Authored by Kiwi Yao, researcher at OKX Ventures and edited by Kelvin Lam, CFA

The path to a thriving Bitcoin Ecosystem in 2024 through technological innovations

Executive summary

OKX Ventures has published its 2024 outlook for the Bitcoin Ecosystem — an area that OKX Ventures is heavily involved in and committed to building in the future.

From a fundamental perspective, multiple data points indicate the Bitcoin ecosystem is continuing its upward trajectory and the Bitcoin halving event set to take place this year is going to act as a catalyst for the Bitcoin ecosystem. From a market perspective, the recent approval of spot Bitcoin ETFs is a clear sign of mainstream acceptance and institutional adoption of Bitcoin as an investment vehicle. These drivers are poised to attract more capital and interest to the Bitcoin ecosystem.

Technological innovations serve as the backbone of the Bitcoin blockchain network's continuous growth and adoption. OKX Ventures, through its interactions with ecosystem builders, anticipates significant advancements in 2024. These include asset issuance protocols, BitVM, Bitcoin covalents, and the maturing concept of Layer 2 solutions in the Bitcoin ecosystem.

OKX Ventures actively invests in and supports innovative projects within the BTC ecosystem, providing not only financial backing but also additional resources to foster success. OKX Ventures organized the BTC Ecosystem Project Winter Roadshow with the aim of guiding and inspiring more developers to devote themselves to the Bitcoin ecosystem. By harnessing their potential, we aim to support the development of a more diverse and vibrant Bitcoin ecosystem.

OKX as a company also showcases its deep commitment to the BTC ecosystem through notable initiatives like the OKX Web3 Wallet. The wallet ecosystem has earned significant recognition and market acclaim, underscored by impressive achievements in 2023. In particular, the OKX Web3 Wallet Ordinals market recorded over $1 billion in total trading volume and 120,332 unique addresses in 2023. This stands as a testament to OKX's unwavering dedication to the Bitcoin ecosystem.

The fundamental and market drivers of Bitcoin ecosystem

From a fundamental perspective, the Bitcoin ecosystem has witnessed a rapid expansion in terms of both the number of users and on-chain addresses, indicating a growing interest and adoption of the digital asset over the years. Meanwhile, the upcoming Bitcoin halving event in 2024 is expected to serve as a significant catalyst, further enhancing its fundamental appeal as a store of value.

When considering market dynamics, several factors contribute to Bitcoin's status as a cornerstone of the crypto industry. Firstly, the recent approval of spot Bitcoin ETFs holds promise for increased accessibility and mainstream acceptance of Bitcoin as an investment vehicle. Additionally, the consistent strength in Bitcoin dominance underscores its market leadership and solidifies its position as the primary digital asset in the crypto space. Collectively, these factors present a compelling case for Bitcoin's leadership in the crypto industry and the massive opportunities for the Bitcoin ecosystem.

