UMA

UMA price

$1.2490

+$0.041000

(+3.39%)

Price change for the last 24 hours

How are you feeling about UMA today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

UMA market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$108.62M

Circulating supply

86,830,372 UMA

69.62% of

124,714,386 UMA

Market cap ranking

--

Audits

Last audit: 1 Mar 2021

24h high

$1.2540

24h low

$1.1860

All-time high

$45.0000

-97.23% (-$43.7510)

Last updated: 4 Feb 2021

All-time low

$0.88800

+40.65% (+$0.36100)

Last updated: 7 Apr 2025

UMA Feed

The following content is sourced from .

Helium🎈 reposted

Yano 🟪

BIG speaker update.

Added founders from:

- Infinex

- Uniswap

- Monad

- Worldcoin

- Ethena

- Succinct

- Bera

- LayerZero

- Helius

- MegaETH

- Eigen

- Aptos

- Helium

- Arbitrum

- StarkWare

- Anza

- Commonware

- Jito

- MoonPay

- Polkadot

- Espresso

- Initia

- Maple

- Sonic

- Aave

- Hyperlane

- Ellipsis

- Skip

- Akash

- Backpack

- Privy

- Frax

- UMA

- Blockdaemon

- Stacks

47 days until @Permissionless

Show original

131.53K

270

Blockworks

Ethereum’s most ambitious upgrade since the Merge is now live.

The Pectra hard fork, which activated smoothly shortly after 6 am ET, delivers a powerful set of upgrades to Ethereum’s execution and consensus layers, affecting everything from validator operations to transaction UX and data availability.

What’s changed?

The upgrade introduces several important features, grouped roughly into three categories:

Smart accounts (EIP-7702)

This upgrade lets EOAs temporarily behave like smart contracts, opening the door to batched transactions, stablecoin and sponsored gas payments — a massive UX unlock, according to Hart Lambur, co-founder of Risk Labs (which built Across and UMA).

For example, “users will be able to sign a single intent that seamlessly triggers actions across chains — no need for native gas, no extra wallet setup and no extra developer work,” Lambur told Blockworks. “It gets us closer to a world where bridging is invisible and cross-chain coordination just happens under the hood.”

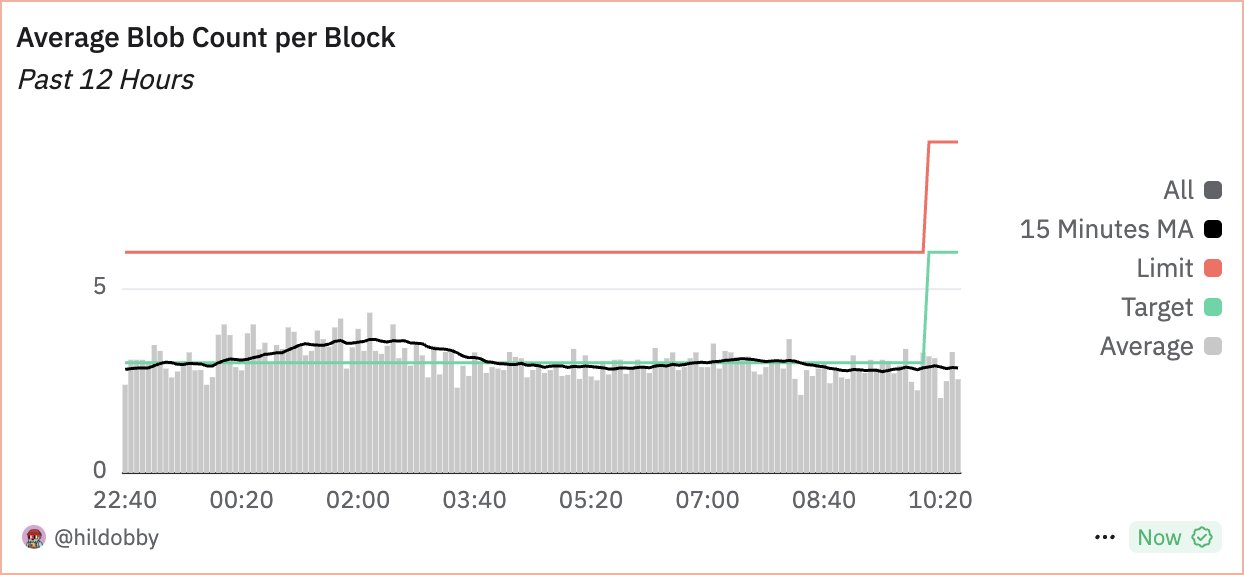

Data availability scaling (EIP-7691)

By doubling blobspace capacity from six to 12 blobs per block, Ethereum increases throughput for rollups and reduces L2 fees. But as Ansgar Dietrichs pointed out, saturation of this new capacity would be good for Ethereum, provided it can continue scaling bandwidth to avoid too much fee pressure as demand grows.

Source: @hildobby

Validator UX and efficiency

Pectra raises the maximum effective validator balance from 32 ETH to 2,048 ETH, which Alluvial co-founder Matt Leisinger calls “a meaningful unlock for institutions.”

“Institutions can now autocompound rewards natively — no more skimming and aggregating 32 ETH to stay efficient,” Leisinger told Blockworks.

Bohdan Opryshko at Everstake thinks it may be the “most institution-friendly update yet.” He notes EIP-7002 also allows validators to exit using execution-layer controls, reducing trust assumptions for stakers and protocols alike — altogether making “staking at scale with operational clarity” possible for more conservative capital.

What happens next?

Pectra sets the stage for Fusaka, Ethereum’s next major upgrade — now tentatively pushed to 2026. That fork is expected to introduce PeerDAS, a more efficient data availability sampling scheme for rollups, and continue laying the groundwork for future upgrades like Verkle trees and full account abstraction.

But in the coming months, attention will shift to ecosystem adoption as teams try to showcase the real-world capabilities of the upgrade.

How will wallets, L2s and dapps move to support EIP-7702? We can expect features like batched transactions, gas sponsorship and stablecoin fee payments.

According to OP Labs’ Sam McIngvale, “apps drive this adoption curve.”

“Wallets will follow once there’s clear demand,” McIngvale told Blockworks. “If widely adopted, 7702 could finally make one-click onboarding and abstracted UX the norm.”

Now that rollups can post more data to Ethereum cheaply, how long will it take to saturate that bandwidth? This could have consequences for rollups’ adoption of alternative DA layers such as EigenDA, Celestia and Avail. If L2 activity fails to match blob supply, scaling momentum could stall. Conversely, if demand rises too quickly, Ethereum may need to accelerate PeerDAS or further blob increases to prevent bottlenecks.

Large operators can collapse thousands of validators into a few, but testnets couldn’t simulate how much that will improve efficiency, so it will be interesting to observe the concrete effects.

Solo stakers may benefit indirectly, according to Preston van Loon, a core developer with Offchain Labs. Fewer attestations from consolidated validators means lower network bandwidth requirements.

“It really does help everybody,” van Loon told Blockworks. “It’s hard to say which group has the outsized benefit.”

Dashboards tracking validator set composition, message propagation and slashing rates will become key indicators.

The “unpredictability of network behavior” may be a risk in the future, MIT professor and Optimum co-founder Muriel Médard warned. “As blob sizes and message throughput increase, Ethereum’s ability to propagate data efficiently and predictably will define how far it can scale,” Médard told Blockworks.

Considering the fork involved more EIPs than any prior upgrade, Pectra’s quiet launch may signal just how much Ethereum has matured as a decentralized protocol. Still, the protocol has a long way to go and faces more competition than ever.

