Staking Economy & PoS Consensus

Staking has become a new buzzword in the crypto space recently. Although this concept has long existed since the introduction of Proof-of-Stake (PoS) consensus, it didn’t come into the public’s focus until staking became one of the higher-yielding methods recently. In this article, we will discuss the concept of staking, its correlation with PoS, and the points to note when traders tap into the game.

What is Staking

Staking is a new trend in the crypto industry. In the PoS consensus mechanism, holders of an asset participate in block hashing and ecology governance through pledging, voting, delegation, authorization, and lock-up, in order to obtain profits in the form of block rewards, governance voting rewards, and trading fees, etc. The economic activities surrounding staking are concluded as staking economy.

In staking, nodes must lock away tokens as a “stake” in order to be validator nodes. The system will elect the block creators of each block based on a specific algorithm, and those validators will be rewarded with a fixed block reward. If the validators conduct a fault, they will be punished and not be rewarded with any staking bonus, or will even lose their stake. This punishment mechanism is called “slash” in PoS.

Size of Staking Market

According to StakingRewards, as of August 1, 2019, there are 47 staking projects with a total market cap of USD16.24 billion, accounting for 5.9% of the total market cap of all digital assets, which is USD 274.26 billion. The total value locked in staking is USD 6.17 billion, with an average staking ratio of 38% and average staking yield of 12.92%.

From the above data, we can see that staking market is booming. Under the stimulation of economic factors, this market will continue to grow as the number of projects and staking assets increase.

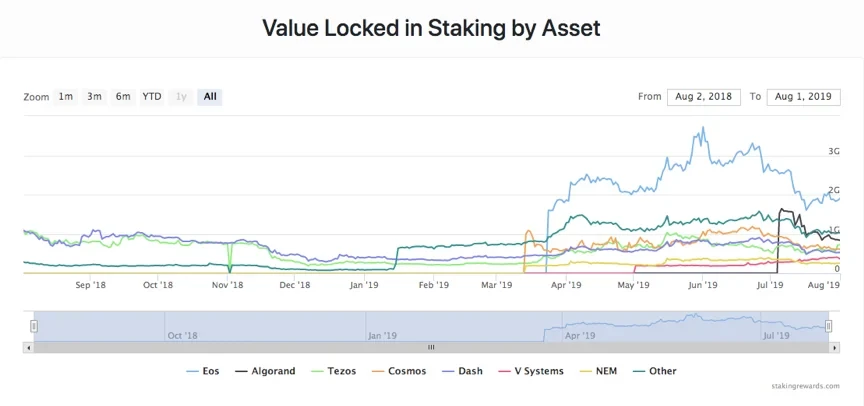

According to Graph 1, the total value locked in staking had maintained at around USD1.8 billion before it started to decline in November 2018. In December, the value dropped to 600 million. It then soared to around USD1.2 billion in mid-January 2019 and hovered around this range until mid-March, followed by a gradual uptrend.

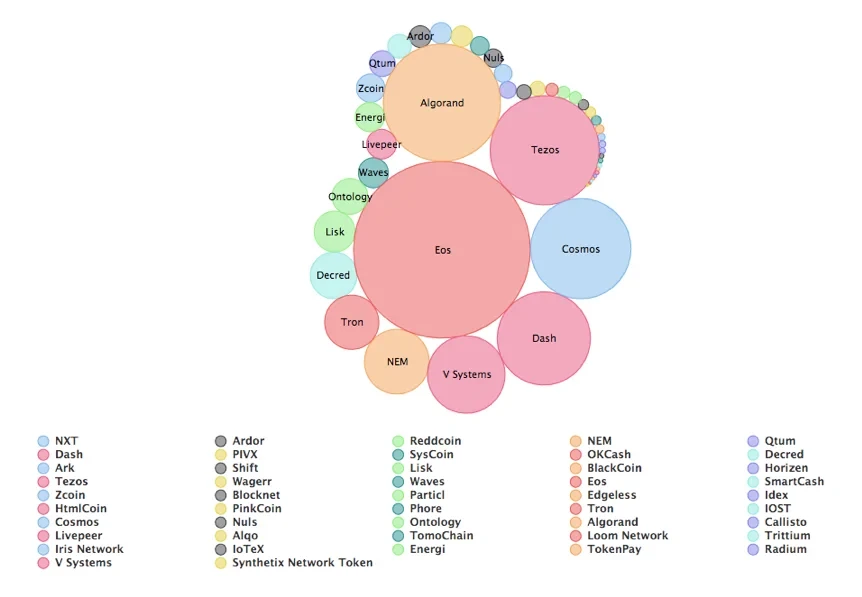

Graph 2 and 3 show the value locked in staking by assets. The top 5 projects are EOS, Algorand, Tezos, Cosmos, and Dash.

Staking Economy

There are two important roles in the staking economy — the validator and the token holder.

Under normal circumstances, there are 6 basic steps in the operations of PoS blockchains: node operator > becomes validator (miner) > select block generation node > validate transaction > broadcast transaction > confirm by validator. Under the PoS mechanism, miners have to be responsible for both block generation and node validation. Before becoming a block generation node, the token holder has to run a software to become a node, which is an entry point of the distributed blockchain network. The node who matches the system requirements will become a validator (a.k.a miner). The system will select the block generation node from validators for every block with an advanced algorithm. Staking can also be understood as the process of becoming a validator.

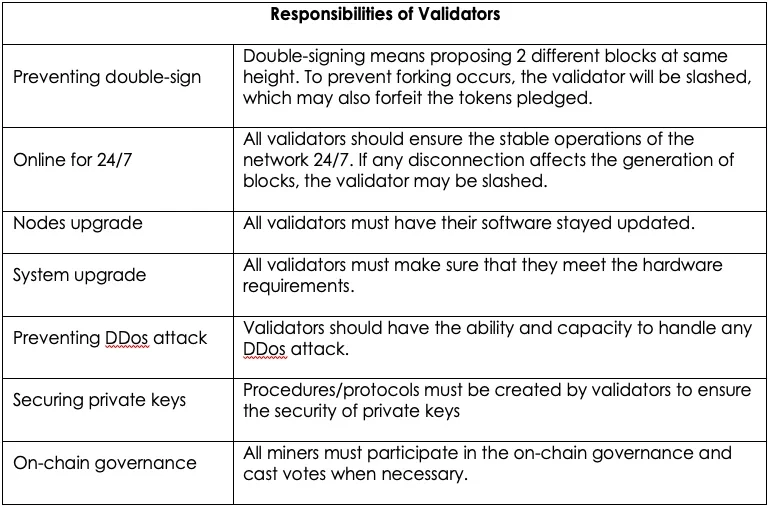

Other than generating new blocks, validators are also responsible for on-chain governance. Generating blocks can make sure that the blockchain remains active. While on-chain governance decides the parameters settings for the whole blockchain system, and these parameters determine the direction of the network.

To become a qualified validator, the user has to meet both the hardware requirements and the token pledging amount. At the same time, they are also required to guarantee that they will be online 24/7 to prevent penalty. For many token holders, they do not have the time, effort, and knowledge to be a validator. It is also very difficult for them to meet the token holding requirement. Therefore, many token holders entrust third parties to run the nodes for them in order to make a profit.

Types of Node Operators

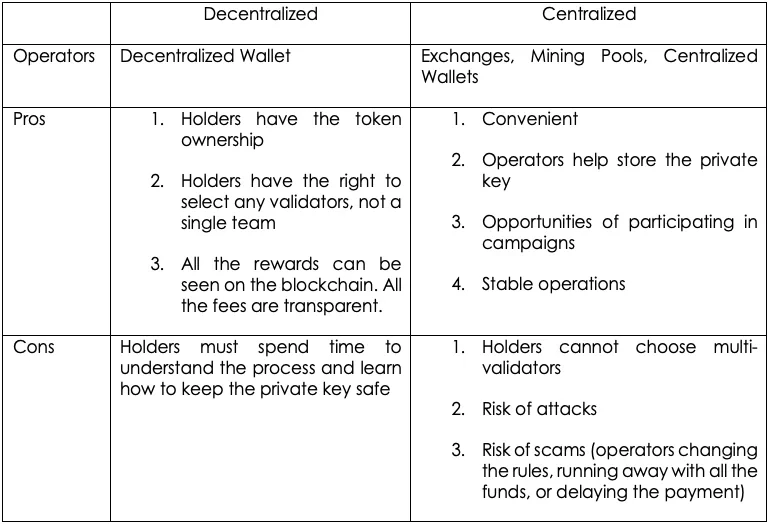

Token holders have ownership and entrustment rights. Staking node operators can be differentiated into centralized and decentralized operators. It is decided by whether they will lose control of the tokens during the staking entrustment.

Decentralized Operators

Decentralized operators ensure that holders keep the ownership. However, operators have control over the tokens. Staking to a node is only an entrustment. In fact, the tokens are still stored on the holders’ addresses. The only changed is the transfer of PoS mining power. The operator receives the staking profit and distributes it back to the holder.

Many of the decentralized operators provide decentralized wallets. Holders are only required to keep their own private keys safe. Decentralized wallets can also be categorized into website wallet and software wallet. Website wallet will help to store the private key in the web browser cache for signatures, while software wallet stores the private key in the user devices. Comparing the two, software wallets are more secure, as website wallet is also vulnerable to phishing attacks.

Centralized Operators

Centralized operators require holders to transfer both the ownership and control of tokens. They will not help holders to create a personal wallet address. Instead, all holders will share the same address. The profit made by the node will be distributed proportionally to the holders. Examples: exchanges, centralized wallets, mining pools.

What You Should Know Before Staking

While staking coins can bring benefits to you, there are various factors that might affect your yield (staking rewards). Here are the key factors you should take into consideration before you start staking:

1. Inflation Rate

Most of the PoS projects offer tokens as staking rewards. As new tokens are minted for this purpose, it may lead to inflation in the overall economic system.

Similar to a central bank printing banknotes, proper token minting is conducive to the improvement and development of an economy. However, if it becomes excessive and is done too rapidly, it may result in depreciation of the cryptocurrency. Putting this scenario to the ecosystem of a PoS token, similarly, staking rewards may not be able to cover the depreciation loss caused by excessive token supply.

Yet, if the minting of tokens falls short, it will fail to reach miners’ expectation for rewards, and thus making it difficult to encourage miners to participate in block validation. As a result, the potential risk for attacks will be much higher and may cause network slowdown. We can see that the early stage of PoS’s projects, such as Nxt, Blackcoin, and SDW, all failed because of this reason. That’s why it’s best to choose a project with a reliable economic mechanism.

2. Lock Up Period

Most PoS projects set a lock-up period for staking to avoid malicious stakers and cheating. When a staker wants to quit staking and sell the tokens, he has to wait until the lock-up period expires before he can transfer and trade the tokens.

This lock-up mechanism helps protect the blockchain from receiving malicious attacks. Yet, it reduces the overall token circulation and thus market liquidity.

Each project has its own lock-up period, for example,15 days for Tezos and 30 days for Cosmos. Investors are advised to check the specific details in a project’s white paper.

3. Estimated Annual Yield Rate

Users should evaluate the staking and yield rates of a project before staking, and try to select the nodes with a relatively stable yield rate to invest in. Node performance is another important indicator, as low-performing nodes not only affect holders’ rewards, but also cause losses to users’ staked tokens.

4. Service Fee

Node operators will receive block rewards. After collecting a certain amount of service fees, these rewards will be rebated to staking users proportionally. Every node operator charges a different service fee according to their background and the properties of the project. Traders are advised to take this into account before staking.

5. Types of Staking Order

As mentioned earlier, users will not lose control over their tokens during staking. While there are two basic approaches to the mechanics of staking, namely the decentralized and centralized approaches, each has its own pros and cons. Users should consider carefully which types of staking order suit their personal needs the best.

Conclusion

Stimulated by economic factors, investors began to flood into the staking game, trigger rapid growth of the market and development of both PoS tokens and consensus mechanism. It is foreseeable that staking will be an important market that will see a surge in stake value and staking projects.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” No derivative works or other uses of this article are permitted.

Information about: digital currency exchange services is prepared by OKX Australia Pty Ltd (ABN 22 636 269 040); derivatives and margin by OKX Australia Financial Pty Ltd (ABN 14 145 724 509, AFSL 379035) and is only intended for wholesale clients (within the meaning of the Corporations Act 2001 (Cth)); and other products and services by the relevant OKX entities which offer them (see Terms of Service). Information is general in nature and should not be taken as investment advice, personal recommendation or an offer of (or solicitation to) buy any crypto or related products. You should do your own research and obtain professional advice, including to ensure you understand the risks associated with these products, before you make a decision about them. Past performance is not indicative of future performance - never risk more than you are prepared to lose. Read our Terms of Service and Risk Disclosure Statement for more information.