PNUT

Peanut the Squirrel price

$0.30070

-$0.03070

(-9.27%)

Price change for the last 24 hours

How are you feeling about PNUT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

PNUT Issuer Risk

Please take all and any precaution and be advised that this crypto-asset is classified as a high-risk crypto-asset. This crypto-asset lacks a clearly identifiable issuer or/and an established project team, which increases or may increase its susceptibility to significant market risks, including but not limited to extreme volatility, low liquidity, or/and the potential for market abuse or price manipulation. There is no absolute guarantee of the value, stability, or the ability to sell this crypto-asset at preferred or desired prices.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Peanut the Squirrel market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$301.16M

Circulating supply

999,858,912 PNUT

100.00% of

999,858,912 PNUT

Market cap ranking

--

Audits

CertiK

Last audit: --

24h high

$0.33190

24h low

$0.28360

All-time high

$2.5000

-87.98% (-$2.1993)

Last updated: Nov 14, 2024

All-time low

$0.10000

+200.70% (+$0.20070)

Last updated: Nov 11, 2024

Peanut the Squirrel Feed

The following content is sourced from .

比特傻

《Today's Primary Market Commentary》

1. On BSC

Unbelievable.

It feels like a wasteland, with people resorting to desperate measures.

From the wishing pool to the donkey, to the gorilla, to the innocent cat—everything is dead.

Almost all the promising bottom-up themes are dead.

The cheapest memes on Binance spot market are those scraps on BSC: mub, bst, tut, etc.

This wave barely pumped at all.

Completely abandoned by everyone—from the whales to the retail investors, from the primary market to the secondary market.

Interesting.

Ironically,

A few days ago, when the gorilla and donkey were pumping,

People said BSC was still suitable for retail investors, while SOL was full of conspiracies.

2. In the secondary market, apart from watching BTC and ETH,

Keep an eye on moodeng and pnut.

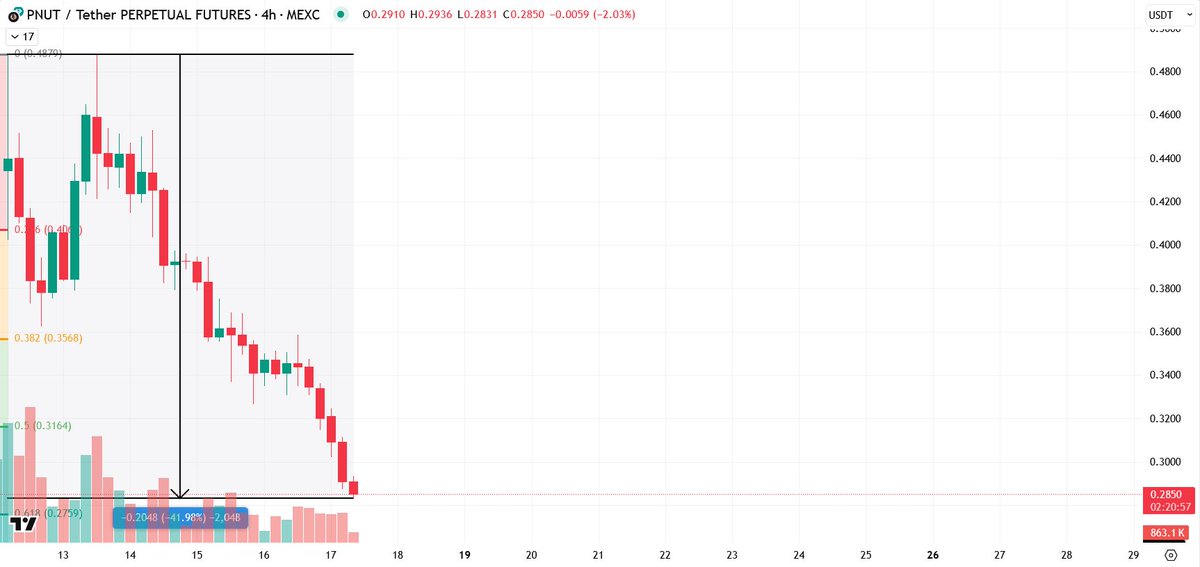

Pnut has dropped to 0.31, already falling below its bottom and doubling back up.

Pnut, as a meme, inherently has a daily volatility of about 2x, but the trend has broken down.

Moodeng has fallen below 200m.

Moodeng represents high control within memes, the best themes with the most conditions and willingness for manipulation.

This indicates a marginal shift; the whales are at a high of 300m, and the cost of retail investors selling off is too high to bear.

It also shows that the market's liquidity margin is contracting.

Show original24.65K

13

土狗大玩家|Bird🕊️

Brother Suo:

TK Trading Rules

1. Cherish your chips, never lose everything, and stay at the table to win. This market is not about luck; it's your persistence, experience, accumulation, determination, and logic that make you profitable.

2. Learn to review and summarize. Always reflect and summarize daily, preferably in written form.

3. Shitcoins are a financial game. Political perspective > monetary perspective ≈ cultural perspective > pure construction perspective. Projects tied to election narratives (e.g., Pnut) > Sotheby's Ban ≈ traditional cultural cult > ordinary project token issuance (project funds > project strength) / pure meme.

4. When you can't resist showing off your gains, it's time to take profits.

5. Maintain emotional stability in your holdings. Avoid self-induced FOMO. For non-top-tier narratives, exit profits anytime. Non-top-tier narratives don't require long-term vision; profit is enough.

6. If you didn't get into the leading token early, don't chase the second-tier token. Wait for the second phase of the leading token. Trust that the strong will remain strong!

7. When encountering a hot trend, rush in immediately without fear of chasing highs. When facing a certain opportunity, judge the peak based on market sentiment, not price (e.g., Trump).

8. Always withdraw your principal after doubling. This market is not about who earns the most but who survives the longest.

9. Use dynamic thinking to analyze narratives. Narrative development often goes in the opposite direction of static logic due to external forces.

10. Only join during an uptrend; don't bottom-fish during a downtrend. There are 18 levels of hell below the bottom.

11. Memes are essentially a game of attention. Think about who will notice a token and who will buy it.

12. Opportunities are endless, and the next one is always better. If you miss or mishandle one, preserve your principal and wait for the next chance.

13. Build your own trading logic. Invest heavily in opportunities that align with your logic. Don't envy money made outside your logic.

14. The obstacles to making money are not market conditions but your own greed, fear, impatience, and hesitation. Missing out, turning profits into losses, and selling too early all stem from poor emotional management.

15. Avoid trash projects and distractions. Focus your limited energy on the most valuable ones.

16. Prejudices are like mountains in the heart. Always remain unbiased and approach new things and narratives with an open mind. For unfamiliar narratives, start with a small position. After entering, research with a different mindset. Even if the outcome isn't significant, you won't completely miss out or damage your mindset.

17. Small narratives should be exited within the day. 3-5M is typically the peak for small narratives. Most shitcoin small narratives don't exceed 1M. For major narratives, 200-300M is a peak; beyond that, it depends on emotional fermentation.

18. Avoid sudden spikes in old projects with small pools, as early investors have already positioned themselves. Entering now only provides them with exit liquidity.

19. Preserving principal is the primary principle. Let profits run to have a chance at big gains.

20. In long-term trading, avoid excessive FOMO-driven additions above your cost line. Reverse bottom-fishing can infinitely raise costs.

21. When a token's market cap/LP and trading volume are severely imbalanced, with a very low market cap but high trading volume, the best strategy is to add some LP to earn fees.

22. The primary market is a place for small bets with big returns. Never aim for big returns with large bets, and avoid large bets for small returns.

23. Quantify every trade strictly: e.g., withdraw 50% of principal at 1.5x, sell 10% for every subsequent 1.5x increase, and prohibit replenishing positions. This is similar to the "cap strategy," where investing 100k to buy 1000u and reaching 100M can yield 130k in excess returns while significantly reducing risk (the reason for withdrawing 50% at 1.5x is that many opportunities may not reach 2x, but top-tier opportunities like Trump can consider not withdrawing principal).

24. Before heavily investing in any token, consider whether you can bear the risk if it goes to zero.

25. For small bets with big returns, don't set stop-losses. For large bets with big returns, always set stop-losses.

26. Many top earners are KOL (Key Opinion Leader) alt accounts. Follow these alt accounts to buy, and let KOL main accounts provide exit liquidity.

27. Avoid replenishing positions if trapped. Adding to positions to average costs often backfires in short-term speculation.

28. After a major loss, immediately summarize, preferably in written form, to give yourself time to calm down. Avoid rushing to recover losses, as impulsive actions can lead to further mistakes. This situation can also occur when refusing to exit after losses and blindly adding positions to bet on rebounds.

29. Prohibit adding positions or replenishing at high levels.

These rules: Red indicates the highest priority, blue indicates secondary priority.

Final note: The most important thing is persistence, reviewing, researching, and continuous learning. Spending 12+ hours daily on persistence, chain scanning, and thinking will eventually bring the desired results. If you can't endure this hardship, don't pursue this field. Remember, we are the most talented traders. We will succeed. We will achieve our big results. Let's encourage each other.

------TK

Brother Suo:

A summary from a fellow trader, very insightful, worth reading.

superalloy.eth

《TK Trading Rules, A Beginner's Review》

1. Cherish your chips, never lose them all, and stay at the table to win. This market is not about luck; it's your patience, experience, accumulation, persistence, and logic that make you profitable.

2. Learn to review and summarize, always reflect, and make it a habit to summarize daily, preferably in writing.

3. Shitcoins are a financial game, with political perspective > monetary perspective ≈ cultural perspective > pure construction perspective. Join the election narrative Pnut > Sotheby's Ban ≈ traditional cultural cult > ordinary project token issuance (project funds > project strength) / pure meme.

4. When you can't resist showing off your gains, it's time to take profits.

5. Keep your holdings stable, don't FOMO yourself. For non-top-tier narratives, retreat profits at any time. Non-top-tier narratives don't require a grand vision; profit is enough.

6. If you didn't get in on the leader first, don't go for the second leader. Wait for the second wave of the leader, and believe in the strong getting stronger!

7. When encountering a hot market, rush in immediately without fear of chasing high. When encountering a certain opportunity, use market sentiment to judge the top, not the price. (e.g., Trump)

8. Always take out your principal when doubling. This market is not about who earns more but who survives longer.

9. View narratives with dynamic thinking. The development of narratives often goes in the opposite direction of static thinking logic due to external forces.

10. Only join in an uptrend, don't bottom fish in a downtrend; there are eighteen levels of hell below the bottom.

11. Memes are essentially a game of attention. Think about who will see a coin and who will buy it.

12. Opportunities are always there, and the next one is better. If you miss or mishandle one, protect your principal and wait for the next opportunity.

13. Establish your own trading logic. Bet heavily on your own opportunities and don't envy money outside your logic.

14. What hinders you from making money is not the market trend but your own greed, fear, impatience, and hesitation. Missing out, turning profit into loss, and selling too early are all due to poor emotional management.

15. Don't touch trash, don't scatter your focus. Allocate your limited energy to the most valuable one.

16. Prejudice in people's hearts is a mountain. Never be biased, approach new things and narratives with an open mind. For narratives you don't understand, start with a small position. The mindset after getting in is completely different. Even if you don't achieve great results, you won't completely miss out and ruin your mindset.

17. Small narratives must be run within the day. 3-5M is basically the top for small narratives. Most shitcoin small narratives can't even reach 1M. For big narratives, 200-300 million is a top, and beyond that, it depends on emotional fermentation.

18. Don't get into old pools with small liquidity that suddenly surge, because those who were already in have preemptively entered, and going in now just provides them with exit liquidity.

19. Preserving your principal is the primary principle. Letting profits run gives you a chance to catch the big gold dog.

20. In long-term trading, don't let your cost line be exceeded by FOMO adding too much. Reverse bottom fishing will infinitely raise costs.

21. When a token's market cap/LP and trading volume are severely imbalanced, with a very low market cap and very high trading volume, the best strategy is to add some LP to earn fees.

22. The primary market is a market of small bets for big returns. Never think of making big bets for big returns, and even less for small returns.

23. Quantify every trade: for example, take out 50% of the principal at 1.5x, and sell 10% for every subsequent 1.5x increase. Prohibit replenishing positions, similar to the cap strategy. Buying 1000u at 100k to 100M can also yield 130k in excess returns, greatly reducing risk (the reason for taking out 50% of the principal at 1.5x is that it often doesn't reach 2x, but for top opportunities like Trump, consider not taking out the principal).

24. Before buying any coin heavily, think about whether you can bear the risk if it goes to zero.

25. Don't stop loss on small bets for big returns, but must set stop loss for big bets for big returns.

26. Many top earners are KOL small accounts. You need to follow these small accounts to buy, and let KOL big accounts help you exit liquidity.

27. Don't replenish positions. If trapped, avoid averaging down, as it often backfires in short-term speculation.

28. After a big loss, immediately summarize, preferably writing it down word by word, to give yourself time to calm down. Don't rush to recover losses, as it's easy to get carried away and make impulsive decisions. This can also happen when you don't want to leave after a loss and blindly add positions to bet on a rebound.

29. Prohibit adding positions at high levels.

30. Meme is a track for small bets for big returns. Don't bottom fish (there will always be newer, better, and more exciting narratives for everyone to FOMO) and only catch the first wave.

In conclusion, the most important thing is to persist in patience, review, research, and continuous learning. Sitting for 12+ hours a day, scanning chains, and thinking will eventually bring you the results you want. If you can't endure this hardship, don't do this job.

Remember, we are the most talented traders, and we will succeed. We will all achieve our great results. Let's encourage each other.

------TK

12.75K

5

比特肥 || Bitfatty (🍀,🍀)

BTC's market share dropped by 5% from a high

Welcoming the altcoin seven-day fun

#moodeng

$pnut

$people

$neiro

$nxcp

#mubarak

Now the market share has increased by 2.5 points

The whole family of altcoins is dead 😂

In the game of pocket-picking, you have to turn quickly and look cool

Otherwise, you'll be kneeling everywhere asking

"Can I still hold it?"

"Will it rise again?"

"What do you think about xxxx?"

Show original

37.9K

29

PNUT calculator

Peanut the Squirrel price performance in USD

The current price of Peanut the Squirrel is $0.30070. Over the last 24 hours, Peanut the Squirrel has decreased by -9.26%. It currently has a circulating supply of 999,858,912 PNUT and a maximum supply of 999,858,912 PNUT, giving it a fully diluted market cap of $301.16M. At present, the Peanut the Squirrel coin holds the 0 position in market cap rankings. The Peanut the Squirrel/USD price is updated in real-time.

Today

-$0.03070

-9.27%

7 days

-$0.03030

-9.16%

30 days

+$0.17150

+132.73%

3 months

+$0.14950

+98.87%

Popular Peanut the Squirrel conversions

Last updated: 05/18/2025, 05:49

| 1 PNUT to USD | $0.30120 |

| 1 PNUT to EUR | €0.26984 |

| 1 PNUT to PHP | ₱16.8080 |

| 1 PNUT to IDR | Rp 4,967.84 |

| 1 PNUT to GBP | £0.22676 |

| 1 PNUT to CAD | $0.42079 |

| 1 PNUT to AED | AED 1.1063 |

| 1 PNUT to VND | ₫7,807.15 |

Peanut the Squirrel FAQ

How much is 1 Peanut the Squirrel worth today?

Currently, one Peanut the Squirrel is worth $0.30070. For answers and insight into Peanut the Squirrel's price action, you're in the right place. Explore the latest Peanut the Squirrel charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Peanut the Squirrel, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Peanut the Squirrel have been created as well.

Will the price of Peanut the Squirrel go up today?

Check out our Peanut the Squirrel price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Asset details

Name

OKcoin Europe LTD

Relevant legal entity identifier

54930069NLWEIGLHXU42

Name of the crypto-asset

peanut_the_squirrel

Consensus Mechanism

Solana uses a unique combination of Proof of History (PoH) and Proof of Stake (PoS) to achieve high throughput, low latency, and robust security. Here’s a detailed explanation of how these mechanisms work: Core Concepts 1. Proof of History (PoH): Time-Stamped Transactions: PoH is a cryptographic technique that timestamps transactions, creating a historical record that proves that an event has occurred at a specific moment in time. Verifiable Delay Function: PoH uses a Verifiable Delay Function (VDF) to generate a unique hash that includes the transaction and the time it was processed. This sequence of hashes provides a verifiable order of events, enabling the network to efficiently agree on the sequence of transactions. 2. Proof of Stake (PoS): Validator Selection: Validators are chosen to produce new blocks based on the number of SOL tokens they have staked. The more tokens staked, the higher the chance of being selected to validate transactions and produce new blocks. Delegation: Token holders can delegate their SOL tokens to validators, earning rewards proportional to their stake while enhancing the network's security. Consensus Process 1. Transaction Validation: Transactions are broadcast to the network and collected by validators. Each transaction is validated to ensure it meets the network’s criteria, such as having correct signatures and sufficient funds. 2. PoH Sequence Generation: A validator generates a sequence of hashes using PoH, each containing a timestamp and the previous hash. This process creates a historical record of transactions, establishing a cryptographic clock for the network. 3. Block Production: The network uses PoS to select a leader validator based on their stake. The leader is responsible for bundling the validated transactions into a block. The leader validator uses the PoH sequence to order transactions within the block, ensuring that all transactions are processed in the correct order. 4. Consensus and Finalization: Other validators verify the block produced by the leader validator. They check the correctness of the PoH sequence and validate the transactions within the block. Once the block is verified, it is added to the blockchain. Validators sign off on the block, and it is considered finalized. Security and Economic Incentives 1. Incentives for Validators: Block Rewards: Validators earn rewards for producing and validating blocks. These rewards are distributed in SOL tokens and are proportional to the validator’s stake and performance. Transaction Fees: Validators also earn transaction fees from the transactions included in the blocks they produce. These fees provide an additional incentive for validators to process transactions efficiently. 2. Security: Staking: Validators must stake SOL tokens to participate in the consensus process. This staking acts as collateral, incentivizing validators to act honestly. If a validator behaves maliciously or fails to perform, they risk losing their staked tokens. Delegated Staking: Token holders can delegate their SOL tokens to validators, enhancing network security and decentralization. Delegators share in the rewards and are incentivized to choose reliable validators. 3. Economic Penalties: Slashing: Validators can be penalized for malicious behavior, such as double-signing or producing invalid blocks. This penalty, known as slashing, results in the loss of a portion of the staked tokens, discouraging dishonest actions.

Incentive Mechanisms and Applicable Fees

Solana uses a combination of Proof of History (PoH) and Proof of Stake (PoS) to secure its network and validate transactions. Here’s a detailed explanation of the incentive mechanisms and applicable fees: Incentive Mechanisms 4. Validators: Staking Rewards: Validators are chosen based on the number of SOL tokens they have staked. They earn rewards for producing and validating blocks, which are distributed in SOL. The more tokens staked, the higher the chances of being selected to validate transactions and produce new blocks. Transaction Fees: Validators earn a portion of the transaction fees paid by users for the transactions they include in the blocks. This provides an additional financial incentive for validators to process transactions efficiently and maintain the network's integrity. 5. Delegators: Delegated Staking: Token holders who do not wish to run a validator node can delegate their SOL tokens to a validator. In return, delegators share in the rewards earned by the validators. This encourages widespread participation in securing the network and ensures decentralization. 6. Economic Security: Slashing: Validators can be penalized for malicious behavior, such as producing invalid blocks or being frequently offline. This penalty, known as slashing, involves the loss of a portion of their staked tokens. Slashing deters dishonest actions and ensures that validators act in the best interest of the network. Opportunity Cost: By staking SOL tokens, validators and delegators lock up their tokens, which could otherwise be used or sold. This opportunity cost incentivizes participants to act honestly to earn rewards and avoid penalties. Fees Applicable on the Solana Blockchain 7. Transaction Fees: Low and Predictable Fees: Solana is designed to handle a high throughput of transactions, which helps keep fees low and predictable. The average transaction fee on Solana is significantly lower compared to other blockchains like Ethereum. Fee Structure: Fees are paid in SOL and are used to compensate validators for the resources they expend to process transactions. This includes computational power and network bandwidth. 8. Rent Fees: State Storage: Solana charges rent fees for storing data on the blockchain. These fees are designed to discourage inefficient use of state storage and encourage developers to clean up unused state. Rent fees help maintain the efficiency and performance of the network. 9. Smart Contract Fees: Execution Costs: Similar to transaction fees, fees for deploying and interacting with smart contracts on Solana are based on the computational resources required. This ensures that users are charged proportionally for the resources they consume.

Beginning of the period to which the disclosure relates

2024-04-20

End of the period to which the disclosure relates

2025-04-20

Energy report

Energy consumption

76.79328 (kWh/a)

Energy consumption sources and methodologies

The energy consumption of this asset is aggregated across multiple components:

To determine the energy consumption of a token, the energy consumption of the network(s) solana is calculated first. Based on the crypto asset's gas consumption per network, the share of the total consumption of the respective network that is assigned to this asset is defined. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.

PNUT calculator