GMX

GMX price

$15.5500

+$1.1600

(+8.06%)

Price change for the last 24 hours

How are you feeling about GMX today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

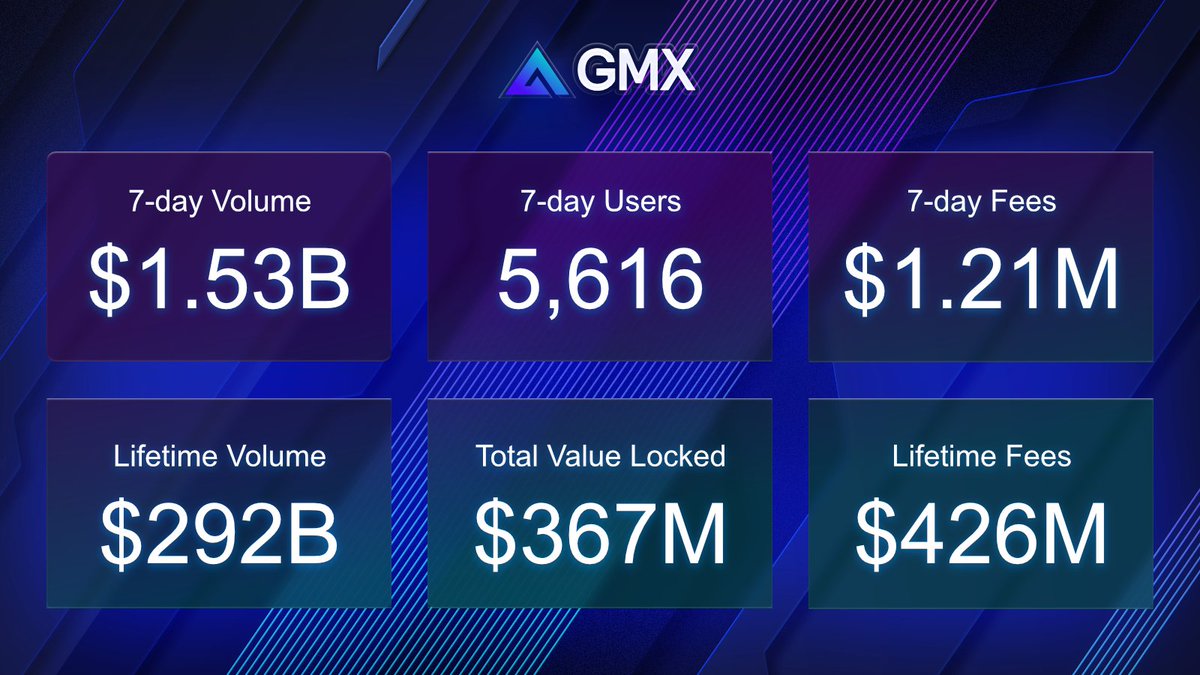

GMX market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$158.34M

Circulating supply

10,137,165 GMX

76.50% of

13,250,000 GMX

Market cap ranking

145

Audits

Last audit: 3 June 2021

24h high

$15.6000

24h low

$14.1500

All-time high

$91.4100

-82.99% (-$75.8600)

Last updated: 18 Apr 2023

All-time low

$9.5600

+62.65% (+$5.9900)

Last updated: 7 Apr 2025

GMX Feed

The following content is sourced from .

ChainCatcher 链捕手

Original title: "What does it mean to be a Hyperliquid-aligned fiat stable?"

Author: husd_fiat

Compilation: zhouzhou, BlockBeats

Editor's note: HUSD is a public stablecoin project launched by Hyperliquid, which returns stablecoin interest to the ecosystem for repurchasing HYPE, subsidizing interface rates, and supporting the Builder Code model to promote ecological growth. It breaks the USDC/Tether model and allows funds to no longer flow to centralized institutions, but to feed back the community and product development.

The following is the original content (the original content has been edited for ease of reading and comprehension):

Something that the ecosystem really needs

HUSD's story is about how to disrupt a multi-billion dollar stablecoin market. Hyperliquid initially emerged as a leading perpetual contract decentralized exchange (perp DEX), outperforming older players like DYDX and GMX. As the product continued to attract new users and was gradually introduced to the spot market, Hyperliquid evolved into a Binance/Coinbase competitor. Next, the ecosystem will be challenged by the fiat stablecoin duopolys of Circle and Tether.

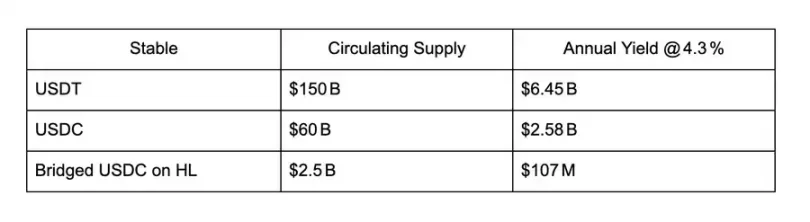

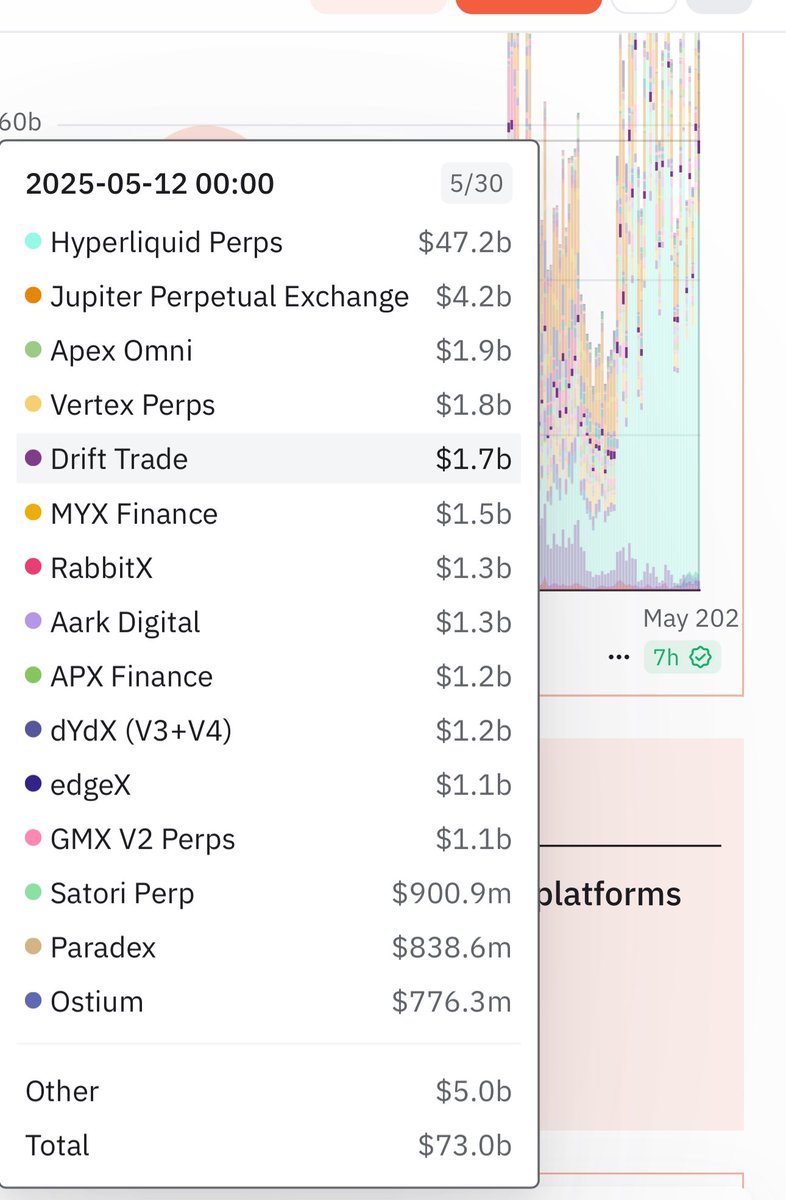

Currently, approximately $2.5 billion in cross-chain USDC is locked in HyperCore's order book and earns about 4.3% in interest earnings. These earnings could generate approximately $107.5 million annually for Circle Internet Financial into its private balance sheet. With each new USDC deposit into Hyperliquid, Circle's cash flow is further expanded. But what if that value doesn't go to Circle, but instead goes to grow the Hyperliquid ecosystem? Why should we be tied down by the outdated traditional stablecoin model of USDC when there is an opportunity to break out of the existing framework?

The opportunity cost of choosing to inherit the old stablecoin

As Hyperliquid's influence in on-chain trading continues to expand, so does the net deposits of fiat stablecoins, providing liquidity to the perpetual contract market and spot market. In a future where Hyperliquid grows 10x, 100x, or even 1000x, the opportunity cost of continuing to use traditional stablecoins will get higher and higher. This value from the stablecoin layer will either continue to flow to Circle and Tether's balance sheets, or flow back into Hyperliquid's own ecosystem.

A new stablecoin model tailored for Hyperliquid

The Assistance Fund, through the automatic buyback of HYPE, has proven that the cash flow generated by the agreement can and should be directly returned to the community. In the past 30 days alone, the aid fund has recovered millions of dollars in HYPE from the market.

HUSD continues this strategy, but at the stablecoin level: initially, a large portion of the interest income generated by HUSD will be used to purchase HYPE, which will then be deployed in various growth directions of the Hyperliquid ecosystem. In other words, every time you use HUSD, you add buying pressure to HYPE and reinvest value into Hyperliquid's growth.

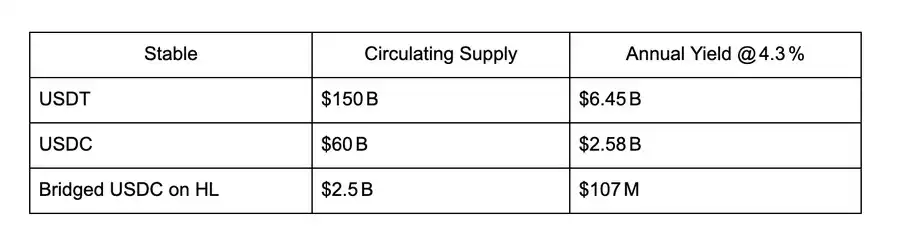

How will the repurchased HYPE be used?

HUSD: Fueling the future of Builder Code

HUSD has played a key role in driving the explosion of the "Builder Code" business model. The Builder Code is a native feature of Hyperliquid that allows an interface operator to charge a fee for spot or futures trades submitted on behalf of a user. Its goal is to monetize Hyperliquid's "last-mile distribution" — meaning that anyone who can effectively attract and retain users can use Builder Code to build a trading business that is not limited by technology or liquidity.

The unit economics of this type of business can be substantial, but at this early stage, new brands are still facing a "cold start" and the moat between the different interfaces is not yet obvious. The advent of HUSDs can help these "Hyperliquid hybrids" kick off and provide a way to differentiate themselves from each other.

By subsidizing the cost of the Builder Code by HUSD, the interface can charge the user more than it would otherwise be, without increasing the cost to the user. The interface captures revenue in real-time and further leverages those funds for growth strategies.

Let's take this as an example: Let's say Interface XYZ gets a rebate budget of 100 HUSD. All futures transactions with their Builder Code will be counted by the system, and the rebate balance of the corresponding user will continue to grow. The interface can handle at least about $100,000 in contract volume (i.e., 100 HUSD divided by 0.1% fee rate) before users actually start incurring fees. At the same time, interface operators can reinvest the revenue generated by Builder Code into user acquisition or user retention.

This is how HUSD is powering the "real-time growth" of the Hyperliquid ecosystem.

summary

HUSD combines two core insights: the denominated asset (stablecoin) used for trading and the cash flow generated by it, all within the trading platform. The end result is a stablecoin of the nature of a "public good", which transforms the originally static reserve interest into the active and compounding growth of the Hyperliquid ecosystem.

HUSD is a public goods project run by Felix and supported by community members, and it will go live through the Felix Points system. This deployment also builds on the foundation laid by @m0foundation, and it is its vision of a "global stablecoin platform" that makes HUSD possible.

Hyperliquid has upended the centralized exchange landscape, and HUSD is poised to do the same with traditional fiat stablecoins.

Show original

10.99K

0

Blockbeats

Original title: What does it mean to be a Hyperliquid-aligned fiat stable?

The original author @husd_fiat

Original compilation: zhouzhou, BlockBeats

Editor's note: HUSD is a public stablecoin project launched by Hyperliquid, which returns stablecoin interest to the ecosystem for repurchasing HYPE, subsidizing interface rates, and supporting the Builder Code model to promote ecological growth. It breaks the USDC/Tether model and allows funds to no longer flow to centralized institutions, but to feed back the community and product development.

The following is the original content (the original content has been edited for ease of reading and comprehension):

Something that the ecosystem really needs

HUSD's story is about how to disrupt a multi-billion dollar stablecoin market. Hyperliquid initially emerged as a leading perpetual contract decentralized exchange (perp DEX), outperforming older players like DYDX and GMX. As the product continued to attract new users and was gradually introduced to the spot market, Hyperliquid evolved into a Binance/Coinbase competitor. Next, the ecosystem will be challenged by the fiat stablecoin duopolys of Circle and Tether.

Currently, approximately $2.5 billion in cross-chain USDC is locked in HyperCore's order book and earns about 4.3% in interest earnings. These earnings could generate approximately $107.5 million annually for Circle Internet Financial into its private balance sheet. With each new USDC deposit into Hyperliquid, Circle's cash flow is further expanded. But what if that value doesn't go to Circle, but instead goes to grow the Hyperliquid ecosystem? Why should we be tied down by the outdated traditional stablecoin model of USDC when there is an opportunity to break out of the existing framework?

The opportunity cost of choosing to inherit the old stablecoin

As Hyperliquid's influence in on-chain trading continues to expand, so does the net deposits of fiat stablecoins, providing liquidity to the perpetual contract market and spot market. In a future where Hyperliquid grows 10x, 100x, or even 1000x, the opportunity cost of continuing to use traditional stablecoins will get higher and higher. This value from the stablecoin layer will either continue to flow to Circle and Tether's balance sheets, or flow back into Hyperliquid's own ecosystem.

A new stablecoin model tailored for Hyperliquid

The Assistance Fund, through the automatic buyback of HYPE, has proven that the cash flow generated by the agreement can and should be directly returned to the community. In the past 30 days alone, the aid fund has recovered millions of dollars in HYPE from the market.

HUSD continues this strategy, but at the stablecoin level: initially, a large portion of the interest income generated by HUSD will be used to purchase HYPE, which will then be deployed in various growth directions of the Hyperliquid ecosystem. In other words, every time you use HUSD, you add buying pressure to HYPE and reinvest value into Hyperliquid's growth.

How will the repurchased HYPE be used?

HUSD: Fueling the future of Builder Code

HUSD has played a key role in driving the explosion of the "Builder Code" business model. The Builder Code is a native feature of Hyperliquid that allows an interface operator to charge a fee for spot or futures trades submitted on behalf of a user. Its goal is to monetize Hyperliquid's "last-mile distribution" — meaning that anyone who can effectively attract and retain users can use Builder Code to build a trading business that is not limited by technology or liquidity.

The unit economics of this type of business can be substantial, but at this early stage, new brands are still facing a "cold start" and the moat between the different interfaces is not yet obvious. The advent of HUSDs can help these "Hyperliquid hybrids" kick off and provide a way to differentiate themselves from each other.

By subsidizing the cost of the Builder Code by HUSD, the interface can charge the user more than it would otherwise be, without increasing the cost to the user. The interface captures revenue in real-time and further leverages those funds for growth strategies.

Let's take this as an example: Let's say Interface XYZ gets a rebate budget of 100 HUSD. All futures transactions with their Builder Code will be counted by the system, and the rebate balance of the corresponding user will continue to grow. The interface can handle at least about $100,000 in contract volume (i.e., 100 HUSD divided by 0.1% fee rate) before users actually start incurring fees. At the same time, interface operators can reinvest the revenue generated by Builder Code into user acquisition or user retention.

This is how HUSD is powering the "real-time growth" of the Hyperliquid ecosystem.

summary

HUSD combines two core insights: the denominated asset (stablecoin) used for trading and the cash flow generated by it, all within the trading platform. The end result is a stablecoin of the nature of a "public good", which transforms the originally static reserve interest into the active and compounding growth of the Hyperliquid ecosystem.

HUSD is a public goods project run by Felix and supported by community members, and it will go live through the Felix Points system. This deployment also builds on the foundation laid by @m0foundation, and it is its vision of a "global stablecoin platform" that makes HUSD possible.

Hyperliquid has upended the centralized exchange landscape, and HUSD is poised to do the same with traditional fiat stablecoins.

「Original link」

Show original

14.76K

0

Kevin Ding reposted

蓝狐

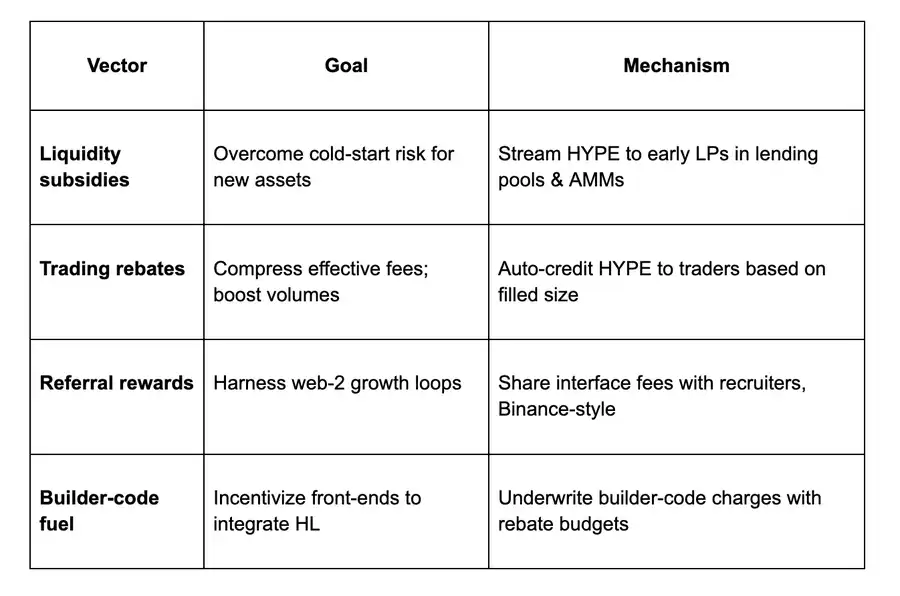

In less than a cycle, the trading volume of the former leader DYDX was left far behind by Hyperliquid. There are two problems:

First, if DYDX (@dYdX) hadn't focused on building its own chain, would it be better off than it is today?

Second, at the current rate of substitution, will Hyperliquid (@HyperliquidX) always maintain its leading position? After DYDX was surpassed by GMX, GMX was surpassed by Hyper. Where exactly is the moat of Perp DEX? How deep?

Show original

31.16K

80

GMX price performance in USD

The current price of GMX is $15.5500. Over the last 24 hours, GMX has increased by +8.06%. It currently has a circulating supply of 10,137,165 GMX and a maximum supply of 13,250,000 GMX, giving it a fully diluted market cap of $158.34M. At present, the GMX coin holds the 145 position in market cap rankings. The GMX/USD price is updated in real-time.

Today

+$1.1600

+8.06%

7 days

+$0.10000

+0.64%

30 days

+$0.18000

+1.17%

3 months

-$4.1300

-20.99%

Popular GMX conversions

Last updated: 20/05/2025, 13:24

| 1 GMX to USD | $15.6200 |

| 1 GMX to AUD | $24.2242 |

| 1 GMX to PHP | ₱870.05 |

| 1 GMX to EUR | €13.8906 |

| 1 GMX to IDR | Rp 256,191.6 |

| 1 GMX to GBP | £11.6854 |

| 1 GMX to CAD | $21.8029 |

| 1 GMX to AED | AED 57.3718 |

About GMX (GMX)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

GMX FAQ

How much is 1 GMX worth today?

Currently, one GMX is worth $15.5500. For answers and insight into GMX's price action, you're in the right place. Explore the latest GMX charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as GMX, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as GMX have been created as well.

Will the price of GMX go up today?

Check out our GMX price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials