Как автоматизировать стратегии сетки спотовой торговли с помощью фьючерсного grid-бота?

Фьючерсный grid-бот OKX — это автоматизированная и эффективная торговая стратегия для увеличения дохода за счет волатильности на рынке фьючерсов. Покупая дешево и продавая дорого в автоматическом режиме, пользователи зарабатывают на разнице цен на рынке с быстрым движением цен активов.

Фьючерсный grid-бот создает сетку уровней цен и ведет торговлю в заданных параметрах. Пользователи могут установить их самостоятельно либо воспользоваться нашими проверенными стратегиями ИИ. Когда цена поднимается, бот исполняет ордеры на основе выбранных вами стратегий. Если вы предпочли лонг-позицию, бот будет покупать и получать прибыль от дальнейшего роста цен. Если вы выбрали шорт-позицию, то тогда бот будет продавать и извлекать выгоду из ожидаемого падения цен. При нейтральной позиции бот будет управлять ордерами и пользоваться колебаниями цен в заданном диапазоне, независимо от направления. Такая гибкость позволяет боту действовать в соответствии с вашими торговыми целями и перспективами рынка.

Подробнее о других торговых ботах читайте здесь.

## Что такое фьючерсный grid-бот и в чем его преимущества?

Фьючерсный grid-бот OKX — это автоматическая стратегия торговли фьючерсными контрактами. Бот устанавливает сетку ордеров на определенных ценовых уровнях выше и ниже цены входа в позицию. Проще говоря, бот продает фьючерсные контракты, когда текущая цена выше цены входа, и покупает, когда цена актива снижается. В результате трейдер получает прибыль от волатильности цен, не управляя при этом позициями вручную.

У фьючерсного grid-бота три режима: лонг, шорт и нейтральный. В лонг-режиме бот будет открывать и закрывать только лонг-позиции. В шорт-режиме — только шорт-позиции. В нейтральном режиме бот будет открывать или закрывать шорт-позиции выше рыночной цены, а лонг-позиции — ниже рыночной.

Важная разница между спотовым grid-ботом и фьючерсным grid-ботом заключается в возможности торговать с кредитным плечом. При использовании фьючерсного grid-бота пользователи могут увеличивать размер позиции с помощью кредитного плеча, что позволяет торговать более крупными суммами.

Однако следует помнить, что кредитное плечо — это инструмент для опытных пользователей, который несет в себе гораздо больше рисков, чем стандартная спотовая торговля. Данный инструмент не предлагает финансовых или инвестиционных советов, а прошлые результаты не гарантируют тех же результатов в будущем. Если вы собираетесь торговать позициями с кредитным плечом с помощью фьючерсного grid-бота, убедитесь, что полностью понимаете все риски. Узнайте больше о кредитном плече и маржинальных требованиях здесь.

## Как автоматизировать покупку и продажу с помощью фьючерсного grid-бота OKX?

Фьючерсный grid-бот в настоящее время доступен как для бессрочных, так и для фьючерсных контрактов. Предлагаемые продукты недоступны в некоторых регионах

Чтобы перейти к фьючерсному grid-боту, откройте главную страницу и выберите Торговать.

В разделе Торговать, выберите торговую пару в верхней части экрана.

Чтобы начать торговлю фьючерсными ботами, выберите «Торговать»

В раскрывающемся меню выберите Торговые боты, чтобы перейти к маркетплейсу ботов.

Выберите «Торговые боты»

Далее выберите Grid-боты

Найдите спотового grid-бота на вкладке >Торговые боты

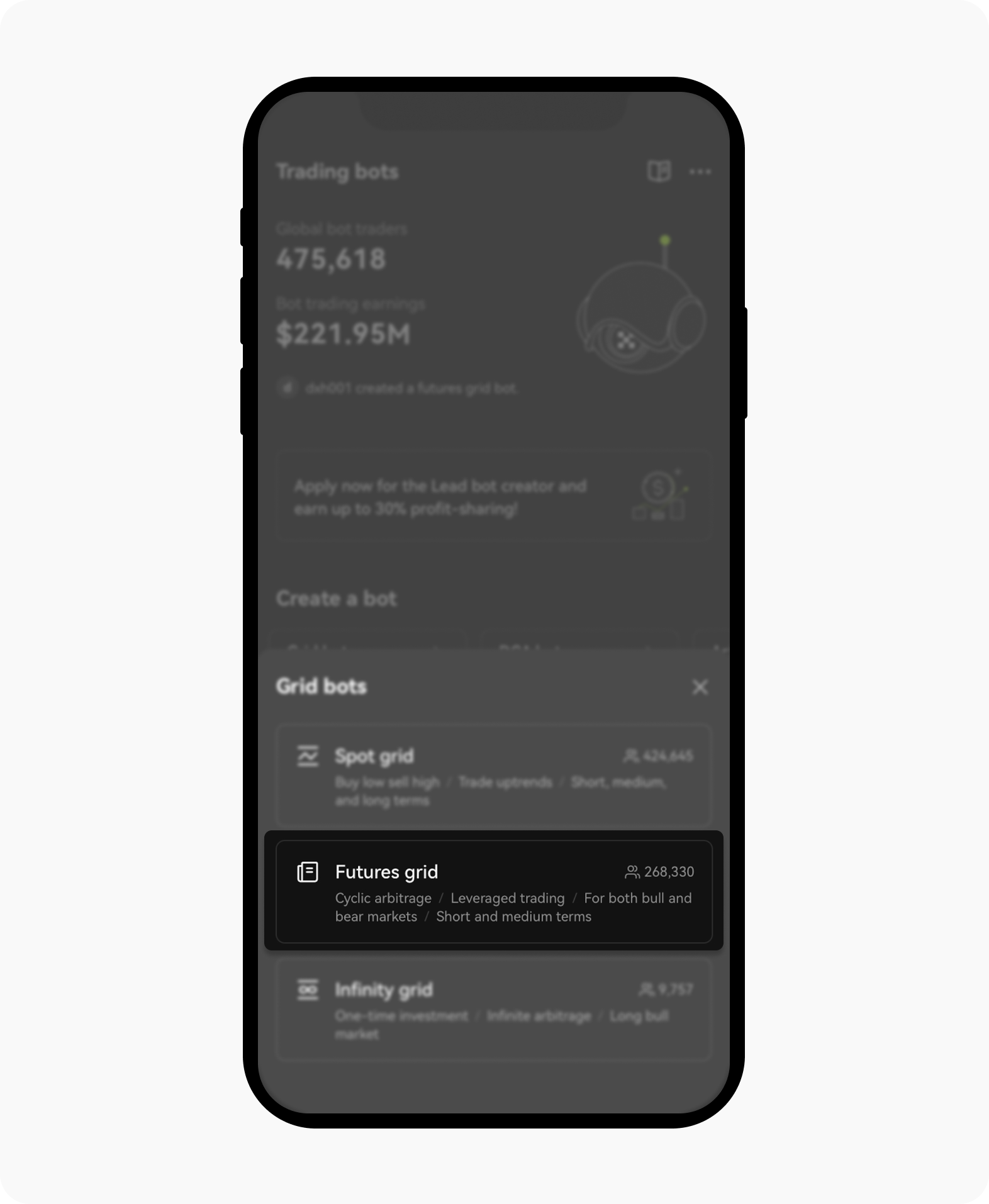

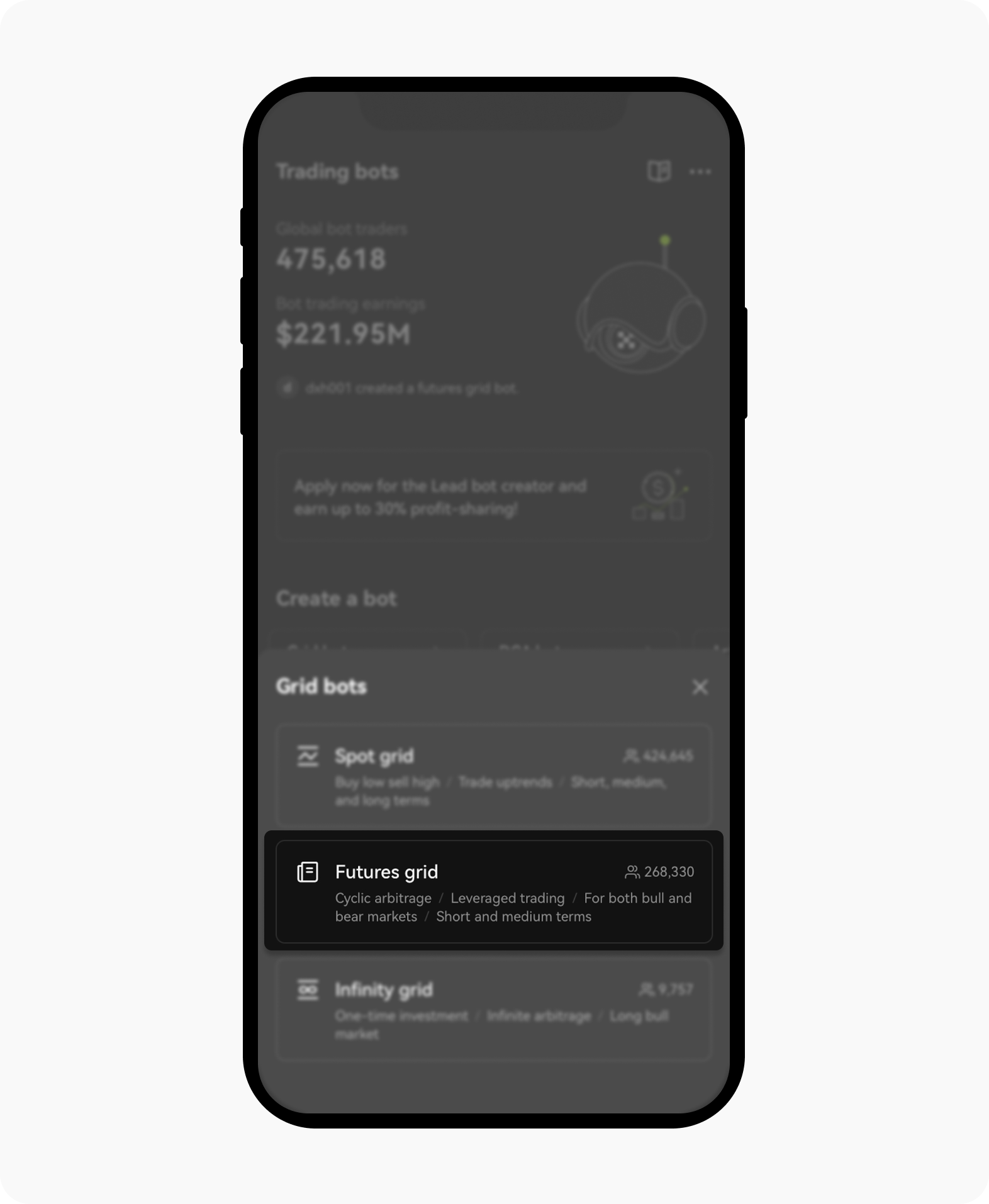

Затем выберите Фьючерсный grid-бот

Фьючерсный grid-бот — один из вариантов Grid-бота

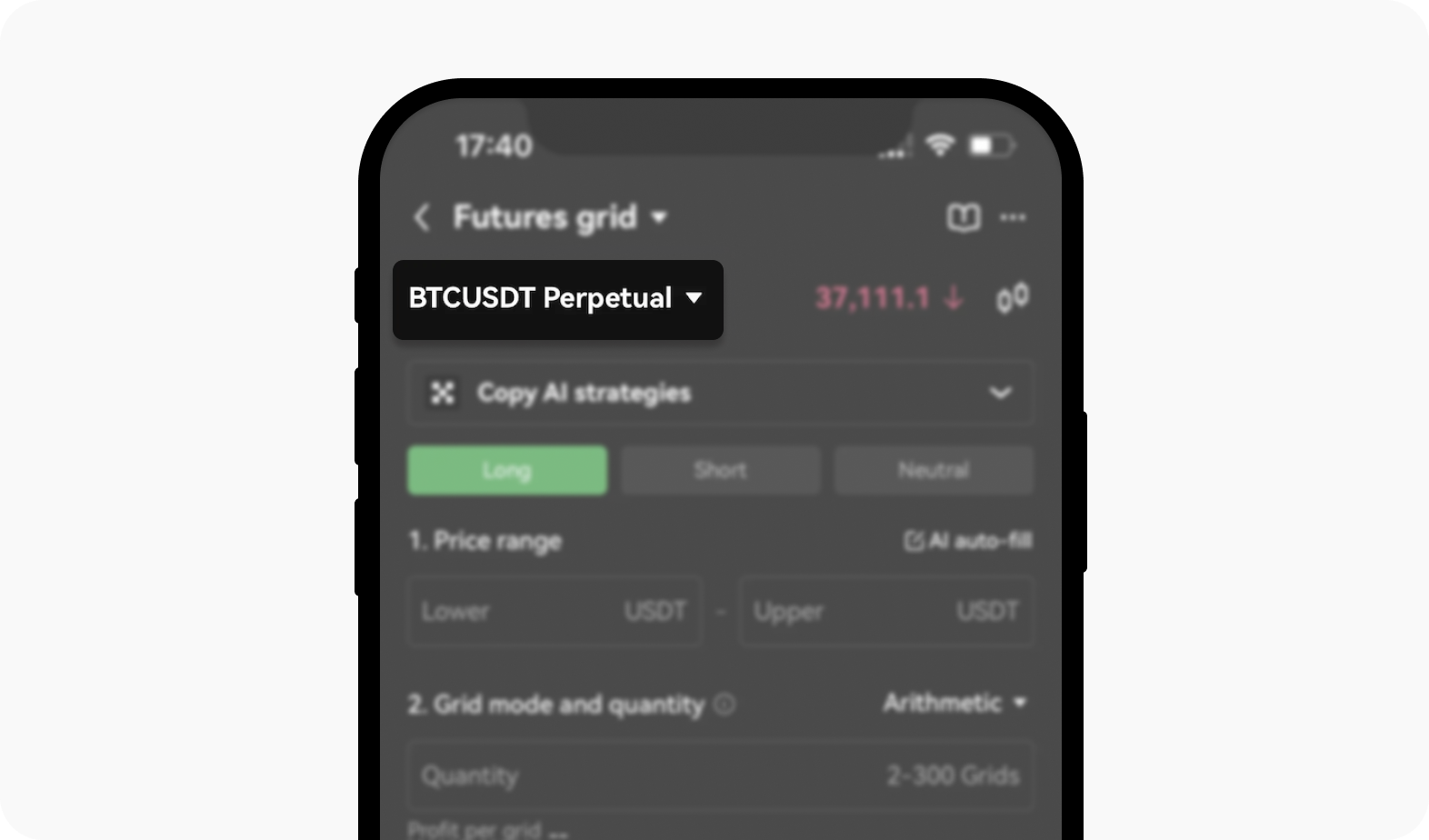

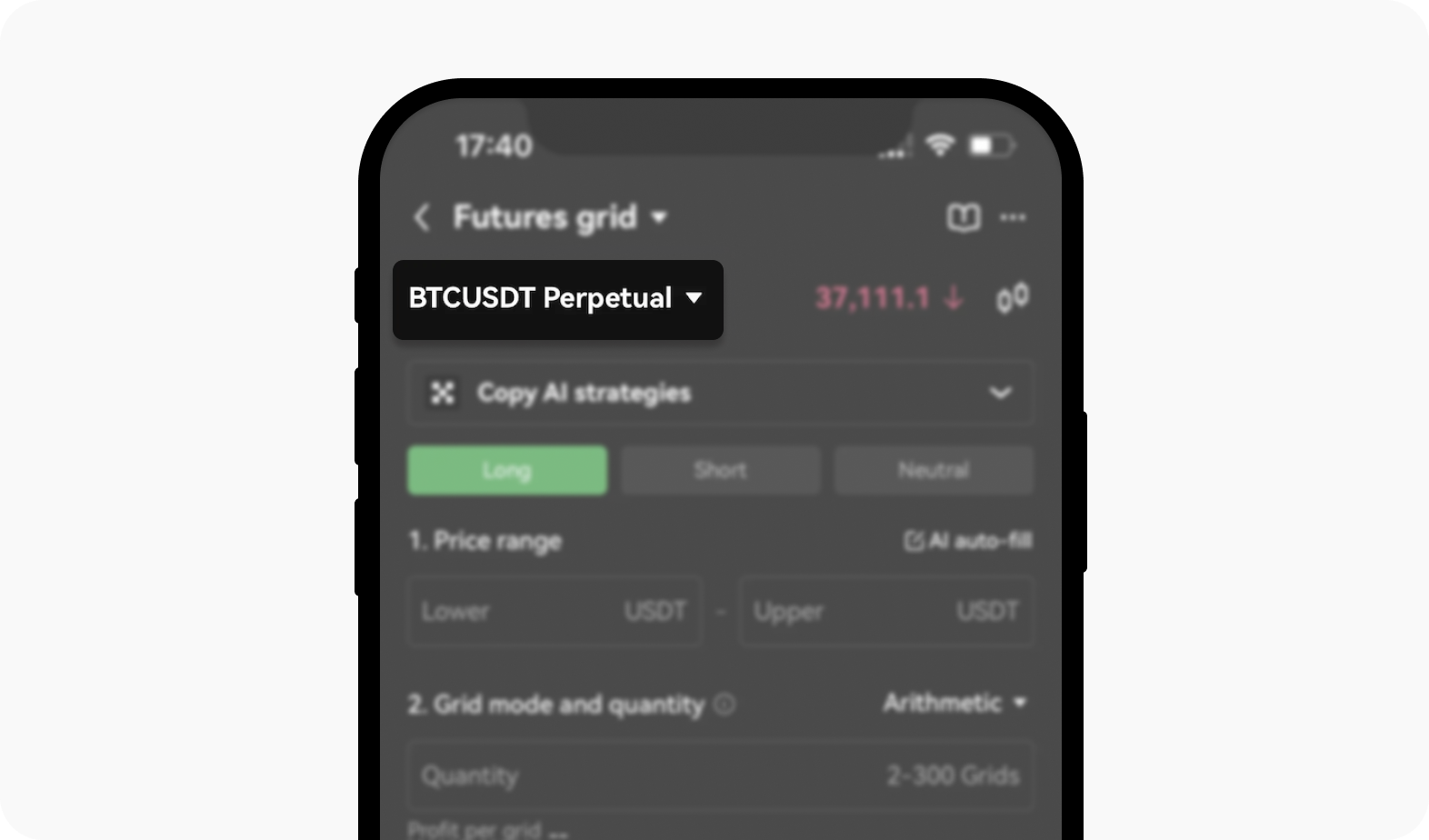

Выберите торговую пару слева вверху экрана и фьючерсный контракт.

Начните торговать, выбрав торговую пару и фьючерсный контракт

Как использовать стратегию ИИ в сетке спота?

По аналогии со спотовым grid-ботом самый простой способ — использовать проверенную стратегию ИИ фьючерсного grid-бота. Следуйте нижеследующей инструкции.

Выберите торговую пару перед тем, как нажать Копирование ИИ-стратегий

Выберите «Копирование ИИ-стратегий», чтобы открыть список стратегий

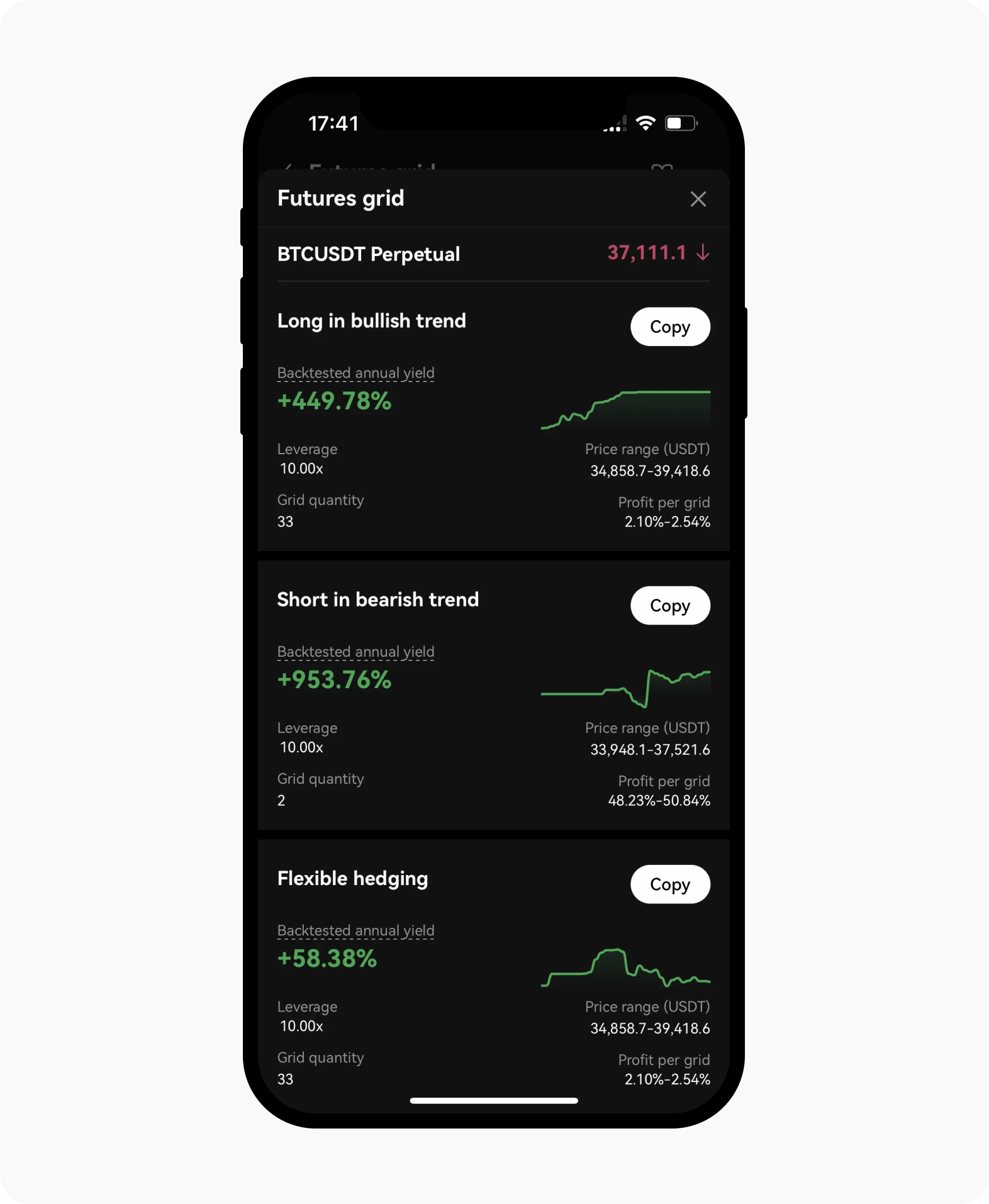

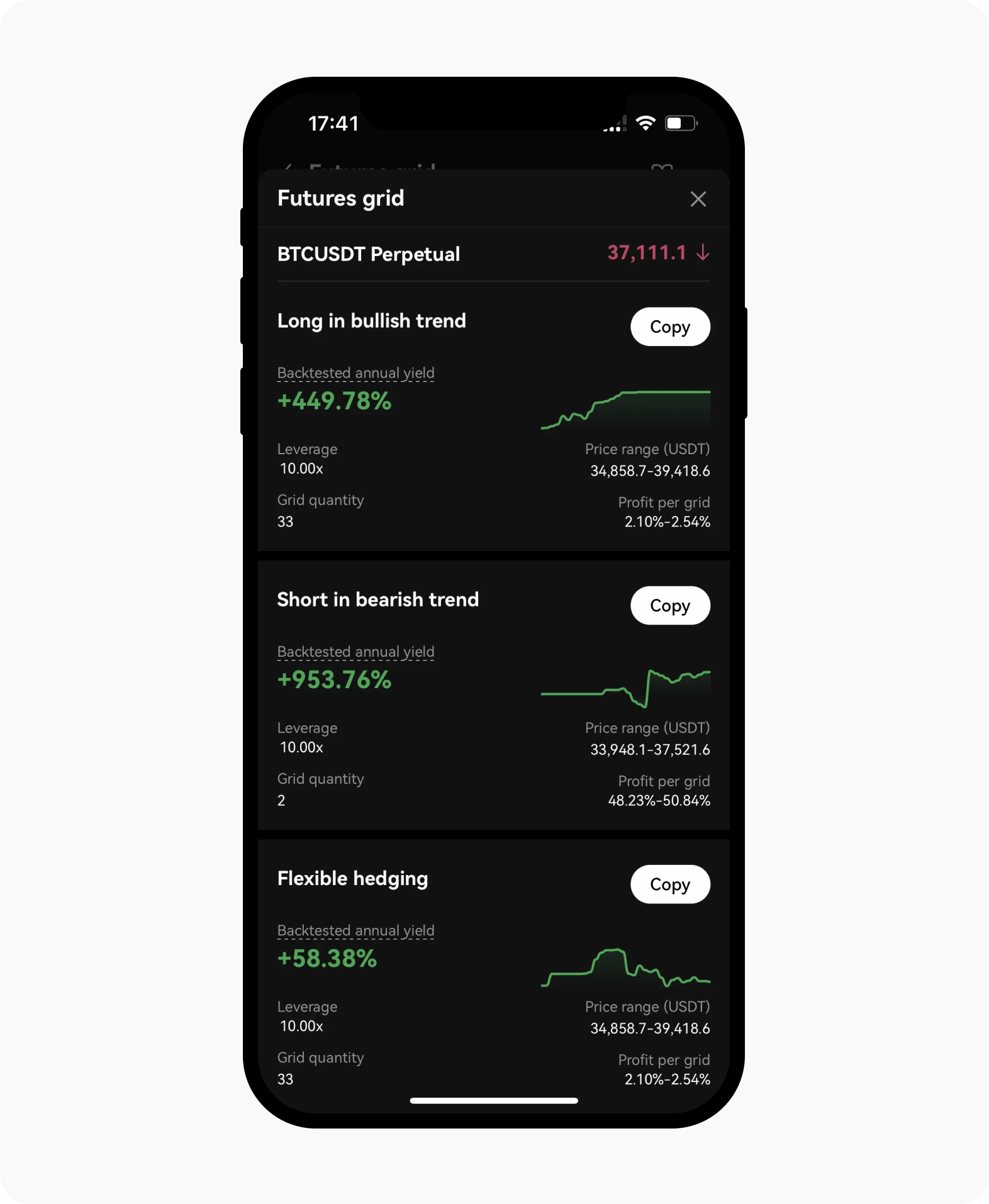

Выберите подходящую вам стратегию. Затем нажмите Копировать

После выбора торговой пары скопируйте предпочтительную ИИ-стратегию

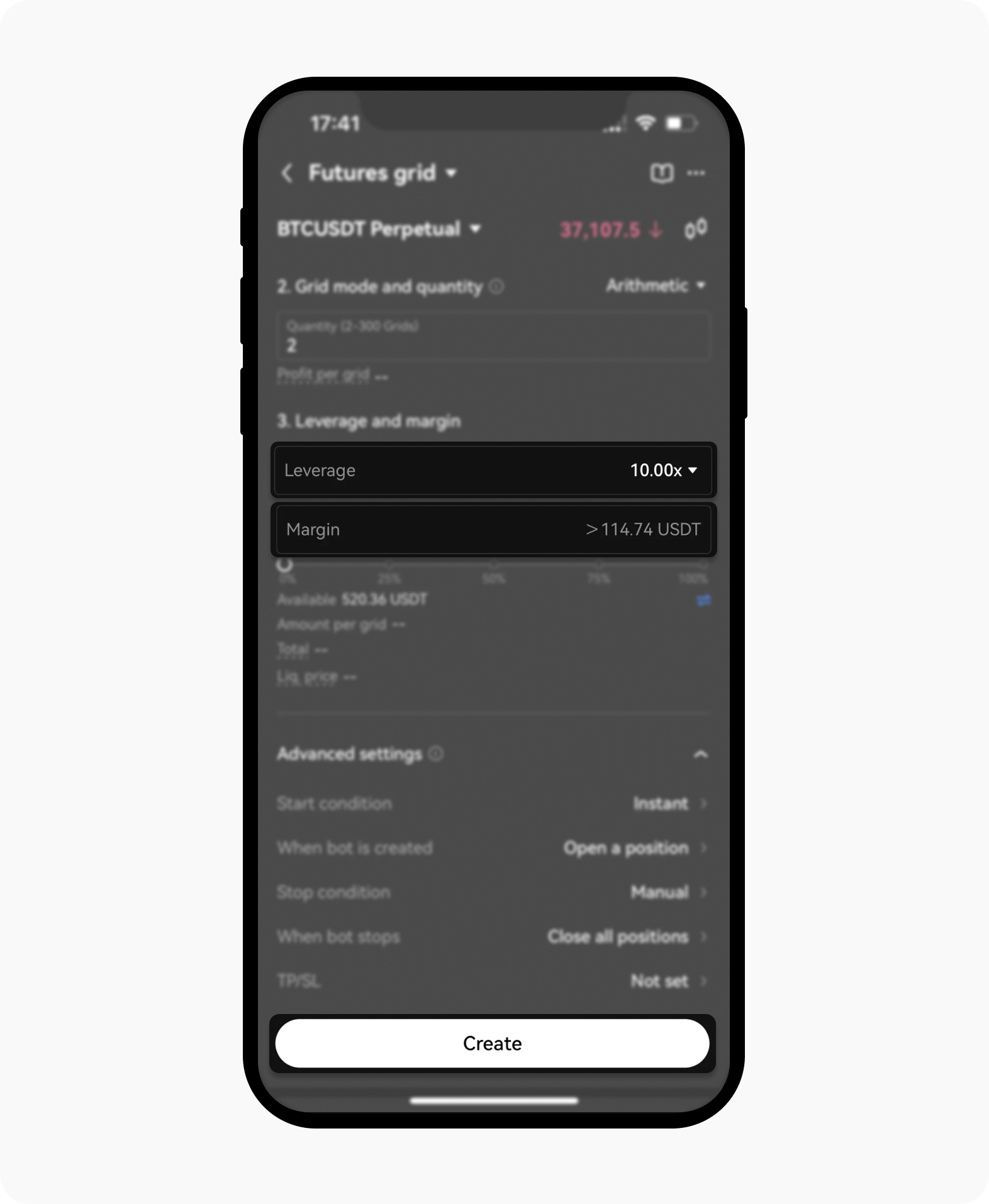

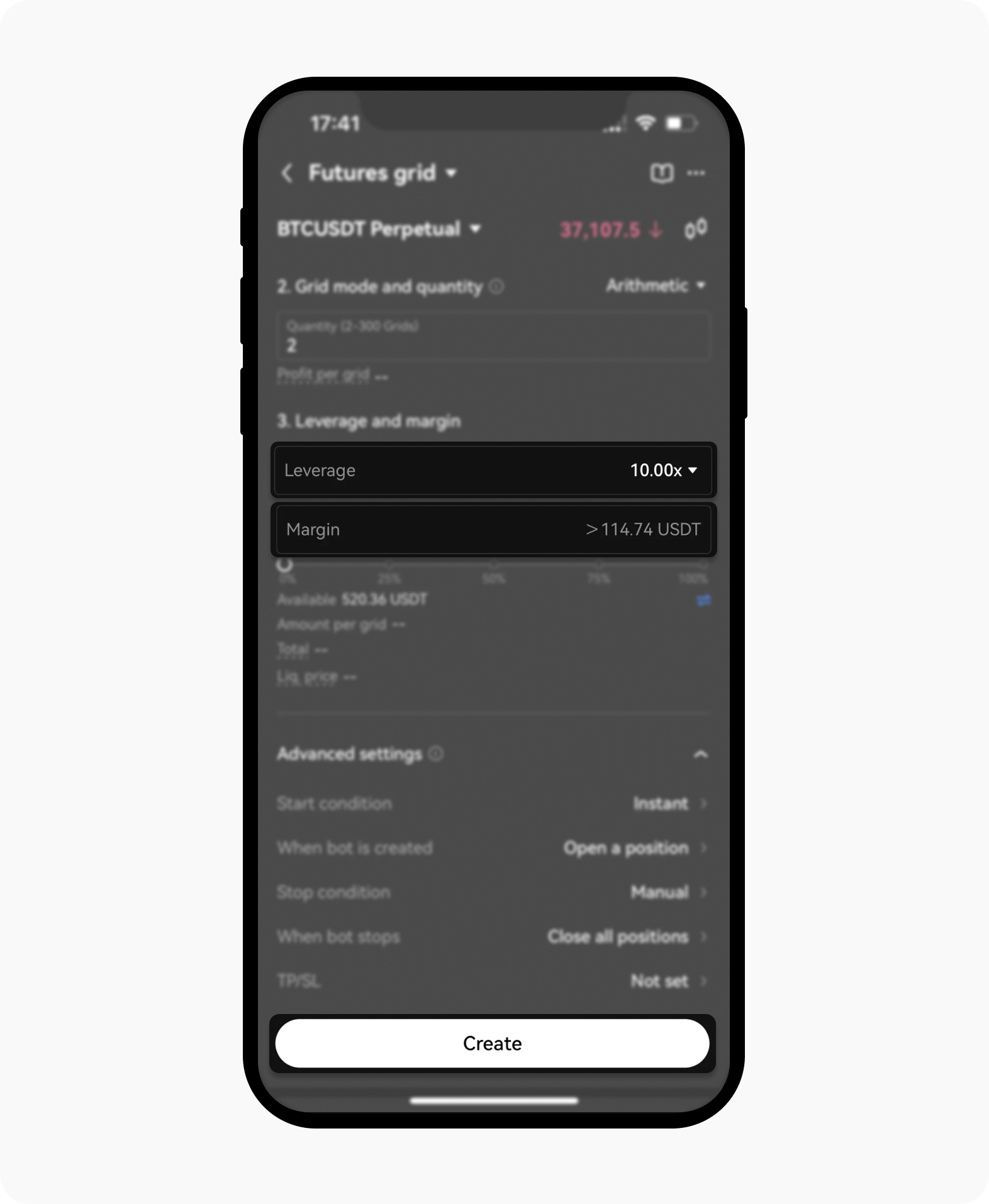

Настройте такие параметры, как кредитное плечо и маржа. Также по желанию можно добавить ордер тейк-профит или стоп-лосс. Затем нажмите Создать

Перед тем как создать бота, настройте параметры по своим предпочтениям

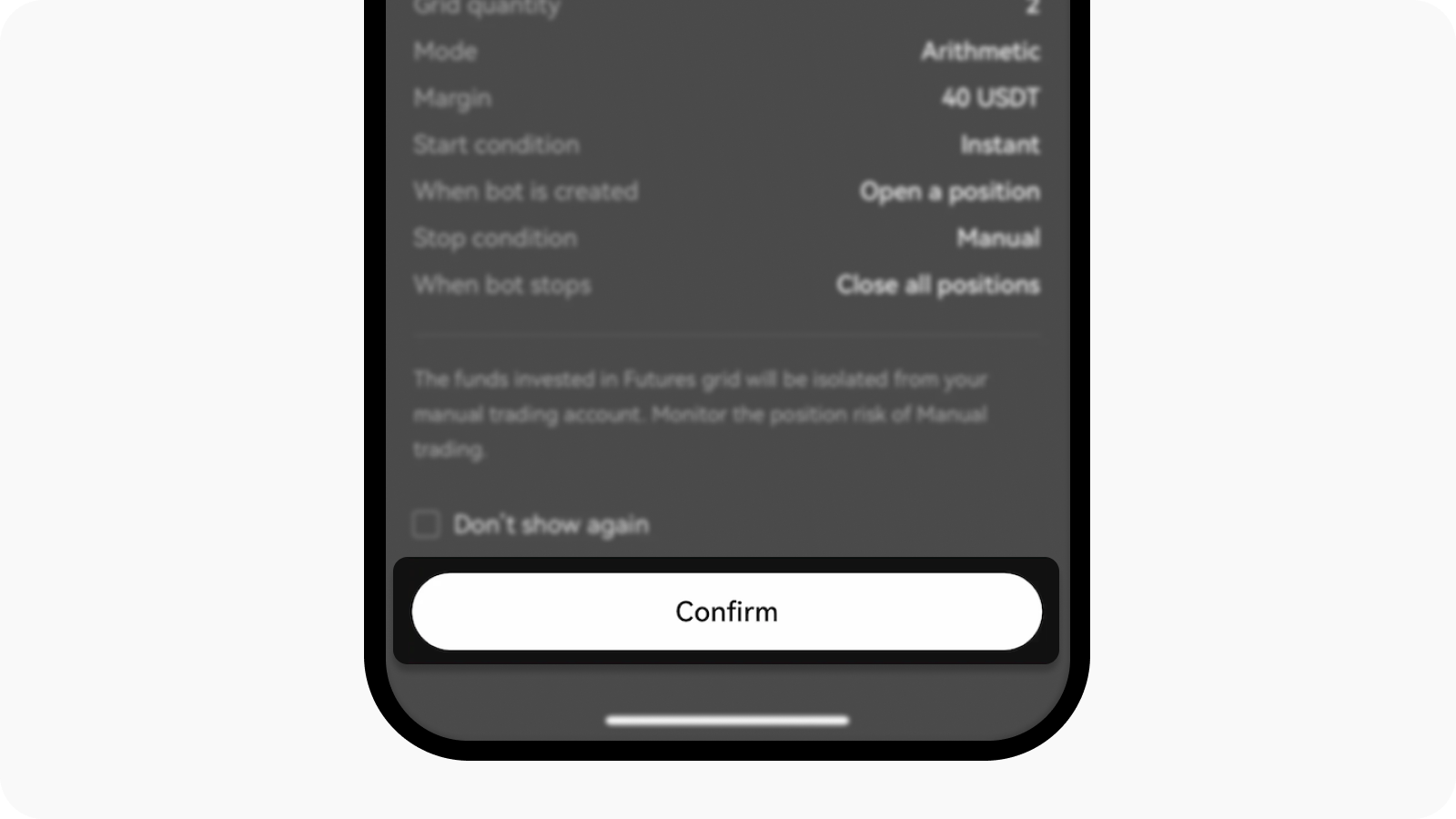

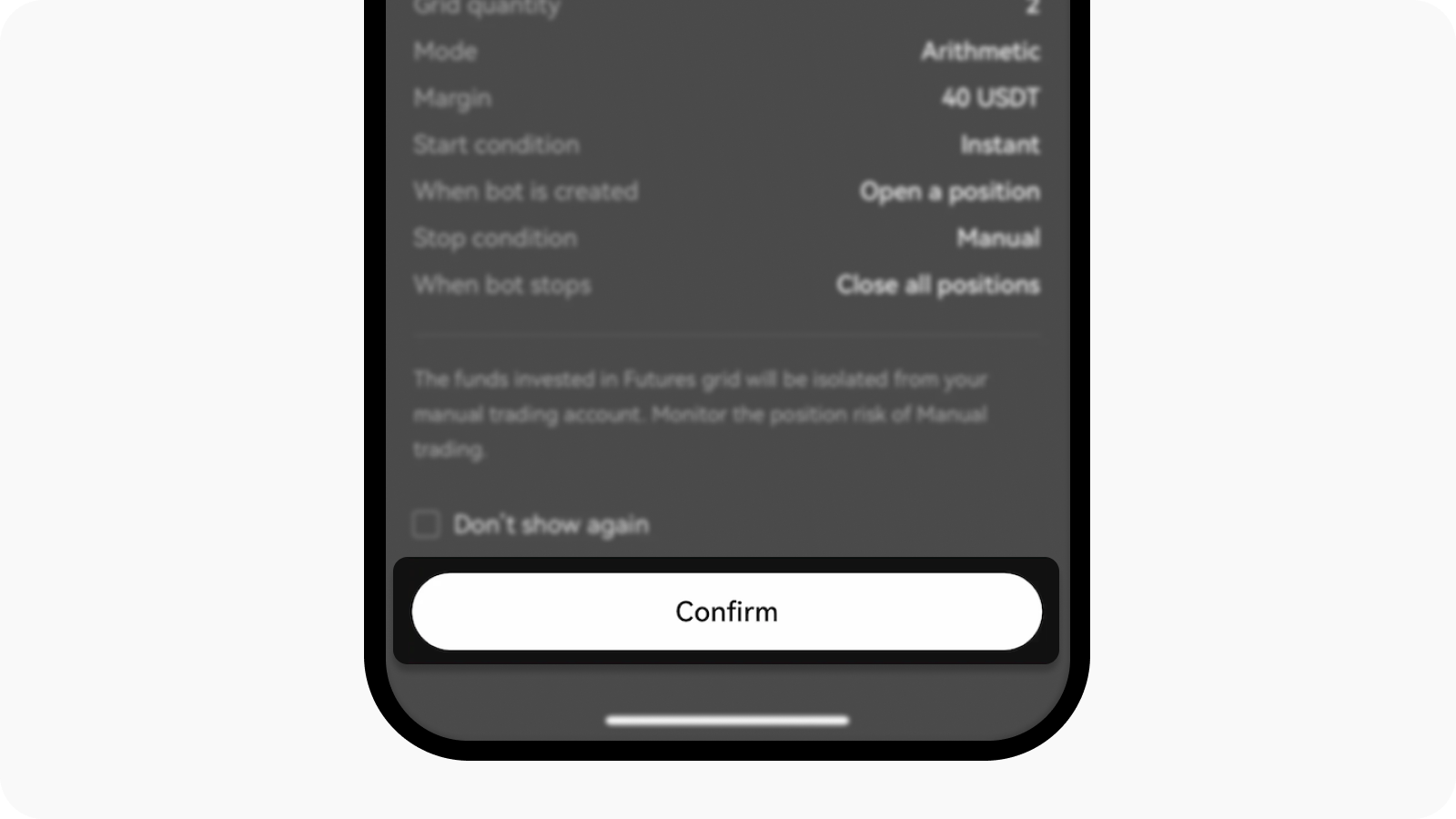

Проверьте данные ордера и нажмите Подтвердить

Подтвердите, когда все детали будут указаны