This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

TUSD

TrueUSD price

0x40af...11c9

$0.99871

-$0.00050

(-0.05%)

Price change for the last 24 hours

How are you feeling about TUSD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

TUSD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$10.02M

Network

BNB Chain

Circulating supply

10,030,364 TUSD

Token holders

10402

Liquidity

$991,494.17

1h volume

$263.84

4h volume

$35,886.90

24h volume

$47,611.70

TrueUSD Feed

The following content is sourced from .

Phyrex

Recently, the topic of RWA and stablecoins has been discussed more and more, especially after the Cirlce impact listing, more and more stablecoin project parties believe that stablecoins based on U.S. bonds are the most stable and guaranteed fixed income products, but in fact, there are still fewer people doing this, without it, on the one hand, although the income is stable, only about 4% yield may not be enough to subsidize the market.

Secondly, the market for stablecoins in terms of purchasing power is saturated enough, USDT and USDC have shared the largest market share, and other stablecoins, even the old DAI, are at the bottom of the market, not to mention the support for exchanges, FDUSD and TUSD are the best examples.

So why are there still people using stablecoins without payment and purchase links, because of the "rate of return", since the stabilization in 2020, stablecoins have become less and less used as a payment channel, and more are used as the support of the protocol to provide income, and staking is the best protocol.

In the early days, DAI was able to gain exposure to stablecoins by staking ETH to be over-collateralized, but as ETH price volatility has amplified, DAI has transformed from a stablecoin to a "staking platform". Therefore, it is better to directly make U.S. bond collateral, which is more stable and less to worry about, although the income may be reduced, but the stability is improved, the liquidation is reduced, and the applicability is also improved.

However, there is still a large amount of $BTC and $ETH collateral demand on the chain, and on-chain lending is also the best way to confirm the right of DeFi now, so through the lending of BTC and ETH to leverage the user's spot leverage, and use U.S. bonds to hedge risks, this is a very standard combination, liquidity through the lending market, liquidity provider positions and yield maximization strategies continue to surpass passive strategies, and make full use of assets.

Resolv's staking pool will evolve into a segregated, yield-optimized cluster of assets that integrate blue-chip DeFi protocols. But ETH and BTC After all, there are already many protocols in the market, so there is a more "wild" way to play, adding altcoins and the collateral and hedging of contracts to the yield pool to expand the yield. Resolv works by building a hedged altcoin vault to capture synthetic USD gains from these high-interest rate environments while maintaining risk control.

@ResolvLabs is such a way to play, Resolv is a neutral spread stablecoin architecture, the core is $USR, a stablecoin pegged to the US dollar, including neutral Delta perpetual contracts, staking, lending, and re-staking.

And it adopts a dual-currency scheme, in which $USR as a stable income layer, which can be regarded as a stablecoin directly generated by collateral, and $RLP is a stable coin that obtains income through fluctuations. At present, Resolv also cooperates with Pandle to support USR's staking and point acquisition in Pandle.