Show original

7.84K

0

Riley

These relayer design tradeoffs are important to understand as Cosmos expands IBC to non-Tendermint chains that have longer time to finality (e.g. Ethereum). We need solvers that can handle faster-than-finality transfers, and they need to be able to handle lots of volume

Hart's thread buried the lede a bit imo. The breakthrough isn't just bond vs. escrow—it's replacing slow, permissioned oracles with quick, user-driven verification secured by economic incentives

Bonding flips the incentives: the relayer puts up collateral rather than the user, so the system can trust user verification instead of waiting an hour for UMA

Bonds get recycled instantly → way less capital sits idle → solvers can process more volume

Example: Bob bridges Base to Ethereum. Instead of waiting an hour for a verifier, Alice sees Bob's transaction complete, references it in her own, and immediately frees the bond

The tradeoff: relayers need enough liquidity on their balance sheets to cover peak traffic, though the design includes just-in-time bonding to help manage this

Smart, elegant approach. Nice work @hal2001 & Across team

Hart Lambur (⛺️,⛺️)

Just shipped the Across Prime paper, a new design for a capital efficient trustless fast bridge authored with @danrobinson, @mrice32, and the @AcrossProtocol team.

Across Prime aims to deliver the near instant speed of intent based bridges but with greater capital efficiency. 🧵

17.26K

13

Riley

These relayer design tradeoffs are important to understand as Cosmos expands IBC to non-Tendermint chains that have longer time to finality (e.g. Ethereum). We'll need solvers to enable faster-than-finality transfers, and we want them to be efficient

Hart's thread buried the lede a bit imo. The breakthrough isn't just bond vs. escrow—it's replacing slow, permissioned oracles with quick, user-driven verification secured by economic incentives

Bonding flips the incentives: the relayer puts up collateral rather than the user, so the system can trust user verification instead of waiting an hour for UMA

Bonds get recycled instantly → way less capital sits idle → solvers can process more volume

Example: Bob bridges Base to Ethereum. Instead of waiting an hour for a verifier, Alice sees Bob's transaction complete, references it in her own, and immediately frees the bond

The tradeoff: relayers need enough liquidity on their balance sheets to cover peak traffic, though the design includes just-in-time bonding to help manage this

Smart, elegant approach. Nice work @hal2001 & Across team

Hart Lambur (⛺️,⛺️)

Just shipped the Across Prime paper, a new design for a capital efficient trustless fast bridge authored with @danrobinson, @mrice32, and the @AcrossProtocol team.

Across Prime aims to deliver the near instant speed of intent based bridges but with greater capital efficiency. 🧵

368

1

UMA price performance in USD

The current price of UMA is $1.2490. Over the last 24 hours, UMA has increased by +3.39%. It currently has a circulating supply of 86,830,372 UMA and a maximum supply of 124,714,386 UMA, giving it a fully diluted market cap of $108.62M. At present, the UMA coin holds the 0 position in market cap rankings. The UMA/USD price is updated in real-time.

Today

+$0.041000

+3.39%

7 days

-$0.09800

-7.28%

30 days

+$0.13400

+12.01%

3 months

-$0.40300

-24.40%

Popular UMA conversions

Last updated: 22/05/2025, 07:38

| 1 UMA to USD | $1.2490 |

| 1 UMA to SGD | $1.6100 |

| 1 UMA to PHP | ₱69.5209 |

| 1 UMA to EUR | €1.1024 |

| 1 UMA to IDR | Rp 20,431.87 |

| 1 UMA to GBP | £0.93072 |

| 1 UMA to CAD | $1.7311 |

| 1 UMA to AED | AED 4.5876 |

About UMA (UMA)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

UMA FAQ

How much is 1 UMA worth today?

Currently, one UMA is worth $1.2490. For answers and insight into UMA's price action, you're in the right place. Explore the latest UMA charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as UMA, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as UMA have been created as well.

Will the price of UMA go up today?

Check out our UMA price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials