Get started with OKX Options

1. Contract Specification

Options contract specification is available here.

1.1 Settlement Currency

OKX Options are settled in BTC or ETH instead of stablecoins. You can use stablecoins as margin if you trade in Portfolio margin or multi-currency cross mode.

1.2 Index

The underlying index is BTC-USD or ETH-USD

1.3 Contract Multiplier

The contract multiplier of BTC options is 0.01 and that of ETH options is 0.1. That means 1 contract of BTC options worth 0.01 BTC while 1 contract of ETH options worth 0.1 ETH. Please note contract multiplier of the perpetual swaps/futures are all 1, and it is contract value that is used to adjust the value of 1 contract of perpetual swaps/futures.

2. Simple Options, Options Chain and RFQ

We offer three channels for options trading:

- Simple options for beginners

- Buy options only

- Options chain for professionals

- RFQ or Liquid marketplace (not available in App)

- Request for quote on any sizable single-leg options or multi-leg strategies

3. Minimum Capital Requirement

OKX imposes minimum capital requirement as below.

| Category | Minimum capital requirement |

|---|---|

| Switch to Multi-currency account | 10,000 USD |

| Switch to Portfolio margin account | 10,000 USD |

| Simple options | None |

| Options (other than simple) Overseas KYC |

None |

| Options (other than simple) China Mainland KYC |

10,000 USD |

| RFQ or Liquid marketplace | 10,000 USD |

Minimum size requirement per RFQ is 10,000 USD.

4. Fees

Fee schedule is listed in OKX Trading Fees. Both transaction fees and exercise fees are applied.

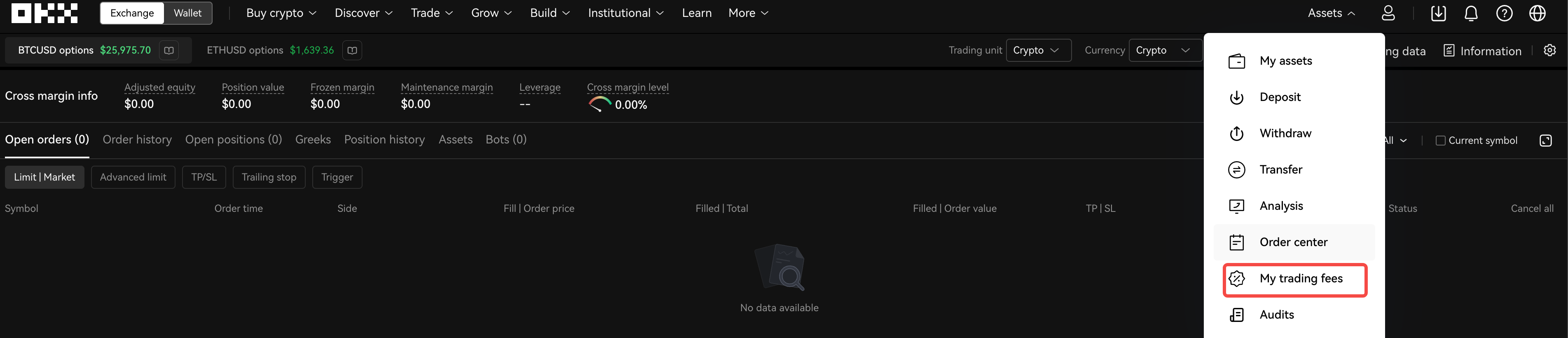

Your own trading fee can be viewable via "My trading fees" in the master account.

5. Account mode/Portfolio margin

For market makers or any sophisticated option trader, please enable Portfolio margin. OKX Portfolio margin (PM) supported most major currencies as margin.

If you are pure option buyers or option is just a small part of your overall portfolio to hedge or enhance yield on delta-one or spot positions, you do not have to switch to portfolio margin at all.

The user guide of PM is available here. Please contact your account manager or institutional@okx.com if you require a thorough examination on margin calculation.

Please note PM margin calculation is based on a risk unit, or underlying concept. BTC-USDT and BTC-USD are two separate underlying. That means, if you use BTC-USDT perpetual to hedge options, it will not bring any margin offset benefit.

PM liquidation starts with delta hedging, which means using perpetual or future to hedge delta risk instead of liquidating options directly to avoid slippage on options. Please be mindful of the account risk as liquidation could be very costly too.

5.1 Isolated vs Cross

In any single-currency/multi-currency/PM account, you can choose to place orders as an isolated or cross position. Isolated means this position is separated from other positions.

In Single/Multi-currency, long option positions could only be placed as isolated positions as it is free of liquidation. For pure option buyers, you could always choose isolated even if you are in PM so that you don't need to worry about any margin requirement for long option positions.

If you intend to use cross margin like margin offsetting in PM or stablecoins as margin, please choose cross. Otherwise, you might have to keep adding margins to an isolated position, especially shorting put positions when the market goes down.

5.2 Autoborrow

Turn on the autoborrow in the trade settings if you intend to use USDT or USDC as margin.

There are two borrowing concepts.

- Actual borrowing or liabilities: liabilities are a negative part of equity. You only have to pay interest for liabilities.

- Potential borrowing: if you only have USDT as margin but you want to choose BTC options. IMR on this option positions are potential borrowing. If you make money on options, BTC equity is positive then there is no actual borrowing, you do not have to pay interest.

For option traders, as the options are traded in BTC or ETH, you will only have borrowings on BTC or ETH. The historical and current interest rates are available here, which is relatively stable.

6. For Institutional Investors:

6.1 API Best Practices

For those connected via API, here is API best practices.

6.2 Market Maker Protection (MMP)

We offer MMP for options market makers to protect makers from executing too much within a short period of time. Please contact your account manager or institutional@okx.com if you want to have it enabled. Please refer to MMP API.

Please note the time interval is in milliseconds, not seconds.

Mass cancel and CAA are available for MMP orders.

6.3 Position Limits

Options position limits lists the default order size and position limits. For market makers, please contact your account manager or institutional@okx.com to raise any limits.

6.4 Self Trade Prevention

Self trade prevention is offered via API.

6.5 Rate Limit

Single order rate limit is 60 requests per 2 seconds. Batch order rate limit is 300 requests per 2 seconds. Colocation users have 4 times of the standard limits.

For market makers, please contact your account manager or institutional@okx.com to raise any rate limit.

6.6 Trade History (Public)

Orderbook trade history is available via websocket. Please note this only includes orderbook option trades.

RFQ trades history is also available via websocket. This includes all the RFQs, so you might have to filter out option trades.

RFQ trades history is also streamed via Telegram channel: OKX Liquid Marketplace Trade

6.7 Trade History (Private)

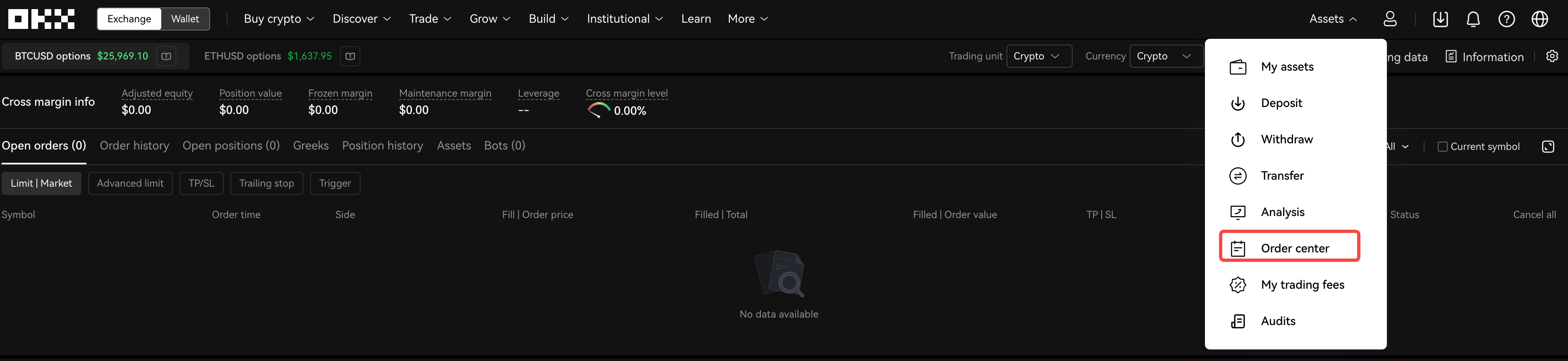

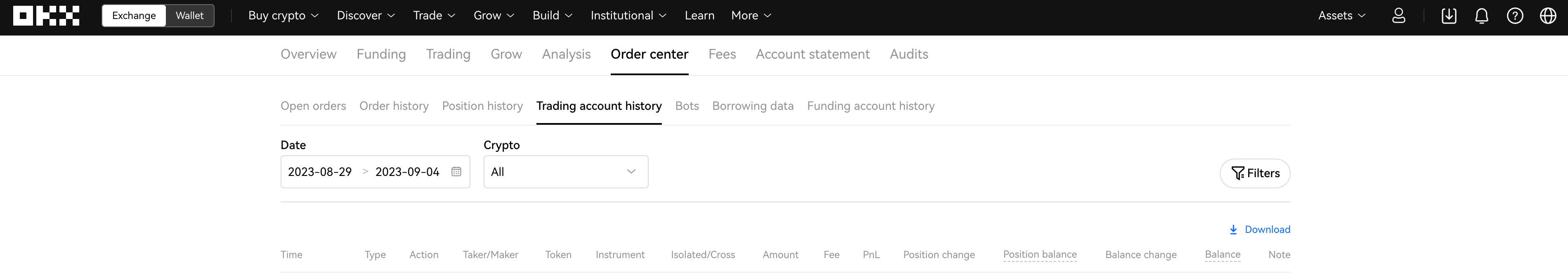

Click Assets - Order center - Trading account history