Tax Center General FAQ

1. How do I find my tax documents?

You can find your tax documents on our platform as follows:

On the web: go to Asset, then select Tax center

On the app: go to menu, then select Tax center

Open the menu page and find the Tax center page

2. How do I update my Taxpayer information?

You're required to verify your tax particulars before accessing your latest tax documents. To verify your taxpayer information, you can follow the guide below:

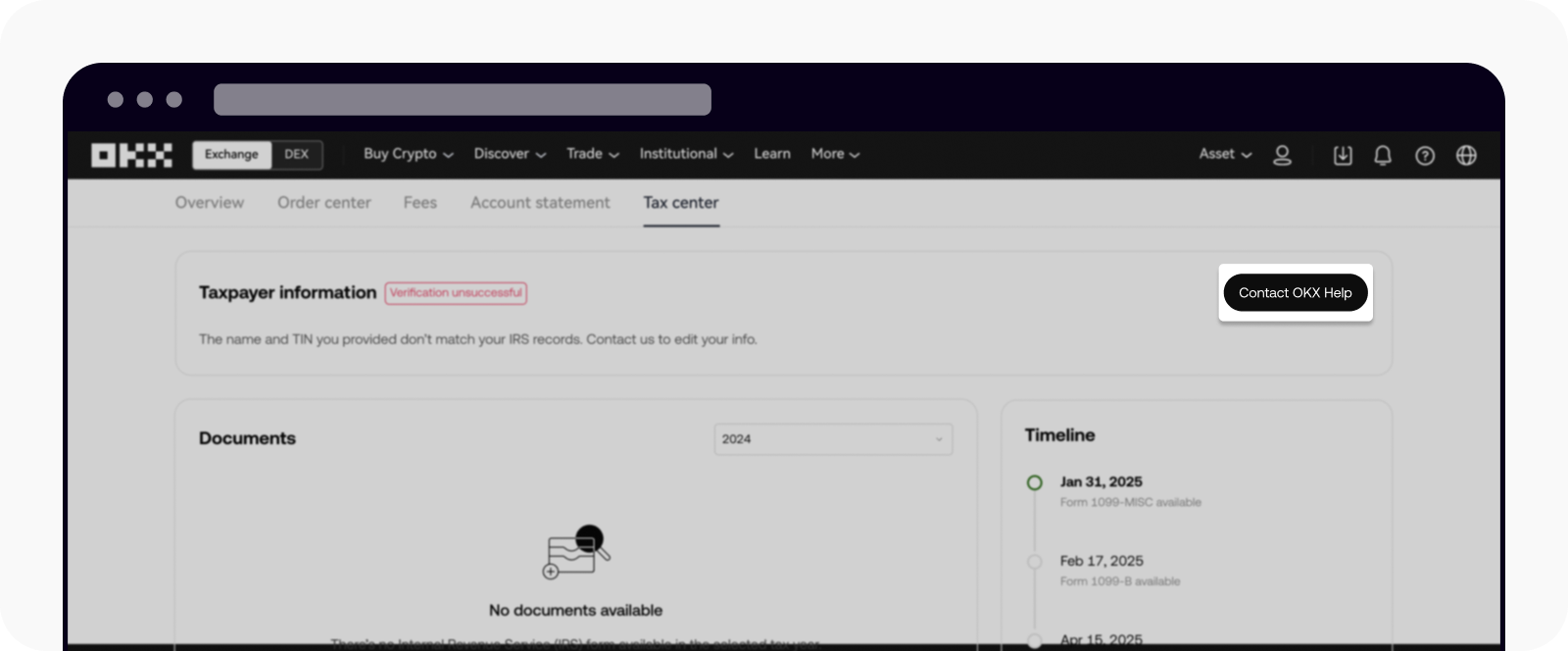

On the web: go to Asset, then select Tax center, then choose Contact OKX Help.

On the app: go to menu, then select Tax center, then choose Contact OKX Help.

You'll be redirected to our customer support for further assistance in updating your taxpayer information.

Select Contact OKX Help to update your taxpayer information

3. What are the tax documents that I will receive?

You'll receive the tax documents depending on your eligibility and activity in the recent tax year. We provide two IRS forms and one supplementary statement - Form 1099-B and Form 1099-MISC & transaction history statement:

Form 1099-B: You'll receive this report if you've bought and sold crypto currency with OKX, which includes proceeds and the cost basis of the corresponding assets. This report will be available for download by the end of January.

Note:Cost basis is the original value of an asset when acquired. It's used to determine the capital gain or loss, which is the difference between the asset's cost basis and the sale proceeds.

We can't calculate the cost basis of assets acquired elsewhere. For example, if you sent or deposited an asset to OKX and later sold it, we can't provide its cost basis. Sell orders without cost basis will have an asterisk (*) on this form.

Form 1099-MISC: You'll receive this report if you've earned income from Earn rewards or other income such as referral bonuses. This report will be available for download around mid to late February.

Note:You'll receive this form only if you've earned 600 USD or more.

Transaction History Statement: You'll receive this statement if you're eligible for the 1099-B report, which can be used for reconciliation and analysis purposes. This is a CSV format statement available after 1099-B form generation.

4. What are the tax reporting dates?

For tax year 2024, we'll prepare the tax reports for you by the following dates:

Forms 1099-MISC: by January 31, 2025

Forms 1099-B: by February 17, 2025

The due date to file individual income tax by April 15, 2025.

Please note these dates are not fixed and are subject to IRS adjustments from year to year, for more information on the dates and crypto transactions in general, please visit IRS FAQs site