April 19, 2024 saw the arrival of the fourth Bitcoin halving event — a significant development affecting the asset's circulation. But what is the Bitcoin halving exactly? According to the Bitcoin white paper, it's a built-in feature of Bitcoin's programming that occurs approximately every four years. This unique event cuts the number of Bitcoins awarded to miners for processing transactions in half. Why does this matter? Well, it's all about supply and control.

Bitcoin, created by Satoshi Nakamoto, was cleverly planned to have a limited supply of 21 million coins to avoid inflation — a familiar issue with traditional currencies that central banks control. The halving procedure is crucial in Bitcoin's strategy to reach its objective. Through a gradual decrease in the number of new Bitcoins entering circulation, the halving seeks to heighten scarcity. This, in theory, helps to drive up the worth of each coin as the maximum supply draws near.

TL;DR

2024 halving occured on April 19, 2024: The 2024 Bitcoin halving cut mining rewards again, stirring excitement and speculation in the crypto world.

Supply and scarcity: This event plays a vital role in controlling Bitcoin's inflation and enhancing its scarcity.

Historical price impact: Past halvings have significantly influenced Bitcoin's price, leading to substantial market surges.

Miners' challenge: The halving impacts mining profitability, pushing the industry towards more efficient practices and technologies.

Future of Bitcoin: The 2024 halving raised intriguing questions about Bitcoin's valuation, adoption, and the sustainability of mining practices.

What is the Bitcoin halving?

The process of Bitcoin halving, which happens every 210,000 blocks, involves cutting the reward for mining Bitcoin transactions in half. This feature was programmed into Bitcoin's code by its creator, Satoshi Nakamoto, and resulted in a reduction in the mining reward every four years.

Initially, miners were given 50 BTC per block, but this reward decreases after each halving. The 2024 halving reduced the reward from 6.25 to 3.125 BTC. The halving procedure plays a significant role in regulating the inflation of Bitcoin and preserving its worth. By decreasing the speed at which fresh Bitcoins are produced, Bitcoin imitates the limited availability of valuable metals such as gold.

This scarcity is believed to have contributed to Bitcoin's price appreciation over time. Halving events are significant because they introduce a deflationary aspect to Bitcoin, opening the door to those seeking to preserve capital value in an environment where traditional currency inflation might devalue. The predictability and transparency of these events contrast sharply with the often discretionary monetary policies of central banks.

The 2024 Bitcoin halving sparked excitement in the crypto community. Previous halving events have resulted in significant surges in Bitcoin's value. For example, after the 2016 halving, Bitcoin's price soared to nearly $20,000 by the end of 2017.

This trend led to speculation that the 2024 halving could trigger another substantial price hike, with some forecasts even predicting new record highs. This potential increase was considered in light of other economic factors, such as the 2022 crypto winter and the 2023 economic downturn.

It's important to remember that historical trends are just that — historic. There's never a guarantee that history will repeat itself. Doing your own research is very important, as crypto is highly volatile. The Bitcoin halving is a key feature that significantly influences the cryptocurrency's economics and market behavior. Here we are, in 2024, with many asking, "what's next for Bitcoin after the halving?"

Impact and historical trends

Historical overview and analysis

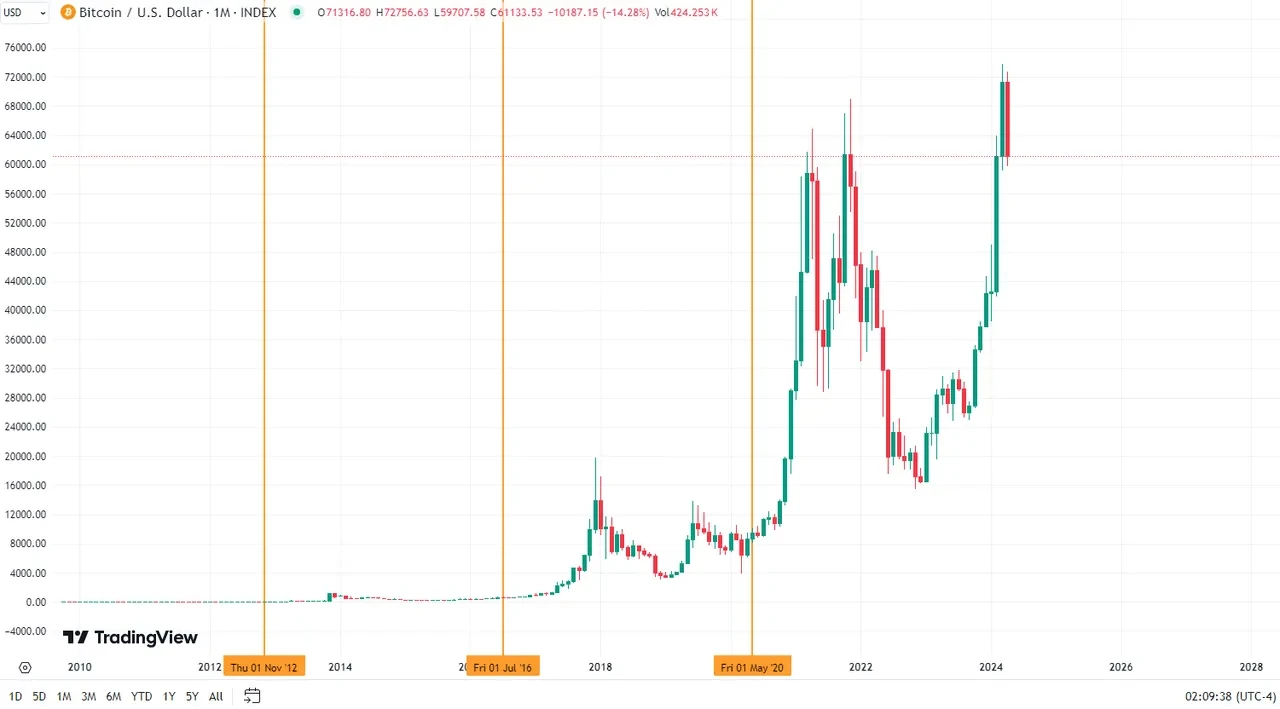

Here's an overview of the Bitcoin halving timeline along with a showcase of each halving through Bitcoin's history as a cryptocurrency.

2009 inception: Bitcoin started with a mining reward of 50 BTC per block.

2012 halving: Rewards were reduced to 25 BTC on November 28, 2012. After months of consolidating prices, Bitcoin prices surged from about $12 to a peak of about $1,240 in December 2013.

2016 halving: Mining rewards were further cut to 12.5 BTC on July 9, 2016. This led to a rally in Bitcoin prices, as BTC went from around $652 to reach highs of approximately $19,800 in December 2017.

2020 halving: Rewards dropped to 6.25 BTC on May 11, 2020, leading Bitcoin's price to soar from $8,571 to achieving all-time highs of nearly $69,000 by November 2021.

In all three previous halvings, we can see a trend developing over time. Post-halving volatility led to Bitcoin prices consolidating in the near-term, but prices appear to rise significantly about a year after the halving. While past performances of Bitcoin may not be indicative of future results, it does suggest that Bitcoin halvings are generally bullish catalysts for the asset and that prices do tend to go up when considering a time-frame beyond that of a year. Although it's impossible to say that this may be the case with the latest Bitcoin halving, it's one thing to keep in mind if you're intending to trade the volatility of the Bitcoin halving.

Need a rough guide that illustrates how to do so? Read our Bitcoin halving price prediction guide to learn more.

Impact on supply and demand dynamics

When Bitcoin is halved, its production rate is reduced, decreasing the overall amount of available Bitcoin. This limited supply, coupled with a rising demand, typically leads to an increase in the value of Bitcoin. The intentional cap of 21 million coins determines Bitcoin's worth. As a result, the halving process plays a significant role in shaping Bitcoin's economic framework and its perception in the marketplace.

Market sentiment and long-term trends

Bitcoin halvings often cause a lot of anticipation in the market. The possibility of a decrease in supply and potential price increases generates optimistic feelings among traders. On the other hand, these events can also instill worry, hesitation, and skepticism, causing temporary changes and instability in the market. Despite these immediate impacts, halvings are essential for the network's long-term security and stability, incentivizing miners to adapt to lower rewards and maintain network integrity.

Effects on the mining community

Bitcoin halving events significantly impact the mining community, prompting immediate adjustments and long-term practice changes. Every halving event reduces the block reward by half, directly impacting miners' earnings. For instance, the 2020 halving lowered rewards from 12.5 BTC to 6.25 BTC per block.

The decrease in efficiency may result in immediate difficulties in generating gains, particularly for less efficient miners. Miners with higher operational expenses and outdated machinery are at risk of losses or being pushed to suspend their mining activities.

This environment favors large-scale mining with advanced machinery and cheap electricity. The halving's short-term effects create a competitive landscape where only the most cost-efficient miners survive.

Long-term changes in mining practices

Here are the long-term changes in mining practices due to the Bitcoin halving:

Technological innovation: Halving events have spurred innovation in the mining industry as miners adjust to the new environment and seek out new ways to operate effectively.

Efficiency: Miners prioritize using energy-efficient and high-performing hardware to sustain profitability.

Optimizing operational efficiency: The industry has shifted from increasing hashrate to efficiency.

Infrastructure upgrades: Infrastructure upgrades are needed to adapt to post-halving changes.

Advanced mining rigs: Use of advanced mining rigs has become essential to remain operational.

Geographic relocation: Miners are moving to locations that offer cheap electricity and cooler climates for cost efficiency.

Popular mining locations: Regions with good mining conditions, like Ulaanbaatar, Mongolia, and Bratsk, Russia, are popular for Bitcoin mining.

Future of Bitcoin mining

The future of Bitcoin mining depends on efficiency and strategic adaptation. The halving's effect on the network's hashrate, a measure of the mining power, is also significant.

Although the hashrate will drop after the halving, this is only temporary. The long-term stability and growth of the network are expected to continue, as the price increase due to reduced supply can balance the lower rewards. Miners need to focus on the most efficient hardware and cheapest electricity to stay profitable in the long run.

The Bitcoin halving poses both obstacles and advantages for miners. It requires modifications to mining processes and promotes the development of new methods and technology, ultimately spurring the evolution of Bitcoin mining.

What's next for Bitcoin halving and mining?

The future of Bitcoin mining is intriguing, especially when we consider halving events.

The endgame of Bitcoin halving

Maximum supply is reached: Bitcoin's supply is capped at 21 million. Once that's been reached, no more Bitcoins will be created.

Impact on miners: The last coins will be mined by 2140. Miners will rely more on transaction fees as the supply limit nears.

Transition in mining rewards

Shift to transaction fees: With block rewards decreasing, transaction fees will be the main incentive for miners. Many expect this will help to make mining profitable and viable.

Sustainability of mining

Energy consumption concerns: Bitcoin mining has high energy usage, but the industry is becoming more energy-conscious.

Eco-friendly solutions: Innovations like flare gas mining, nuclear energy, and more are emerging. Flare gas mining uses a byproduct of oil extraction to power mining operations. Nuclear energy offers a zero-carbon resource that could power mining facilities.

Renewable energy adoption: Efforts are being made to improve hardware efficiency and use renewable energy sources like solar, wind, and hydropower.

Future projections: Energy-efficient and environmentally-friendly mining solutions are expected to evolve to meet global sustainability goals.

What are the industry experts saying?

Paul West, CEO of Fumb Games, finds the price fluctuations post-halving interesting but is more captivated by Bitcoin's future role in society. He proudly notes that his company's mobile game has introduced over a million new users to Bitcoin, contributing to its ongoing journey.

Mithil Thakore, Co-founder and CEO VelarBTC, believes that "billions in new institutional liquidity" could flow into Bitcoin as a result of the 2024 halving event and the decisions among US regulators to approve the first spot Bitcoin ETFs. Thakore also expects developments such as ordinals, BRC-20, and various layer-2 advancements to help the crypto market transform significantly through 2024 and 2025.

Nazareth Q, a crypto native and podcast host, anticipates the network remaining active post-halving, reinforcing Bitcoin's status as a scarce, optimistic asset class, and a strong hedge against inflation. He foresees increases in institutional attention, Bitcoin's credibility, and value.

Phil Champagne, author of "The Book of Satoshi" and "Bitcoin vs Altcoin," has scrutinized the complexity of predicting Bitcoin's price action, especially central bank policies. He believes the halving will exert upward pressure on Bitcoin's price, though the broader economic context and stock market dynamics will also play significant roles in determining its value. Champagne also acknowledges technical analysts like Blockchain Backer, who, despite focusing on XRP, recognize Bitcoin's influence in the crypto market.

The final word

April 2024 saw the fourth and latest Bitcoin halving occur — an event that stirred much anticipation and speculation to the crypto scene. Historically, halving events have led to significant surges in Bitcoin's price, fueling speculation and excitement about its future impact.

However, it's crucial to remember that past trends don't guarantee future results, and the volatile nature of cryptocurrencies calls for careful research and consideration. As this fascinating event unfolds, one question remains: could the 2024 halving event trigger a new era of Bitcoin adoption globally?

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” No derivative works or other uses of this article are permitted.

Information about: digital currency exchange services is prepared by OKX Australia Pty Ltd (ABN 22 636 269 040); derivatives and margin by OKX Australia Financial Pty Ltd (ABN 14 145 724 509, AFSL 379035) and is only intended for wholesale clients (within the meaning of the Corporations Act 2001 (Cth)); and other products and services by the relevant OKX entities which offer them (see Terms of Service). Information is general in nature and should not be taken as investment advice, personal recommendation or an offer of (or solicitation to) buy any crypto or related products. You should do your own research and obtain professional advice, including to ensure you understand the risks associated with these products, before you make a decision about them. Past performance is not indicative of future performance - never risk more than you are prepared to lose. Read our Terms of Service and Risk Disclosure Statement for more information.