Notice: The trading of this cryptocurrency is currently not supported on OKX. Continue trading with cryptocurrencies listed on OKX.

EURC

EURC price

This data isn’t available yet

You’re a little early to the party. Check out these other crypto for now.

EURC Feed

The following content is sourced from .

Blue 🐈⬛

NICE

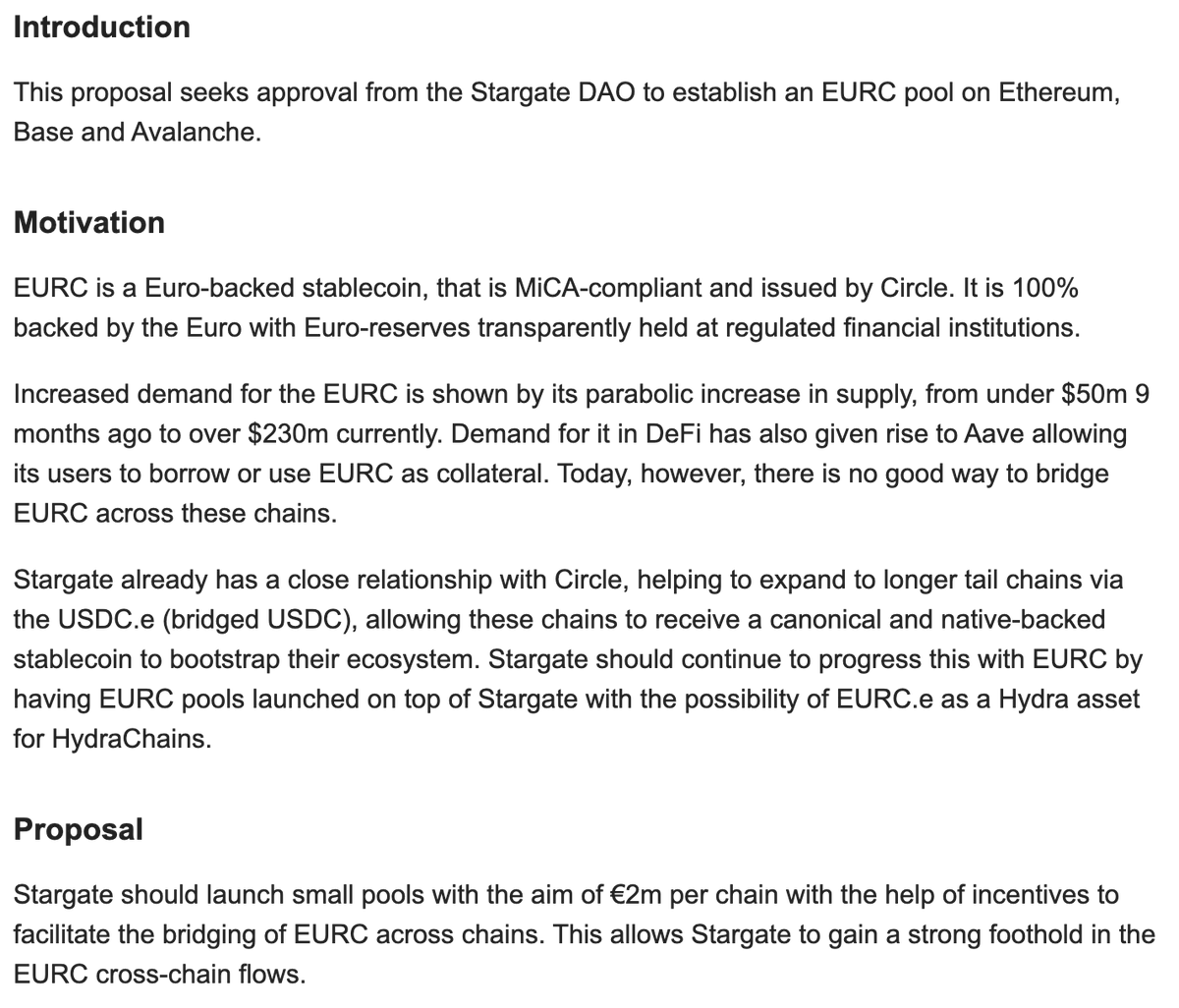

$EURC proposal to @StargateFinance for pools on Eth, Base and Avalanche. This would be the first non-USD based currency token on Stargate and would act as a precursor to EURC's Stargate Hydra integration (which would then make it posible to issue and distribute EURC over a much wider network).

EUROCHADS WILL BE ELATED.

Show original

2.62K

6

Gasp (🔮,🔮)

🚨 One of the BIGGEST lies in DeFi?

"You can swap anything, anywhere, anytime."

Think again.

Want to swap $EURC on Ethereum for $EURC on Base?

Try your favorite DEX.

Try any aggregator.

You’ll hit a wall. 🚫 Dead end 🚫

Because many cross-chain routes don’t exist - unless you go through a CEX.

That’s broken UX. That’s not DeFi.

And it’s costing users time, trust, and $$$.

What if GASP could reward decentralized intelligence?

💰 Scout a missing route

⚙️ We enable it

🏆 You earn

Crowdsource the edge. Trade where no one else can. Only with GASP.

Would you be interested in joining the Pathfinders Guild?

Show original

3.67K

21

100y.eth : : FP

First Federal Stablecoin Law Passed in the U.S. Senate, What About Korea?

With the upcoming Korea presidential election many hot topics are being discussed. One of them, aimed at winning support from men in their 20s and 30s is crypto policy, especially around Korean won-based stablecoins.

Unfortunately Korea currently has no clear laws or policies about stablecoins. Meanwhile today in the U.S., the first federal stablecoin bill, the GENIUS Act, just passed the Senate. Other countries like Singapore, Japan, Hong Kong, and those in Europe already have well-developed regulatory frameworks. For example, Singapore’s SCS framework, Japan’s Payment Services Act amendments, Hong Kong’s sandbox for stablecoin issuers, and the EU’s MiCA framework are already in effect.

What’s more worrying is that Korean politicians and public institutions still don’t fully understand stablecoins. For example, presidential candidates Lee Jae-myung and Kim Moon-soo say Korea must issue a won-based stablecoin to protect monetary sovereignty from the growing use of U.S. dollar-backed stablecoins. But they don’t give any details on how this would actually work. The issue isn’t just about making a new coin – it’s about the fundamental competitiveness of our currency. Stablecoins have no borders, so the global trend toward the dollar can't simply be stopped. Even euro or yen-backed stablecoins haven’t been able to challenge the dominance of dollar-based ones.

Even Lee Jun-seok, a candidate who is considered to understand crypto better, made a mistake during a recent debate. He said that USDC can freeze user funds, but USDT cannot – which is incorrect.

Stablecoins are now an unstoppable trend. According to a report by @ARKInvest, in 2024, stablecoin transaction volume has already surpassed that of Visa and Mastercard. The U.S. just passed the GENIUS Act in the Senate, so Korea is not too late – but to catch up, we must act fast to build a regulatory framework and infrastructure.

That’s why @FourPillarsFP in partnership with Hashed Open Research (led by former Vice Minister of Finance Yongbeom Kim), is working on a follow-up to our first report on won-based stablecoins. We're collaborating with legal, accounting, and finance experts to explore practical ways to issue and use a Korean won stablecoin.

In this new report, I personally focus on how stablecoins are being used for payments, remittances, interbank settlements, and as base currencies on exchanges. I argue that how stablecoins are used is just as important as how they are issued.

Right now, Korea is leaning toward a bank-centered model for stablecoin issuance. But even if issuance is safe, a coin is useless if people don’t use it. Japan’s bank-issued stablecoins have seen very low adoption, and in Europe, EURCV (issued by Societe Generale) is far less used than EURC (issued by Circle), even though both follow MiCA.

Why? Because stablecoins issued by banks are usually overregulated, making them hard to use overseas or on-chain. They end up being treated like just another deposit, which defeats the purpose of stablecoins and makes adoption very slow.

Korean politicians say they want to issue a won stablecoin to protect the country from the growing power of the dollar. But if it's only issued by banks, it likely won’t be used outside of Korea. And since Korea already has great fintech and banking services, there won’t be strong reasons for people to switch to a domestic-only stablecoin. So this would not actually help protect monetary sovereignty.

Instead, if we want to issue a Korean won stablecoin, we should take a capital markets approach and allow non-bank issuers, as long as they meet strict requirements for user protection, just like in MiCA, MAS, and the GENIUS Act. We should also make sure stablecoins have real use cases where their unique strengths can shine.

Stablecoins are here to stay. Korea shouldn’t just build a regulatory framework that “looks good on paper.” We need to build a real environment where a won-based stablecoin can be issued and used in ways that truly protect our monetary sovereignty.

Show original

12.17K

4

How are you feeling about EURC today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

About EURC (EURC)

EURC FAQ

What is cryptocurrency?

Cryptocurrencies, such as EURC, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as EURC have been created as well.

Can I buy EURC on OKX?

No, currently EURC is unavailable on OKX. To stay updated on when EURC becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of EURC fluctuate?

The price of EURC fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials