Known for its volatility and unpredictability, the crypto market can sometimes feel like a rollercoaster ride even for veteran crypto traders. Amid the ups and downs, there's one factor that often impacts said volatility and often flies under the radar: the U.S. Federal Reserve (also known as the 'Fed') and its interest rate decisions. As much as crypto enthusiasts will say crypto is detached from the realm of traditional finance (TradFi), what happens in these government meetings can technically have a sizable impact on the price of your favorite cryptocurrencies.

Whether you're a seasoned crypto trader or just dipping your toes into the crypto markets, understanding the connection between FOMC meetings and crypto is crucial for making informed trading decisions. Keen to find out why this is the case? From knowing what the Fed is to understanding how the federal funds interest rate impacts market sentiment, here's everything you'll need to know about how Fed meetings impact Bitcoin and broader crypto prices.

What is the Fed and what does it do?

Formally known as the United States Federal Reserve System, the Fed is the most powerful economic institution in the United States and acts as the central bank of America. Led by chairman Jerome Powell, the Fed's core responsibility is to maintain price stability and employment by managing the overarching money supply and interest rates. In turn, these factors affect various aspects of the economy, ranging from borrowing costs to inflation.

In recent years, interest rates have been a key topic for discussion as the Fed uses it to keep rising prices under control. This comes in the form of the federal funds rate, which represents the interest rates at which banks lend excess reserve balances to each other overnight. In the broader economy, the federal funds rate plays a crucial role in the overall financial system as it dictates borrowing costs and economic growth.

Higher for longer: interest rates and combating inflation

The phrase "higher for longer" seems to have stolen the spotlight at recent federal reserve meetings as traders keep a watchful eye on federal funds rate levels while speculating on market sentiment. In essence, this phrase refers to how the Fed intends to keep interest rates at a high in order to keep inflation levels under control. If you're confused as to how this works, let's first break down the impact of interest rates on the economy.

To put things in perspective, interest rates act like a faucet for the flow of money in the economy. When the Fed raises interest rates, it's like tightening the faucet. This makes borrowing money more expensive, both for individuals and businesses. As a result, people tend to spend less and businesses invest less, ultimately slowing down economic activity. This slowdown helps to curb inflation, which is the sustained increase in the price of goods and services. If the economy is a car speeding down the highway, raising interest rates is like tapping the brakes, gradually reducing the economy's growth and preventing it from speeding out of control.

As for the "higher for longer" phrase, this implies that the Fed is signaling that it's committed to keeping interest rates elevated for an extended period, even if it means slowing down economic growth. This is because they believe that inflation is a bigger threat to the economy right now, and needs to be brought under control of the targeted 2% before they can start easing interest rates.

The macroeconomic issue with higher for longer

Unfortunately, this "higher for longer" approach also comes with its own set of challenges. A slower economy can lead to job losses and decreased consumer spending, impacting businesses and individuals alike. This puts Jerome Powell and the Fed between a rock and a hard place. On one hand, the economy is screaming for a cooling measure so that prices can be kept under control. On the other hand, growth has to be sustained so the American economy maintains a healthy job market and prevents a recession. This creates a delicate balancing act for the Fed, requiring them to thread the needle between controlling inflation without causing unnecessary economic hardship.

Interest rates and crypto prices: discovering the link

Despite often being viewed as independent and outside the TradFi system, cryptocurrencies exist within a larger economic ecosystem. While not directly regulated by the Fed, crypto prices are susceptible to broader market forces influenced by interest rates. Here's how:

Risk-on vs risk-off assets

Crypto is often categorized as a "risk-on" asset, meaning its price tends to rise when speculators and traders are optimistic about the market and fall when they become risk-averse. When the Fed raises rates, it generally signals economic stability concerns. This prompts traders to favor safer assets like bonds and pull money out of riskier options like crypto.

Liquidity and inflation

Interest rate hikes often reduce overall liquidity in the market, meaning less money is readily available for spending and growth. This can lead to a decrease in demand for assets across the board, including cryptocurrencies. Additionally, if the Fed is raising rates to combat inflation, it could further dampen market sentiment towards risk-on assets like crypto.

Short-term volatility vs long-term trends

Even though rate hikes and cuts might trigger short-term price swings, the long-term outlook for crypto depends on various factors beyond interest rates, such as technological advancements, adoption, and regulatory developments.

Cost of borrowing and leverage

When the Fed raises interest rates, borrowing becomes more expensive, incentivizing people to spend less and save more. As higher interest rates directly translate to increased borrowing costs, it makes leveraged positions more expensive to maintain, since the overall cost of holding a leveraged position also rises. This could potentially ruin trading plans if the overall gains made from the trade don't cover the increased borrowing costs.

Interest rate hikes negatively impacting crypto prices: a 2022 case study

An example of the above occurring is during the March 2022 Federal Open Market Committee (FOMC) meeting, where the Fed approved an interest rate hike that took the entire market by surprise. This combined with the emergence of the Ukraine-Russia conflict caused a panic in the TradFi markets as commodity prices soared and kicked inflation into high gear. With increased interest rates and fears of inflation, crypto markets took a significant hit. Bitcoin plummeted from a high of $48,000 in late March 2022 to under $18,000 by mid-June 2022. This mirrored the broader risk-off sentiment in TradFi markets as traders shifted towards safer risk-off assets like treasury bonds and gold.

This episode highlights the complex relationship between interest rates, inflation, and the crypto market. While higher interest rates and inflation generally put downward pressure on riskier assets like crypto, other factors like market psychology and geopolitical events can also play a significant role in crypto price movements.

When is the Fed going to cut interest rates?

While interest rate hikes towards a 23-year high of 5.25% to 5.5% have been long and painful for bullish traders, the Fed seems to have finally achieved its goal of a "soft landing". This is a rare case in which a central bank finds the sweet spot in preventing an overheated economy while also maintaining growth numbers and avoiding a recession.

Now that America's inflation seems to be on a downtrend and supply chain bottlenecks have been resolved, it seems like the perfect time to introduce interest rate cuts before the economy breaks and goes through a recession. That's why many traders have been speculating on the forward nature of the markets by frontrunning these interest rate cuts and getting ahead by first building long positions in risk-on assets.

What has the Fed said about the federal funds rate?

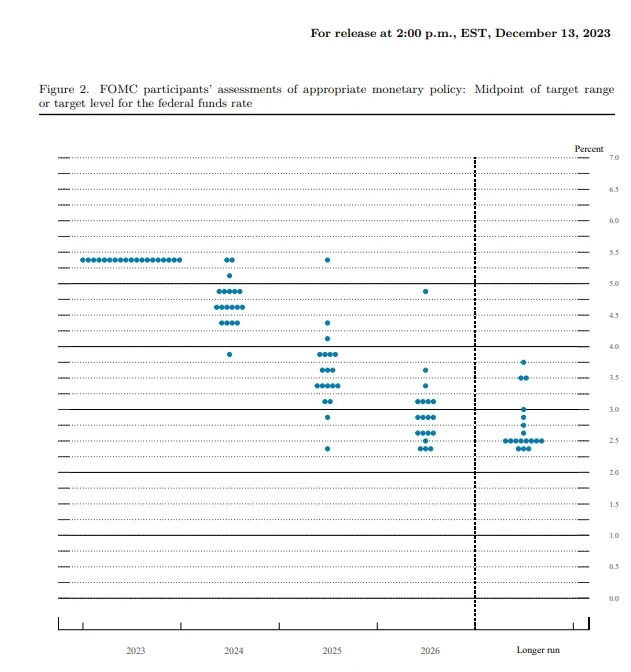

Source: Federal Reserve Board

Although Jerome Powell has gone on record to state that there won't be any rate cuts by March 2024, December's Summary of Economic Projections suggests that there may be at least three rate cuts by the end of 2024. In the Fed dot plot shown above, we can see that the Fed is in agreement that rates need to be cut in 2024. However, the rate at which they'll be cut seems to depend on the ongoing inflation and employment data that's coming in every month. Currently, it seems the Fed is leaning towards three 25-basis-point cuts, meaning federal funds rates will be from 4.5% to 4.75% by the end of 2024. Additionally, we can see from the dot plot that the Fed is aiming to bring the federal funds rate down to 2.5% in 2027 and beyond. This likely means more aggressive rate cuts once we enter 2025.

Therefore, to answer the question of when interest rates are going to be cut, traders will need to keep a watchful eye on Jerome Powell's statements and the general macroeconomic data in order to gain a better sense of when the first interest rate cuts will come in. After all, speculators are no longer asking when there'll be interest rate cuts. Rather, they're wondering how many there'll be and whether the Fed will loosen up on its hawkish sentiment once the data shows that the U.S. economy is indeed heading towards a soft landing.

How to trade based on the next FOMC meeting

According to the Fed's meeting calendar, the next FOMC meeting will be held from March 19 to 20, 2024. This gave crypto traders some time to plan ahead and make use of the volatility that's likely to occur following the event. For this trading example, we'll be using Bitcoin's chart as of March 19, 2024.

Source: TradingView

A lot can happen in the lead-up to an FOMC meeting. During the last January 2024 FOMC meeting, Bitcoin prices declined almost 3% due to Jerome Powell's insistence of there not being any interest rate cuts due for March 2024. For the March 2024 FOMC meeting, we might witness chatter and speculation of possible rate cuts in May in the runup to the actual announcement during the Fed meeting. This could cause a rally that might be bullish enough to break out of the previously established all-time high of $73,787.10 and now acts as a supply zone.

Using the relative strength index indicator, Bitcoin currently sits at an oversold level of 29.27 on the four-hour timeframe. With BTC prices fast approaching the 200-day moving average, all bets are off as bullish crypto traders are hoping that the moving average acts as a key level of support while bearish crypto traders are hoping that momentum pushes past this level so the longs will capitulate and cause BTC prices to plunge further.

Final words and next steps

From knowing what the Fed is to understanding how Fed news can affect crypto prices, we hope our guide to exploring the link between rate hikes and crypto prices has been useful.

While interest rate hikes can introduce short-term volatility, it's crucial to remember that the crypto market is influenced by a complex interplay of factors and news events. By staying informed, diversifying your portfolio, and aligning your trades with your long-term goals, you can navigate the dynamic world of crypto with greater confidence. This example of interest rates impacting crypto prices is ultimately a great way for beginner crypto traders to grasp how interwoven TradFi is with the crypto markets in the entire financial ecosystem. Overall, understanding the nuances of each asset market will help you better piece facts and figures together, so you're able to make the most informed decisions when trading crypto.

Keen to learn more about the links between TradFi and crypto? Check out our article on how spot BTC ETFs impact mainstream adoption. Alternatively, you can also read up on how to trade Bitcoin if you're interested in getting started with crypto trading.

FAQs about the link between FOMC meetings and crypto

Does every FOMC meeting automatically cause a shift in crypto prices?

Not necessarily. The impact depends on various factors like the magnitude of the rate change, market expectations, and overall economic sentiment. Smaller anticipated hikes might have minimal impact, while unexpected or larger changes can trigger more significant price movements.

How can I stay up-to-date on upcoming Fed meetings and their potential impact?

Several resources can help you stay informed of Fed and crypto news. From following the Fed's official website to considering news outlets specializing in financial markets, you'll discover all kinds of insights and predictions before and after FOMC meetings.

Should I adjust my trading strategy based on FOMC decisions?

While staying informed is crucial, avoiding impulsive reactions based solely on short-term market fluctuations should also be something to consider. When reading headlines related to FOMC meetings, you should take into account your overall trading strategy, risk tolerance, and long-term goals before making crypto trading decisions.

Are there any cryptocurrencies less affected by interest rate changes?

Contrary to popular belief, not all coins and tokens are volatile. Stablecoins are generally less volatile than other cryptocurrencies because of their peg to fiat currencies like the U.S. dollar.

What other economic factors should I consider alongside Fed policy?

Numerous factors influence the crypto market, including global economic events, geopolitical tensions, technological advancements, and regulatory developments. It's key to stay informed about the broader economic landscape to make well-rounded trading decisions.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” No derivative works or other uses of this article are permitted.

Information about: digital currency exchange services is prepared by OKX Australia Pty Ltd (ABN 22 636 269 040); derivatives and margin by OKX Australia Financial Pty Ltd (ABN 14 145 724 509, AFSL 379035) and is only intended for wholesale clients (within the meaning of the Corporations Act 2001 (Cth)); and other products and services by the relevant OKX entities which offer them (see Terms of Service). Information is general in nature and should not be taken as investment advice, personal recommendation or an offer of (or solicitation to) buy any crypto or related products. You should do your own research and obtain professional advice, including to ensure you understand the risks associated with these products, before you make a decision about them. Past performance is not indicative of future performance - never risk more than you are prepared to lose. Read our Terms of Service and Risk Disclosure Statement for more information.