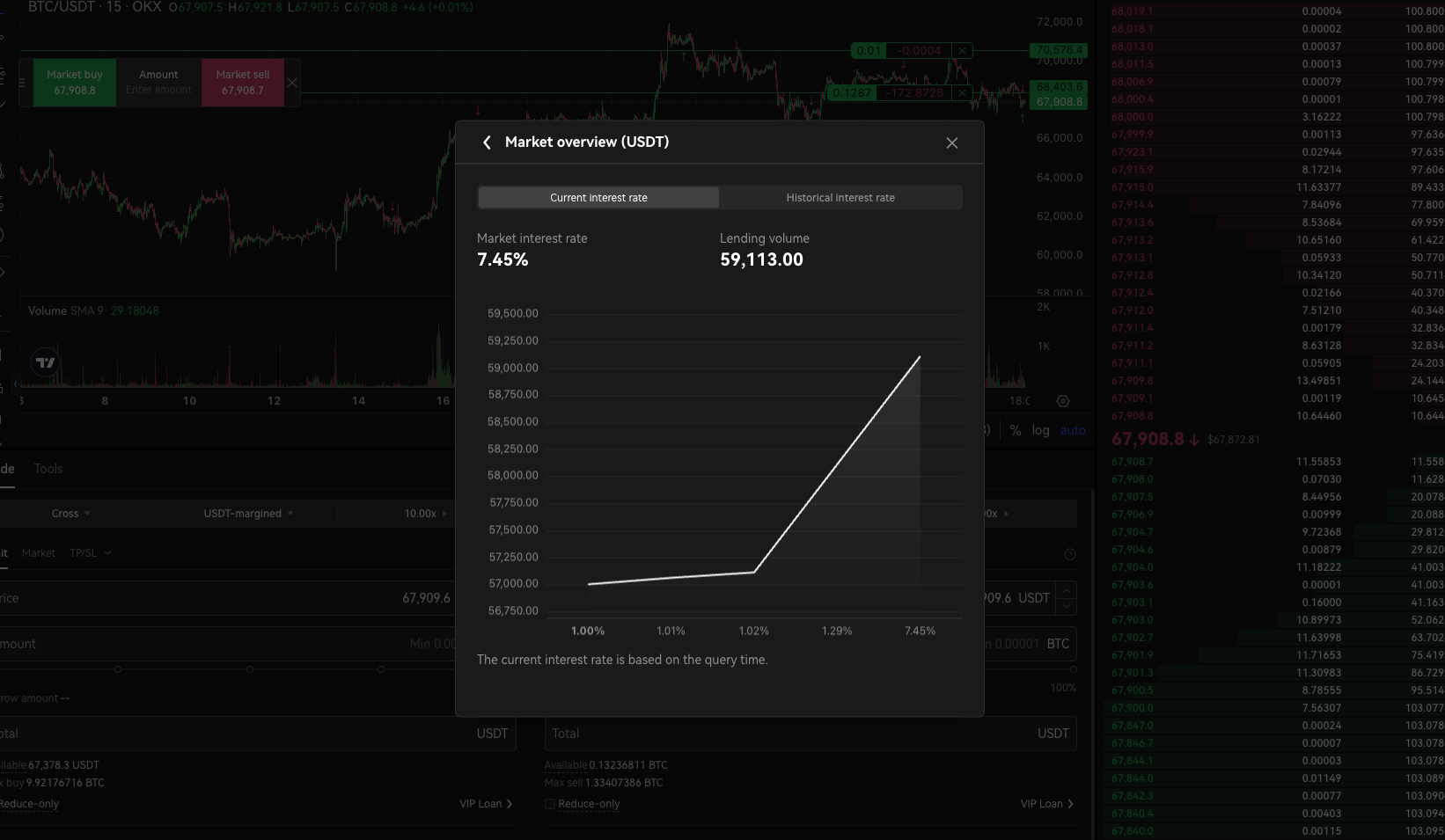

Once a borrowing order matches a lending order, interest is charged from the available balance in the borrower’s trading account. To avoid placing failed borrowing orders, check the Market overview page for the estimated interest rates of lending orders beforehand.

The annualized interest over a 30-day period is calculated as follows:

Interest = Borrowing amount × Interest rate × 30 / 365

Example:

Borrowing amount: 100,000 USDT

Matched interest rate: 6%

Loan term: 30 days

Interest = 100,000 USDT × 6% × 30 / 365 = 493.15 USDT (rounded to 2 decimal places)

What is the prepayment fee

If you repay or roll over your loan before maturity, you’ll incur a fee equivalent to 30% of all interest due from the time of repayment or early roll over until maturity, which will be deducted from the prepaid interest held by OKX. This fee isn’t retained by the platform. Instead, it’s used to compensate lenders for loans that end before maturity.

What is the overdue fee

When your loan reaches maturity, it’s automatically repaid. However, if your liability at the repayment time exceeds your total amount due from other loans, the repayment will fail and your loan will become overdue.

Example:

VIP Loan order 1: 20,000 USDT

VIP Loan order 2: 70,000 USDT

Liability: 60,000 USDT

In this scenario, the total VIP Loan quota is 90,000 USDT, which covers the 60,000 USDT of liability. As such, you can repay a total of 30,000 USDT.

Let’s assume VIP Loan order 2 reaches maturity, and the system automatically tries to repay it. However, during the repayment process, the system determines that the total quota available from other loans after repayment will be 20,000 USDT, which doesn’t cover the 60,000 USDT liability. As such, the repayment will fail and VIP Loan order 2 will incur the overdue fee.

The overdue fee is calculated on an hourly basis and deducted from the available balance in your trading account until the loan is fully repaid. This fee isn’t retained by the platform. Instead, it’s used to compensate lenders for late repayments.

If a loan is overdue by more than 30 days, forced repayment is triggered. As such, overdue loans should be repaid as soon as possible.

How do I use VIP Loan

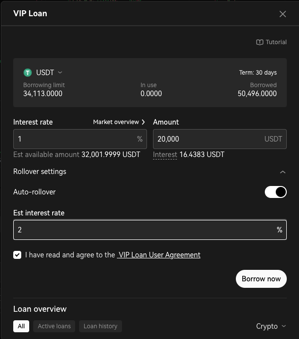

Enter your expected maximum interest rate on the order placement page. You can check the current lending interest rate on the Market overview page.

After you enter your interest rate, the estimated amount available for borrowing is displayed. Note that this amount is for reference only.

Enter the amount you want to borrow.

After you enter your interest rate and amount, make sure the available balance in your trading account is sufficient to cover the interest. Otherwise, your borrowing order may fail.

Lastly, you can enable the Auto-rollover feature and set your expected rollover interest rate.

Repayment

Auto-repayment

When your loan reaches maturity, it’s automatically repaid. However, if your liability at the repayment time exceeds your total amount due from other loans, the repayment will fail and your loan will become overdue. To repay an overdue loan:

Reduce your liability.

Place a new borrowing order for the same amount as your overdue loan, or for an amount that covers your liability released by repaying the order.

Early repayment

You can repay a loan before maturity, but you’ll incur a prepayment fee.

If you repay your loan within the last 6 hours before maturity, you won’t be charged the prepayment fee.

If you repay your loan more than 6 hours before maturity, you will be charged a fee equivalent to 30% of all interest due from the time of repayment until maturity, which will be deducted from the prepaid interest held by OKX.

Before repaying your loan, you can check the prepayment fee on the order confirmation page.

Rollover

Auto rollover

You can automatically roll over your loan at maturity in an amount that covers at least your current liability. However, if there are no matching orders in the lending market, or if you don’t meet the MMR or interest requirements, your auto-rollover may fail.

The Auto-rollover feature can be enabled with your expected interest rate on the Rollover settings page. When this feature is enabled, the system will try to match a new borrowing order to lending orders when your current loan reaches maturity.

Early rollover

You can roll over your loan before maturity, canceling your current order.

If you roll over your loan within the last 6 hours of maturity, you’ll avoid the prepayment fee.

If you roll over your loan more than 6 hours before maturity, you will be charged a fee equivalent to 30% of all interest due from the time of early roll over until maturity, which will be deducted from the prepaid interest held by OKX.

If you roll over your loan before maturity, the system will try to place and match a new borrowing order for the same amount as your current order.

Risk management

Amounts borrowed from VIP Loan don’t count in margin calculations.

Interest for VIP Loan is deducted from the available balance in your trading account.

For leveraged trading with actual borrowing, the system applies the risk control rules based on your account and position mode. For more details, refer to the risk control rules.

Terminology

Terms | Description |

Borrowing limit | The borrowing limit of an account for a specific cryptocurrency is determined by your VIP level. This limit is shared between the main account and its sub-accounts. |

Borrowed | The loan quota already allocated to your account. This quota can be used to cover liability. |

In use | The quota already borrowed by your account and used to cover your position liability. |

Available for borrowing | The quota that you can still use to borrow. It’s calculated as the borrowing limit minus the borrowed amount. |

Repayable | The quota that you can repay. It’s calculated as your borrowed quota minus your in-use quota. |

This document is a summary of how VIP Loan works. For details, and definitive rules, please see the VIP Loan User Agreement.