Show original69.71K

54

Crypto Town Hall

STABLECOINS, SCANDALS & SUN’S $50M BOUNTY

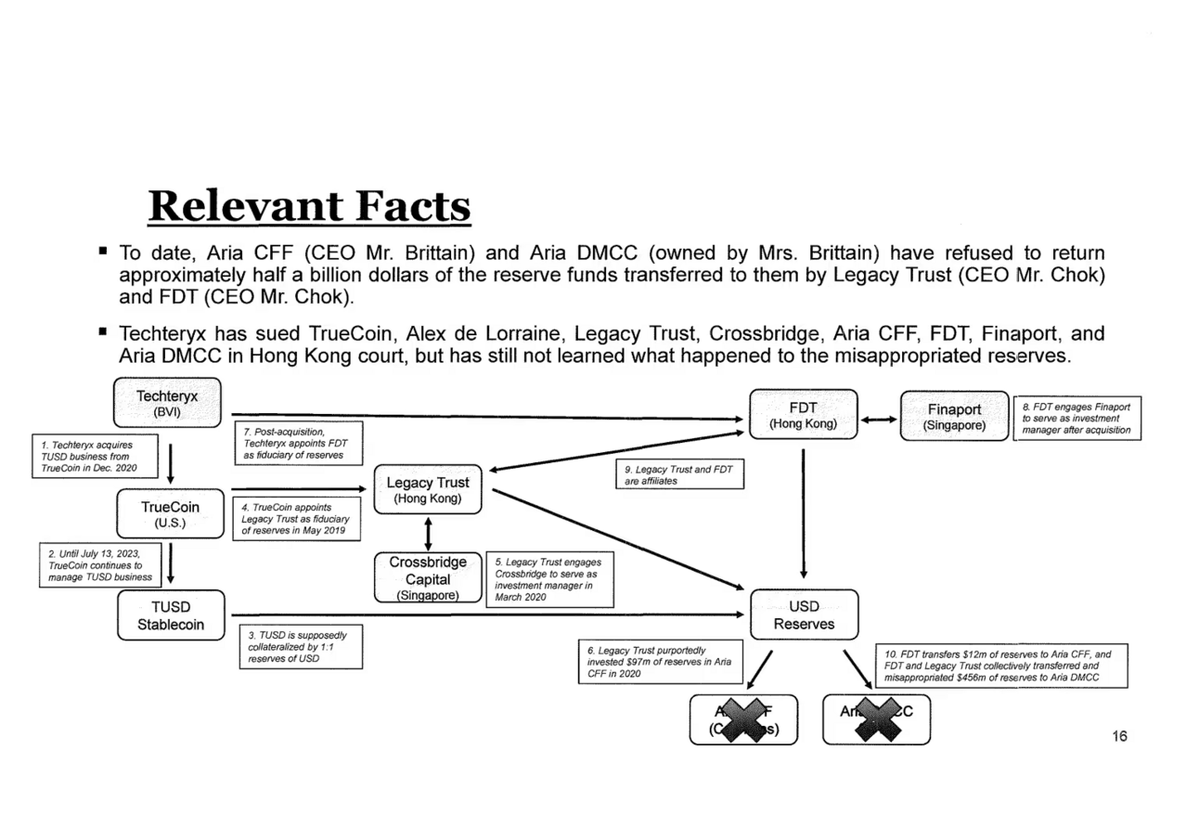

Tron’s Justin Sun compares First Digital Trust’s alleged $456M unauthorized TUSD transfer to the FTX collapse—calling it "significantly worse." He claims the funds were funneled to a shady Dubai firm without client consent.

Sun is offering a $50M bounty to recover the assets and defend Hong Kong’s reputation. FDT, however, denies insolvency and says it’ll pursue legal action, calling the claims malicious.

Will this reshape trust in stablecoins and prompt tighter oversight?

Source: @BTCTN

Show original

21.45K

42

May

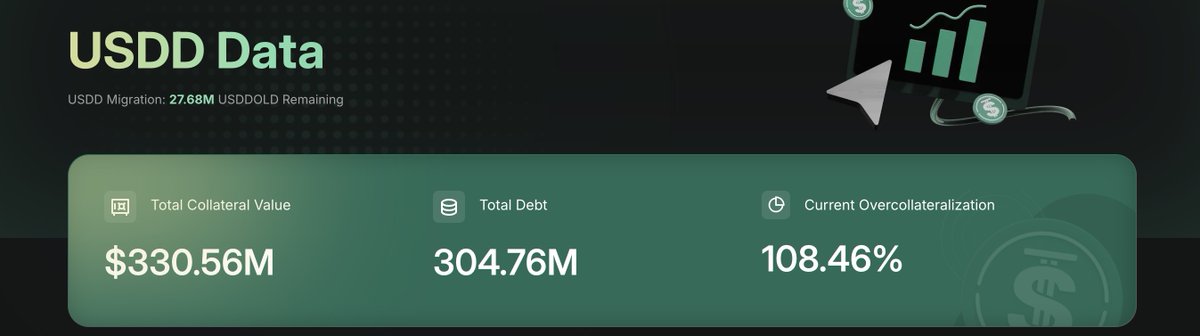

Congratulations to USDD minting exceeding 300 million TRON stablecoin entering a new stage 🎉

The first thing I do when I wake up is to review all the TRON data. I just opened the USDD official website and found that the minting volume has officially exceeded 300 million! This marks a new stage for the TRON ecosystem stablecoin, and further confirms the market's recognition of USDD.

From February to now, the rhythm of USDD has become more and more stable

Looking back at USDD 2.0, which was launched in February this year, it features a combination of high APY+ overcollateralization and provides an annualized subsidy of up to 20%, which is particularly attractive in the current market environment of generally weak returns for stablecoins.

Judging from the data, in just two months, the market value of USDD has grown steadily to $330 million, and the minting volume has also successfully exceeded the 300 million mark, which is far beyond market expectations in terms of growth rate and number of participants.

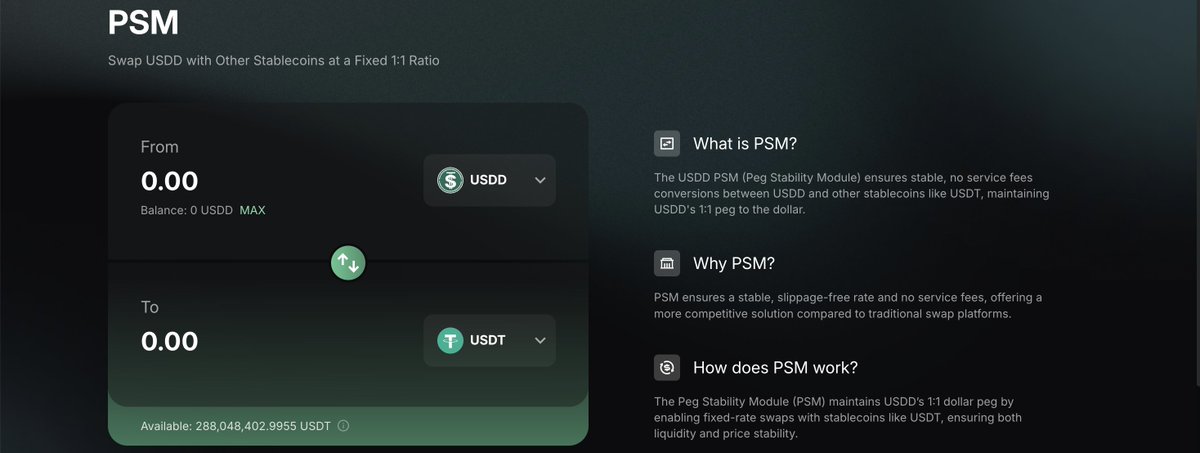

PSM lossless exchange + Brother Sun's 500 million aid, USDD stability is more solid

Compared with other stablecoins, USDD has a significant advantage of the PSM (Peg Stability Module) exchange mechanism - users can exchange USDT 1:1 lossless through the official channels of TRON, which greatly enhances the liquidity and "convertibility" of USDD.

At the same time, there is also the TRON ecology and Brother Sun's banknote ability behind it. Not long ago, TUSD fell into a liquidity crisis due to the reserve problem, and Brother Sun took decisive action and directly injected $500 million to stabilize market sentiment. This wave of operations not only demonstrates its long-term confidence in the stablecoin market, but also strengthens the trust of the outside world in USDD.

USDD is not alone, but a "serious project" with a team, a channel, and real money.

Breaking through 300 million is just the beginning

Breaking 300 million minted is an important milestone, but it is not the end. What's more exciting to see is how USDD can be integrated into more application scenarios.

The real value of a stablecoin is not only anchored and minted, but also whether it can be used, circulated and relied upon. However, judging by the current trend, USDD has run out of its own rhythm.

While others are still discussing whether it can be stable, USDD is already expanding.

The current TRON is not only catching up, but also defining its own stablecoin logic.

@justinsuntron @usddio #TRONEcoStar

Show original

126.25K

51

ChainCatcher 链捕手

On April 2, 2025, Justin Sun once again set the crypto world abuzz. As reported by CoinDesk, Sun stepped in with a critical injection of liquidity to support TrueUSD (TUSD) amid a staggering $456 million reserve gap—averting a potential depegging crisis that could have rocked the stablecoin ecosystem.

"Godzilla was destroying the city. I’m Ultraman—I came in and punched Godzilla to save everyone," Sun told Hong Kong media outlet Sing Tao Daily, in his trademark flair.

But behind the theatrics lies a much graver mission. Sun is taking on the alleged fraud by First Digital Trust (FDT) and its affiliated partners, urging Hong Kong regulators & and law enforcement agencies to take decisive measures to address these loopholes. "These assets are essentially public users’ money," he said. "To protect users and uphold Hong Kong’s credibility as a global financial hub, I had to step in. The scale of the fraud shocked me. All fraudsters must be held accountable."

A Relentless Defender of Crypto

Crypto has always been a volatile adventure. Bull runs feel like reaching for the stars, while crashes leave only wreckage. But in these uncertain times, Justin Sun has made it his role to keep the lights on. He’s not just a survivor—he’s a watchman. Someone who shows up when others hesitate.

The Ethereum Showdown: Twice Tested, Never Broken

Sun’s relationship with Ethereum has been nothing short of a saga.

During the infamous May 19, 2021 crash, ETH dipped below $2,000 and Sun was inches away from liquidation. He repaid $300 million just in time to protect his 606,000 ETH position and threw in another $280 million to buy more ETH and BTC at fire-sale prices.

“My assets were safe, but it felt like a bullet grazed my scalp. The wick was brutal,” he wrote on Weibo. It wasn’t just a trade. It was a battle of conviction. He shielded his own position while keeping the crypto dream alive.

In 2024, ETH lagged in performance and Sun faced fresh rumors of massive losses and sell-offs. Instead of retreating, he proposed bold plans: Halt ETH Sales, heavily tax Layer 2 solutions, streamline foundation & optimize revenue.

Wild? Maybe. But Sun has always married ambition with execution.

Reviving HTX: From Burnout to Breakout

Critics once joked that Sun "got burned" buying into HTX (formerly Huobi). When he stepped in as Global Advisor in October 2022, the market was reeling from FTX’s collapse, and centralized exchanges were under siege. HTX had lost ground—and users.

Today, HTX is thriving. Trading volume and user activity are up, euro-stablecoin trading is on top three globally, and its CIS market share is dominant. It even made Forbes’ list of "Top 25 Most Trustworthy Crypto Exchanges of 2025."

The same exchange that once looked like a liability? Now a pillar of Sun’s empire.

FTX Fallout: Standing in the Storm

When FTX collapsed in November 2022, chaos swept the markets. Sun publicly pledged to support TRON-related tokens and HT assets with 1:1 redemption. He even told Bloomberg he was prepared to inject "billions" to help FTX, subject to due diligence.

FTX ultimately folded, but Sun’s swift move bought time for users and preserved value within the TRON and HTX ecosystems.

The Curve Crisis: DeFi Gets a Lifeline

DeFi’s fragility was exposed again in 2023 when Curve Finance was hacked. Founder Michael Egorov faced possible liquidation on $100M in loans. As CRV tanked, Sun and allies stepped in, purchasing 72 million CRV for $28.8 million to shore up the protocol.

He didn’t stop there—Sun launched a stUSDT pool on TRON, giving the ecosystem a boost. Some say it was strategic self-interest. But in a storm, does it matter who holds the umbrella, as long as someone does?

Controversial but Unshaken

Sun’s name always invites debate. Opportunist or idealist? Visionary or self-promoter? The truth probably lies somewhere in between. Yes, he’s bold. Yes, he’s ambitious. But when others flee, he steps forward.

From converting $HT to $HTX, to partnering with WLFI on reserve-backed assets, Sun continues to bet on crypto’s long-term future. “I’m not here to make a quick buck,” he once said. “I want to build something that lasts."

Love him or not, in the darkest hours of Web3, Justin Sun has made a habit of showing up with a flashlight.

Show original4.19K

0

TUSD price performance in USD

The current price of trueusd is $0.99871. Over the last 24 hours, trueusd has decreased by -0.05%. It currently has a circulating supply of 10,030,364 TUSD and a maximum supply of 10,030,364 TUSD, giving it a fully diluted market cap of $10.02M. The trueusd/USD price is updated in real-time.

5m

-0.16%

1h

+0.00%

4h

-0.02%

24h

-0.05%

About TrueUSD (TUSD)

TUSD FAQ

What’s the current price of TrueUSD?

The current price of 1 TUSD is $0.99871, experiencing a -0.05% change in the past 24 hours.

Can I buy TUSD on OKX?

No, currently TUSD is unavailable on OKX. To stay updated on when TUSD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of TUSD fluctuate?

The price of TUSD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 TrueUSD worth today?

Currently, one TrueUSD is worth $0.99871. For answers and insight into TrueUSD's price action, you're in the right place. Explore the latest TrueUSD charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as TrueUSD, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as TrueUSD have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials