dYdX price

dYdX market info

Market cap = Circulating supply × Last price

dYdX Feed

DYDX calculator

dYdX price performance in USD

Popular dYdX conversions

| 1 DYDX to USD | $0.66170 |

| 1 DYDX to PHP | ₱36.9247 |

| 1 DYDX to EUR | €0.59204 |

| 1 DYDX to IDR | Rp 10,917.34 |

| 1 DYDX to GBP | £0.49846 |

| 1 DYDX to CAD | $0.92434 |

| 1 DYDX to AED | AED 2.4304 |

| 1 DYDX to VND | ₫17,155.82 |

About dYdX (DYDX)

- Official website

- Github

- Block explorer

dYdX FAQ

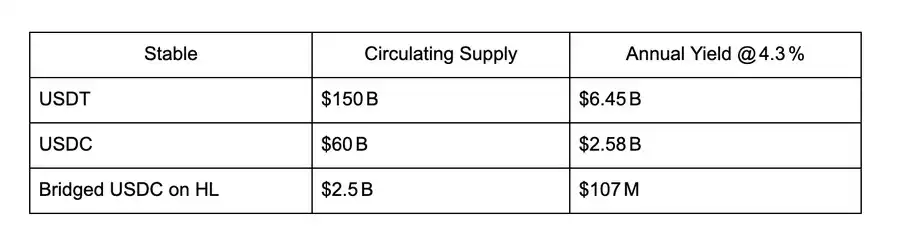

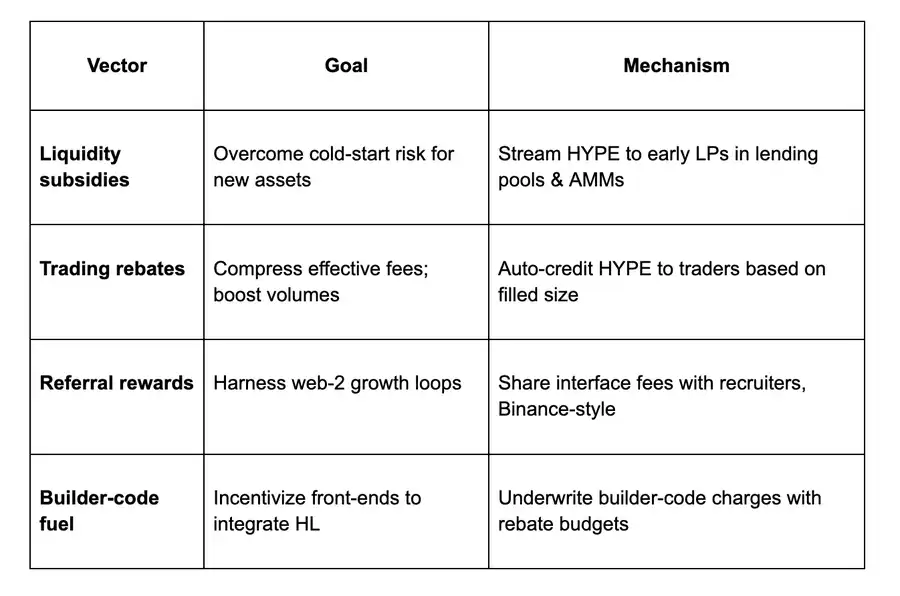

dYdX is an advanced trading exchange for spot, margin, and perpetual futures trading. Traders can directly access the platform without handing over their assets to a central entity. The platform is powered by smart contracts on Ethereum, making dYdX an open, permissionless, noncustodial DEX. DYDX is the ticker symbol of the exchange’s native governance token.

dYdX offers various trading tools and features that help with faster trade execution, security, and platform transparency. Moreover, there have been no gas fees after implementing Layer 2 scaling solutions, giving traders access to more trading pairs.

The noncustodial dYdX exchange uses smart contracts for all its services. Each asset listed on dYdX has its own lending pool. Lenders and borrowers interact within asset pools, determining the supply and demand and each asset’s interest rates. DeFi services such as margin trading and perpetual futures trading are also available.

Monitor crypto prices on an exchange

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

DYDX calculator

Socials