1. The rapid expansion of users in Bitcoin ecosystem

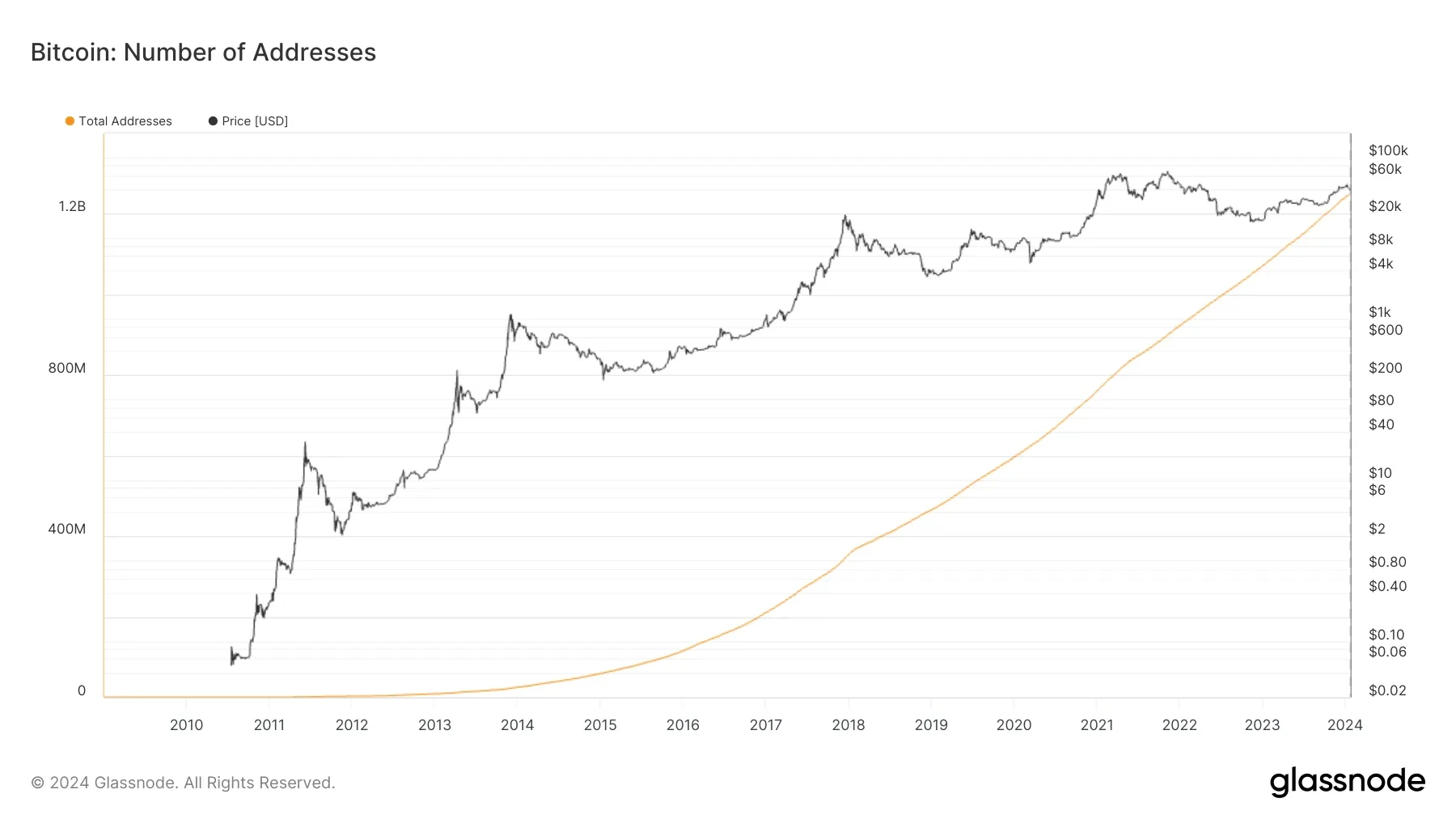

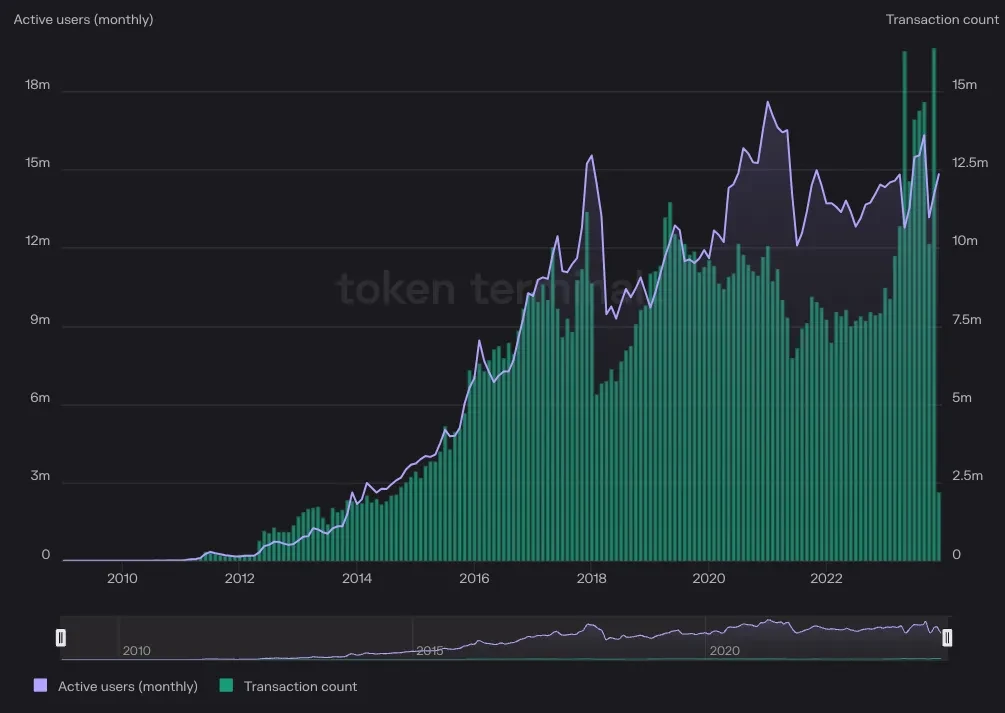

The number of accumulated Bitcoin addresses surpassed 1.2 billion in 2023 (first chart below) and the global user base of cryptocurrency assets has increased from 5 million users in 2016 to over 500 million users in 2023, according to data from Statista. Regarding network activity, Bitcoin's monthly active users were approximately 13.7 million at the time of publishing, with on-chain transaction data reaching 17.5 million (second chart below). From an on-chain data growth perspective, the size of the Bitcoin blockchain is approximately 542 GB as of Jan 16, 2024 — a 70% increase compared to three years ago. All of this reflects the explosive growth in the usage of Bitcoin as the leading cryptocurrency.

Source: Glassnode

Source: Token Terminal

2. Bitcoin halving in 2024 as a catalyst

Bitcoin halving reduces the rate at which new Bitcoins are created, effectively slowing down the new supply entering the market. If the demand for Bitcoin remains constant or increases, the reduced supply can create a scarcity effect, potentially driving up the price.

Bitcoin went up by over 150% in 2023*, and the market's optimism towards Bitcoin has started to be priced in. The upward price trajectory leading to the Bitcoin halving event in April 2024 may continue or even accelerate.

Historical prices reveal a compelling pattern: following the previous two halving events in 2016 and 2020, Bitcoin exhibited an average return of over 400%* within the subsequent 12 months. This historical precedent allows investors to observe and predict potential future trends, instilling a level of confidence in the investment prospects of Bitcoin.

*Source: OKX

3. Spot Bitcoin ETFs approval

The January 2024 approval of Spot Bitcoin ETFs holds the promise of providing widespread accessibility to the asset for the general public. By gaining support from the major financial institutions, the introduction of a Spot Bitcoin ETF is viewed as significant recognition of the cryptocurrency from traditional finance. Consequently, it's expected to attract fresh capital from previously cautious investors who were hesitant to enter the crypto market. In fact, certain media outlets have predicted that ETFs could bring billions of dollars of inflows to Bitcoin within the next year.

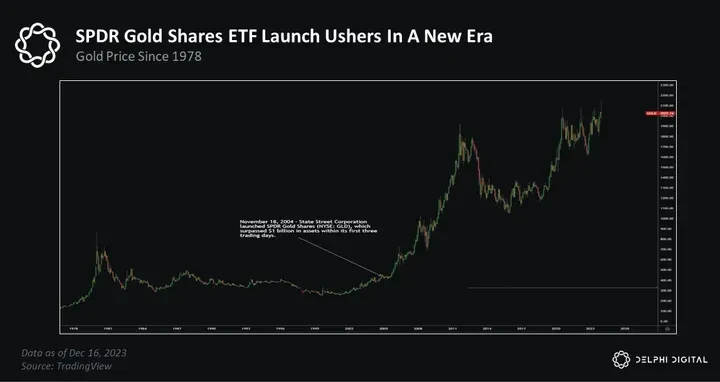

By taking gold as a reference, the launch of the first gold ETF SPDR Gold Shares (GLD) in November 2004 accumulated a remarkable $1 billion in assets within three days. This momentum continued, with GLD's Assets Under Management (AUM) soaring to over $3 billion in its inaugural year. Fast forward to 2023, the global gold ETF boasts an impressive AUM of about $150 billion, demonstrating the profound and enduring impact these investment instruments have had on the gold market.

In addition, the macroeconomic environment can potentially provide some tailwinds for Bitcoin. The recent rally in US government bonds and optimism around Federal Reserve rate cuts in 2024* is predicted to bring a liquidity injection into the market. This will act as a formidable driving force behind Bitcoin and the wider crypto asset market throughout the year, shaping their price trajectory and overall performance.

*Source: Bloomberg, Jan 8 2023

4. Bitcoin dominance remains elevated

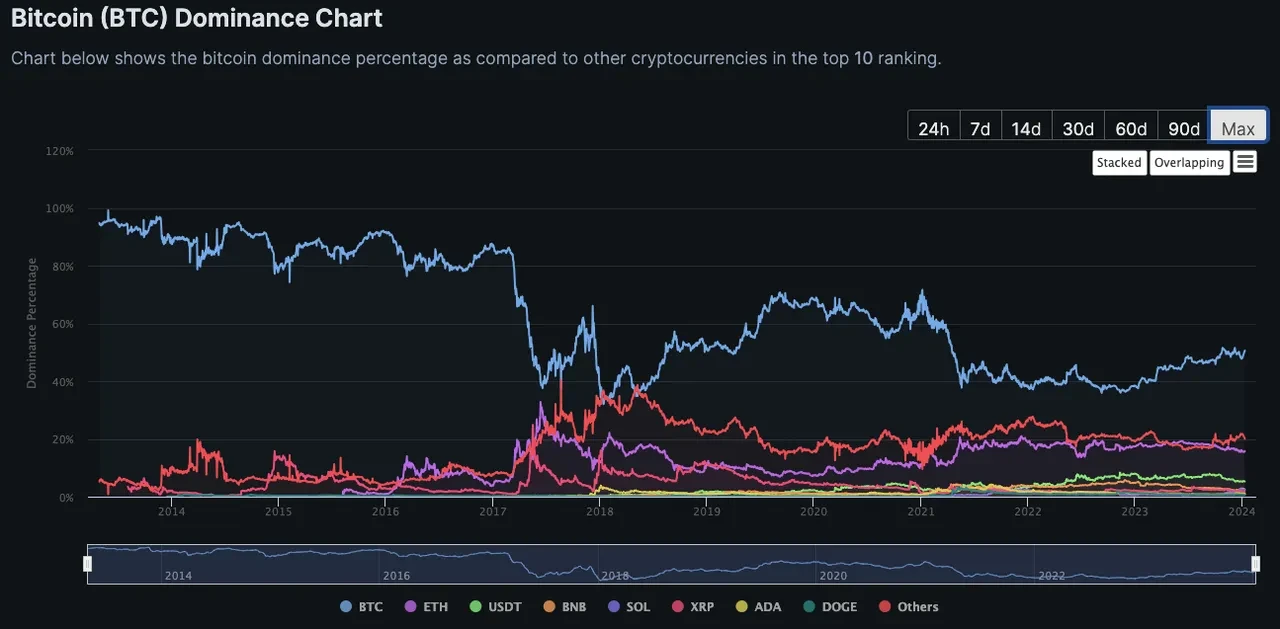

Bitcoin remains the unrivaled leader in the cryptocurrency market, currently representing over 50% of the total market value of all crypto assets. While this ratio may fluctate due to the emergence of other cryptocurrencies, Bitcoin has managed to maintain its leading position over multiple market cycles.

Source: Coingecko

Technological innovations and Layer 2 development trends in the BTC ecosystem

Key technological innovations to watch in 2024

Asset issuance protocols drive innovation

Ordinals: Allow for the creation of unique NFTs using sats (the smallest unit of Bitcoin). Market consensus has been reached on the leading inscriptions on Ordinals. However, there are also some concerns about network congestion and centralization risks

RGB: extended colored coins and the Lightning Network, optimizing the network's privacy and scalability

Taproot assets: leveraging the Taproot protocol activated in 2021, Taproot assets optimize privacy and efficiency in smart contracts. Combined with the Lightning Network, they accelerate asset issuance and transfers, revolutionizing the Bitcoin ecosystem

BitVM: a Turing-complete virtual machine

The concept of BitVM enables complex smart contract verification without altering the Bitcoin consensus mechanism, by using a combination of off-chain computation and on-chain validation.

Potential advantages: Enhances programmability without the need to upgrade the core protocol; reduces on-chain data burden; and increases fraud protection in the Bitcoin ecosystem.

Limitations: Only supports two-party contracts; practicality needs further testing, implementation may face performance and cost challenges.

Revival of OP_CAT: The potential revival of this opcode could provide BitVM with additional adaptability and efficiency.

Development of Bitcoin covenants:

Core value: Allows additional conditional restrictions to be added into UTXO creation, increasing the diversity and security of smart contracts.

Developments:

Early proposals: various proposals such as OP_CHECKOUTPUTVERIFY and OP_CHECKSIGFROMSTACK aim to improve Bitcoin's smart contract capabilities.

Latest developments: OP_TXHASH and OP_CHECKTXHASHVERIFY enhance script access to segregated witness data, as well as the flexibility and decentralization of Layer 2 solutions.

BTC's relentless pursuit of technological advancements is focused on enhancing the feasibility of asset issuance standards, improving the network's privacy and strengthening the complexity and security of smart contracts. These remarkable innovations unlock a world of exciting possibilities for the future of the Bitcoin ecosystem. With the collaborative efforts of the community and developers, the BTC ecosystem is poised to flourish, expanding its horizons and pushing the boundaries of what's achievable.

Source: Information gathered and researched by OKX Ventures from mentioned projects.

Layer 2 innovations focus on rollup and sidechain

Layer 2 solutions encompass various technologies, including sidechains, plasma, rollups, and many others. The key distinction between rollups and sidechains lies in their functionality during mainnet failures. Rollups relies on the mainnet for consensus, rendering it unable to operate independently in such situations. On the other hand, sidechains can continue functioning autonomously even when the mainnet fails, attributed to their independent consensus mechanism.

Rollups can be divided into two solutions:

Witness only (no verification): This approach only stores and aggregates detailed availability sampling (DAS) data. For example, schemes like Celestia may generate detailed DAS information and store it in a dedicated secure layer or aggregate the DAS data and store it using technologies like taproot, which helps reduce the cost of storing detailed DAS.

Verification through zero-knowledge proof (ZKP): Fraud-proof schemes leveraging zero-knowledge proofs (ZKP). One notable example is B² Network, which converts ZKP verification programs into arithmetic circuits. By using AND gates and XOR gates to implement the multiplication gate, the arithmetic circuit is then transformed into a comprehensive logic gate circuit. Bitcoin script is employed to implement this circuit, resulting in the formation of Circuit Taproot. The taproot commitment is subsequently placed on the main chain, making sure of its validity and security. Compared to BitVM, Circuit Taproot offers a deterministic circuit, simplifying the overall design process. Additionally, rollup, a key component, stores transaction details and proof data using decentralized storage protocols, guaranteeing data integrity. Even if rollup temporarily stops running, it can resume operations seamlessly, showcasing its resilience and continued functionality.

Sidechain projects have different preferences for security, speed, and decentralization:

Stacks - Proof of Transfer (PoX): Stacks miners verify transactions by bidding Bitcoin to become the next block producer. They then verify the block by generating and sending the hash block header of the completed block in the message field of Bitcoin transactions, which is permanently recorded on the Bitcoin main blockchain.

RSK: Rootstock (RSK) uses the same SHA-256 algorithm as Bitcoin and is connected to Bitcoin through a two-way bridge. Bitcoin miners can engage in "merged mining" without additional resource consumption while mining. They can also earn transaction fee income from Rootstock.

Drivechain: A Bitcoin open-sidechain protocol that allows customization of different sidechains according to different needs. Its design is based on two Bitcoin Improvement Proposals (BIPs): BIP 300 "Hashrate Escrows" compresses 3-6 months of transaction data into 32 bytes using "Container UTXOs". Meanwhile, BIP 301 "Blind Merged Mining" provides network security through a similar approach as RSK, with existing Bitcoin miners maintaining it.

Source: Information gathered and researched by OKX Ventures from mentioned projects.

Assessing Layer 2 solutions: reusing mainnet security as the key criterion

There are two ways of reusing:

Reuse mainnet consensus, reuse PoW: This involves adopting the mainnet's data availability and consensus. It's crucial to evaluate how it can be used as a Layer 1 solution. ZK schemes like Bitmap and B^2 aggregate zk-proofs that aim to securely store them on the mainnet. Confirming commitments can be accomplished by employing mechanisms akin to optimistic rollup challenges.

In the near term, we believe the mainstream approach is the mainnet "witness" data solution. In the longer term, we're more optimistic about the mainnet "validator" data solution. Fraud proofs used in optimistic rollup can be a better solution. For instance after off-chain ZKP verification, the inscription is stored in the BTC network. The ZKP verification program generates logical gates as commitments, which are written in the Bitcoin network as Taproot. Bitcoin on-chain confirmation can be carried out through fraud proofs, guaranteeing legitimacy while inheriting BTC's security and efficiency.

Currently, projects like B^2 are moving in this direction, with nodes and some Bitcoin together serving as the DA layer, responsible for the validity and data availability of zk-rollup transactions. Meanwhile, the BTC mainnet serves as the settlement layer, responsible for transaction finality.

Reuse mainnet liquidity, reuse PoS: For example, Babylon provides comprehensive punishability security, security of stakers, and staking liquidity. For example, WBTC bridges BTC to ETH and Solana, where ETH and Solana can be considered as BTC sidechains. Projects like Stacks and Bevm adopt similar approaches.

In this case, we we're optimistic about Babylon, which leverages the security of the Bitcoin native chain while bringing additional trust and capital to the PoS chain. This cross-chain staking structure helps establish a new economic model in which the PoS chain can strengthen its security through the market value of Bitcoin, and Bitcoin holders can potentially make gains by supporting the security of the PoS chain. This mechanism also increases the utility of Bitcoin and may incentivize more people to participate in the Bitcoin ecosystem.

Source: Information gathered and researched by OKX Ventures from mentioned projects.

OKX is committed to building the BTC ecosystem

OKX Ventures is actively investing in and providing support to drive forward innovative projects within the BTC ecosystem. Here are some examples:

B^2 Network

Project introduction

B^2 Network is a Layer 2 solution built on top of Bitcoin, combining ZKP BTC rollup to achieve higher scalability and usability of BTC Layer 2. Aggregated storage and ZKP are written into BTC inscriptions to provide authenticity and higher availability.

It operates the first zk-proof commitment rollup using zk-proof technology. With rollup technology, it supports Turing-complete smart contracts, enables off-chain transactions, and reduces costs. It combines zk-proof technology, gate commitments, and Taproot's challenge-response mechanism to ensure privacy and security in Bitcoin transaction confirmations.

The goal of this network is to transform Bitcoin into a versatile platform, laying the foundation for applications such as DeFi, NFTs, and other decentralized systems.

Project advantages

Security and decentralization: Being based on Bitcoin, all B^2 rollup transactions can be recovered. By adopting zero-knowledge proof commitments and challenge-response, bidirectional confirmations are achieved on Bitcoin, not just one-way data writes.

Seamless development and integration: EVM compatibility allows developers to quickly migrate from other EVM-compatible chains to the B^2 network and simplify decentralized application (DApp) development. By implementing account abstraction, it supports Bitcoin address accounts, Ethereum address accounts, and email accounts, enabling Bitcoin users to interact across chains on B^2 without changing wallets. Storing Bitcoin state eliminates the need for a bridge between Layer 1 and Layer 2 to trigger cross-chain transactions. It also provides developers with the ability to develop on top of Bitcoin transactions and offers a reliable decentralized Bitcoin indexer service.

Performance readiness for mass users: The rollup layer using rollup technology operates without consensus, guaranteeing high performance. What's more, the robust data availability layer of the B^2 network maintains high security. It provides low-cost, affordable fees for users, without increasing costs during high demand.

Bitmap Tech (previously known as Recursiverse)

Project introduction

Bitmap Tech (formerly Recursiverse) is an innovative project that aims to build an intelligent, decentralized, and composable digital world through the Ordinals network and Bitcoin Layer 1. The project reflects a strong commitment to creating a valuable metaverse ecosystem and has launched a series of cutting-edge products:

BRC-420 Protocol: A decentralized economic framework that operates on the Ordinals network. It allows creators to directly earn income without relying on platforms for transaction acceptance or hosting.

Recursive indexing and inception inscriptions: Showcases the relationships and reference counts between inscriptions, emphasizing the value that interconnected inscriptions can bring to the network. Inception introduces a multi-layer recursive inscription approach where top-level inscriptions can contain a significant amount of content and logic within a very small digital footprint.

Bitcoin Layer 2 network: The plan is to bridge the BRC-420 protocol and Bitmap with second-layer solutions such as ZKP, rollups, and the Lightning Network. This is expected to further develop its decentralized metaverse vision, making it a significant participant in the evolving digital world.

Bitmap.Game: The first metaverse product based on Bitmap assets, where users can enter this world to chat, trade, and play games with other players. It's currently the largest metaverse product in terms of user volume on the Bitcoin network.

Project highlights

High degree of freedom: Anyone can use the BRC-420 protocol to create their own metaverse inscriptions.

Composability: The protocol is designed to integrate with Bitcoin Layer 2 solutions, providing liquidity and scalability to the second layer.

Innovative narrative approach: Introduces the novel "Bitmap Protocol" for metaverse land, going beyond the limitations of a single NFT form and using it to tell broader metaverse stories.

Clear positioning: Bitmap is positioned as a metaverse protocol and NFT marketplace on Bitcoin, supporting inscriptions based on the BRC-420 protocol, with plans for future integration of liquidity mechanisms through the second layer.

Experienced team: The CEO has a rich entrepreneurial history in Web2, VR, and Web3 development engines.

Compelling products: The BRC-420 market already has derivatives and an active community. The presence of high-priced low-floor items indicates strong user interest and the involvement of whale participants.

Operational momentum: The evident market FOMO around Bitmap NFTs, significant whale participation, and partnerships within the Bitcoin ecosystem highlight the project's operational strength.

Babylon

Project introduction

The Babylon project is a proposed Bitcoin staking protocol that allows Bitcoin holders to stake their idle Bitcoin to increase the security of the Proof of Stake (PoS) chain and earn rewards in the process. It aims to integrate Bitcoin with the PoS economy.

The Babylon project seeks to use Bitcoin staking as a new way to enhance the efficiency of Bitcoin as an asset and strengthen the economic security of PoS chains. This new use case has a positive impact on Bitcoin itself, Layer 2, and related PoS ecosystems.

Project highlights

Strong security: The Babylon protocol guarantees comprehensive security of the PoS chain, and in the event of security violations, at least 1/3 of the staked Bitcoin will be deducted.

Staker protection: As long as stakers comply with the rules of the PoS protocol, they can maintain the safe withdrawal of their funds.

High liquidity: Babylon allows stakers to quickly unbind their staked Bitcoin without relying on community consensus mechanisms.

Modular design: The protocol is designed to be modular, making it easy to integrate with various PoS consensus algorithms.

System architecture: A system architecture has been introduced for scaling multiple stakers and multiple PoS chain protocols.

Fast unbinding: A fast, frictionless asset unbinding process has been designed to reduce the time required for unbinding.

BitSmiley

Project introduction

BitSmiley is the first native stablecoin project in the BTC ecosystem, which is built on the Bitcoin blockchain as part of the Fintegra framework. It consists of three key components:

Decentralized stablecoin protocol: Through the Bitcoin network, BitSmiley introduces an overcollateralized stablecoin protocol. The UNO issued by this protocol is a stablecoin pegged to the U.S. dollar. Users can mint UNO by locking their Bitcoin as collateral in the BitSmiley treasury, which is a smart contract on the Bitcoin blockchain.

Trustless lending protocol: BitSmiley's native lending platform allows users to participate in decentralized lending activities. Borrowers can receive the tokens they wish to borrow by collateralizing BTC, and once the borrowed assets and interest are repaid, the collateralized BTC will be returned.

Derivatives protocol: BitSmiley plans to expand into lending-based derivatives to enhance capital efficiency and meet the demand for more complex financial instruments in the DeFi space.

Project highlights

Integrated stablecoin issuance mechanism with the Bitcoin blockchain: Effectively reduces market risks caused by Bitcoin price volatility, providing users with a more stable medium of exchange.

Advanced liquidation and auction design: Adopts the Dutch auction mechanism to address the issue of undercollateralization and automates the execution through smart contracts, guaranteeing system robustness and decentralization.

Advanced insurance and risk management solutions: Proposes an insurance pricing model based on extreme value theory and T-Copula, allowing lending participants to hedge potential large price fluctuations and increasing the security of the protocol.

Improved capital efficiency: Loan fragmentation and merging features enhance capital utilization to meet the borrowing needs of different users.

Future scalability and innovation guidance: The project plans to develop various derivatives, including credit default swaps (CDS), aiming to build BitSmiley into a one-stop decentralized financial platform supporting multiple financial services.

alexGo

Project introduction

alexGo is a platform based on the Bitcoin DeFi (Decentralized Finance) ecosystem. Its goal is to become a top DeFi platform for Bitcoin users, innovators, and a wider ecosystem, addressing the limitations faced by Bitcoin in the DeFi space due to the need for smart contracts and a computing layer.

alexGo applies the Stacks Layer 2 solution to introduce smart contract functionality to Bitcoin, aiming to eliminate barriers between Bitcoin Layer 1 and Layer 2, creating a seamless DeFi experience.

ALEX has established the "Bitcoin Lab" ecosystem fund, which provides funding support, technical services, community involvement, and a platform for project initiation and growth, making it highly attractive for project developers and investors.

Project advantages

Seamless Bridging: Strengthens the entire Bitcoin DeFi experience through seamless bridging between Bitcoin Layer 1 and Stacks Layer 2.

Transaction speed: Reduces the confirmation time for each block from 10 to 15 minutes to just five seconds through Stack's Nakamoto Release.

Reliability and security: Comprehensive integration and cross-layer security measures, including collaboration with industry groups to establish on-chain Oracles for BRC-20 and enhance its reliability and security in the Bitcoin DeFi space.

Portal Defi

Project introduction

Portal DeFi has proposed the first truly cross-chain private DEX protocol, aiming to address the risks of centralized exchanges and the risks associated with decentralized exchanges using cross-chain bridges and wrapped tokens.

The introduction of the PortalX system enables decentralized trading of Bitcoin and other assets and the creation of financial contracts.

Users can directly access decentralized services using non-custodial wallets, achieving comparable responsiveness and liquidity to centralized exchanges while maintaining the security of assets and data.

Adopts technological innovations such as multi-party hash time lock contracts and smart contracts, as well as validator sets to guarantee fast, cost-effective, and secure execution of transactions.

Project highlights

Cross-chain interoperability: PortalX supports the exchange of assets across different blockchains, completely eliminating the need for reliance on centralized third parties.

Zero-knowledge protocols: By utilizing zk-proof technology, Portal achieves transaction privacy protection and security in the exchange process.

Resistance to censorship: The provided financial applications adhere to decentralized principles, ensuring freedom and the ability to resist external interference.

Non-custodial design: Users can trade without giving up asset control, solving the problem of asset custody.

PortalOS operating system: A comprehensive operating system that supports various functions of Portal DeFi, ensuring efficient system operation.

Validator incentive mechanism: Introduces PoS mechanism, where native tokens are staked to ensure sufficient incentives for network participants to engage in system maintenance.

Solution to Tier-Nolan atomic swap problem: Provides answers to challenges existing in classical atomic swap protocols, such as the fair option problem and the lack of convenient incentives.

Liquidity aggregation: Through the design of on-chain contracts and protocols, Portal aims to aggregate and match liquidity in decentralized financial applications.

Source: Information gathered and researched by OKX Ventures from mentioned projects.

OKX Ventures launches Bitcoin ecosystem hackathon, empowering the BTC ecosystem

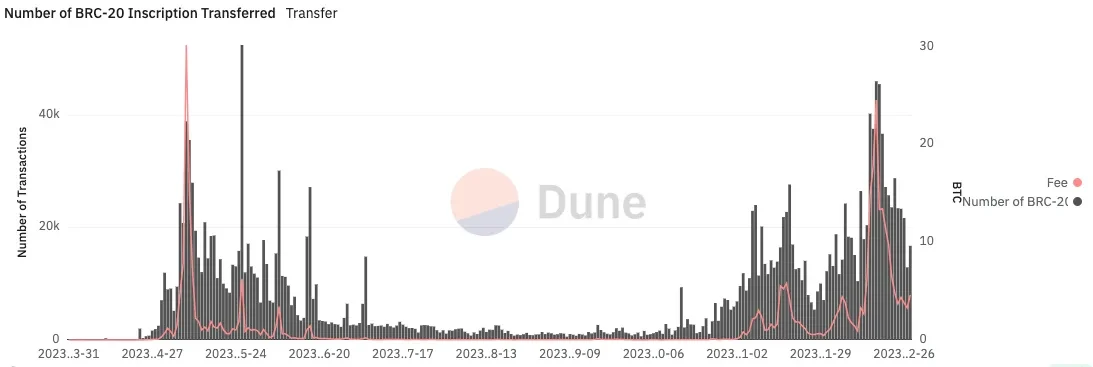

Ordinals made significant strides last year, representing a groundbreaking advancement in asset issuance within the Bitcoin ecosystem. This breakthrough has been met with widespread adoption. Subsequently, various other asset issuance protocols emerged, such as BRC-20, RGB, Taproot Assets, Runes, Taro, Atomicals, TAP, PIPE, and more. The growth statistics are as follows:

BRC 20: The cumulative number of BRC-20 transfers exceeds 45.4 million, and the cumulative transaction fees generated by BRC-20 exceed 4,290 BTC.

Ordinals: The cumulative inscription total exceeds 53 million, and the cumulative transaction fees generated by Ordinals exceed 5,383 BTC.

Source: Dune analytics

As we witness the remarkable surge of Bitcoin Ordinals and the extensive issuance of assets, accompanied by the increasing demand for liquidity and applications (like infrastructure, GameFi, and NFTs), our aspiration is to guide and inspire more developers to invest in the Bitcoin ecosystem. By harnessing its potential, we aim to foster the development of a more diverse and vibrant Bitcoin ecosystem.

OKX Ventures organized the BTC Ecosystem Project Winter Roadshow, held online by ABCDE and BeWater. A total of 51 projects applied, and seven projects received final investment.

The hackathon project tracks include Layer 2, RGB, Lightning Network, Taproot, Ordinals, BRC20, stablecoins, and lending.

Project teams come from around the world, including Singapore, Hong Kong, the United States, Russia, and Hungary.

82% of founders are serial entrepreneurs.

OKX Web3 pioneering the BTC ecosystem with industry leadership

OKX Web3 Wallet is at the forefront of wallet ecosystems, showcasing a profound commitment to the BTC ecosystem by investing substantial resources. This unwavering dedication has earned it consistent market acclaim and recognition.

OKX Web3 Wallet in 2023: overview of key data and achievements

By the end of 2023, the OKX Web3 Wallet Ordinals market achieved a remarkable milestone, surpassing $1 billion in total trading volume. This impressive feat was accompanied by 120,332 unique addresses and a total of 552,818 transactions. Furthermore, the OKX Web3 Wallet secured the highest market share of daily trading volume at 92%, solidifying its position at the forefront of the industry.

Currently, the OKX Web3 Wallet Ordinals market stands as the preeminent trading platform for BRC-20 tokens and BTC NFTs, offering the largest selection of 16,000 token types available for trading. This market operates in a fully decentralized manner, devoid of any platform service fees for interactions. Moreover, it offers a multitude of functionalities, including batch transfers, transactions, and the engraving of BRC-20 and BTC NFTs.

As of the end of December 2023, the OKX NFT marketplace reached notable achievements, recording an annual transaction volume of approximately 20 million transactions. The market exhibits a daily trading volume of around $6.5 million, resulting in a substantial total trading volume of $2.366 billion. The growing demand for tokens with engravings has significantly contributed to the rapid rise of the OKX NFT marketplace, positioning it as the second-largest NFT market in terms of trading volume. During the final two months of 2023, the marketplace held an impressive 32% share of the total market.

OKX Web3 Wallet: user-centric innovation, translating user needs into product solutions

OKX Web3 Wallet always adheres to the needs of users and quickly refines them into product requirements, rather than imposing its own needs as user requirements.

OKX has launched a one-stop DApp exploration and reward interaction platform called Cryptopedia. We regularly launch activities with different blockchain networks as themes and collaborate with corresponding partners to set DApp interaction tasks, helping our users reduce search costs and enabling precise interaction during fragmented time.

OKX Web3 Wallet has launched the DeFi section, an all-in-one on-chain investment platform. It aggregates multiple investment products from 10+ public chains, 60+ projects, and 200+ protocols. It supports V3 liquidity pools, one-click cross-currency investments, automatic profit calculation, and gas-saving features, making DeFi investment extremely simple.

OKX Web3 Wallet has also released the latest ecosystem overview, which shows that the wallet section has connected to 70+ public chains, the DeFi section supports over 120 protocols, and the NFT marketplace aggregates more than 30 platforms. It also supports multiple ecosystems such as Game, Social, MEME, Tool, and others, totaling support for over 300 platforms and protocols.

Source: OKX Web3, Jan 3, 2024.

Concluding thoughts

OKX Ventures stands as a dedicated and determined contributor to the Bitcoin ecosystem, committed to fostering innovation and accelerating the development of blockchain technology. With the exponential increase in Bitcoin users, the growing transaction volume on the Bitcoin blockchain, and the emergence of groundbreaking protocols like Ordinals, the Bitcoin ecosystem is experiencing unprecedented growth.

In our mission to support the thriving Bitcoin ecosystem, OKX Ventures goes beyond financial investments. We provide essential services and resources to help our partners flourish. By offering platform-level support through OKX Web3 Wallet and OKX Chain, we empower projects to find their footing in this vast and dynamic crypto space.

At OKX Ventures, we recognize the immense potential for innovation within the Bitcoin ecosystem. Our focus extends beyond short-term gains, as we emphasize long-term industry development and scalability. Even amid ever-evolving market dynamics, we remain committed to the core of the industry, closely monitoring theoretical innovations, practical applications, user traffic growth, and overall industry expansion.

Looking ahead, we firmly believe that OKX Ventures is poised to seize even greater market opportunities within the Bitcoin ecosystem over the next three to five years. As the ecosystem evolves, we're prepared to adapt and capitalize on these opportunities, aligning ourselves with the market and driving continued progress in the industry.

© 2025 OKX. Este artículo puede reproducirse o distribuirse en su totalidad, o pueden utilizarse fragmentos de 100 palabras o menos de este artículo, siempre que dicho uso no sea comercial. Cualquier reproducción o distribución del artículo completo debe indicar también claramente, lo siguiente: "Este artículo es © de OKX 2025 y se utiliza con permiso". Los fragmentos permitidos deben citar el nombre del artículo e incluir su atribución, por ejemplo "Nombre del artículo, [nombre del autor, en su caso], © 2025 OKX". No se permiten obras derivadas ni otros usos de este artículo.