Знайомство з позиками OKX

В OKX ми віримо в принцип «позичай, щоб заробляти, позичай, щоб витрачати». Ми пропонуємо користувачам легкий доступ до різноманітних криптовалютних продуктів з внесенням їхніх активів у стейкінг. За допомогою сервісу Позики OKX ви можете збільшити грошовий потік і підписатися на нові криптовалюти, не піддаючи свій портфель впливу цінової волатильності.

Що таке гнучка позика?

Гнучка позика не має фіксованого терміну або заздалегідь встановленої процентної ставки. Він підтримує понад 120 типів криптоактивів як заставу. Гнучка позика, що фінансується з пулу ліквідності Earn, пропонує ринкову процентну ставку, яка оновлюється щогодини.

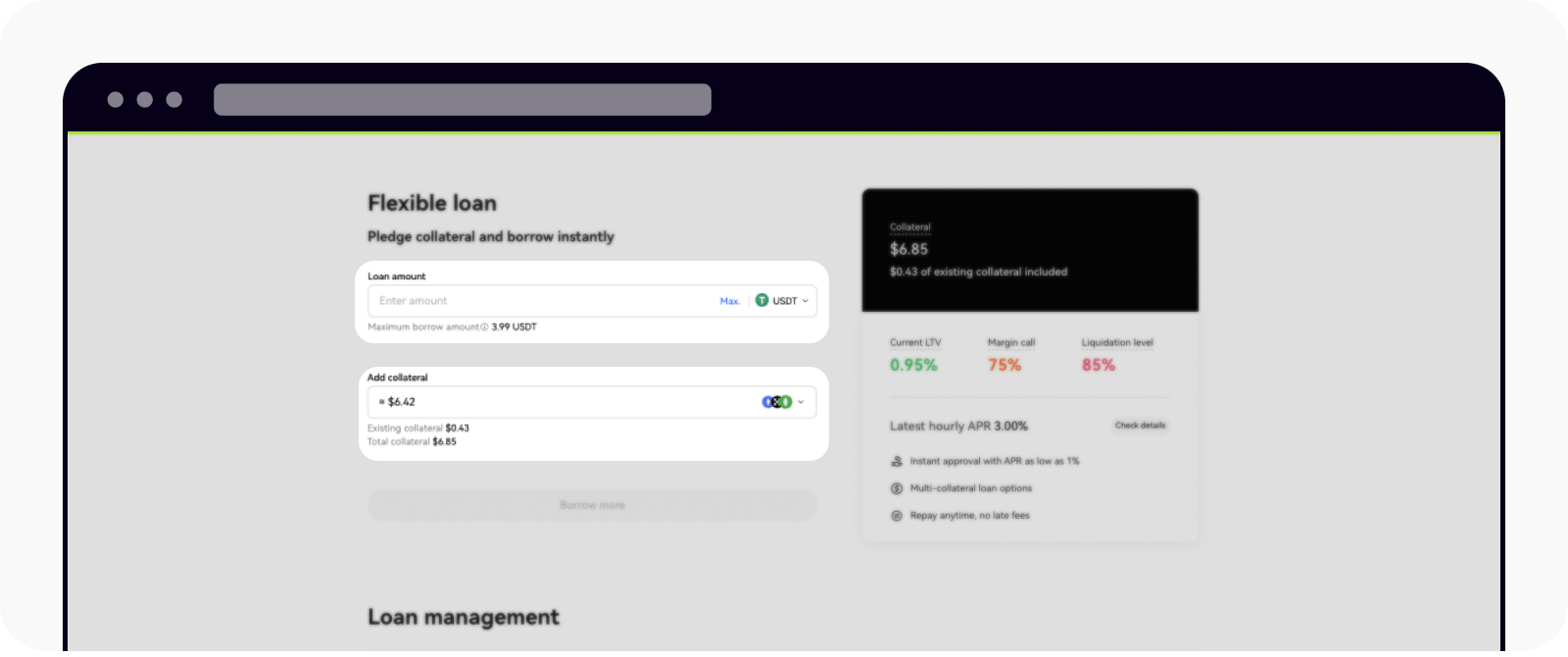

Заповніть суму кредиту й додайте заставу, щоб розпочати позику.

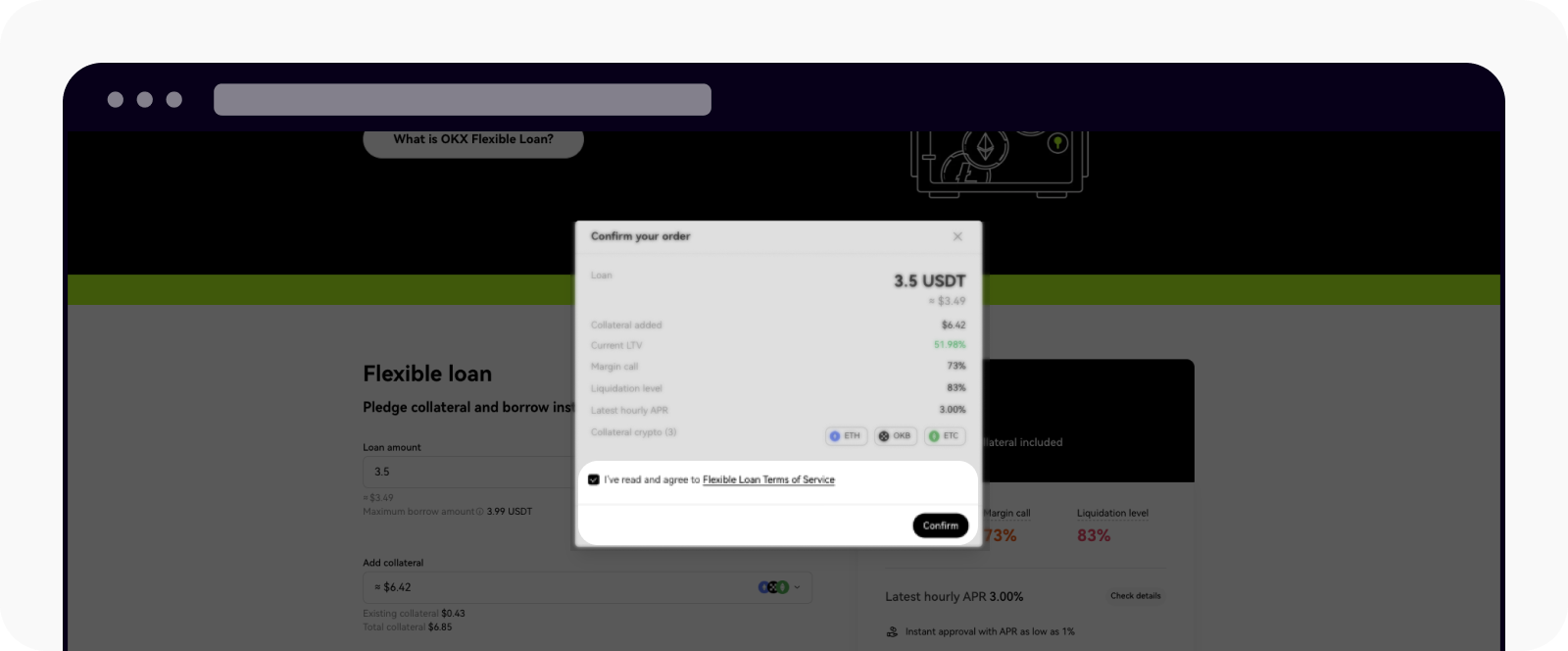

Ознайомтеся з умовами надання послуг Гнучкої позики, перш ніж погоджуватися на її отримання.

Як позичати, щоб заробляти?

Ось кілька способів, як ви можете скористатися додатковими послугами, які пропонує сервіс Позики OKX:

Позика x Jumpstart

Jumpstart — це платформа для користувачів OKX для вивчення перспективних криптовалютних проєктів. Вона дозволяє користувачам отримувати нові криптовалюти, просто здійснюючи стейкінг OKB. Для тих, хто побоюється коливань цін, розгляньте можливість передплати на нові продукти за допомогою OKB, запозиченого через позику. Цей варіант з низьким рівнем ризику дозволяє вам брати участь в ICO, зберігаючи при цьому свої наявні активи.Позика x Earn

Earn пропонує своїм користувачам можливість позичати й заробляти привабливі відсотки за допомогою Simple Earn та Ончейн Earn. Користувачам, які не схильні до ризику, ми рекомендуємо купувати продукти Earn, використовуючи криптовалюту, запозичену в сервісі Позика.

Візьмемо для прикладу OpenDAO: припускаючи, що поточна річна вартість SOS становить 70%, якщо ви позичите 10 000 SOS як Гнучку позику з відсотковою ставкою 5%, ви зможете отримати 6500 SOS до кінця терміну позики (10 000 * 70% - 10 000 * 5% = 6 500). Таким чином, Позика x Earn дозволяє вам сидіти склавши руки і насолоджуватися високими доходами, не турбуючись про волатильність цін.

Як можна позичити, щоб купити?

Якщо вам терміново потрібна ліквідність, але ви не хочете продавати свою криптовалюту, розгляньте можливість позичити USDT у сервісі Позика й обміняти її на фіатну валюту.

Як працює крос-платформний арбітраж?

Якщо припустити, що ставка позики OKX становить 5%, а інша платформа пропонує 10% річних, сміливо позичайте у нас криптовалюту, щоб інвестувати в інші платформи.

Як можна позичити для торгівлі?

Якщо ви вважаєте, що криптовалюта буде рости або падати, розгляньте можливість позичити USDT у сервісі Позика, щоб відкрити довгу або коротку позицію по цій криптовалюті на торговому ринку. Коли ви досягнете бажаної ціни, просто погасіть позику й залиште собі прибуток.