ACT

Act I: The AI Prophecy price

$0.060440

+$0.0023300

(+4.00%)

Price change from 00:00 UTC until now

How are you feeling about ACT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Act I: The AI Prophecy market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$57.39M

Circulating supply

948,245,002 ACT

94.82% of

1,000,000,000 ACT

Market cap ranking

--

Audits

CertiK

Last audit: --

24h high

$0.060980

24h low

$0.057330

All-time high

$0.99000

-93.90% (-$0.92956)

Last updated: Nov 14, 2024

All-time low

$0.041300

+46.34% (+$0.019140)

Last updated: Apr 15, 2025

Act I: The AI Prophecy Feed

The following content is sourced from .

财经悟空

On-chain Meme platform hundred-group battle, AI Agent sector revival

1. Meme platform competitive landscape: Believe, Bonk, Pump dominate the market

Believe's advantages highlighted:

Focuses on real-name issuance (such as $dupe, $superfriend), attracting genuine traffic project parties.

No internal market mechanism, reducing the risk of retail investors being cut, stronger user confidence.

Platform coin $launchcoin FDV surpasses $100 million-$200 million, boosting ecosystem popularity

Bonk rises, challenges Pump:

Today, $glonk launched simultaneously with Pump, Bonk version $glonk data crushes Pump version (FDV 8M vs. 1.7M, trading volume doubled)

Recent frequent golden dogs (such as $doom, $ikun, $bonkify), strong momentum

Pump's moat is weak, platform cashing out SOL leads to user loss.

Platform differentiation trend:

Believe: High-end route, attracting real-name projects

Pump/Bonk: Fast-consumption Meme main battlefield

2. AI Agent sector revival, leading projects surge

Leading $virtual rebounds 5 times, launches staking and DAO governance, solving token economic model issues

Other AI project performance:

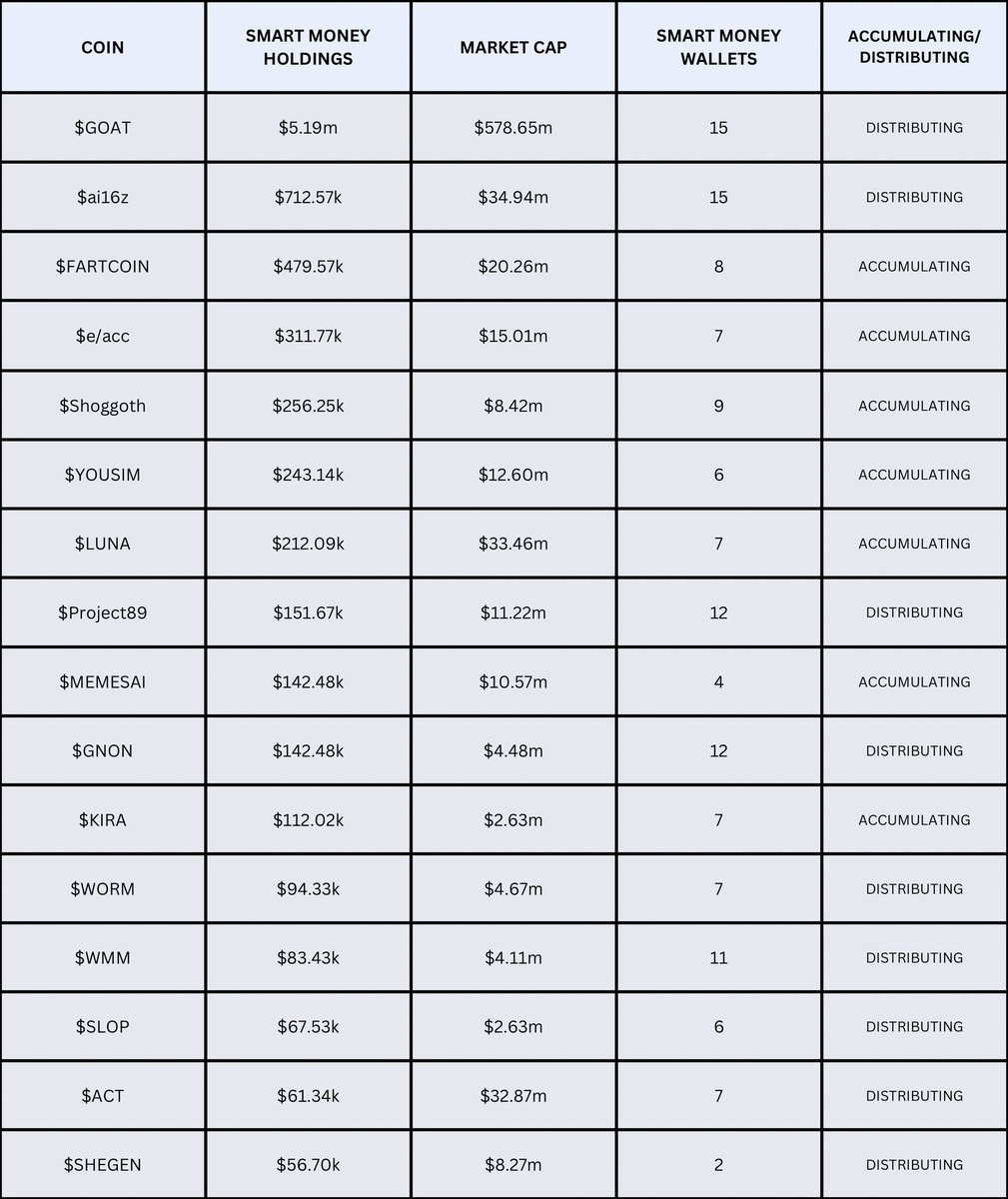

Backbone: $ai16z, $aixbt (3x), $goat, $act (7x), $fartcoin (FDV 1.4 billion, new high)

Potential lagging targets: $griffain (7x), $arc (4x), $pippin (4x), $vvv (3x)

Market rotation logic: After the Meme craze, funds may flow back to the AI track, old Agent projects may usher in a second spring

3: Future focus directions:

Meme platform: Whether Believe can maintain its advantage, how Bonk/Pump optimize the economic model.

AI Agent: The ecological development of leading $virtual, the opportunity for lagging projects to catch up.

Market rhythm: If the altcoin bull continues, the AI sector may take over Meme as the next focus.

Short-term focus on new Meme on Believe/Bonk, beware of Pump risks. Long-term layout of AI Agent leaders and undervalued old projects in spot.

Show original

58.29K

23

Gold

Tightened a lot of my risk:

Closed some excess trades for good profit

Still have $BTC position + RWA + $ACT for potential scam pump (seems like a good candidate

I’ve been max bullish about going higher etc… but also need to be cognisant of changing market dynamics:

1. 4% pump from equities vs 1% BTC pump

2. Multiple LTF rejections of 105k~ region

3. Big OI added but not much movement in price

I have strong opinions on the market, but also need to know when to switch bias if necessary

I’m keeping these positions open in the event we keep flying without giving away all profits from the last week

68.28K

93

老八只白嫖

Brothers, in a market that benefits everyone, not making money is no reason to #FOMO!

Let’s not talk about #memecoin, but focus on altcoins. Most tokens are on the rise, even $ACT, which I hoped would revive a while ago, and $BERA, which I criticized the most, have started to make small gains. $Parti has gone crazy and almost broke its previous high.

In such a market, it’s only a matter of earning more or less. If you haven’t made any profit, it’s time to change your strategy. Projects that haven’t seen any growth are even less worth your attention.

Even in such a favorable market, the most common sentiment I’ve heard recently is still lamentation. It’s mostly about seeing others’ coins rise while either missing out or holding stagnant positions, leading to self-doubt.

Not making money in a good market is actually normal. It simply means this market isn’t aligned with your area of focus. For example, the tokens that are rising might not be on your research list. Even if you were given another chance, the result would be the same. Opportunities that don’t belong to you won’t make you money, no matter how much you FOMO. It’s better to stick to your own ground and wait patiently.

To be honest, once this mindset sets in, brothers, you really need to be cautious. It’s a sign that your trading behavior might start to distort, which is the beginning of losing money. Confidence is the most crucial aspect of trading, while self-disruption and frequent position changes are the biggest pitfalls. The best approach is to do nothing. Even in the best market, not making money is better than losing money.

Show original

67.27K

18

Act I: The AI Prophecy price performance in USD

The current price of Act I: The AI Prophecy is $0.060440. Since 00:00 UTC, Act I: The AI Prophecy has increased by +4.01%. It currently has a circulating supply of 948,245,002 ACT and a maximum supply of 1,000,000,000 ACT, giving it a fully diluted market cap of $57.39M. At present, the Act I: The AI Prophecy coin holds the 0 position in market cap rankings. The Act I: The AI Prophecy/USD price is updated in real-time.

Today

+$0.0023300

+4.00%

7 days

-$0.00079

-1.30%

30 days

+$0.0033400

+5.84%

3 months

-$0.12136

-66.76%

Popular Act I: The AI Prophecy conversions

Last updated: 05/18/2025, 13:42

| 1 ACT to USD | $0.060450 |

| 1 ACT to EUR | €0.054157 |

| 1 ACT to PHP | ₱3.3733 |

| 1 ACT to IDR | Rp 997.03 |

| 1 ACT to GBP | £0.045509 |

| 1 ACT to CAD | $0.084452 |

| 1 ACT to AED | AED 0.22203 |

| 1 ACT to VND | ₫1,566.87 |

About Act I: The AI Prophecy (ACT)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Act I: The AI Prophecy FAQ

How much is 1 Act I: The AI Prophecy worth today?

Currently, one Act I: The AI Prophecy is worth $0.060440. For answers and insight into Act I: The AI Prophecy's price action, you're in the right place. Explore the latest Act I: The AI Prophecy charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Act I: The AI Prophecy, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Act I: The AI Prophecy have been created as well.

Will the price of Act I: The AI Prophecy go up today?

Check out our Act I: The AI Prophecy price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Asset details

Name

OKcoin Europe LTD

Relevant legal entity identifier

54930069NLWEIGLHXU42

Name of the crypto-asset

the_ai_prophecy

Consensus Mechanism

Solana uses a unique combination of Proof of History (PoH) and Proof of Stake (PoS) to achieve high throughput, low latency, and robust security. Here’s a detailed explanation of how these mechanisms work: Core Concepts 1. Proof of History (PoH): Time-Stamped Transactions: PoH is a cryptographic technique that timestamps transactions, creating a historical record that proves that an event has occurred at a specific moment in time. Verifiable Delay Function: PoH uses a Verifiable Delay Function (VDF) to generate a unique hash that includes the transaction and the time it was processed. This sequence of hashes provides a verifiable order of events, enabling the network to efficiently agree on the sequence of transactions. 2. Proof of Stake (PoS): Validator Selection: Validators are chosen to produce new blocks based on the number of SOL tokens they have staked. The more tokens staked, the higher the chance of being selected to validate transactions and produce new blocks. Delegation: Token holders can delegate their SOL tokens to validators, earning rewards proportional to their stake while enhancing the network's security. Consensus Process 1. Transaction Validation: Transactions are broadcast to the network and collected by validators. Each transaction is validated to ensure it meets the network’s criteria, such as having correct signatures and sufficient funds. 2. PoH Sequence Generation: A validator generates a sequence of hashes using PoH, each containing a timestamp and the previous hash. This process creates a historical record of transactions, establishing a cryptographic clock for the network. 3. Block Production: The network uses PoS to select a leader validator based on their stake. The leader is responsible for bundling the validated transactions into a block. The leader validator uses the PoH sequence to order transactions within the block, ensuring that all transactions are processed in the correct order. 4. Consensus and Finalization: Other validators verify the block produced by the leader validator. They check the correctness of the PoH sequence and validate the transactions within the block. Once the block is verified, it is added to the blockchain. Validators sign off on the block, and it is considered finalized. Security and Economic Incentives 1. Incentives for Validators: Block Rewards: Validators earn rewards for producing and validating blocks. These rewards are distributed in SOL tokens and are proportional to the validator’s stake and performance. Transaction Fees: Validators also earn transaction fees from the transactions included in the blocks they produce. These fees provide an additional incentive for validators to process transactions efficiently. 2. Security: Staking: Validators must stake SOL tokens to participate in the consensus process. This staking acts as collateral, incentivizing validators to act honestly. If a validator behaves maliciously or fails to perform, they risk losing their staked tokens. Delegated Staking: Token holders can delegate their SOL tokens to validators, enhancing network security and decentralization. Delegators share in the rewards and are incentivized to choose reliable validators. 3. Economic Penalties: Slashing: Validators can be penalized for malicious behavior, such as double-signing or producing invalid blocks. This penalty, known as slashing, results in the loss of a portion of the staked tokens, discouraging dishonest actions.

Incentive Mechanisms and Applicable Fees

Solana uses a combination of Proof of History (PoH) and Proof of Stake (PoS) to secure its network and validate transactions. Here’s a detailed explanation of the incentive mechanisms and applicable fees: Incentive Mechanisms 4. Validators: Staking Rewards: Validators are chosen based on the number of SOL tokens they have staked. They earn rewards for producing and validating blocks, which are distributed in SOL. The more tokens staked, the higher the chances of being selected to validate transactions and produce new blocks. Transaction Fees: Validators earn a portion of the transaction fees paid by users for the transactions they include in the blocks. This provides an additional financial incentive for validators to process transactions efficiently and maintain the network's integrity. 5. Delegators: Delegated Staking: Token holders who do not wish to run a validator node can delegate their SOL tokens to a validator. In return, delegators share in the rewards earned by the validators. This encourages widespread participation in securing the network and ensures decentralization. 6. Economic Security: Slashing: Validators can be penalized for malicious behavior, such as producing invalid blocks or being frequently offline. This penalty, known as slashing, involves the loss of a portion of their staked tokens. Slashing deters dishonest actions and ensures that validators act in the best interest of the network. Opportunity Cost: By staking SOL tokens, validators and delegators lock up their tokens, which could otherwise be used or sold. This opportunity cost incentivizes participants to act honestly to earn rewards and avoid penalties. Fees Applicable on the Solana Blockchain 7. Transaction Fees: Low and Predictable Fees: Solana is designed to handle a high throughput of transactions, which helps keep fees low and predictable. The average transaction fee on Solana is significantly lower compared to other blockchains like Ethereum. Fee Structure: Fees are paid in SOL and are used to compensate validators for the resources they expend to process transactions. This includes computational power and network bandwidth. 8. Rent Fees: State Storage: Solana charges rent fees for storing data on the blockchain. These fees are designed to discourage inefficient use of state storage and encourage developers to clean up unused state. Rent fees help maintain the efficiency and performance of the network. 9. Smart Contract Fees: Execution Costs: Similar to transaction fees, fees for deploying and interacting with smart contracts on Solana are based on the computational resources required. This ensures that users are charged proportionally for the resources they consume.

Beginning of the period to which the disclosure relates

2024-04-20

End of the period to which the disclosure relates

2025-04-20

Energy report

Energy consumption

76.24475 (kWh/a)

Energy consumption sources and methodologies

The energy consumption of this asset is aggregated across multiple components:

To determine the energy consumption of a token, the energy consumption of the network(s) solana is calculated first. Based on the crypto asset's gas consumption per network, the share of the total consumption of the respective network that is assigned to this asset is defined. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.