SCR

Scroll price

$0.36130

-$0.02310

(-6.01%)

Price change for the last 24 hours

How are you feeling about SCR today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Scroll market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$68.72M

Circulating supply

190,000,000 SCR

19.00% of

1,000,000,000 SCR

Market cap ranking

203

Audits

CertiK

Last audit: --

24h high

$0.38720

24h low

$0.35750

All-time high

$1.4428

-74.96% (-$1.0815)

Last updated: 13 Dec 2024

All-time low

$0.20670

+74.79% (+$0.15460)

Last updated: 17 Apr 2025

Scroll Feed

The following content is sourced from .

TechFlow

Written by Arcana, Crypto Institute

Compilation: Groove small deep

Editor's note: "Fat Application Theory" believes that as the cost of block space approaches zero, L1 blockchains will shift from monopoly to commoditization, and value will shift from the underlying protocol layer (such as Ethereum, Solana) to the application layer. Successful apps capture more revenue through vertical integration, control of order flow, and MEV to become sovereign appchains. The market is repricing L1/L2, and the winners of the future will be applications that are close to demand and focus on utility, rather than chains that are chasing high TPS.

The following is the original content (the original content has been edited for ease of reading and comprehension):

The crypto infrastructure stage is entering a world of post-marginal costs. As with bandwidth and hash power, the price of block space will quickly move towards zero. The only strands that survive are those that can:

Growth is achieved today through subsidies

Capture non-inflationary income tomorrow

Provide infrastructure that applications can't easily replicate or discard

But in this new environment, L1 is no longer a monopolist defined by early advantages or native ecology. Instead, they have become commodities – interchangeable tools for competing economic activity based on performance, interoperability, and cost efficiency.

Their value now depends on how well they are embedded in application processes and provide services that are indispensable or cannot be outsourced. The "protocol premium" that once drove high valuations is fading and is being replaced by a demand for real utility and performance. The current market repricing of many L1/L2 is a reflection of this trend.

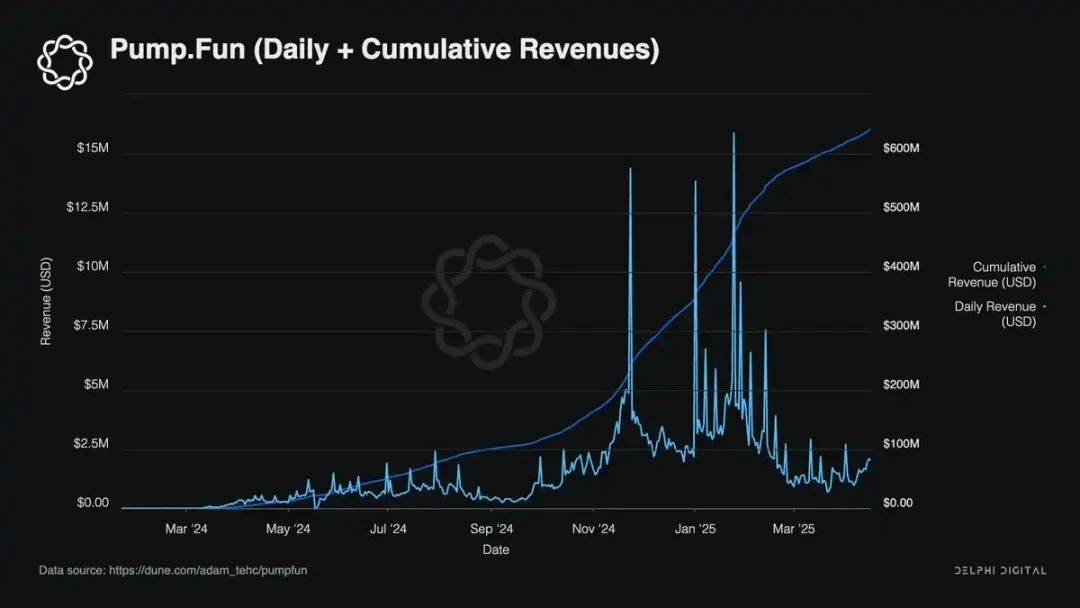

Charts include: BERA, MOVE, SCR, STRK

Is the fat protocol wrong?

In 2016, Joel Monegro proposed the thick protocol theory, stating that in crypto networks, most of the value is concentrated in the underlying protocol layer (Ethereum, Solana, etc.) rather than the application layer. This is very different from the Web2 model, where applications like Facebook, Google, and Amazon capture most of the value, while protocols like HTTP, TCP/IP, etc., are commoditized.

The fat protocol theory has indeed been true for the past eight years. This can be seen in the huge difference between the valuation and revenue multiples of infrastructure and applications. On average, the transaction valuation of applications is still much lower than that of infrastructure relative to revenue.

In this model, the crypto infrastructure receives a lot of funding and venture capital. In fact, it's so common that founders and developers are almost incentivized to launch another alternative L1 or generic rollup, knowing that venture capital will be ready to support it.

As I mentioned in a recent report, data availability (DA) is commoditizing and inevitably trending towards zero. Based on the same logic, we can assume that all parts of the infrastructure stack will eventually be commoditized and extracted value. Why?

1. Fat application theory: Applications realize that by becoming a sovereign "appchain" and vertically integrating the entire stack, more value can be captured.

2. App-specific ordering: Apps can control their own transaction ordering and inclusion processes. This is an alternative path for apps that don't want to build an appchain from scratch.

Fat application theory

Thick application theory argues that successful cryptographic applications will capture more value than the underlying blockchain protocol. The simple rationale is this: the app is a business entity, and the business entity prioritizes maximizing revenue.

The most successful apps in the space are those that consistently generate revenue, such as: pumpfun, Hyperliquid, Jupiter, and Uniswap. What do they have in common? Fee income. It makes perfect sense that these business entities would want to control their own order flow and MEV capture, or in many cases, become sovereign appchains.

Vertical integration seems to be the most cost-effective way for applications to plug value leaks. As the size of the application grows, the opportunity cost of not doing so will only increase. This is good for applications, but not so much for underlying infrastructure such as Ethereum. We are already seeing clear signs of this trend in Unichain and JupNet.

What's left of the protocol layer?

There are two points of view regarding the future value accumulation of the underlying protocol layer:

1. Base fees and transaction fees will tend to zero over time. MEV, as the only remaining source of revenue, will be abstracted by apps that seek to internalize all values. The protocol layer (e.g. Ethereum, Solana) will provide value as a settlement layer, but will not be able to capture any value – similar to HTTP and TCP/IP.

2. Cheap block space will lead to increased demand and a surge in applications. Trading volume will increase as a result to offset the low base fees and re-accumulate value to the protocol layer.

Let's break down the first scenario:

A series of possible occurrences: · SOL Beyond ETH · We all realize that no one is special, just technology · SOL Surpassed · L1 offers more and more value to the world, but its tokens capture less value · BTC reigns king

This view is based on the assumption that infrastructure is fully commoditized. Regardless of data availability, expense, or compute cost, all parts of the stack will tend to zero over time. The cheap and abundant block space of the rollup and DA layers is eroding Ethereum's trading monopoly.

Blob-based data inclusion (EIP-4844) will be performed and settlement will be decoupled, and L2 will choose an alternative DA solution, resulting in a further reduction in the residual value of sorting and data storage over the past year.

But the main evidence in this direction is the decline in the share of MEV captured by L1 block proposers. In 2024, the majority of MEV will be captured by searchers and relayers through systems such as Flashbots, rather than Ethereum validators. Currently, 90% of Ethereum blocks are proposed via MEV-Boost, and a significant portion of them are processed through Flashbots-linked relays.

And that's without taking into account applications like CoW Swap, which use a network of solvers to handle matching and execution off-chain, bypassing the public mempool and its associated MEV entirely.

The second scenario is highly dependent on the surge in demand and transaction volume that comes with near-zero fees. It assumes that the abundance of cheap block space will lead to increased consumption, rather than a deflationary effect.

Just as the falling cost of computing spawned the internet boom, lower transaction fees will unlock new application categories and use cases. The main analogy here is that the general-purpose compute and orchestration layer is more akin to AWS or Linux than to HTTP. Ethereum and Solana are not just "settled" transactions, but support massively programmable state coordination.

As usage grows and cost barriers fall, this support for trustless computing power becomes more valuable, not less. Instead of pushing the value to zero, the low fees expand the addressable market for the block space.

Low fees > Increased network demand

Network requirements increase > total expense income

Token Valuation – What Does This Mean for My Investment?

If there is one thing to sum up, it is this: the allocation of capital will be transformed in a way that is alien to many since 2016/17.

The fat protocol theory unfortunately implants the illusion of an L1 premium subsidized by hundreds of millions of dollars in venture capital. However, we are currently at an inflection point in the value distribution curve, and the growth of application revenue relative to the protocol layer is evident.

Fat Application Theory > Fat Protocol Theory

When it comes to L1 valuations, we've misused the narrative to the point where these tokens can no longer sustain their price after TGE. Hundreds of millions of dollars in funding and billion-dollar valuations before mainnet launch have become the norm for L1/L2. The common trend of most new agreements is that prices will only fall, not rise.

That's not to say that infrastructure is going to become irrelevant; But the signs that the market is maturing are clear. However, L1/L2 transactions are saturated. This is reflected in the sentiment of low liquidity, high FDV. The FDV of the new L1 is orders of magnitude higher than that of the previous cycle. Monad, Bera, and Story Protocol all raised nine-figure funding before going live, while Solana was just $45 million (which also includes a public token sale).

The next cycle will not be led by chains racing to reach 100,000 TPS. It will be driven by focused and composable applications that focus on use rather than architecture, sustainability rather than speculation. The winners will be those apps that are closest to the source of demand.

Show original

29.95K

0

Scroll

Did you know 80% of $100 bills are held outside the US?

People around the world have always needed dollars - they just kept them under mattresses.

Now they can have digital dollars on their phones that move like a text message.

This is what @circle is building with @USDC.

Show original

21.26K

89

Scroll price performance in USD

The current price of Scroll is $0.36130. Over the last 24 hours, Scroll has decreased by -6.01%. It currently has a circulating supply of 190,000,000 SCR and a maximum supply of 1,000,000,000 SCR, giving it a fully diluted market cap of $68.72M. At present, the Scroll coin holds the 203 position in market cap rankings. The Scroll/USD price is updated in real-time.

Today

-$0.02310

-6.01%

7 days

-$0.02810

-7.22%

30 days

+$0.14840

+69.70%

3 months

-$0.27740

-43.44%

Popular Scroll conversions

Last updated: 18/05/2025, 04:27

| 1 SCR to USD | $0.36170 |

| 1 SCR to AUD | $0.56366 |

| 1 SCR to PHP | ₱20.1841 |

| 1 SCR to EUR | €0.32404 |

| 1 SCR to IDR | Rp 5,965.69 |

| 1 SCR to GBP | £0.27230 |

| 1 SCR to CAD | $0.50531 |

| 1 SCR to AED | AED 1.3285 |

About Scroll (SCR)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Learn more about Scroll (SCR)

Scroll Launch: What's Driving the Hype Behind SCR

Exploring the Scroll Hype: A Deep Dive into the Scroll Launch and Its zkEVM Rollup The cryptocurrency world is abuzz with the Scroll hype , a phenomenon fueled by the recent Scroll launch of the SCR token. As a bytecode-level compatible zkEVM Rollup, Scroll is positioned as one of the most promising scaling solutions for Ethereum. This article delves into the origins, technology, and reasons behind the growing popularity of Scroll, while also exploring its potential as one of the trending tokens 2025 .

13 Mar 2025|OKX

Is Scroll Legit? A look at whether SCR is real or a scam

Is Scroll Legit? Exploring SCR Tokenomics and Community Engagement Scroll (SCR) is gaining attention as a bytecode-level compatible zkEVM Rollup, positioning itself as one of the mainstream scaling solutions for Ethereum. With its innovative approach to scalability and a growing community, many are asking, is Scroll legit? This article delves into the background of Scroll, its economic model, community engagement, and the potential for SCR to be listed on major exchanges.

6 Mar 2025|OKX

OKX Ventures Announces Strategic Investment in Scroll to Support Ethereum Scalability

- OKX Ventures invests in Scroll, a community-first zkEVM-based zkRollup which enables builders to make apps that are natively compatible with Ethereum - The investment is in line with OKX Ventures’ v

26 Feb 2025|OKX

OKX Wallet Integrates Scroll, Rarible and Trader Joe XYZ, Grows OKX Web3 Ecosystem, Expands User Access to DeFi Solutions

__SAN FRANCISCO, June 23, 2023__ - [OKX](/), a leading Web3 technology company, has integrated [Scroll](https://scroll.io), a zk-EVM scaling solution for Ethereum, [Rarible](https://rarible.com), an a

25 Apr 2024|OKX

Scroll FAQ

How much is 1 Scroll worth today?

Currently, one Scroll is worth $0.36130. For answers and insight into Scroll's price action, you're in the right place. Explore the latest Scroll charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Scroll, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Scroll have been created as well.

Will the price of Scroll go up today?

Check out our Scroll price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials