Notice: The trading of this cryptocurrency is currently not supported on OKX. Continue trading with cryptocurrencies listed on OKX.

CKB

Nervos Network price

This data isn’t available yet

You’re a little early to the party. Check out these other crypto for now.

Nervos Network Feed

The following content is sourced from .

Nervos.bit reposted

Messari

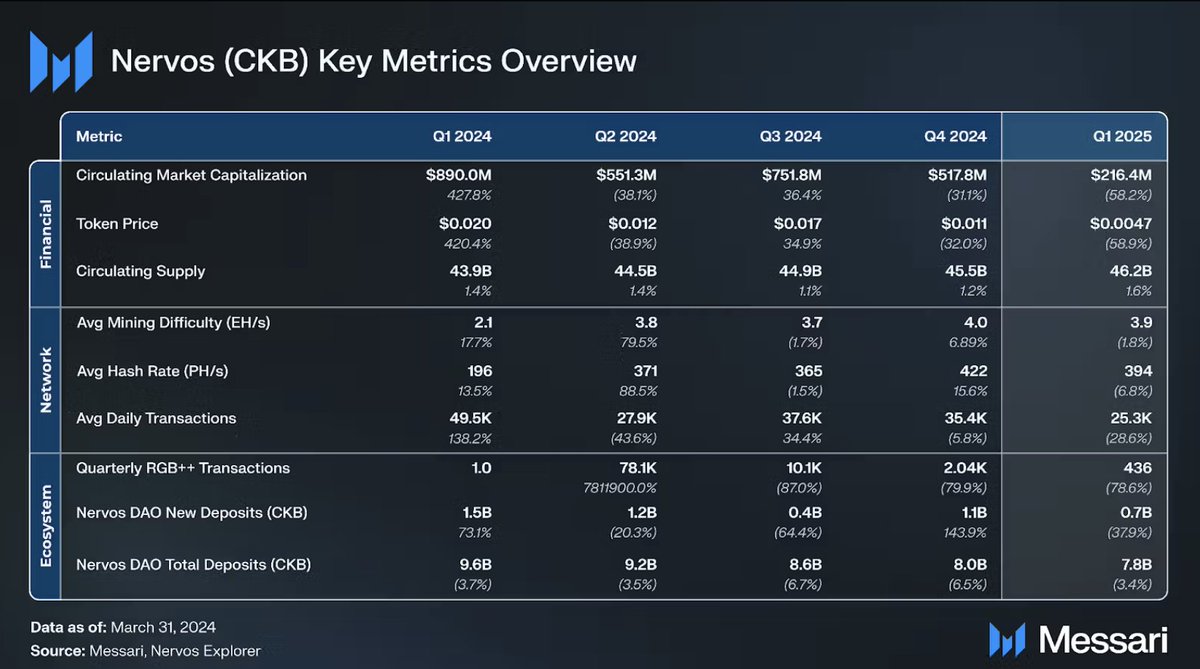

State of @NervosNetwork Q1

Key Update: Nervos Network launched Fiber Network on mainnet, bringing privacy-preserving payments and Bitcoin Lightning compatibility to CKB.

QoQ Metrics 📊

• Total unique addresses ⬆️ 7.5%

• RGB++ assets ⬆️ 4.20%

• JoyID wallet users ⬆️ 800,000+

Read the full report 🔗

Show original

15.19K

130

↾⇃ CKB 中文

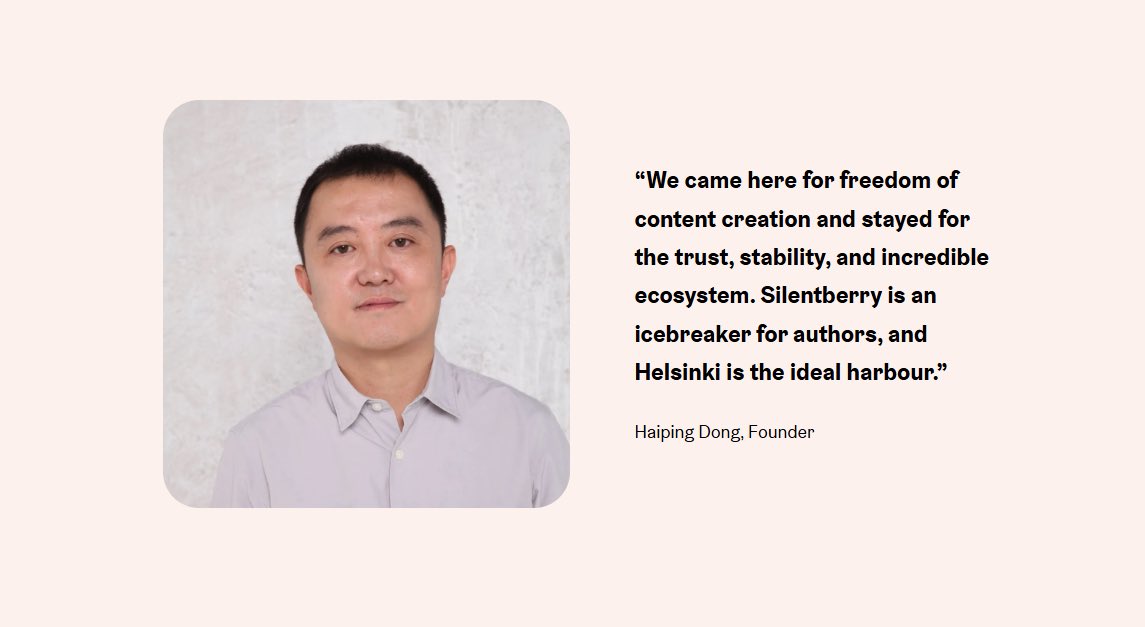

🌍 Helsinki is rapidly emerging as a hub for Web3 and blockchain innovation. In a recent article in Helsinki, it is mentioned that startups like SilentBerry are revolutionizing content creation and ownership.

📚SilentBerry moved to Finland in 2022. It enables authors to record their books on the Bitcoin blockchain, turning ownership and usufruct rights into digital assets. This innovation is supported by the CKB Ecosystem Fund, which has made strategic investments to enhance SilentBerry's capabilities and support cross-chain interoperability.

⚡️With its modular architecture and strong interoperability, CKB Nervos provides a solid foundation for decentralized applications such as SilentBerry. By leveraging the RGB++ protocol and UTXO model, CKB enhances Bitcoin's capabilities, enabling scalable and programmable solutions without compromising security.

In Helsinki's culture of trust and innovation, CKB and Web3 startups are collaborating to build a more open and inclusive digital future.

#CKB #SilentBerry #Web3 #Blockchain #DecentralizedPublishing #HelsinkiInnovation

CKB Eco Fund

📚 Helsinki is becoming a hub for Web3 innovation!

SilentBerry, a decentralized publishing platform, empowers authors to inscribe their works onto the Bitcoin blockchain, transforming ownership and revenue rights into digital assets.

CKB Eco Fund's strategic investment supports this groundbreaking approach, enhancing cross-chain interoperability and expanding the platform's capabilities.

Discover how SilentBerry and CKB are revolutionizing publishing:

👉

#CKB #SilentBerry #Web3 #Blockchain #DecentralizedPublishing #HelsinkiInnovation

6.19K

91

Neo-法恒 | Bird🕊️

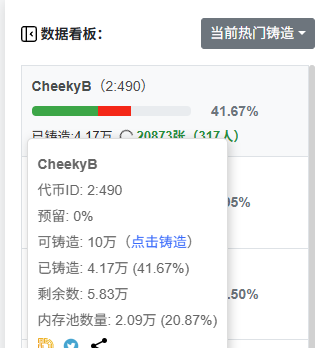

I'm going to talk about Alkanes Asset 2: 490, CheekyB, and the symbol is CKB.

In the morning, the gas of bitcoin is still between 2-3, and in the afternoon the gas slowly rises, to about 5, and when it is low, it is also 2-3. Around 7 p.m., the gas soared to around 8 and remained high, and now it is directly above 11.

I guess it's the assets of alkanes Alkanes in mint, and then I went to the panel of mint, and it went crazy, there are 20,000 transactions in the mempool waiting to be blocked, and the highest transaction gas has been given to 14-15. Then I went to Twitter to search for relevant information, and it was this dude @GIZG0D who tweeted about it first, and I guess he deployed it.

The next question is, is the deployment of this asset his personal behavior, or is it supported by the puppet community, I did 2 actions:

1⃣ Ask btc's puppet core volunteer @btc_ordi, who just lay down in the early morning and was woken up by my WeChat voice. I sent him what I found and asked him to verify it in the puppet community. He checked it for about 10 minutes and told me that it was most likely caused by people in the community.

2⃣ At the same time, I asked @GIZG0D directly in a private message, which roughly means that this protocol asset is issued by the community or a personal act, this guy did not respond directly, he implied that he was inspired by the puppet's work, and then did the asset issuance action. Because it's a Twitter private message, it's inconvenient to take a screenshot.

Conclusion: Alkanes' 2:490 is a spontaneous act by a dude in the puppet community, but it is unknown if it will be supported by the community. But overall, this is a favorable sign, that is, the Alkanes protocol is getting more and more attention from Bitcoin veterans and some large mainstream communities, and even participating in the end.

#Bitcoin #Alkanes #METHANE

Show original

10.6K

22

TechFlow

Source: Vitalik Buterin

Compilation: KarenZ, Foresight News

On April 20th, Vitalik Buterin presented an important proposal on the Ethereum Magicians platform for Ethereum's long-term L1 execution layer. He proposed replacing the existing EVM (Ethereum Virtual Machine) with the RISC-V architecture as a virtual machine language for writing smart contracts, aiming to fundamentally improve the operational efficiency of Ethereum's execution layer, break through one of the current major scaling bottlenecks, and greatly simplify the simplicity of the execution layer.

Foresight News has compiled the full text of the proposal to help readers understand this technical vision. The following is a compilation of the original proposal:

This paper presents a radical idea about the future of Ethereum's execution layer, no less ambitious than the consensus layer's Beam Chain initiatives. The proposal aims to dramatically improve the efficiency of Ethereum's execution layer, address one of the major scaling bottlenecks, and significantly simplify the execution layer – in fact, this may be the only way to achieve this.

Core idea: Replace EVM with RISC-V as a virtual machine language for smart contracts.

Important Notes:

Concepts such as account system, cross-contract calling, storage, etc., will be fully retained. These abstract designs work well and developers are used to using them. OPCODES SUCH AS SLOAD, SSTORE, BALANCE, CALL, ETC., ARE CONVERTED INTO RISC-V SYSTEM CALLS.

In this mode, smart contracts can be written in Rust, but I expect most developers to continue to write contracts in Solidity (or Vyper), which will adapt to RISC-V as the new backend. Because smart contracts written in Rust are actually less readable, while Solidity and Vyper are clearer and easier to read. The development experience may be barely affected, and developers may not even notice the change.

The old EVM contract will continue to run and is fully bidirectionally compatible with the new RISC-V contract. There are several ways to do this, which will be discussed in more detail later in this article.

Nervos CKB VM has set a precedent and is essentially a RISC-V implementation.

Why?

In the short term, upcoming EIPs (e.g., block-level access lists, deferred execution, distributed history storage, and EIP-4444) will address the major scaling bottlenecks of Ethereum L1. More problems will be solved in the medium term with statelessness and ZK-EVM. In the long term, the main limiting factors for Ethereum L1 scaling will become:

Stability of data availability, sampling, and historical storage protocols

Maintain the demand for competition in the block production market

Proof of the ZK-EVM

I will argue that replacing ZK-EVM with RISC-V can solve the key bottlenecks in (2) and (3).

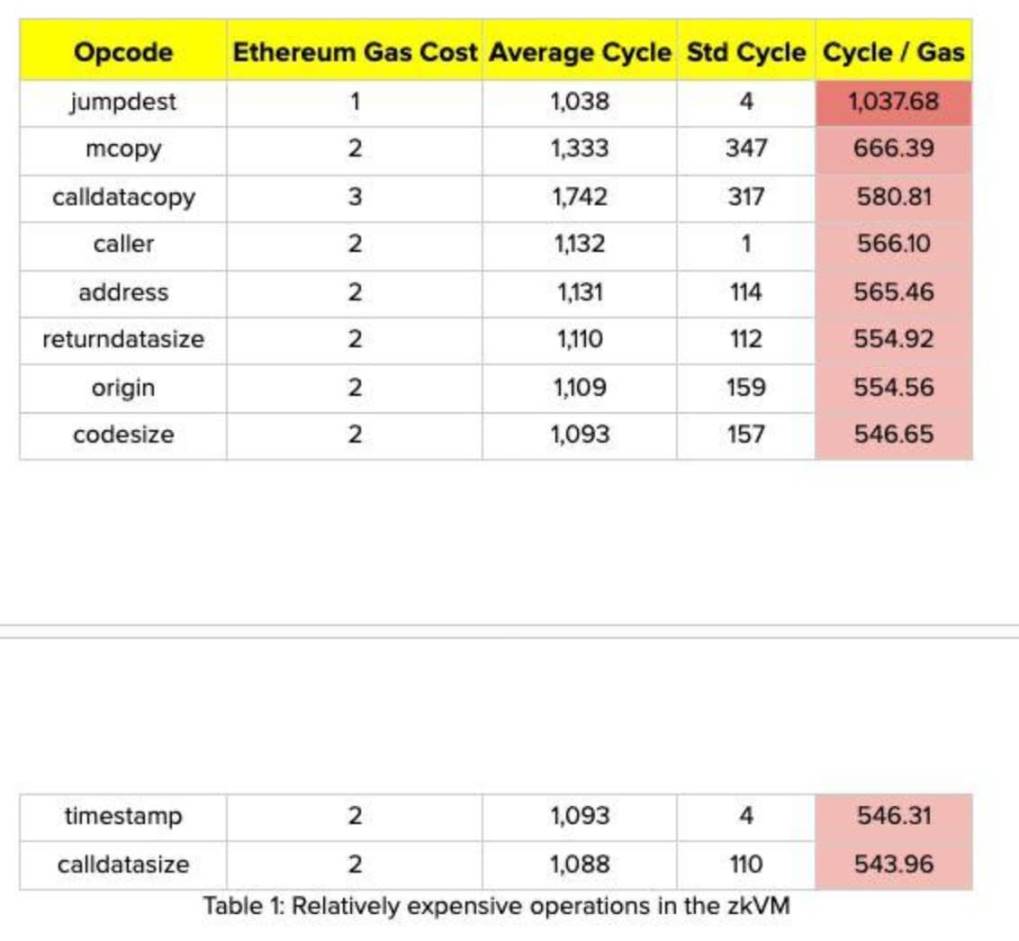

The following table illustrates the number of cycles required for each step of the Succinct ZK-EVM Proof EVM execution layer:

Diagram description: The four main time-consuming segments are deserialize_inputs, initialize_witness_db, state_root_computation, and block_execution

initialize_witness_db and state_root_computation are related to state trees, and deserialize_inputs involve the process of converting block and witness data into internal representations – more than 50% of which is actually proportional to the size of the witness data.

These sections can be greatly optimized by replacing the current keccak 16-ary Merkle patricia tree with a binary tree that uses an easy-to-prove hash function. If we use Poseidon, we can prove 2 million hashes per second on a laptop (compared to about 15,000 hash/sec for keccak). In addition to Poseidon, there are many other options. Overall, there is a lot of room for optimization for these components. In addition, we can eliminate accrue_logs_bloom by removing bloom.

The remaining block_execution accounts for about half of the current prover cycles. To achieve a 100x increase in overall proof efficiency, an EVM proof efficiency of at least 50x is required. One solution is to create a more efficient proof implementation for the EVM, and the other is to notice that the current ZK-EVM prover actually compiles the EVM to RISC-V for proof, giving smart contract developers direct access to the RISC-V virtual machine.

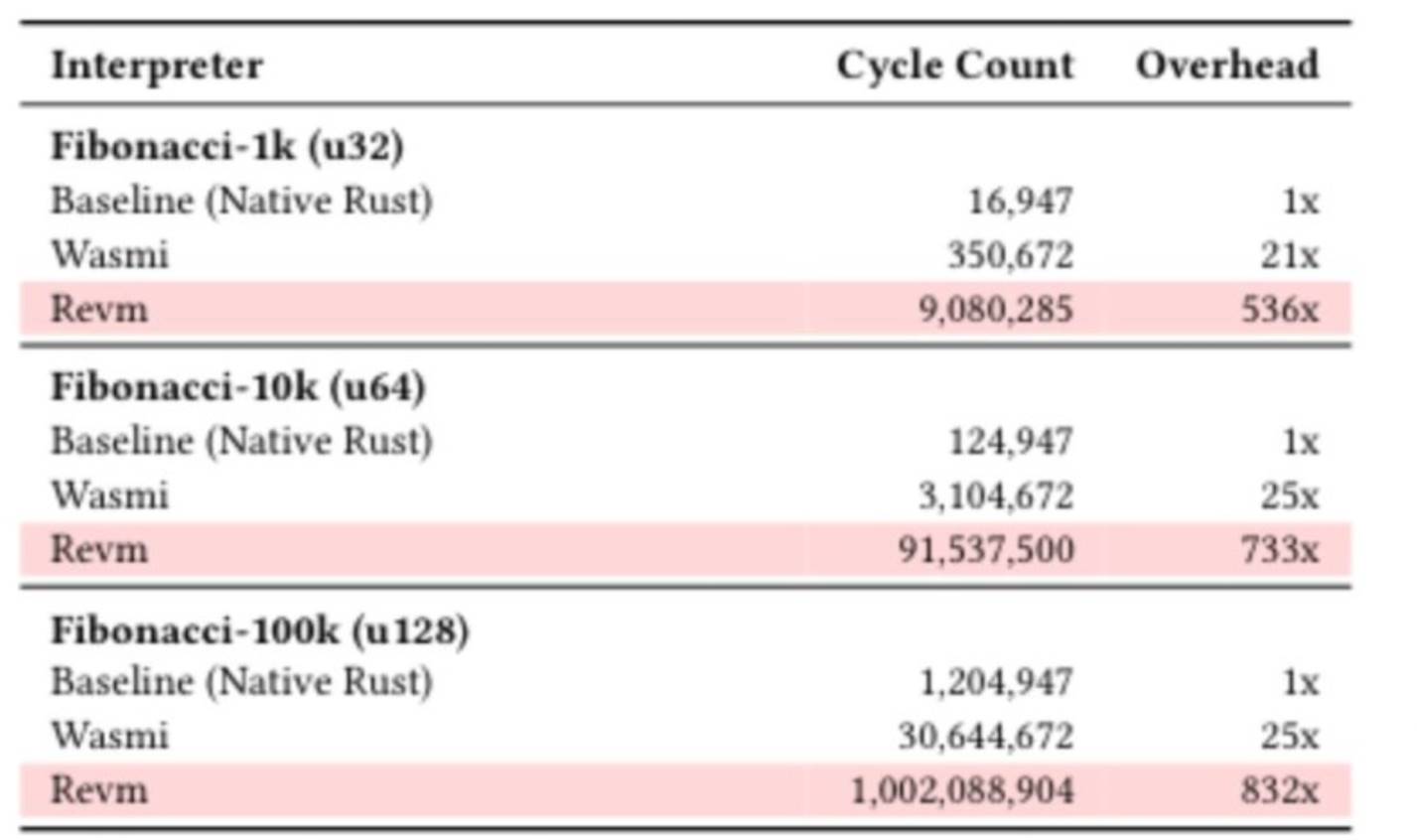

Some data shows that efficiency gains of more than 100 times can occur in certain situations:

In practice, the remaining prover time may be mostly occupied by the current precompile operation. With RISC-V as the primary VM, the gas schedule will reflect the actual proof time, and the economic pressure will drive developers to reduce the use of high-cost precompilation. Even then, the gains won't be so significant, but we have good reason to believe that they will be substantial.

(It's worth noting that the time taken for "EVM operations" and "other operations" in regular EVM execution is also close to 50/50, so we intuitively assume that removing the EVM as an "intermediate layer" will bring an equally significant gain.)

Implementation details

There are several ways to implement this proposal. The least disruptive solution is to support both virtual machines and allow the contract to be written in one of them. Both types of contracts have access to the same features: persistent storage (SLOAD/SSTORE), the ability to hold ETH balances, initiate/receive calls, and more. EVM and RISC-V contracts can be called to each other - from a RISC-V perspective, calling the EVM contract is equivalent to executing a system call with special parameters; The EVM contract that receives the message will interpret it as a CALL.

A more radical approach from a protocol perspective is to convert an existing EVM contract to a call to an EVM interpreter contract written in RISC-V to run its existing EVM code. That is, if an EVM contract has code C and the EVM interpreter is at address X, then the contract will be replaced with top-level logic that, when called from the outside with a call argument D, calls X and passes in (C, D), then waits for the return value and forwards. If the EVM interpreter itself calls the contract, asking to run CALL or SLOAD/SSTORE, then the contract performs these operations.

The compromise is the second option, but with explicit support for the concept of a "virtual machine interpreter" through a protocol that requires its logic to be written in RISC-V. EVM will be the first instance, with support for other languages in the future (Move may be a candidate).

The core advantage of the second and third options is that they greatly simplify the execution layer specification. GIVEN THE DIFFICULTY OF EVEN REMOVING INCREMENTAL SIMPLIFICATIONS LIKE SELFDESTRUCT, THIS LINE OF THINKING MAY BE THE ONLY VIABLE PATH TO SIMPLIFY. Tinygrad adheres to the hard rule of "no more than 10,000 lines of code", and the optimal blockchain underlying should be able to easily meet this limit and streamline it further. The Beam Chain initiative promises to dramatically simplify Ethereum's consensus layer, and such a radical change may be the only way to achieve a similar boost at the execution layer.

Show original

6.54K

0

How are you feeling about CKB today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

About Nervos Network (CKB)

Nervos Network FAQ

What is cryptocurrency?

Cryptocurrencies, such as CKB, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as CKB have been created as well.

Can I buy CKB on OKX?

No, currently CKB is unavailable on OKX. To stay updated on when CKB becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of CKB fluctuate?

The price of CKB fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.