As we might be entering a 2024 crypto bull run, it's useful to understand the main indicators and tools to trade Bitcoin. Whether you're new to trading crypto or are something of a veteran, the idea of trading Bitcoin might have crossed your mind. After all, Bitcoin has stood the test of time by proving itself to be the digital gold of the crypto scene. It's also one of the original cryptocurrencies that's disrupting the world of traditional finance. Compared to stocks and commodities, which have been around for centuries, Bitcoin is a relatively new asset. This is why newcomers and experienced traders alike often ask how to trade Bitcoin.

From future catalysts to unique tokenomics, there's a whole lot to unpackage when it comes to breaking down where Bitcoin might be headed next. Curious about how to trade Bitcoin and what catalysts to pay attention to? Our BTC trading guide will include basic technical analysis and Bitcoin price predictions, so you'll have everything you need to know about how to trade BTC in light of the existing market sentiment and macroconditions.

What is Bitcoin (BTC)?

Launched as a response to the 2008 financial crisis, Bitcoin is the world's first decentralized peer-to-peer payment network that operates without traditional intermediaries like central banks or governments. With blockchain technology as its foundation, Bitcoin allows for secure and transparent transactions that are open for all to view on its publicly accessible ledger. Since its proof of concept in 2009 by the anonymous Satoshi Nakamoto, Bitcoin has grown in terms of accessibility and scalability thanks to widespread availability from various exchanges and network upgrades like Taproot. Today, Bitcoin acts as the crypto market's largest cryptocurrency by market cap.

BTC tokenomics

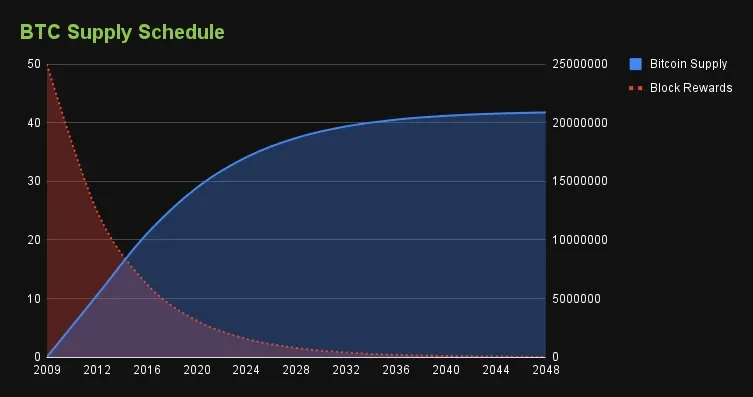

Unlike the tokenomics of other cryptocurrencies, Bitcoin has no venture capitalist backing or community treasury. Rather, all newly minted Bitcoin is awarded to whichever individual or entity mines a new block. With a fixed, pre-programmed total supply of 21,000,000, mining for Bitcoin started with its genesis block in 2009 and will continue until all Bitcoins have been minted. Due to the halving process every 210,000 blocks, the last BTC satoshi will be expected to be distributed in 2142. Thereafter, while BTC miners might not be able to mint any new Bitcoin, they'll be incentivized to stay on as a validator and earn their revenue through transaction fees. Curious about the overarching supply schedule of Bitcoin? Check out the graph below for more details.

Source: coingecko.com

Why is Bitcoin so popular among crypto traders?

With one of the highest non-stablecoin trading volumes in the crypto market, many crypto traders are choosing Bitcoin because of its liquidity and product variety that includes derivatives like futures and options. This phenomenon might get crypto beginners and newcomers to trading curious as to why Bitcoin commands so much popularity among avid crypto traders. Chief among the reasons for Bitcoin's mass popularity is its first-mover advantage. As the pioneer in the world of digital assets, Bitcoin's inception in 2009 marked the beginning of a new era in finance as it sought to establish a niche detached from the centralized ideas of traditional finance.

Also, given that Bitcoin has stood the test of time and lasted more than a decade, it's garnered the reputation of being "digital gold" and a store of value that can potentially protect wealth in times of economic uncertainty. This narrative has strengthened over the years, especially during periods of inflation or recession as crypto traders look towards Bitcoin's price fluctuations to determine the overall trajectory and sentiment of the market.

Key events impacting Bitcoin's price

While there have been many incidents affecting Bitcoin's price, none have been more impactful than BlackRock's announcement of a spot Bitcoin ETF filing. BlackRock intends to create an exchange-traded fund (ETF) that's listed on a traditional stock exchange. Since it's a physically-backed spot Bitcoin ETF, retail and institutional investors can buy a share of BlackRock's spot Bitcoin ETF and get a stake in the BTC held in BlackRock's Bitcoin reserves. On top of an inflow of traders into Bitcoin who are crypto curious, Bitcoin could also enjoy an added boost of trading activity from pension funds and 401K tax-advantaged retirement accounts as they can gain access to Bitcoin through the convenience of a spot BTC ETF.

Spot Bitcoin ETF excitement aside, here are some other reasons Bitcoin's price has been a main topic of discussion among mainstream media headlines:

Argentina's new president Javier Milei has promised to close the Central Bank of Argentina and has been a vocal supporter of crypto. This has led to rampant speculation on how Argentina might follow in El Salvador's footsteps to become the next country to announce Bitcoin as legal tender.

US Senator Elizabeth Warren introduced a Bitcoin crack-down bill to increase oversight and regulation within the crypto space.

Amid 2023's year of volatility, Bitcoin enthusiast Michael Saylor continues to dollar-cost average into Bitcoin as MicroStrategy now holds 193,000 BTC in total.

Rate cuts have been a hot topic among macroeconomists and those attempting to gauge the health of the economy. If the US Federal Reserve proceeds to aggressively cut rates in 2024, the cost of borrowing will significantly fall, leading to increased liquidity. This is because funds that were formally used to pay off borrowing costs can now be directed towards digital assets like Bitcoin.

Future Bitcoin catalysts to look forward to

Regarding Bitcoin catalysts that are around the corner, the Bitcoin halving is something many crypto traders are paying close attention to. Since the Bitcoin halving reduces Bitcoin mining rewards by half about every four years, this is a key catalyst for Bitcoin prices because it marks another drop in the rate of new Bitcoins entering the crypto market as it approaches its finite supply of 21,000,000. As the previous three Bitcoin halvings kickstarted a crypto bull market rally, traders will be keeping a close eye on price levels in April 2024 as we close in on yet another halving. The next halving will bring mining rewards down to 3.125 BTC per successfully mined block.

Bitcoin price movements

2023 has been dubbed by many as the year of recovery for the crypto market as Bitcoin leads the charge in the market's resurgence with 155.57% annual performance. Since hitting its 2023 low on 1 January, 2023, Bitcoin's price has recovered in light of all the positive news from the spot ETF and bullish macroeconomic sentiment. This gives BTC a 2023 trading range of $16,502 to $44,726.80.

While some recent crypto traders may have been spooked by news of an anti-crypto bill, the overall market sentiment remains bullish as BTC approaches its previous all-time high of $69,000. At its current pace, we may see BTC enter a state of price consolidation as buyers seek to lock in their gains after a massive rally while we head towards the Bitcoin halving.

Bitcoin projections and BTC price predictions

Any cryptocurrency that isn’t a stablecoin is likely to experience a high level of volatility. While it may be hard to accurately predict BTC's price in the near future, some websites and analysts have stepped forward to provide their own opinion when it comes to future projections on where Bitcoin is headed. Here's a quick summary of what these Bitcoin price predictions for the years ahead, as of March 8, 2024.

2024 | 2025 | 2030 | |

$ 29,564 - $ 101,528 | $ 60,024 - $ 177,384 | $ 139,026 - $ 266,977 | |

$57,027 - $120,000 | $61,357 - $140,449 | $277,751 - $347,783 | |

$45,615 - $68,422 | $51,891 - $77,837 | $98,862 - $148,293 | |

$72,000 - $75,000 | $78,000 - $78,500 | $98,000 - $105,000 | |

$100,000 | - | - | |

$21,324 - $35,584 | $95,388 - $116,344 | $623,939 - $744,564 |

From the BTC projections and price predictions collated above, we can observe that analysts are indeed bullish for the future of Bitcoin as most of them expect Bitcoin to end the year strong with prices above the 2023 close of $42,283. With more than half of the Bitcoin price predictions having minimum BTC price estimates above $51,891 by 2025, it's safe to say analysts are having a bullish inclination with respect to the outlook for Bitcoin's future.

Bitcoin technical analysis

To further validate any Bitcoin price prediction and sentiment projection, experienced crypto traders can make use of basic technical analysis to create a trading plan and draw a conclusion on where BTC is headed. This typically involves a combination of trading indicator usage and charting pattern recognition. In the example below, we'll be making use of popular technical analysis indicators like the simple moving average and the relative strength index while referring to BTC's price as of December 13, 2023.

Simple moving average (SMA)

Ever heard of terms like a golden cross or death cross? Traders who often use technical analysis come to these conclusions thanks to the use of the SMA indicator. As a representation of the average closing price of the asset over a specified period, SMA lines typically represent the trend of a particular asset and can be used as a shorthand to determine if the asset is in a bullish or bearish trend.

In BTC's case throughout 2023, we can spot a golden cross forming at the middle of October as the 50 SMA crossed above the 200 SMA, indicating strong bullish momentum behind Bitcoin's sudden price appreciation. Coincidentally, it's the same time frame when Bitcoin prices rallied towards the $36,000 range as excitement behind the spot Bitcoin ETF approval began soaring. With both moving averages continuing to diverge, it might be safe to assume we're far from a death cross formation any time soon.

As for 2024, we can see that Bitcoin is still bullish as the 50 SMA has further diverged from the 200 SMA and shows no signs of stopping so far. With $69,000 in its sights, we may see further retests of the previous all-time highs as bullish and bearish crypto traders battle it out to see if we witness a breakout or another rejection off the $69,000 resistance.

Relative strength index (RSI)

The RSI is a lagging momentum indicator that gauges recent price changes and indicates whether it's currently overbought or oversold. With a range of 0 to 100, values over 70 are usually a telltale sign that the asset is currently overbought and due for a correction in the short-term. On the other hand, an RSI value below 30 generally indicates that the asset is oversold and has a short-term rally coming up because of its undervalued nature.

Looking at Bitcoin's RSI on the daily time frame, we can see that it currently sits at 73.85. This represents somewhat of a overbought sentiment and is understandable given that BTC continues to rally as crypto traders are bullish for the upcoming catalyst that is the Bitcoin halving. Interestingly, during the previous crypto bull market, BTC's RSI values reached an overbought peak of 83.46. This may have been another reason why Bitcoin prices consolidated in that range, as traders with a technical analysis inclination chose to sell and lock in their gains after gauging BTC's overbought state.

Examples of trading strategies on how to trade Bitcoin

Entirely new to the world of trading Bitcoin? Not to worry, here are some examples of trading strategies that you can reference when mapping out your trading plan.

Day trading Bitcoin

Also known as intraday trading, day trading Bitcoin is not for the faint of heart given the usual volatility associated with trading cryptocurrencies. However, this volatility is a double-edged sword as it offers plenty of opportunities for day traders to lock in their gains and cut their losses short without incurring overnight exposure to Bitcoin.

When day trading Bitcoin, you'll want to have a trading setup that's on the shorter time frame. This lets you enter and exit trades while reacting to leading technical indicators and volume numbers that hint on whether you should buy or sell. Additionally, strict risk management and knowing when to cut the trade short is required as holding and hoping often leads to unintended losses.

Swing trading Bitcoin

Bitcoin swing trading is often seen as the more forgiving form of active trading as the crypto trader takes note of short-term price patterns and waits for confirmation of this pattern or trend before deciding to execute a trade. While not entirely useful in a market that's constantly trending in a single direction, swing trading Bitcoin can be extremely fruitful when Bitcoin prices are consolidating and trading in a range. Ultimately, a Bitcoin swing trader has to be objective and look to make returns from both the upside and downside of the market.

Since swing trading Bitcoin takes place on a slightly longer time frame, traders can afford to take on more risk by setting looser stop-loss and take-profit price levels. On top of this, because trades are less frequently made, swing trading lets crypto traders take a step back and look at the big picture of the overall price trend as swing traders won't need to worry about closing their position and not holding it overnight. This leads to less emotional trading and more objective trading, which can potentially lead to more gains over time.

Is Bitcoin good for trading?

Before deciding whether Bitcoin is good for trading, it's important to realize the dangers of diving into trades blind and relying on the fear of missing out (FOMO). To avoid making such a mistake, it's key to understand what you're getting yourself into as a crypto trader. With flash crashes and rallies that can result in double-digit percentage moves overnight, trading Bitcoin can be volatile as sharp price movements can weed out the inexperienced and greed-driven crypto traders. Ultimately, trading Bitcoin is risky but can be considered good for trading because of the following factors:

High liquidity: As one of the most accessible cryptocurrencies today, Bitcoin is highly liquid as a digital asset and is available for trading across different platforms and exchanges. With a spot Bitcoin ETF potentially on the horizon, Bitcoin is likely to become even more accessible. This generally leads to less slippage as you can likely make swift buy-and-sell transactions without more price discrepancy.

High volatility: It's usually difficult to trade an asset that's stable and not moving much in price. While the huge price fluctuations of Bitcoin might scare away risk-averse traders, they also present opportunities for gains to be made for anyone with a tried-and-tested trading plan.

Competitive trading fees: if you're someone who actively trades frequently, trading fees can eat into your gains over time. This is especially the case for over-the-counter stocks as stock traders run into the risk of racking up expensive trading fees when dabbling with less popular penny stocks. Fortunately, compared to other assets, Bitcoin's popularity among various exchanges gives it the benefit of competitive spread and trading fees. With tiered fee structures based on personal trading volume, trading Bitcoin can be considered affordable because of the different maker and taker fees that vary with your personal trading volume.

Final words and next steps

Keen to give trading Bitcoin a go? Get started today by checking out our Bitcoin USDT spot pair. Conversely, you can learn more about BTC with our Bitcoin price page.

Some may say knowledge is power when trading Bitcoin and other cryptocurrencies. To familiarize yourself with trading in the market, why not read up on our spot trading guide? Also, if you want to learn how to trade Bitcoin, it'll be beneficial for you to know what makes Bitcoin such a valuable digital asset. Learn why Bitcoin has value with our guide on the intrinsic value of cryptocurrencies.

© 2025 OKX. Este artículo puede reproducirse o distribuirse en su totalidad o pueden utilizarse fragmentos de 100 palabras o menos de este artículo, siempre que dicho uso no sea comercial. Cualquier reproducción o distribución del artículo completo debe indicar también claramente lo siguiente: "Este artículo es © 2025 OKX y se utiliza con permiso". Los fragmentos permitidos deben citar el nombre del artículo e incluir su atribución, por ejemplo "Nombre del artículo, [nombre del autor, en su caso], © 2025 OKX." No se permiten obras derivadas ni otros usos de este artículo.